JKG 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive jkg review presents a detailed analysis of what appears to be a complex entity with multiple business facets. Based on available information, JKG operates in various sectors including audio equipment manufacturing and potentially financial services, though our investigation reveals significant information gaps that prevent a definitive assessment of their trading services capabilities.

The limited data available suggests JKG has some presence in the consumer electronics market, particularly with audio products such as deep bass earphones with noise cancellation features. The company appears to distribute products through major e-commerce platforms like Flipkart, indicating an established retail presence in certain markets, but this connection to trading services remains unclear.

For potential clients seeking trading services, this review must emphasize the critical lack of transparent information regarding regulatory status, trading conditions, and platform capabilities. The absence of clear financial services documentation raises important questions about the scope and legitimacy of any investment-related offerings, making it impossible to verify their credibility in the financial sector.

Important Disclaimer

This jkg review is based on extremely limited publicly available information. Readers should note that different business entities may operate under similar names across various sectors and jurisdictions, creating potential confusion about their actual services and capabilities.

The lack of comprehensive regulatory information means potential clients cannot verify the legitimacy or safety of any financial services that may be offered. Our evaluation methodology relies on publicly accessible data, user feedback when available, and industry standard assessment criteria, but the scarcity of relevant information significantly limits the depth and accuracy of this analysis.

Potential clients are strongly advised to conduct independent due diligence before engaging with any services. This recommendation becomes even more critical given the substantial information gaps we have identified throughout our research process.

Rating Framework

Based on available information, we provide the following preliminary assessments:

Overall Rating: Unable to Assess - Insufficient information available for comprehensive evaluation.

Broker Overview

The entity known as JKG presents a complex picture with limited verifiable information about its financial services operations. Available data primarily relates to consumer electronics products, specifically audio equipment marketed through e-commerce platforms, which suggests either a diversified business model or potential confusion between different entities operating under similar names.

From the available search results, JKG appears to manufacture and distribute audio products, including deep bass earphones with noise cancellation technology and gaming headsets. These products are available through major Indian e-commerce platforms, particularly Flipkart, where customer reviews and ratings are accessible, but this consumer electronics focus raises questions about their trading service capabilities.

However, the connection between these consumer electronics operations and any potential financial trading services remains unclear. The absence of regulatory documentation, trading platform information, or clear financial services marketing materials raises significant questions about the scope of JKG's operations in the forex or trading sector, making it difficult to assess their legitimacy as a financial services provider.

The lack of transparent corporate information, regulatory disclosures, or detailed service descriptions makes it impossible to provide a comprehensive assessment of JKG as a trading services provider. This jkg review must therefore focus on the limited information available while highlighting the critical gaps that potential clients should consider before making any financial commitments.

Regulatory Status

Specific information regarding regulatory oversight for financial services is not available in current documentation. This represents a significant concern for potential trading clients, as regulatory compliance is fundamental to broker legitimacy and client protection in the financial services industry.

Account Types and Conditions

Details about account structures, minimum deposit requirements, and account-specific features are not documented in available sources. This information gap prevents assessment of accessibility and suitability for different trader profiles, making it impossible to determine whether JKG offers competitive account conditions.

No information is available regarding trading platform options, whether proprietary or third-party solutions like MetaTrader are offered, or the technological infrastructure supporting trading operations. Modern traders require reliable, fast, and user-friendly platforms to execute their strategies effectively.

Available Assets

The range of tradeable instruments, including forex pairs, commodities, indices, or cryptocurrencies, is not specified in current documentation. This fundamental information is essential for trader decision-making and strategy development.

Cost Structure

Spread information, commission rates, overnight financing costs, and other fee structures are not available for analysis. Understanding costs is crucial for evaluating broker competitiveness and trading viability, particularly for high-frequency traders who are sensitive to transaction costs.

Geographic Restrictions

Information about service availability in different jurisdictions and any geographic limitations is not provided in current sources. This jkg review cannot determine market accessibility for international clients, which is a critical factor for global traders seeking reliable service providers.

Comprehensive Rating Analysis

Account Conditions Analysis

The absence of detailed account information represents a critical limitation in this jkg review. Standard broker evaluations require comprehensive data about account types, minimum deposits, leverage options, and special account features such as Islamic accounts for Muslim traders, but none of this information is available for JKG.

Without access to account documentation, terms of service, or client agreements, it's impossible to assess whether JKG offers competitive account conditions. The lack of transparency regarding account structures, funding requirements, and account-specific benefits or limitations prevents meaningful comparison with established brokers in the market, raising serious concerns about their professionalism and commitment to client service.

Professional traders typically require detailed information about account tiers, the benefits associated with higher deposit levels, and any restrictions or requirements for accessing premium features. The absence of such information raises concerns about the comprehensiveness and professionalism of any potential trading services offered, making it difficult for serious traders to evaluate JKG as a viable option.

A comprehensive assessment of trading tools and resources cannot be completed due to insufficient available information. Modern forex brokers typically provide extensive analytical tools, charting software, economic calendars, market research, and educational resources to support trader decision-making, but JKG's offerings in these areas remain completely unknown.

The lack of documentation regarding research capabilities, analytical tools, or educational materials suggests either limited service offerings or poor transparency in marketing communications. Professional trading requires access to real-time market data, technical analysis tools, and fundamental research resources, all of which are standard offerings from reputable brokers in the industry.

Without evidence of comprehensive tool suites, research departments, or educational programs, potential clients cannot evaluate whether JKG provides the resources necessary for informed trading decisions. This represents a significant limitation for traders who depend on broker-provided analysis and market intelligence to develop and execute their trading strategies effectively.

Customer Service and Support Analysis

Information about customer service capabilities, support channels, and service quality is not available in current documentation. Effective customer support is crucial for trading operations, particularly during market volatility or technical issues that require immediate assistance to prevent potential losses.

Standard broker evaluations examine support availability, response times, communication channels, multilingual capabilities, and the technical expertise of support staff. The absence of such information prevents assessment of service reliability and client support quality, which are essential factors for traders who need dependable assistance when problems arise.

Professional traders require confidence that technical issues, account problems, or trading disputes can be resolved quickly and efficiently. The lack of transparent information about customer service capabilities represents a significant concern for potential clients considering JKG for trading services, as poor support can lead to substantial financial losses during critical trading situations.

Trading Experience Analysis

Without access to platform demonstrations, user interfaces, or performance data, this jkg review cannot assess the quality of the trading experience that JKG might provide. Modern trading requires fast execution, reliable platform stability, comprehensive order types, and intuitive interface design to ensure traders can implement their strategies effectively without technical hindrances.

The absence of information about execution speeds, platform uptime, mobile trading capabilities, or advanced trading features prevents meaningful evaluation of the trading environment. Professional traders require detailed performance metrics and platform capabilities to make informed broker selection decisions, as platform quality directly impacts trading profitability and risk management.

Critical factors such as slippage rates, requote frequency, platform stability during high-volatility periods, and the availability of advanced order types remain unknown. This information gap significantly limits the ability to recommend JKG for serious trading activities, as traders cannot assess whether the platform will meet their technical requirements and performance expectations.

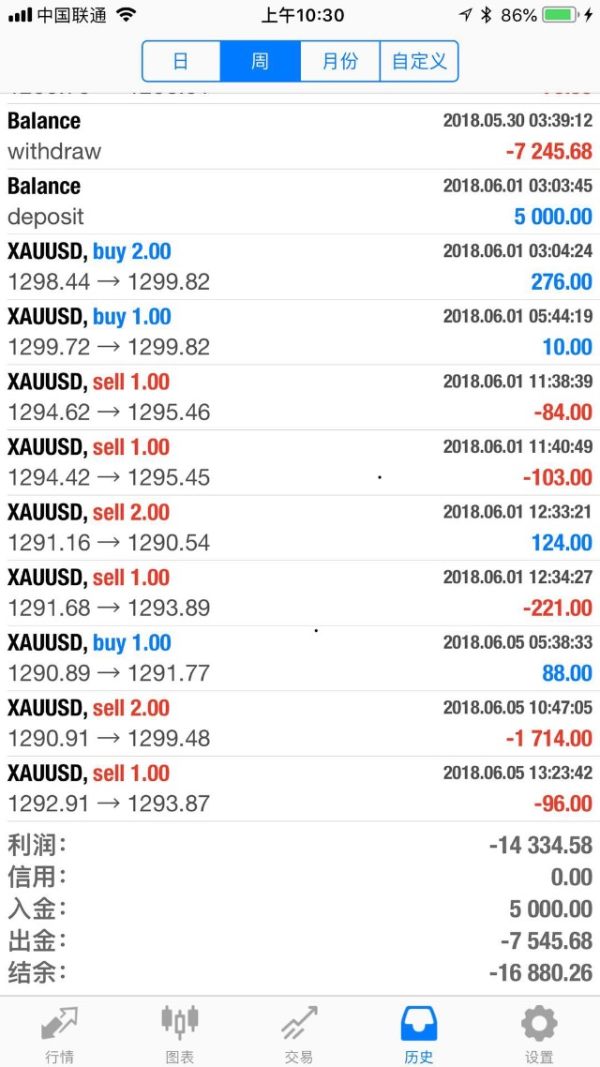

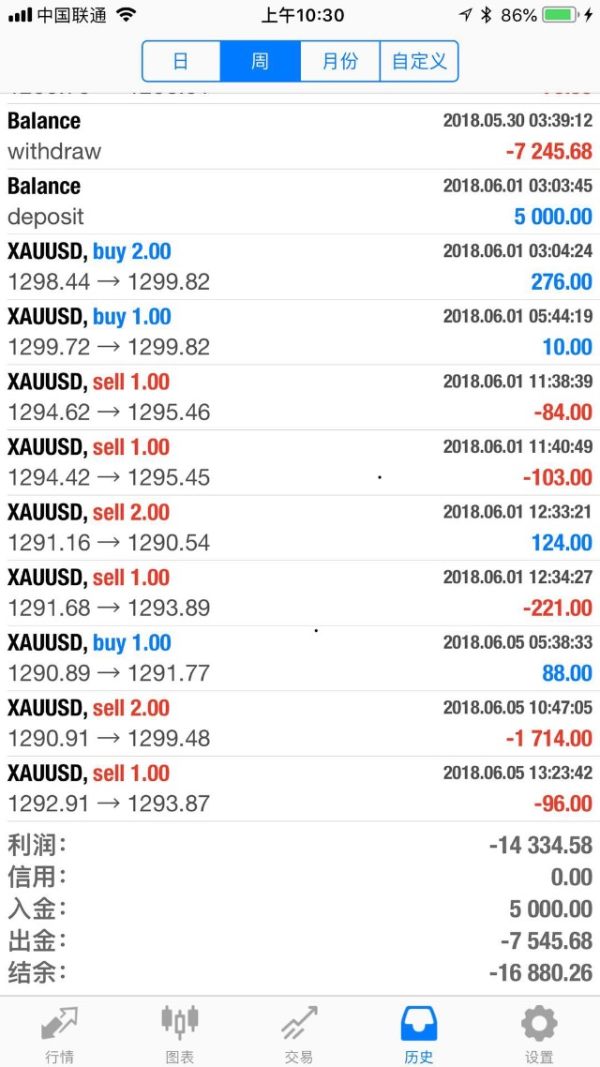

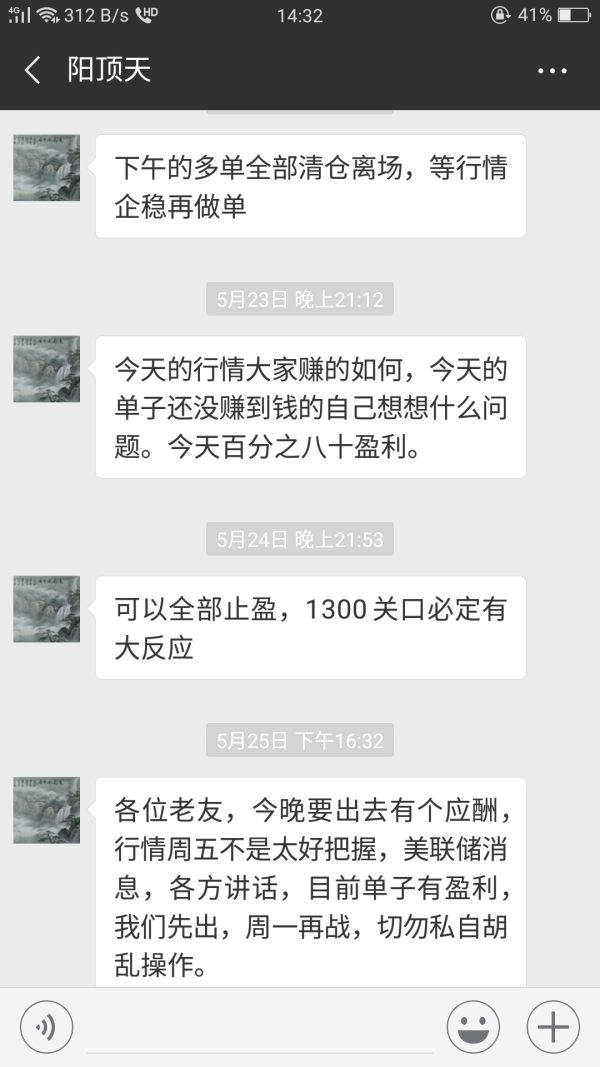

Trust and Regulation Analysis

The most significant concern in this jkg review is the absence of clear regulatory information and transparency about corporate structure. Regulatory oversight is fundamental to broker legitimacy and client fund protection in the financial services industry, and the lack of such information raises serious red flags about JKG's credibility as a financial services provider.

Without verifiable regulatory licenses, compliance documentation, or clear corporate governance information, potential clients cannot assess the safety and legitimacy of any financial services that might be offered. Established brokers typically provide detailed regulatory information, segregated account policies, and investor protection details to demonstrate their commitment to client safety and regulatory compliance.

The lack of transparency regarding fund segregation, regulatory compliance, dispute resolution procedures, and corporate governance represents a critical limitation. Professional traders require confidence in broker legitimacy and regulatory oversight before committing funds to trading accounts, as unregulated brokers pose significant risks to client capital and have limited accountability for their actions.

User Experience Analysis

Comprehensive user experience evaluation is not possible due to the absence of user feedback, interface demonstrations, or detailed service descriptions. Modern broker selection depends heavily on user experience factors including platform usability, account management efficiency, and overall service satisfaction, but none of this information is available for JKG.

The lack of accessible user reviews, testimonials, or detailed service descriptions prevents assessment of client satisfaction levels and common user experiences. Professional traders typically rely on peer feedback and detailed user experience reports when evaluating potential brokers, as real user experiences provide valuable insights into service quality and reliability.

Without evidence of positive user experiences, efficient onboarding processes, or satisfaction with service delivery, potential clients cannot gauge whether JKG provides a competitive user experience compared to established market participants. This absence of user feedback represents a significant limitation for traders who value peer recommendations and proven track records when selecting financial service providers.

Conclusion

This jkg review reveals significant limitations in available information that prevent a comprehensive assessment of JKG as a potential trading services provider. The absence of regulatory documentation, detailed service descriptions, and transparent corporate information raises serious concerns about the scope and legitimacy of any financial services offerings, making it impossible to recommend JKG to serious traders seeking reliable service providers.

While some evidence suggests JKG operates in the consumer electronics sector, the connection to forex or trading services remains unclear and unsubstantiated. Potential clients seeking reliable trading services should prioritize brokers with clear regulatory oversight, transparent service descriptions, and comprehensive client protection measures rather than entities with questionable credentials and limited public information.

The critical information gaps identified in this review suggest that serious traders should consider well-established, regulated brokers with proven track records and transparent operations rather than entities with unclear service offerings and limited public information. This recommendation becomes particularly important given the substantial financial risks associated with unregulated or poorly documented financial service providers in the trading industry.