Legit Crypto Broker 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Legit Crypto Broker positions itself as an enticing option for novice and risk-seeking traders keen on entering the cryptocurrency market without requiring substantial initial investments. This unregulated platform offers a variety of cryptocurrency trading opportunities, ranging from major coins like Bitcoin and Ethereum to emerging altcoins. However, the brokers lack of regulatory oversight and insufficient transparency about their fee structures elevate the inherent risks for prospective investors. While the allure of potentially high returns can be tempting, it's crucial for potential users to weigh these opportunities against the substantial risks posed by the unregulated nature of such trading platforms. Legit Crypto Broker may attract those willing to proceed with caution, but experienced traders are likely to avoid it due to the absence of the robust protections they desire.

⚠️ Important Risk Advisory & Verification Steps

Risk Alert: Engaging with services like Legit Crypto Broker entails significant risks, primarily due to its unregulated status. The absence of oversight increases the likelihood of operational issues and potential losses for investors.

- Potential Harms:

- Financial losses due to unregulated trading practices.

- Withdrawal issues and potential for fraud.

- Lack of clarity and transparency in fee structures, leading to unexpected expenses.

How to Self-Verify:

- Research Regulation: Check if the broker is listed on trusted regulatory authority websites such as the FCA or SEC.

- Review User Testimonials: Look for feedback from current or former users about their experiences, especially regarding withdrawals and fees.

- Estimate True Costs: Inquire about all potential fees, including withdrawals and hidden charges, before opening an account.

- Review Security Measures: Ensure that the broker employs strong security protocols to protect client funds.

- Seek Help: If questionable issues arise, report them to relevant regulatory bodies or legal authorities.

Rating Framework

Broker Overview

Company Background and Positioning

Legit Crypto Broker has emerged in the burgeoning field of cryptocurrency trading, catering particularly to novice traders. However, little is known about its founding history, physical presence, or management team, which raises concerns regarding transparency and accountability. The broker operates without regulatory oversight from recognized financial authorities, severely undermining its legitimacy in the eyes of informed investors.

Core Business Overview

The core business model of Legit Crypto revolves around offering a range of cryptocurrency trading options, including major cryptocurrencies and emerging altcoins. However, it is crucial to note that this broker lacks regulation from any notable financial authority. As such, potential investors should approach with skepticism and ensure they have a clear understanding of the risks involved.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The absence of regulation raises severe red flags about Legit Crypto Brokers operational integrity. The lack of oversight typically results in increased risks for investors, who may face problems without any recourse to authority. Reports indicate that users struggle to resolve issues with withdrawals or fees.

User Self-Verification Guide

- Visit Regulatory Websites: Check if Legit Crypto Broker appears on FCA or SEC databases.

- Search for Reviews: Look for user feedback on forums or review sites.

- Investigate Security Measures: Research what security protocols the broker claims to implement.

- Contact Customer Support: Reach out with questions to gauge responsiveness.

“I experienced significant issues attempting to withdraw funds, and customer support was slow to respond.” - User feedback from various forums.

Trading Costs Analysis

Advantages in Commissions

While Legit Crypto claims low commission fees, the lack of transparency regarding their fee structure can lead to confusion.

The "Traps" of Non-Trading Fees

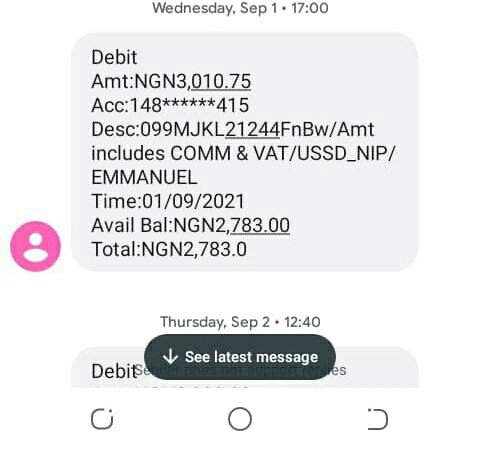

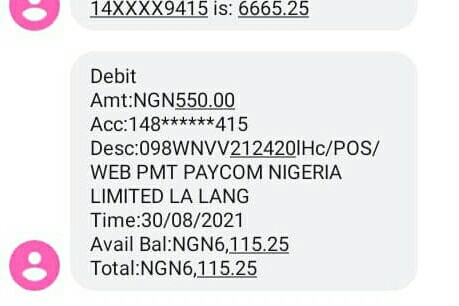

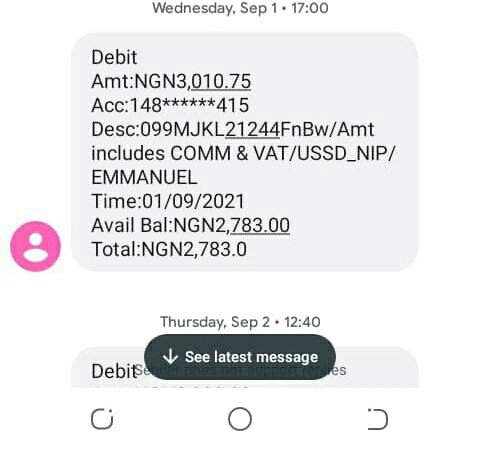

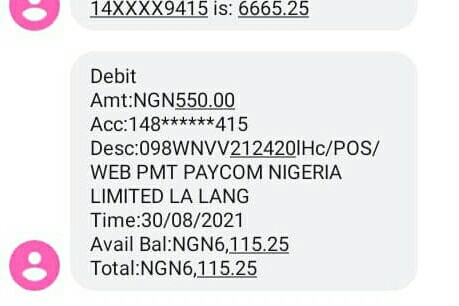

Users have reported unexpected withdrawal fees reaching as high as $40, which can significantly impact profitability.

“I was shocked when I was charged $40 to withdraw my funds. There was no mention of it during account setup.” - User testimonial.

Cost Structure Summary

For novice traders, the potential low commission may seem appealing, but hidden costs associated with withdrawals and unclear fees suggest a need for caution.

Legit Crypto Broker utilizes a proprietary platform that lacks advanced features like those offered by competitors. While its interface is user-friendly, it is not equipped with the sophisticated tools experienced traders expect.

Although some analytical tools are offered, they are basic compared to those available on more established trading platforms.

Users report mixed experiences with the platform's execution speed during high volatility, leading to missed opportunities.

"I faced several issues with order execution on busy trading days, which was frustrating." - User feedback from online discussions.

User Experience Analysis

Customer Support Analysis

Response Times

Many users have indicated that response times from customer support are unacceptably slow, especially during crucial trading periods.

Customer Support Summary

The overall sentiment regarding customer service is negative, with users frequently citing the difficulty in resolving issues related to their accounts promptly.

Account Conditions Analysis

Withdrawal Issues

Multiple complaints prominently feature withdrawal issues, highlighting the potential risks associated with investing in an unregulated broker.

Account Conditions Summary

Concerns over transparency and clarity of account conditions suggest that traders should approach with considerable caution.

Conclusion

In reviewing Legit Crypto Broker, it becomes abundantly clear that while attractive to some novice traders, the lack of regulation and transparency presents considerable risks. Given the persistent complaints related to operational inefficiencies and financial discrepancies, it is imperative for potential investors to exercise extreme caution. This platform may not provide the legitimacy or safety that informed investors typically seek. In light of these findings, alternatives that offer stronger regulatory protection and a proven record of satisfied users should be heavily considered.