Is DSOFX safe?

Business

License

Is DSOFX Safe or Scam?

Introduction

DSOFX, a forex broker operating under the name DSOFX Global Markets (U.K.) Limited, has been making waves in the online trading community. Positioned as a platform for forex trading, it markets itself to both novice and experienced traders. However, the forex market is notorious for its volatility and the presence of unscrupulous brokers, making it imperative for traders to conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive evaluation of DSOFX, exploring its regulatory compliance, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of various online sources, including user feedback, regulatory databases, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its safety. DSOFX currently operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy. Below is a summary of the regulatory information we found:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that DSOFX is not subject to the stringent rules and oversight that protect traders from fraud and malpractice. In regulated environments, brokers must adhere to strict guidelines concerning capital requirements, client fund segregation, and transparency in their operations. Without these safeguards, traders face a higher risk of losing their investments. Furthermore, the lack of any historical compliance record or regulatory scrutiny leaves potential clients vulnerable to potential scams or unethical practices.

Company Background Investigation

DSOFX was established recently, with a business model that has raised eyebrows among industry experts. The company is registered in Hong Kong, a region known for its lax regulatory environment concerning forex brokers. The management team behind DSOFX is not well-documented, which adds to the opacity surrounding the broker. This lack of transparency is alarming, as a strong management team with proven experience in the financial sector is essential for maintaining trust and reliability in any brokerage.

Additionally, the ownership structure of DSOFX is unclear, which is a red flag for potential investors. A transparent ownership model allows clients to understand who is managing their funds and what their interests are. The absence of such clarity can lead to a lack of accountability, especially if issues arise. Overall, the companys background does not inspire confidence, raising further questions about whether DSOFX is truly safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is crucial. DSOFX claims to provide competitive trading conditions; however, the lack of transparency in its fee structure is concerning. Traders often find themselves entangled in hidden fees that can significantly affect their profitability. Heres a brief overview of the core trading costs associated with DSOFX:

| Fee Type | DSOFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (1-3 pips) |

| Commission Model | N/A | Varies (0-10 USD) |

| Overnight Interest Range | N/A | Varies (1-3%) |

The absence of clear information regarding spreads and commissions suggests that traders may encounter unexpected costs that are not disclosed upfront. This lack of clarity can lead to frustration and financial loss, making it essential for traders to carefully consider whether DSOFX meets their trading needs without hidden pitfalls.

Customer Funds Safety

The safety of client funds is paramount when choosing a forex broker. DSOFX has not provided adequate information regarding its safety measures for client funds. In a well-regulated environment, brokers are required to segregate client funds from their operational capital, ensuring that traders money is protected even in the event of company insolvency. However, DSOFX's lack of regulatory oversight means that it may not have such protections in place.

Additionally, there is no mention of investor protection schemes that would typically safeguard clients in case the broker faces financial difficulties. This raises significant concerns about the safety of funds held with DSOFX. Historical incidents involving unregulated brokers often involve clients being unable to access their funds or facing long delays in withdrawals. Such scenarios highlight the risks associated with trading with a broker like DSOFX.

Customer Experience and Complaints

Customer feedback is invaluable when assessing the reliability of a broker. Reviews for DSOFX reveal a mixed bag of experiences, with several users expressing dissatisfaction regarding customer service and withdrawal processes. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresolved issues |

| Lack of Transparency | High | No clear answers |

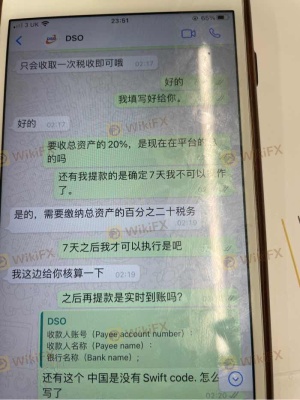

Many users have reported difficulties when attempting to withdraw their funds, often citing delays and a lack of communication from the support team. This pattern of complaints is alarming, as it indicates that DSOFX may not prioritize customer satisfaction or transparency. One typical case involved a trader who experienced a prolonged process when trying to withdraw funds, leading to frustration and a loss of trust in the platform.

Platform and Trade Execution

The trading platform offered by DSOFX is another critical aspect to consider. A reliable and efficient platform is essential for executing trades promptly and accurately. However, reviews indicate that users have faced issues with platform stability, including slow load times and occasional downtime. Additionally, concerns regarding order execution quality, such as slippage and rejected orders, have been reported.

The potential for platform manipulation is also a concern, especially with unregulated brokers. Traders have expressed worry about whether DSOFXs platform operates fairly and transparently. Without regulatory oversight, there is little recourse for traders if they suspect foul play.

Risk Assessment

Using DSOFX for trading carries several risks that potential users should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulation in place |

| Fund Safety | High | No segregation of funds |

| Customer Support | Medium | Slow response times |

| Platform Reliability | High | Reports of instability |

To mitigate these risks, traders should consider using only regulated brokers with a proven track record. Additionally, performing thorough research and starting with a small investment can help limit potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that DSOFX raises several red flags regarding its safety and reliability. The lack of regulation, transparency, and adequate customer support indicates that it may not be a trustworthy platform for trading. Therefore, traders should exercise extreme caution before engaging with DSOFX.

For those seeking safer trading environments, it is advisable to consider brokers that are regulated by reputable authorities such as the FCA, ASIC, or SEC. These brokers not only provide better security for client funds but also offer enhanced customer support and transparency in their operations. In the world of forex trading, choosing a reliable broker is paramount, and DSOFX does not currently meet the necessary criteria for safety.

Is DSOFX a scam, or is it legit?

The latest exposure and evaluation content of DSOFX brokers.

DSOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DSOFX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.