Is HND safe?

Pros

Cons

Is HND Safe or Scam?

Introduction

HND, also known as HND Global, positions itself as an online brokerage firm offering services in forex trading, cryptocurrencies, and CFDs. With the rise of online trading, the number of brokers has also surged, making it crucial for traders to carefully evaluate the credibility of these platforms. Many traders have lost significant amounts of money due to scams or unregulated brokers, which is why assessing the legitimacy of HND is essential. This article investigates whether HND is safe for trading or if it poses a risk to investors. Our analysis is based on a comprehensive review of various sources, including regulatory information, customer feedback, and operational practices.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when assessing its safety. Regulation ensures that brokers adhere to specific standards, which can protect traders' funds and provide avenues for recourse in case of disputes. Unfortunately, HND does not hold any regulatory licenses from major financial authorities, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that HND does not have to comply with the stringent requirements that regulated brokers must follow, such as maintaining segregated accounts and providing negative balance protection. This lack of oversight is alarming, as it leaves traders vulnerable to potential fraud and mismanagement of funds. Historical compliance issues are also a red flag, as unregulated brokers often engage in practices that are not in the best interest of their clients.

Company Background Investigation

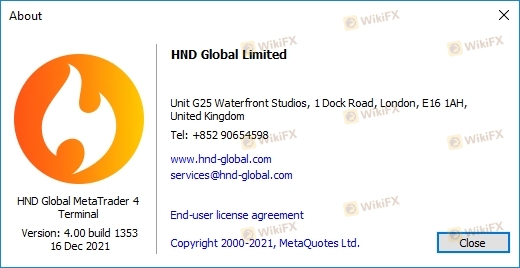

HND Global Limited claims to be based in the United Kingdom, yet there is little information to verify this assertion. The company reportedly began operations in 2021, but its ownership structure and management team remain largely undisclosed. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their leadership and operational history.

The management teams experience is crucial in determining the broker's reliability. A lack of experienced professionals in key positions can lead to poor decision-making and operational inefficiencies. Furthermore, the absence of clear ownership raises questions about accountability and the potential for fraudulent activities. Without a well-established background, it is difficult to trust HND as a reliable trading partner.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. HND offers a variety of trading instruments, but the specifics of its fee structure are less clear. Traders need to be aware of any hidden fees that could significantly affect their profitability.

| Fee Type | HND | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding fees is concerning. Traders should be wary of brokers that do not clearly outline their cost structures, as this can lead to unexpected charges that eat into profits. Furthermore, high spreads or commissions can make trading unprofitable, especially for those employing high-frequency trading strategies.

Client Funds Security

The security of client funds is paramount when selecting a broker. HND does not provide sufficient information regarding its measures for safeguarding client deposits. In regulated environments, brokers are required to maintain segregated accounts, ensuring that client funds are protected in case of bankruptcy or other financial issues.

Additionally, the absence of investor protection schemes is a significant risk. In many jurisdictions, regulated brokers are part of compensation schemes that reimburse clients in the event of insolvency. Without such protections, traders using HND risk losing their entire investment without any recourse.

Customer Experience and Complaints

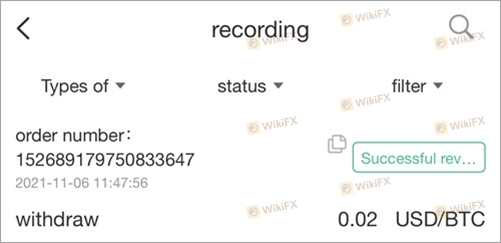

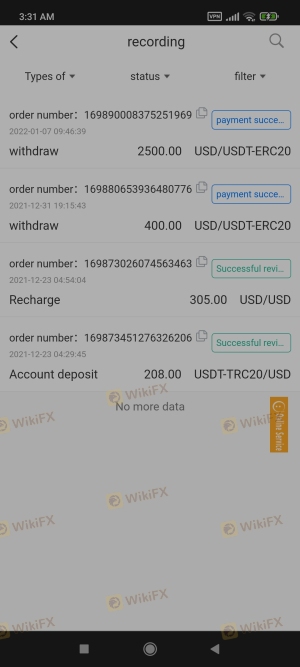

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of HND reveal a pattern of negative experiences, with many users reporting difficulties in withdrawing funds and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| Customer Service Delays | High | Poor |

Typical complaints include delays in processing withdrawals and a lack of communication from customer support. These issues can be particularly concerning for traders who need timely access to their funds. In some cases, users have reported being unable to withdraw their money altogether, raising serious questions about HND's operational practices and reliability.

Platform and Trade Execution

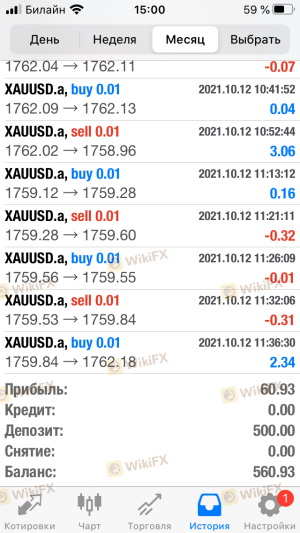

The trading platform offered by HND is Metatrader 4, a widely used software in the trading community. While MT4 is known for its robust features, the effectiveness of the platform can be undermined if the broker manipulates prices or executes trades poorly.

Concerns have been raised about order execution quality, including instances of slippage and rejected orders. Such issues can significantly impact trading outcomes, especially for strategies that rely on precise entry and exit points. If traders experience consistent problems with execution, it could indicate underlying issues within HND's operational framework.

Risk Assessment

Engaging with HND presents several risks that traders should carefully consider. The lack of regulation, combined with poor customer feedback and transparency issues, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | No investor protection |

| Operational Risk | Medium | Issues with trade execution |

To mitigate risks, traders are advised to conduct thorough research before investing. It is also recommended to start with a small amount of capital or seek out regulated alternatives to protect their investments.

Conclusion and Recommendations

In conclusion, HND appears to pose significant risks to potential investors. The absence of regulation, poor customer feedback, and transparency issues suggest that HND is not a safe trading environment. Traders should be cautious and consider the implications of engaging with an unregulated broker.

For those seeking reliable trading options, it is advisable to explore well-regulated brokers with established reputations. By prioritizing safety and transparency, traders can protect their investments and enhance their trading experience. Ultimately, the question "Is HND safe?" leans heavily towards the negative, indicating that caution is warranted when considering this broker.

Is HND a scam, or is it legit?

The latest exposure and evaluation content of HND brokers.

HND Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HND latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.