Is Weltrade safe?

Pros

Cons

Is Weltrade Safe or Scam?

Introduction

Weltrade is an international brokerage firm established in 2006, primarily operating in the foreign exchange (forex) market. It has positioned itself as a platform catering to a diverse range of traders, from beginners to experienced professionals, by offering various account types and trading instruments. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities is significant, making it crucial for traders to thoroughly evaluate the credibility and reliability of their chosen broker. This article investigates Weltrade's legitimacy, focusing on its regulatory status, company background, trading conditions, customer fund safety, and overall user experience. The findings are based on an analysis of various online sources, including reviews and regulatory databases, to provide a comprehensive assessment of whether Weltrade is safe for trading.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a critical determinant of its legitimacy and safety. Regulatory bodies are responsible for overseeing brokers to ensure they adhere to strict standards, thus protecting traders interests. In the case of Weltrade, it is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. While Weltrade claims to be regulated by several entities, including the Financial Sector Conduct Authority (FSCA) of South Africa, the legitimacy of these claims is questionable.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 50691 | South Africa | Exceeded |

| NBRB | 192727233 | Belarus | Revoked |

| FSC | IFSC/60/350/TS/17 | Belize | Revoked |

The table above highlights the regulatory status of Weltrade and indicates that it has faced issues with licensing in multiple jurisdictions. The FSCA's status of "exceeded" raises concerns about the broker's compliance with the necessary regulatory requirements. Furthermore, the revocation of licenses by the NBRB and FSC suggests a history of non-compliance or operational issues, which could jeopardize client funds and trading conditions. Given the lack of robust regulatory oversight, it is vital for potential traders to consider the risks associated with trading through an unregulated broker like Weltrade.

Company Background Investigation

Weltrade's history and ownership structure provide insight into its operational integrity. Established in 2006, the firm has undergone several changes, including rebranding and shifting its registration across different jurisdictions. The company's ownership is held by System Gates Ltd, which operates in various countries, including Russia, Belarus, and Ukraine. However, the frequent changes in registration and the offshore nature of its operations raise questions about transparency and accountability.

The management team behind Weltrade consists of professionals with varying degrees of experience in finance and technology. While the firm claims to prioritize customer service and transparency, there is limited publicly available information about the management's qualifications and experience. This lack of transparency can be a red flag for potential investors, as it complicates the assessment of the broker's reliability and operational practices.

Moreover, the company's commitment to transparency is further challenged by its history of changing regulatory jurisdictions. Frequent relocations can be indicative of a broker attempting to evade regulatory scrutiny, which is a concerning factor for traders evaluating whether Weltrade is safe to use.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall value proposition. Weltrade provides a variety of account types, each with different minimum deposit requirements, leverage options, and spreads. However, the overall cost structure can significantly impact a trader's profitability.

| Fee Type | Weltrade | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips (Micro) | 1.0 - 1.5 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

The table above illustrates the fee structure associated with Weltrade. While the spreads for the micro account are competitive, the lack of commission on trades may be offset by wider spreads on certain account types. Additionally, the overnight interest rates can vary, which may affect traders holding positions overnight.

Moreover, some users have reported unexpected fees or unfavorable trading conditions, such as increased spreads during volatile market conditions. Such practices can lead to significant losses, particularly for scalpers or day traders who rely on tight spreads and low fees. Therefore, it is essential for traders to scrutinize the trading conditions carefully and consider whether Weltrade is safe for their trading strategies.

Customer Fund Safety

The safety of customer funds is paramount for any trading platform. Weltrade claims to implement various measures to ensure the security of client funds, including segregating client accounts from the company's operating funds. This practice is crucial for protecting traders' investments in the event of financial difficulties faced by the broker.

However, the lack of regulation raises concerns about the effectiveness of these measures. Without oversight from a reputable regulatory authority, there is no guarantee that client funds are adequately protected. Additionally, Weltrade offers negative balance protection, which is a positive feature, but it does not entirely mitigate the risks associated with trading with an unregulated broker.

Historically, some traders have reported issues with fund withdrawals and delays in processing, which can be indicative of underlying financial problems within the broker. Such incidents raise significant concerns about the overall safety of funds held with Weltrade and whether traders can trust that their investments are secure. Consequently, potential clients should carefully weigh these risks when considering whether Weltrade is safe for their trading activities.

Customer Experience and Complaints

Customer feedback is an essential component in evaluating a broker's performance. Reviews of Weltrade reveal a mixed bag of experiences among users. While some traders report positive experiences, including responsive customer support and efficient withdrawals, others have raised serious complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| High Spreads During Volatility | High | No explanation |

The table above summarizes common complaints associated with Weltrade. Withdrawal delays have been a recurring issue, with some traders reporting that their requests were not processed in a timely manner. This can be particularly concerning for traders who need quick access to their funds. Furthermore, the quality of customer support appears to be inconsistent, with some users experiencing unhelpful or unresponsive service.

A typical case involves a trader who attempted to withdraw funds only to encounter delays and a lack of communication from the support team. This experience can lead to frustration and a loss of trust in the broker's ability to manage clients' funds effectively. Such issues raise significant concerns about whether Weltrade is safe for trading, as a broker's reliability is often reflected in its ability to address customer inquiries and resolve issues promptly.

Platform and Execution

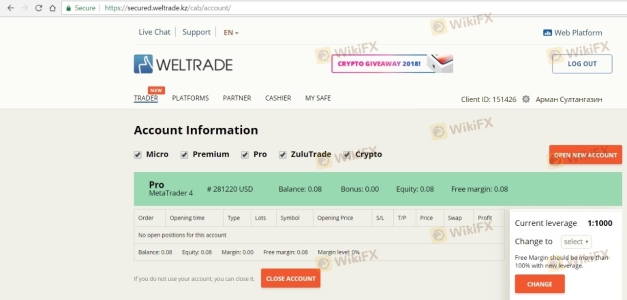

The performance of a trading platform is critical to a trader's success. Weltrade offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are well-regarded in the industry for their robust features and user-friendly interfaces. However, the overall execution quality and stability of the platform are equally important.

Traders have reported varying experiences with order execution on Weltrade. While some users praise the speed and reliability of the platform, others have noted instances of slippage and order rejections. Such issues can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies.

Additionally, there are concerns about potential platform manipulation, especially during periods of high volatility. If traders experience significant slippage or are unable to execute trades at their desired prices, it could indicate underlying issues with the broker's execution practices. Therefore, it is essential for traders to assess whether Weltrade is safe based on their specific trading needs and strategies.

Risk Assessment

Trading with any broker carries inherent risks, and Weltrade is no exception. The lack of regulation, combined with reports of customer complaints and withdrawal issues, raises several risk factors for potential traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates without robust oversight |

| Withdrawal Risk | High | Complaints about delays |

| Trading Condition Risk | Medium | Potentially high trading costs |

The table above summarizes key risk areas associated with trading with Weltrade. The high regulatory risk stems from its unregulated status, which can leave traders vulnerable in the event of disputes or financial issues. Furthermore, the withdrawal risk is exacerbated by reports of delays and poor customer service, making it essential for traders to consider these factors when evaluating whether Weltrade is safe for their investments.

To mitigate these risks, potential traders should conduct thorough research, consider starting with a smaller investment, and be prepared for potential challenges when withdrawing funds.

Conclusion and Recommendations

In conclusion, the investigation into Weltrade reveals several concerning factors that potential traders should consider. While the broker offers a range of trading instruments and competitive account options, its lack of robust regulation and history of customer complaints raises significant concerns about its safety and reliability.

Traders should approach Weltrade with caution, especially given the numerous reports of withdrawal issues and inconsistent customer support. It is essential to weigh these risks against the potential benefits of trading with this broker.

For those seeking a more secure trading environment, it may be advisable to consider alternative brokers that are well-regulated and have a proven track record of reliability. Some recommended alternatives include brokers regulated by the FCA, ASIC, or CySEC, which typically offer greater protection for traders' funds and more transparent trading conditions.

Ultimately, whether Weltrade is safe for trading depends on individual risk tolerance and trading strategies, but potential clients should proceed with caution and conduct thorough due diligence before making any commitments.

Is Weltrade a scam, or is it legit?

The latest exposure and evaluation content of Weltrade brokers.

Weltrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Weltrade latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.