Cemx 2025 Review: Everything You Need to Know

Executive Summary

This Cemx review looks at the broker's current position in the forex trading market. The company shows mixed results for potential traders based on employee data and limited public information. Cemx received a solid 4.6 out of 5 rating on AmbitionBox, which suggests the company runs well internally. However, the CareerBliss rating of 6 out of 5 seems wrong and makes us question if the data is reliable.

Cemx focuses on traders who want forex trading and stock investment options. Our analysis shows big gaps in information about trading conditions, regulatory oversight, and client service standards that potential users should think about carefully. The lack of complete trading data and client reviews makes it hard to give a clear recommendation for this broker right now.

Important Notice

This Cemx review uses information from employee satisfaction websites and limited public sources. Different regional offices may operate differently, though we don't have details about specific regulatory differences. Our review method looks at company performance data and employee feedback while noting that important information about regulatory compliance, trading conditions, and client protection is missing from the materials we reviewed. Traders should do more research before making investment decisions.

Rating Framework

Broker Overview

Cemx works in the financial services sector. We don't have complete details about when the company started or its founding background from available materials. The company seems to focus on providing trading services to clients interested in forex markets and stock investments based on limited available information.

However, specific details about the company's history, leadership, and business growth are not documented in current sources. The broker's business model and how it operates are not clearly explained in accessible materials. Without detailed information about how trading works, revenue structures, or client relationship management, it's hard to give a thorough assessment of Cemx's market position.

This Cemx review must acknowledge these information gaps while highlighting the need for better transparency in the broker's public communications. Available information doesn't specify the trading platforms offered by Cemx or detail the range of financial instruments available to clients. Similarly, regulatory oversight details, including licensing jurisdictions and compliance frameworks, are not documented in reviewed sources, creating big gaps in our evaluation process.

Regulatory Jurisdictions: Specific regulatory information not available in current sources, creating uncertainty about client protection measures and compliance standards.

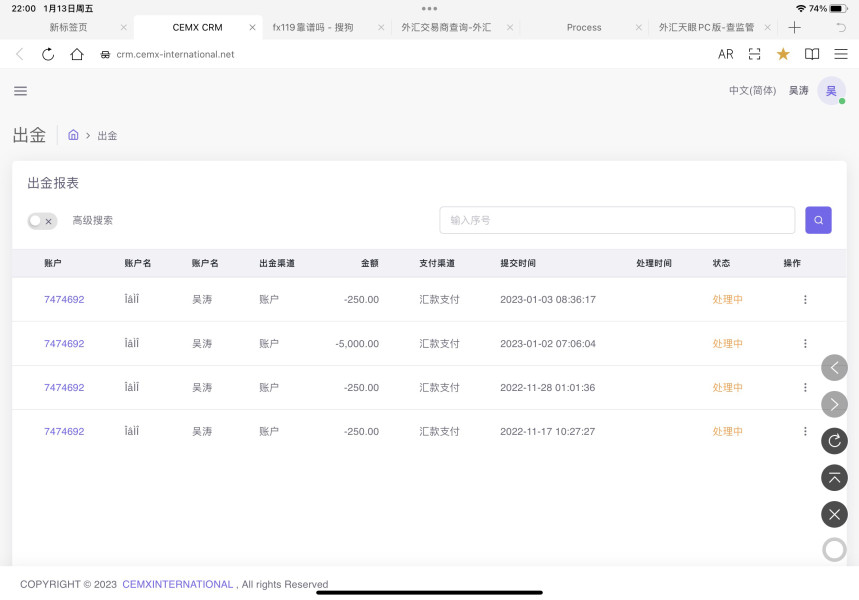

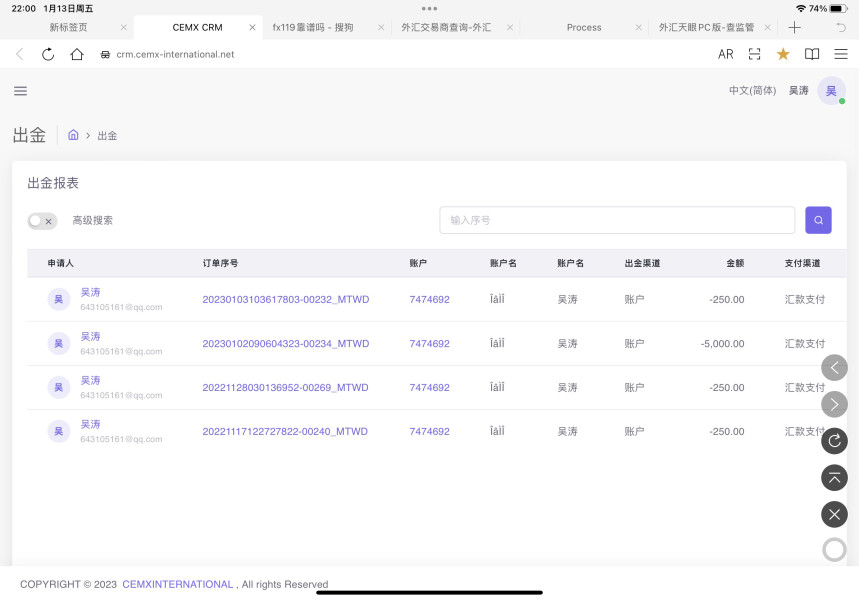

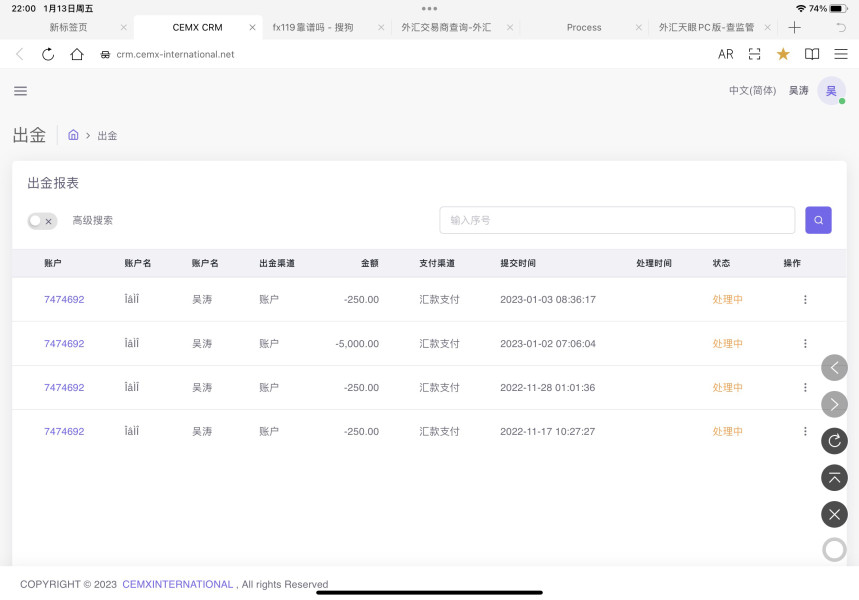

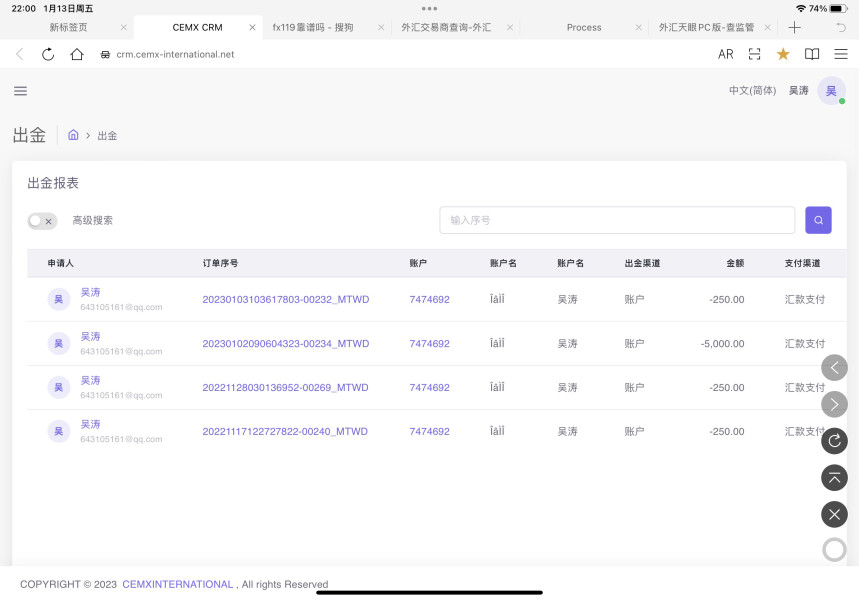

Deposit and Withdrawal Methods: Payment processing options and fund transfer procedures not detailed in accessible materials.

Minimum Deposit Requirements: Entry-level investment thresholds not specified in reviewed sources.

Promotional Offers: Current bonus structures and incentive programs not documented in available information.

Available Assets: Specific tradeable instruments and market coverage not outlined in accessible materials.

Cost Structure: Commission rates, spread information, and fee schedules not provided in current sources, making cost comparison difficult.

Leverage Options: Maximum leverage ratios and margin requirements not specified in reviewed materials.

Platform Selection: Trading software options and technological infrastructure not detailed in available sources.

Geographic Restrictions: Regional availability and access limitations not documented in current materials.

Customer Support Languages: Multilingual service availability not specified in accessible information.

This Cemx review highlights big information gaps that potential clients should address through direct broker contact before opening accounts.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Cemx's account conditions faces major limitations due to insufficient publicly available information. Standard account types, their features, and minimum funding requirements are not detailed in current sources. This lack of transparency makes it difficult for potential traders to understand entry barriers and account progression opportunities within the broker's service structure.

Account opening procedures, verification requirements, and approval timeframes remain unspecified in accessible materials. The absence of information about specialized account options, such as Islamic accounts for Shariah-compliant trading or professional accounts for experienced traders, makes the assessment process more complicated. Without clear documentation of account benefits, restrictions, and operational parameters, this Cemx review cannot provide clear guidance about account suitability for different trader profiles.

The broker's approach to client categorization, risk assessment procedures, and account management services are not outlined in available sources, creating more uncertainty about the overall account experience.

Assessment of Cemx's trading tools and resources proves challenging due to limited available information about the broker's technology offerings. Details about charting capabilities, technical analysis tools, and market research resources are not specified in current sources. This information gap makes it difficult to evaluate the broker's competitive position in terms of trading support and analytical capabilities.

Educational resources, including webinars, tutorials, and market commentary, are not documented in accessible materials. The availability of automated trading support, expert advisors, and algorithmic trading capabilities remains unspecified. Without complete information about research quality, market insights, and educational content, potential traders cannot properly assess the value of Cemx's supplementary services.

Third-party integrations, mobile applications, and cross-platform compatibility details are not provided in reviewed sources, limiting our ability to evaluate the broker's technology ecosystem completely.

Customer Service and Support Analysis

Evaluation of Cemx's customer service capabilities is limited by the absence of detailed information about support channels, response times, and service quality standards. Available sources don't specify whether the broker offers live chat, phone support, email assistance, or other communication methods. Operating hours, regional support availability, and escalation procedures remain undocumented.

Multilingual support capabilities and the geographic distribution of customer service teams are not outlined in accessible materials. Without specific client feedback about problem resolution efficiency, support staff competency, or overall service satisfaction, this assessment cannot provide concrete insights into the customer service experience.

The broker's approach to handling complaints, dispute resolution procedures, and client relationship management practices are not detailed in current sources, creating big gaps in service quality evaluation.

Trading Experience Analysis

The trading experience evaluation for Cemx faces major limitations due to insufficient information about platform performance, execution quality, and user interface design. Details about order execution speeds, slippage rates, and server stability are not provided in accessible sources. This absence of technical performance data makes it challenging to assess the broker's operational reliability.

Platform functionality, including order types, risk management tools, and customization options, remains unspecified in available materials. Mobile trading capabilities, cross-device synchronization, and offline functionality details are not documented. Without complete information about trading environment quality, execution transparency, and platform reliability, potential users cannot make informed decisions about the technical aspects of trading with Cemx.

User interface design, navigation efficiency, and overall platform usability metrics are not available in reviewed sources, further limiting our ability to provide a thorough Cemx review of the trading experience.

Trust and Security Analysis

Assessment of Cemx's trustworthiness and security measures is significantly hampered by the lack of available regulatory information and transparency details. Specific licensing jurisdictions, regulatory compliance status, and oversight mechanisms are not documented in accessible sources. This absence of regulatory clarity raises important questions about client protection standards and fund security measures.

Information about segregated client accounts, deposit insurance coverage, and financial reporting transparency is not provided in current materials. The broker's operational history, including any regulatory actions, client disputes, or industry recognition, remains undocumented. Without clear evidence of regulatory compliance, financial stability, and operational integrity, potential clients face uncertainty about the safety of their investments.

Third-party audits, security certifications, and risk management frameworks are not detailed in available sources, creating additional concerns about the broker's commitment to client protection and operational transparency.

User Experience Analysis

The user experience evaluation for Cemx is limited by insufficient information about client satisfaction levels, platform usability, and overall service quality. Available sources don't provide complete user feedback, satisfaction surveys, or detailed testimonials that would enable a thorough assessment of the client experience.

Registration procedures, account verification processes, and onboarding efficiency are not detailed in accessible materials. Fund deposit and withdrawal experiences, including processing times and potential complications, remain unspecified. Without concrete user feedback about common issues, service strengths, or areas for improvement, this evaluation cannot provide clear insights into the overall user experience.

Interface design quality, learning curve considerations, and user support effectiveness are not documented in current sources, limiting our ability to assess the broker's user-focused approach completely.

Conclusion

This complete Cemx review reveals major information limitations that make it challenging to provide a clear assessment of the broker's services and reliability. While employee satisfaction ratings on platforms like AmbitionBox show some positive signs with a 4.6 out of 5 rating, the overall lack of transparency about essential trading conditions, regulatory status, and client service standards raises important concerns.

For traders seeking a well-documented, transparent, and completely regulated forex broker, Cemx may not currently meet these requirements based on available information. The absence of detailed trading conditions, regulatory clarity, and client testimonials suggests that potential users should exercise considerable caution and conduct extensive additional research before considering this broker.

The primary advantage appears to be some positive employee feedback, indicating potential internal operational competency. However, the major disadvantages include substantial information gaps, unclear regulatory status, and insufficient transparency about trading conditions and client protection measures that are essential for informed trading decisions.