WealthFX 2025 Review: Everything You Need to Know

Executive Summary

WealthFX is a forex broker that operates under Wealth FX Liquidity Limited. The Mauritius Financial Services Commission regulates this company and provides oversight for its trading operations. This wealthfx review shows a broker that offers commission-free trading services with a low minimum deposit of just $100. This makes it easy for beginner traders and small investors to start trading without a large upfront cost.

The platform gives traders access to multiple types of investments including forex, indices, and stocks. WealthFX claims to use an advanced trading platform that processes trades quickly and efficiently. However, our research shows some potential problems with how transparent the company is about its operations. According to Scams Report, there are questions about how clearly the broker explains its business practices to customers.

The broker mainly targets retail traders who are new to forex trading. Its low entry requirements and commission-free structure appeal to people just starting out in trading. Despite having 18 reviews on Trustpilot, the overall user feedback is still limited and doesn't give us a complete picture of customer satisfaction. The Mauritius FSC regulation does provide some protection for traders, but this may not be as strong as regulation from top-tier financial authorities.

Important Disclaimers

Traders should know that WealthFX operates through Wealth Fx Liquidity Limited. Users must understand that the regulatory background may affect trading safety and how secure their funds are. The Mauritius Financial Services Commission provides oversight, but traders should think about whether this level of protection matches their comfort with risk.

This review uses information from multiple sources including Scams Report and Trustpilot reviews. The analysis includes user feedback and regulatory information that was available when this review was written. Prospective traders should do their own research and check all information on their own before making any trading decisions.

Rating Framework

Broker Overview

WealthFX operates under the company name Wealth FX Liquidity Limited. The company says it focuses on following rules and being reliable in the competitive forex market. WealthFX emphasizes that it wants to provide trading services that are easy to access, especially for people who are new to forex trading.

The broker's business model centers around commission-free trading across many different financial products. This means they make money through spread-based pricing instead of charging direct fees to traders. The platform offers trading access to foreign exchange pairs, stock indices, individual stocks, and other financial products that traders can buy and sell.

According to available information, WealthFX uses what they call an advanced trading platform designed to execute trades quickly. However, specific details about the platform and its technology are not well documented in the sources we found. WealthFX operates under the regulatory oversight of the Mauritius Financial Services Commission, which provides a framework for how the broker must conduct its business.

This wealthfx review notes that while FSC regulation offers some protection, traders should understand what this means compared to other international regulatory bodies. The broker says it emphasizes compliance and reliability, which suggests it wants to build trust in a market where regulatory credibility is very important.

Regulatory Jurisdiction: WealthFX operates under the supervision of the Mauritius Financial Services Commission. This regulatory body provides oversight for financial services companies that operate within and from Mauritius.

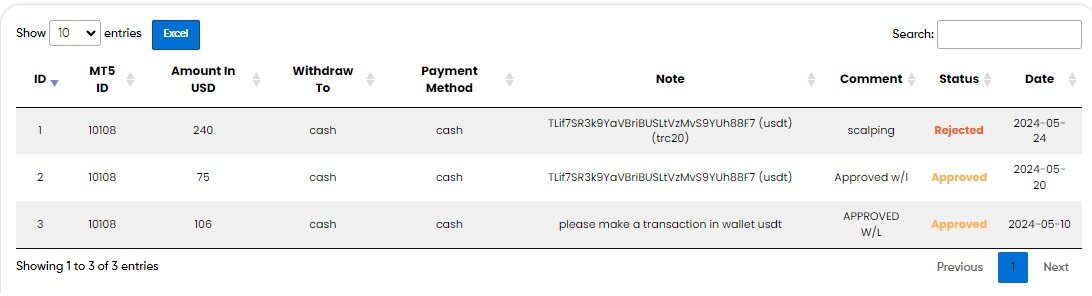

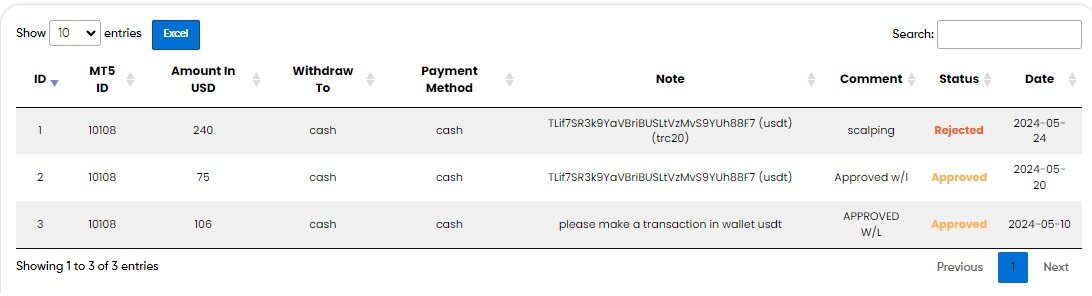

Deposit and Withdrawal Methods: Specific information about how to deposit and withdraw money is not detailed in available sources. Prospective traders need to contact the broker directly to get complete information about payment processing options.

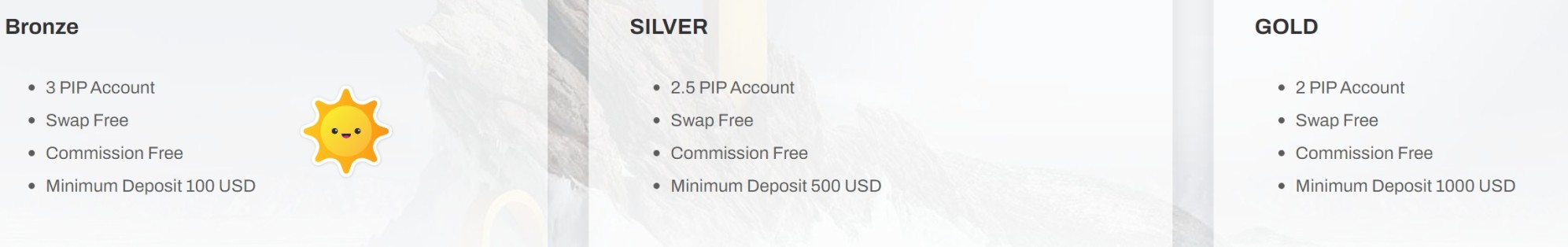

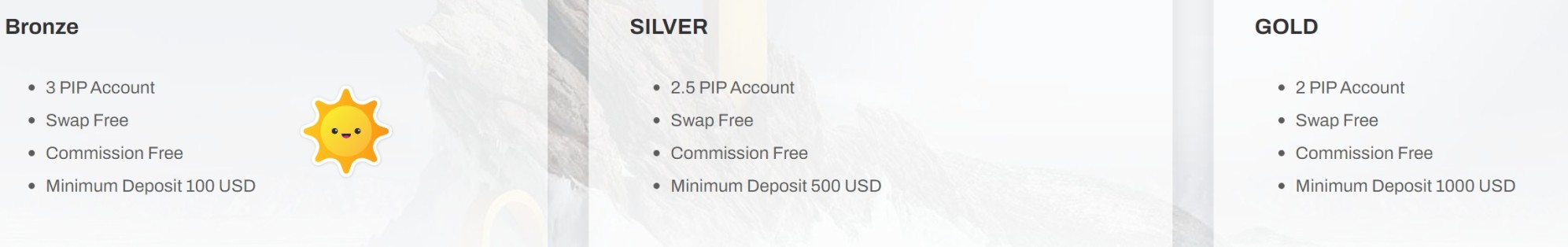

Minimum Deposit Requirements: The broker requires a minimum deposit of $100 to start trading. This low threshold makes the platform accessible to retail traders who don't have a lot of money to start with.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not specifically detailed in available documentation. Traders should ask the broker directly about any available incentives or special offers.

Tradeable Assets: The platform provides access to forex currency pairs, stock indices, individual stocks, and additional financial instruments. This gives traders opportunities to diversify their portfolios across different types of investments.

Cost Structure: WealthFX operates on a commission-free model and makes money through spread-based pricing instead. However, specific information about spreads is not detailed in available sources.

Leverage Ratios: Leverage information is not specified in available materials. Traders need to contact the broker directly to find out what leverage options are available.

Platform Options: The broker claims to offer an advanced trading platform with fast execution capabilities. However, specific platform names and detailed technical specifications are not provided in current documentation.

Geographic Restrictions: Specific information about which countries or regions cannot use the platform is not detailed in available sources. Traders should check with the broker about any geographic limitations that might apply.

Customer Support Languages: The languages that customer service supports are not specified in current available information. This wealthfx review highlights that prospective traders need to get additional information directly from the broker about specific operational details.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

WealthFX shows competitive account conditions mainly through its accessible minimum deposit requirement of $100. This significantly lowers the barrier for new forex traders who want to start learning without risking large amounts of money. The commission-free trading structure is another positive aspect that can reduce overall trading costs for people who trade frequently.

However, there isn't enough detailed information about different account types and their specific features. Available sources don't specify whether multiple account levels exist or what additional features might be available to clients who deposit more money. The absence of information about special account features, such as Islamic accounts for Muslim traders, represents a gap in available documentation.

Details about the account opening process are not extensively documented in available sources. This makes it difficult to assess how efficient and user-friendly the registration procedure actually is. This wealthfx review notes that while the basic account conditions appear competitive, the lack of comprehensive information about account variations and features prevents a higher rating in this category.

The trading tools and resources offered by WealthFX include access to multiple asset classes such as forex pairs, indices, and stocks. This provides traders with opportunities to diversify across different markets and investment types. The broker's claim of offering an advanced trading platform suggests some level of technological sophistication, though specific details about platform features and capabilities are not extensively documented.

Research and analysis resources are not specifically detailed in available sources. This leaves questions about whether traders can access market analysis, economic calendars, or technical analysis tools. Educational resources such as webinars, tutorials, or trading guides are not mentioned in current documentation, which is a significant gap for a broker that targets beginner traders who typically need substantial educational support.

Automated trading support, including Expert Advisor compatibility or signal services, is not addressed in available information. This omission is notable because automated trading tools are important for many modern forex traders. The lack of detailed information about research tools, educational materials, and advanced trading features limits the overall assessment of what the broker offers in terms of tools and resources.

Customer Service and Support Analysis (Score: 5/10)

Customer service information for WealthFX is notably limited in available sources. There are no specific details about support channels, availability hours, or how quickly they respond to customer inquiries. This lack of transparency about customer support is a significant concern for potential traders who may need help with platform navigation, account issues, or trading questions.

The absence of information about available communication methods such as live chat, email support, or telephone assistance makes it difficult for prospective clients to understand how they can reach support when needed. Response time expectations and service quality indicators are not documented in available sources, which prevents assessment of how efficient their support actually is.

Multilingual support capabilities are not specified, which could be problematic for international traders who may need assistance in their native languages. The lack of documented customer service hours or 24/7 availability information is particularly concerning for forex traders who may need support during various global trading sessions. Without specific user feedback about support experiences or how they resolve problems, this category receives a below-average rating.

Trading Experience Analysis (Score: 7/10)

WealthFX promotes fast execution speeds as a key feature of their trading platform. This is crucial for forex traders who need timely order processing to take advantage of market movements. The commission-free trading structure can enhance the overall trading experience by reducing transaction costs, which is particularly beneficial for people who trade frequently or have smaller account balances.

However, specific information about order execution quality, including potential slippage rates or how often quotes change, is not detailed in available sources. Platform stability and reliability data are not documented, making it difficult to assess how well the technology performs during high-volatility market conditions or busy trading hours.

The lack of detailed information about charting tools, technical indicators, and analytical features limits our assessment of how well the platform works for technical analysis. Mobile trading platform availability and user experience are not specifically addressed in current documentation. While the basic trading experience appears to offer some positive elements such as fast execution and commission-free trading, the absence of comprehensive platform details prevents a higher rating in this wealthfx review.

Trust and Security Analysis (Score: 6/10)

WealthFX operates under the regulatory oversight of the Mauritius Financial Services Commission with license number 0563334. This provides some level of regulatory protection for traders who use the platform. However, according to Scams Report, there are concerns about transparency and fund management practices that potential traders should carefully consider before opening accounts.

Specific fund safety measures such as segregated client accounts, investor compensation schemes, or third-party fund custody arrangements are not detailed in available sources. This lack of transparency about how client funds are protected represents a significant concern for traders who prioritize keeping their money safe.

The broker's industry reputation and any awards or recognition are not documented in available sources. Trustpilot shows 18 user reviews, though the specific overall rating and detailed user experiences about trustworthiness are not comprehensively detailed. How the company handles negative events or disputes is not addressed in current documentation, making it difficult to assess the broker's approach to problem resolution and client protection.

User Experience Analysis (Score: 6/10)

User experience assessment for WealthFX is limited by the availability of comprehensive user feedback. Trustpilot shows 18 reviews, which indicates some level of user engagement with the platform. However, the specific overall satisfaction rating and detailed user experiences are not extensively documented in available sources, making it challenging to provide a complete user experience evaluation.

Interface design and platform usability feedback are not detailed in current documentation. This prevents assessment of how user-friendly the platform is and how difficult it might be for new traders to learn. Registration and verification process experiences are not documented, making it difficult to evaluate how convenient and efficient the account opening process actually is.

The user demographic appears to align with the broker's targeting of beginners and small-scale investors, given the low minimum deposit requirement and commission-free structure. However, specific user complaints or common issues are not detailed in available sources. The lack of balanced positive and negative user feedback presentation limits the comprehensive assessment of overall user satisfaction and experience quality.

Conclusion

This wealthfx review reveals a forex broker with mixed characteristics that may appeal to specific types of traders while raising some concerns for others. WealthFX operates under Mauritius FSC regulation and offers accessible entry conditions with a $100 minimum deposit and commission-free trading structure, making it potentially suitable for beginning traders and small-scale investors.

The broker's main advantages include low barrier to entry, commission-free trading, and claimed fast execution speeds. However, significant concerns exist regarding transparency and fund management practices, as noted by industry watchdogs. The limited availability of detailed information about platform features, customer support, and user experiences represents additional considerations for prospective traders.

WealthFX may be most appropriate for novice traders seeking low-cost entry into forex markets. However, more experienced traders or those prioritizing comprehensive platform features and robust regulatory protection may find better alternatives elsewhere. Potential clients should conduct thorough research and carefully consider the transparency concerns before committing funds to this platform.