ViewTrade 2025 Review: Everything You Need to Know

Executive Summary

ViewTrade is a global brokerage firm and technology provider that specializes in financial technology and cross-border investment solutions. The company operates under the regulation of the United States Securities and Exchange Commission and maintains memberships with several key financial industry organizations including FINRA, SIPC, NYSE Arca, NASDAQ, CBOE Edge, and CBOE BATS. This comprehensive viewtrade review examines the broker's offerings for investors seeking online stock and options trading capabilities.

The platform stands out through its strong API infrastructure and advanced front-end trading technology. ViewTrade uses artificial intelligence to reshape wealth management practices. The broker's primary focus centers on providing institutional-grade trading solutions while maintaining accessibility for individual investors. The broker offers multiple account types including Pattern Day Trader accounts, Cash accounts, and Margin accounts to accommodate different trading styles and regulatory requirements.

Based on available information and user feedback analysis, ViewTrade demonstrates strong regulatory compliance and technological capabilities. However, certain areas such as detailed fee structures and comprehensive user experience data remain limited in publicly available sources. The platform appears well-suited for investors prioritizing regulatory security and advanced trading technology in their brokerage selection process.

Important Notice

This evaluation acknowledges that different regional entities may present varying regulatory standards and service offerings to users across different jurisdictions. Potential clients should verify specific regulatory compliance and available services in their respective regions before engaging with the platform.

The assessment methodology employed in this review relies on comprehensive analysis of publicly available information, regulatory filings, and aggregated user feedback from multiple sources. All data presented has been cross-referenced where possible. However, some information gaps exist due to limited public disclosure in certain operational areas.

Rating Framework

The scoring methodology considers regulatory strength, platform capabilities, available account options, and limited user feedback data. Higher scores in trust and regulation reflect the broker's comprehensive regulatory framework. Lower scores in customer service and user experience indicate areas where publicly available information remains insufficient for thorough evaluation.

Broker Overview

ViewTrade operates as a comprehensive financial services provider focusing on the intersection of traditional brokerage services and modern financial technology solutions. The company positions itself as a bridge between conventional trading practices and innovative fintech applications. It emphasizes cross-border investment capabilities for a global client base. While specific founding details are not extensively documented in available sources, the firm has established itself within the competitive landscape of online trading platforms through its technology-first approach.

The brokerage model centers on providing direct market access through sophisticated trading infrastructure while maintaining regulatory compliance across multiple jurisdictions. ViewTrade's business approach emphasizes scalability and customization. The company offers both retail and institutional clients access to equity and options markets through advanced technological interfaces.

This viewtrade review reveals that the platform primarily serves online stock and options trading markets. It operates under SEC oversight with additional regulatory relationships through industry organization memberships. The regulatory framework provides a foundation of credibility, particularly important for investors prioritizing security and compliance in their brokerage relationships. The company's focus on artificial intelligence integration suggests a forward-looking approach to wealth management and trading execution.

Regulatory Framework: ViewTrade maintains regulatory compliance through SEC oversight and holds memberships with FINRA, SIPC, NYSE Arca, NASDAQ, CBOE Edge, and CBOE BATS. This comprehensive regulatory structure provides multiple layers of oversight and industry standard compliance protocols for client protection.

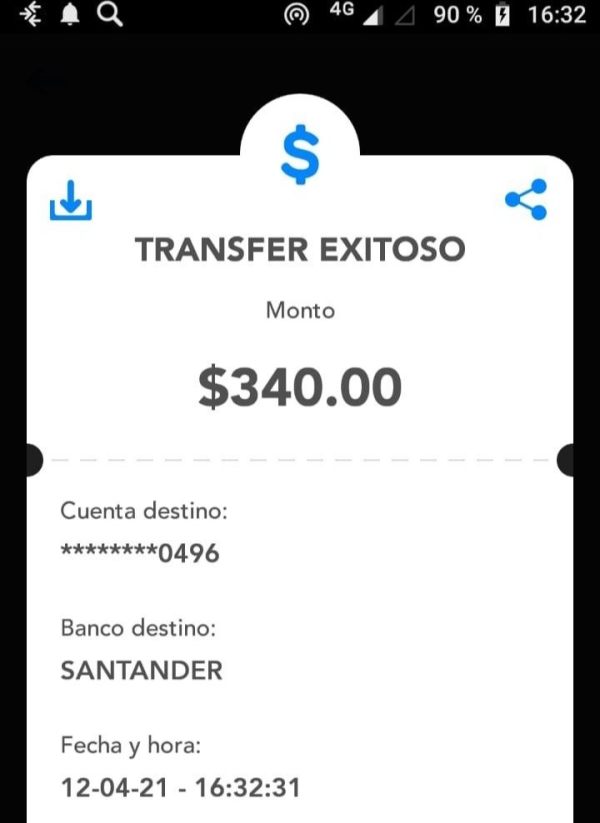

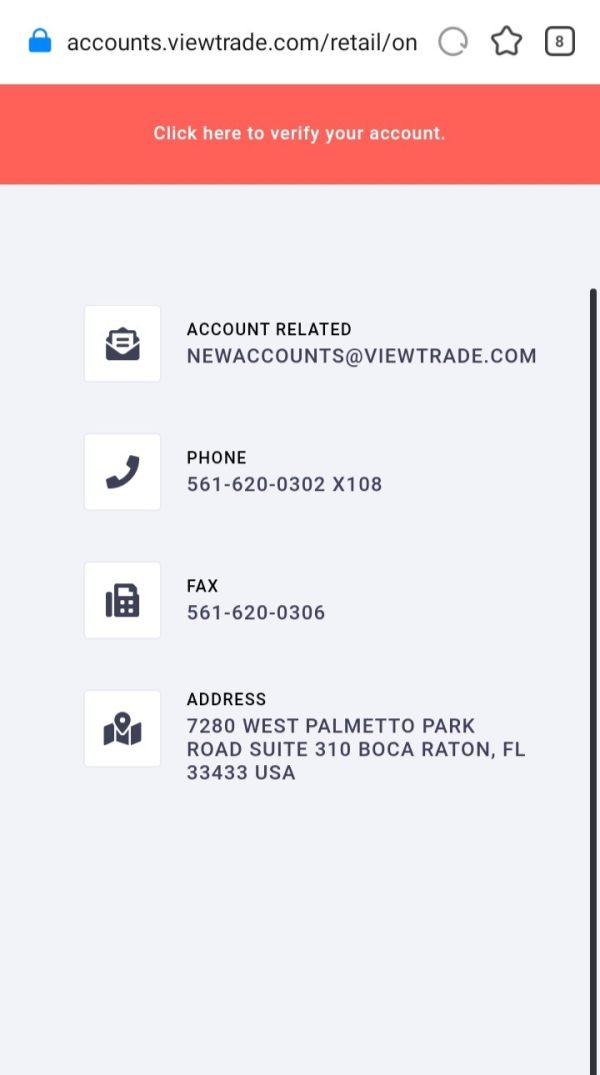

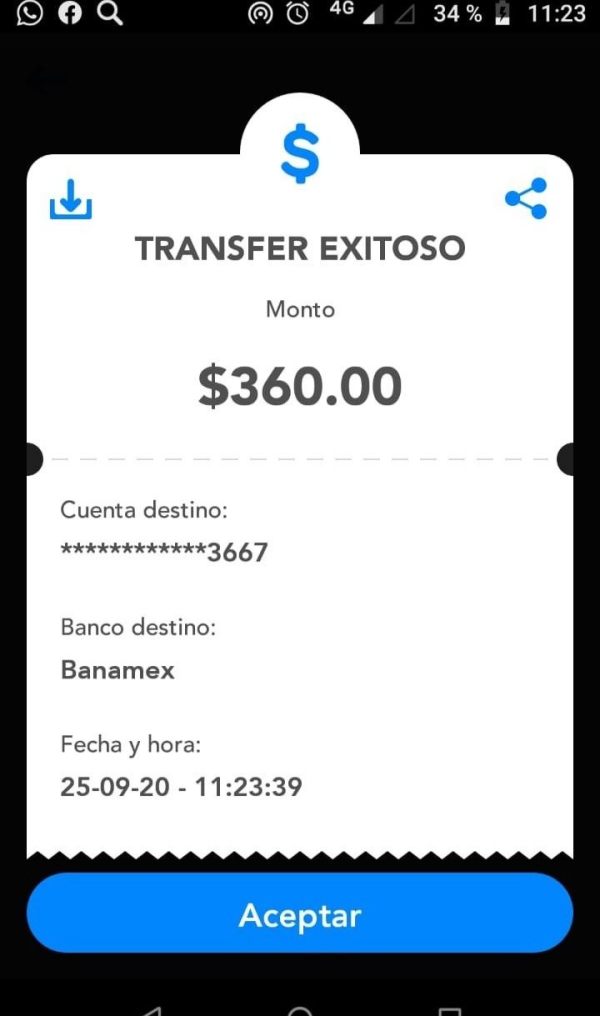

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal mechanisms is not detailed in available public sources. This requires direct contact with the broker for comprehensive funding options and processing procedures.

Minimum Deposit Requirements: Minimum deposit thresholds for account opening are not specified in publicly available documentation. This suggests potential variation based on account type and individual circumstances.

Promotional Offers: Current promotional offerings and bonus structures are not detailed in accessible marketing materials. This indicates either absence of such programs or limited public disclosure of incentive structures.

Tradeable Assets: The platform focuses primarily on online stock and options trading. It provides access to major equity markets and options chains through the broker's technological infrastructure.

Cost Structure: Detailed commission schedules, spread information, and additional fee structures are not comprehensively outlined in available public sources. Potential clients should request specific pricing information directly from the broker to understand complete cost implications.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in publicly available information. However, margin account availability suggests some leverage capabilities exist within regulatory parameters.

Platform Options: While the broker emphasizes strong API and front-end trading technology, specific platform names and detailed feature sets are not extensively documented in accessible sources.

Geographic Restrictions: Regional availability and access limitations are not clearly outlined in available documentation. This requires verification for specific jurisdictional access.

Customer Service Languages: Available customer support languages are not specified in publicly accessible information sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

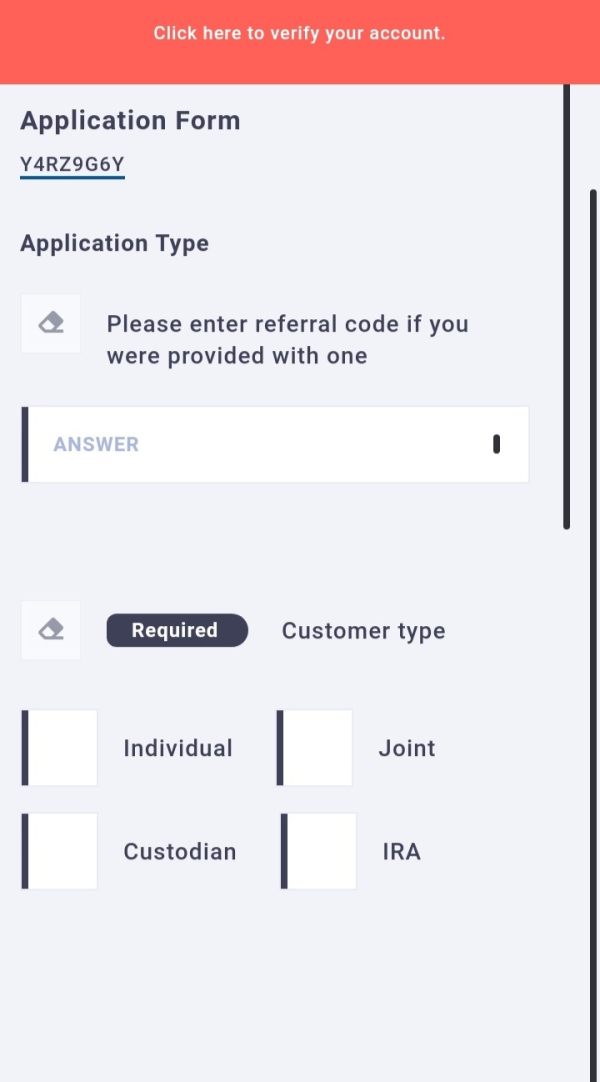

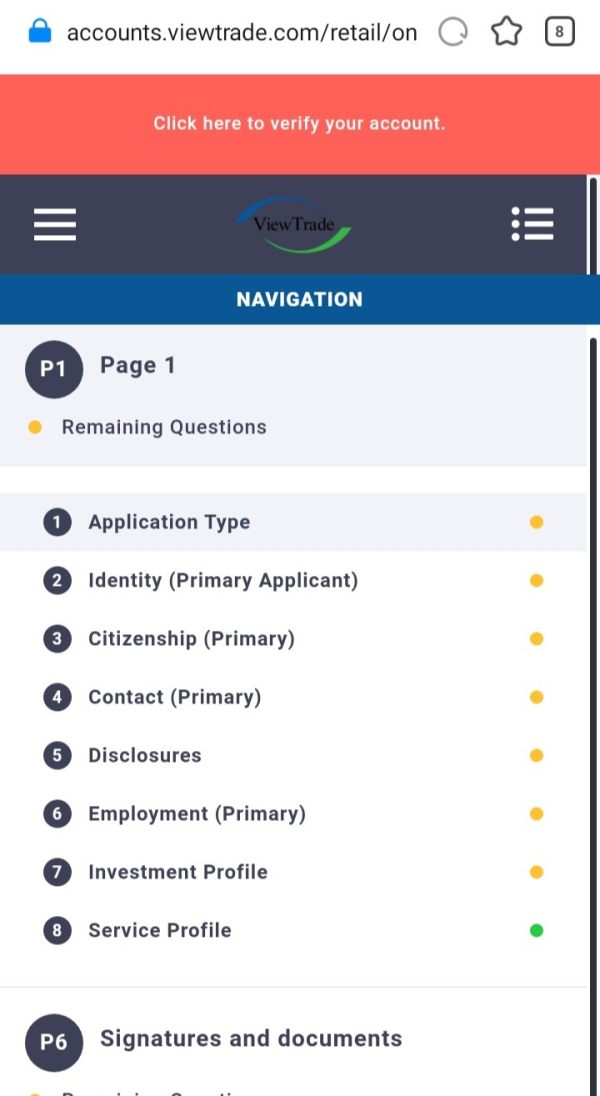

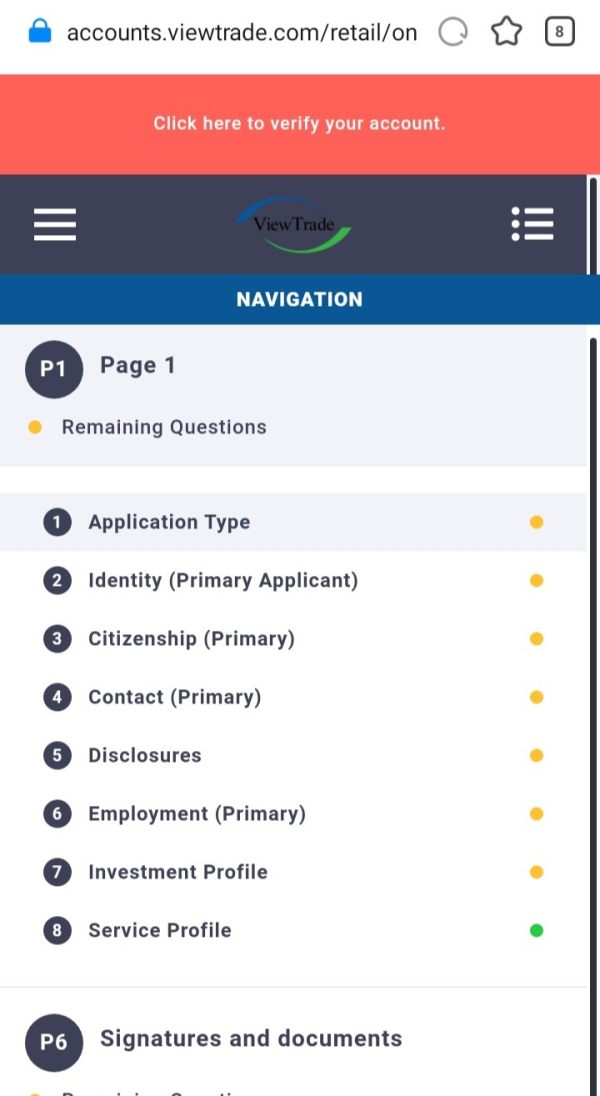

ViewTrade's account structure provides three distinct account types designed to accommodate different trading approaches and regulatory requirements. The Pattern Day Trader account specifically addresses active traders who execute frequent transactions within short timeframes. Cash accounts serve conservative investors preferring settled fund trading. Margin accounts bridge these approaches by offering enhanced purchasing power through approved credit facilities.

The variety of account types demonstrates understanding of diverse client needs. However, publicly available information lacks detailed specifications regarding minimum balance requirements, fee structures, and specific feature differentiation between account categories. This information gap prevents comprehensive evaluation of account condition competitiveness relative to industry standards.

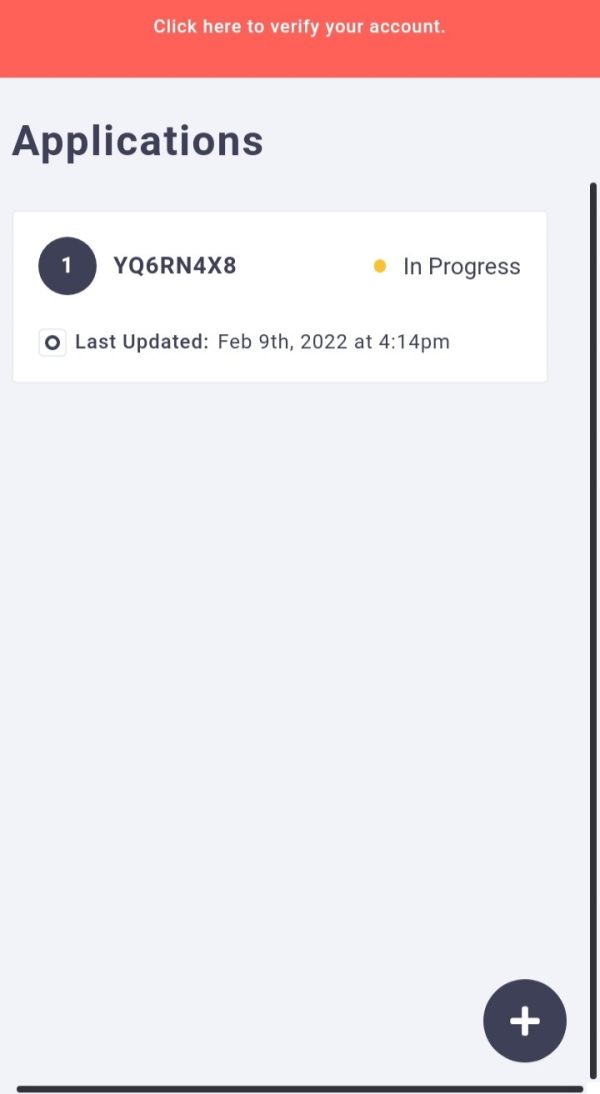

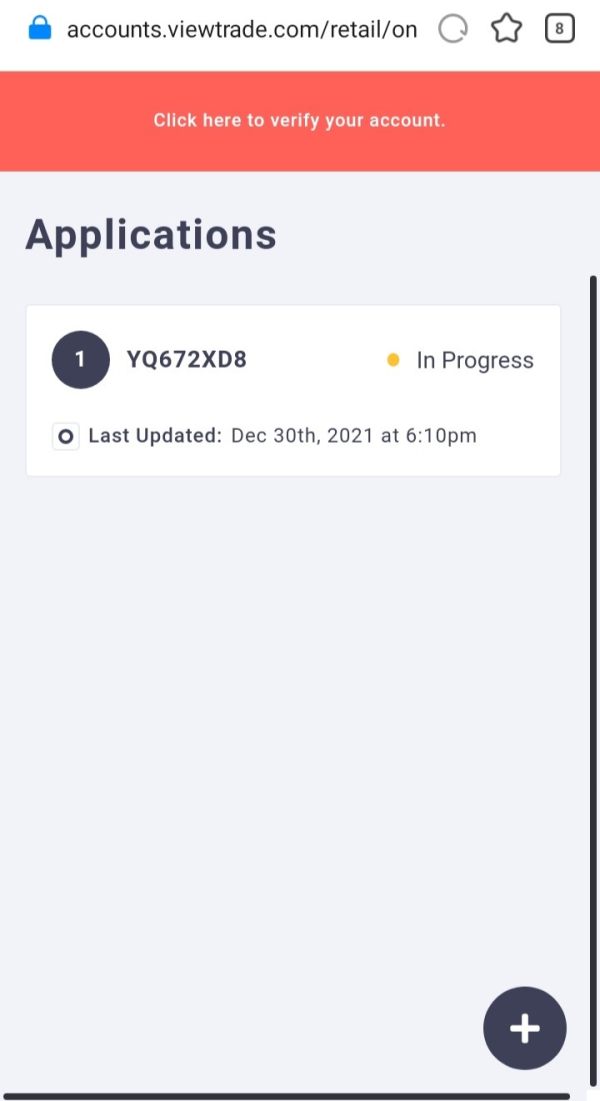

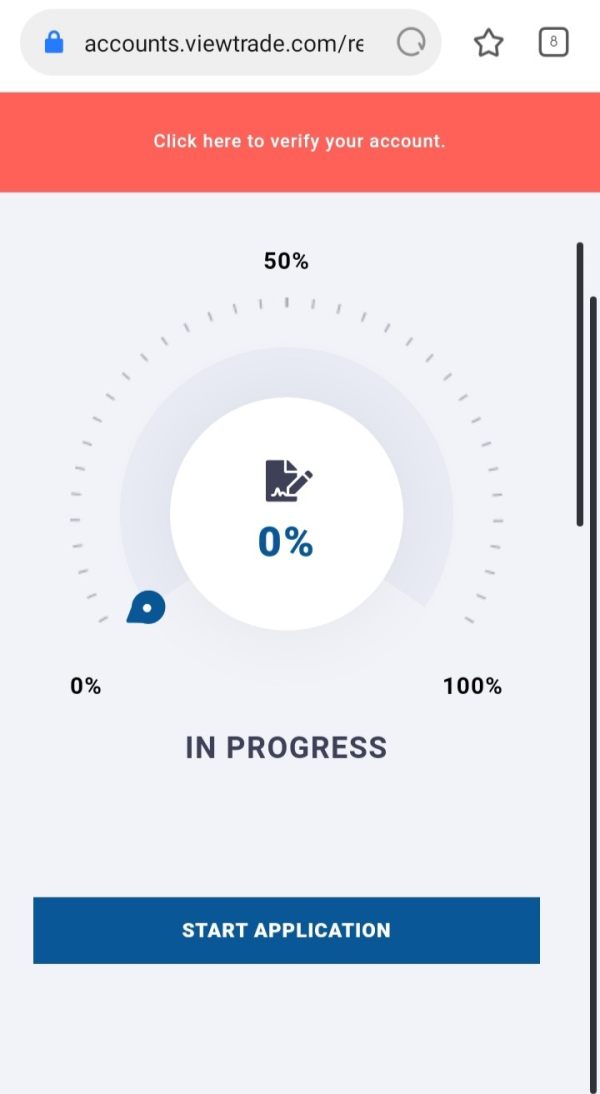

Account opening procedures and verification requirements are not extensively documented in accessible sources. This creates uncertainty about onboarding efficiency and documentation requirements. The absence of detailed eligibility criteria and special account features such as retirement account options or international client accommodations limits the complete assessment of account condition offerings.

This viewtrade review notes that while basic account structure appears sound, the lack of transparent pricing and detailed terms affects the overall account conditions rating. Potential clients would benefit from direct consultation to understand complete account specifications and associated costs.

The broker's technological infrastructure represents a significant strength, with emphasis on robust API capabilities and advanced front-end trading platforms. The integration of artificial intelligence into wealth management processes suggests sophisticated analytical and execution tools. However, specific feature details remain limited in public documentation.

API accessibility indicates institutional-grade connectivity options, potentially supporting algorithmic trading strategies and custom application development. This technological approach appeals to advanced traders requiring programmatic market access and automated execution capabilities. However, the absence of detailed platform specifications and available analytical tools limits comprehensive evaluation of the complete resource offering.

Research and analysis resources are not extensively detailed in available information. This creates uncertainty about fundamental analysis tools, market research access, and educational content availability. The technology-forward approach suggests potential strength in these areas, but verification requires direct platform examination or broker consultation.

Educational resources and training materials are not specifically outlined in accessible sources. However, the sophisticated technological approach implies potential availability of advanced learning materials for platform utilization and trading strategy development.

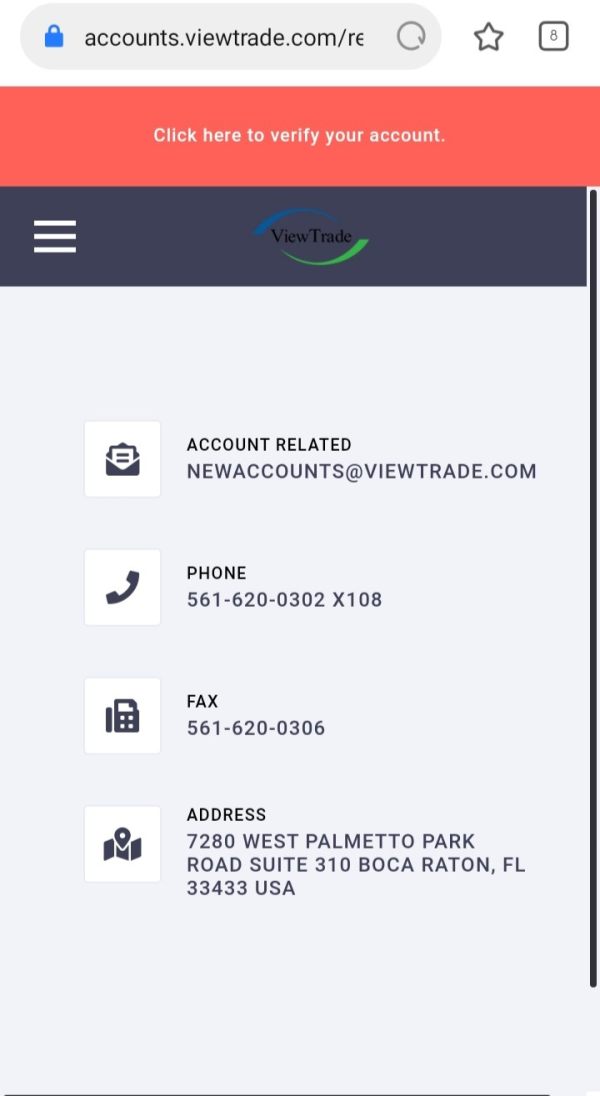

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation faces significant limitations due to insufficient publicly available information regarding support channels, availability hours, and service quality metrics. The absence of detailed customer service specifications prevents comprehensive assessment of support infrastructure and responsiveness capabilities.

Available user feedback is limited, with only 12 reviews identified in accessible sources. This is insufficient for reliable service quality evaluation. This limited feedback sample prevents meaningful analysis of customer satisfaction trends and common service issues or strengths.

Response time expectations, escalation procedures, and specialized support for technical or account issues are not documented in available sources. The technological focus of the platform suggests potential for sophisticated support systems. However, verification requires direct experience or additional information gathering.

Multilingual support capabilities and international customer service accommodations are not specified. This potentially limits accessibility for global clients despite the broker's emphasis on cross-border investment solutions.

Trading Experience Analysis (Score: 6/10)

Platform stability and execution quality assessment faces limitations due to insufficient user feedback and technical performance data in publicly available sources. The emphasis on robust API and front-end technology suggests potential for reliable trading infrastructure. However, verification requires direct platform testing or additional user experience data.

Order execution quality and speed metrics are not detailed in accessible documentation. This prevents evaluation of fill rates, slippage characteristics, and execution efficiency compared to industry benchmarks. The regulatory framework and exchange memberships suggest access to quality execution venues, but specific performance data remains unavailable.

Mobile trading capabilities and cross-platform functionality are not extensively documented. However, the technological focus implies potential mobile solution availability. The absence of specific mobile platform features and functionality details limits assessment of trading flexibility and accessibility.

This viewtrade review identifies the need for additional user experience data and technical performance metrics to provide comprehensive trading experience evaluation. The technological infrastructure foundation appears solid. However, practical implementation assessment requires more detailed information.

Trust and Regulation Analysis (Score: 8/10)

ViewTrade demonstrates strong regulatory credentials through SEC oversight and comprehensive industry organization memberships. The regulatory framework provides multiple layers of supervision and compliance verification. This significantly enhances client protection and operational transparency. SIPC membership specifically provides account insurance protection, addressing fundamental security concerns for client assets.

Exchange memberships with NYSE Arca, NASDAQ, CBOE Edge, and CBOE BATS indicate direct market access capabilities and adherence to exchange-specific operational standards. These relationships suggest robust operational infrastructure and compliance with industry best practices for trade execution and market connectivity.

FINRA membership adds another regulatory layer, ensuring adherence to broker-dealer conduct standards and providing additional recourse mechanisms for client disputes. This comprehensive regulatory structure significantly exceeds minimum requirements. It demonstrates commitment to operational excellence and client protection.

The absence of documented negative regulatory events or sanctions in available sources supports the positive regulatory standing. However, comprehensive regulatory history verification would require additional research through official regulatory databases.

User Experience Analysis (Score: 5/10)

User experience evaluation encounters significant challenges due to limited available feedback and review data. With only 12 identified reviews in accessible sources, comprehensive user satisfaction assessment proves difficult. This makes drawing broad conclusions about platform performance and client satisfaction potentially unreliable.

Interface design and platform usability are not extensively documented in available sources. However, the technological emphasis suggests potential for modern, intuitive design approaches. The integration of artificial intelligence and advanced front-end technology implies sophisticated user interface capabilities, but practical usability assessment requires direct platform examination.

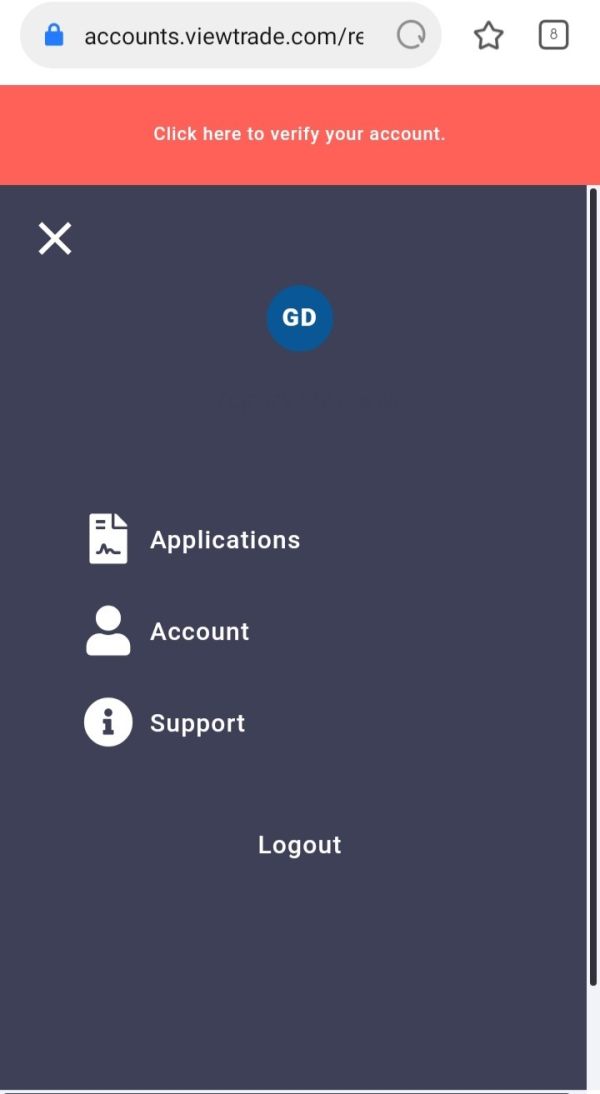

Registration and account verification processes are not detailed in publicly available information. This prevents evaluation of onboarding efficiency and user-friendliness. The regulatory compliance requirements suggest thorough verification procedures, but processing times and complexity levels remain unspecified.

Funding and withdrawal experience evaluation faces similar information limitations, with processing times, available methods, and user satisfaction with financial transactions not documented in accessible sources. This information gap significantly impacts overall user experience assessment capabilities.

Conclusion

ViewTrade presents a mixed profile in the competitive online brokerage landscape, demonstrating particular strength in regulatory compliance and technological infrastructure while facing evaluation challenges due to limited publicly available information in several key areas. The broker's comprehensive regulatory framework, including SEC oversight and multiple industry organization memberships, provides a solid foundation for client trust and operational credibility.

The platform appears well-suited for investors prioritizing regulatory security and advanced technological capabilities, particularly those interested in API access and artificial intelligence-enhanced trading tools. However, potential clients should conduct direct consultation to address information gaps regarding pricing structures, detailed platform features, and customer service specifications.

Primary advantages include strong regulatory standing, sophisticated technology infrastructure, and multiple account type options. Key limitations involve insufficient public information about costs, customer service quality, and comprehensive user experience data. This necessitates direct broker contact for complete evaluation.