Is ViewTrade safe?

Pros

Cons

Is ViewTrade Safe or a Scam?

Introduction

ViewTrade is a brokerage firm that positions itself as a provider of financial services, including forex trading. With a claim of facilitating access to various financial markets, it aims to cater to both retail and institutional investors. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams in this sector necessitates thorough research and evaluation of any brokers legitimacy. This article investigates whether ViewTrade is safe or if it raises red flags for potential investors. Our analysis draws from various sources, including user reviews, regulatory information, and industry standards, providing a comprehensive framework for assessing the broker's credibility.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its safety. A well-regulated broker is typically subject to strict oversight, which can enhance investor protection. In the case of ViewTrade, it claims to be registered with the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA). However, user reviews and independent assessments question the validity of these claims, suggesting a lack of transparency regarding its regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SEC | N/A | United States | Unverified |

| FINRA | N/A | United States | Unverified |

The absence of a valid license and the unverified status raise concerns about the broker's regulatory compliance. Furthermore, historical compliance issues, such as fines imposed by FINRA for deficiencies in anti-money laundering (AML) programs, further cast doubt on its reliability. Therefore, the question remains: Is ViewTrade safe for investors looking to enter the forex market?

Company Background Investigation

ViewTrade was founded in 1998 and has undergone various phases of development, positioning itself as a technology-driven brokerage firm. The company claims to offer innovative solutions for financial services, catering primarily to fintech startups and large financial institutions. However, the lack of detailed information about its ownership structure and management team raises questions about its transparency.

The management team's backgrounds are critical in assessing the firm's credibility. While the company touts its extensive experience in financial technology, the absence of publicly available information on the key executives and their qualifications limits our ability to evaluate their expertise. This lack of transparency can be a significant concern for potential investors, who may wonder about the firm's commitment to ethical practices and regulatory compliance.

In conclusion, the opaque nature of ViewTrade's management and ownership structure poses risks for investors. As we delve deeper into the various aspects of its operations, it becomes increasingly relevant to ask: Is ViewTrade safe for your investments?

Trading Conditions Analysis

Understanding a brokers trading conditions is crucial for assessing its overall value proposition. ViewTrade offers a range of trading services with varying fees, but the lack of clarity in its pricing structure raises red flags. Potential investors need to be aware of all costs associated with trading, including spreads, commissions, and overnight fees.

| Fee Type | ViewTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While the specifics of these fees are not readily available, user complaints often highlight unexpected charges and a lack of transparency in fee disclosures. Such practices can lead to significant costs for traders, making it essential to evaluate whether ViewTrade is safe regarding trading conditions. The absence of detailed information about the fee structure can be a cause for concern, as it may indicate hidden costs that could erode profits.

Client Fund Security

The safety of client funds is a primary concern for any broker. ViewTrade claims to implement various security measures, including fund segregation and investor protection policies. However, the lack of independent verification of these claims raises questions about their effectiveness.

The absence of a clear policy on negative balance protection and investor compensation schemes further exacerbates concerns about fund safety. Historical issues regarding fund security, such as the aforementioned regulatory fines, indicate that ViewTrade may not prioritize client fund safety. As such, potential investors should exercise caution and consider the risks associated with entrusting their capital to this brokerage.

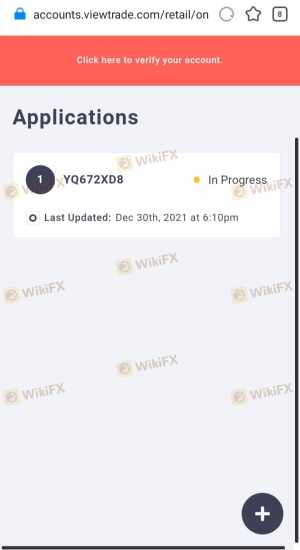

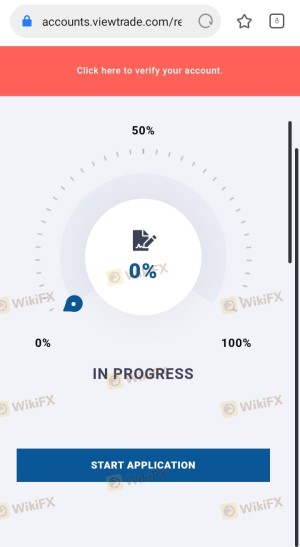

Customer Experience and Complaints

Customer feedback is an invaluable resource for evaluating a broker's reliability. In the case of ViewTrade, numerous complaints have surfaced regarding withdrawal difficulties and poor customer support. These issues can significantly impact the overall trading experience and raise concerns about the broker's legitimacy.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

Typical cases involve clients experiencing delays in fund withdrawals, which can lead to frustration and loss of trust. The company's response to these complaints has often been deemed inadequate, further contributing to negative perceptions. As such, it is crucial to ask: Is ViewTrade safe for clients who may need timely access to their funds?

Platform and Execution

The performance of a trading platform is critical for a seamless trading experience. ViewTrade offers various trading platforms, but user reviews indicate mixed experiences regarding stability and execution quality. Reports of slippage and order rejections have been common among users, which can adversely affect trading outcomes.

A reliable trading platform should provide quick execution and minimal slippage. However, if traders frequently encounter issues, it raises concerns about the broker's operational integrity. Therefore, the question persists: Is ViewTrade safe when it comes to platform reliability and execution quality?

Risk Assessment

Utilizing ViewTrade entails several risks that potential investors must consider. These risks stem from regulatory concerns, trading conditions, and customer service issues.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of clear regulatory verification |

| Trading Costs | Medium | Potential hidden fees |

| Fund Security | High | Unclear safety measures for client funds |

Given these risks, it is advisable for potential traders to conduct thorough due diligence. Seeking alternative brokers with solid regulatory oversight and transparent practices may be a prudent approach.

Conclusion and Recommendations

In conclusion, the evidence suggests that ViewTrade raises several red flags regarding its safety and reliability. The lack of regulatory clarity, combined with numerous customer complaints and operational issues, indicates that potential investors should proceed with caution. While some traders may find the low initial deposit attractive, the risks associated with trading through an unverified broker may outweigh the benefits.

For traders seeking safer alternatives, consider brokers that are well-regulated and have a proven track record of customer satisfaction. Ultimately, the question of whether ViewTrade is safe remains open, but the information gathered strongly suggests that potential investors should be wary.

Is ViewTrade a scam, or is it legit?

The latest exposure and evaluation content of ViewTrade brokers.

ViewTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ViewTrade latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.