InvesaCapital 2025 Review: Everything You Need to Know

Summary

This complete invesacapital review looks at a South African forex broker that says it provides personal investment plans and great customer service. The company gets a 4.0 rating from 112 reviews, and 79% of users recommend the platform based on feedback we found. InvesaCapital works from Johannesburg and offers advanced trading platforms plus easy-to-use mobile apps.

But our review found big problems that traders should think about carefully. Users complain about hidden fees, including an $80 charge to take out money, and they have trouble talking to customer support. The broker also has unclear rules about who watches over them, and some reviews question if the company is real and safe.

InvesaCapital wants to help forex traders who need personal service and trading advice. However, the mixed user reviews mean people should be careful and research the platform well before putting money in. Some traders might like the personal approach, but the fee problems and service issues are serious concerns.

Important Notice

InvesaCapital has its main office at 2nd Floor, Rivonia Village, Cnr Mutual Road & Rivonia Boulevard, Rivonia, 2191, Johannesburg, South Africa. Important information about who regulates the company is not clear in the documents we found, which creates big concerns for people thinking about using their services.

This review uses public user feedback, company information, and market research that anyone can find. We could not find clear details about licensing and regulation in our research, so we tell readers to check this information themselves before using the platform. Our review method uses user stories, company data that is available, and standard ways to judge brokers instead of direct regulatory papers.

Rating Framework

Broker Overview

InvesaCapital works as a forex broker with headquarters in Johannesburg, South Africa, at Rivonia Village. The company says it focuses on giving personal investment plans that fit what each client needs and wants to keep customer service standards high. InvesaCapital tries to be different from other brokers by offering custom approaches to forex trading instead of the same service for everyone.

The company's business plan centers on giving each person a unique service experience. They work closely with clients to make strategies that match their specific investment goals and how much risk they want to take. This approach makes InvesaCapital different from bigger, more standard trading platforms because they focus on personal attention and strategy advice as their main services.

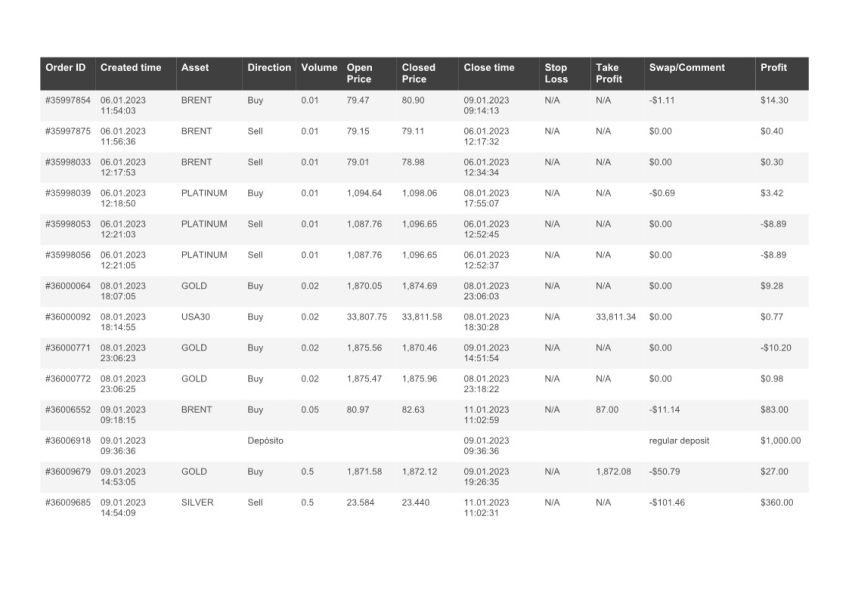

For trading technology, InvesaCapital gives users advanced trading platforms plus easy-to-use mobile apps for both computer and phone trading. The platform lets people trade forex pairs, commodities, and different market indices, so traders can access many different markets. However, we need more information about platform technology, how trades work, and trading conditions because this invesacapital review found limited technical details in available documents.

Regulatory Status: The information we found does not clearly say which regulatory bodies watch over the company or give licensing details, which is a big concern for people who want regulated trading environments.

Deposit and Withdrawal Methods: We could not find specific payment processing options in source materials, but user feedback mentions an $80 withdrawal commission that has made users unhappy.

Minimum Deposit Requirements: The company information and user feedback do not specify how much money you need to start.

Bonus and Promotional Offers: We did not find any specific promotional programs or bonus structures in the research materials.

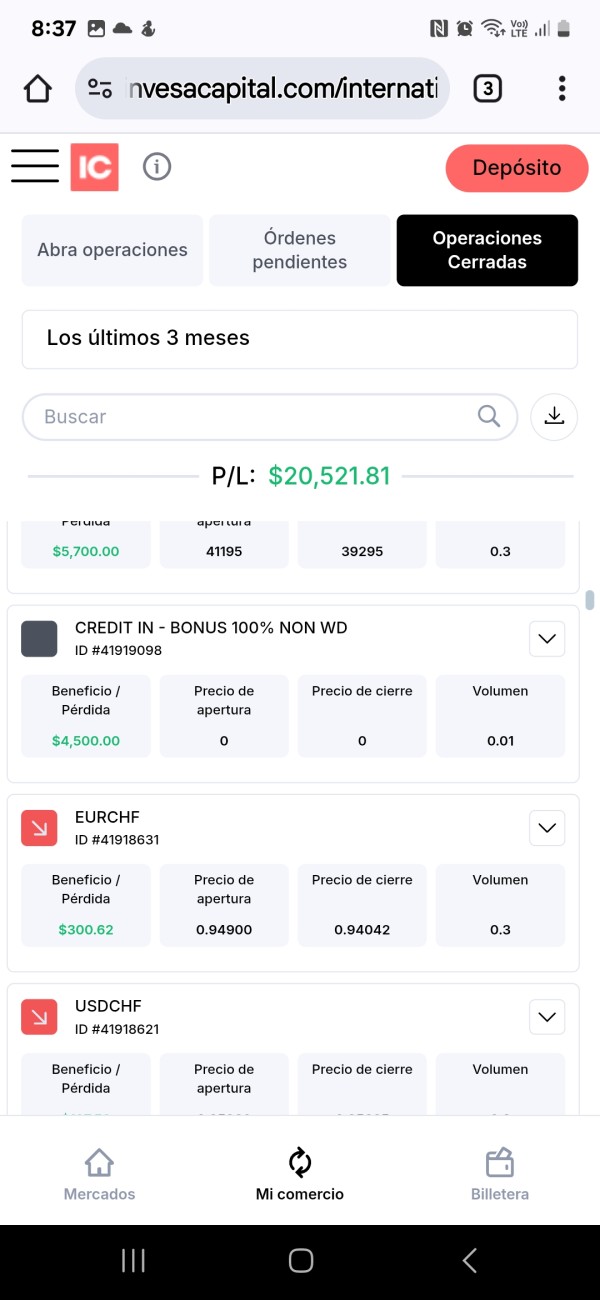

Tradeable Assets: The platform supports forex currency pairs, commodities trading, and market indices, giving traders access to different markets for various trading strategies and preferences.

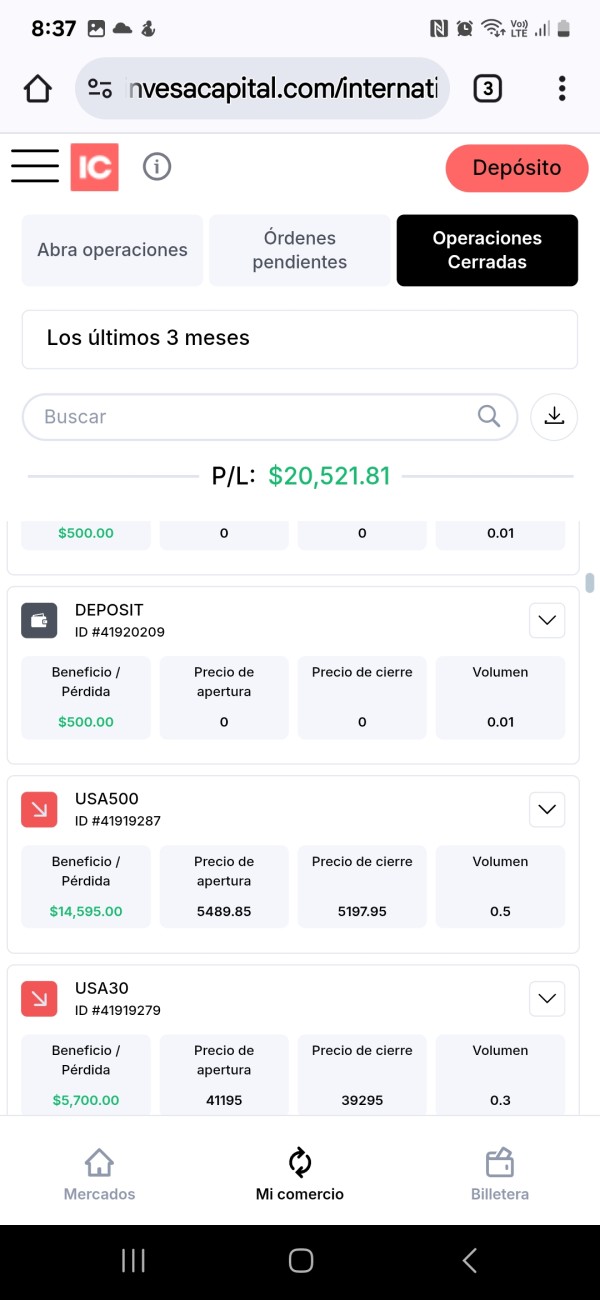

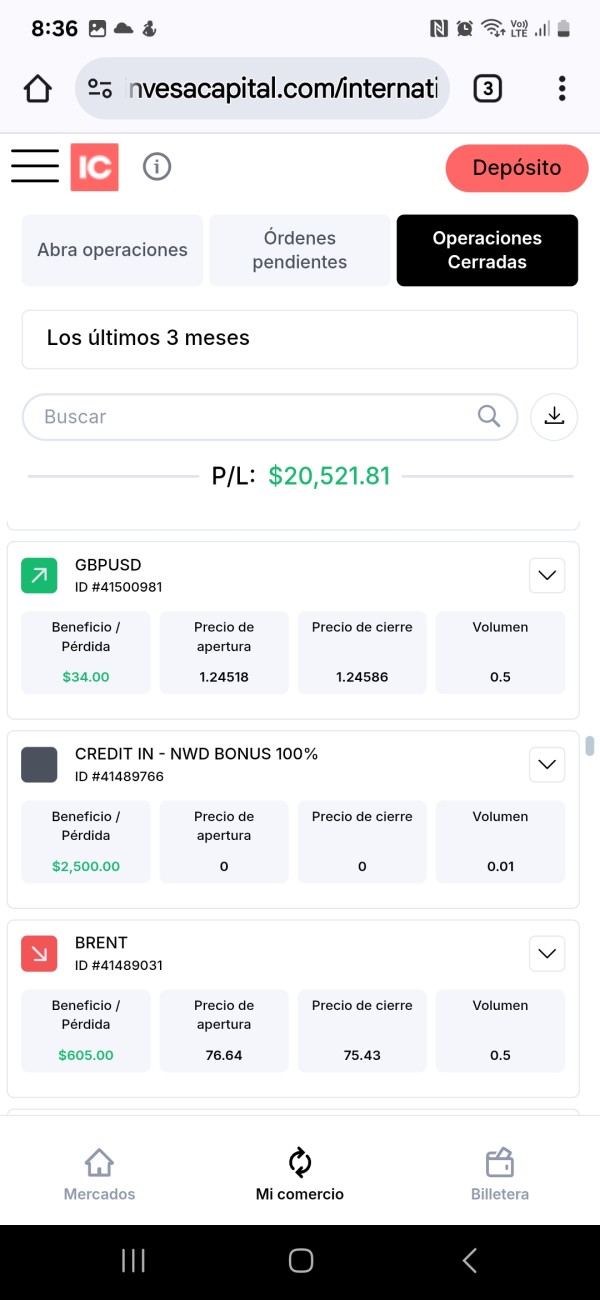

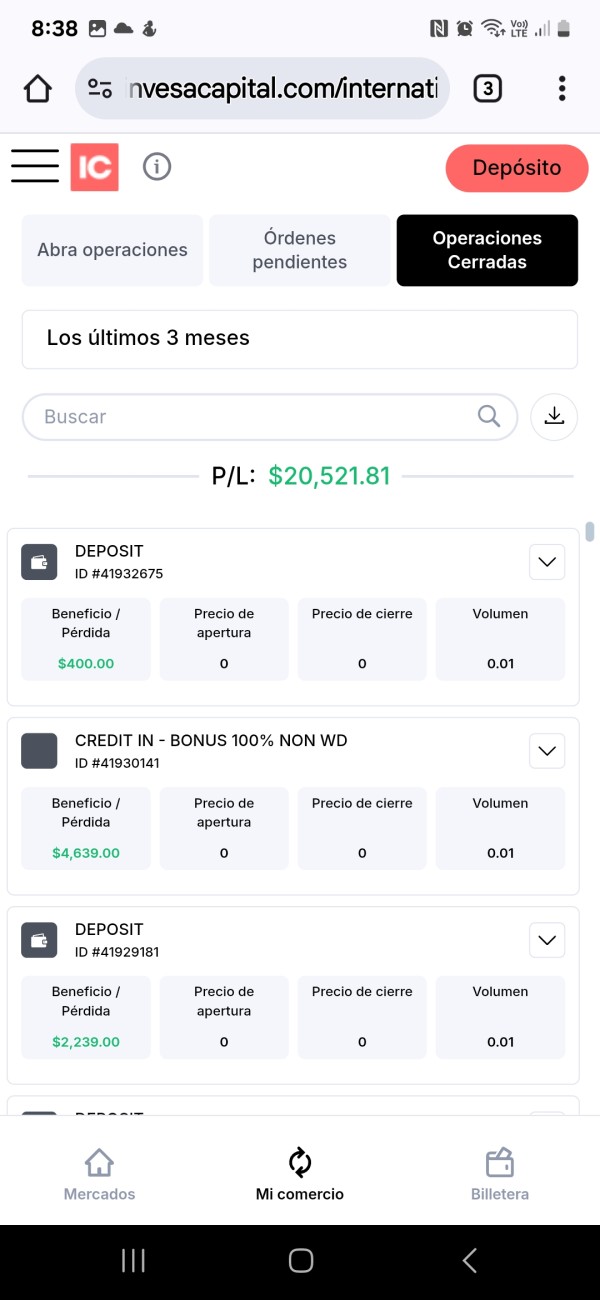

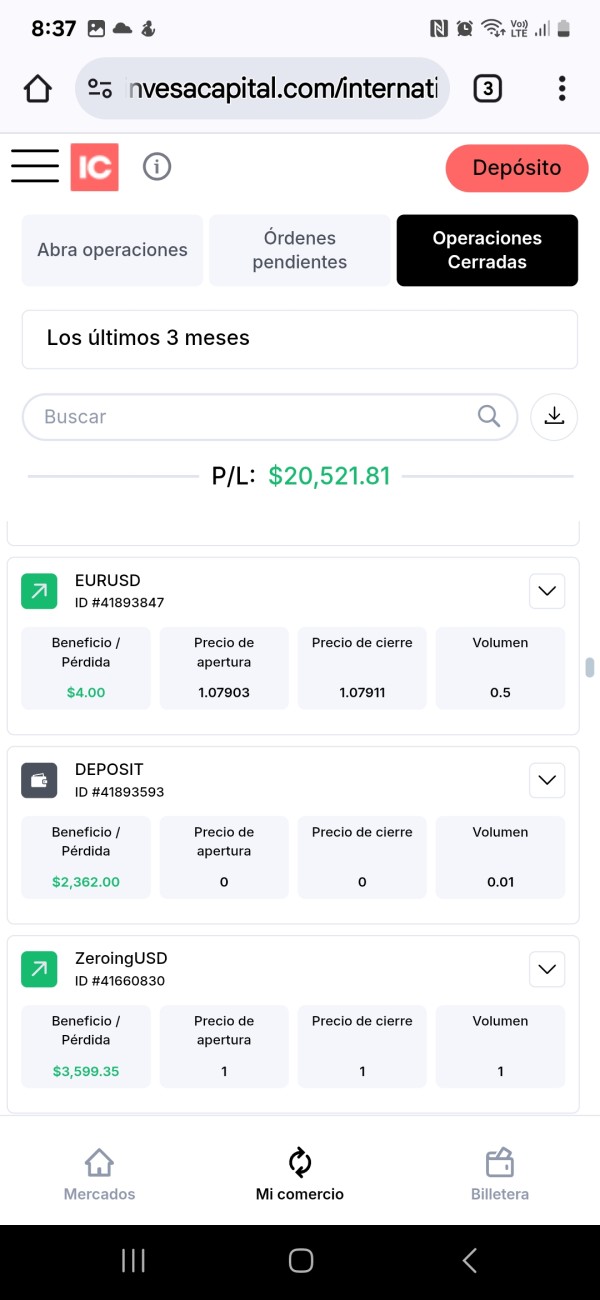

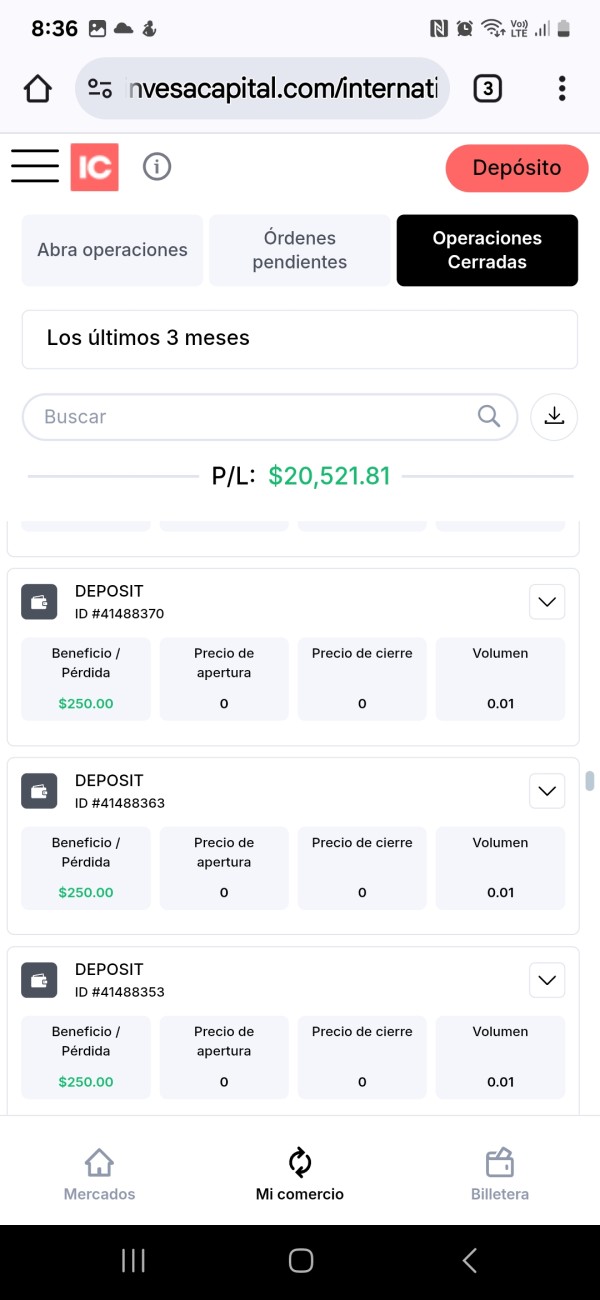

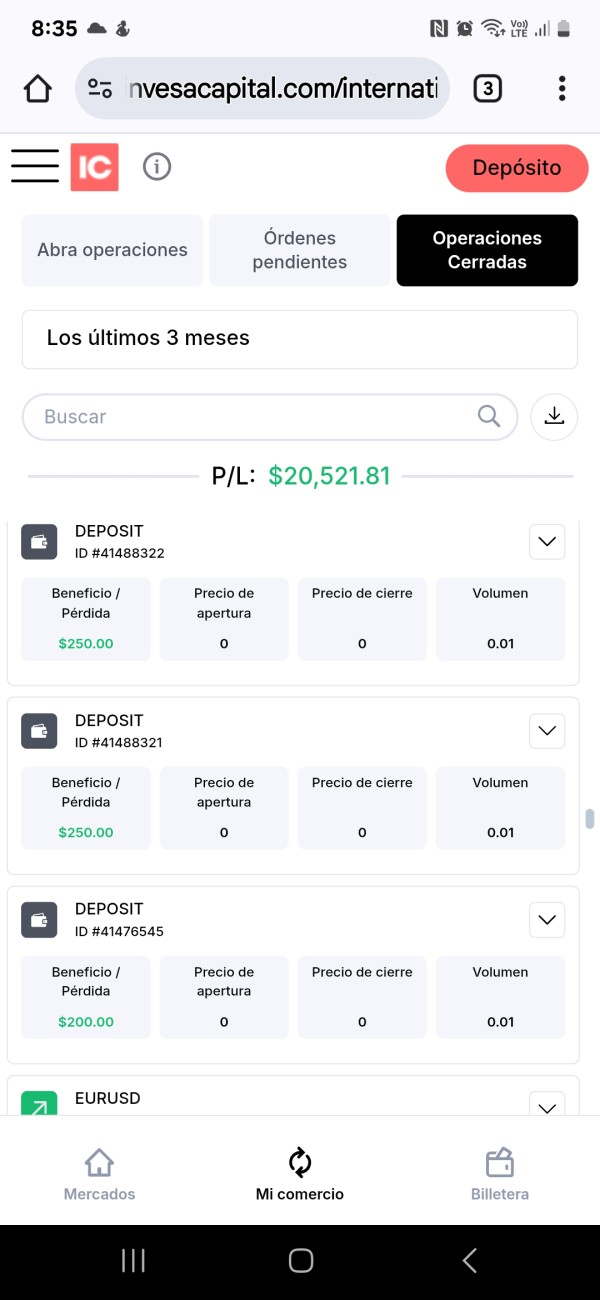

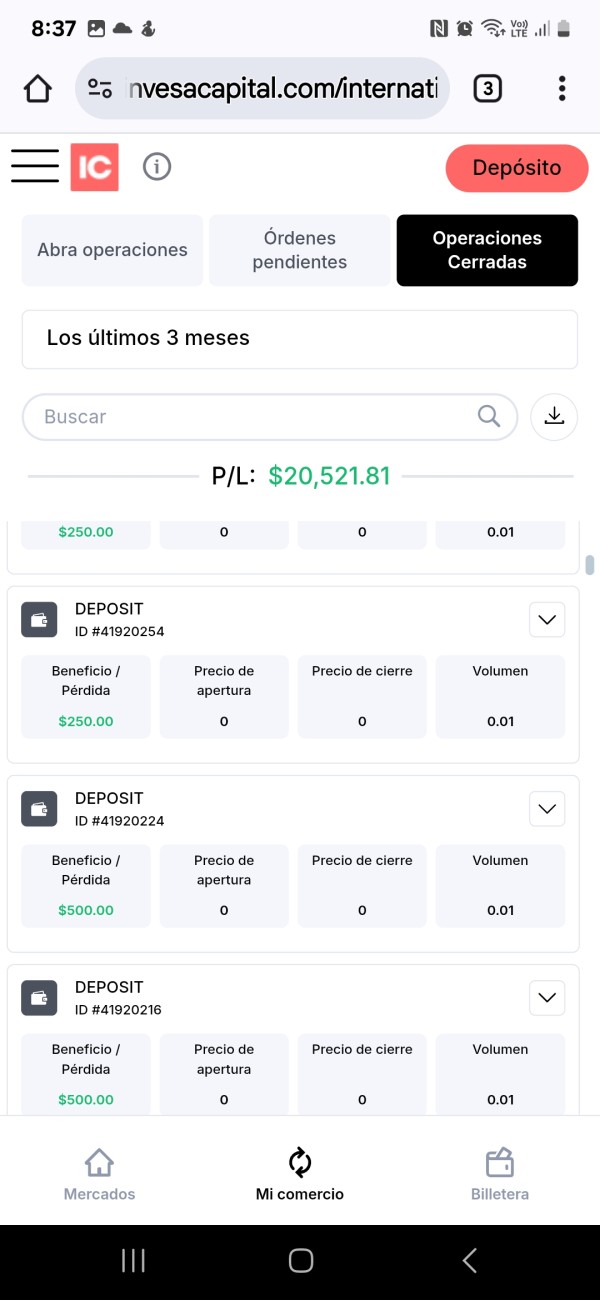

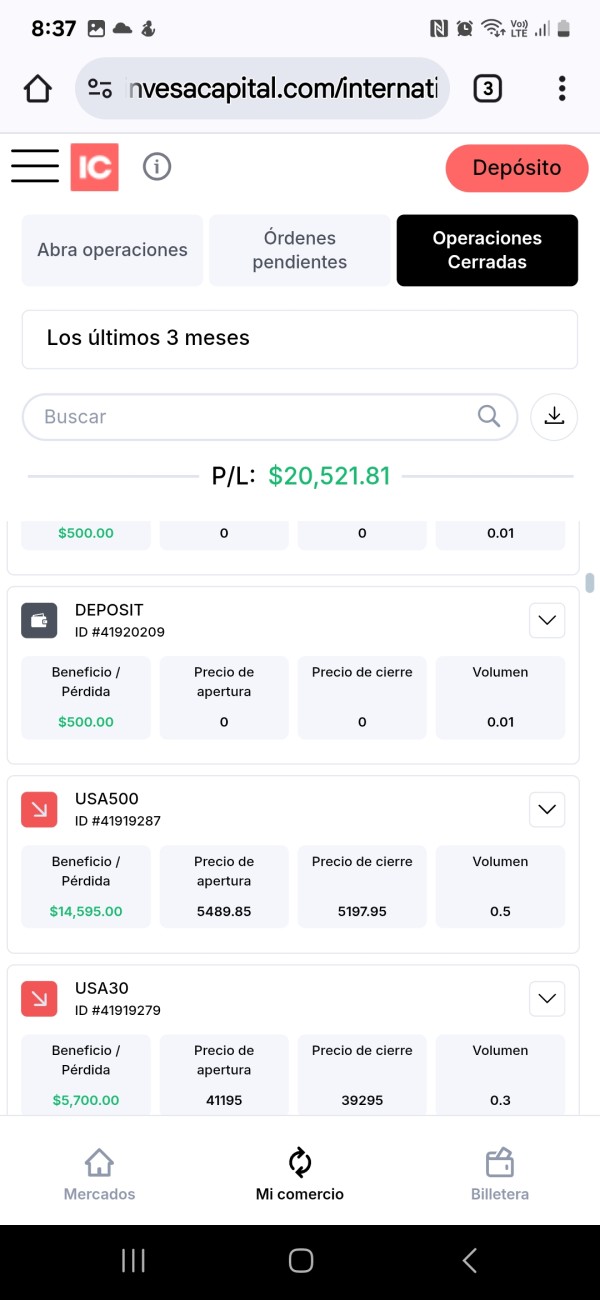

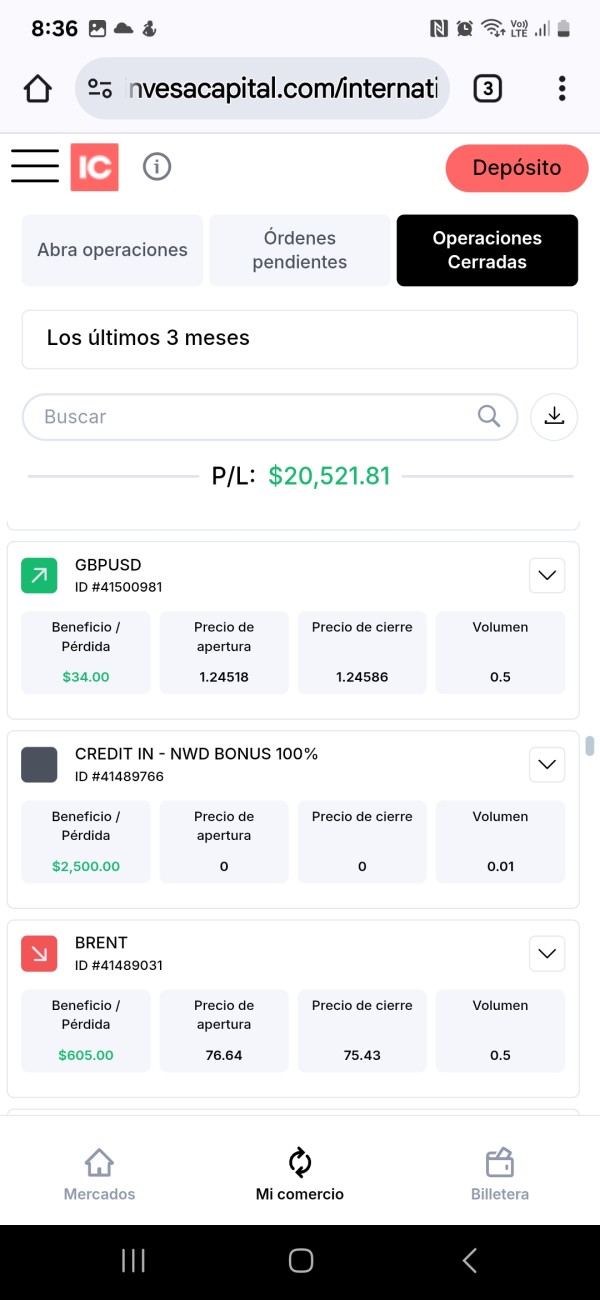

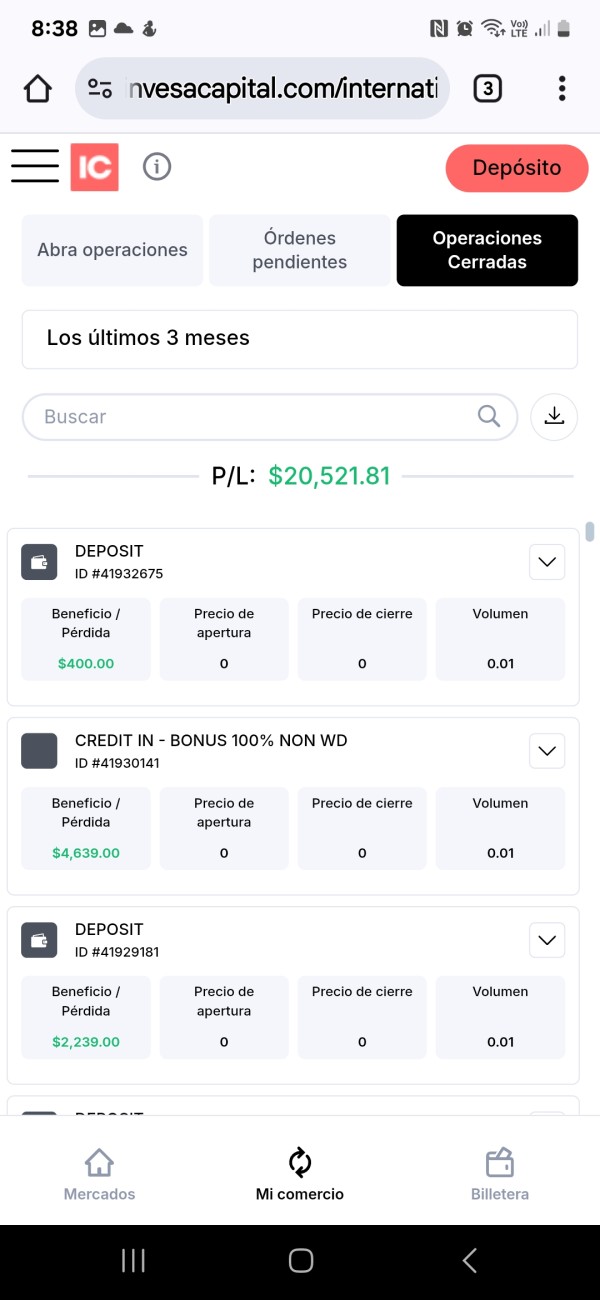

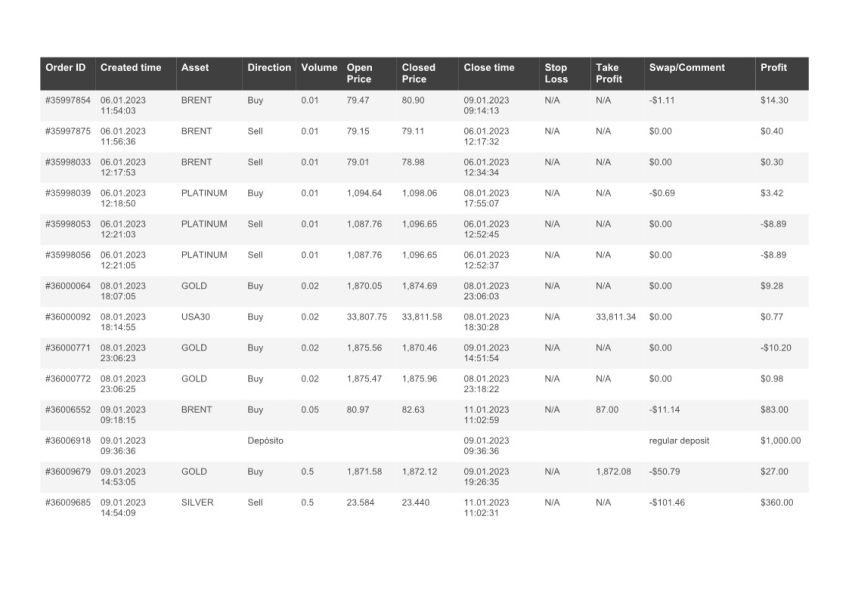

Cost Structure: User feedback specifically points out an $80 withdrawal commission and mentions hidden fees that have made some clients unhappy. But detailed information about spreads, commissions, and other trading costs is not clear in available documents.

Leverage Options: Source materials do not detail specific leverage ratios and margin requirements.

Platform Options: InvesaCapital offers advanced trading platforms along with mobile applications designed for easy operation across different devices and trading environments.

Geographic Restrictions: Available information does not clearly outline specific country limitations or regional restrictions.

Customer Support Languages: Source documentation does not specify language support options for customer service.

This invesacapital review notes that many important details are not clear, so potential clients should ask for complete information directly from the broker before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis

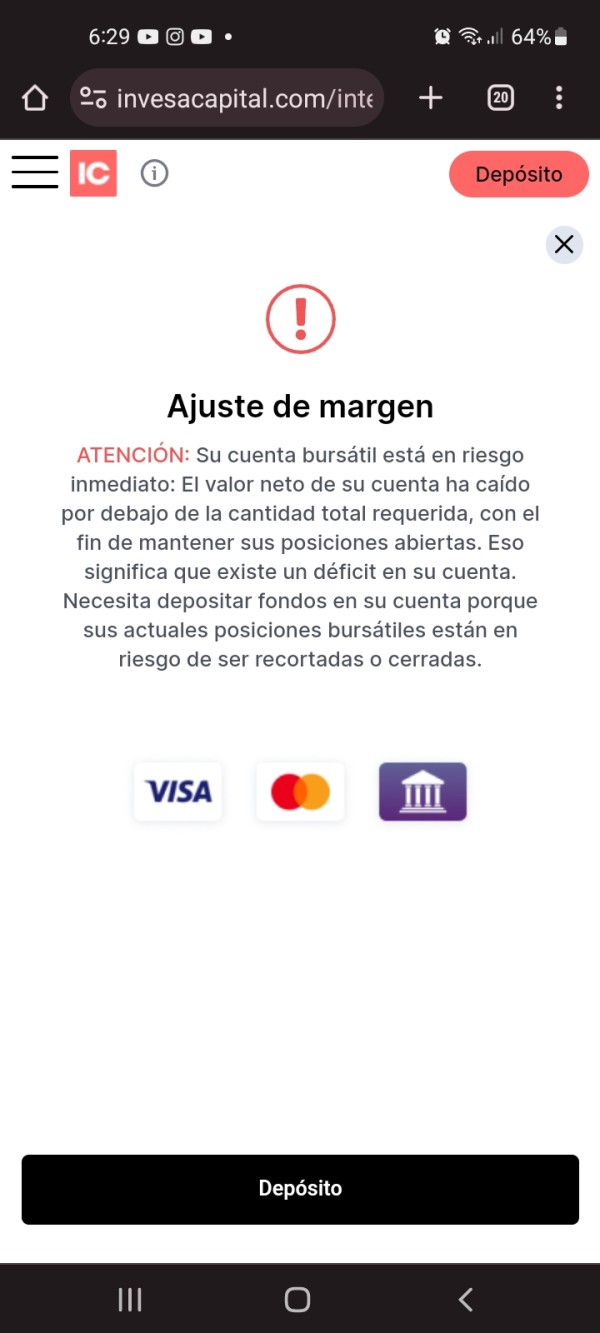

The evaluation of InvesaCapital's account conditions has big limitations because there is not enough information in available source materials. Standard account features like account types, minimum balance requirements, and account-specific benefits are not clearly documented in public information. This lack of transparency about basic account structures creates concerns for potential clients who need clear understanding of trading conditions before putting money in.

Traders cannot effectively compare InvesaCapital's offerings against industry standards or competitor platforms without detailed account specifications. The absence of clear account tier information, associated benefits, and qualification requirements makes it hard for potential clients to determine which account type might suit their trading needs and experience levels.

The account opening process details are similarly unclear, with no specific information about required documentation, verification procedures, or timeline expectations. This opacity in fundamental account information adds to the overall concerns about transparency that characterize this invesacapital review. Potential clients should request complete account documentation directly from the broker to understand available options and associated conditions.

InvesaCapital shows strength in its technology offerings, providing advanced trading platforms alongside user-friendly mobile applications that meet modern trading requirements. The platform's focus on delivering sophisticated trading tools suggests investment in technology infrastructure designed to support various trading strategies and user preferences across different experience levels.

The mobile application gets particular attention for its user-friendly design, showing that the broker understands the importance of mobile trading capabilities in today's market environment. This technology approach aligns with industry trends toward accessible, multi-device trading solutions that allow traders to monitor and execute trades regardless of location or device preference.

However, specific details about research resources, market analysis tools, educational materials, and automated trading support are not clear in available documentation. The absence of detailed information about analytical tools, economic calendars, technical indicators, and educational resources limits the ability to fully assess the platform's complete tool offerings. While the basic platform infrastructure appears robust, the lack of detailed tool specifications prevents a complete evaluation of the broker's resource capabilities.

Customer Service and Support Analysis

Customer service represents a significant concern area for InvesaCapital based on available user feedback and documentation gaps. User reviews specifically mention communication difficulties and support challenges that have negatively affected client experiences. These communication issues appear to be recurring themes in user feedback, suggesting systematic problems rather than isolated incidents.

The lack of clear information about customer support channels, availability hours, and response time standards further complicates the support landscape. Without transparent communication about how clients can reach support teams, expected response times, or escalation procedures, users may face frustration when requiring assistance with account issues, technical problems, or trading questions.

Additionally, multilingual support capabilities remain unclear, which could present barriers for international clients who require assistance in languages other than English. The combination of reported communication problems and unclear support infrastructure contributes to the lower rating in this category. Effective customer service requires both accessible communication channels and responsive, knowledgeable support staff, areas where InvesaCapital appears to face challenges based on available feedback.

Trading Experience Analysis

The trading experience evaluation reveals mixed feedback from users, with both positive elements and concerning issues that affect overall platform performance. Some users report satisfactory trading experiences with the platform's advanced technology and user-friendly interfaces, but others have encountered problems that impact their trading activities and satisfaction levels.

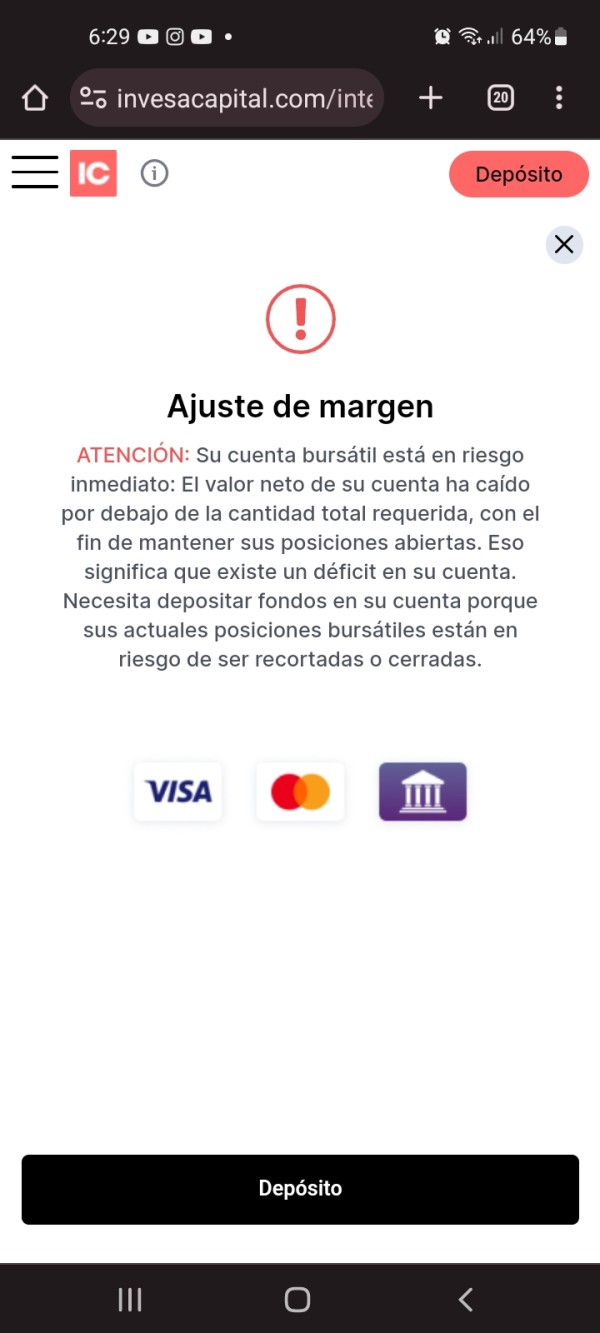

The presence of hidden fees, particularly the reported $80 withdrawal commission, significantly affects the trading experience by creating unexpected costs that users discover after engaging with the platform. These surprise fees can substantially impact trading profitability and create trust issues between the broker and clients who feel they were not adequately informed about cost structures.

Platform stability and execution quality information remains limited in available documentation, making it difficult to assess technical performance aspects such as order execution speed, slippage rates, or system reliability during high-volume trading periods. The lack of detailed technical performance data prevents a comprehensive evaluation of the actual trading environment quality.

Mobile trading capabilities appear to be a positive aspect based on mentions of user-friendly mobile applications, though specific functionality details and performance metrics are not available. This invesacapital review notes that while technology infrastructure seems adequate, the overall trading experience is significantly impacted by fee transparency issues and limited performance documentation.

Trust and Safety Analysis

Trust and safety concerns represent the most significant challenges identified in this evaluation of InvesaCapital. The absence of clear regulatory information in available documentation raises fundamental questions about oversight, client protection, and operational standards that regulated brokers typically must maintain.

Some user feedback and online discussions have raised concerns about the broker's legitimacy and safety, with references to potential fraudulent activities that require serious consideration by potential clients. While these allegations require careful verification, their presence in user discussions indicates that trust issues have emerged within the trading community.

The lack of transparent information about client fund segregation, insurance protection, compensation schemes, or regulatory compliance creates additional uncertainty about client protection measures. Established brokers typically provide clear documentation about these safety measures, and their absence raises concerns about operational transparency and client security.

Company transparency regarding ownership, management, financial backing, and operational history also appears limited based on available information. Without clear corporate disclosure and regulatory oversight documentation, potential clients cannot adequately assess the broker's stability, legitimacy, or long-term viability as a trading partner.

User Experience Analysis

User experience evaluation shows a complex picture with 79% of reviewers recommending InvesaCapital, indicating that a significant majority of users have had satisfactory experiences with the platform. This positive recommendation rate suggests that many clients find value in the broker's services and approach to trading support.

However, the user experience is notably impacted by fee transparency issues, particularly regarding the $80 withdrawal commission and other hidden costs that users discover during their trading journey. These unexpected fees create negative experiences that can overshadow positive aspects of the platform and contribute to user dissatisfaction and trust concerns.

The emphasis on personalized service and individualized investment strategies appears to resonate with users seeking customized approaches to trading, suggesting that the broker's target market of traders wanting personalized attention is being served to some degree. This personalization approach may explain the relatively high recommendation rate despite other concerns.

Interface design and platform usability appear to be positive aspects based on references to user-friendly applications and advanced platform features. However, the overall user experience is complicated by transparency concerns, fee issues, and the regulatory uncertainty that affects user confidence in the platform's long-term reliability and safety.

Conclusion

This invesacapital review reveals a broker with mixed characteristics that potential clients must carefully evaluate. InvesaCapital demonstrates technology competence through advanced trading platforms and user-friendly mobile applications, while its focus on personalized service appears to satisfy a significant portion of users, as evidenced by the 79% recommendation rate.

However, substantial concerns exist regarding fee transparency, regulatory oversight, and trust factors that significantly impact the broker's overall assessment. The reported $80 withdrawal commission and hidden fees create cost concerns, while the lack of clear regulatory information raises safety questions that potential clients cannot ignore.

InvesaCapital may suit traders specifically seeking personalized service and willing to accept the associated risks and costs, but the platform appears unsuitable for traders prioritizing regulatory protection, fee transparency, and established safety measures. Potential clients should conduct thorough research, request detailed fee schedules, and carefully verify regulatory status before engaging with this broker.