Velos Technology 2025 Review: Everything You Need to Know

Summary

This Velos Technology review examines a forex broker that offers low spreads and fast execution in the competitive trading market. The company was established in 2021 and has its headquarters in the Virgin Islands, providing access to forex, commodities, and cryptocurrency trading through popular MT4 and MT5 platforms. The broker claims to deliver competitive trading conditions with tight spreads. This makes it potentially attractive to cost-conscious retail traders.

However, our analysis reveals significant concerns regarding the broker's regulatory status. Velos Technology operates as an unregulated financial company, which substantially increases the risk profile for potential clients. While the broker offers access to mainstream trading platforms and multiple asset classes, the absence of proper regulatory oversight creates uncertainty about client fund protection and operational transparency.

This review provides a neutral assessment. We acknowledge that while Velos Technology may offer certain trading advantages such as low spreads and platform variety, the lack of regulatory compliance presents considerable risks that traders must carefully consider before committing funds.

Important Notice

Traders should exercise particular caution when considering Velos Technology due to its unregulated status across all regions. Different jurisdictions have varying investor protection standards. The absence of regulatory oversight means clients may have limited recourse in case of disputes or operational issues.

This evaluation is based on available information from multiple sources, including company materials and third-party reviews. Actual user experiences and market performance may vary significantly from advertised claims. Potential clients are strongly advised to conduct thorough due diligence and consider regulated alternatives before making investment decisions.

Rating Framework

Broker Overview

Founded in 2021, Velos Technology emerged as a forex trading service provider based in the Virgin Islands. The company positions itself in the competitive retail trading market by emphasizing low-cost trading conditions and technical execution capabilities. Despite its relatively recent establishment, Velos Technology has attempted to build a presence in the forex industry.

The broker operates under a business model that prioritizes cost-effective trading solutions. They claim to provide tight spreads and rapid order execution. However, the company's operational framework remains largely unclear, with limited public information about its management structure, business partnerships, or operational scale. This lack of transparency raises questions about the broker's long-term viability and commitment to industry best practices.

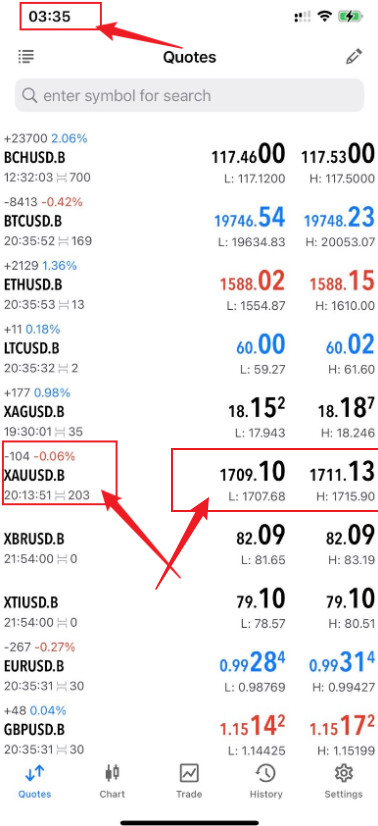

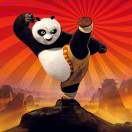

Velos Technology supports MT4 and MT5 trading platforms, which are industry standards favored by retail traders worldwide. The broker offers access to forex pairs, commodities, and cryptocurrency markets. This provides a diversified trading environment. However, the company is notably described as an unregulated financial entity, which significantly impacts its credibility and the level of client protection it can offer compared to properly licensed competitors.

Regulatory Status: Velos Technology operates without specific regulatory oversight from recognized financial authorities. This unregulated status means the broker does not adhere to standard industry compliance requirements for client fund segregation, capital adequacy, or operational transparency.

Deposit and Withdrawal Methods: Available information does not specify the payment methods supported by Velos Technology. This creates uncertainty about fund accessibility and transaction processes.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit thresholds. This makes it difficult for potential clients to assess account accessibility and initial investment requirements.

Promotional Offers: No information is available regarding bonus programs, promotional campaigns, or special trading incentives offered by the broker.

Tradeable Assets: The platform provides access to forex currency pairs, commodity markets, and cryptocurrency trading. This offers reasonable market diversity for retail traders seeking multi-asset exposure.

Cost Structure: While Velos Technology advertises low spreads as a key selling point, detailed information about commission structures, overnight fees, and other trading costs remains undisclosed in available materials.

Leverage Ratios: Specific leverage offerings and risk management parameters have not been clearly communicated in accessible broker information.

Platform Options: Trading is conducted through MetaTrader 4 and MetaTrader 5 platforms. These provide familiar interfaces for experienced traders and comprehensive charting tools.

Geographic Restrictions: The broker has not specified regional limitations or restricted territories for its services.

Customer Support Languages: Information about supported languages for customer service communication is not available in current materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Velos Technology's account conditions reveals significant information gaps that impact trader decision-making. This Velos Technology review finds that the broker has not publicly disclosed essential details about account types, minimum deposit requirements, or fee structures that typically form the foundation of broker-client relationships.

Without clear information about different account tiers, traders cannot assess which service level best suits their trading volume and experience. The absence of minimum deposit disclosures makes it impossible to determine accessibility for retail traders with varying capital levels. Additionally, the lack of detailed fee structure information prevents accurate cost-benefit analysis compared to regulated competitors.

Most concerning is the absence of information about account opening procedures, verification requirements, and fund protection measures. Regulated brokers typically provide comprehensive documentation about these processes to ensure transparency and compliance. The limited information available suggests either inadequate operational procedures or poor communication of existing policies.

The broker also fails to mention specialized account features such as Islamic accounts for Muslim traders or institutional accounts for larger clients. This indicates either limited service offerings or insufficient marketing communication about available options.

Velos Technology's tool and resource offerings appear limited based on available information. The broker provides access to MT4 and MT5 trading platforms, which are industry-standard solutions offering comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors.

However, beyond these basic platform offerings, the broker has not demonstrated additional value-added tools that distinguish it from competitors. There is no mention of proprietary trading tools, advanced market analysis software, or specialized trading calculators that could enhance the trading experience. Educational resources appear to be entirely absent from the broker's service portfolio.

Most reputable brokers provide educational materials including webinars, trading guides, market analysis, and tutorials to support trader development. The absence of such resources suggests either minimal investment in client education or poor communication of existing educational support. Research and analysis capabilities also remain unclear, with no indication of daily market reports, economic calendars, or expert market commentary that traders typically expect from full-service brokers.

This limitation could particularly impact newer traders who rely on broker-provided analysis for trading decisions.

Customer Service and Support Analysis

Customer service evaluation for Velos Technology is challenging due to the complete absence of information about support infrastructure, response capabilities, or service quality metrics. This lack of transparency about customer service arrangements is particularly concerning for an unregulated broker where client protection depends heavily on responsive support.

The broker has not disclosed available communication channels, whether through live chat, email, phone support, or ticket systems. Without this basic information, potential clients cannot assess accessibility or expected response times for urgent trading issues or account inquiries. Multi-language support capabilities remain unknown, which could limit accessibility for international clients.

Professional brokers typically specify supported languages and regional service hours to help clients understand available support levels. The absence of customer service information also raises questions about technical support for platform issues, account management assistance, and dispute resolution procedures. These services are essential for maintaining positive client relationships and ensuring smooth trading operations.

Trading Experience Analysis

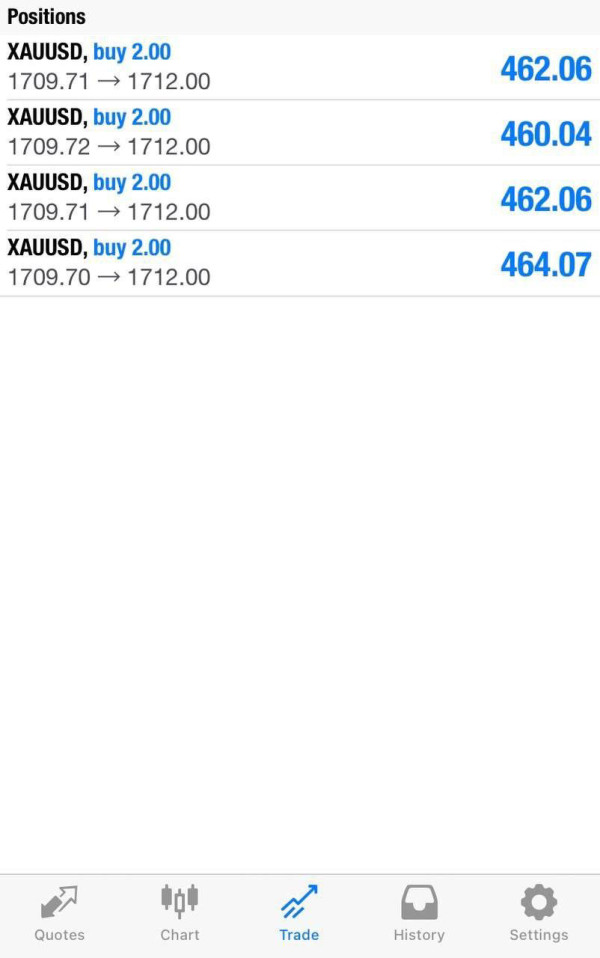

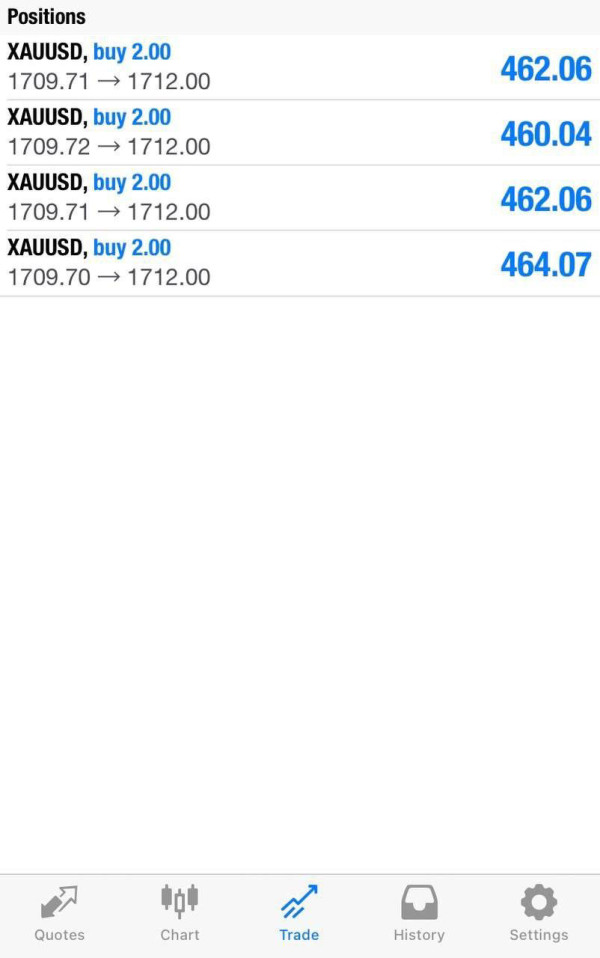

This Velos Technology review finds that the broker's trading experience claims center on low spreads and fast execution, though these assertions lack independent verification or detailed specifications. The use of MT4 and MT5 platforms provides a familiar trading environment for experienced users, with access to comprehensive charting tools and automated trading capabilities.

The claimed low spreads could provide cost advantages for active traders, particularly in major currency pairs where spread differences significantly impact profitability. However, without specific spread data or comparison benchmarks, traders cannot accurately assess the competitive value of these offerings. Fast execution claims require verification through actual trading conditions, as execution speed can vary significantly based on market conditions, server infrastructure, and order size.

The broker has not provided performance metrics or independent testing results to support these claims. Platform stability and reliability information is not available, though the use of established MT4/MT5 infrastructure suggests reasonable technical foundations. However, broker-specific server performance and connectivity quality remain unverified aspects of the trading experience.

Trust and Reliability Analysis

The trust and reliability assessment reveals the most significant concerns about Velos Technology review findings. The broker's unregulated status represents a fundamental risk factor that affects all aspects of client relationships and fund security.

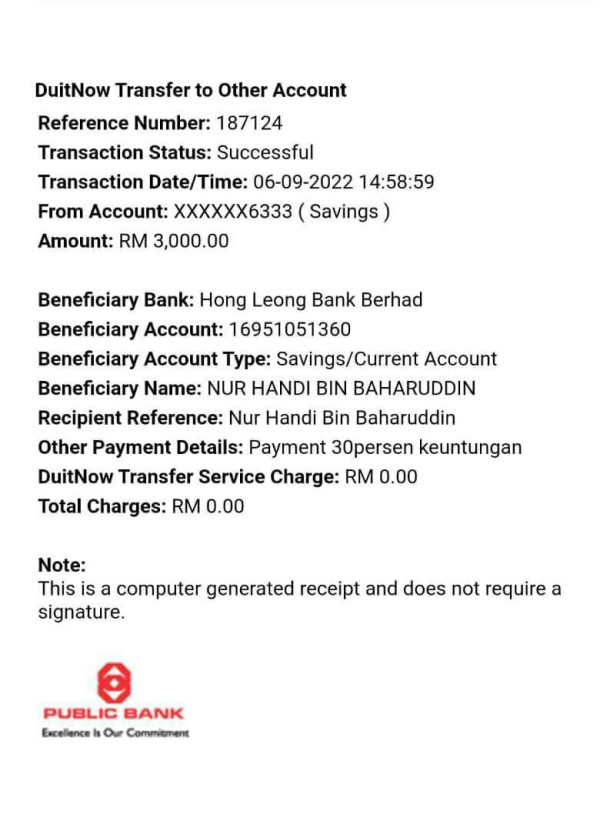

Operating without regulatory oversight means Velos Technology is not subject to capital adequacy requirements, client fund segregation mandates, or operational transparency standards that protect traders in regulated environments. This creates substantial counterparty risk for clients who have no regulatory recourse in case of operational problems or disputes. The lack of regulatory compliance also means no deposit insurance protection, no external audit requirements, and no standardized complaint resolution procedures.

These protections are considered essential safeguards in the modern forex industry. Company transparency is severely limited, with minimal information about management, operational scale, or business partnerships. This opacity makes it difficult to assess the broker's financial stability or long-term viability in the competitive forex market.

The absence of third-party certifications, industry awards, or professional recognition further undermines confidence in the broker's operational standards and market reputation.

User Experience Analysis

User experience evaluation is significantly hampered by the absence of verified client feedback and detailed operational information. The limited available data suggests a basic service offering without the comprehensive support systems that characterize established brokers.

Registration and account verification procedures remain undisclosed, creating uncertainty about onboarding efficiency and compliance requirements. Professional brokers typically provide clear guidance about documentation requirements and processing timeframes. The user interface experience depends largely on the MT4/MT5 platforms rather than proprietary solutions, which may limit customization options but provides familiar functionality for experienced traders.

Fund management procedures, including deposit and withdrawal processes, processing times, and fee structures, are not clearly documented. This lack of transparency can create frustration and uncertainty for clients managing their trading capital. Overall user satisfaction metrics are unavailable due to limited public feedback and the broker's relatively recent market entry.

Without established user communities or review platforms, potential clients cannot benefit from peer experiences and recommendations.

Conclusion

This Velos Technology review concludes with a neutral but cautious assessment of the broker's offerings. While the company provides access to popular trading platforms and claims competitive trading conditions, the fundamental lack of regulatory oversight creates significant risks that overshadow potential benefits.

The broker may appeal to experienced traders willing to accept higher risk levels in exchange for potentially lower trading costs, but this approach is not recommended for most retail traders who benefit from regulatory protections and established operational standards. Primary advantages include claimed low spreads and access to MT4/MT5 platforms, while major disadvantages center on the unregulated status, limited transparency, and absence of comprehensive support services. The risk-reward profile strongly favors regulated alternatives for most trading scenarios.