Is GROWFX safe?

Pros

Cons

Is GrowFX A Scam?

Introduction

GrowFX is a forex broker that has garnered attention in the financial trading community for its promise of diverse trading options and high leverage. Positioned in a highly competitive market, GrowFX claims to offer a wide range of trading instruments, including forex, stocks, commodities, indices, and cryptocurrencies. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is rife with both legitimate opportunities and potential scams, making it essential for traders to assess brokers critically to protect their investments.

In this article, we will investigate whether GrowFX is a safe trading platform or if it exhibits characteristics of a scam. Our evaluation will be based on a comprehensive analysis of its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. By employing a structured approach, we aim to provide traders with a clear understanding of the potential risks and rewards associated with using GrowFX.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure that they operate fairly and transparently. Unfortunately, GrowFX operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation means that GrowFX is not required to adhere to any industry standards or best practices, leaving traders vulnerable to potential misconduct. This lack of oversight can lead to issues such as withdrawal difficulties, hidden fees, or even the risk of losing invested funds without recourse. Historical compliance records indicate that unregulated brokers like GrowFX may engage in practices that are detrimental to traders, further emphasizing the need for caution.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its credibility. GrowFX claims to be registered in Australia, yet there is little verifiable information regarding its ownership structure or management team. The lack of transparency surrounding its corporate governance raises red flags about the broker's reliability.

The management teams background is a crucial aspect of a broker's trustworthiness. A team with extensive experience in finance and trading can provide reassurance to clients. However, GrowFX does not disclose information about its management, making it difficult for potential clients to evaluate their expertise and professionalism. This opacity contributes to the overall skepticism surrounding the broker and its operations.

Furthermore, the absence of a functional official website adds to the doubts regarding GrowFX's legitimacy. A non-functional website hinders access to vital information and diminishes the broker's credibility, making it challenging for traders to verify claims or seek support.

Trading Conditions Analysis

An essential factor in determining a broker's reliability is the clarity and fairness of its trading conditions. GrowFX presents itself as a competitive player in the forex market, but its trading fees and conditions warrant careful scrutiny. The broker requires a high minimum deposit of $2,000, which is significantly above the industry average, potentially limiting access for novice traders.

| Fee Type | GrowFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable (high) | Variable (low) |

| Commission Model | Not disclosed | Typically low |

| Overnight Interest Range | Not specified | Typically specified |

The fees associated with trading on the GrowFX platform appear to be less favorable compared to other brokers, raising questions about the overall cost-effectiveness of using this broker. Additionally, the lack of transparency regarding commission structures and overnight interest rates can lead to unexpected costs for traders. This ambiguity surrounding fees is a common trait among brokers that may not have the best interests of their clients in mind.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. A reputable broker should implement robust measures to protect clients' investments. GrowFX's lack of regulation raises concerns about the safety of client funds, particularly regarding the segregation of accounts and investor protection mechanisms.

Segregation of client funds is a critical safety measure that ensures traders' money is kept separate from the broker's operational funds. This practice protects clients in the event of the broker's insolvency. However, without regulatory oversight, there is no guarantee that GrowFX employs such measures. Additionally, the absence of negative balance protection can leave traders exposed to significant financial risk, especially in volatile market conditions.

Historically, unregulated brokers have faced allegations of misappropriating client funds, which further underscores the importance of assessing a broker's fund safety measures. Traders should be wary of any broker that does not provide clear and verifiable information regarding the protection of their investments.

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. Reviews and testimonials can shed light on the experiences of other traders and highlight any recurring issues. In the case of GrowFX, there are numerous reports of withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

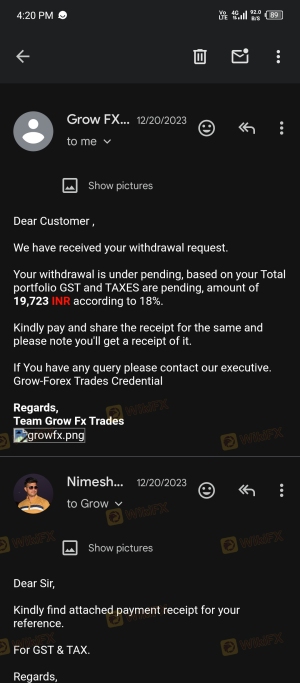

Common complaints include delays in processing withdrawals and difficulty in contacting customer support. These issues can severely impact a trader's experience and raise concerns about the broker's operational integrity. For instance, some users have reported that after requesting withdrawals, they received requests for additional fees or taxes, which is a common tactic employed by potentially fraudulent brokers.

Overall, the pattern of complaints associated with GrowFX suggests that traders may face significant obstacles when trying to access their funds or receive assistance, indicating that the broker may not be a safe option for trading.

Platform and Trade Execution

The performance of a trading platform can significantly influence a trader's success. GrowFX claims to utilize advanced trading technology, but the lack of transparency regarding the platform's capabilities raises concerns.

Traders need to know about order execution quality, slippage, and the frequency of rejected orders. A reliable trading platform should provide quick and efficient order execution, allowing traders to capitalize on market opportunities. However, without verifiable data on GrowFX's execution metrics, it is difficult to assess the platform's reliability.

Additionally, potential signs of platform manipulation, such as unexpected price changes or frequent re-quotes, can be indicative of a broker that does not operate in the best interests of its clients. Traders should be cautious and consider these factors when evaluating whether GrowFX is a safe option for their trading activities.

Risk Assessment

Engaging with an unregulated broker like GrowFX carries inherent risks that traders must carefully consider. A comprehensive risk assessment reveals several critical areas of concern.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Safety Risk | High | Lack of fund segregation and investor protection measures. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

| Trading Conditions Risk | Medium | High minimum deposit and unclear fee structures. |

To mitigate these risks, traders should approach GrowFX with caution. It is advisable to consider alternative brokers that are regulated and have a proven track record of transparency and client satisfaction. Conducting thorough research and seeking out reputable trading platforms can help protect traders from potential losses.

Conclusion and Recommendations

After analyzing the various aspects of GrowFX, it is evident that the broker presents several red flags that warrant caution. The lack of regulation, transparency issues, and a history of customer complaints suggest that GrowFX may not be a safe option for traders.

While the broker offers a range of trading instruments and high leverage, the associated risks far outweigh the potential benefits. Traders should be particularly wary of the high minimum deposit requirement and the unclear fee structures, as these factors can lead to unexpected costs and challenges in accessing funds.

For those seeking a reliable trading experience, it is recommended to explore alternatives that are regulated and have demonstrated a commitment to client safety and satisfaction. Brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback should be prioritized to ensure a safer trading environment. In conclusion, traders should exercise caution and conduct thorough research before engaging with GrowFX or any similar unregulated broker.

Is GROWFX a scam, or is it legit?

The latest exposure and evaluation content of GROWFX brokers.

GROWFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GROWFX latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.