WavFX 2025 Review: Everything You Need to Know

Summary

This wavfx review shows a concerning picture of an unregulated forex and CFD broker that poses significant risks to traders. WavFX Trading Index Limited claims to offer competitive trading services, but it operates without proper financial regulation and has received mostly negative user feedback. According to Reviews.io, only 14% of the 102 reviewers recommend WavFX. This highlights serious concerns about the platform's reliability and trustworthiness.

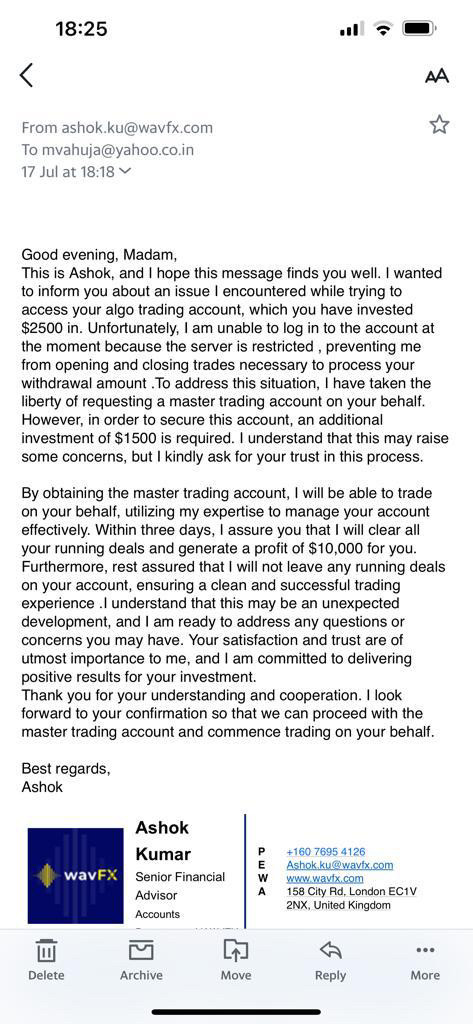

The broker offers high leverage up to 1:2000 and claims to provide six different live account types. These features may initially appear attractive to experienced traders seeking flexible trading conditions. However, these features are overshadowed by reports of withdrawal difficulties, poor customer service, and the complete absence of regulatory oversight. The Financial Conduct Authority (FCA) has specifically identified WavFX as an unauthorized firm. This means they may be providing financial services without proper permission, raising red flags about the safety of client funds and the legitimacy of their operations.

Given the substantial risks associated with trading through an unregulated broker and the mostly negative user experiences, potential traders should exercise extreme caution when considering WavFX for their trading activities.

Important Notice

Regional Entity Differences: WavFX operates across different jurisdictions without proper regulatory authorization. This means traders in various regions may face different levels of legal protection and recourse options. The broker's unauthorized status in the UK, as confirmed by the FCA, suggests similar regulatory issues may exist in other territories.

Review Methodology: This evaluation is based on publicly available information, user feedback from verified review platforms, and regulatory warnings. The assessment has not involved direct trading testing with the platform. Traders should conduct their own due diligence before making any investment decisions.

Rating Framework

Broker Overview

WavFX Trading Index Limited was established in 2015 and claims to operate from London, United Kingdom, with additional presence in Cyprus. The company presents itself as a provider of forex and CFD trading services. It targets traders who seek high leverage opportunities and flexible trading conditions. However, beneath this surface lies a troubling reality of regulatory non-compliance and questionable business practices that have earned the broker a poor reputation within the trading community.

According to the Financial Conduct Authority (FCA), WavFX operates as an unauthorized firm. This wavfx review finds that the company's registered address at 124 Leadenhall Street, London, along with its Cyprus operations, lack the necessary regulatory approvals that legitimate brokers typically maintain. The absence of proper licensing raises serious questions about client fund protection, dispute resolution mechanisms, and the overall legitimacy of the trading environment offered by WavFX.

Regulatory Status: WavFX operates without authorization from major financial regulatory bodies, including the FCA in the UK. This unauthorized status creates significant legal and financial risks for traders.

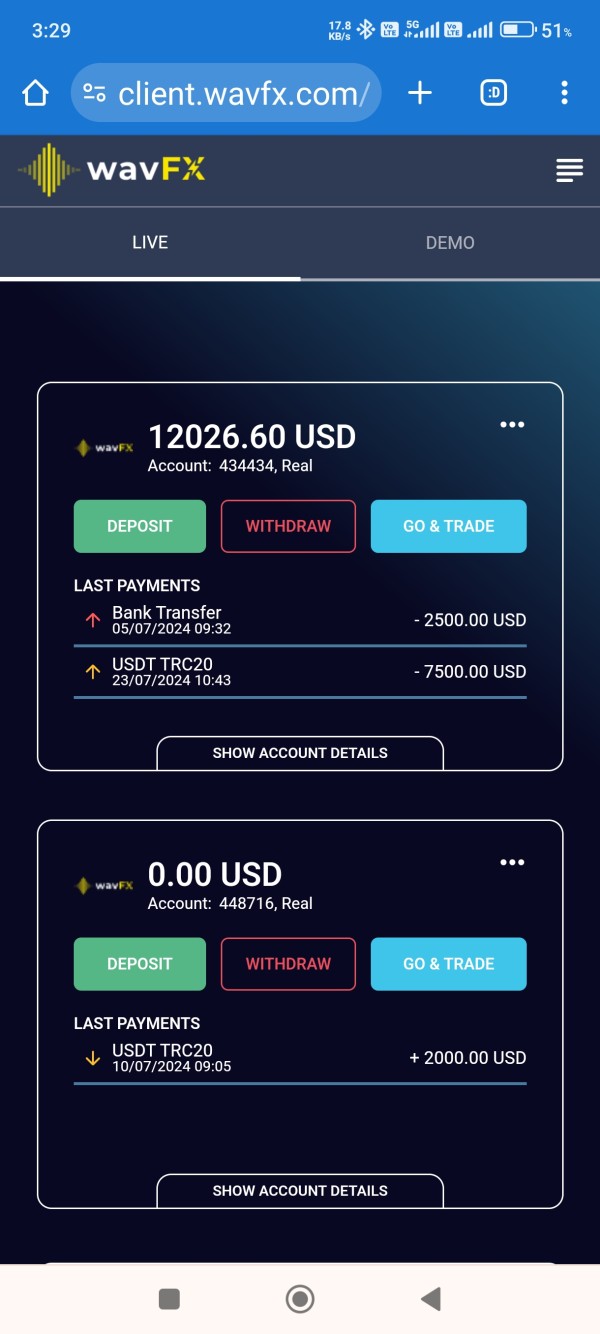

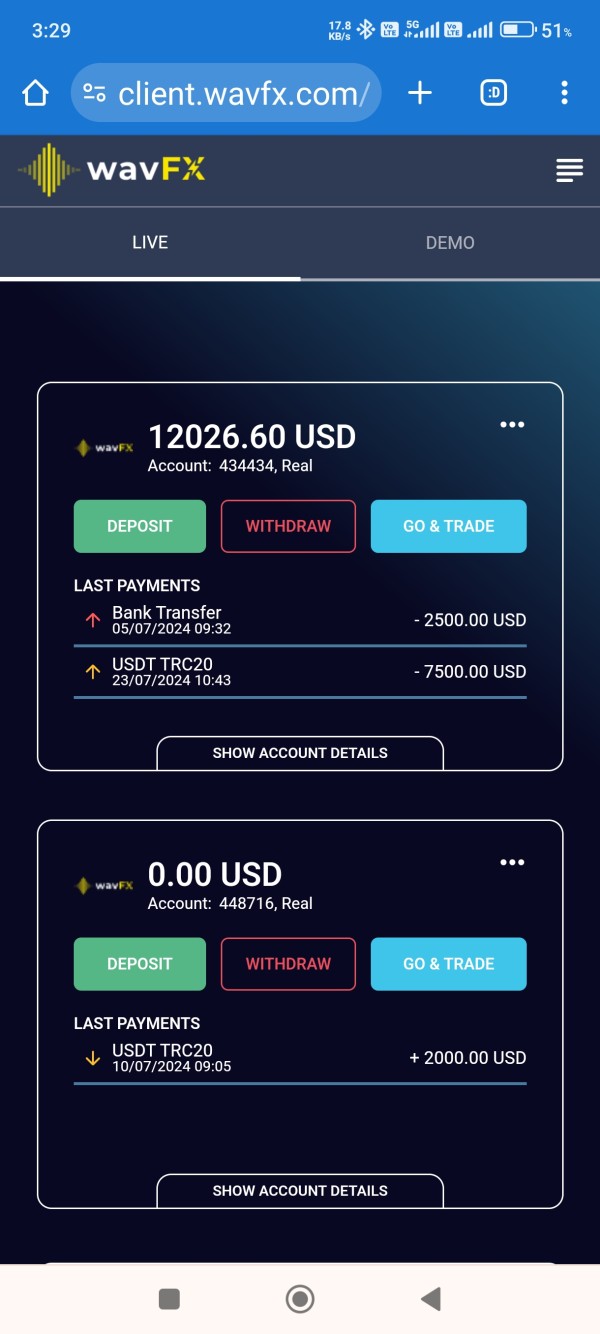

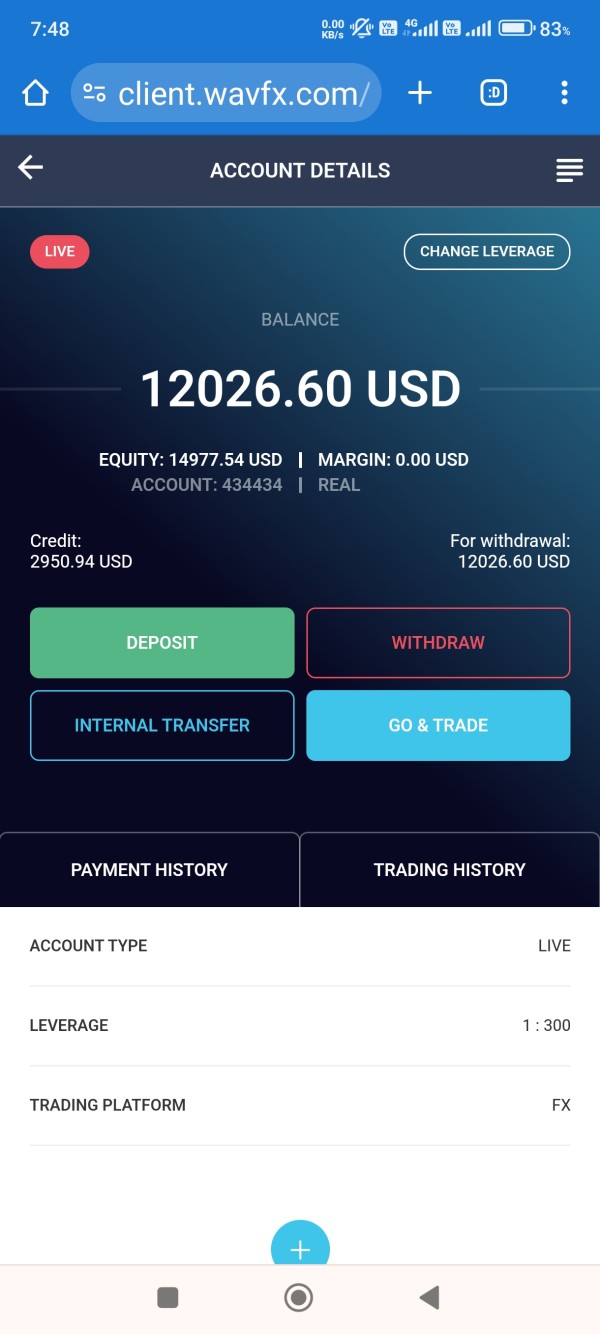

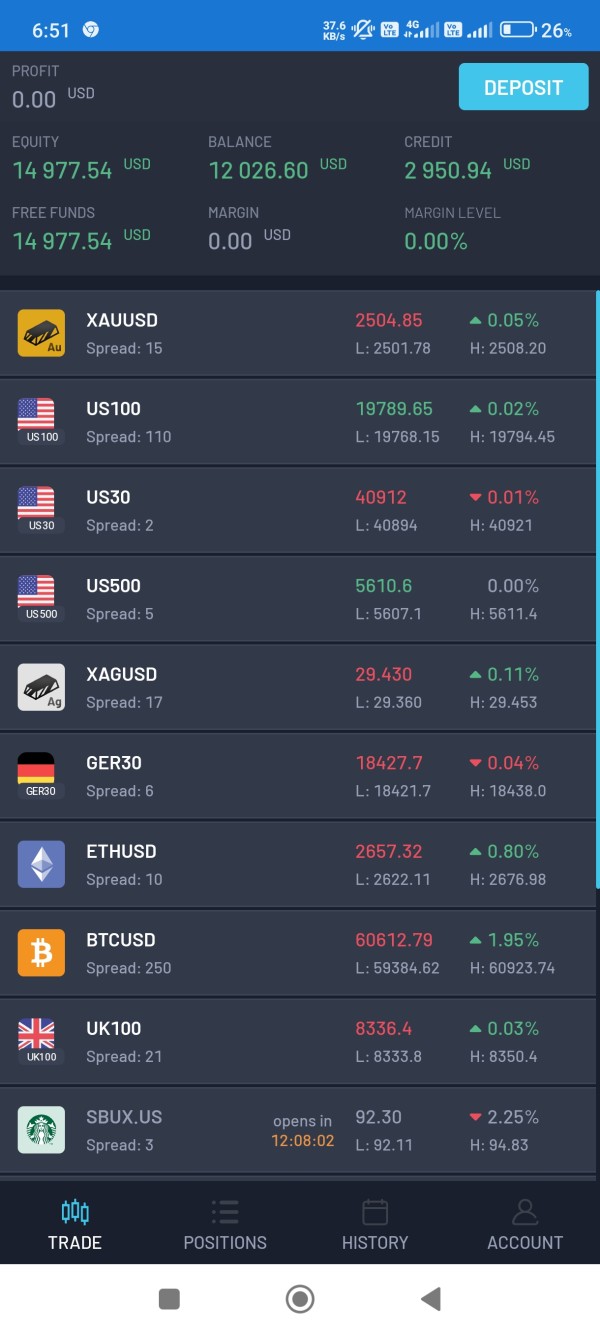

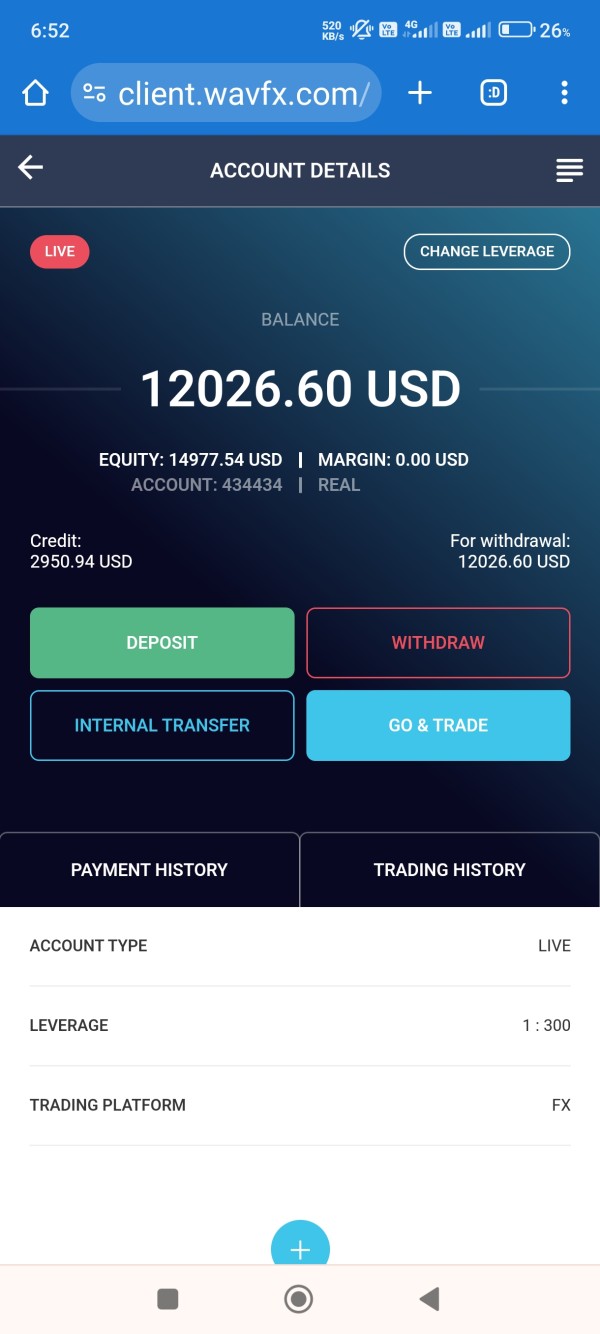

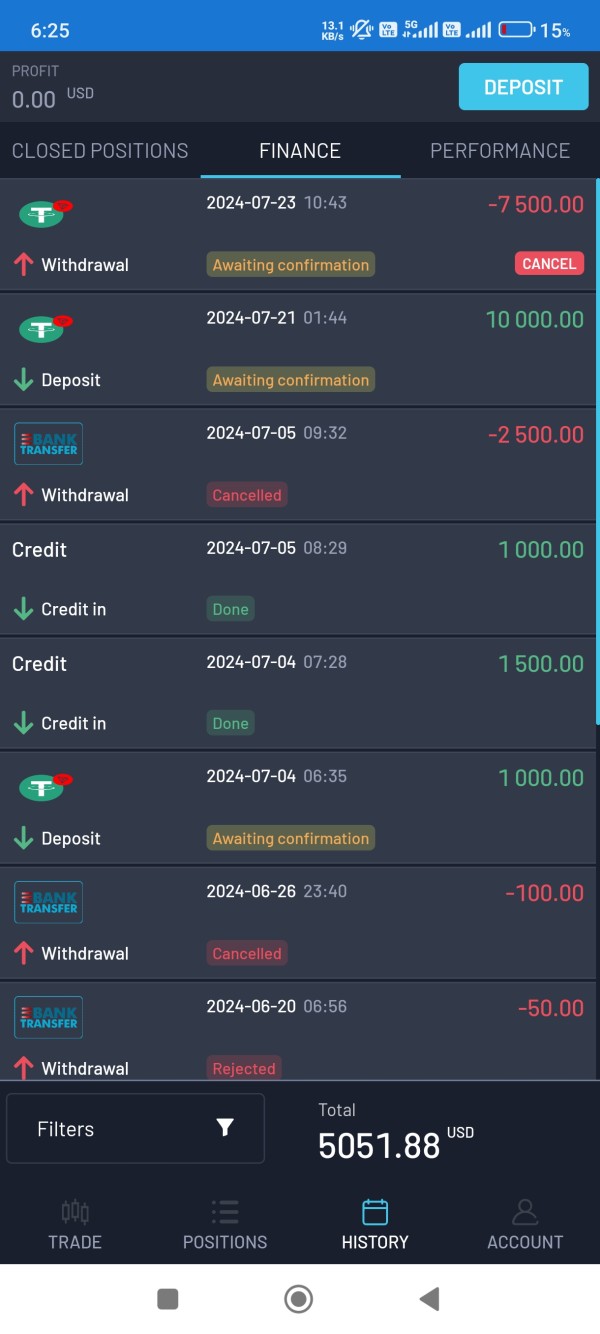

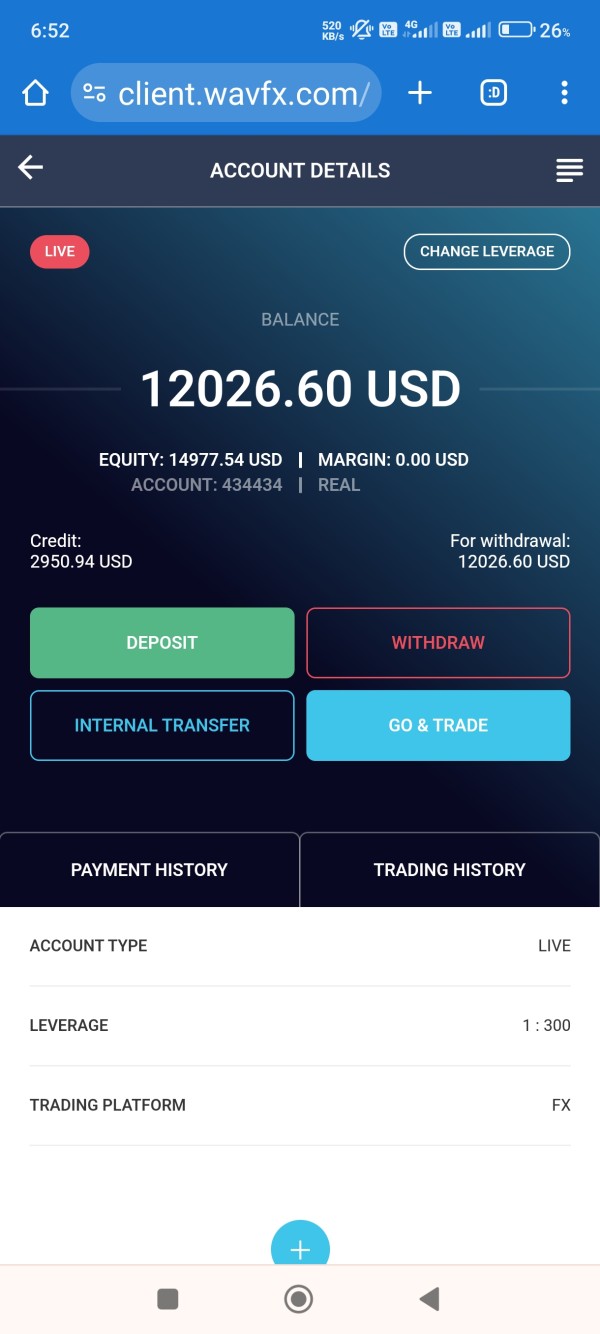

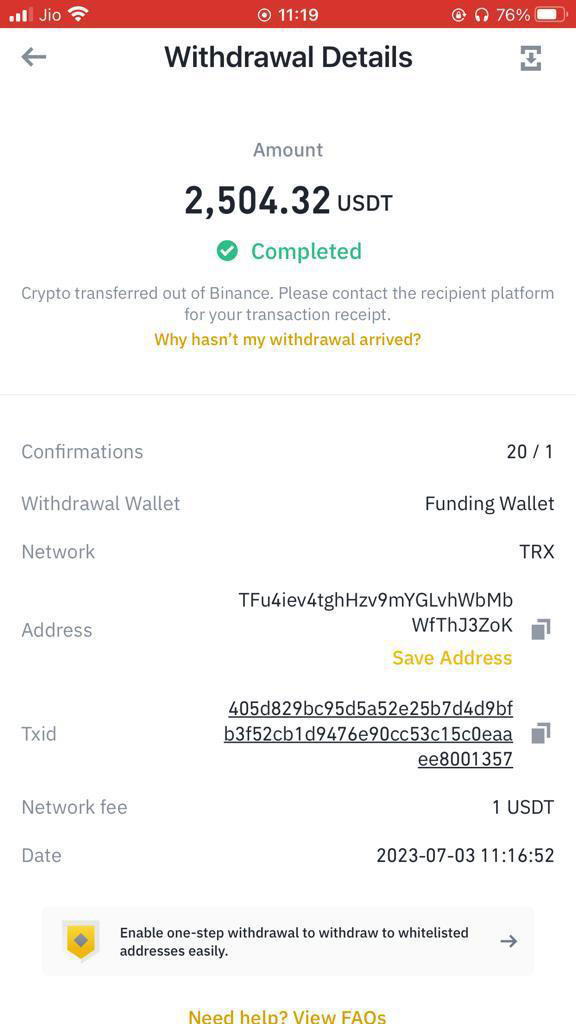

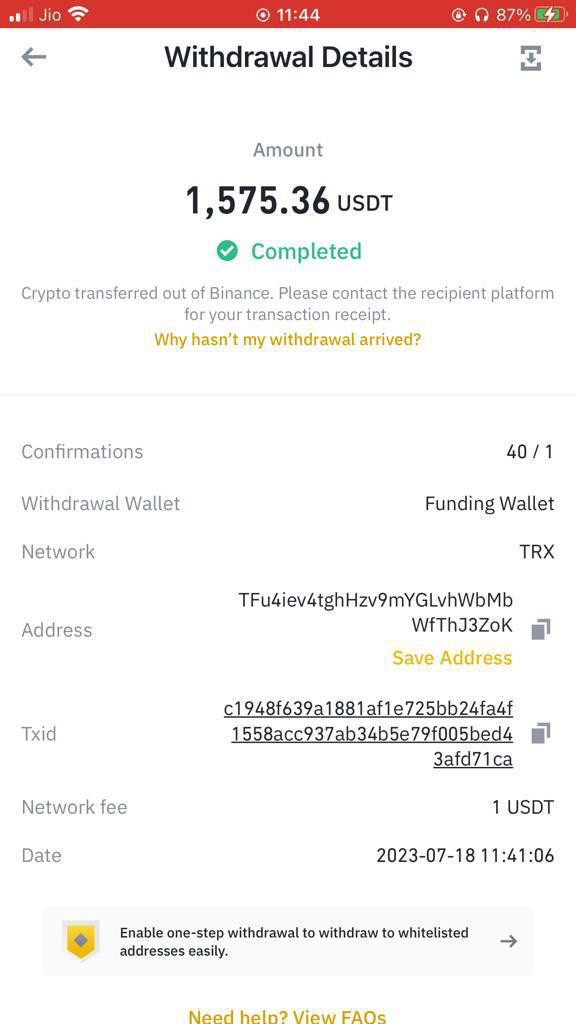

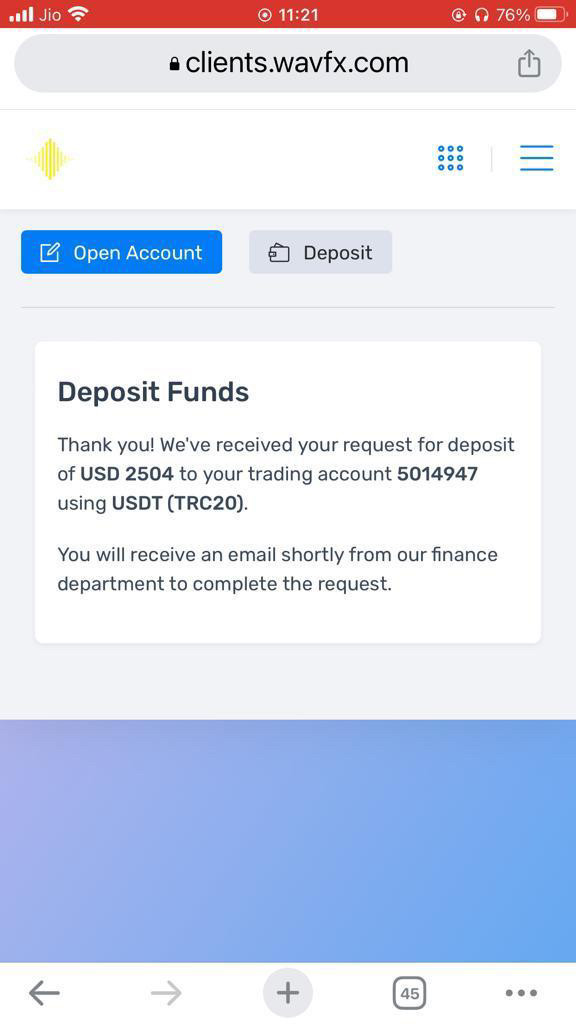

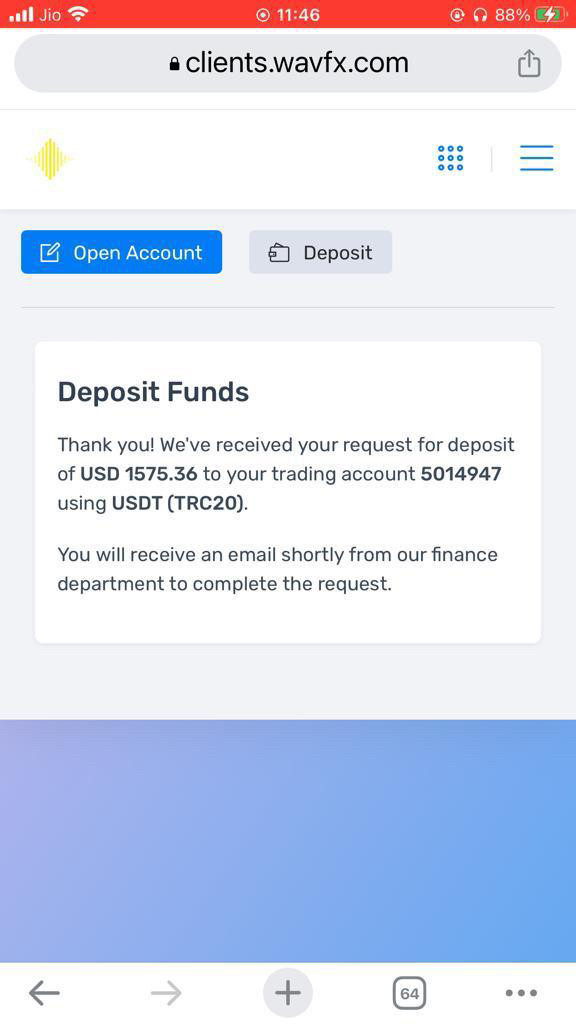

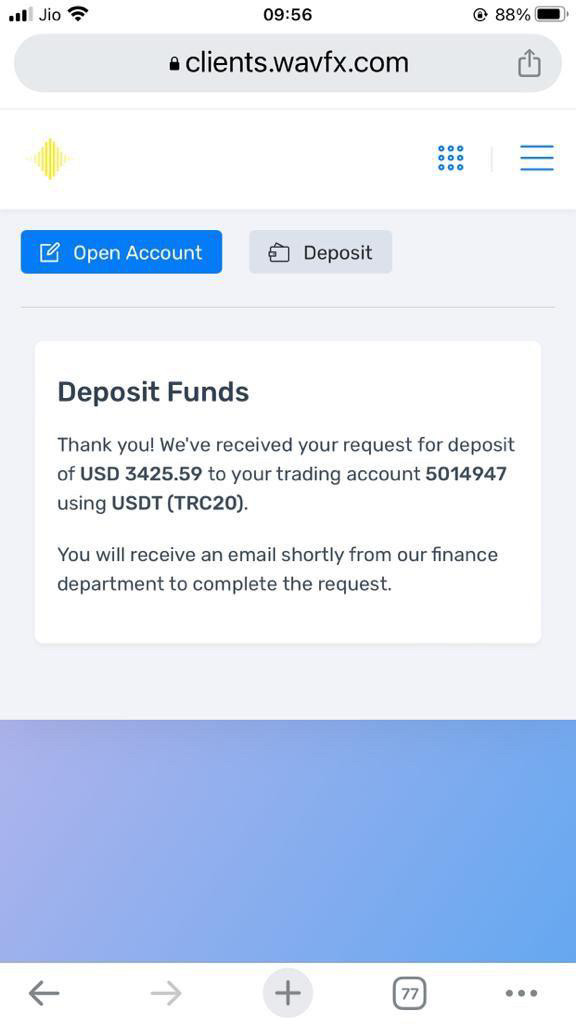

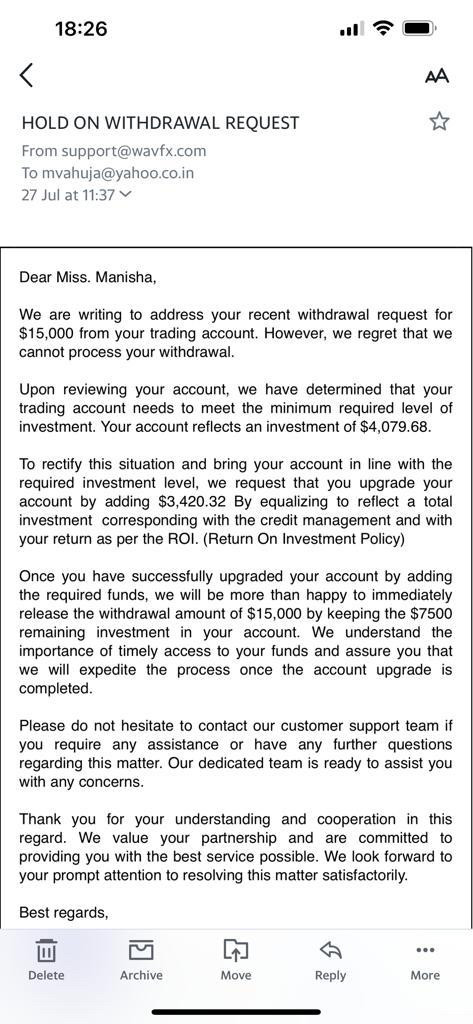

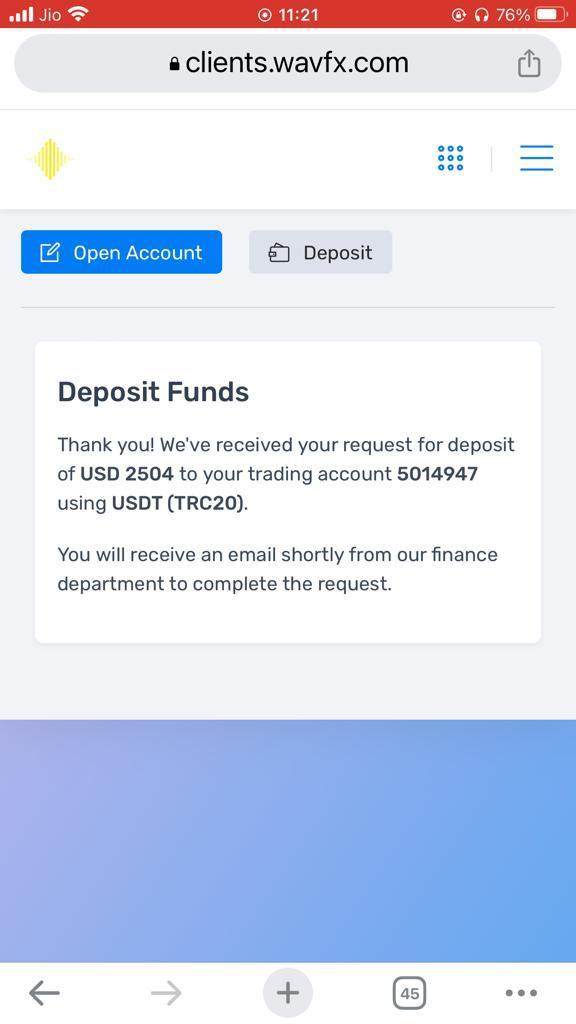

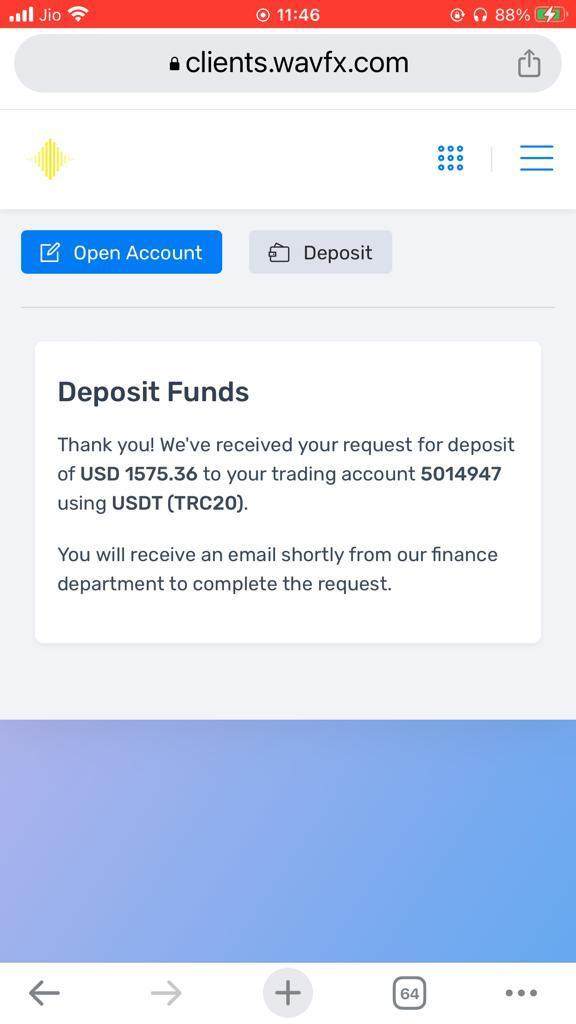

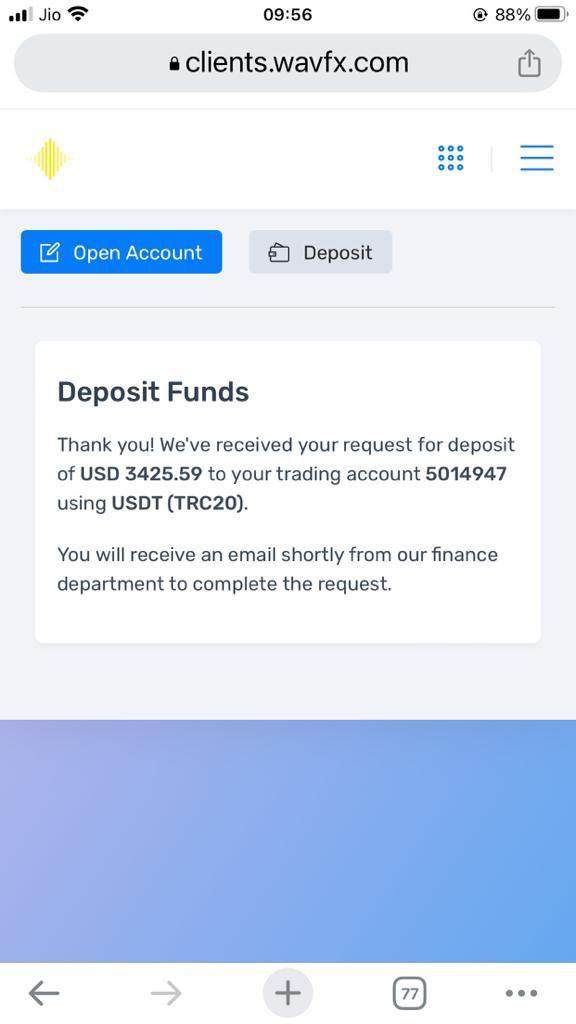

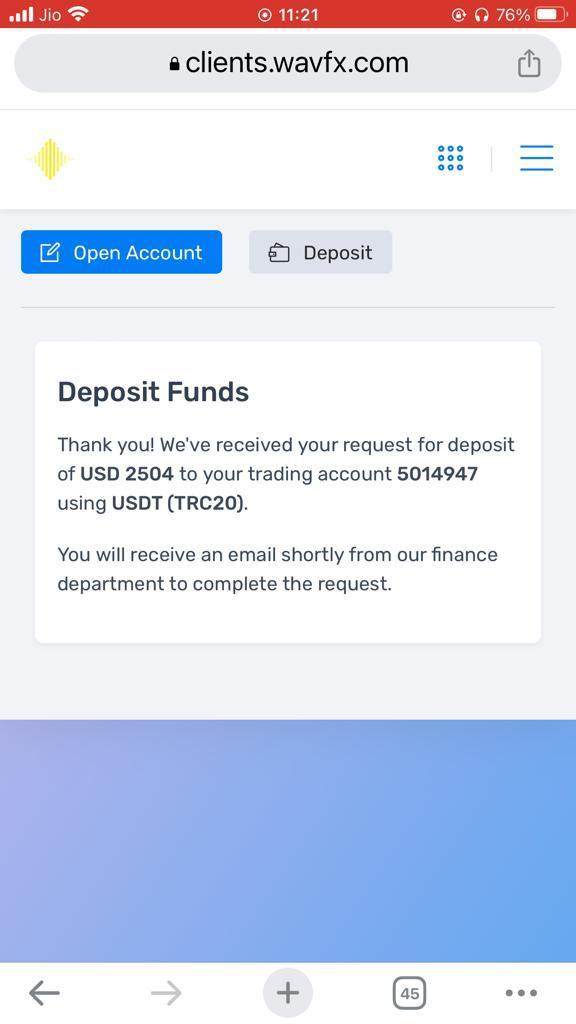

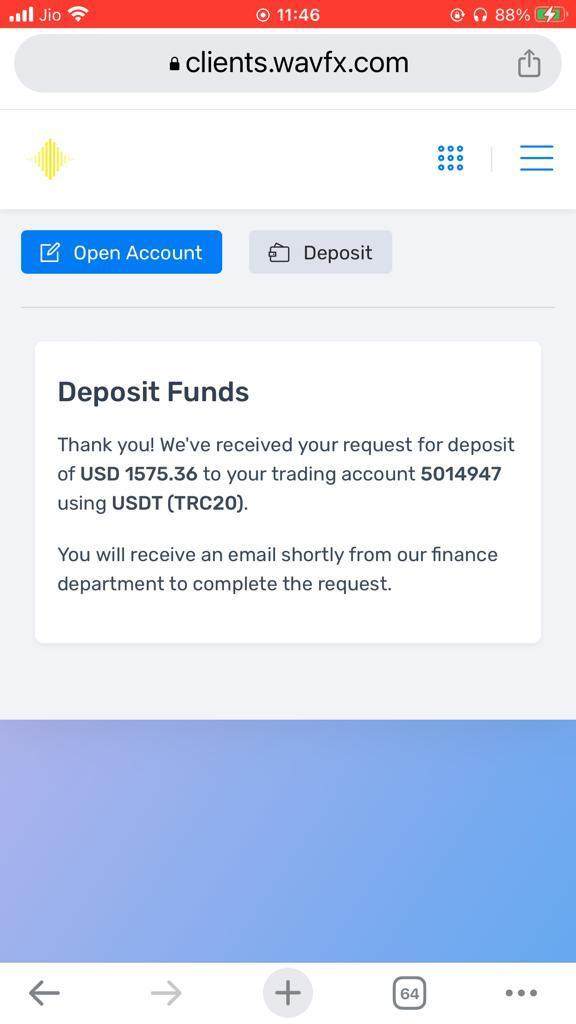

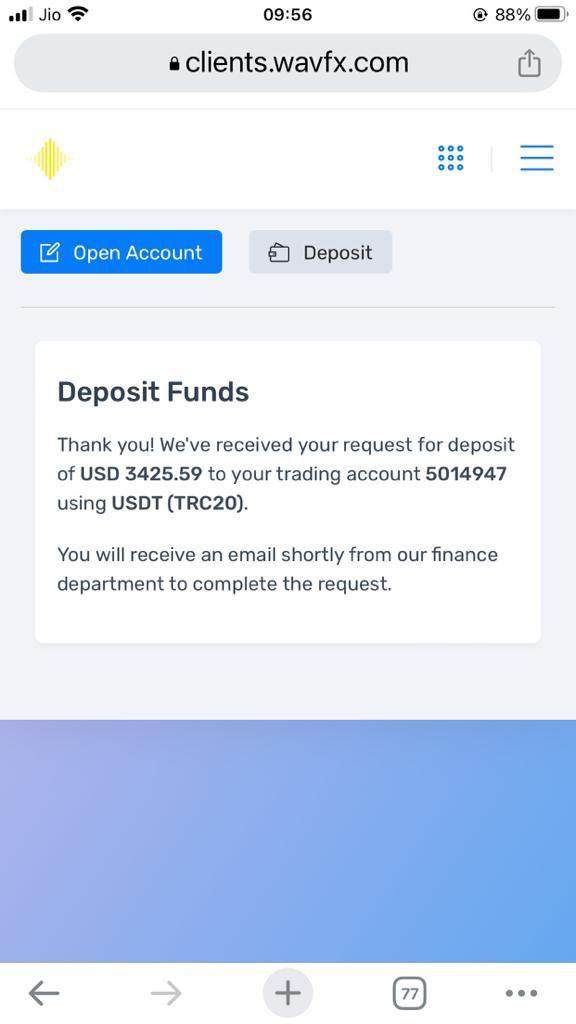

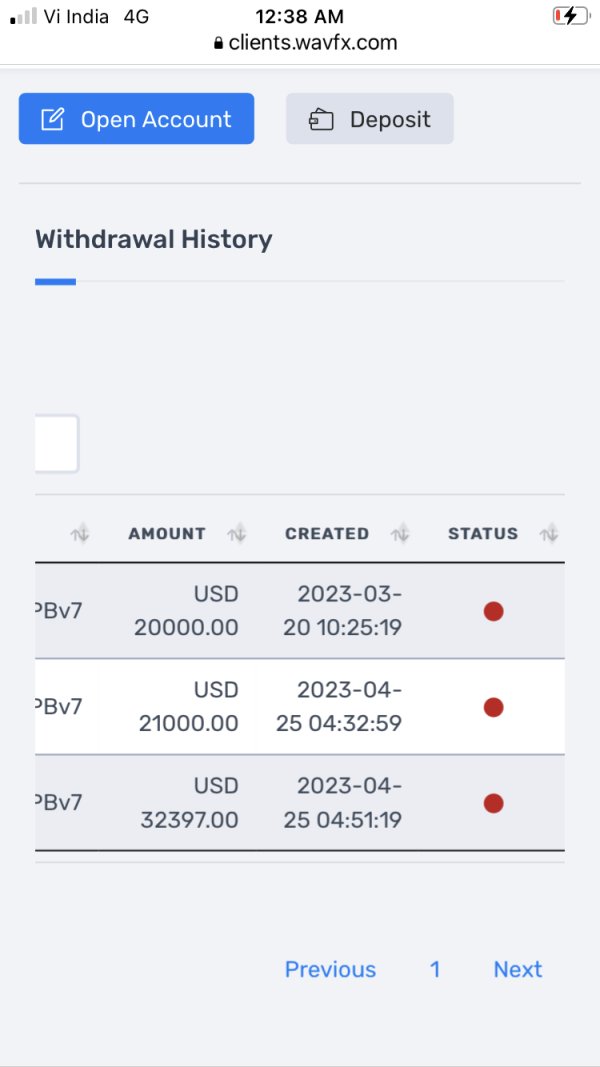

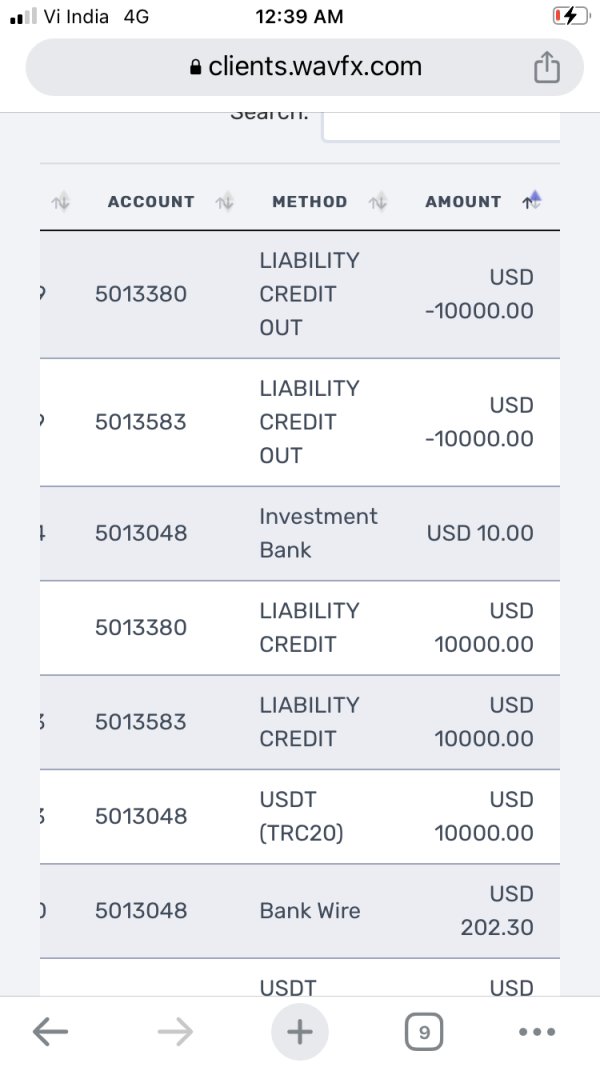

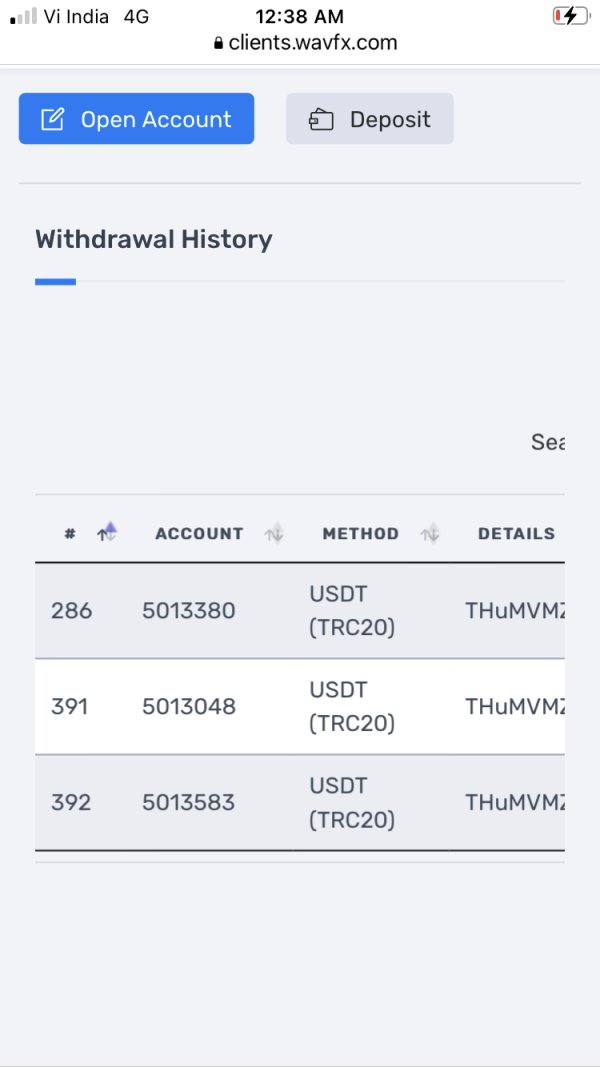

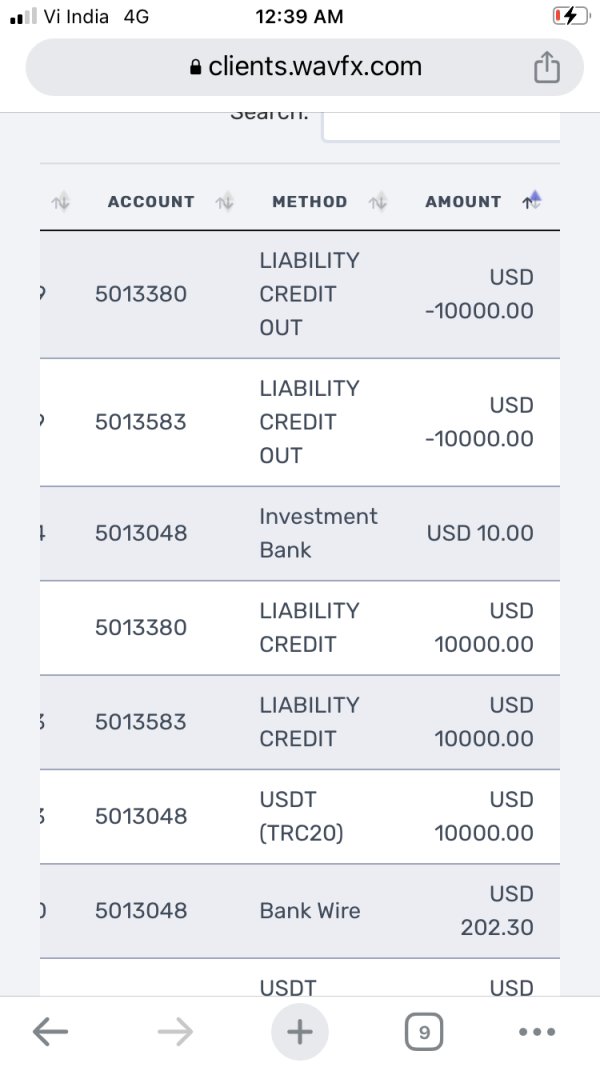

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not clearly disclosed in available materials. This itself raises transparency concerns.

Minimum Deposit Requirements: The broker has not clearly specified minimum deposit requirements in publicly available information. This makes it difficult for potential clients to assess accessibility.

Bonuses and Promotions: No specific bonus or promotional offerings are mentioned in available documentation. This suggests either absence of such programs or lack of transparency in marketing.

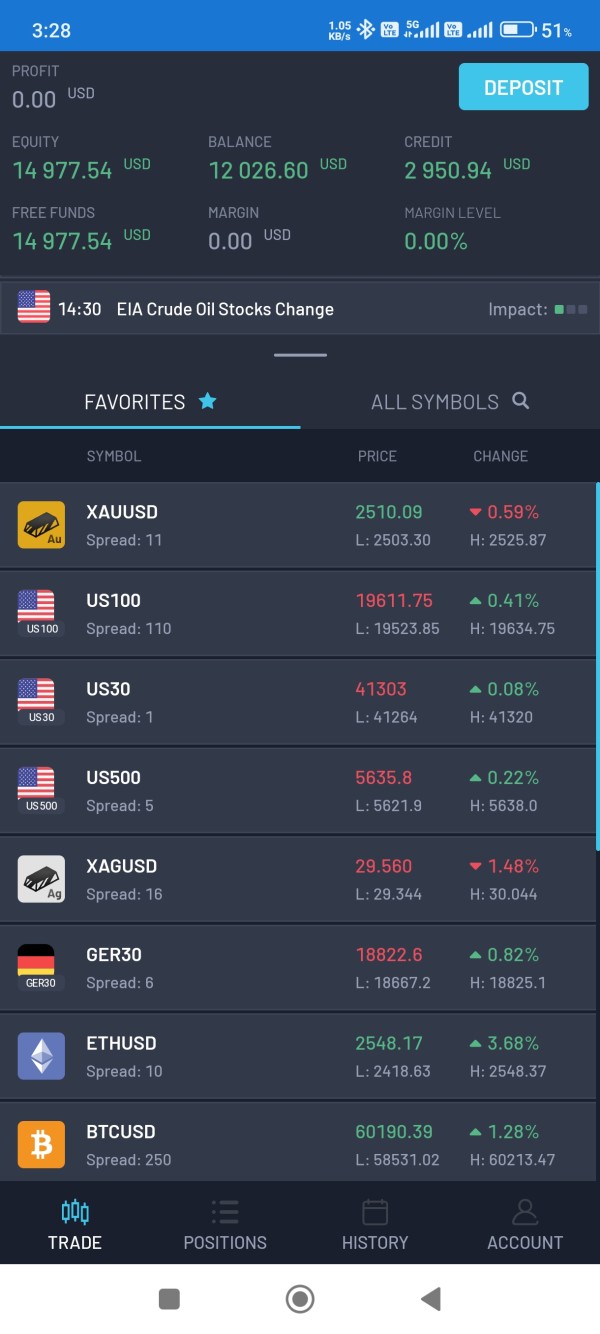

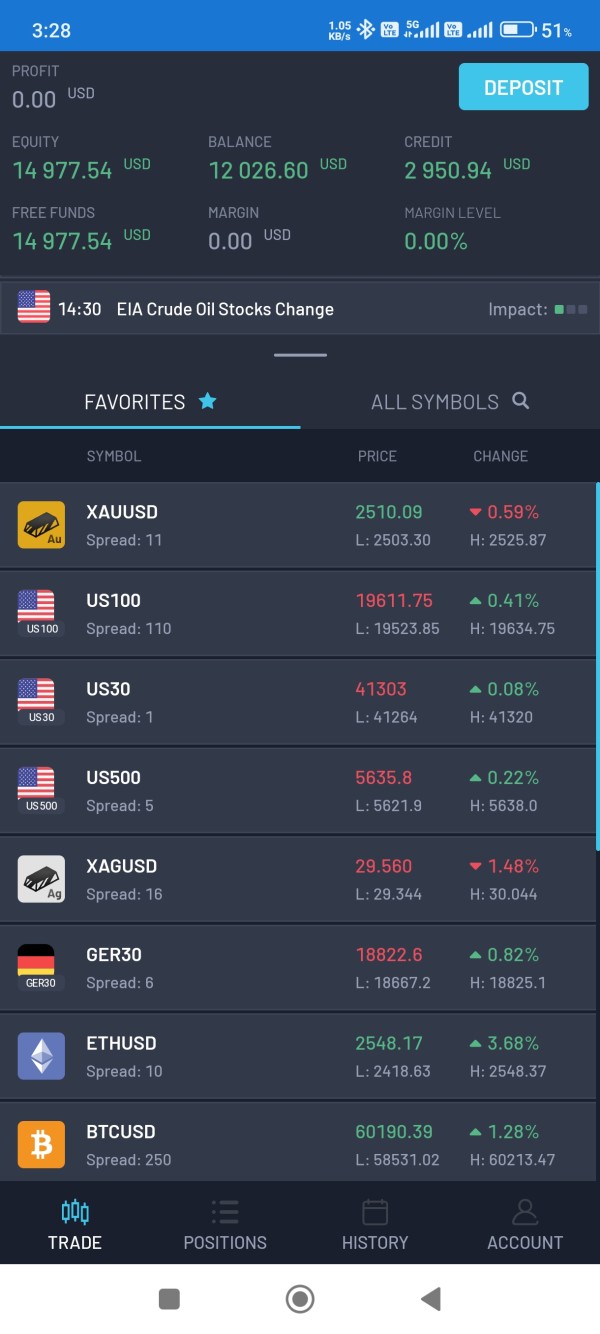

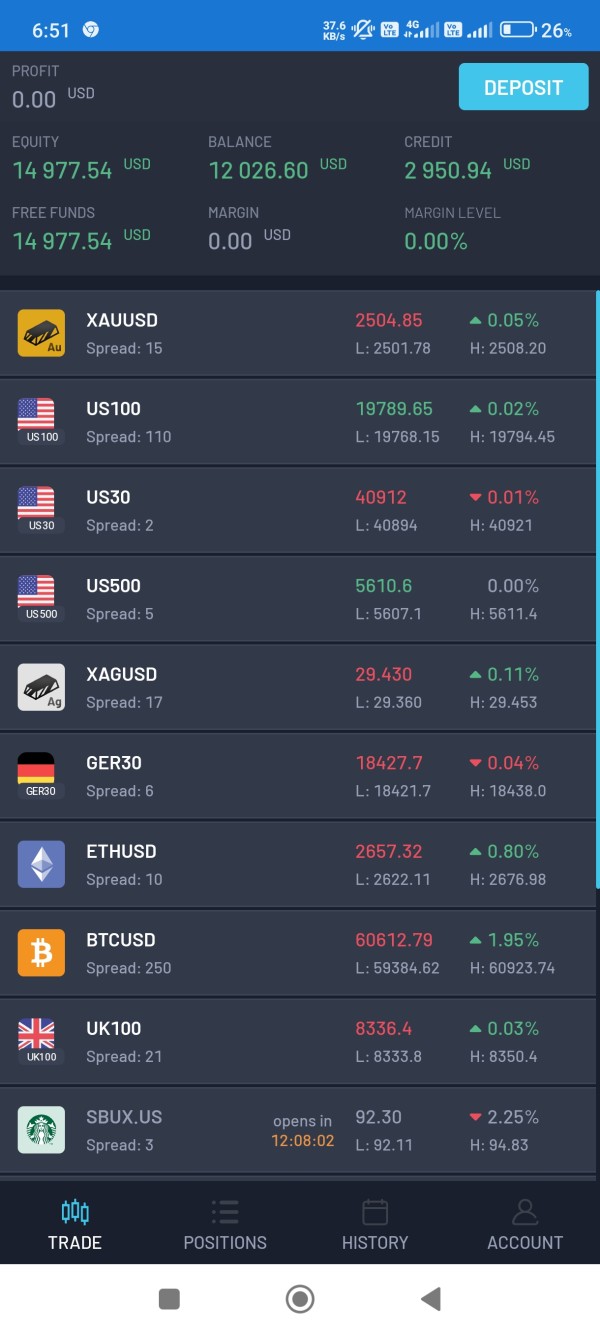

Tradeable Assets: The platform primarily focuses on forex and CFD trading. However, specific asset coverage details remain unclear from available information.

Cost Structure: The broker advertises floating spreads starting from 0 pips. However, comprehensive commission structures and hidden fees are not transparently disclosed in this wavfx review.

Leverage Ratios: WavFX offers leverage up to 1:2000. This significantly exceeds regulatory limits in many jurisdictions and poses substantial risk to traders.

Platform Options: Specific trading platform information is not adequately disclosed in available materials. This raises questions about technological infrastructure.

Regional Restrictions: Clear information about geographical restrictions and compliance requirements is not readily available.

Customer Support Languages: Available customer service languages are not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

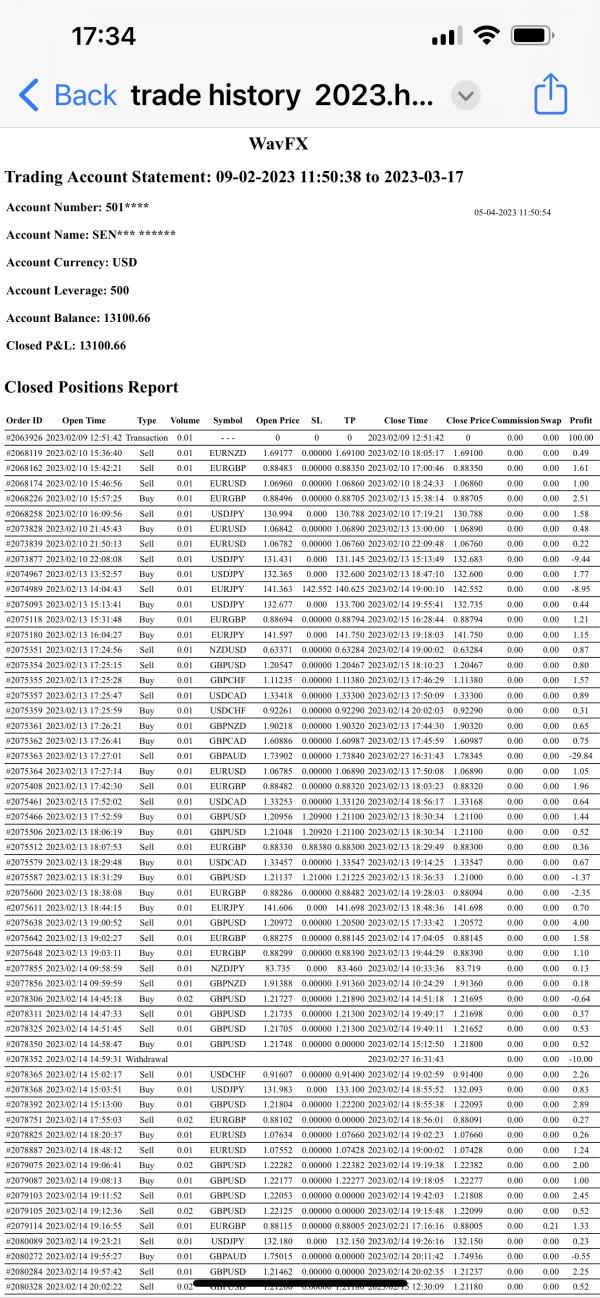

WavFX claims to offer six different live account types. This theoretically provides options for traders with varying experience levels and capital requirements. However, the lack of transparent information about account specifications, minimum deposit requirements, and specific features of each account type significantly undermines the value proposition. The absence of clear documentation about account opening procedures and requirements creates uncertainty for potential clients.

User feedback from the 102 reviews analyzed reveals that only 14% of customers recommend the platform. Many cite issues related to account management and unclear terms and conditions. The lack of regulatory oversight means that account holders have limited protection and recourse in case of disputes or issues with their trading accounts.

Compared to regulated brokers that provide comprehensive account information and regulatory protection, WavFX falls significantly short of industry standards. The wavfx review data suggests that traders should be extremely cautious about opening accounts with this broker given the documented issues and lack of transparency in account conditions.

The available information regarding WavFX's trading tools and resources is notably sparse. This itself indicates a significant deficiency in the broker's offering. Professional forex trading requires access to comprehensive market analysis tools, charting capabilities, economic calendars, and educational resources. Yet WavFX fails to clearly communicate what tools are available to their clients.

User feedback suggests a lack of adequate trading tools and analytical resources. This hampers traders' ability to make informed decisions. The absence of detailed information about research capabilities, market insights, or technical analysis tools represents a major weakness in the broker's service offering.

Without proper regulatory oversight, there are also questions about the quality and reliability of any tools that may be provided. Regulated brokers typically offer robust platforms with professional-grade tools. WavFX's unclear offerings suggest a substandard trading environment that may not meet the needs of serious traders.

Customer Service and Support Analysis (Score: 2/10)

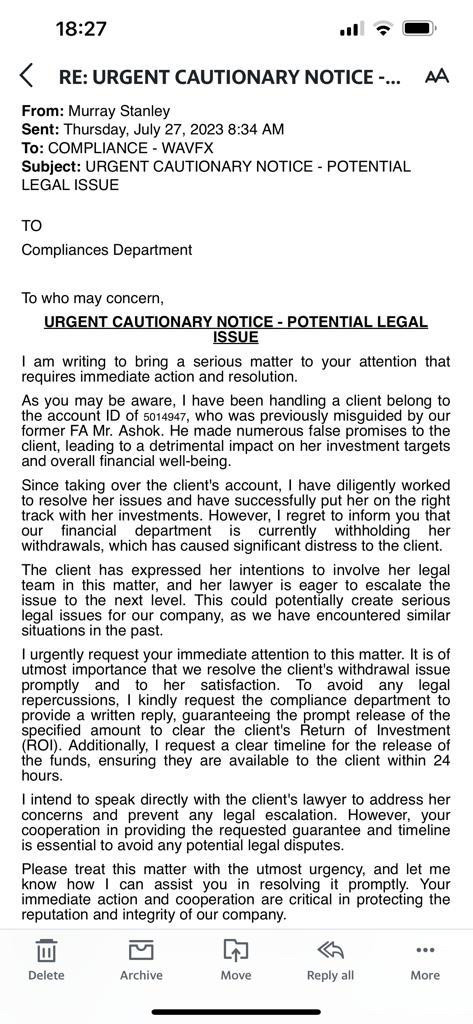

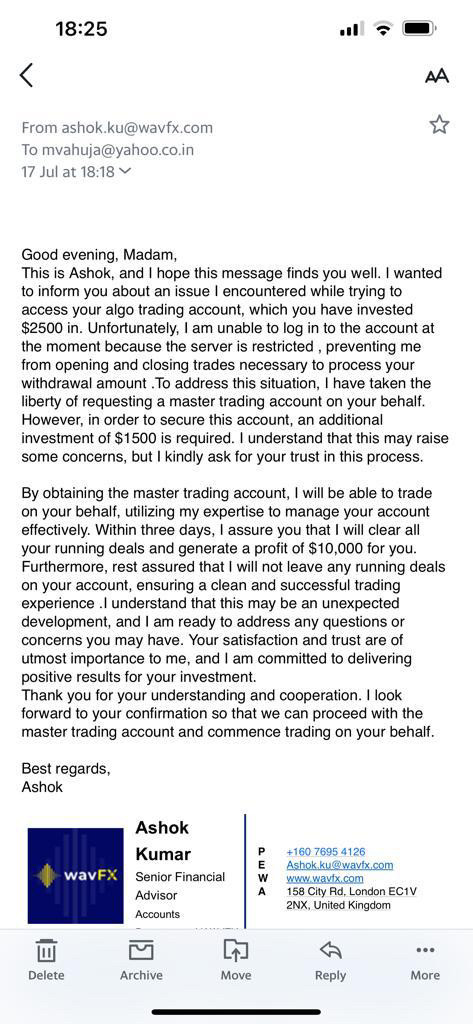

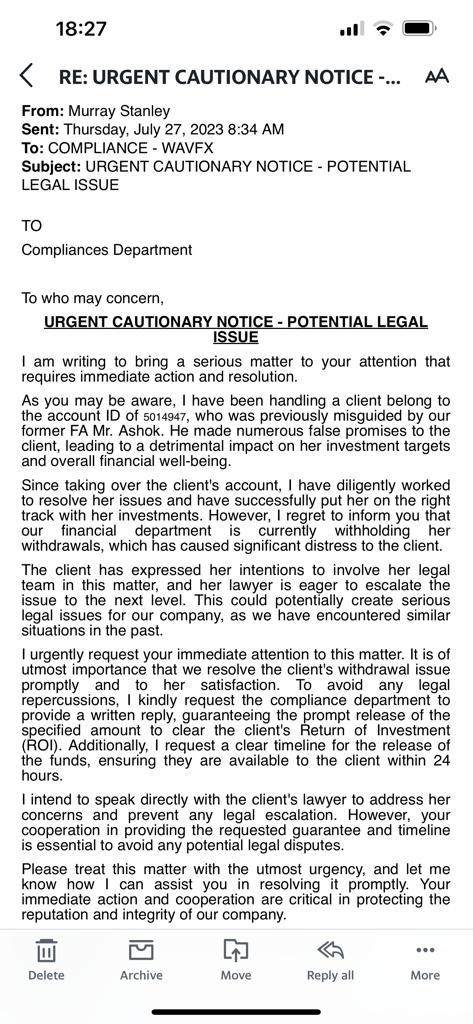

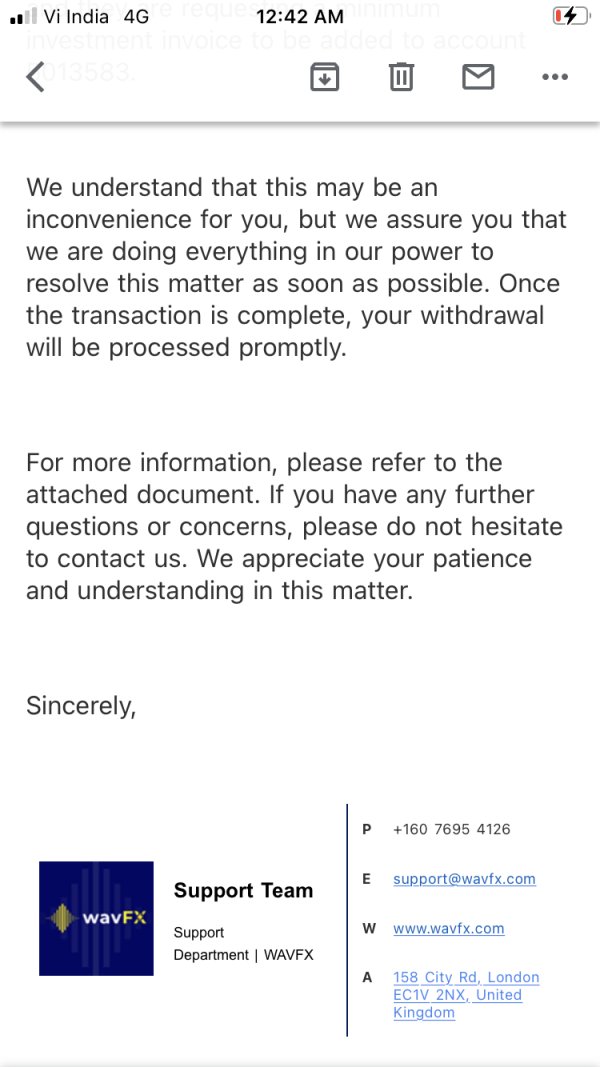

Customer service quality emerges as one of the most significant weaknesses in user feedback about WavFX. Multiple contact methods are listed, including telephone numbers for UK and US, along with several email addresses. However, user experiences suggest that the quality and responsiveness of support services are severely lacking.

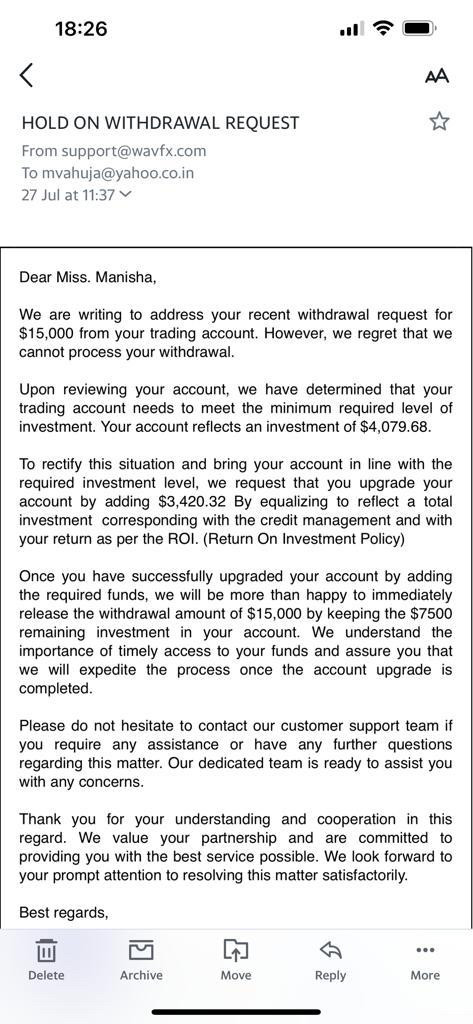

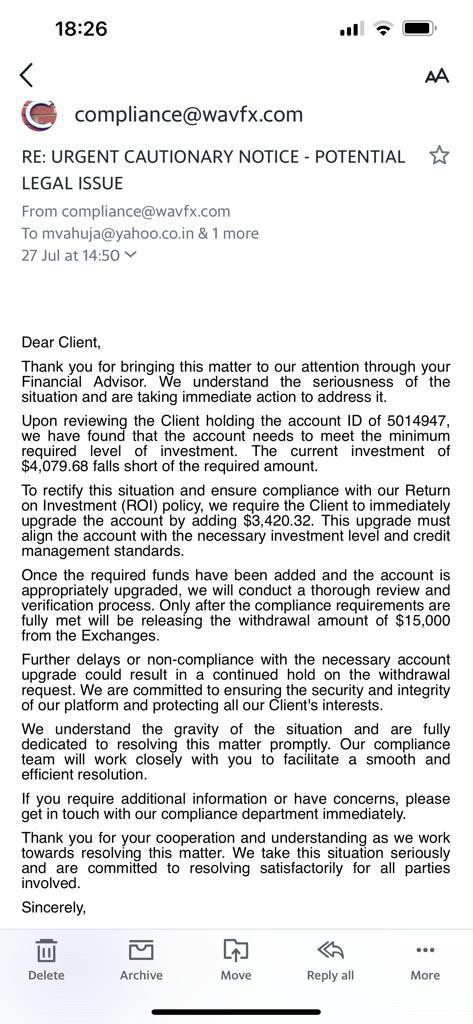

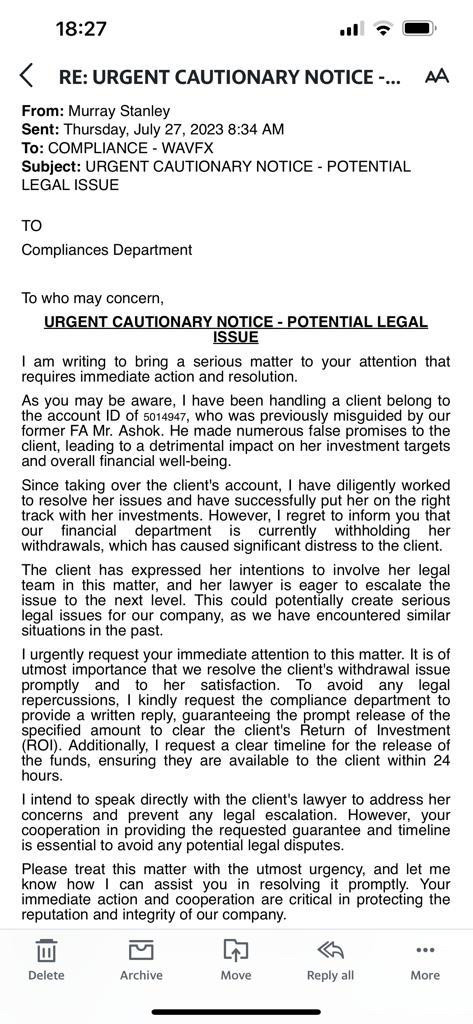

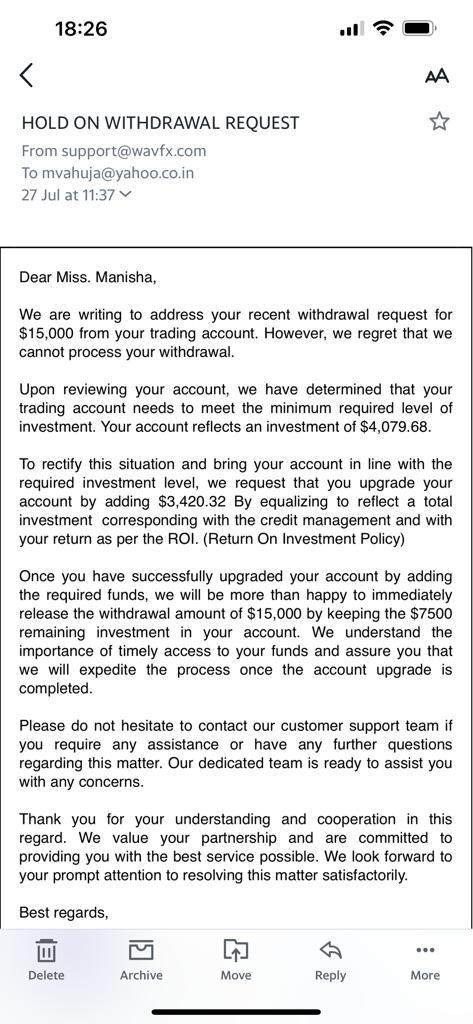

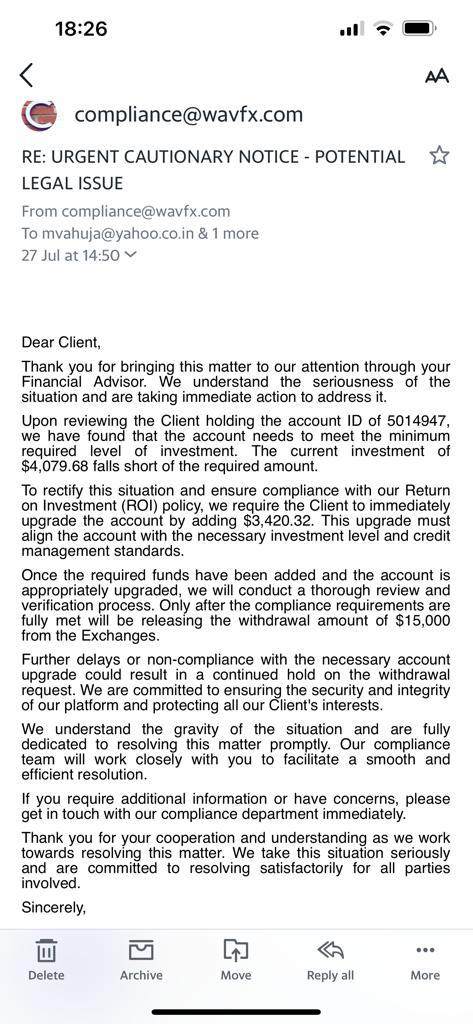

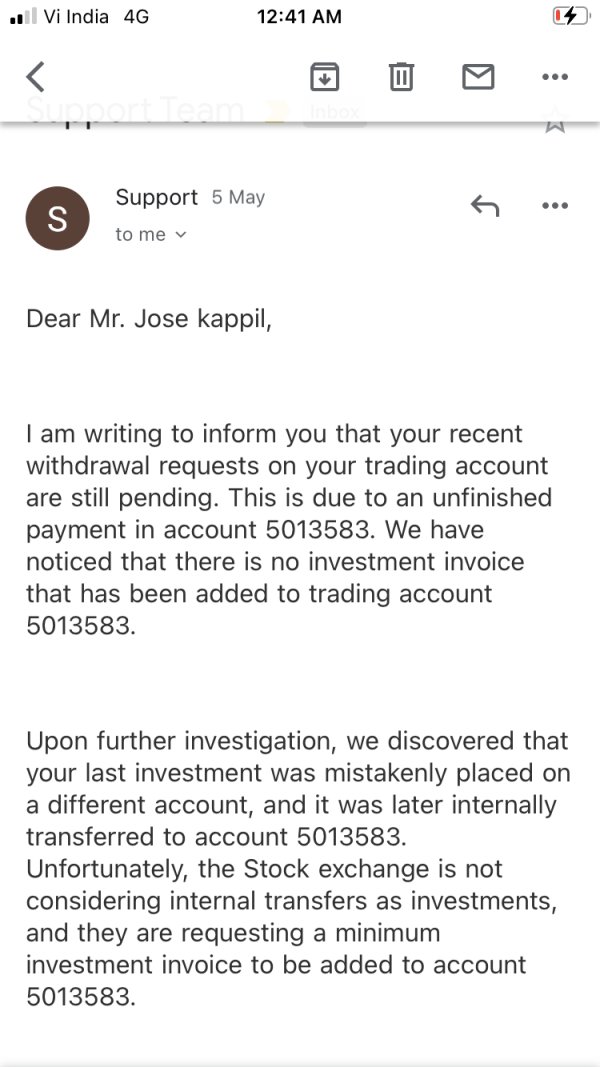

Reviews consistently highlight poor response times, unhelpful customer service representatives, and difficulty in resolving issues, particularly those related to fund withdrawals. The lack of clear information about customer service hours, available languages, or escalation procedures further compounds these problems.

The unauthorized status of the broker means that customers have limited recourse when customer service fails to resolve issues adequately. Unlike regulated brokers that must maintain certain service standards and provide complaint resolution mechanisms, WavFX operates without such oversight. This leaves customers vulnerable to poor service experiences.

Trading Experience Analysis (Score: 4/10)

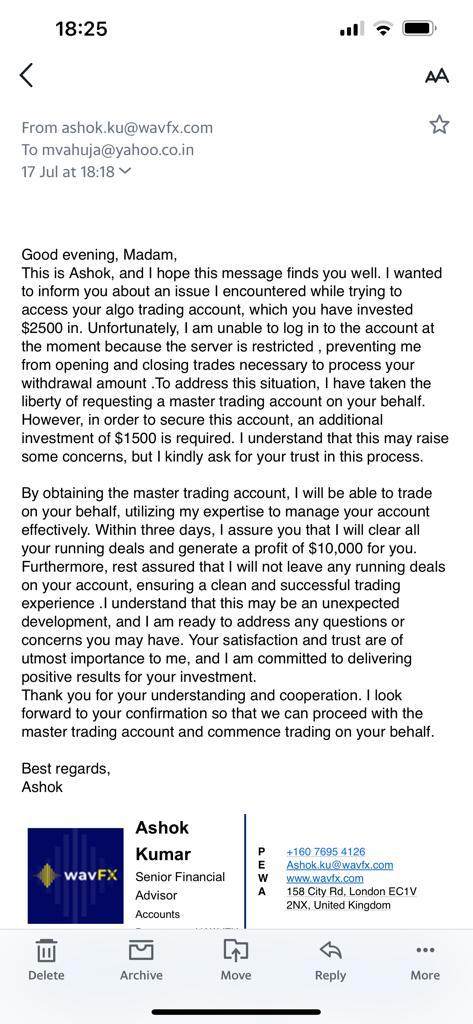

The trading experience with WavFX appears to be compromised by several factors that negatively impact user satisfaction. While the broker offers high leverage up to 1:2000, which may appeal to some traders, user feedback suggests that the overall trading environment lacks the stability and reliability that professional traders require.

Reports indicate issues with platform stability, unclear execution quality, and concerns about the integrity of the trading environment. The absence of detailed information about order execution policies, slippage management, and platform performance metrics raises questions about the quality of the trading experience.

The wavfx review findings suggest that the trading environment may not meet professional standards. Users report various technical and operational issues that interfere with effective trading. Without regulatory oversight to ensure fair trading practices, clients may face additional risks related to execution quality and market access.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent the most critical concerns with WavFX. This is evidenced by its unauthorized status and poor user feedback. The Financial Conduct Authority's specific warning about WavFX operating without proper authorization fundamentally undermines any trust that potential clients might have in the platform.

The absence of regulatory oversight means that client funds lack the protection typically provided by regulatory frameworks. This includes segregated account requirements and compensation schemes. This creates significant risk for traders who may find their funds at risk without adequate legal recourse.

Industry reputation is severely damaged by the combination of regulatory warnings and overwhelmingly negative user feedback. The fact that only 14% of users recommend the platform speaks to fundamental trust issues. These extend beyond simple service quality problems to more serious concerns about the broker's legitimacy and reliability.

User Experience Analysis (Score: 3/10)

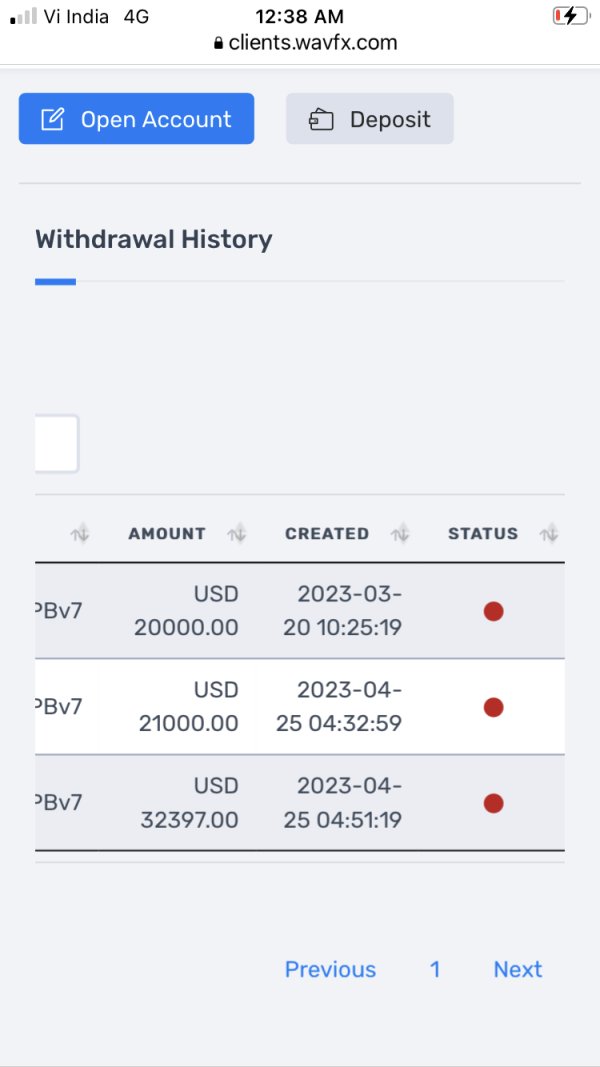

Overall user satisfaction with WavFX is notably poor. This is reflected in the low recommendation rate and negative feedback patterns. The user experience is compromised by multiple factors including unclear website information, poor customer service, and reported difficulties with fund withdrawals.

The lack of transparent information about key aspects of the service creates a frustrating experience for users. This ranges from account conditions to platform features, making it difficult for users to understand what they can expect from the broker. Registration and verification processes are not clearly documented, adding to user uncertainty.

The most significant user complaints center around withdrawal difficulties and poor customer service responsiveness. These fundamental operational issues, combined with the lack of regulatory protection, create a user experience that falls far below industry standards. The experience fails to meet expectations for professional forex trading services.

Conclusion

This comprehensive wavfx review reveals a broker that poses significant risks to traders due to its unauthorized status and poor track record. WavFX's operation without proper regulatory oversight, combined with overwhelmingly negative user feedback and documented issues with customer service and fund withdrawals, makes it unsuitable for serious forex trading.

While the broker may offer high leverage and claims multiple account types, these features cannot compensate for the fundamental lack of regulatory protection and poor service quality. The platform is particularly inappropriate for new traders or those with limited risk tolerance. Even experienced traders should avoid the substantial risks associated with unregulated brokers.

The main disadvantages significantly outweigh any potential benefits. Regulatory non-compliance, poor customer service, and withdrawal difficulties represent major red flags that should deter potential clients from engaging with this platform.