GrowFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive growfx review shows serious problems with GrowFX as a forex broker. The review reveals major regulatory issues and poor user feedback that raise serious questions about whether this broker is legitimate. According to WikiFX reports, GrowFX operates with suspicious regulatory licenses and maintains a concerning business scope that puts traders at high risk. The broker's WikiFX rating of 1.36 out of 10 shows widespread user dissatisfaction and safety concerns within the trading community.

GrowFX presents itself as a multi-asset trading platform. It offers access to forex, stocks, commodities, indices, and cryptocurrencies. However, the broker lacks effective regulatory oversight from recognized financial authorities, which seriously undermines its credibility. User feedback consistently highlights issues with customer service quality, trading experience, and overall platform reliability. The broker's registration in Indonesia with a 2-5 year operational history does little to inspire confidence given the absence of proper regulatory backing.

For traders seeking reliable trading conditions and regulatory protection, GrowFX presents substantial risks that outweigh any potential benefits. The combination of suspicious licensing, poor user ratings, and lack of transparency makes this broker unsuitable for serious trading activities.

Important Notice

This review is based on publicly available information from regulatory databases, user feedback platforms, and industry reports, particularly WikiFX assessments. GrowFX operates with what appears to be suspicious regulatory licenses. Traders should exercise extreme caution when considering this broker. The regulatory landscape varies significantly across different jurisdictions, and GrowFX's lack of oversight from recognized authorities like the FCA, ASIC, or CySEC represents a major red flag.

Our evaluation methodology incorporates multiple data sources, including user reviews, regulatory status verification, and platform testing reports where available. However, the limited information transparency from GrowFX itself constrains the depth of analysis possible. Traders are strongly advised to verify all information independently and consider regulated alternatives.

Rating Framework

Broker Overview

GrowFX operates as a forex and multi-asset trading broker with registration in Indonesia. It maintains an operational history of 2-5 years according to available records. The company presents itself as a comprehensive trading solution, offering access to multiple financial markets including foreign exchange, equity markets, commodity trading, and cryptocurrency investments. However, the broker's fundamental business model raises significant concerns due to its suspicious regulatory framework and limited transparency regarding operational procedures.

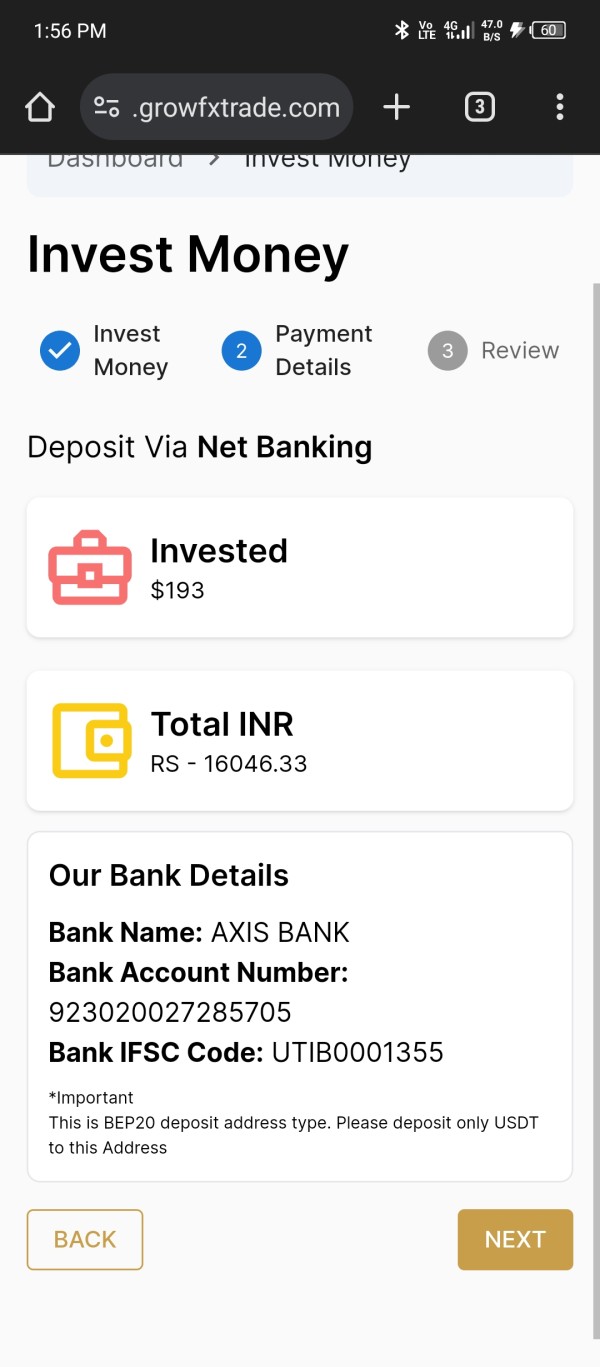

The broker's business approach focuses on attracting traders through multi-asset offerings. However, the lack of proper regulatory oversight severely undermines its market position. According to WikiFX assessments, GrowFX operates under suspicious regulatory licenses, which creates substantial risks for client fund security and dispute resolution. The company's website at growfxtrade.com provides limited information about its corporate structure, regulatory compliance, or operational transparency, further contributing to concerns about its legitimacy.

GrowFX's trading platform claims to support various asset classes including forex pairs, stock indices, commodities, and digital currencies. However, specific information about trading platforms, such as whether they offer MetaTrader 4, MetaTrader 5, or proprietary solutions, remains unclear from available documentation. This lack of transparency regarding essential trading infrastructure represents another significant concern for potential clients seeking reliable trading conditions.

Regulatory Status: GrowFX operates with suspicious regulatory licenses according to WikiFX reports. It lacks oversight from recognized financial authorities. This regulatory deficiency creates substantial risks for trader protection and fund security.

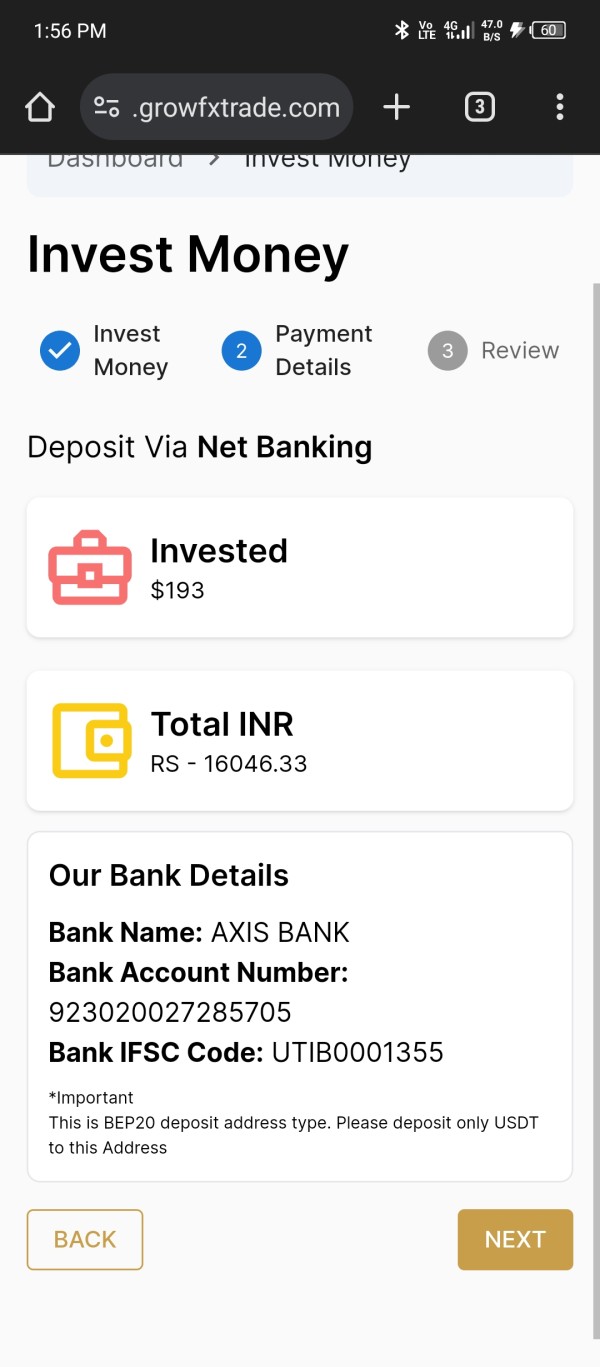

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees remains undisclosed in available documentation. This raises concerns about operational transparency.

Minimum Deposit Requirements: The broker has not clearly specified minimum deposit amounts for different account types. This makes it difficult for traders to understand entry-level requirements.

Bonus and Promotions: Available information does not detail any specific promotional offers, welcome bonuses, or ongoing incentive programs that the broker may provide to new or existing clients.

Tradeable Assets: GrowFX claims to offer access to multiple asset classes including forex currency pairs, stock market indices, commodity markets, and cryptocurrency trading. However, specific instruments and market depth remain unspecified.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available. This prevents accurate cost analysis for potential traders.

Leverage Options: Specific leverage ratios offered across different asset classes and account types are not clearly disclosed in available documentation.

Platform Options: The types of trading platforms supported, whether web-based, desktop applications, or mobile solutions, remain unclear from current information sources.

Geographic Restrictions: Information about restricted countries or regional limitations for account opening and trading activities is not specified in available materials.

Customer Support Languages: Supported languages for customer service and platform interfaces are not detailed in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by GrowFX present significant concerns for traders seeking transparent and competitive trading environments. Available information fails to specify account types, minimum deposit requirements, or specific features that differentiate various account tiers. This lack of transparency regarding basic account structures represents a fundamental weakness in the broker's service offering and suggests inadequate attention to client needs and market standards.

User feedback indicates confusion about account opening procedures and unclear terms regarding trading conditions. The absence of detailed information about account features, such as educational resources, research tools, or premium services, further diminishes the value proposition. Without clear account specifications, traders cannot make informed decisions about which account type might suit their trading strategies and capital requirements.

The broker's failure to provide comprehensive account condition details contrasts sharply with industry standards. Reputable brokers offer detailed comparisons of account features, costs, and benefits. This opacity in account structuring, combined with suspicious regulatory status, creates additional barriers for traders seeking reliable and transparent trading relationships. The lack of institutional or professional account options also suggests limited scalability for growing trading operations.

According to available assessments, GrowFX's account management procedures lack the sophistication and transparency expected from legitimate forex brokers. This contributes to its poor rating in this growfx review category.

GrowFX claims to provide access to multiple trading instruments across various asset classes, including forex, stocks, commodities, indices, and cryptocurrencies. This diversified offering represents the broker's strongest feature. It potentially appeals to traders seeking multi-asset exposure through a single platform. However, the actual quality and depth of these trading tools remain questionable due to limited detailed information about specific instruments, market access, and execution capabilities.

The broker's resource offerings appear limited compared to established competitors. There is insufficient information about research capabilities, market analysis tools, or educational materials. Professional traders typically require comprehensive charting tools, technical indicators, fundamental analysis resources, and real-time market data to make informed trading decisions. The absence of detailed information about these essential resources suggests potential deficiencies in the broker's analytical capabilities.

Educational resources, which are crucial for developing traders, appear to be minimal or non-existent based on available information. Reputable brokers typically offer webinars, tutorials, market commentary, and educational courses to support client development. The lack of such resources indicates limited commitment to client success and professional development, which is particularly concerning for novice traders who rely on broker-provided education.

Automated trading support, algorithmic trading capabilities, and third-party tool integration remain unclear. This limits the broker's appeal to sophisticated trading strategies and professional applications.

Customer Service and Support Analysis (Score: 3/10)

Customer service quality represents a critical weakness in GrowFX's operations. User feedback indicates significant concerns about support responsiveness and problem resolution capabilities. Available contact information includes a phone number and website reference, but the scope and quality of support services remain questionable based on user experiences and limited service channel information.

Response times for customer inquiries appear to be problematic according to user reports. There are delays in addressing account issues, technical problems, and general support requests. Effective customer service requires prompt response times, knowledgeable support staff, and comprehensive problem-solving capabilities, all of which appear to be deficient in GrowFX's current operations.

The availability of multiple communication channels, such as live chat, email support, phone assistance, and comprehensive FAQ sections, is not clearly established. Professional brokers typically offer 24/5 or 24/7 support to accommodate global trading schedules and urgent client needs. The limited information about GrowFX's support availability suggests potential gaps in service coverage that could leave traders without assistance during critical trading periods.

Language support capabilities and regional expertise are not specified. This could create communication barriers for international clients. Quality customer service requires multilingual support and cultural understanding to serve diverse client bases effectively.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by GrowFX raises several concerns based on available user feedback and platform information. Users report suboptimal trading conditions, suggesting issues with platform stability, execution quality, and overall trading environment. These problems significantly impact trader satisfaction and can affect trading performance, particularly in fast-moving market conditions where reliable execution is crucial.

Platform stability and speed appear to be problematic areas. There are potential issues affecting order placement, position management, and market data reliability. Modern trading requires robust technological infrastructure capable of handling high-frequency trading, multiple asset classes, and real-time market conditions. Technical difficulties can result in missed trading opportunities, execution delays, and increased trading costs through slippage or requotes.

Order execution quality, including fill rates, slippage control, and price improvement, remains unclear from available information. Professional traders require transparent execution statistics, competitive spreads, and minimal market impact to achieve optimal trading results. The absence of detailed execution data suggests potential deficiencies in trading infrastructure and market connectivity.

Mobile trading capabilities, which are essential for modern trading flexibility, are not adequately described in available materials. Traders increasingly rely on mobile platforms for position monitoring, order management, and market analysis while away from desktop setups. Limited mobile functionality restricts trading flexibility and market participation opportunities.

This growfx review indicates that the trading experience falls short of professional standards expected in competitive forex markets.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most critical concerns regarding GrowFX. Multiple red flags indicate substantial risks for potential clients. The broker operates under suspicious regulatory licenses according to WikiFX assessments, lacking oversight from recognized financial authorities such as the FCA, ASIC, CySEC, or other established regulatory bodies. This regulatory deficiency creates significant risks for client fund protection, dispute resolution, and legal recourse.

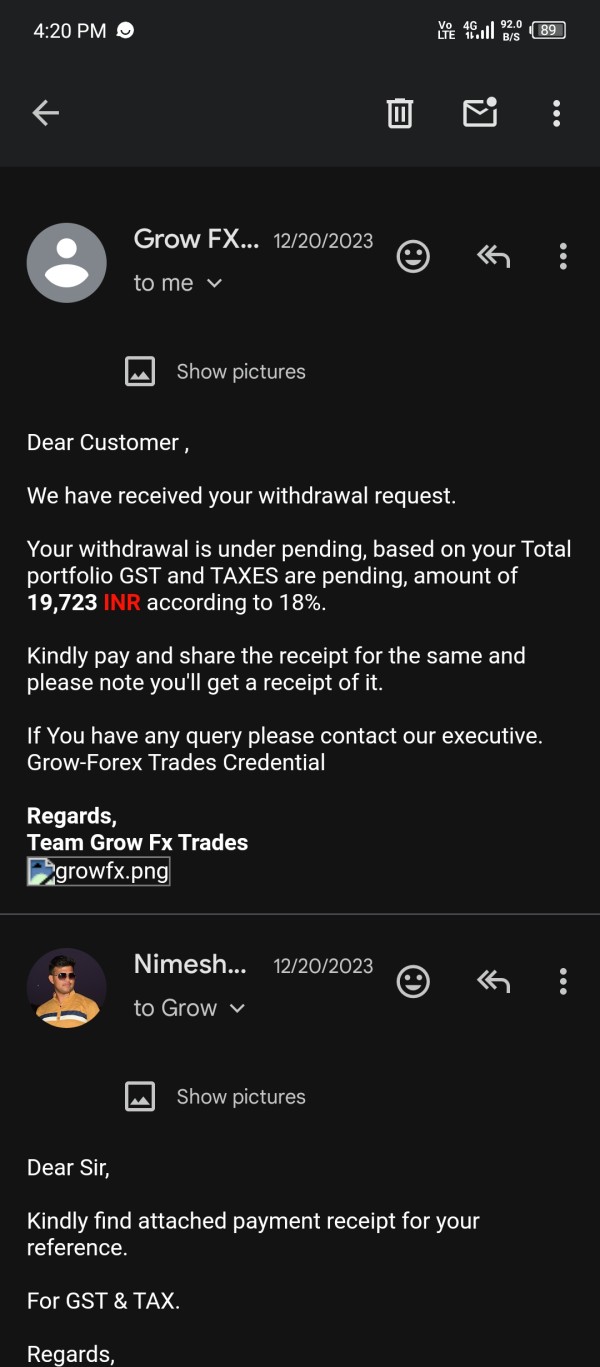

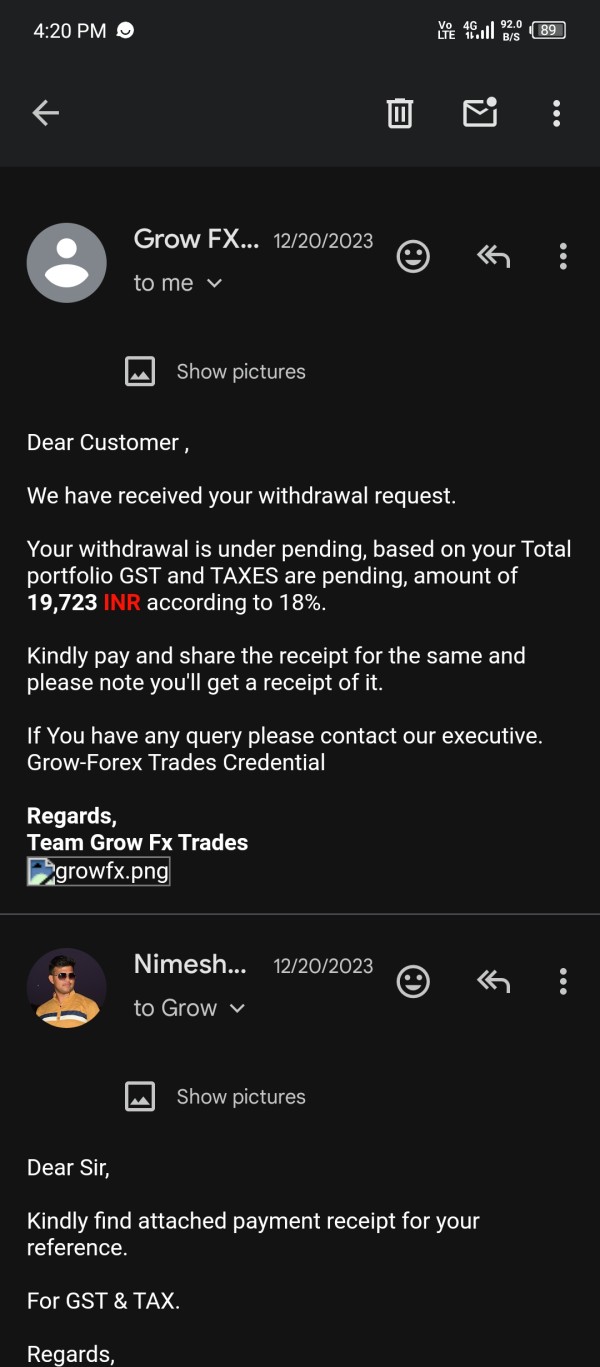

Fund security measures, including segregated client accounts, deposit protection schemes, and third-party fund custody arrangements, are not clearly established or verified. Reputable brokers typically maintain client funds in segregated accounts with tier-1 banks and provide detailed information about fund protection measures. The absence of such transparency raises serious concerns about client capital security and potential misuse of client funds.

Corporate transparency issues further undermine trust. There is limited information available about company ownership, management structure, financial statements, or regulatory compliance history. Professional brokers typically provide comprehensive corporate information, regulatory documentation, and financial transparency to build client confidence and demonstrate legitimacy.

The high potential risk designation from WikiFX, combined with scam risk allegations, represents severe warnings about the broker's legitimacy. These assessments suggest significant risks of financial loss, fraudulent activities, or operational failures that could result in complete capital loss for traders.

User Experience Analysis (Score: 2/10)

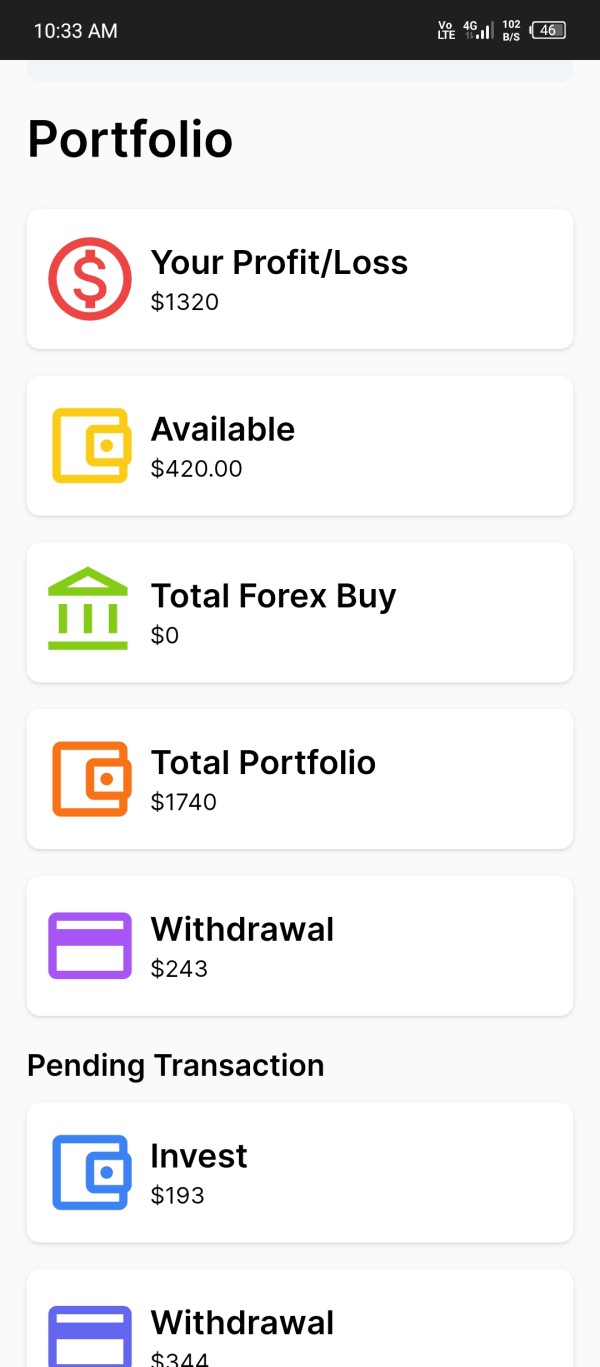

Overall user satisfaction with GrowFX appears to be extremely low based on the WikiFX rating of 1.36 out of 10. This indicates widespread dissatisfaction among traders who have experienced the broker's services. This poor rating reflects multiple operational deficiencies, service quality issues, and fundamental problems with the broker's business model and execution capabilities.

User interface design and platform usability information is limited, but negative user feedback suggests potential issues with platform navigation, feature accessibility, and overall user experience design. Modern trading platforms require intuitive interfaces, customizable layouts, and efficient workflow management to support effective trading activities. Poor interface design can significantly impact trading efficiency and user satisfaction.

Account registration and verification processes appear to lack the streamlined efficiency expected from professional brokers. Lengthy verification procedures, unclear documentation requirements, and complex account opening processes can create barriers to market entry and frustrate potential clients seeking quick market access.

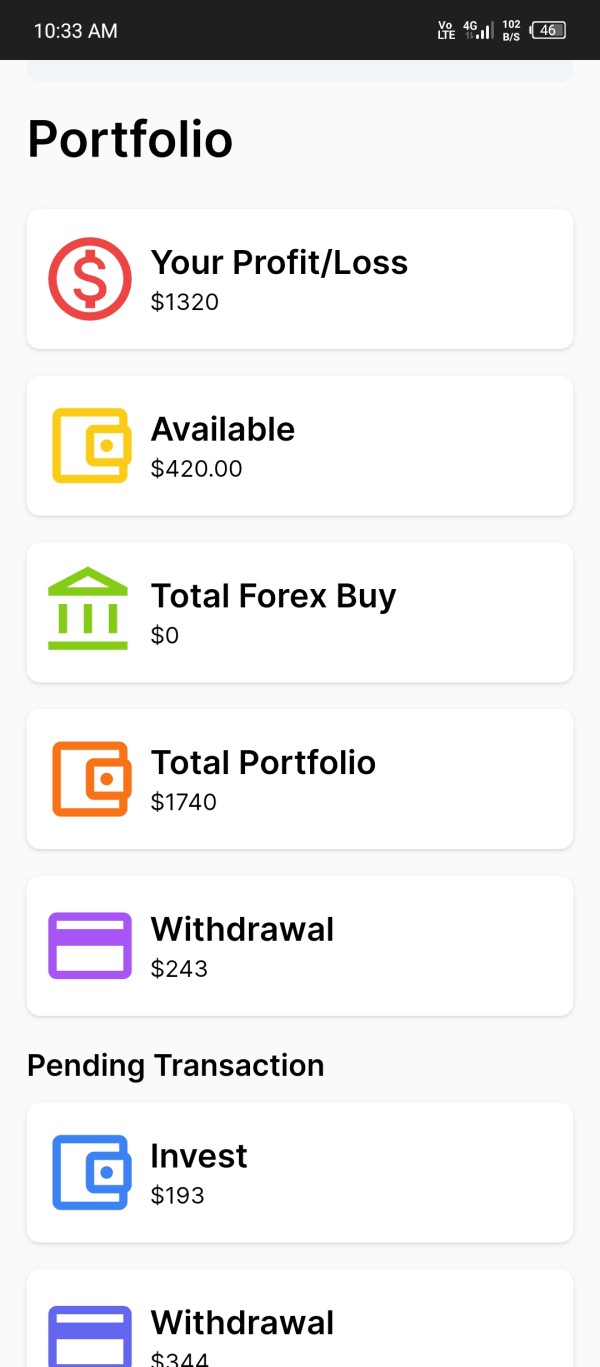

Fund management experiences, including deposit and withdrawal processes, appear to be problematic based on user feedback patterns. Reliable fund management requires transparent procedures, reasonable processing times, and clear fee structures. Issues in this area can create significant stress for traders and raise concerns about fund accessibility and security.

The user profile best suited for GrowFX is difficult to identify given the numerous operational deficiencies and safety concerns. Even traders seeking diverse asset exposure would be better served by regulated alternatives that offer proper client protection and transparent operations.

Conclusion

This comprehensive growfx review reveals significant concerns that make GrowFX unsuitable for serious trading activities. The broker's suspicious regulatory status, poor user ratings, and lack of operational transparency create substantial risks that far outweigh any potential benefits from its multi-asset offerings. With a WikiFX rating of 1.36 and high potential risk designations, GrowFX fails to meet basic standards for legitimate forex brokerage operations.

The broker may theoretically appeal to traders seeking diverse asset exposure. However, the regulatory deficiencies and safety concerns make it inappropriate for any trader prioritizing capital protection and reliable service. The combination of poor customer service, questionable trading conditions, and fundamental trust issues creates an environment unsuitable for professional trading activities.

Traders are strongly advised to consider regulated alternatives that offer proper client protection, transparent operations, and established track records of reliable service delivery.