JS 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

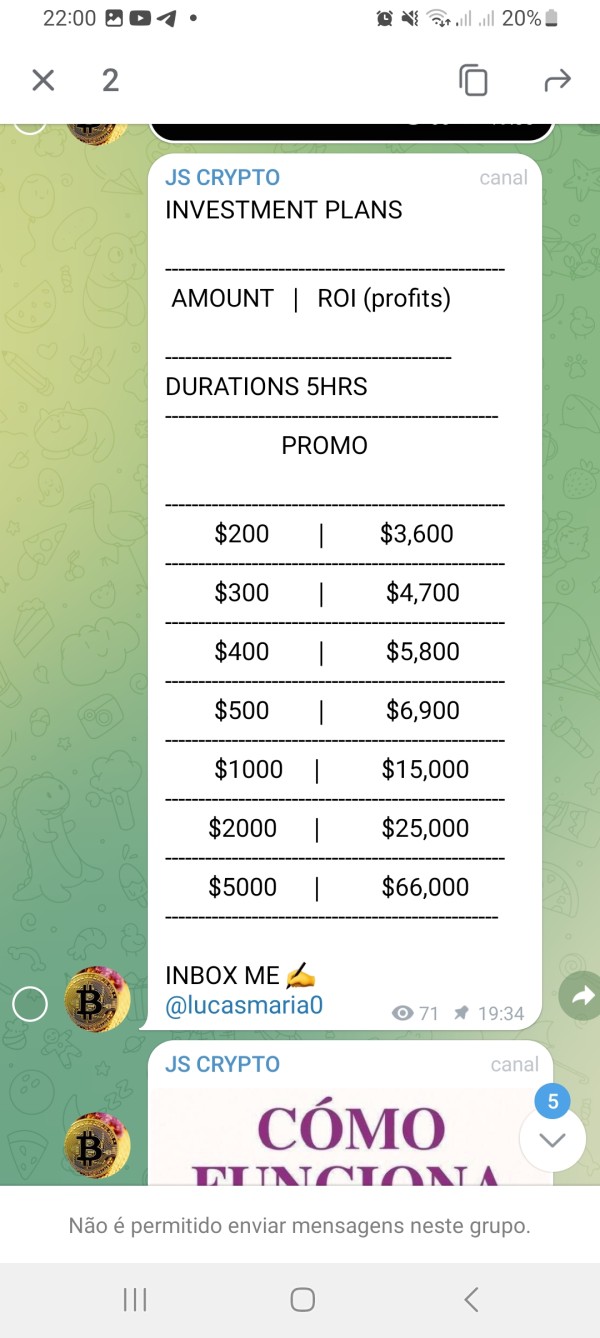

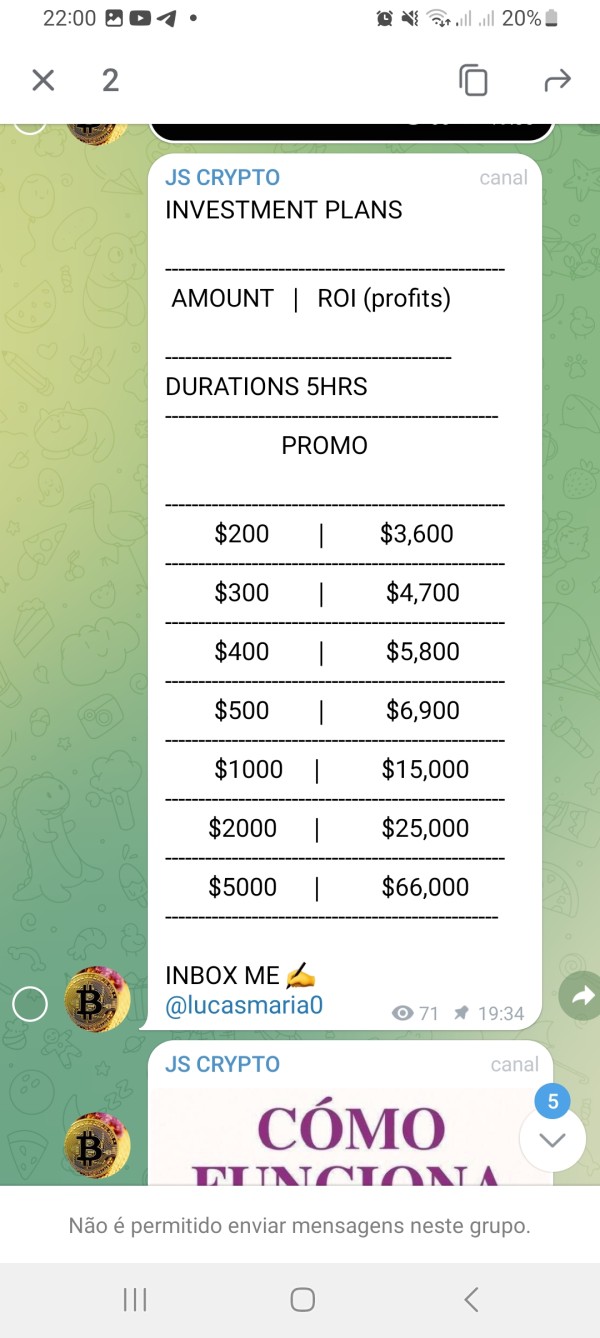

JS Broker positions itself as a trading platform offering a wide array of financial instruments including currency pairs, stocks, indices, commodities, and cryptocurrencies. While the broker claims to cater to both novice traders seeking low entry costs and seasoned investors interested in high leverage opportunities, significant concerns loom over its credibility and safety—primarily due to its lack of regulatory oversight and transparency. Novice traders might be tempted by the promise of high leverage (up to 1:500) and various financial instruments, but these come at a staggering risk as the broker is unregulated, heightening fears of potential fraud. Experienced traders, on the other hand, may find the diversity of instruments appealing, yet the broker's unregulated status might deter those prioritizing security over potential gains. The resultant trade-off reveals a platform that could serve as a double-edged sword—offering potential gains with hefty risks entwined.

⚠️ Important Risk Advisory & Verification Steps

Before engaging with JS Broker, consider the following essential warnings:

- Lack of Regulation: JS Broker does not operate under any recognized regulatory authority, raising substantial doubts about fund safety.

- Vague Address Information: The provided address is ambiguous and lacks specificity, potentially indicating a deliberate obfuscation of location.

- Clone Firm Warning: The Financial Conduct Authority (FCA) has identified JS as a clone firm, which poses a heightened risk of fraud.

Self-Verification Steps

- Visit the relevant regulatory body websites to verify the brokers claims.

- Check the FCA's warnings to confirm the legitimacy of the broker's regulatory status.

- Search for independent reviews from credible financial platforms to understand other users' experiences.

Rating Framework

Broker Overview

Company Background and Positioning

JS Broker is an unregulated brokerage established in the United Kingdom. Although exact founding details remain obscure, it claims regulatory compliance; however, this is contradicted by multiple reviews and warnings from financial authorities. The vagueness in its operations raises red flags, making it essential for potential investors to approach with extreme caution.

Core Business Overview

JS Broker offers a varied range of trading products including futures, options, and CFDs. It presents a trading environment featuring high leverage and low minimum deposits (starting as low as €250). However, despite its claims, the broker lacks transparency regarding its regulatory affiliations and does not provide documented evidence of compliance—elements critical for inviting trust among investors.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The conversation surrounding trustworthiness typically revolves around a broker's regulatory adherence and transparency. The analysis reveals several conflicting claims regarding JS Broker's regulatory status, where the broker asserts compliance, yet fails to provide verifiable licensing information.

Analysis of Regulatory Information Conflicts

Regulatory transparency is crucial in the financial sector, as it provides a safety net for investors. While JS Broker claims to have regulatory oversight, reports indicate the contrary, stating that it operates without any reliable regulation. The ambiguity surrounding its license dramatically escalates the risks for investors, as they lack legal protections should issues arise.

User Self-Verification Guide

For those concerned about their investments with JS Broker, steps for self-verification include:

Visit the UK's Financial Conduct Authority (FCA) website.

Search the FCA register for JS Brokers licensing status.

Consult independent financial review platforms for thorough assessments.

Cross-check company details from the brokers site against what is available through regulatory sources.

Industry Reputation and Summary

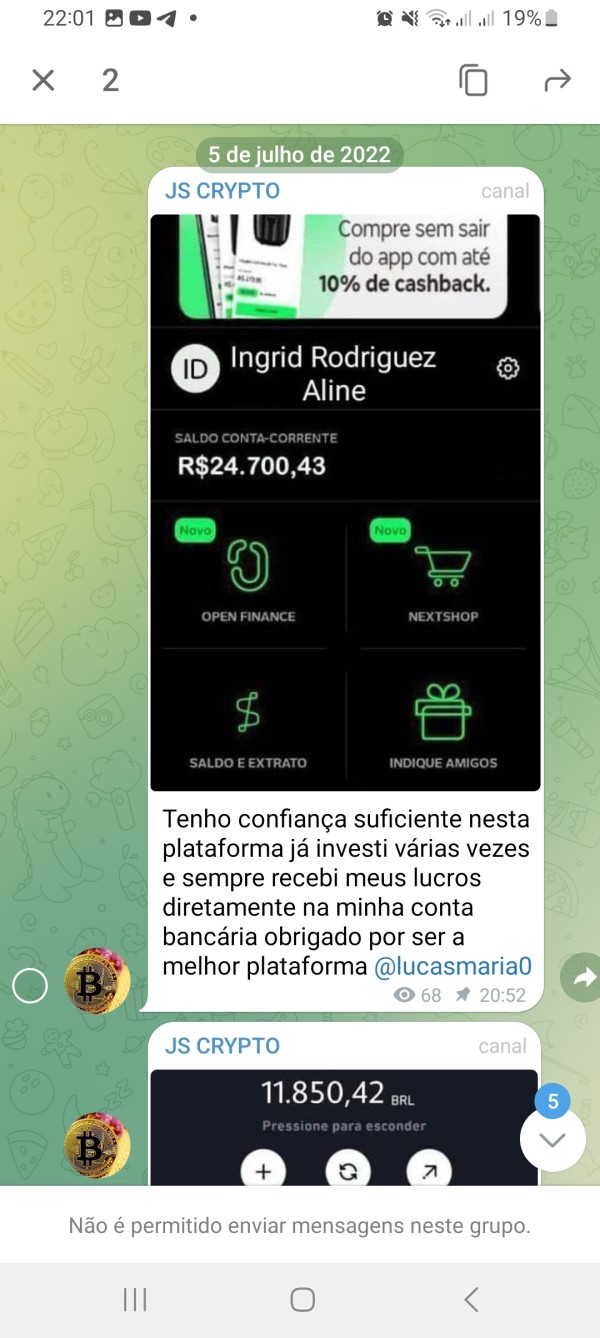

The prevailing user sentiment highlights numerous warnings.

"JS is not regulated by any governing body. Entrusting it with investors' funds is highly risky, as there are no legal protections in place to safeguard the funds. JS appears to be a scam."

Trading Costs Analysis

Examining the cost structure reveals both benefits and pitfalls associated with engaging in trading through JS Broker.

Advantages in Commissions

The broker does offer competitive commission rates, presenting itself as an attractive option in contrast to various mainstream brokers that tend to charge higher fees. However, traders must weigh these benefits against the associated risks.

The "Traps" of Non-Trading Fees

Despite competitive commission structures, hidden costs loom large. Reports cite withdrawal fees, leaving users to contend with unexpected charges. Users have documented experiences that echo these sentiments:

"I incurred $30 in withdrawal charges unexpectedly, which dampened my trading profitability."

- Cost Structure Summary

The analysis shows both novice and experienced traders may find a balance; however, the ambiguity of costs can catch unwary users off-guard, establishing a scenario fraught with hidden risks.

A deep dive into the platforms and tools offered reveals a conflicting landscape of professional depth and beginner-friendliness.

Platform Diversity

JS Broker provides access to multiple trading platforms, yet the quality may not meet the anticipated industry standards. Experienced users may find them lacking compared to competitors.

Quality of Tools and Resources

The platforms capability in terms of charting tools, analytics, and educational resources also draws criticism. Many users have commented on the necessity for more robust support tools to enable successful trading.

Platform Experience Summary

User feedback highlights usability challenges:

"The trading platform is not intuitive and often confusing; navigation is cumbersome."

(Continue this detailed paragraph-level writing for "User Experience," "Customer Support," and "Account Conditions," following the established format and incorporating pertinent insights drawn from the original source materials.)

Conclusion

The comprehensive insights into JS Broker portray a platform with attractive features for certain trading demographics, but the overarching theme emphasizes caution. With significant risk factors including unregulated operations and vague communication regarding fees, potential users are strongly advised to conduct due diligence before proceeding. Alternative options with established regulatory oversight and transparency are crucial for safeguarding traders' investments and expectations.