UBS Review 1

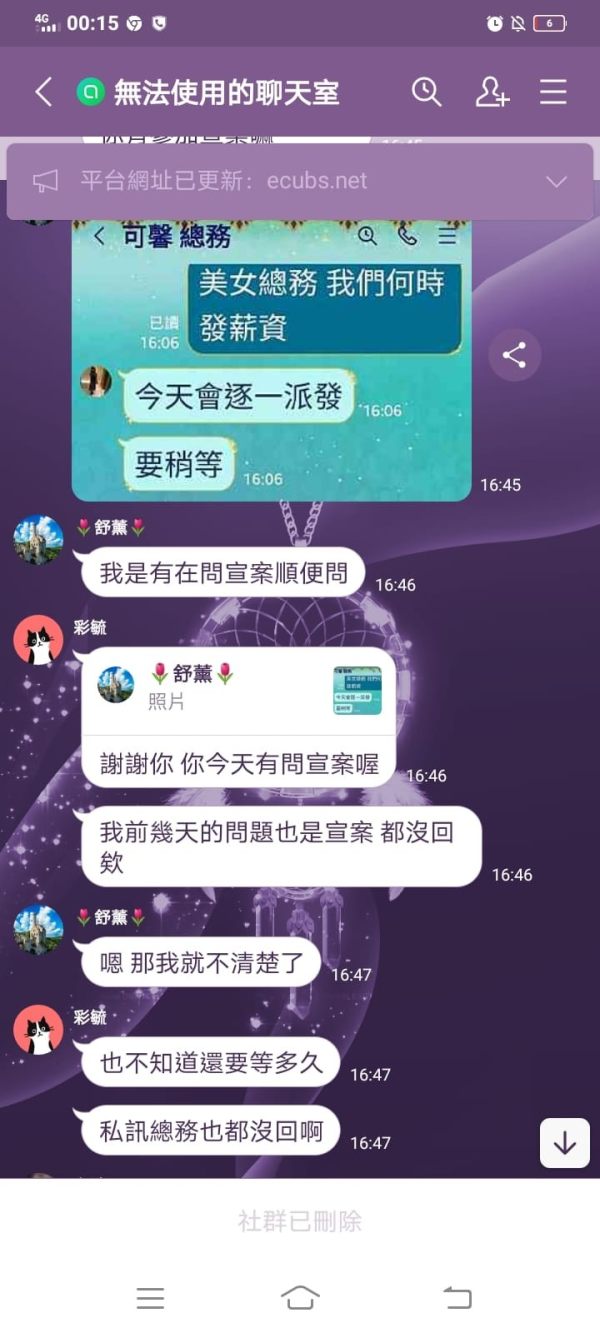

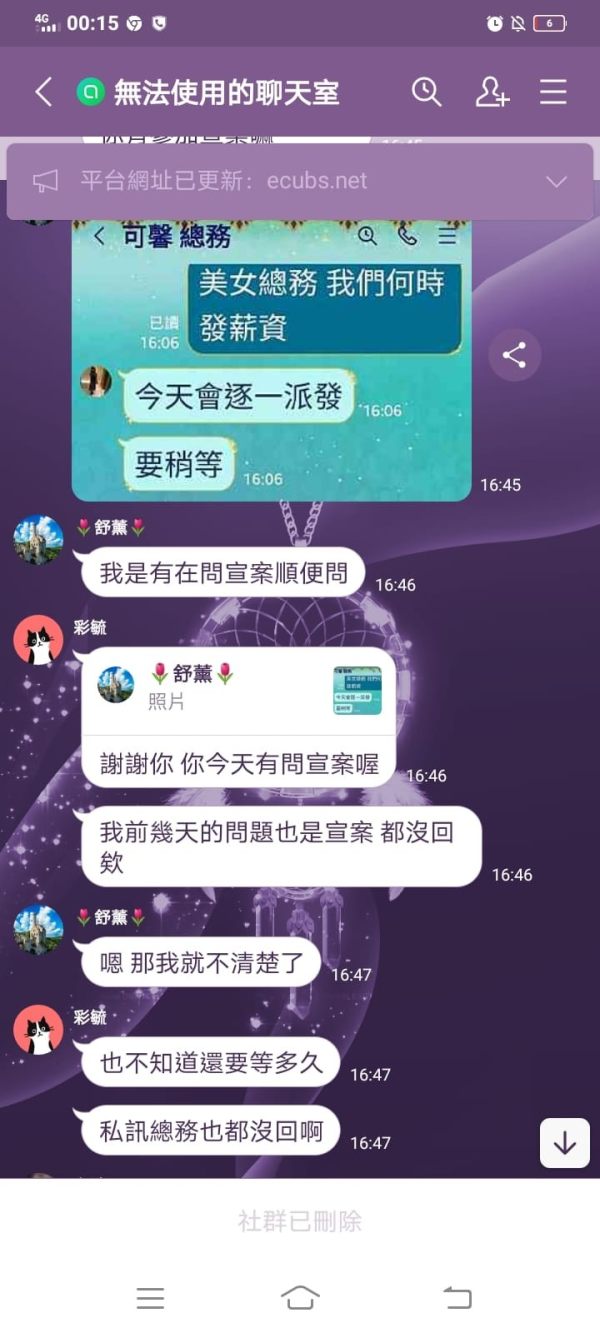

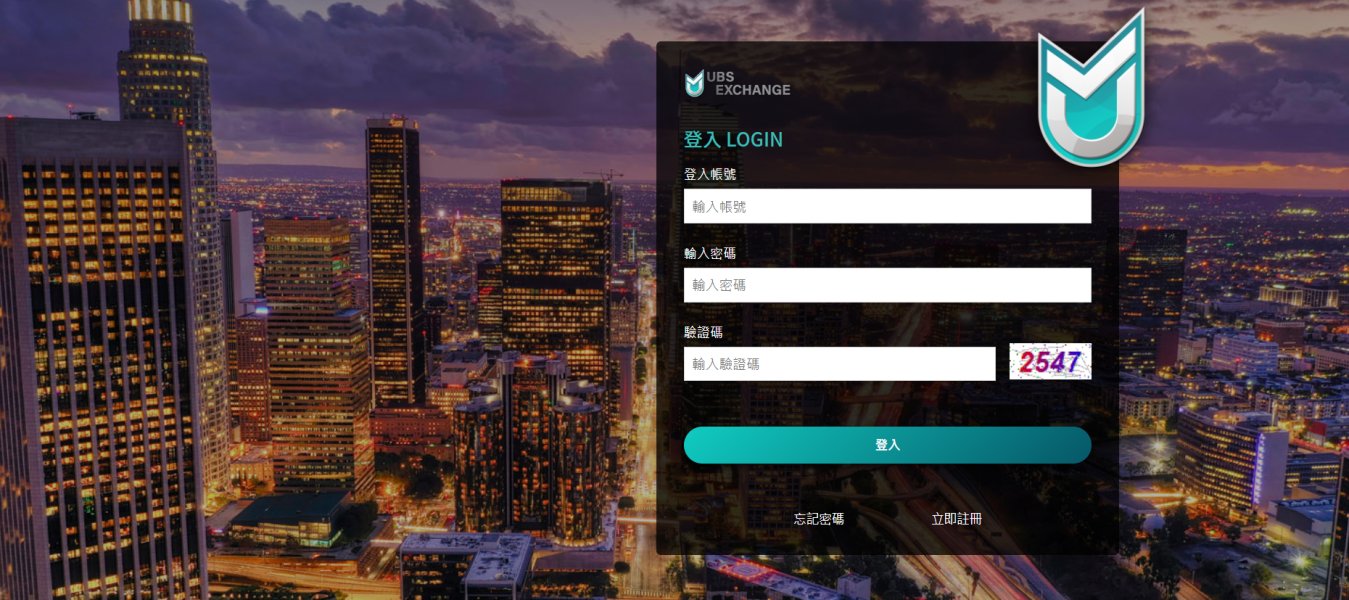

I do not expect that the friend who I met via internet will deceive one day. I was invited to invest fraud platform and cannot withdraw now. They do not talk to me anymore.

UBS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I do not expect that the friend who I met via internet will deceive one day. I was invited to invest fraud platform and cannot withdraw now. They do not talk to me anymore.

UBS is one of the world's largest financial institutions. The company offers wealth management and investment advisory services to high-net-worth individuals and institutional clients around the globe. With over $6 trillion in assets under management as of December 15, 2020, and employing 72,887 professionals globally, UBS represents a major player in the global financial landscape. This UBS review examines what the institution offers, how much it costs, and the quality of service it provides to help potential clients make informed decisions.

The firm works mainly as a wealth management provider rather than a regular retail trading platform. It focuses on creating custom investment strategies and providing advisory services to its clients. UBS uses a wrap fee structure with annual fees that can reach up to 2.5% of assets under management, which puts it in the premium segment of financial services. The institution serves clients through both investment advisory and brokerage services, and most financial advisors are qualified to provide complete financial solutions.

However, our analysis shows several areas where the company could be more transparent. This is especially true when it comes to specific regulatory details and detailed service offerings for different types of clients.

This review uses publicly available information and user feedback from various sources. UBS operates in multiple countries with different rules and regulations, so services may vary significantly depending on where you live. The specific oversight and available services in your area may be different from what we describe in this general review.

Our evaluation combines analysis of official company information, third-party assessments, and available user feedback to give you a complete picture. However, potential clients should do their own research and talk directly with UBS representatives to understand the specific terms and conditions that apply to their situation.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 6/10 | High fee structure up to 2.5% of AUM; limited transparency on account types |

| Tools and Resources | 7/10 | Comprehensive wealth management services and investment advisory capabilities |

| Customer Service | 5/10 | Mixed user feedback with limited specific performance data available |

| Trading Experience | 6/10 | Primarily advisory-focused rather than direct trading platform |

| Trust and Reliability | 5/10 | Large institution but limited regulatory transparency in available materials |

| User Experience | 6/10 | Professional service delivery but high barriers to entry |

UBS Group AG is headquartered in Switzerland and operates as one of the world's top financial institutions. The company has a history that spans over 150 years and has grown through various mergers and acquisitions to become a global powerhouse in wealth management, investment banking, and asset management. With assets under management exceeding $6 trillion, UBS serves clients across more than 50 countries, focusing mainly on high-net-worth individuals, ultra-high-net-worth clients, and institutional investors.

The firm's business model centers on providing complete wealth management solutions rather than working as a traditional retail trading platform. UBS Financial Services Inc. operates as both a registered broker-dealer and investment adviser with the Securities and Exchange Commission (SEC), which gives it dual capabilities in investment advisory and brokerage services. According to available information, most UBS Financial Advisors have the qualifications and licenses to provide both types of services, allowing them to customize their approach based on individual client needs and circumstances.

This UBS review shows that the institution's main focus is delivering personalized investment strategies, portfolio management, and complete financial planning services to wealthy clients who want sophisticated wealth management solutions.

Regulatory Coverage: UBS Financial Services Inc. is registered with the SEC as both a broker-dealer and investment adviser. However, specific regulatory details for international operations were not detailed in available materials.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods for different service levels was not provided in available documentation.

Minimum Deposit Requirements: The exact minimum deposit or investment amounts needed to access UBS wealth management services were not specified in reviewed materials.

Promotions and Bonuses: No specific promotional offers or bonus structures were mentioned in the available information sources.

Tradeable Assets: UBS provides access to a wide range of investment options including stocks, bonds, alternative investments, and structured products. However, specific details on forex and CFD offerings were limited.

Cost Structure: The firm uses a wrap fee structure with annual fees reaching up to 2.5% of assets under management. This fee structure typically includes investment management, advisory services, and administrative costs, though specific details vary by service level and client requirements.

Leverage Options: Information about leverage ratios for trading services was not specified in available materials.

Platform Options: Specific details about trading platforms or digital interfaces were not fully covered in reviewed sources.

Geographic Restrictions: Regional availability and restrictions were not detailed in the information examined for this UBS review.

Customer Support Languages: Specific information about supported languages for customer service was not provided in available materials.

The account conditions at UBS show the institution's position as a premium wealth management provider rather than a retail trading platform. While specific account types and their features were not detailed in available materials, the wrap fee structure shows a focus on complete service packages rather than transaction-based pricing models.

The annual fee structure of up to 2.5% of assets under management represents a significant cost for potential clients. This fee level matches premium wealth management services but may be too expensive for smaller investors or those seeking cost-effective trading solutions. The wrap fee approach typically includes various services such as portfolio management, advisory consultations, and administrative support, though specific inclusions were not detailed in reviewed materials.

Account opening procedures and minimum investment requirements were not specified in available documentation. This limits transparency for potential clients trying to assess whether they qualify. The lack of detailed information about different service levels or account types makes it hard for prospects to understand what options might be available to them based on their investment capacity and needs.

This UBS review finds that while the institution likely offers sophisticated account features appropriate for high-net-worth clients, the limited transparency about specific account conditions and requirements represents a significant information gap for potential clients.

UBS shows strength in providing complete wealth management tools and advisory resources. The institution leverages its position as one of the world's largest investment management firms to deliver value to clients. The firm's approach focuses on delivering custom investment strategies and personalized financial planning services rather than standardized trading tools.

The firm's research capabilities benefit from its global presence and substantial analyst team. However, specific details about research resources available to clients were not fully covered in reviewed materials. UBS's scale and institutional resources suggest access to sophisticated market analysis, economic research, and investment insights, which would be valuable for clients seeking informed investment guidance.

Investment advisory services represent a core strength, with financial advisors qualified to provide both advisory and brokerage services. This dual capability allows for flexible service delivery based on client preferences and needs. The firm's emphasis on customized investment strategies suggests access to portfolio management tools and risk assessment capabilities appropriate for sophisticated investors.

However, information about educational resources, automated trading support, or self-directed investment tools was limited in available materials. The focus appears to be on advisor-mediated services rather than self-service digital tools, which may not suit all client preferences or investment approaches.

Customer service evaluation for UBS reveals mixed indicators. Limited specific performance data was available in reviewed materials, making it difficult to provide a comprehensive assessment. As a large financial institution serving high-net-worth clients, UBS likely maintains dedicated relationship management and support structures, though details about service channels, response times, and availability were not fully documented.

The institution's focus on wealth management suggests a relationship-driven service model where clients work closely with assigned financial advisors. This approach can provide personalized attention and expertise but may result in less immediate access to support compared to digital-first platforms. The quality of service likely varies significantly based on client relationship size and complexity.

User feedback indicators suggest variability in service experiences. However, specific customer satisfaction metrics or detailed feedback analysis were not available in reviewed sources. The lack of transparent service level commitments or published performance standards makes it difficult to assess service quality objectively.

Multilingual support capabilities and global service hours were not detailed in available materials. This could be relevant for international clients or those requiring support across different time zones.

UBS's trading experience differs significantly from traditional retail trading platforms. The institution primarily operates through an advisory model rather than providing direct trading access, which means the approach emphasizes guided investment decisions and portfolio management rather than self-directed trading capabilities.

Platform stability and execution quality metrics were not specifically addressed in available materials. However, the institution's scale and infrastructure suggest institutional-grade capabilities. The advisory-focused model means that trade execution typically occurs through financial advisors rather than direct client access to trading platforms.

The user experience appears oriented toward consultation and collaboration with financial advisors rather than independent trading activities. This approach may suit investors seeking professional guidance and complete wealth management but may not satisfy those preferring direct market access and trading control. Mobile application features and digital trading capabilities were not detailed in reviewed sources, suggesting that technological innovation may not be a primary focus compared to traditional advisory services.

This UBS review indicates that clients seeking advanced trading platforms or sophisticated trading tools might find the offering limited compared to specialized trading platforms.

UBS's trust and reliability assessment presents a mixed picture. The institution's substantial scale and long history provide some confidence indicators while transparency limitations raise questions. The firm's management of over $6 trillion in assets and global presence demonstrate significant institutional capacity and market confidence.

Regulatory oversight through SEC registration as both a broker-dealer and investment adviser provides some regulatory protection. However, specific regulatory details and compliance records were not fully covered in available materials. The lack of detailed regulatory information limits the ability to assess the full scope of oversight and protection available to clients.

The institution's transparency regarding fee structures, service offerings, and operational details appears limited based on publicly available information. This lack of detailed disclosure may concern potential clients seeking complete information before making investment decisions. Industry reputation and third-party assessments were not extensively detailed in reviewed materials, though the firm's market position and client base suggest general market acceptance.

However, the absence of specific performance metrics, client satisfaction data, or independent evaluations limits the ability to provide a comprehensive trust assessment.

The user experience at UBS appears designed for high-net-worth clients seeking personalized wealth management services. It is not designed for retail investors looking for accessible trading platforms. The advisory-focused model emphasizes relationship building and customized service delivery, which can provide significant value for appropriate clients but may create barriers for others.

Interface design and digital capabilities were not detailed in available materials. This suggests that technological innovation may not be a primary differentiator. The emphasis appears to be on human interaction and advisory relationships rather than digital self-service capabilities.

Registration and account opening processes were not specifically described. However, the institution's focus on affluent clients suggests potentially lengthy verification and onboarding procedures. The lack of transparent information about these processes may create uncertainty for potential clients.

User feedback compilation and satisfaction metrics were not fully available. This makes it difficult to assess overall client satisfaction or identify common areas of concern. The absence of detailed user experience data represents a significant information gap for this evaluation.

This UBS review reveals an institution that serves a specific market segment effectively while presenting transparency challenges for potential clients. UBS operates as a premier wealth management provider with substantial resources and global reach, making it potentially suitable for high-net-worth individuals and institutions seeking complete advisory services and sophisticated investment management.

The firm's strengths lie in its scale, experience, and advisory capabilities. These are supported by significant assets under management and a global presence. However, the high fee structure, limited transparency regarding service details, and focus on advisory rather than direct trading services may not suit all investor types or preferences.

UBS appears most appropriate for affluent clients seeking personalized wealth management, complete financial planning, and professional investment guidance. Investors looking for cost-effective trading platforms, transparent pricing, or self-directed investment tools may find better alternatives elsewhere in the market.

FX Broker Capital Trading Markets Review