Is ZOENOVA safe?

Pros

Cons

Is Zoenova Safe or a Scam?

Introduction

Zoenova is an online forex broker that has garnered attention in the trading community, primarily for its claims of offering a diverse range of trading products and high leverage options. However, the increasing prevalence of scams in the forex market makes it imperative for traders to carefully evaluate the legitimacy of any broker before committing their funds. This article aims to provide a comprehensive assessment of Zoenova, analyzing its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on a review of multiple sources, including user feedback, regulatory databases, and industry analyses.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in determining its trustworthiness. Zoenova's regulatory situation raises several red flags. According to various sources, it appears that Zoenova operates without proper regulation from any recognized financial authority. This lack of oversight can expose traders to significant risks, as unregulated brokers are not bound by strict compliance standards that protect investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that Zoenova does not have to adhere to any established guidelines regarding fund management, transparency, or dispute resolution. This situation is concerning, as it implies that traders have little recourse if issues arise, such as withdrawal problems or disputes over trading conditions. Additionally, the broker's website has faced complaints regarding its operational integrity, including allegations of users being unable to withdraw their funds after fulfilling withdrawal conditions. Such incidents contribute to the growing skepticism surrounding whether Zoenova is safe for trading.

Company Background Investigation

Understanding a broker's history, ownership structure, and management team can provide further insights into its reliability. Zoenova claims to have been operational for several years; however, detailed information about its ownership and management is sparse. Reports indicate that the broker may have changed names in the past, which often serves as a tactic for concealing a problematic history.

The management teams qualifications and experience in the financial industry also play a pivotal role in a broker's credibility. Unfortunately, there is little publicly available information that outlines the backgrounds of Zoenova's leadership. This lack of transparency is a significant concern, as it prevents potential clients from assessing the competence and integrity of those running the broker. Overall, the limited information about Zoenova's company structure and history raises questions about its legitimacy and whether Zoenova is safe to use.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's profitability. For Zoenova, the overall fee structure and trading conditions are critical areas of concern. Reports suggest that the broker claims to offer competitive spreads and high leverage, but specific details regarding these claims are often vague or unsubstantiated.

| Fee Type | Zoenova | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-2 pips |

| Commission Structure | $10 per lot | $5-10 per lot |

| Overnight Interest Range | Varies | 0.5%-3% |

The lack of clarity regarding spreads and commissions can mislead traders into thinking they are receiving favorable trading conditions. Additionally, the high leverage ratios (up to 1:1000) can be attractive to traders looking to maximize their potential gains; however, such high leverage also comes with increased risk. The potential for significant losses is amplified when trading with unregulated brokers like Zoenova. Therefore, it is essential to consider whether Zoenova is safe for trading, especially in light of the ambiguous trading conditions and potential hidden fees.

Client Fund Safety

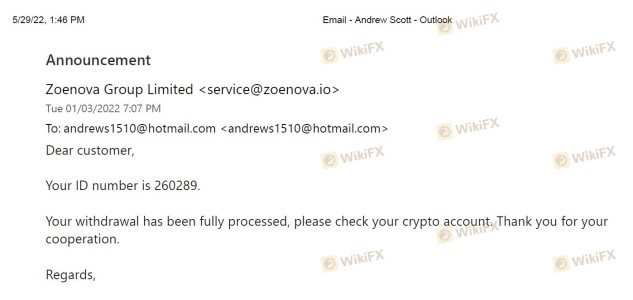

The safety of client funds is paramount when evaluating a broker's credibility. In the case of Zoenova, there are concerning reports regarding its fund security measures. It appears that the broker does not offer adequate measures for fund protection, such as segregated accounts or investor compensation schemes. This lack of security can leave traders vulnerable to losing their funds without any means of recourse.

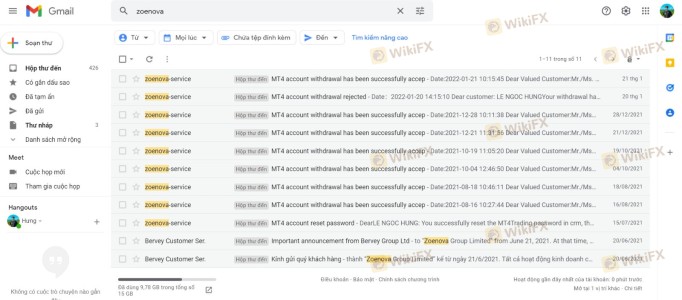

Moreover, there have been multiple complaints about clients being unable to withdraw their funds, often after being asked to pay additional fees or taxes. Such practices are red flags indicative of potential fraudulent activity. The absence of negative balance protection further exacerbates the risk, as traders could end up owing more than they initially deposited. Given these factors, it is crucial for potential clients to carefully consider whether Zoenova is safe before opening an account.

Customer Experience and Complaints

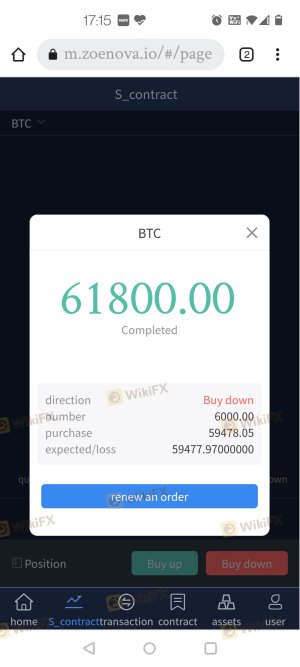

Customer feedback provides valuable insights into the reliability of a brokerage. In the case of Zoenova, user reviews paint a troubling picture. Many clients have reported negative experiences, particularly regarding withdrawal issues and customer service responsiveness. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Information | High | Poor |

Several users have shared their experiences of being unable to access their funds after making withdrawal requests, often without any clear explanation from the broker. In some cases, clients reported that the broker's website became inaccessible, further complicating their attempts to recover their funds. Such patterns suggest a lack of accountability and transparency on the part of Zoenova, raising concerns about whether Zoenova is safe for traders.

Platform and Execution

The performance of a trading platform is crucial for a trader's success. Zoenova offers a trading platform that has received mixed reviews regarding its stability and user experience. Users have reported issues with order execution, including slippage and rejections of trades, which can adversely affect trading outcomes.

Moreover, the platform's design and functionality have been criticized for lacking essential features that traders expect from reputable brokers. The absence of advanced charting tools and trading indicators can hinder traders' ability to make informed decisions. Given these factors, potential clients should weigh their options carefully and consider whether Zoenova is safe for their trading activities.

Risk Assessment

Engaging with an unregulated broker like Zoenova comes with inherent risks that traders must acknowledge. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Inadequate fund protection measures. |

| Execution Risk | Medium | Issues with order execution and slippage. |

| Customer Service Risk | High | Poor response to client complaints. |

To mitigate these risks, traders should consider using regulated brokers that offer greater transparency and protection. Conducting thorough research and due diligence before trading with any broker is essential to safeguard one's investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Zoenova exhibits several characteristics commonly associated with untrustworthy brokers. The lack of regulation, transparency issues, negative customer feedback, and poor fund safety measures raise significant concerns about whether Zoenova is safe for trading.

Traders should exercise extreme caution when considering Zoenova as their broker. It is advisable to explore alternative options that are regulated by reputable financial authorities, ensuring a safer trading environment. Brokers with established regulatory frameworks provide greater security for client funds and better overall trading conditions, which are essential for any trader looking to succeed in the forex market.

Is ZOENOVA a scam, or is it legit?

The latest exposure and evaluation content of ZOENOVA brokers.

ZOENOVA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZOENOVA latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.