Zoenova 2025 Review: Everything You Need to Know

In this comprehensive review of Zoenova, we delve into the broker's offerings, user experiences, and expert opinions. Overall, Zoenova is viewed negatively, primarily due to its lack of regulation and numerous user complaints about withdrawal issues and service reliability. Key features noted include its high leverage offerings and a limited range of tradable assets.

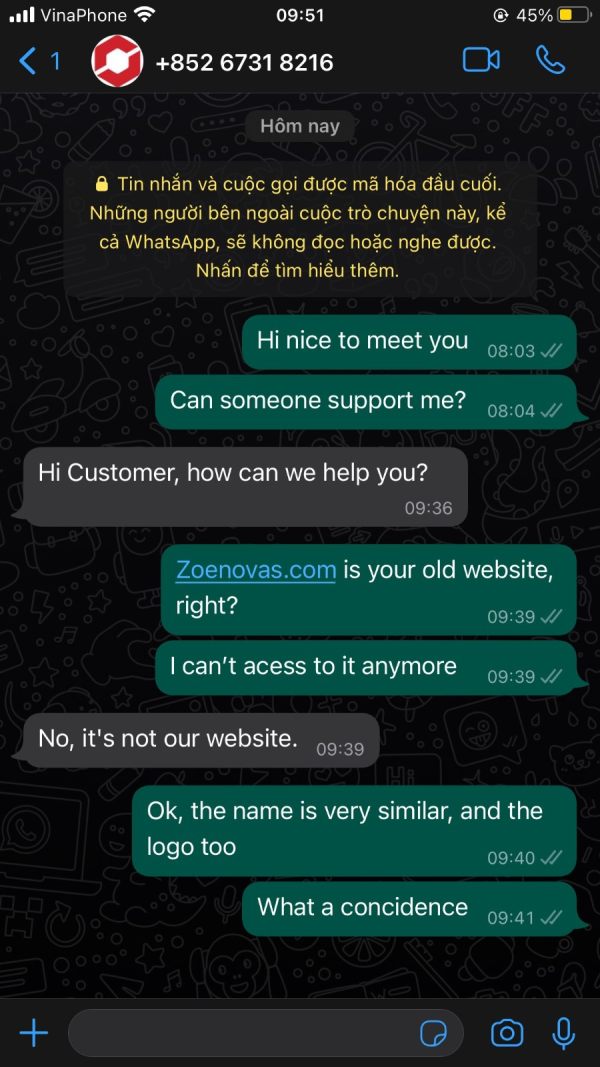

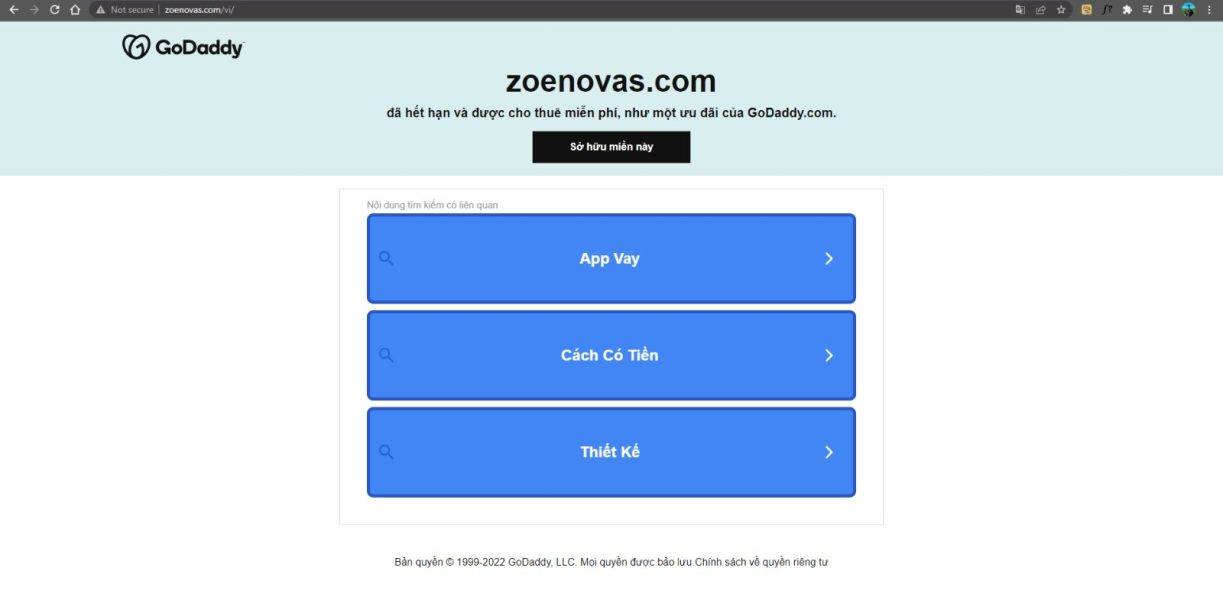

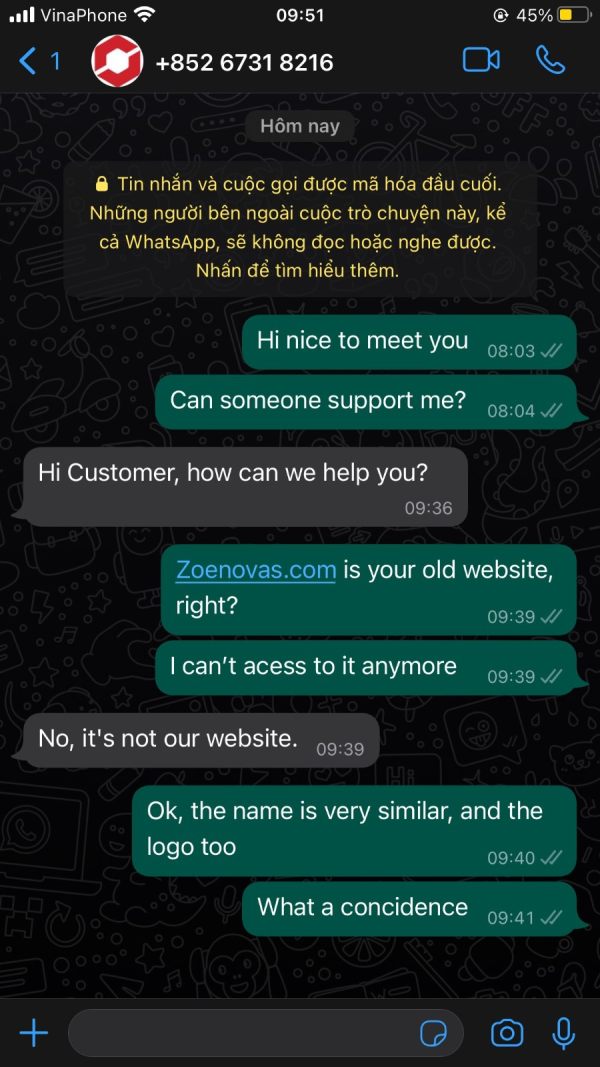

Note: It's important to highlight that there are different entities operating under similar names across various regions, which can lead to confusion. This review employs a methodical approach to ensure fairness and accuracy in the assessment of Zoenova.

Ratings Overview

We evaluate brokers based on user feedback, expert reviews, and factual data regarding their offerings and operations.

Broker Overview

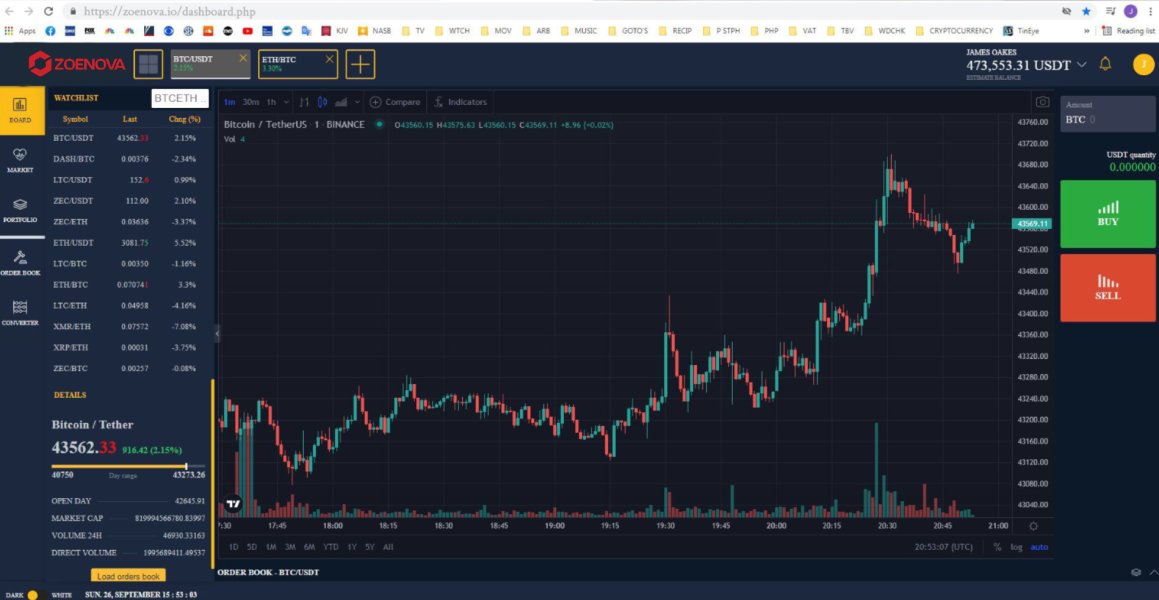

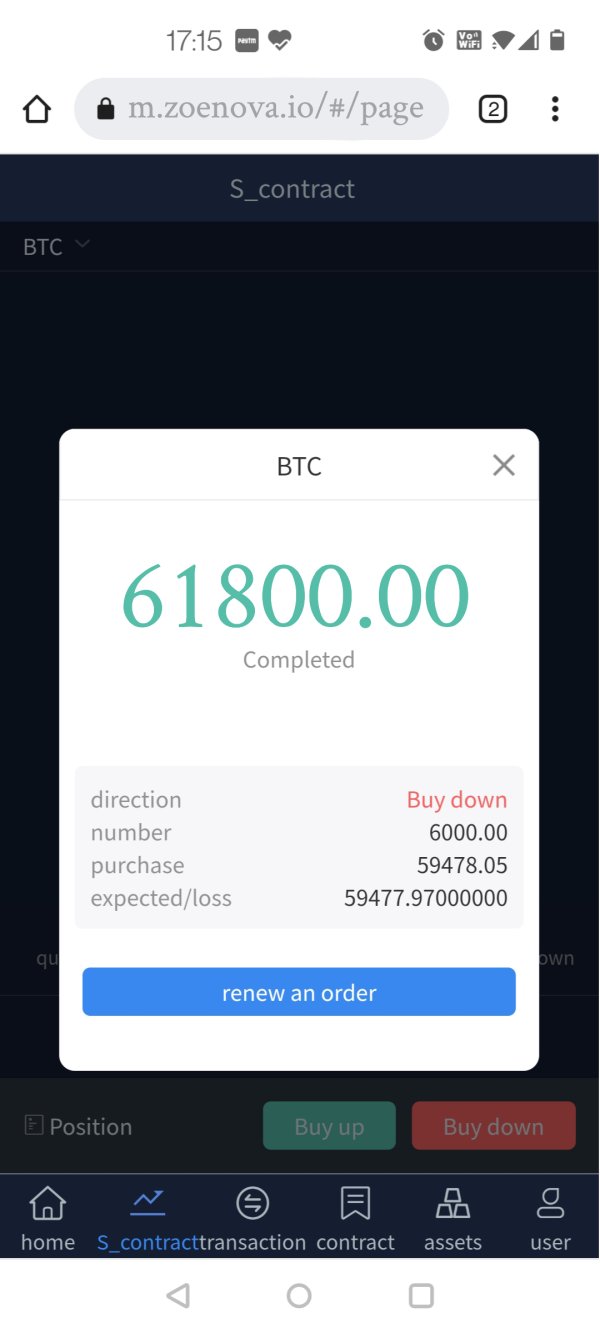

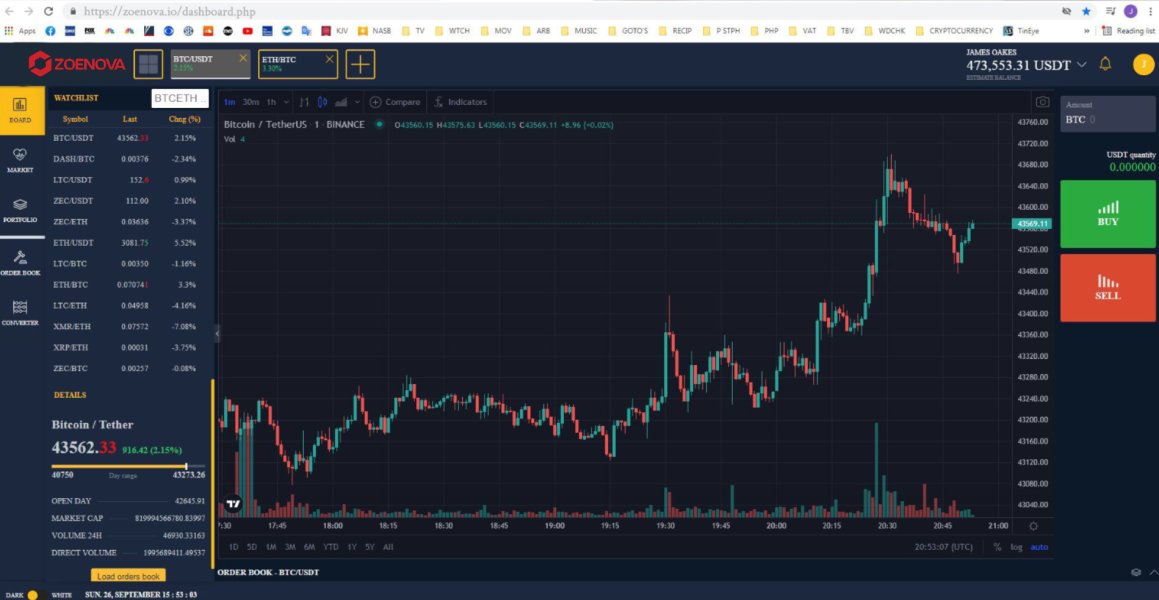

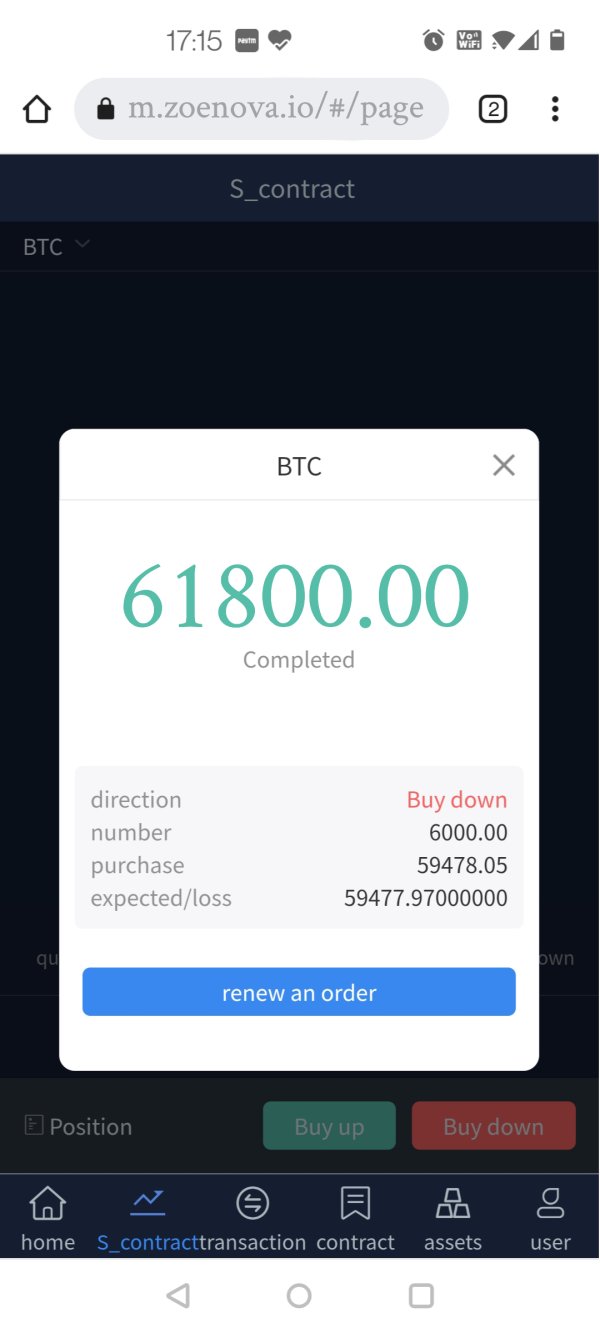

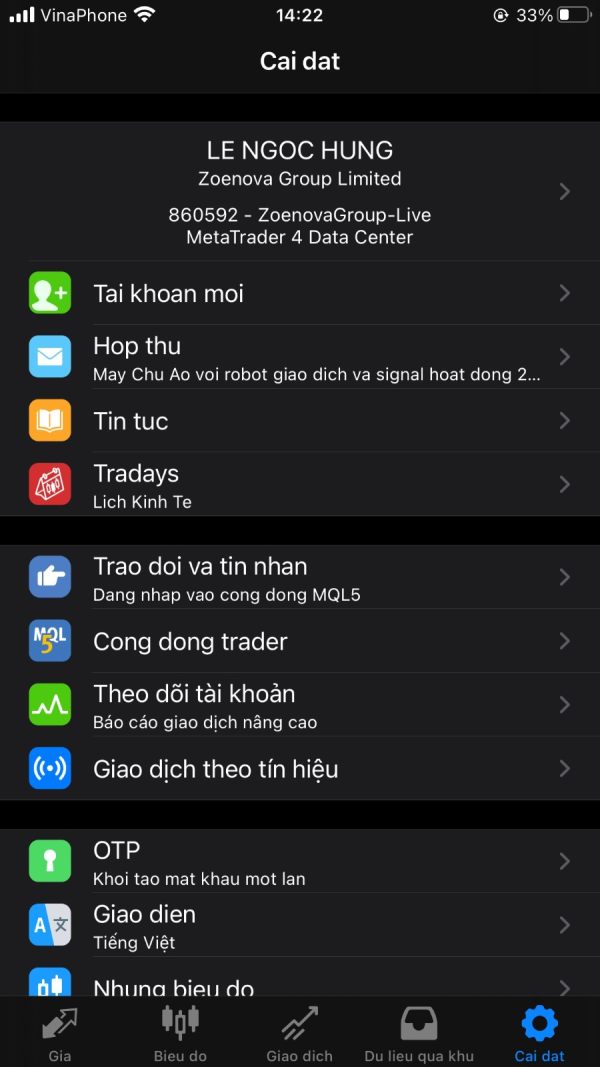

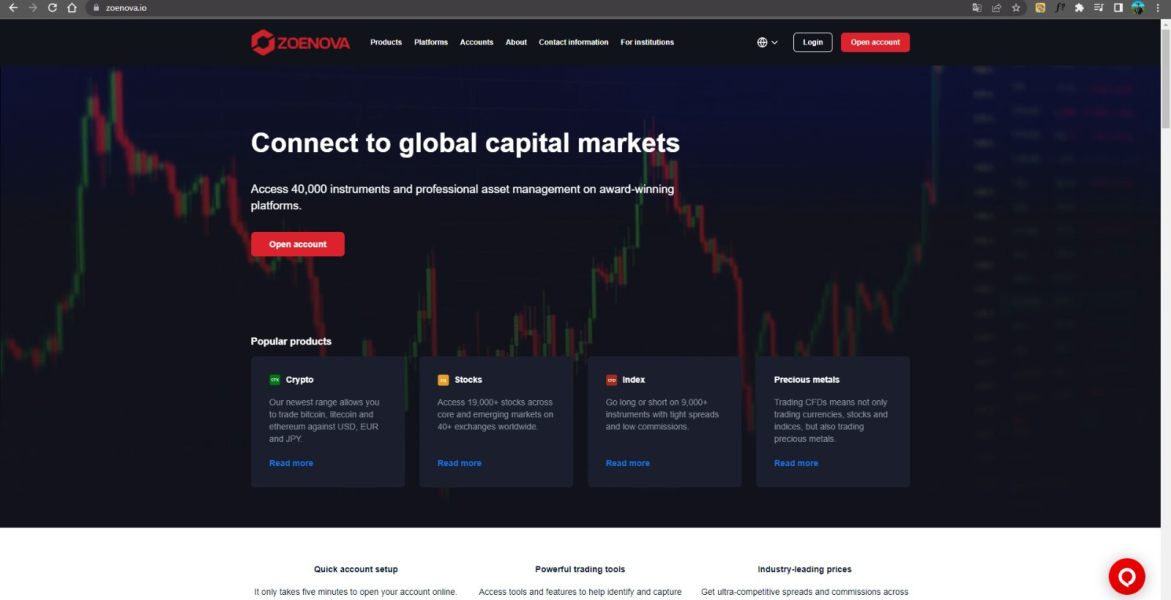

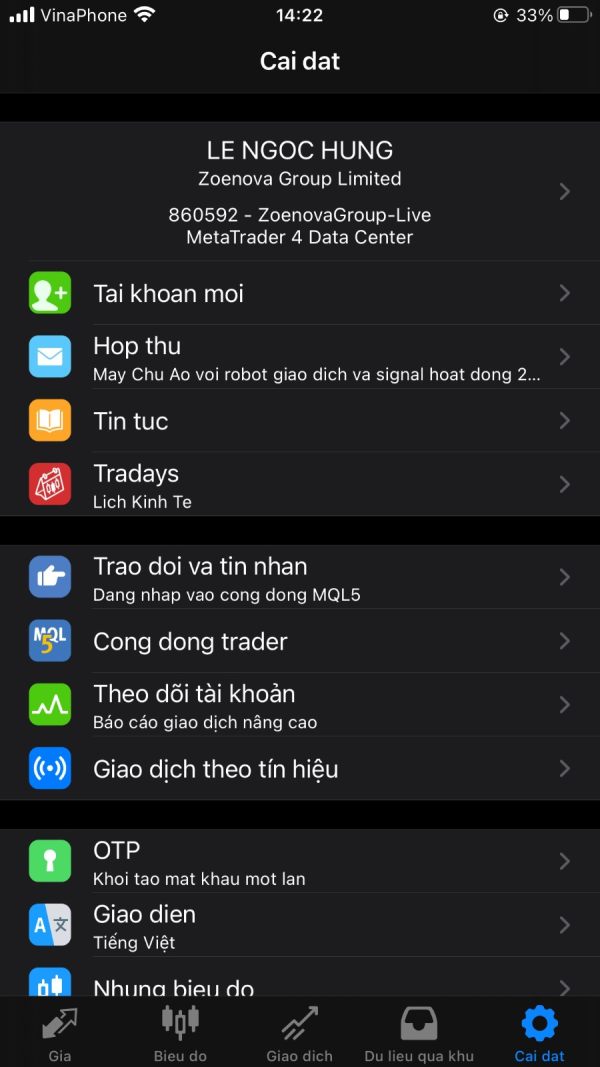

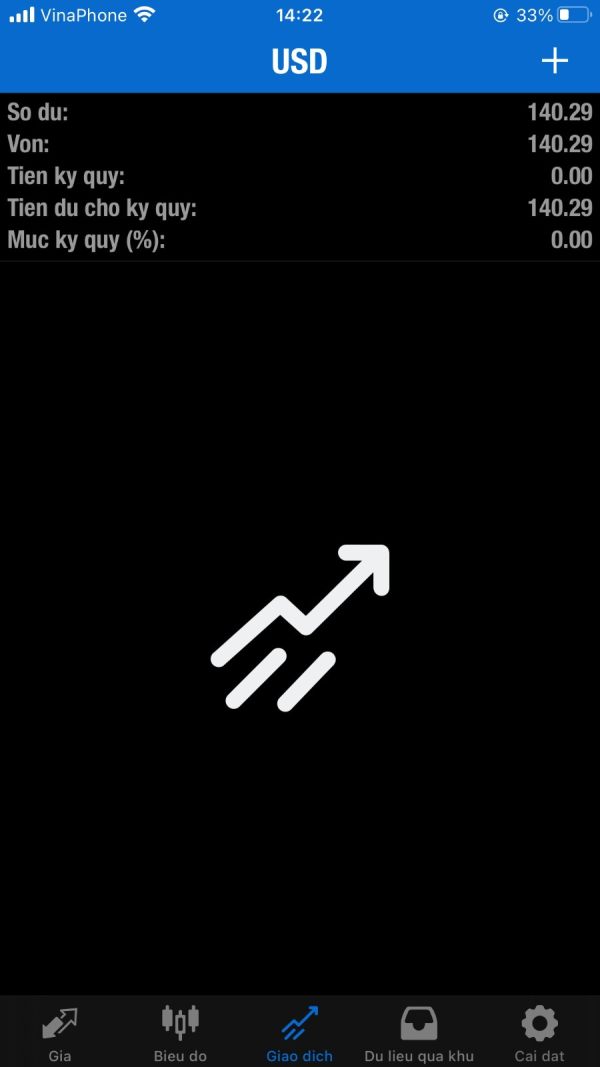

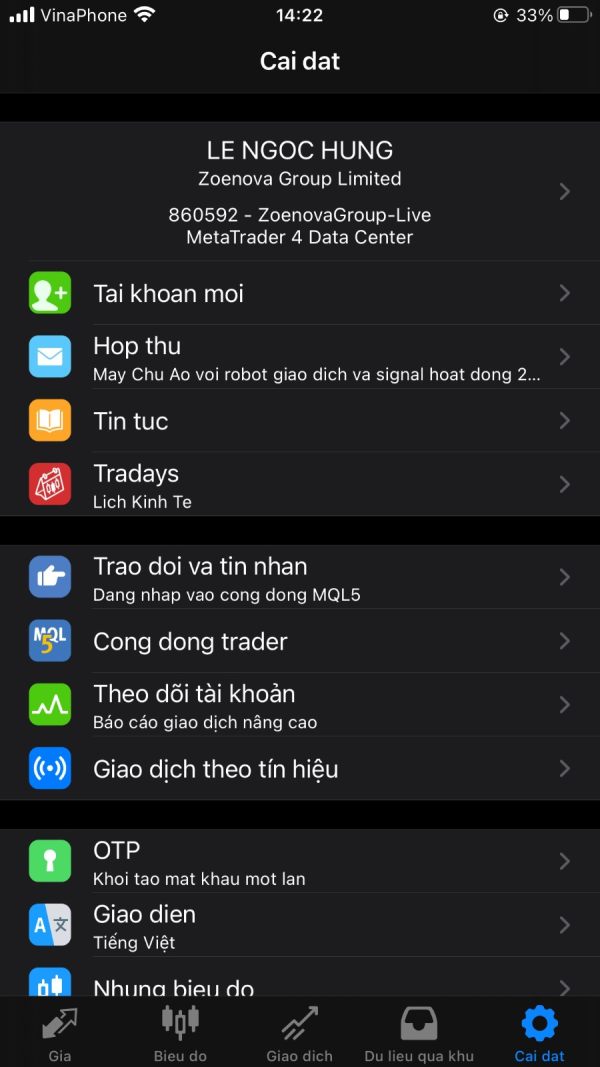

Zoenova is an online forex broker that has been operating for a few years, although specific details about its founding year are scarce. It claims to offer a variety of trading products, including currencies, commodities, and indices, with maximum leverage reaching up to 1:1000. However, the broker does not utilize industry-standard trading platforms like MetaTrader 4 or 5, instead offering a proprietary app for mobile and desktop.

The range of tradable assets is notably limited, which raises concerns for traders looking for diversity in their portfolios. Furthermore, Zoenova does not appear to be regulated by any recognized financial authority, which is a significant red flag for potential users.

Detailed Analysis

- Regulatory Regions:

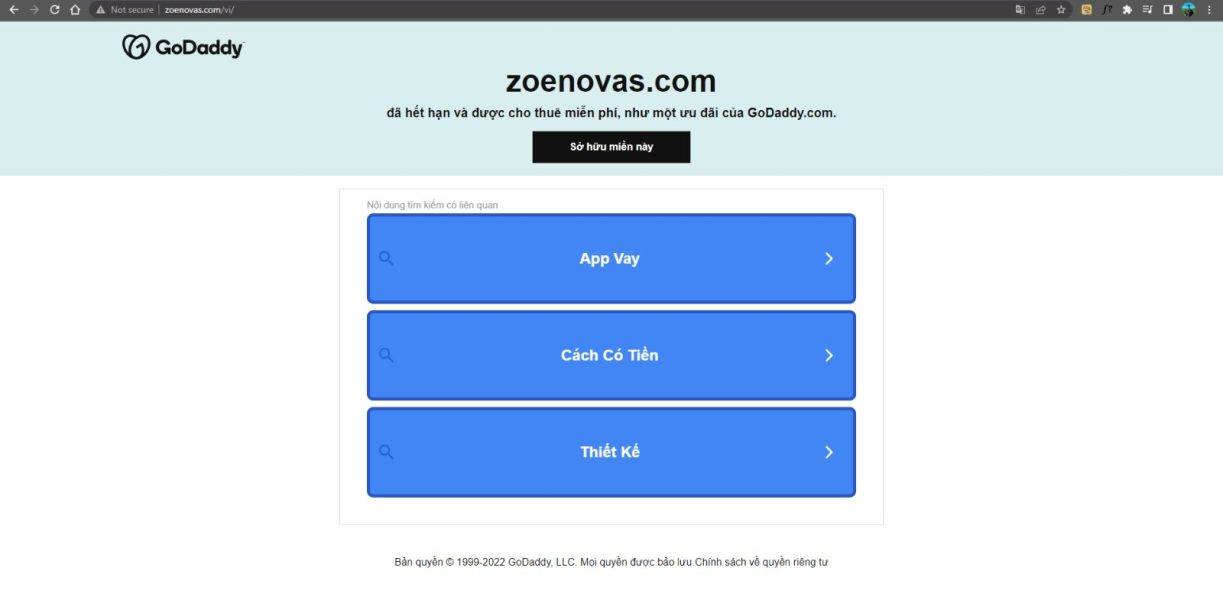

- Zoenova operates without any regulatory oversight. This lack of regulation means that users have little recourse in the event of disputes or issues, making it a risky choice for traders. According to WikiFX, the broker has been flagged for suspicious activities.

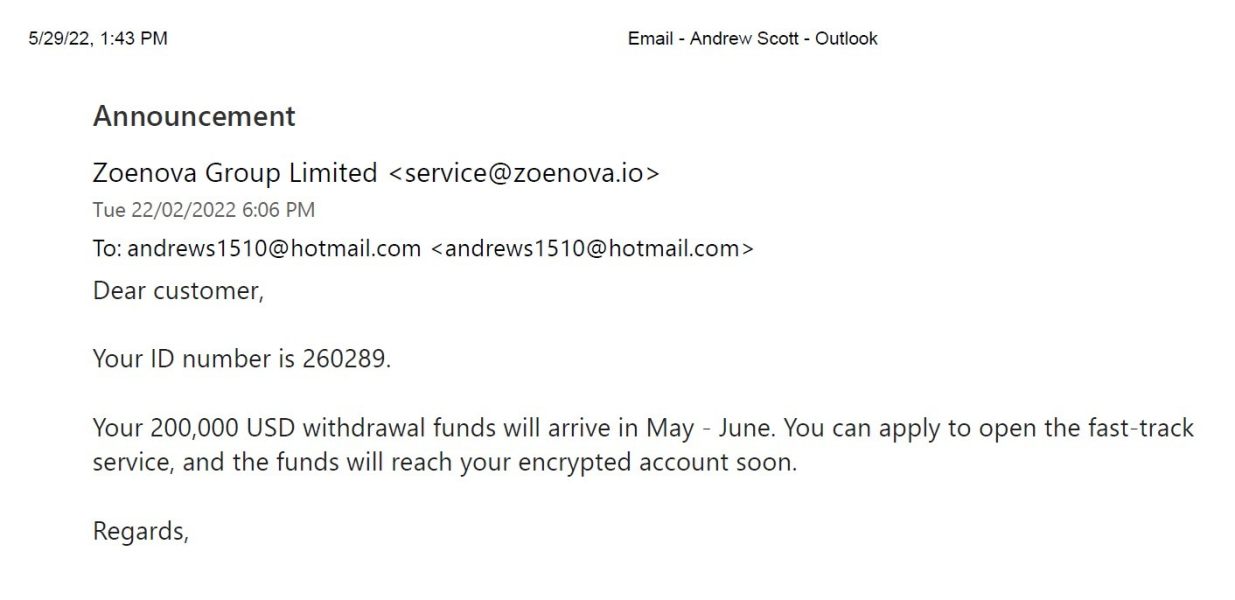

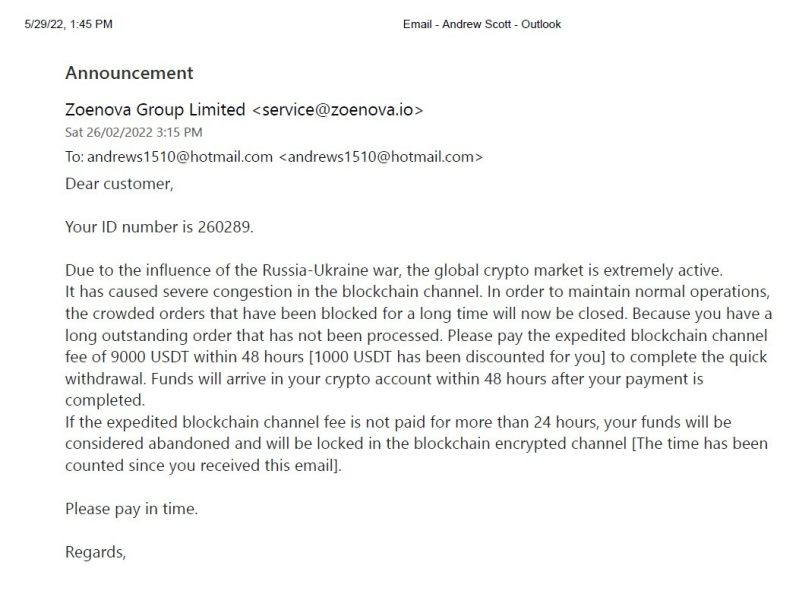

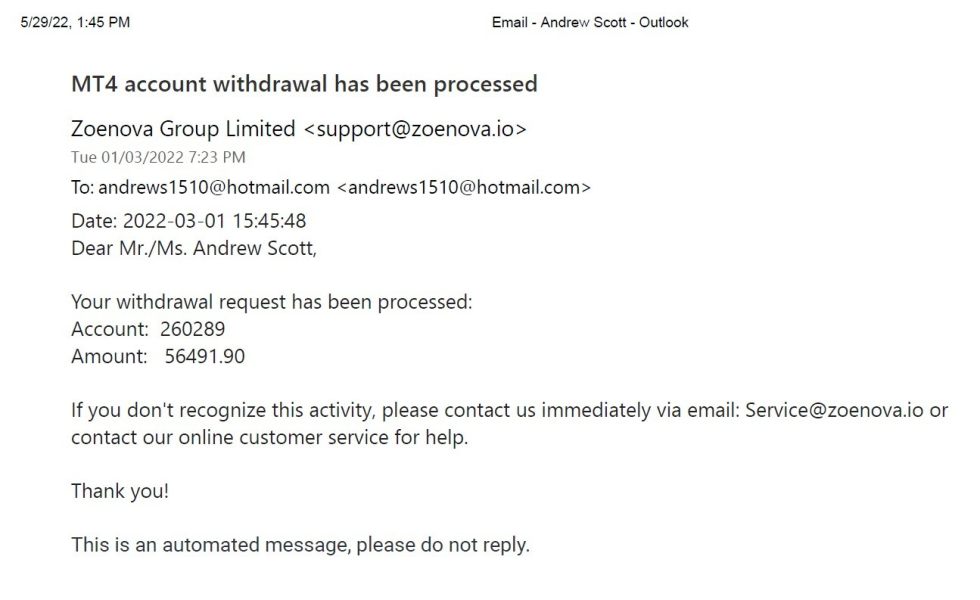

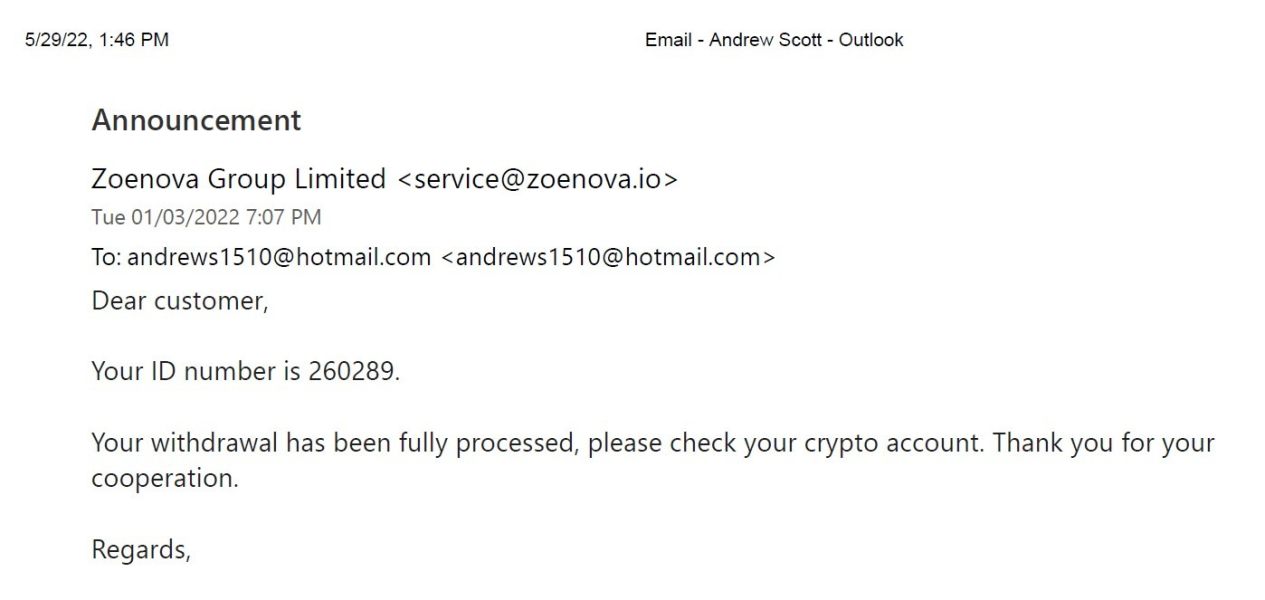

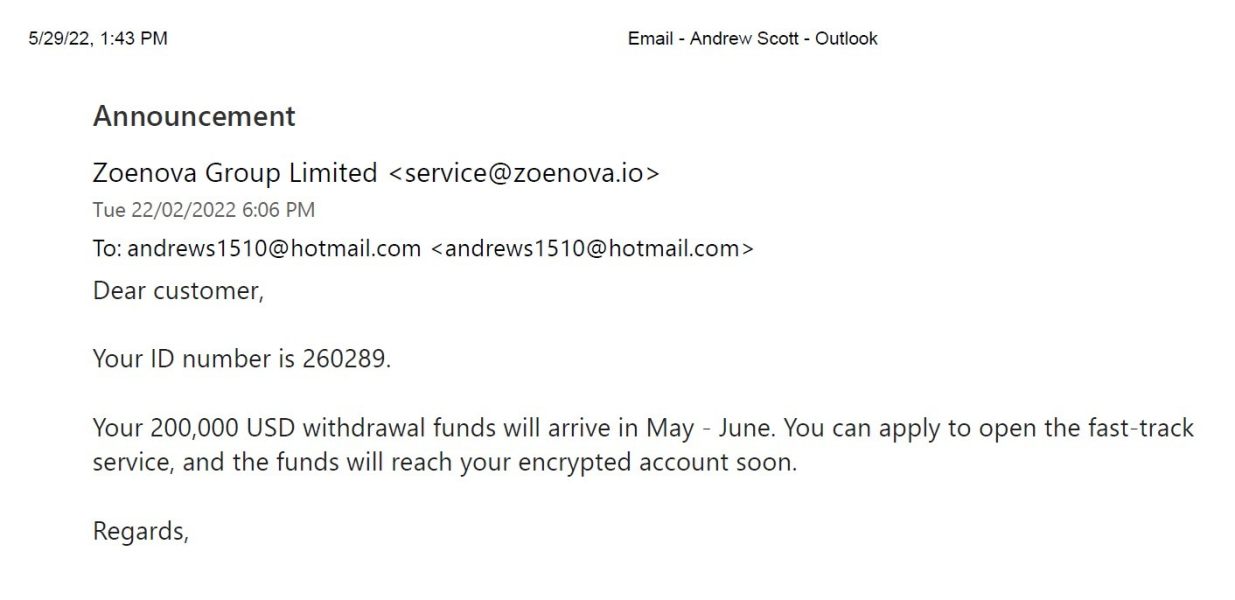

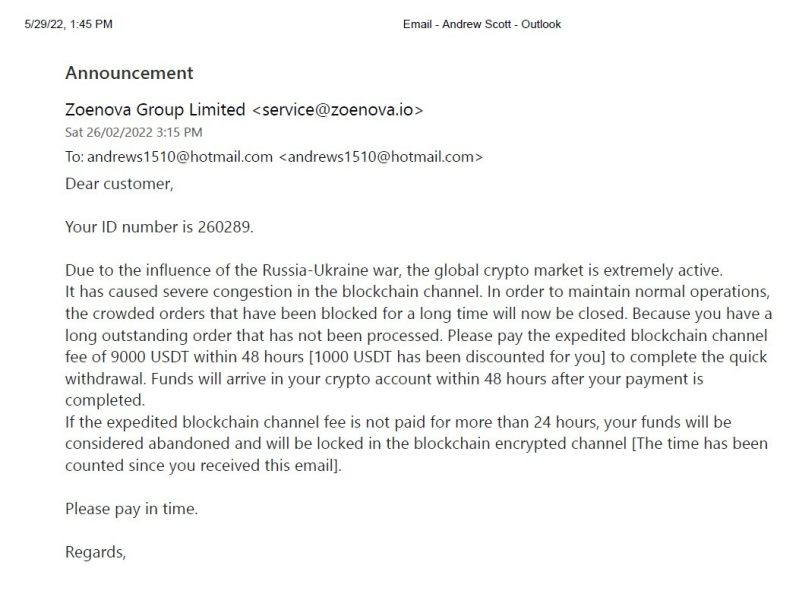

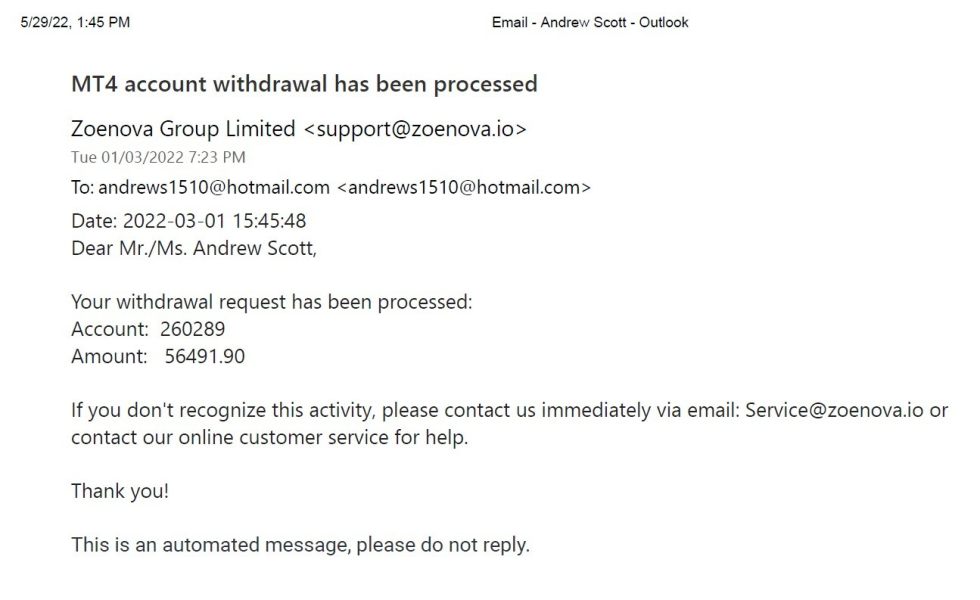

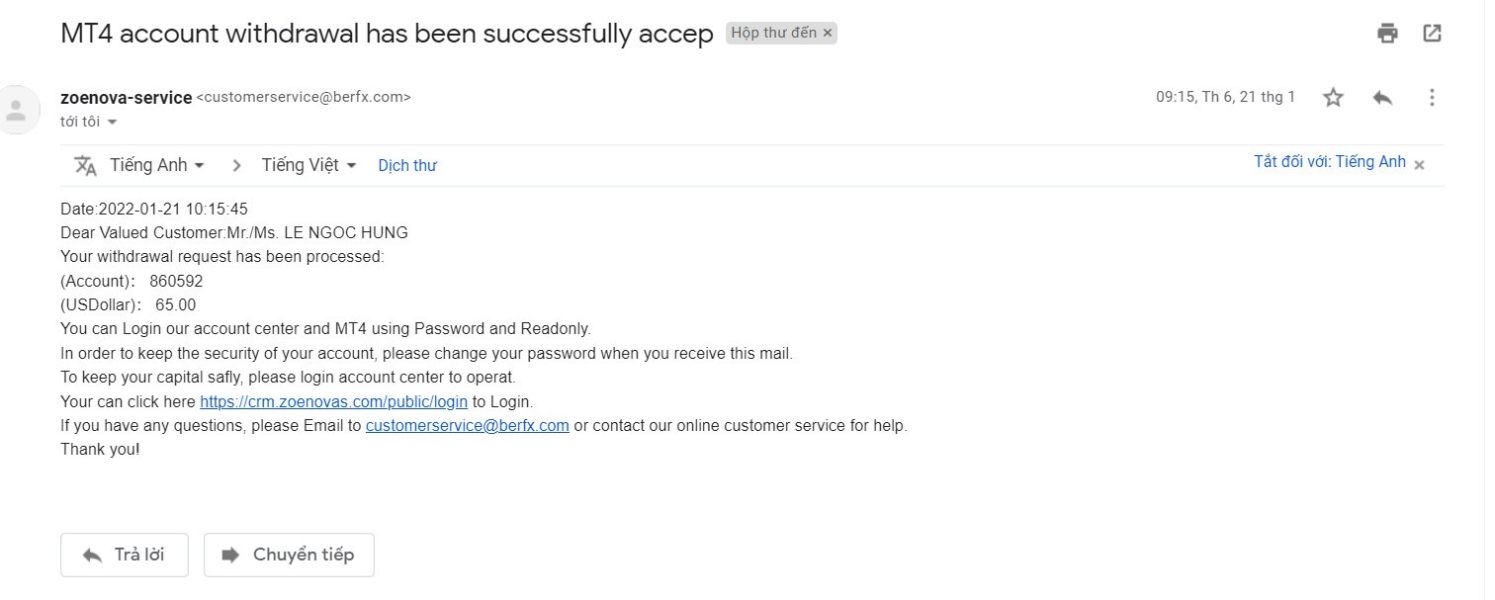

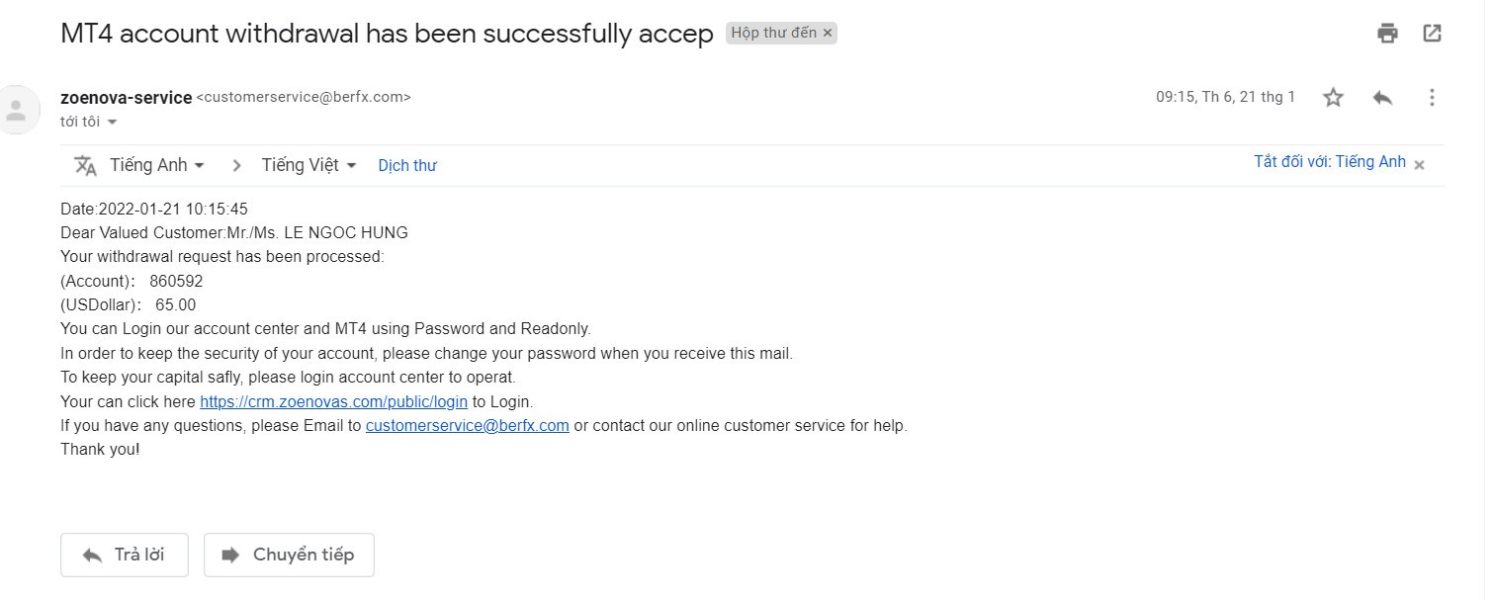

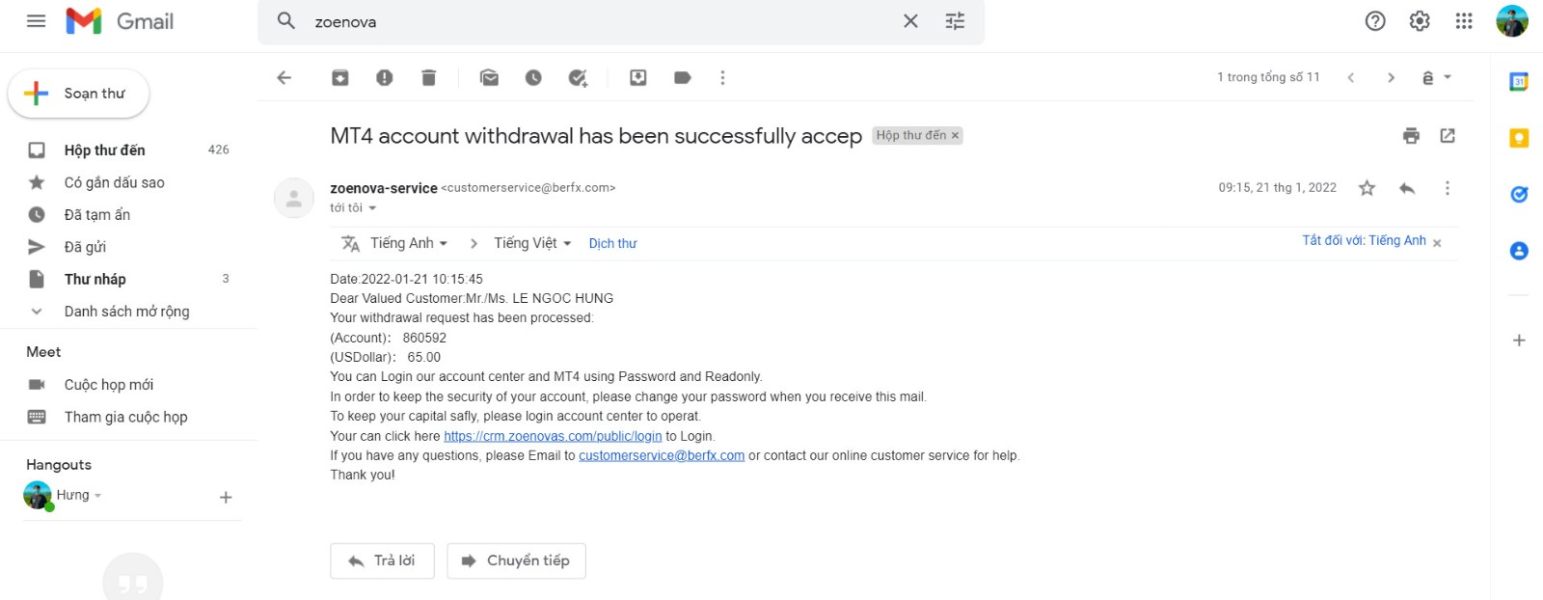

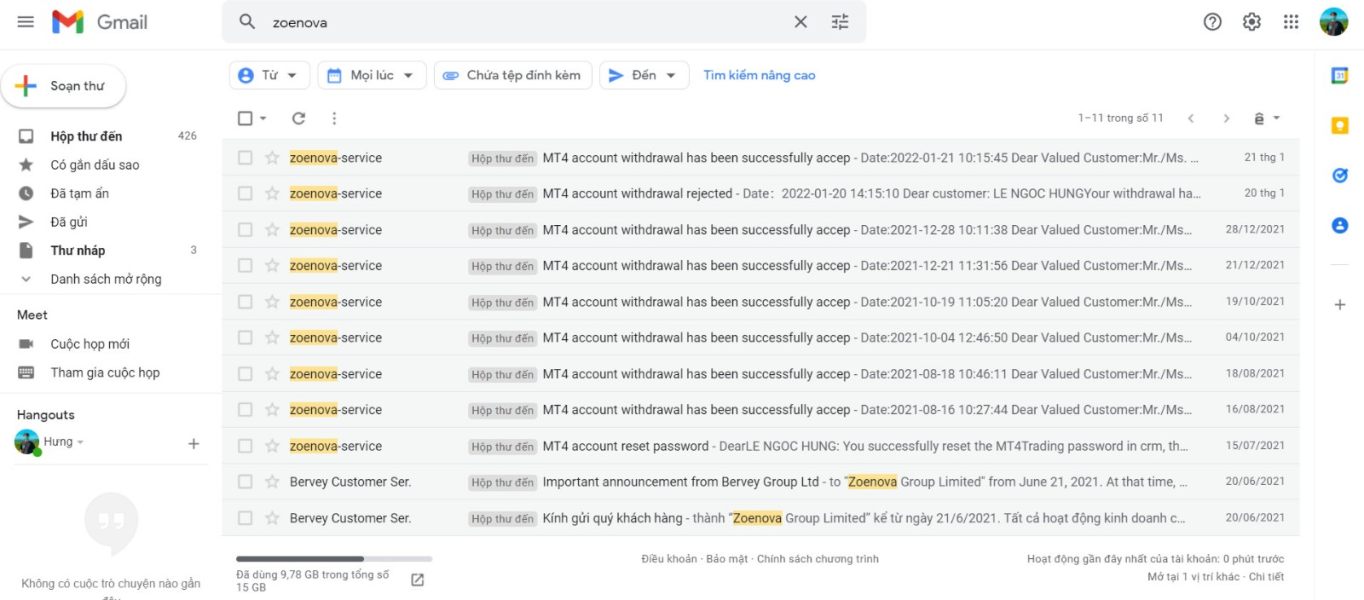

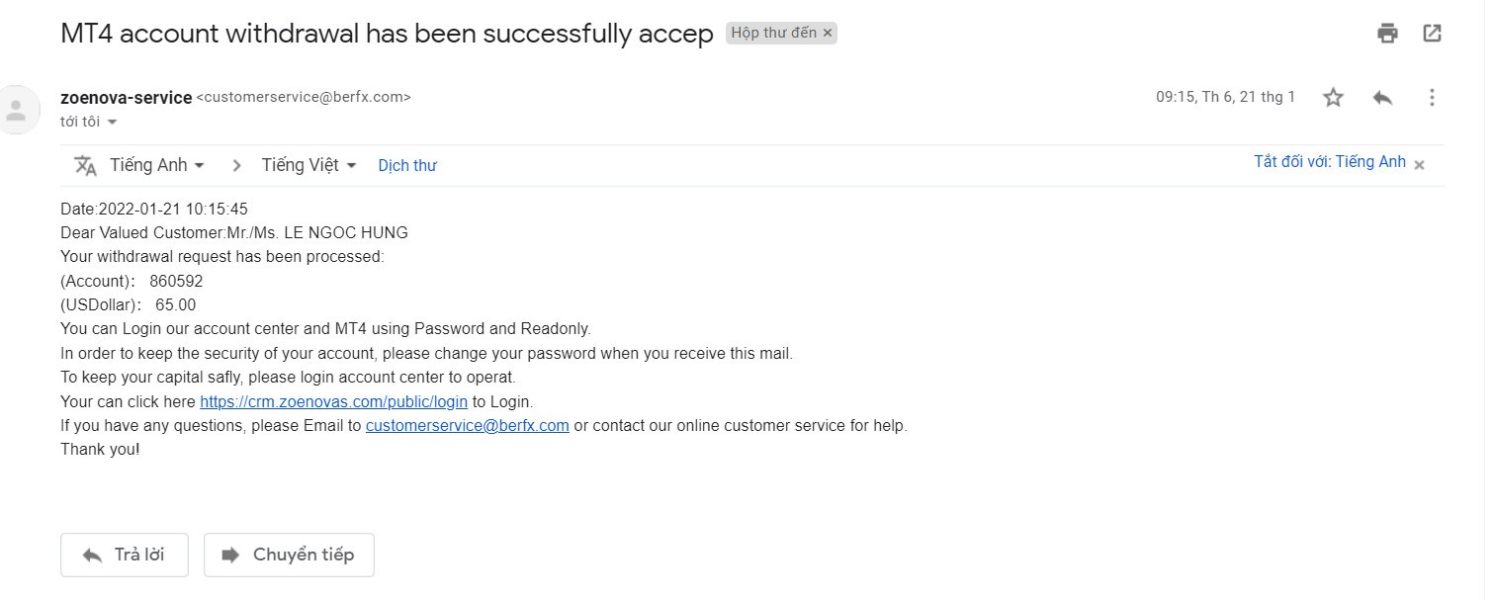

- Deposit/Withdrawal Methods:

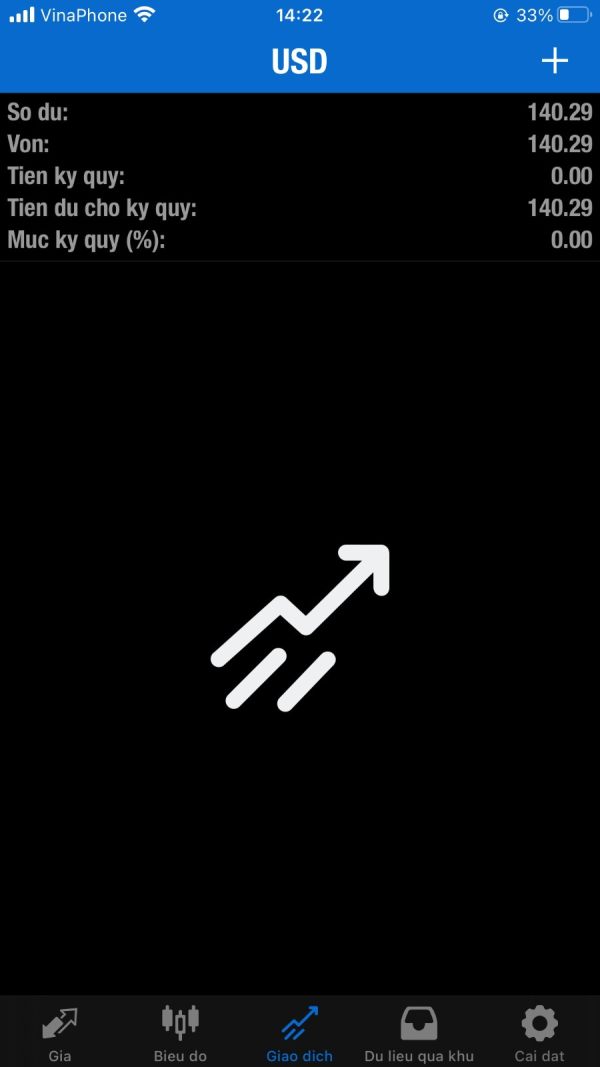

- Specific information regarding accepted currencies and cryptocurrencies is not disclosed. The minimum withdrawal amount is set at $15, but users have reported difficulties in processing withdrawals, leading to complaints about the broker's reliability.

- Minimum Deposit:

- The minimum deposit requirement is considerably high, reaching up to $1,000, which may deter novice traders from engaging with the platform.

- Bonuses/Promotions:

- There is no clear information available about any bonuses or promotional offers that Zoenova may provide, which is often a standard feature among competitive brokers.

- Asset Classes:

- The available tradable asset classes include forex currency pairs, commodities, and indices. However, the limited selection may not meet the needs of more experienced traders.

- Costs (Spreads, Fees, Commissions):

- While Zoenova claims to offer low spreads, specific rates are not provided. The ECN account incurs a commission of $10 per lot, which can add up for active traders.

- Leverage:

- The broker offers leverage up to 1:1000, which is attractive for traders looking to maximize their positions but also increases the risk significantly.

- Allowed Trading Platforms:

- Zoenova does not support widely recognized platforms like MT4 or MT5, opting instead for a proprietary application that may not have the same level of functionality and user-friendliness.

- Restricted Regions:

- Information on restricted regions is not explicitly stated, but the lack of regulation suggests that the broker may not operate in jurisdictions with stringent regulatory requirements.

- Available Customer Support Languages:

- Customer support is available in English, but the overall quality of service has been criticized, with many users reporting unresponsive support channels.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions: The high minimum deposit requirement and lack of regulatory oversight contribute to a low score in this category. Users have expressed concerns about the broker's transparency and reliability.

Tools and Resources: While some basic tools may be available, the absence of industry-standard platforms like MT4 or MT5 limits the trading experience, leading to a below-average rating.

Customer Service and Support: Numerous complaints have surfaced regarding the lack of effective customer service, with users reporting difficulties in contacting support and resolving issues.

Trading Experience: The limited range of tradable assets and the proprietary trading platform detract from the overall trading experience, resulting in a low score.

Trustworthiness: Zoenova's lack of regulation and the numerous negative user experiences contribute to an extremely low trustworthiness rating.

User Experience: The overall user experience is marred by withdrawal issues and poor customer support, leading to significant dissatisfaction among users.

In conclusion, the Zoenova review highlights serious concerns regarding the broker's regulatory status, customer service, and overall user experience. Potential traders should exercise extreme caution and consider more reputable, regulated alternatives in the forex market.