ZERO Review 1

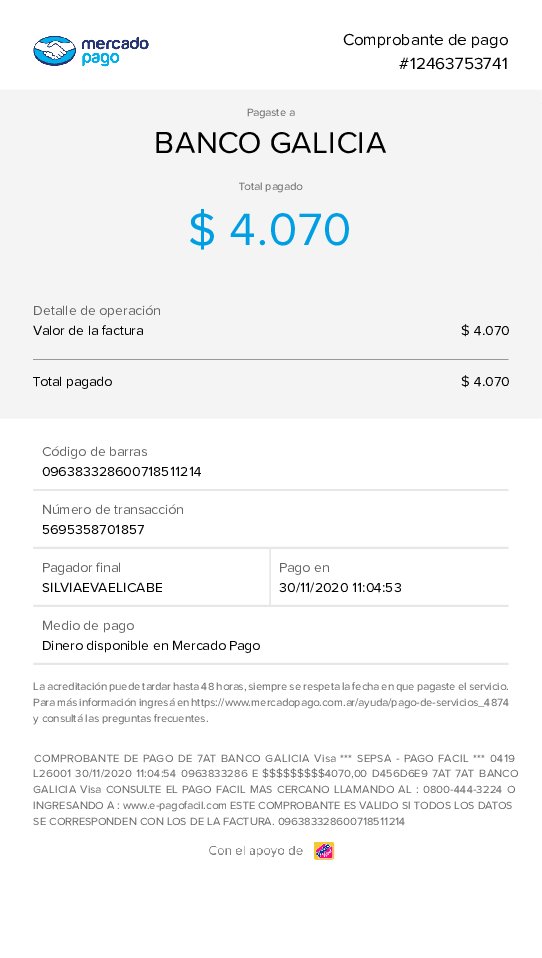

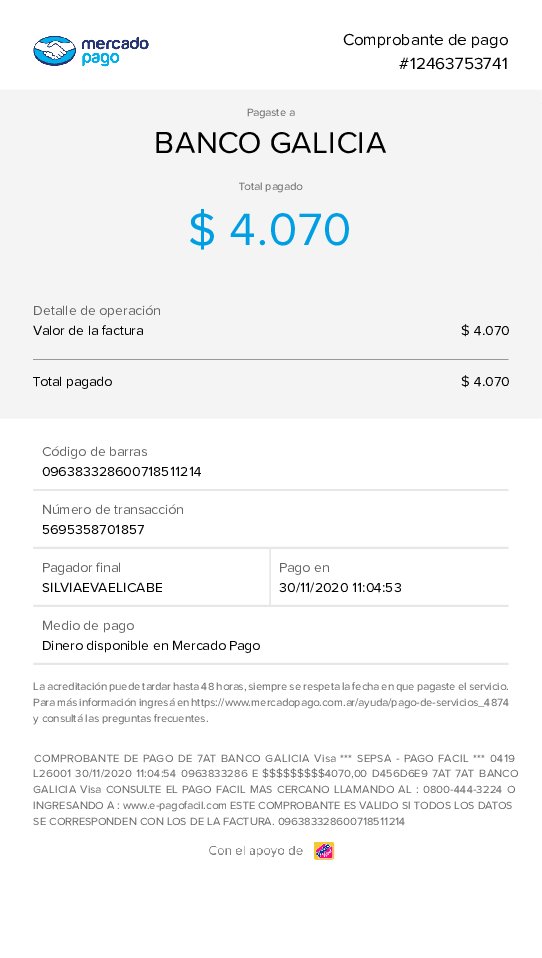

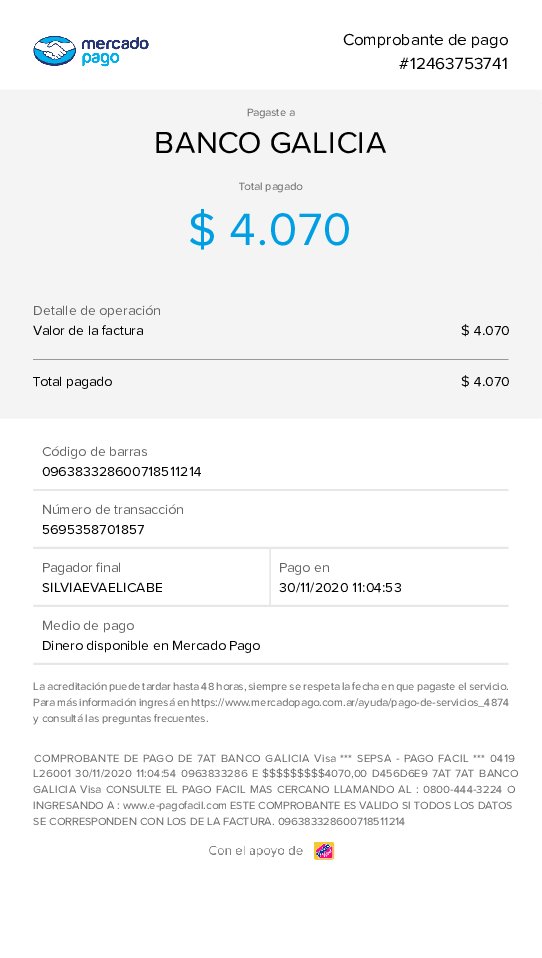

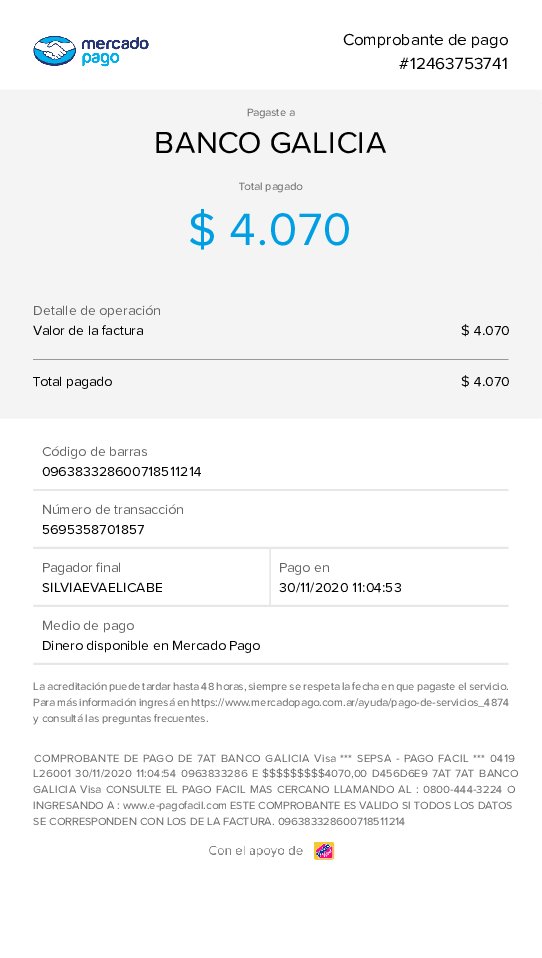

I lost $4,070. Because I was unfamiliar about trading, I found the first broker after distinguishing different information. However this broker only stole my investment and my payment was never available in the account.

ZERO Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I lost $4,070. Because I was unfamiliar about trading, I found the first broker after distinguishing different information. However this broker only stole my investment and my payment was never available in the account.

This comprehensive zero review examines the current landscape of zero-commission trading platforms and their impact on the financial services industry. Zero-commission brokerages have fundamentally transformed how traders approach the markets. They eliminated traditional brokerage fees that once served as barriers to entry for many retail investors. The zero brokerage model represents a significant shift in the industry, where platforms generate revenue through alternative means rather than charging per-transaction fees.

The zero-commission approach has gained substantial traction among cost-conscious traders who prioritize minimizing trading expenses. However, the absence of traditional commission structures doesn't necessarily mean trading is entirely free. Platforms may implement other fee structures or revenue models. This zero review focuses on understanding the broader implications of zero-tolerance policies in trading environments and their effectiveness in creating sustainable business models while serving trader needs.

The target demographic for zero-commission platforms typically includes active retail traders, millennials entering the investment space, and cost-sensitive investors who execute frequent transactions. Our assessment considers various factors including platform reliability, hidden costs, execution quality, and overall user experience. This provides a balanced perspective on this evolving sector.

This zero review is based on publicly available information and industry analysis as of 2025. Different regions may have varying regulatory requirements that affect zero-commission trading models. The effectiveness and availability of zero-commission services may differ significantly across jurisdictions due to local financial regulations and market structures.

Our evaluation methodology incorporates multiple data sources, user feedback when available, and industry reports to provide the most accurate assessment possible. Readers should conduct their own due diligence and consider their specific trading needs and regulatory environment before making decisions based on this review.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 6/10 | Limited specific information available about account requirements and features |

| Tools and Resources | 5/10 | Insufficient data on trading tools and educational resources provided |

| Customer Service | 5/10 | No detailed information available regarding support quality and availability |

| Trading Experience | 6/10 | Basic functionality expected but specific performance metrics unavailable |

| Trust and Reliability | 5/10 | Limited regulatory and safety information available for assessment |

| User Experience | 6/10 | General industry trends suggest improved accessibility but specific feedback limited |

The zero-commission trading model emerged as a disruptive force in the financial services industry. It fundamentally challenged traditional brokerage fee structures. Zero-tolerance policies and zero-commission models have been implemented across various sectors, including educational institutions and financial services, with varying degrees of success and controversy.

The concept of zero brokerage means that regardless of the trades executed, no traditional commission fees are charged to clients. This model has gained significant traction due to technological advancements and increased competition among trading platforms. The zero-commission approach has democratized access to financial markets by removing cost barriers that previously prevented smaller investors from participating actively.

However, the implementation of zero-commission models requires careful analysis of their long-term sustainability and effectiveness. Research on zero-tolerance policies in other sectors suggests that while these approaches can achieve certain immediate objectives, their overall effectiveness may vary depending on implementation and context. The trading industry's adoption of zero-commission structures represents a significant shift toward more accessible financial services. The full implications continue to evolve.

Regulatory Coverage: Specific regulatory information is not detailed in available sources. Zero-commission platforms typically operate under standard financial services regulations in their respective jurisdictions.

Deposit and Withdrawal Methods: Detailed information about funding options is not specified in available sources. Industry standards typically include bank transfers and electronic payment methods.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available sources for zero-commission platforms.

Promotional Offers: Information regarding bonuses or promotional offerings is not detailed in available sources.

Tradeable Assets: Specific asset classes available for trading are not comprehensively detailed in available sources. Zero-commission platforms typically focus on stocks and ETFs.

Cost Structure: While traditional commissions are eliminated, the complete fee structure including potential spreads, financing costs, and other charges is not fully detailed in available sources.

Leverage Options: Specific leverage ratios offered are not mentioned in available sources.

Platform Choices: Detailed information about trading platform options is not specified in available sources.

Geographic Restrictions: Specific regional limitations are not detailed in available sources.

Customer Support Languages: Information about multilingual support options is not specified in available sources.

This zero review acknowledges the limited specific details available. It highlights the need for potential users to conduct additional research directly with service providers.

The account conditions for zero-commission trading platforms represent a fundamental departure from traditional brokerage models. These platforms typically offer simplified account structures designed to attract cost-conscious traders. However, specific details regarding account types, minimum balance requirements, and special features are not comprehensively detailed in available sources.

The zero-commission model suggests that account holders can execute trades without traditional per-transaction fees. These historically represented significant costs for active traders. This approach potentially makes frequent trading more economically viable for retail investors. The absence of detailed information about account opening procedures, verification requirements, and ongoing maintenance conditions limits our ability to provide a comprehensive assessment.

Industry analysis indicates that zero-commission platforms often compensate for eliminated fees through alternative revenue streams. This may indirectly affect account conditions. The long-term sustainability of zero-commission models depends on these alternative revenue mechanisms, which may include payment for order flow, premium service tiers, or margin lending revenues.

This zero review cannot provide definitive conclusions about the practical experience of account management without specific user feedback or detailed account documentation available in our sources. Potential users should directly investigate account terms, conditions, and any hidden requirements that may not be immediately apparent in marketing materials.

The tools and resources provided by zero-commission trading platforms play a crucial role in determining their overall value proposition beyond the elimination of trading fees. Specific information about trading tools, research capabilities, educational resources, and analytical features is not detailed in available sources for comprehensive evaluation.

Industry standards suggest that competitive trading platforms, regardless of their commission structure, typically provide basic charting tools, market data, and order management systems. The quality and comprehensiveness of these tools often differentiate platforms in an increasingly competitive market. Advanced features such as algorithmic trading support, sophisticated analytical tools, and comprehensive research resources may vary significantly among zero-commission providers.

Educational resources represent another critical component, particularly for platforms targeting newer investors attracted by zero-commission structures. The availability of tutorials, market analysis, webinars, and educational content can significantly impact user success and platform loyalty. Our available sources do not provide specific details about educational offerings or their quality.

The integration of automated trading capabilities and third-party tool compatibility also influences platform utility for more sophisticated traders. Without detailed information about API access, plugin support, or integration with popular trading software, this assessment remains necessarily limited in scope.

Customer service quality represents a critical factor in evaluating any trading platform. It potentially becomes even more important for zero-commission providers who may have different resource allocation strategies. However, specific information regarding customer support channels, response times, service quality, and availability is not detailed in available sources.

The zero-commission model's impact on customer service resources presents an interesting consideration. Platforms eliminating traditional revenue streams may need to optimize operational costs, potentially affecting support quality or availability. Increased user volumes attracted by zero-commission structures might necessitate enhanced support infrastructure.

Multi-channel support availability, including phone, email, live chat, and social media assistance, typically characterizes competitive trading platforms. The hours of operation, particularly for platforms serving global markets, can significantly impact user experience. Weekend and holiday support availability often distinguishes premium service providers.

Language support capabilities also influence accessibility for international users. This zero review cannot provide detailed assessments of customer service capabilities without specific information about multilingual support options or regional service variations. Resolution effectiveness for technical issues, account problems, and trading disputes remains unspecified in available sources.

The trading experience encompasses platform stability, execution quality, interface design, and overall functionality that directly impacts user success and satisfaction. For zero-commission platforms, the trading experience becomes particularly important as it represents the primary value proposition beyond cost savings.

Platform stability and execution speed are fundamental requirements for any trading environment. The ability to execute orders reliably during market volatility, maintain consistent platform availability, and provide accurate real-time data affects trader outcomes significantly. Specific performance metrics, uptime statistics, or execution quality data are not available in our sources for detailed analysis.

Order execution quality, including fill rates, slippage characteristics, and price improvement opportunities, can significantly impact trading profitability even in zero-commission environments. The routing of orders and potential conflicts of interest in zero-commission models represent important considerations. Specific details are not provided in available sources.

Mobile trading capabilities have become increasingly important as traders seek flexibility and accessibility. The quality of mobile applications, feature parity with desktop platforms, and offline functionality can influence platform selection decisions. This zero review acknowledges the limitation of not having specific mobile platform assessments available in our source materials.

Trust and reliability form the foundation of any financial services relationship, particularly in trading environments where users entrust platforms with significant capital and sensitive financial information. The assessment of zero-commission platforms' trustworthiness requires examination of regulatory compliance, financial stability, and operational transparency.

Regulatory oversight provides essential protection for traders, ensuring platforms operate within established legal frameworks and maintain appropriate safeguards. Specific regulatory authorizations, compliance records, and oversight mechanisms are not detailed in available sources for comprehensive evaluation. The regulatory landscape for zero-commission trading continues evolving as authorities adapt to new business models.

Financial stability of zero-commission providers presents unique considerations given their alternative revenue models. The sustainability of business models that eliminate traditional fee structures while maintaining operational quality requires careful evaluation. Specific financial performance data, capitalization levels, or stability indicators are not available in our sources.

Operational transparency regarding order routing, revenue sources, and potential conflicts of interest becomes particularly relevant for zero-commission platforms. The disclosure of payment for order flow arrangements, market maker relationships, and other revenue mechanisms affects user trust and informed decision-making. This assessment remains necessarily limited without detailed transparency information available.

User experience encompasses the overall satisfaction, ease of use, and practical functionality that traders encounter when using zero-commission platforms. This includes registration processes, platform navigation, account management, and the general accessibility of services provided.

The onboarding experience for new users often sets expectations for the entire relationship with a trading platform. Simplified registration processes, efficient identity verification, and intuitive initial setup procedures can significantly impact user adoption and satisfaction. Specific information about user onboarding experiences is not detailed in available sources.

Interface design and usability affect daily trading activities and user productivity. Intuitive navigation, customizable layouts, and efficient workflow design contribute to positive user experiences. The learning curve for new users and the depth of functionality for experienced traders represent important balance considerations for platform developers.

Account management functionality, including funding procedures, withdrawal processes, and account monitoring tools, influences ongoing user satisfaction. The efficiency and reliability of these operational aspects can significantly impact user retention and platform reputation. This evaluation remains necessarily general in scope without specific user feedback or detailed operational assessments available in our sources.

This zero review highlights the significant transformation occurring in the trading industry through the adoption of zero-commission models. These approaches offer clear cost advantages for traders. However, the limited availability of specific operational details, user feedback, and performance metrics prevents a comprehensive definitive assessment.

The zero-commission trend appears to benefit cost-conscious traders and those seeking more accessible entry points to financial markets. Potential users should conduct thorough due diligence regarding platform reliability, hidden costs, execution quality, and regulatory protections before committing to any specific provider.

The evolving nature of zero-commission trading models suggests continued development in this sector. This includes potential improvements in service offerings and operational transparency over time.

FX Broker Capital Trading Markets Review