Onderson 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the world of forex trading, myriad brokers offer varying incentives and features that can either attract or repel traders. Onderson Group, a closed forex broker, has positioned itself with compelling cashback incentives aimed primarily at beginner traders. Its offer is attractive for those scouting low-cost trading options that promise a financial return per trade. However, this allure comes at a significant cost—serious trust issues due to regulatory ambiguities and a plethora of negative user experiences that cast long shadows over its operational integrity.

Beginning traders seeking cashback may view Onderson as a viable option, but risk-averse traders, particularly those managing larger capitals and requiring robust support, would be better off looking elsewhere. Regulatory compliance and transparent fees are critical components for such investors, and Onderson's offerings reveal troubling deficiencies in these areas. Ultimately, while cashback incentives can enhance trading profitability, they are overshadowed by significant risks that should not be overlooked.

⚠️ Important Risk Advisory & Verification Steps

When considering engagements with Onderson Group, it is crucial to remain cautious and perform due diligence.

Risk Statement: Onderson Group displays significant credibility concerns that can lead to financial loss.

Potential Harms:

- Regulatory ambiguity resulting in unaccountability.

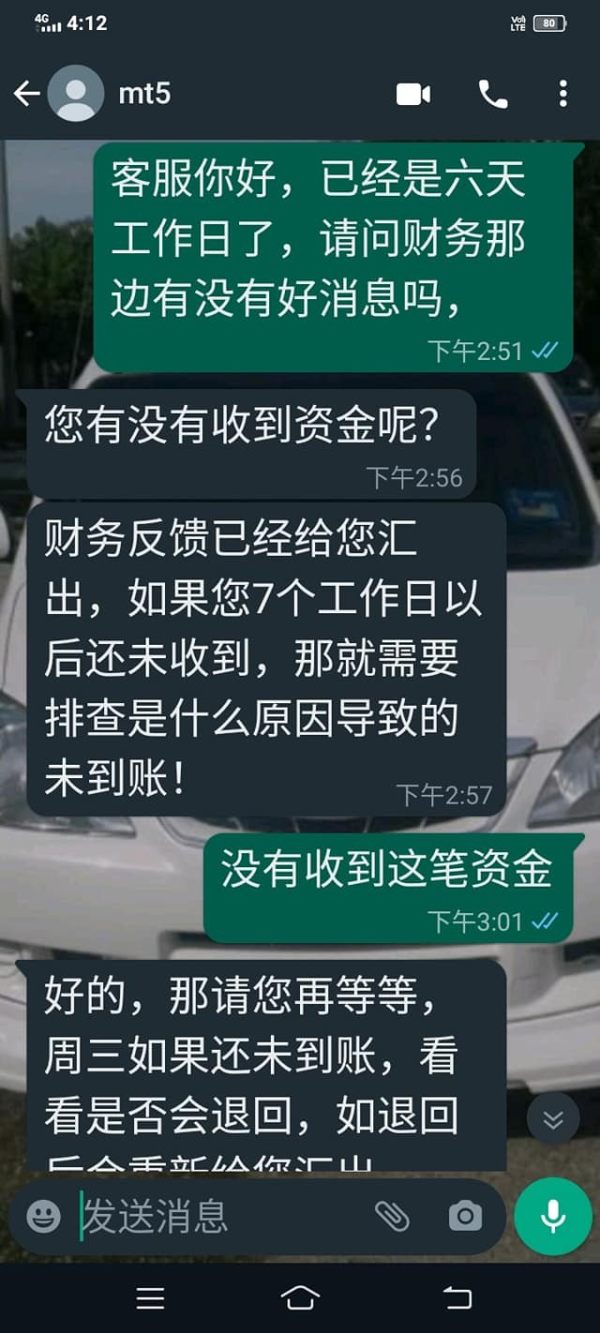

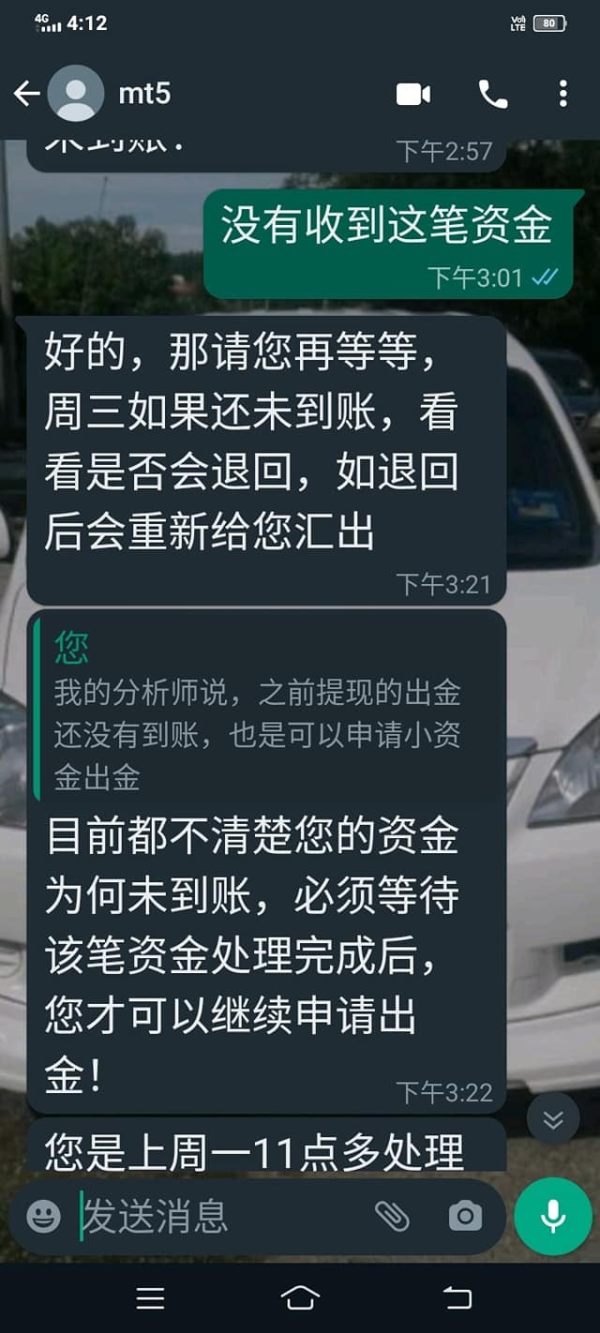

- User complaints about withdrawal issues and lack of customer support.

How to Self-Verify the Broker's Legitimacy:

- Check Regulatory Listings: Utilize resources like the NFA's BASIC database to verify regulatory status.

- Review User Feedback: Visit independent review sites to garner insights into user experiences, particularly concerning withdrawals.

- Observe Transparency: Ensure that the broker provides clear information regarding fees and trading conditions.

- Contact Support: Attempt to communicate with customer support to gauge responsiveness and professionalism before opening an account.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2007, Onderson Group markets itself as a forex brokerage offering cashback incentives but is currently labeled as a closed broker. Chronic issues regarding its operational transparency, especially regarding regulatory compliance, prompted many users to harbor significant distrust. Numerous sources indicate the firm may be out of business, casting a shadow over its historical positioning within the market.

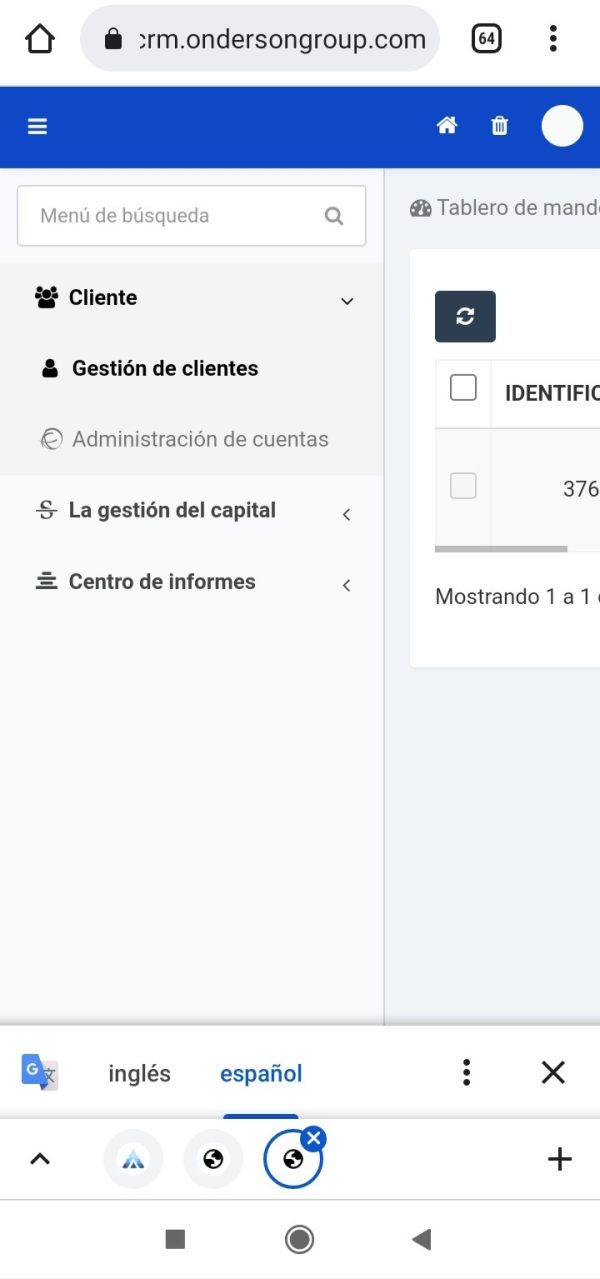

Core Business Overview

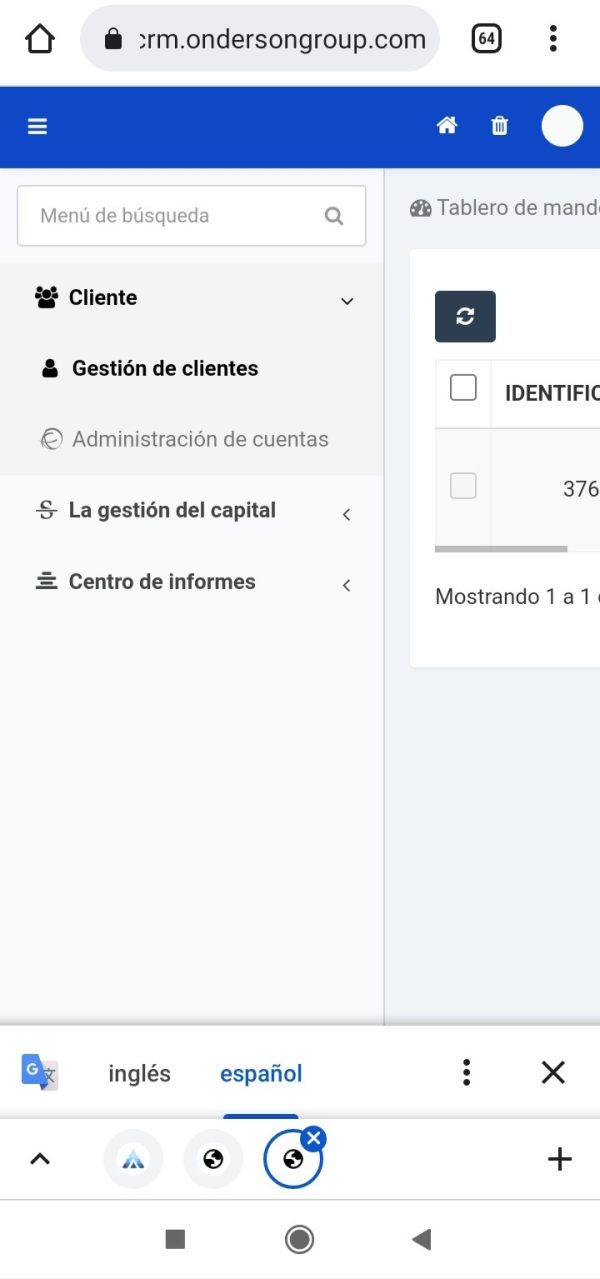

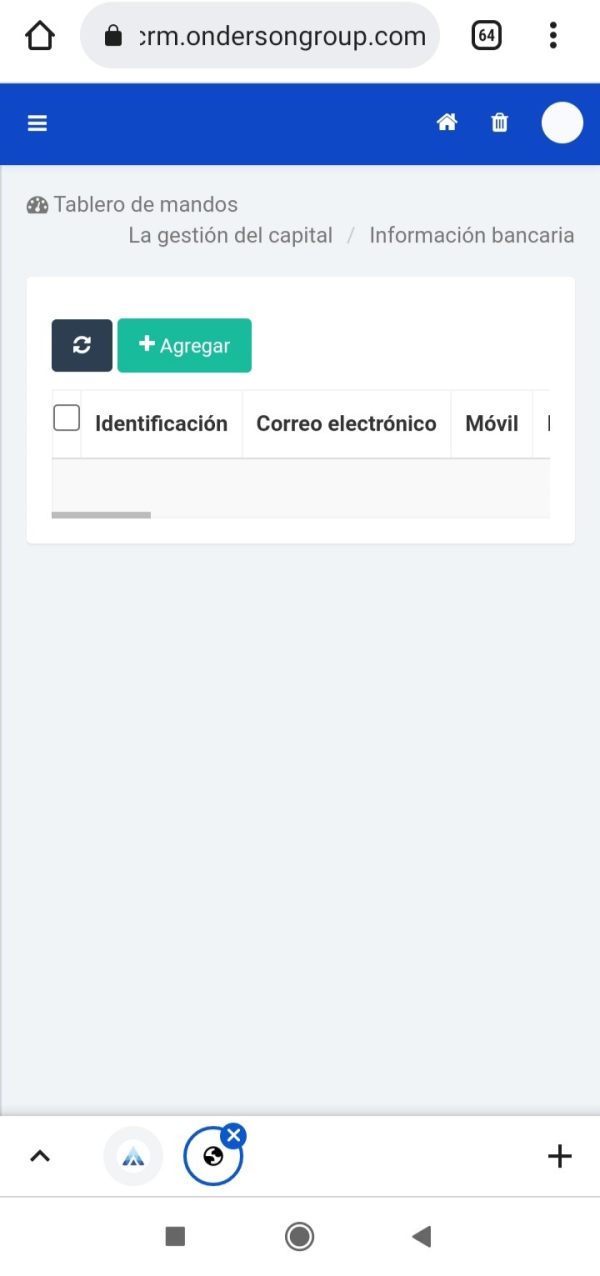

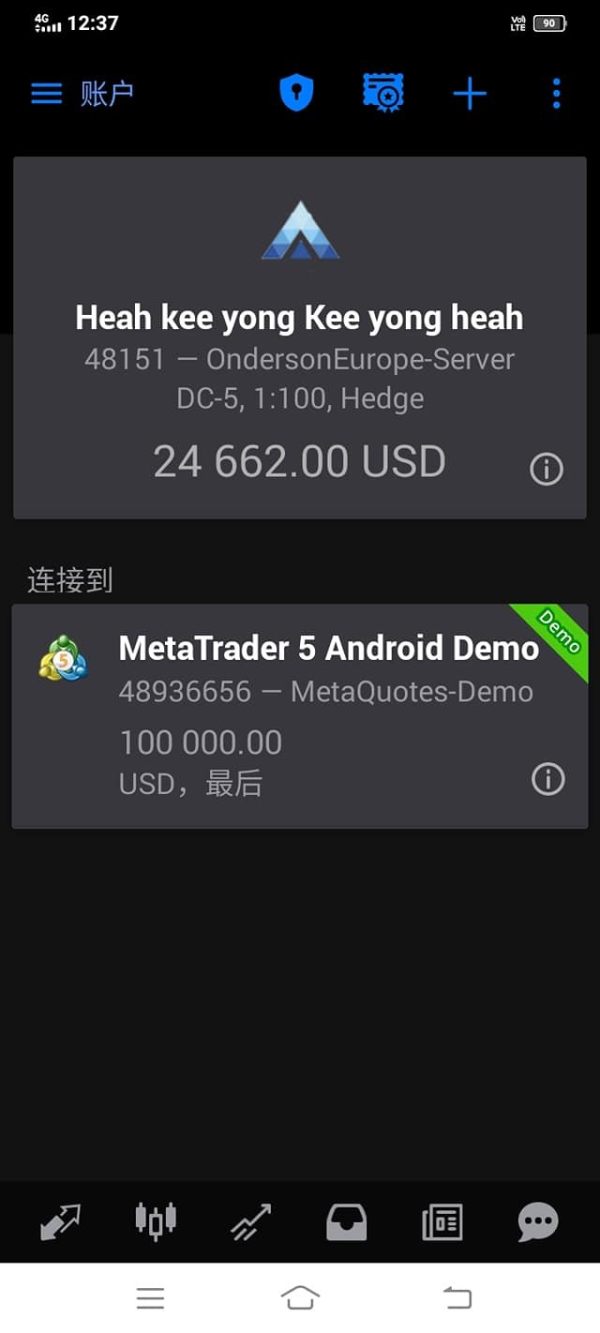

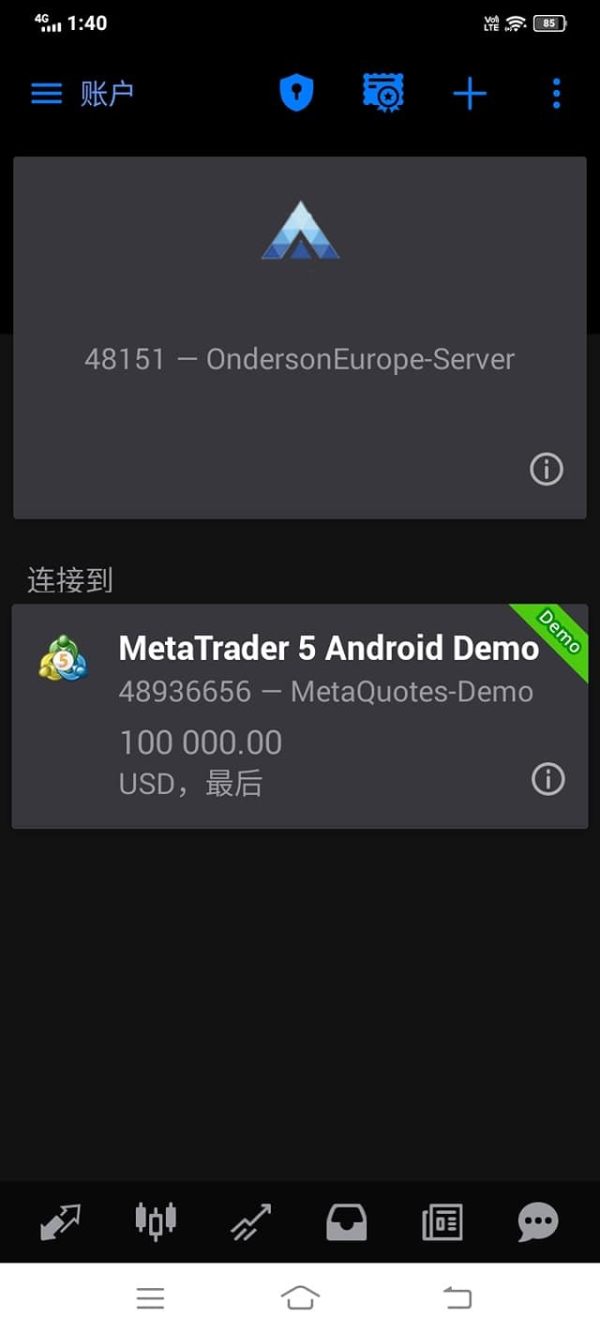

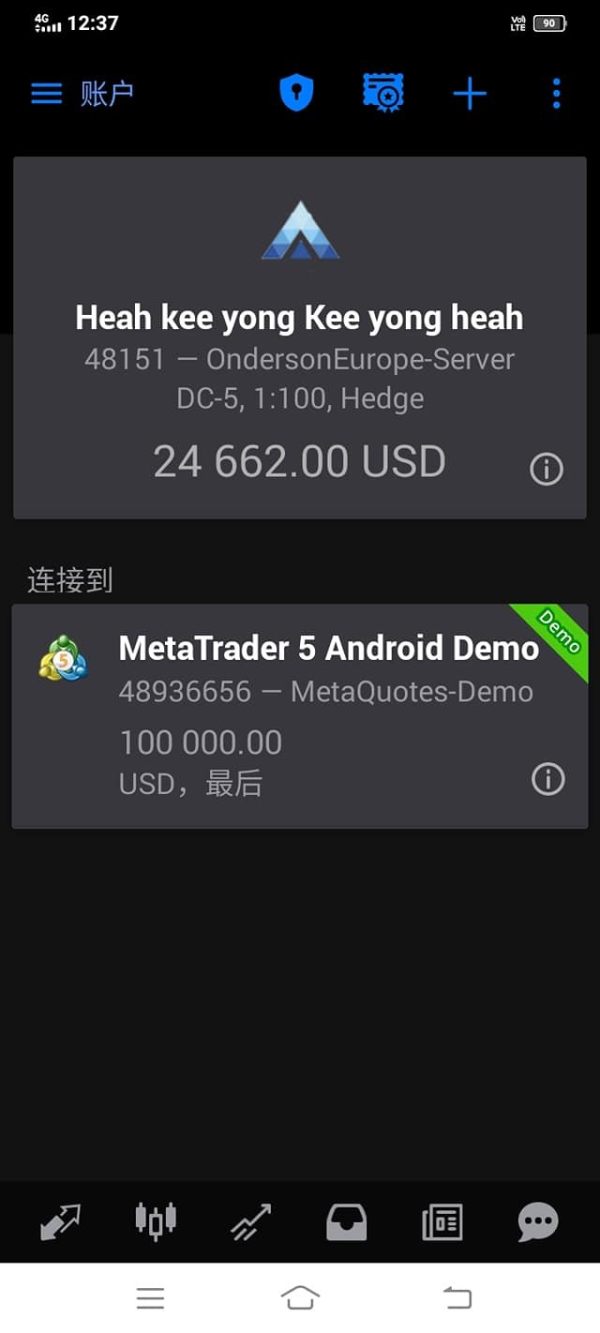

Onderson Group primarily engages in forex trading through a cashback model, promising to return part of the trading fees to its clients. It primarily proposes trading through the MT5 platform, facilitating access to a range of financial instruments, including forex, commodities, and indices. However, the firm lacks clarity concerning its claimed regulatory affiliations, with sources mentioning that details around their operational license and regulatory standing are highly ambiguous.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Analyzing the regulatory information surrounding Onderson reveals significant contradictions. The firm claims affiliations with regulatory bodies, yet many users and reviews express concerns regarding their compliance status, casting doubt on their operational integrity.

To assist potential clients in verifying Onderson's legitimacy, follow these steps:

- Visit the NFA's BASIC database.

- Enter Onderson Group's name to check registration and compliance status.

- Review details and note any discrepancies with their promotional claims.

- Look for past sanctions or user complaints associated with the broker.

User Feedback Summary:

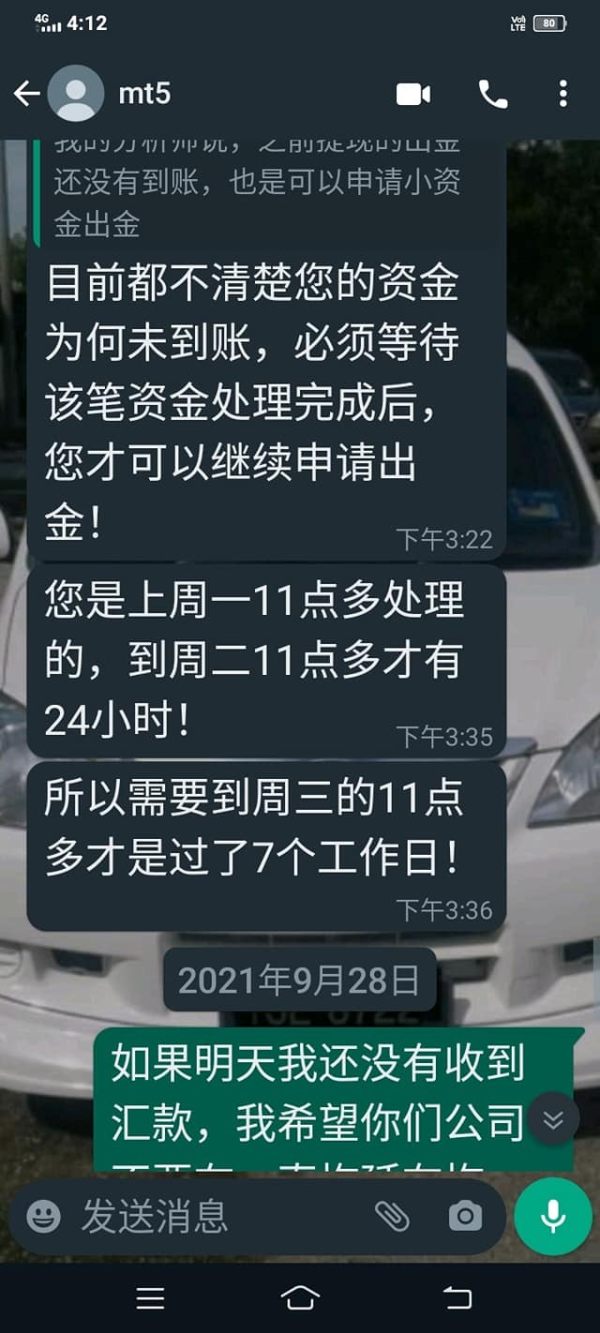

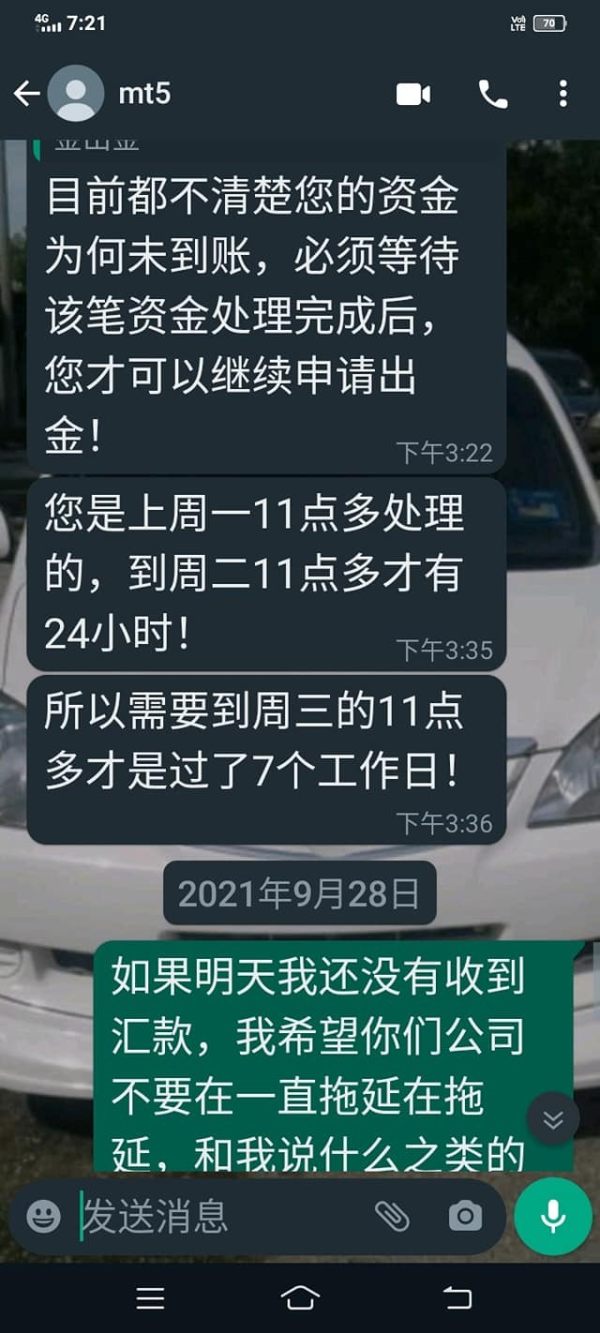

"I invested an amount of USD 26,000 and requested for withdrawal, but the customer service and broker ignored all my messages." – An anonymous user review highlighting significant trust issues with Onderson.

Trading Costs Analysis

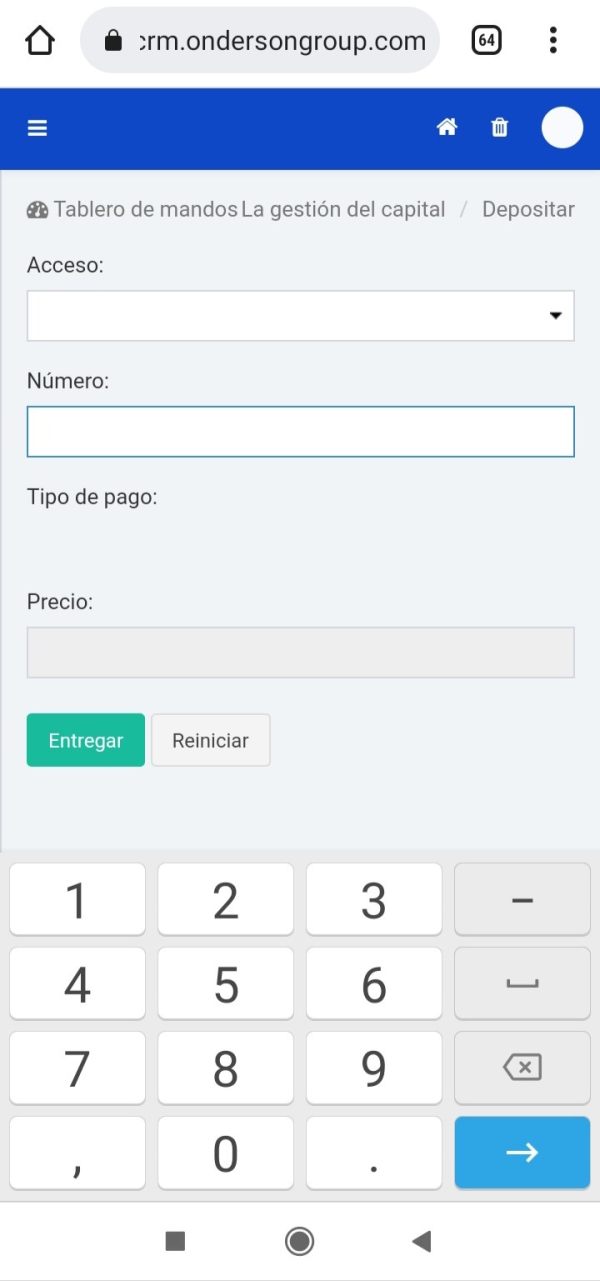

Onderson Group advertises itself as a low-cost trading option, particularly attractive for novice traders. Its cashback model aims to reduce overall trading costs, but beneath this facade lies complexity.

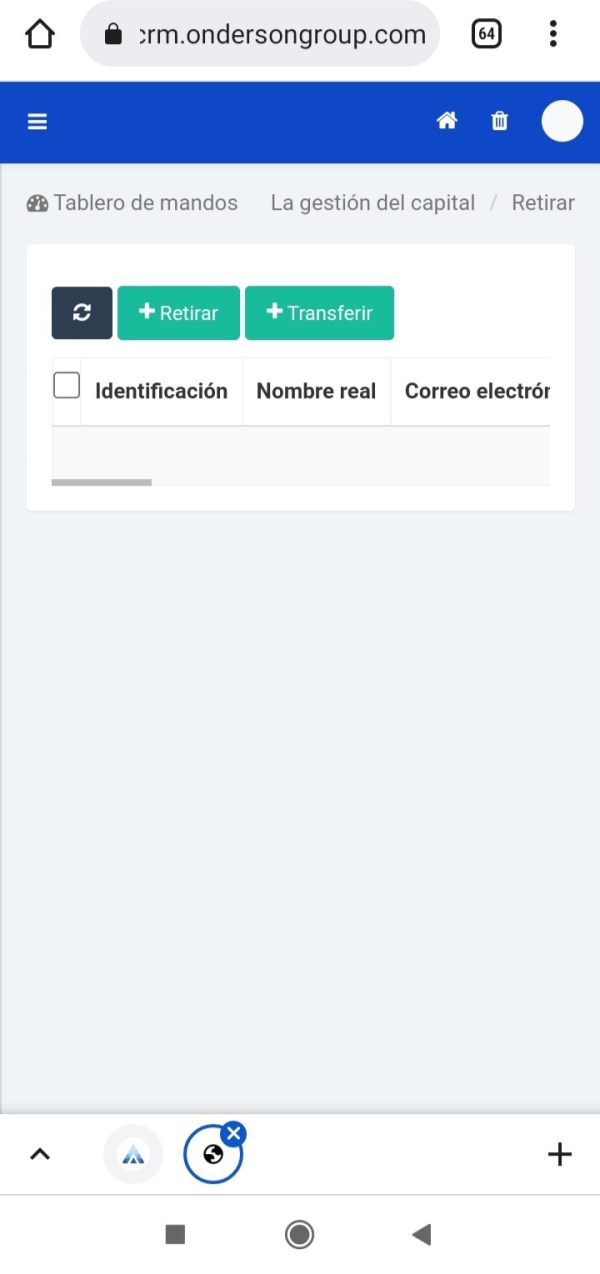

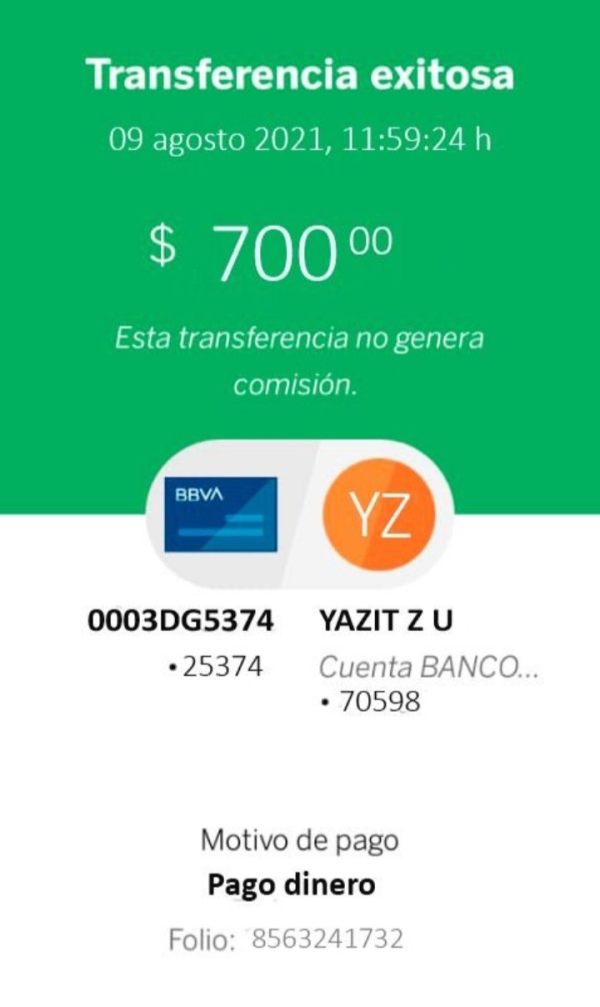

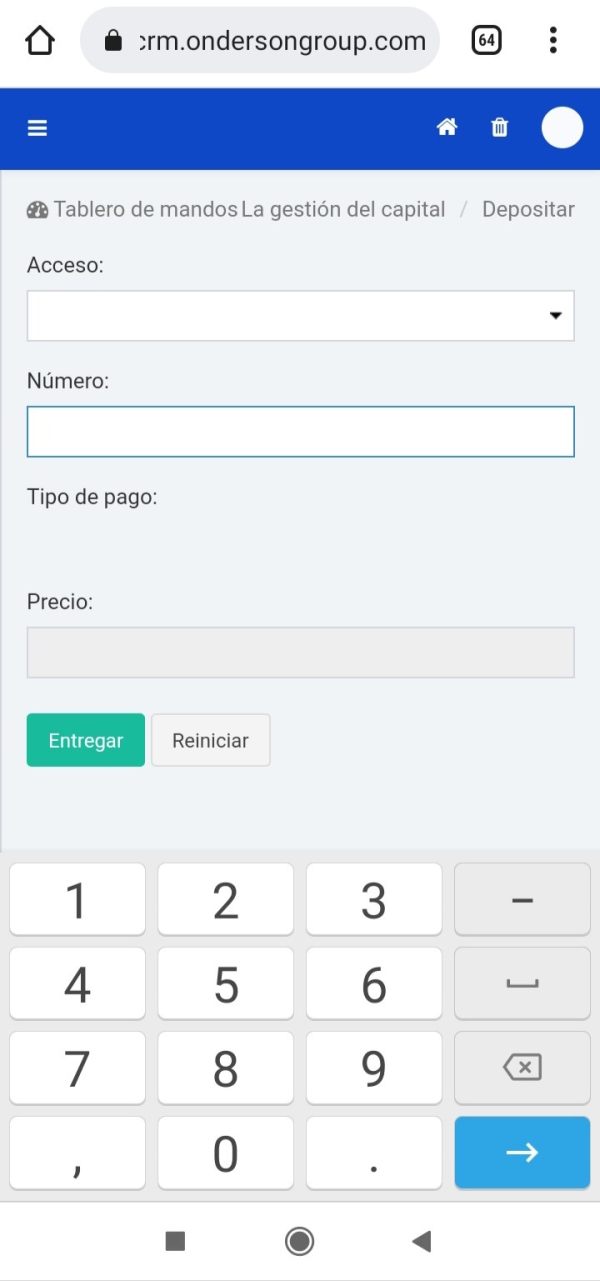

The apparent advantage of low trading costs often leads traders into the traps of non-trading fees. Many complaints mention high withdrawal fees and unexplained service charges, which can undermine the cost-effectiveness promised by cashback incentives.

$30 withdrawal fee has been reported by multiple users, significantly offsetting any potential gains from cashback received.

In summary, while Onderson presents a potentially appealing cost structure for beginner traders, the hidden fees may lead to an overall negative financial return for users.

Onderson offers the MT5 platform, a widely recognized trading software. However, many user reviews indicate dissatisfaction with Onderson's approach to user experience on this platform.

The features available on MT5, such as advanced charting and trading analysis tools, do not appear to be adequately supported or integrated within Onderson's offerings. Users have reported difficulty navigating MT5 in a manner conducive to effective trading strategies.

"The platform is slow and clunky; I've had multiple issues with trading orders not executing on time." – User feedback shows frustration with the trading environments.

Overall, while the platform may be robust, the lack of proper support and smooth operation significantly diminishes its value for users.

User Experience Analysis

Customer feedback regarding Onderson reflects ongoing dissatisfaction, with an alarming number of negative reviews focusing on their service quality and platform usability. Users frequently highlight their struggles with navigating the trading interface and dealing with customer support delays.

Rated at 1.5/5 in user experience evaluations, the sentiment within the user base leans heavily negative, stressing a pattern of frustration and disappointment that should be thoroughly considered before engaging with Onderson.

Customer Support Analysis

Users have expressed their frustrations concerning customer support accessibility. Reports frequently mention that responses from the support team come at a snail's pace, often leaving traders in precarious situations when immediate assistance is needed.

These issues are underscored by the inadequate support structure, with connectivity limited primarily to email without any live support options being available.

Account Conditions Analysis

The clarity surrounding account conditions for trading with Onderson is notably lacking. The absence of a clearly defined minimum deposit amount or transparent leverage details often leaves potential clients unsure of the requirements for engaging with the broker.

This reinforces the ambiguity that surrounds Onderson Group and emphasizes why experienced traders may be discouraged from choosing this broker.

Conclusion

In conclusion, while Onderson Group attempts to attract beginner traders with cash incentives, it exhibits severe shortcomings in trustworthiness, user experience, and customer service. With an exiguous ratings profile and numerous flags raised concerning regulatory compliance, prospective clients must weigh the risks heavily against the allure of cashback offerings. For those prioritizing regulatory integrity and fund safety, seeking reputable alternatives would be wiser in the ever-complicated landscape of forex trading.