- Rowe Price Investment Services operates as a registered broker-dealer providing investment services to retail investors within the United States financial system. The company maintains registration with the Securities and Exchange Commission and holds membership in both the Financial Industry Regulatory Authority and the Securities Investor Protection Corporation. This establishes a foundation of regulatory compliance and investor protection. Their business model centers on offering access to a comprehensive range of TRP Funds, including open-end funds, closed-end funds, and private fund opportunities, allowing investors to participate in professionally managed investment strategies without requiring direct account establishment with the firm.

The firm's operational approach distinguishes between brokerage services and investment advisory services. Each service offers different fee structures and service levels. This trp review notes that investors can access TRP Funds through various channels, providing flexibility in how they engage with the company's investment offerings. The emphasis on retail investor access suggests a focus on making institutional-quality investment management available to individual investors. However, specific details about minimum investment requirements and detailed fee schedules require direct inquiry with the firm for complete transparency.

Regulatory Status: TRP Investment Services operates under SEC registration as a broker-dealer. FINRA membership ensures compliance with industry standards and SIPC membership provides investor protection coverage.

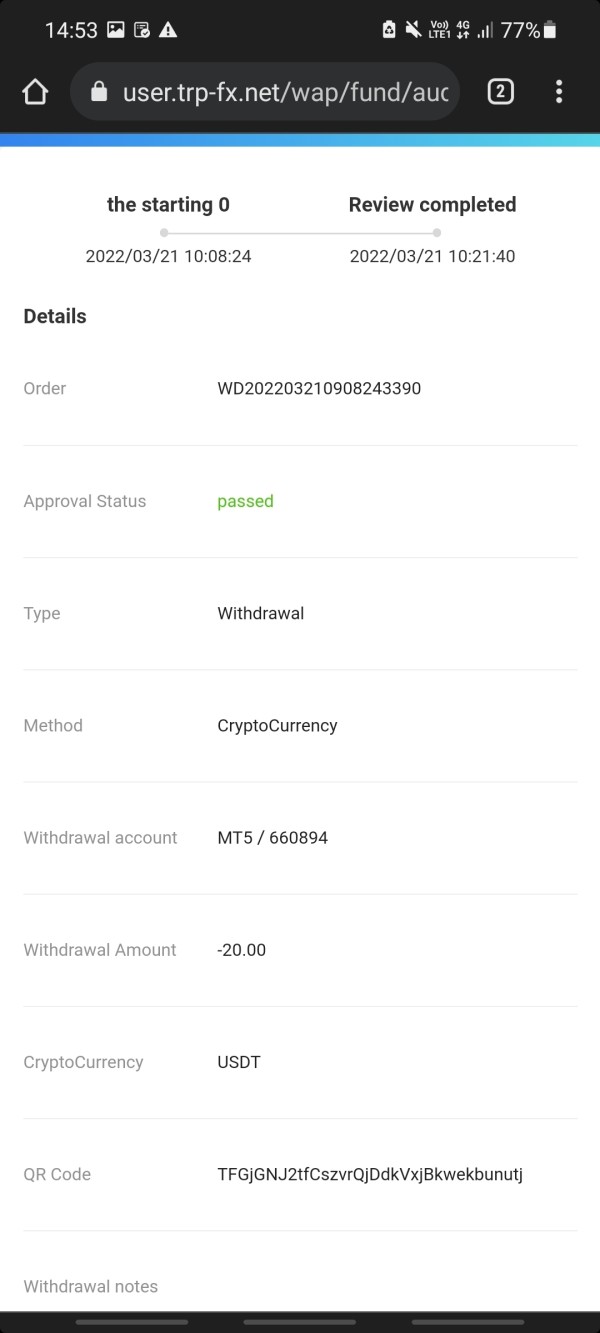

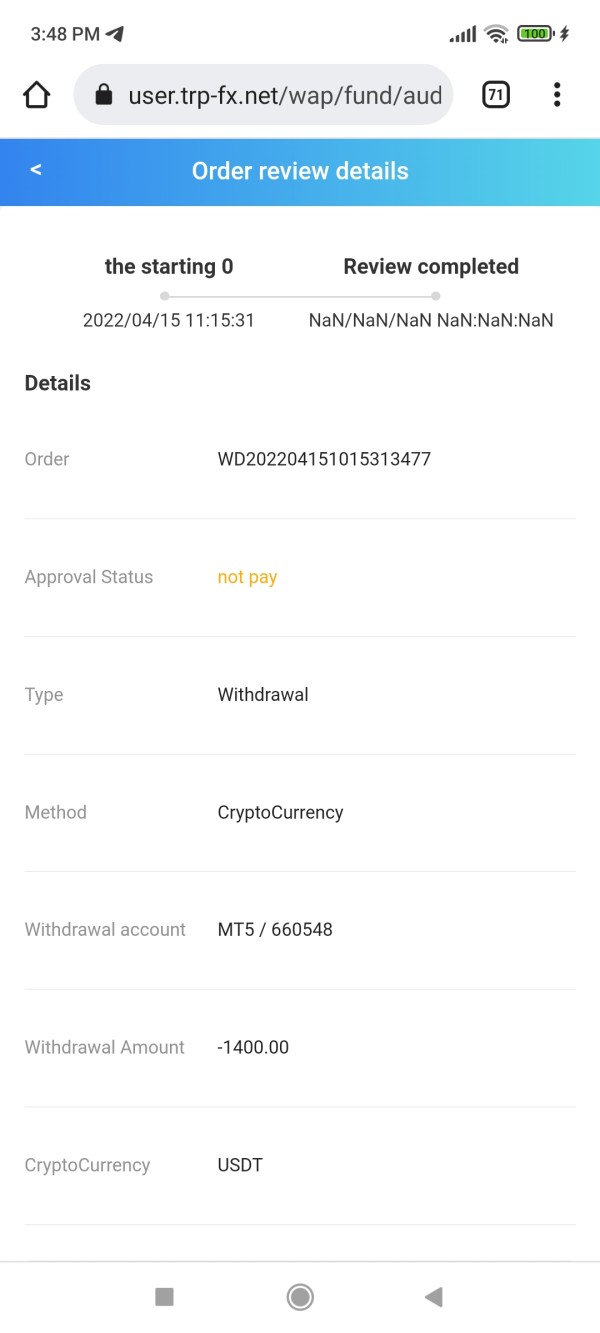

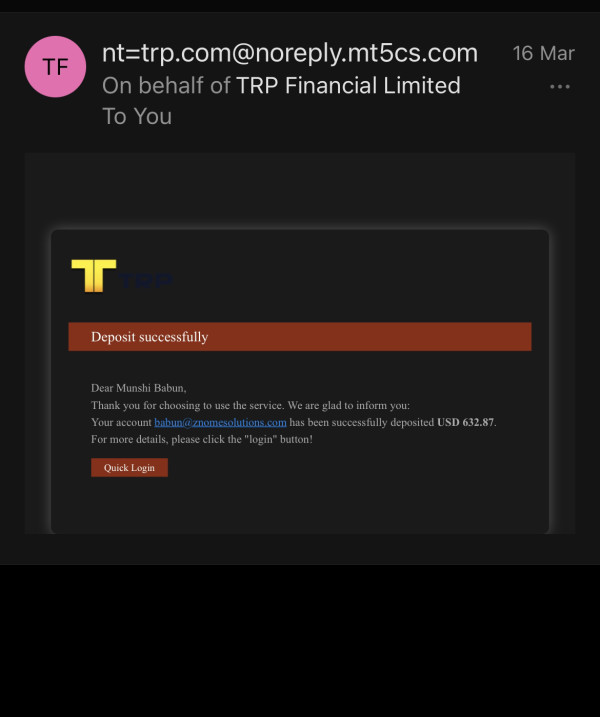

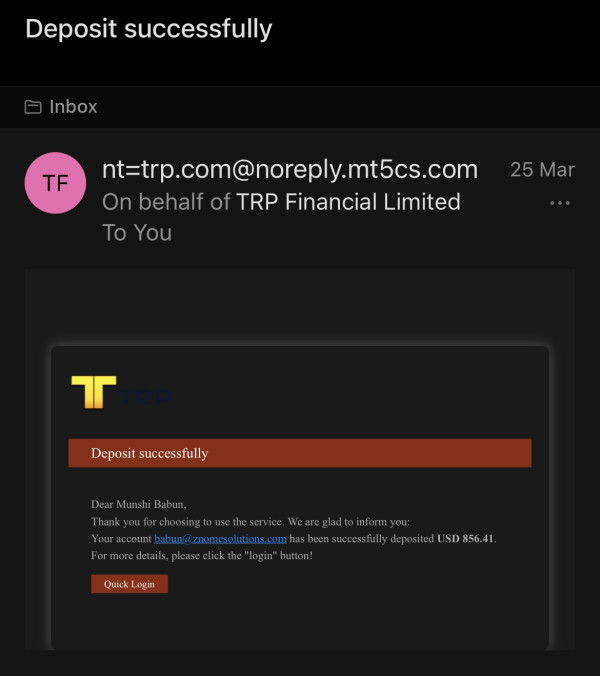

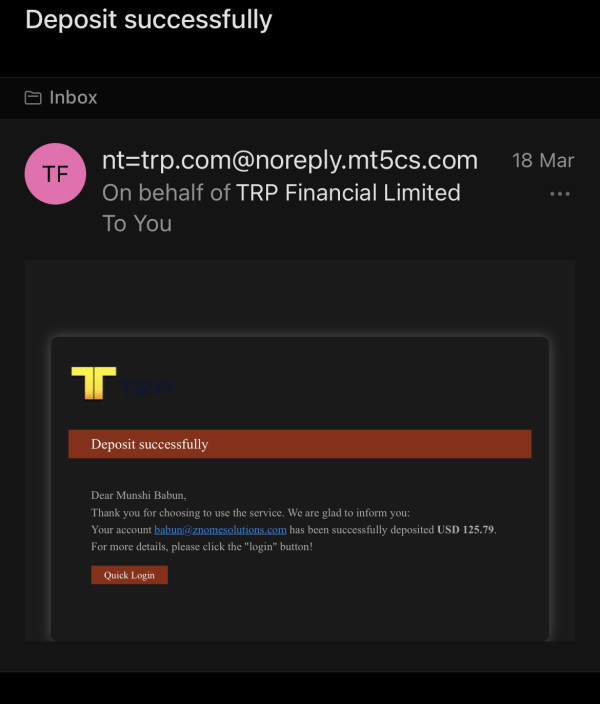

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal processes is not detailed in available documentation. This information would require direct contact with the firm.

Minimum Deposit Requirements: Minimum investment amounts for accessing TRP Funds are not specified in available materials. These amounts may vary by fund type and investor classification.

Bonus and Promotions: No specific promotional offers or bonus structures are mentioned in available documentation. This is consistent with the firm's professional investment management approach.

Tradeable Assets: The platform provides access to TRP Funds including open-end funds, closed-end funds, and private funds. These offerings provide diversified investment opportunities across various asset classes and investment strategies.

Cost Structure: Fee information distinguishes between brokerage and investment advisory services. However, specific rates and fee schedules are not detailed in available public documentation.

Leverage Options: As a fund-based investment service, traditional trading leverage is not applicable to this trp review. Investment exposure is managed through fund selection rather than leveraged positions.

Platform Options: Access to TRP Funds can be obtained through multiple channels. However, specific platform interfaces and technology offerings are not detailed in available materials.

Geographic Restrictions: As a U.S.-registered entity, services are primarily designed for U.S. retail investors. International access is subject to regulatory restrictions.

Customer Support Languages: Support language options are not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis

The account structure at TRP Investment Services reflects their dual approach of offering both brokerage and investment advisory services. However, specific details about account types and requirements are not comprehensively outlined in available public documentation. The firm emphasizes that investors do not need to open accounts directly with TRP or their affiliates to access TRP Funds, suggesting a flexible approach to client onboarding that accommodates various investor preferences and existing brokerage relationships. This trp review finds that while the regulatory framework provides confidence in account security through SIPC membership, the lack of detailed information about minimum deposit requirements, account tiers, or specific qualification criteria makes it difficult for potential clients to fully evaluate their eligibility and expected costs before initial contact. The distinction between brokerage and investment advisory services suggests different account structures may apply depending on the chosen service model. However, comprehensive details require direct consultation with the firm for accurate assessment.

TRP Investment Services provides access to professionally managed investment funds rather than traditional trading tools. This represents a different approach to investment services that focuses on fund selection and professional management rather than direct market access. The availability of open-end funds, closed-end funds, and private funds suggests a comprehensive range of investment strategies and asset class exposure, though specific details about research resources, fund analysis tools, or client education materials are not detailed in available documentation. The firm's SEC registration and FINRA membership suggest access to institutional-quality investment management and research capabilities. However, the specific tools and resources available to retail clients for fund evaluation and portfolio management are not clearly outlined. This approach may appeal to investors seeking professional management over direct trading capabilities, though the lack of detailed information about available resources makes it challenging to fully evaluate the comprehensiveness of client support tools.

Customer Service and Support Analysis

The customer service framework at TRP Investment Services operates within the regulatory structure established by FINRA membership. This typically ensures certain standards for client communication and support, though specific details about service channels, response times, and support availability are not outlined in available documentation. The firm's emphasis on serving retail investors suggests a client service model designed to accommodate individual investor needs. However, information about contact methods, service hours, multilingual support, or dedicated account management is not specified in publicly available materials. The distinction between brokerage and investment advisory services may result in different support levels and communication protocols depending on the client relationship type, but these differences are not clearly detailed. While regulatory oversight provides confidence in professional service standards, the absence of specific information about customer service capabilities makes it difficult to evaluate the quality and accessibility of client support.

Trading Experience Analysis

The trading experience at TRP Investment Services differs from traditional brokerage platforms as the focus centers on fund-based investing rather than direct market trading. This represents a managed investment approach that may appeal to investors seeking professional portfolio management over active trading capabilities. Access to TRP Funds provides exposure to various investment strategies and asset classes through professional management, though specific details about fund selection interfaces, portfolio monitoring tools, or investment tracking capabilities are not outlined in available documentation. This trp review notes that the investment experience emphasizes long-term wealth building through diversified fund offerings rather than short-term trading opportunities. This aligns with the firm's positioning as an investment management provider. The flexibility of accessing funds without direct account opening suggests streamlined investment processes, though specific details about transaction execution, settlement procedures, and ongoing portfolio management interfaces require direct inquiry with the firm.

Trust and Reliability Analysis

TRP Investment Services demonstrates strong regulatory credentials through SEC registration as a broker-dealer and membership in both FINRA and SIPC. This establishes a comprehensive framework of regulatory oversight and investor protection that significantly enhances trust and reliability. The SEC registration ensures compliance with federal securities laws and regulatory standards, while FINRA membership provides additional industry oversight and dispute resolution mechanisms. SIPC membership offers crucial investor protection coverage, safeguarding client assets in the event of firm financial difficulties. The firm's focus on retail investors within this regulated framework suggests a commitment to transparent and compliant operations, though specific details about additional security measures, asset segregation procedures, or internal risk management protocols are not detailed in available documentation. The regulatory structure provides substantial confidence in the firm's operational integrity and investor protection measures. This represents a significant strength in overall reliability assessment.

User Experience Analysis

The user experience at TRP Investment Services appears designed around fund-based investing rather than traditional trading interfaces. This potentially offers a simplified approach for investors seeking professional management without complex trading platforms. The ability to access TRP Funds without requiring direct account opening with the firm suggests flexibility in how clients can engage with their investment offerings, potentially accommodating existing brokerage relationships and preferred service providers. However, specific details about user interfaces, account management tools, mobile accessibility, or digital service capabilities are not outlined in available documentation. This makes it difficult to evaluate the modern technology experience and convenience factors that many contemporary investors expect. The distinction between brokerage and investment advisory services may result in different user experiences depending on the chosen service model, but these differences are not clearly detailed. While the professional investment management approach may appeal to certain investor segments, the lack of specific information about user interface design and digital capabilities suggests potential areas where additional information would benefit prospective clients.

Conclusion

This trp review reveals T. Rowe Price Investment Services as a properly regulated investment firm offering fund-based investment opportunities to retail investors through SEC registration and FINRA/SIPC membership. The firm's strength lies in its regulatory compliance and professional investment management approach. This makes it suitable for investors seeking diversified fund access with institutional oversight. However, the limited availability of specific operational details regarding fees, account requirements, and service interfaces presents challenges for comprehensive evaluation. Investors interested in professional fund management within a regulated framework may find TRP Investment Services appealing, though direct consultation with the firm is necessary to fully understand costs, requirements, and service capabilities before making investment decisions.