Is TRP safe?

Pros

Cons

Is TRP Safe or a Scam?

Introduction

TRP Forex, a relatively new player in the forex trading market, has garnered attention for its claims of extensive experience and a wide range of trading instruments. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with such brokers. The forex market is rife with both legitimate opportunities and potential scams, making it imperative for traders to evaluate the credibility of brokers carefully. This article aims to investigate the safety and legitimacy of TRP Forex by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Our investigation is based on a thorough review of various online sources, including user feedback, regulatory databases, and expert analyses. The evaluation framework includes an assessment of regulatory compliance, financial transparency, customer protection measures, and the overall reputation of TRP Forex in the trading community.

Regulation and Legitimacy

One of the fundamental aspects of any forex broker's credibility is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect client funds and maintain market integrity. Unfortunately, TRP Forex operates without any recognized regulatory oversight, which raises significant concerns about its legitimacy and the safety of funds deposited with the broker.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that TRP Forex is not subject to the stringent requirements imposed by financial authorities, such as the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA) in the United States. This lack of oversight leaves traders vulnerable to potential fraud and mismanagement of their funds. Moreover, multiple sources have flagged TRP Forex as a high-risk entity, with warnings advising traders to exercise caution.

Company Background Investigation

TRP Forex claims to have been operational for several years, yet a closer examination reveals discrepancies regarding its establishment. The company's website indicates a registration date of 2022, contradicting its assertions of a decade-long presence in the market. This inconsistency raises questions about the company's history, ownership structure, and the legitimacy of its claims.

The management team behind TRP Forex lacks publicly available information, which further diminishes transparency. A broker's credibility is often bolstered by the expertise and experience of its leadership, and the absence of such details can be a significant red flag. Additionally, the company's contact information appears limited, with users primarily directed to an email address for customer support, which can hinder effective communication.

Trading Conditions Analysis

TRP Forex offers a variety of trading conditions, including high leverage options and a diverse range of trading instruments. However, the overall fee structure and trading conditions warrant closer scrutiny. Traders should be aware of any unusual fees that may not be immediately apparent.

| Fee Type | TRP Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by TRP Forex are slightly above the industry average, which could indicate higher trading costs for clients. Additionally, the broker's lack of transparency regarding its commission structure raises concerns. Traders should be cautious, as undisclosed fees can significantly impact profitability.

Customer Fund Safety

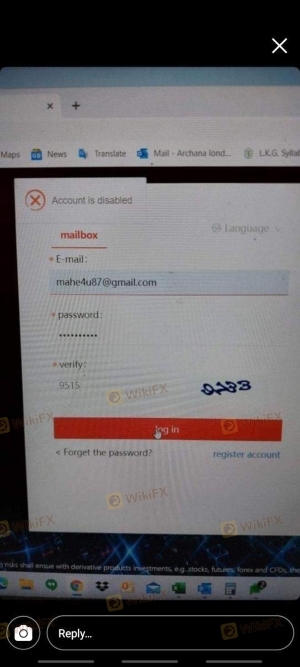

The safety of customer funds is paramount when evaluating any forex broker. TRP Forex does not provide clear information on its fund protection measures, which is a critical factor for traders. Without regulatory oversight, there are no guarantees regarding the segregation of client funds or insurance policies that might protect traders in the event of insolvency.

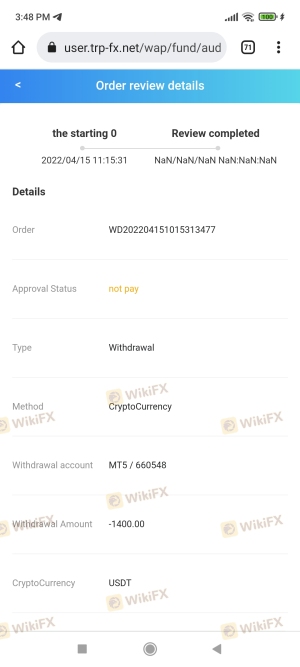

Furthermore, the absence of negative balance protection policies means that traders could potentially lose more than their initial deposits, exposing them to significant financial risks. Historical complaints from users indicate issues with fund withdrawals, which further compounds concerns about the safety of funds held with TRP Forex.

Customer Experience and Complaints

User feedback is a vital component in assessing a broker's reputation. Unfortunately, reviews of TRP Forex reveal a concerning pattern of complaints, particularly regarding withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

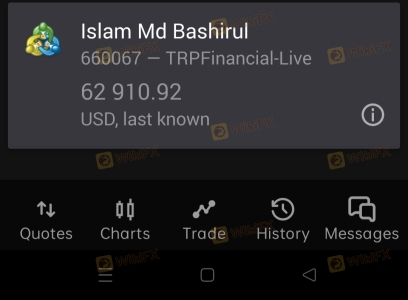

Numerous users have reported being unable to withdraw their funds, with some claiming that their accounts were blocked after attempting to access their profits. This type of behavior is often indicative of a scam, as it suggests that the broker may be engaging in practices designed to retain client funds.

In one notable case, a user reported investing $6,000 and experiencing difficulties when trying to withdraw, ultimately leading to a complete loss of funds. Such incidents underscore the importance of evaluating a broker's customer service and responsiveness.

Platform and Trade Execution

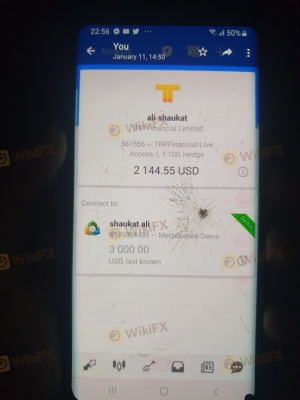

The trading platform offered by TRP Forex is based on MetaTrader 5 (MT5), a widely recognized and reputable trading software. However, the quality of execution, slippage, and overall user experience on the platform are critical factors that can impact trading performance.

While MT5 is generally known for its stability and features, there have been reports of execution issues and high slippage on TRP Forex. Traders have expressed concerns about the potential for manipulation, particularly during volatile market conditions, which can lead to unfavorable trading outcomes.

Risk Assessment

Using TRP Forex presents several risks that traders should carefully consider. The absence of regulation, coupled with the broker's questionable practices, contributes to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | Potential for loss exceeding deposits. |

| Operational Risk | Medium | Issues with fund withdrawals and support. |

To mitigate these risks, traders should exercise extreme caution when dealing with TRP Forex. It is advisable to consider alternative brokers with established regulatory frameworks and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that TRP Forex is not safe for traders. The lack of regulation, transparency issues, and numerous complaints regarding fund withdrawals raise significant red flags. Traders should be particularly cautious when dealing with brokers that operate outside established regulatory frameworks, as they often lack the necessary safeguards to protect client funds.

For traders seeking reliable alternatives, it is recommended to consider well-regulated brokers with a strong reputation in the industry. Always prioritize brokers that provide clear information about their regulatory status, fees, and customer protection measures to ensure a safer trading experience. Ultimately, the question "Is TRP safe?" can be answered with a resounding no, and it is prudent to explore other options for trading in the forex market.

Is TRP a scam, or is it legit?

The latest exposure and evaluation content of TRP brokers.

TRP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRP latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.