TradeTime 2025 Review: Everything You Need to Know

Executive Summary

This tradetime review looks at a forex broker that works without proper licensing. TradeTime creates big risks for traders who want to invest their money safely. TradeTime started in 2017 and registered in Saint Lucia, calling itself an online investment platform that focuses on forex and CFD trading through a No Dealing Desk model.

The broker gives access to over 200 trading tools across different types of investments. This wide selection attracts traders who want variety in their investment choices, but the lack of oversight from major financial authorities creates serious concerns about trader protection and money security. TradeTime targets people interested in forex and CFD trading, but the missing proper licensing makes it wrong for traders who put safety and regulatory protection first.

User reviews show mixed results. Some positive feedback gets overshadowed by big concerns about the platform's legitimacy and how openly it operates, which should worry potential clients. The broker's NDD trading model should provide direct market access without dealer interference, but without regulatory supervision, traders cannot check if this model actually works as promised.

This tradetime review shows critical gaps in information about trading conditions, costs, and customer protection measures. Potential clients must think carefully about these missing details before choosing this broker.

Important Notice

TradeTime operates from Saint Lucia without licenses from major regulatory authorities like the FCA, ASIC, CySEC, or other recognized financial supervisors. This regulatory gap means traders don't get standard protections that licensed brokers typically provide, including deposit insurance and ways to resolve disputes when problems arise.

This evaluation uses available public information and user feedback from various sources. The broker's limited regulatory transparency means some operational details stay unclear or unverified, so potential clients should be extremely careful and do thorough research before using this platform.

Rating Framework

Broker Overview

TradeTime launched in 2017 as an online investment platform focusing on forex and CFD trading services. The company set up its base in Saint Lucia, working under local registration but without getting licenses from major international regulatory bodies, which limits the broker's ability to serve clients in heavily regulated areas while potentially reducing operational compliance costs.

The broker's business model centers on providing No Dealing Desk trading services. This approach should offer direct market access without broker interference in trade execution, and TradeTime markets itself to retail traders seeking access to global financial markets through forex and CFD instruments. The platform positions itself as suitable for both new and experienced traders who want comprehensive market access.

The platform emphasizes its diverse asset offering by providing access to over 200 trading instruments across multiple asset classes. This breadth of available markets represents a key selling point for the broker, attempting to attract traders looking for comprehensive market access through a single platform, but the lack of detailed information about trading conditions and platform specifications raises questions about operational transparency.

TradeTime's registration in Saint Lucia places it outside major regulatory frameworks. This location significantly impacts trader protection and dispute resolution options, and this tradetime review highlights the importance of understanding these regulatory limitations before considering the platform for trading activities.

Regulatory Status: TradeTime operates from Saint Lucia without holding licenses from recognized regulatory authorities. This unregulated status means traders don't get standard protections and ways to resolve problems that are typically available with licensed brokers.

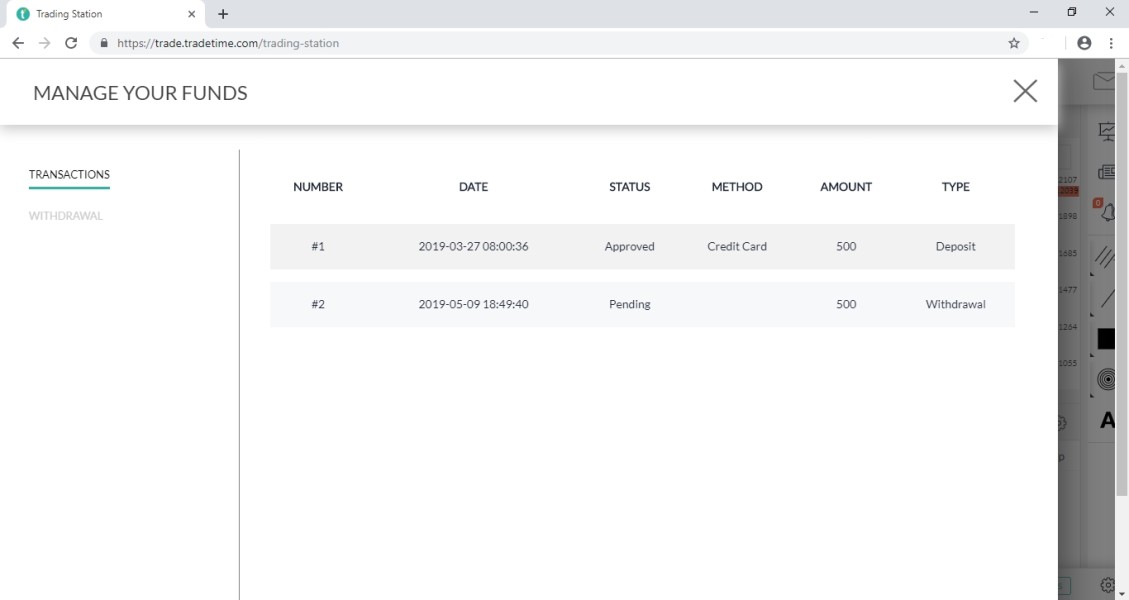

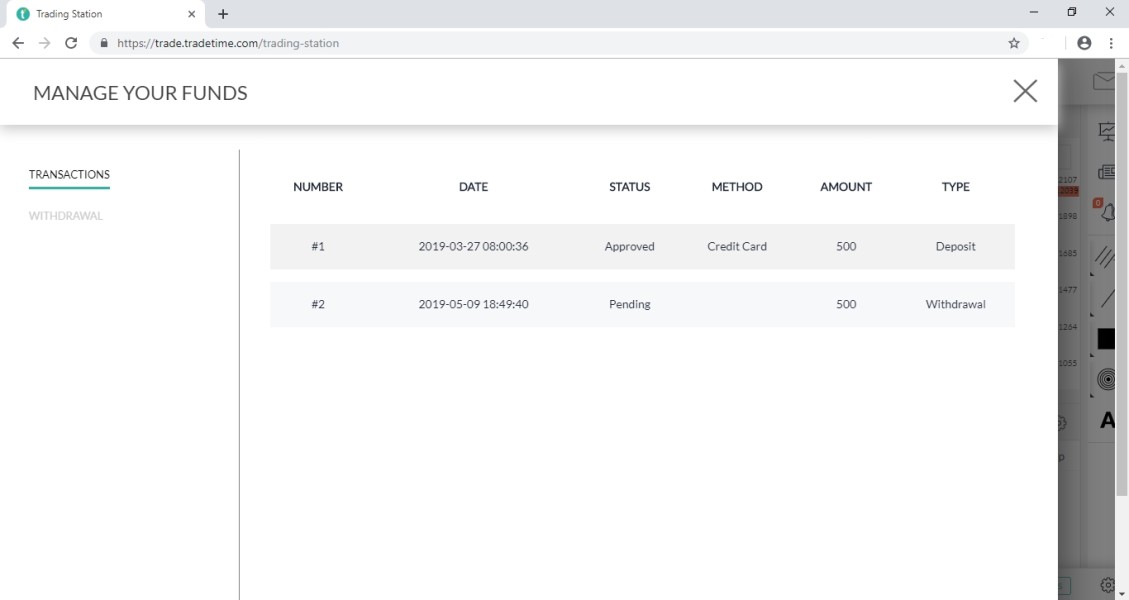

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been shared in available materials. This represents a significant transparency gap for potential clients who need to know how they can move their money.

Minimum Deposit Requirements: The broker has not publicly specified minimum deposit amounts for different account types. This makes it difficult for traders to assess accessibility and account tier structures before they decide to open accounts.

Bonus and Promotions: Details about promotional offers, welcome bonuses, or loyalty programs are not available in public materials. This suggests either absence of such programs or limited marketing transparency that could help traders save money.

Tradeable Assets: TradeTime provides access to over 200 trading instruments, including forex pairs and CFD products across various asset classes. However, specific instrument lists and categories remain undisclosed, making it hard for traders to know exactly what they can trade.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs has not been made publicly available. This creates uncertainty about the true cost of trading with this broker, and this lack of pricing transparency significantly hampers traders' ability to assess competitiveness against other brokers.

Leverage Ratios: Maximum leverage offerings and risk management parameters have not been specified in available materials. This leaves traders without crucial information for position sizing and risk assessment that they need to trade safely.

Platform Options: While TradeTime mentions providing NDD trading platform access, specific platform software, features, and technological specifications remain undisclosed. This tradetime review cannot verify what tools traders actually get when they sign up.

Geographic Restrictions: Information about restricted countries or regional limitations has not been clearly communicated. This potentially creates compliance issues for international clients who might not be allowed to use the platform.

Customer Support Languages: Available support languages and communication channels have not been specified in accessible materials. Traders don't know if they can get help in their preferred language.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

TradeTime's account conditions get a below-average rating because of significant information gaps and lack of transparency. The broker has not shared specific account types, their respective features, or minimum deposit requirements, making it impossible for potential clients to make informed decisions about account selection.

The absence of publicly available information about account tiers, their benefits, and associated costs represents a major problem in the broker's transparency. Most reputable brokers provide detailed account specifications, including minimum deposits, maximum leverage, and special features for different trader segments, but TradeTime fails to meet this basic standard.

Without clear information about Islamic accounts, professional trading accounts, or beginner-friendly options, traders cannot assess whether TradeTime offers suitable account structures for their specific needs. The lack of educational account features or demo account details further limits the platform's appeal to new traders who need practice before risking real money.

This tradetime review finds that the broker's failure to provide comprehensive account information significantly impacts its competitiveness in the market. Potential clients must contact the broker directly to obtain basic account details, creating unnecessary barriers to evaluation and comparison with other brokers that provide this information openly.

The scoring reflects these substantial information gaps and the resulting difficulty in assessing account condition competitiveness against industry standards.

TradeTime gets an average rating for tools and resources, primarily based on its offering of over 200 trading instruments across various asset classes. This diverse instrument selection provides traders with substantial market access opportunities, covering major forex pairs, commodities, indices, and other CFD products that give traders many choices for their investments.

However, the broker falls short in providing detailed information about analytical tools, research resources, or educational materials. Most competitive brokers offer comprehensive market analysis, economic calendars, trading signals, and educational content to support trader development and decision-making, but TradeTime doesn't clearly provide these important resources.

The absence of information about automated trading support, expert advisors, or API access limits the platform's appeal to advanced traders seeking sophisticated trading solutions. Additionally, no details are available about charting capabilities, technical indicators, or fundamental analysis resources that serious traders need to make good decisions.

While the broad instrument selection demonstrates market access strength, the lack of supporting tools and educational resources prevents a higher rating. Traders seeking comprehensive analytical support and learning materials may find the platform lacking compared to more established competitors that offer complete trading packages.

The average rating reflects the positive aspect of diverse trading opportunities balanced against the absence of detailed tool specifications and educational resources.

Customer Service and Support Analysis (5/10)

Customer service evaluation gets an average rating because of limited available information about support channels, response times, and service quality. The broker has not clearly communicated its customer support structure, available contact methods, or operating hours, creating uncertainty about assistance accessibility when traders need help.

User feedback lacks specific details about customer service experiences, response times, or problem resolution effectiveness. Without concrete examples of support interactions or service quality metrics, it becomes difficult to assess the broker's commitment to customer assistance, and traders cannot know if they will get good help when problems arise.

The absence of information about multilingual support capabilities may limit the broker's accessibility to international clients. Most competitive brokers provide comprehensive language support and multiple communication channels including live chat, phone, and email support, but TradeTime doesn't clearly offer these standard services.

No information is available about dedicated account managers, educational support, or technical assistance programs that could enhance the overall client experience. The lack of publicly available support policies or service level commitments further impacts the evaluation and makes it hard for traders to know what kind of help they can expect.

The average rating reflects the uncertainty surrounding customer service capabilities rather than confirmed poor performance, acknowledging that adequate support may exist but remains unverified through available materials.

Trading Experience Analysis (5/10)

The trading experience evaluation yields an average rating because of insufficient information about platform stability, execution quality, and overall trading environment. While TradeTime claims to operate an NDD model suggesting direct market access, specific performance metrics and execution statistics are not publicly available for traders to review.

User reviews do not provide detailed feedback about platform reliability, order execution speed, or slippage experiences. Without concrete performance data or user testimonials about trading conditions, it becomes challenging to assess the actual trading environment quality, and traders cannot know if their orders will be executed fairly and quickly.

The absence of information about mobile trading capabilities, platform features, and trading tools significantly impacts the evaluation. Modern traders expect comprehensive platform functionality including advanced charting, risk management tools, and seamless mobile access that lets them trade from anywhere.

No details are available about platform uptime, server reliability, or technical support for trading-related issues. The lack of information about order types, execution methods, and market depth access further limits the assessment of trading experience quality and makes it hard for traders to plan their strategies.

The average rating acknowledges the potential for satisfactory trading conditions while recognizing the significant information gaps that prevent a more definitive evaluation of platform performance and user experience.

Trustworthiness Analysis (3/10)

TradeTime gets a poor trustworthiness rating primarily because of its unregulated status and lack of oversight from recognized financial authorities. Operating without proper licensing from major regulatory bodies creates significant concerns about trader protection, fund security, and operational accountability that should worry any potential client.

User feedback indicates skepticism about the broker's legitimacy and safety, with concerns raised about the platform's regulatory status and operational transparency. The absence of regulatory oversight means traders lack standard protections including deposit insurance, segregated accounts, and formal dispute resolution mechanisms that regulated brokers must provide to keep client money safe.

The broker's limited transparency about operational details, financial statements, and compliance procedures further undermines trustworthiness. Reputable brokers typically provide comprehensive information about their regulatory status, financial backing, and client protection measures, but TradeTime fails to meet these basic transparency standards.

No information is available about third-party audits, financial reporting, or industry certifications that could enhance credibility. The lack of clear communication about fund handling, client money protection, and operational procedures raises additional concerns about trustworthiness and makes it risky for traders to deposit their money.

The poor rating reflects the significant risks associated with trading through an unregulated broker and the absence of standard protection mechanisms that regulated entities must provide to their clients.

User Experience Analysis (4/10)

User experience gets a below-average rating based on mixed user feedback and significant information gaps about platform usability and client satisfaction. Available reviews present conflicting perspectives, with some positive feedback overshadowed by concerns about legitimacy and operational transparency that create doubt about the platform's reliability.

The lack of detailed information about platform interface design, navigation ease, and user-friendly features impacts the evaluation. Modern traders expect intuitive platforms with streamlined registration processes, efficient account management, and seamless trading workflows, but TradeTime doesn't clearly provide information about these basic features.

No specific information is available about the registration and verification process, account funding procedures, or withdrawal experiences. These fundamental user interactions significantly impact overall satisfaction and platform usability, and traders need to know these processes will work smoothly before they commit their money.

User concerns about the broker's legitimacy and regulatory status negatively affect the overall experience evaluation. Traders seeking confidence and peace of mind in their broker selection may find TradeTime's unclear regulatory position problematic and stressful.

The below-average rating reflects the mixed user feedback, concerns about legitimacy, and lack of detailed information about user interface quality and customer journey optimization that characterizes competitive trading platforms.

Conclusion

This tradetime review reveals a broker with significant limitations and potential risks that traders must carefully consider before making any investment decisions. TradeTime's unregulated status represents the most critical concern, leaving clients without standard protections and regulatory oversight that characterize reputable brokers in the industry.

While the broker offers access to over 200 trading instruments and claims to operate an NDD model, the lack of transparency about trading conditions, costs, and operational procedures creates substantial uncertainty. The absence of detailed information about essential aspects like spreads, commissions, platform features, and customer support significantly hampers evaluation and comparison with regulated alternatives that provide clear, comprehensive information to potential clients.

TradeTime may appeal to traders seeking diverse market access and willing to accept higher risks associated with unregulated brokers. However, it is unsuitable for traders prioritizing safety, regulatory protection, and operational transparency, and most serious traders should look elsewhere for their investment needs.

The mixed user feedback and concerns about legitimacy further support a cautious approach to this platform. Potential clients should thoroughly investigate regulated alternatives that provide comprehensive trader protections, transparent operating conditions, and established track records in the industry before considering TradeTime for their trading activities.