Trade GF 2025 Review: Everything You Need to Know

Executive Summary

This trade gf review shows major concerns about the broker's credibility and how openly it operates. We looked at user feedback and industry analysis to find that Trade GF has many red flags that potential investors should think about carefully. The broker gets very low trust ratings on multiple review platforms, and users question if it's real and how it operates.

Trade GF says it's a forex broker for retail traders, especially people new to foreign exchange trading. But there's no clear regulatory information, users have bad experiences, and the business practices seem questionable, which makes the platform's reliability very concerning. Many review sources show trust scores as low as 30 out of 100, which means there are big problems with how it operates and its credibility.

The broker seems to target investors who want to do forex trading, especially beginners who like potentially good trading conditions. However, most evidence suggests that people thinking about using this platform should be extremely careful.

Important Notice

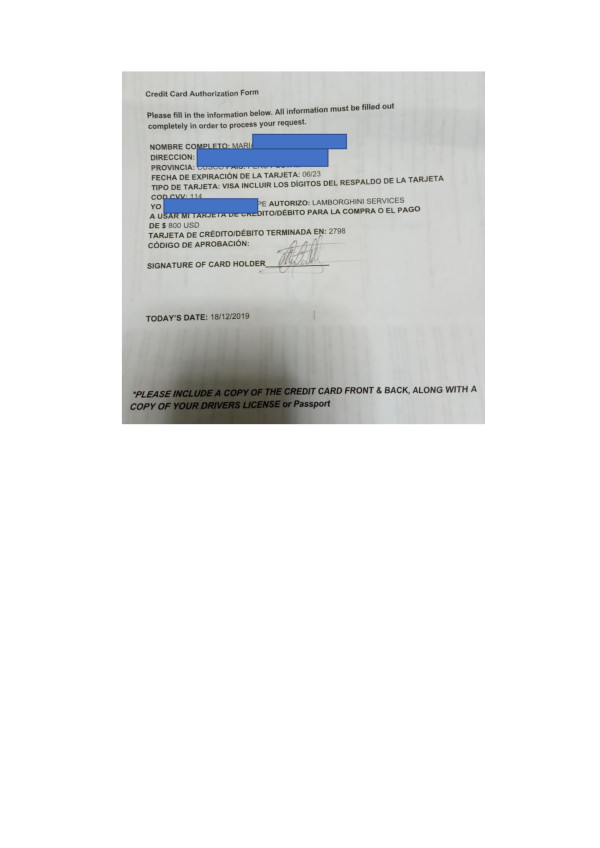

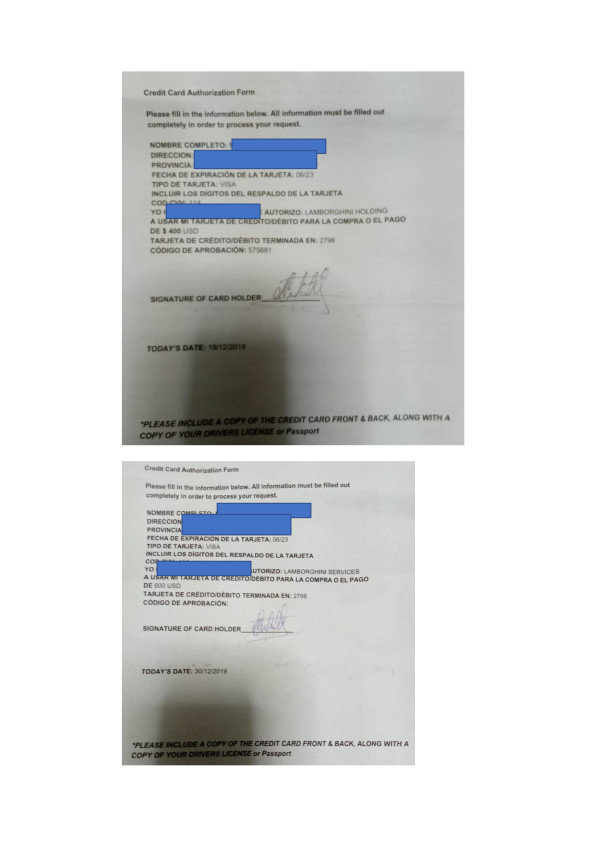

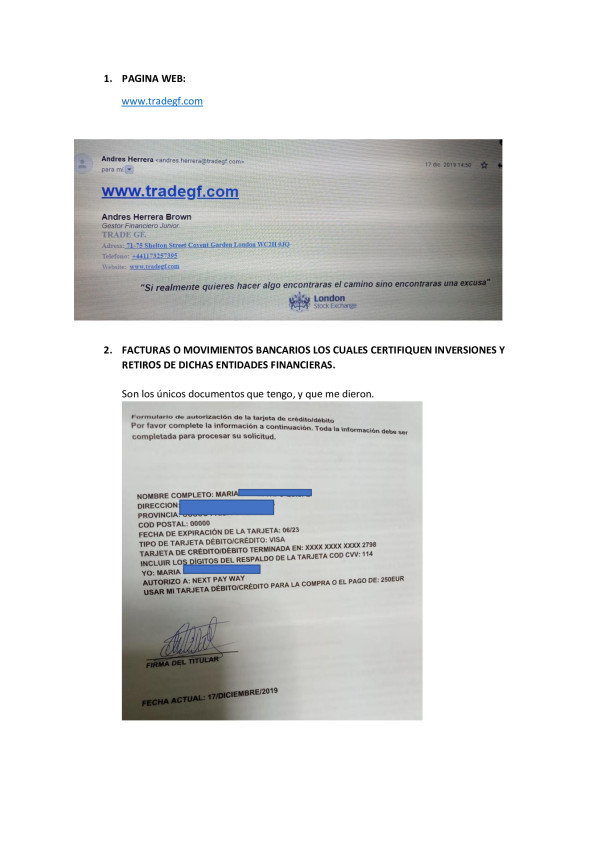

This review uses publicly available information, user feedback, and trust ratings from various review platforms. Trade GF doesn't have much regulatory information available, so potential clients should do thorough research before working with this broker. Our evaluation method mainly uses user testimonials, trust scores, and available operational data.

There may be regional differences in how the broker operates, though we don't know which regulatory jurisdictions Trade GF works under. Readers should check the current regulatory status and operational legitimacy on their own before making any investment decisions.

Rating Framework

Broker Overview

Trade GF works as a forex broker in the retail trading space, though we don't know specific details about when it was established. The company's background information is very limited, with little transparency about its corporate structure, founding date, or operational history. This lack of basic business information immediately creates concerns about the broker's commitment to transparency and regulatory compliance.

The broker's business model seems to focus on attracting retail forex traders, particularly those new to the market. But there's no clear information about trading conditions, fee structures, and operational procedures, which suggests potential problems with business transparency. Available sources show that Trade GF may operate without proper regulatory oversight, which is a major risk factor for potential clients.

The broker's trading platform types and asset offerings are not clearly specified in public documentation. This trade gf review finds concerning gaps in basic operational information that legitimate brokers usually provide transparently. The lack of specific regulatory authority oversight makes these transparency concerns even worse, making it hard for potential clients to assess the broker's legitimacy and operational standards.

Regulatory Status: Available sources don't mention specific regulatory authorities that oversee Trade GF operations, which is a major red flag for potential investors who want regulated trading environments.

Deposit and Withdrawal Methods: Specific payment methods and processing procedures are not detailed in available documentation, creating uncertainty about fund accessibility and transaction security.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available sources, making it difficult for potential clients to understand entry requirements.

Promotional Offers: No specific information about bonuses or promotional campaigns appears in available documentation, though this may be due to limited marketing transparency.

Available Trading Assets: The range of tradeable instruments is not clearly specified in available sources, limiting potential clients' ability to assess platform suitability for their trading strategies.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in reviewed sources, creating uncertainty about the true cost of trading with this trade gf review subject.

Leverage Options: Specific leverage ratios offered by the broker are not mentioned in available documentation.

Platform Options: Trading platform types and technological infrastructure details are not specified in available sources.

Geographic Restrictions: Regional availability and restrictions are not clearly outlined in available documentation.

Customer Support Languages: Supported languages for customer service are not specified in available sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions that Trade GF offers remain mostly unclear because there's not enough public information. Available sources don't give specific details about account types, their features, or the requirements for opening different account tiers. This lack of transparency in account structure is a major concern for potential clients who want to understand their trading environment.

Minimum deposit requirements are not specified in available documentation, making it impossible for potential traders to plan their initial investment properly. The absence of clear account opening procedures makes the evaluation process even more complicated. User feedback suggests that account conditions are not clearly communicated, leading to confusion and dissatisfaction among traders trying to understand their trading parameters.

There's no information about special account features, such as Islamic accounts for Muslim traders or professional trading accounts for experienced investors, which shows either limited service offerings or poor communication of available services. This trade gf review finds that the opacity around account conditions significantly undermines the broker's credibility and makes informed decision-making difficult for potential clients.

Trade GF's trading tools and educational resources are not specifically detailed in available sources, suggesting either limited offerings or inadequate marketing of available features. The absence of information about analytical tools, charting capabilities, and technical indicators represents a significant gap in service transparency that legitimate brokers typically address comprehensively.

Research and market analysis resources are not mentioned in available documentation, which is concerning given that such resources are standard offerings from reputable forex brokers. Educational materials, webinars, and trading guides that help new traders develop their skills appear to be absent or poorly communicated in available sources.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, is not addressed in available information. The lack of detail about trading tools and educational resources suggests that Trade GF may not prioritize trader development and support, which is essential for long-term client success and satisfaction.

Customer Service and Support Analysis (Score: 3/10)

Customer service quality emerges as a major concern in user feedback about Trade GF. Available reviews show that response times are often unsatisfactory, with users reporting delays in receiving support for urgent trading and account-related issues. The quality of customer service interactions appears to be consistently below industry standards.

Communication channels and availability hours are not clearly specified in available documentation, creating uncertainty about when and how clients can access support. User testimonials suggest that when support is available, the quality of assistance provided often fails to resolve issues effectively or professionally.

Multi-language support capabilities are not detailed in available sources, potentially limiting the broker's accessibility to international clients. The combination of poor response times, inadequate service quality, and unclear support procedures creates a concerning picture of customer service that falls well below industry expectations for professional forex brokers.

Trading Experience Analysis (Score: 3/10)

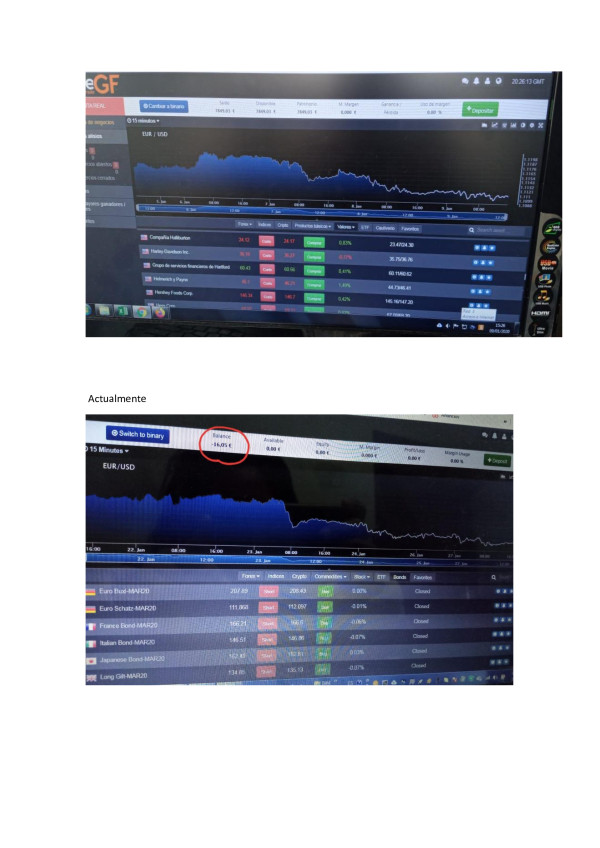

User feedback shows major concerns about platform stability and execution quality at Trade GF. Traders report experiencing platform instability issues that can interfere with order placement and trade management, creating frustrating and potentially costly trading environments.

Order execution quality appears to be problematic based on available user reviews, with complaints about slippage and execution delays that can impact trading profitability. The reliability of trade execution is crucial for forex trading success, and negative feedback in this area represents a serious operational concern.

Platform functionality and user interface design are not well-documented in available sources, though user feedback suggests that the trading environment may not meet modern standards for functionality and ease of use. Mobile trading capabilities and app performance are also not specifically addressed in available documentation. This trade gf review finds that the overall trading experience appears to fall short of industry standards based on available user feedback.

Trust and Security Analysis (Score: 2/10)

The trust and security profile of Trade GF presents the most significant concerns in this evaluation. With a trust score of only 30 out of 100 reported across review platforms, the broker faces serious credibility challenges that potential clients must carefully consider.

Regulatory oversight information is notably absent from available sources, which represents a major red flag for traders seeking secure and compliant trading environments. Legitimate forex brokers typically operate under strict regulatory frameworks that provide client protection and operational oversight.

Fund security measures and client protection protocols are not detailed in available documentation, creating uncertainty about the safety of deposited funds. Company transparency regarding ownership, operational procedures, and financial stability appears to be limited, further undermining trust in the platform's legitimacy and operational integrity.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Trade GF appears to be consistently low based on available feedback across multiple review platforms. Users report various issues ranging from platform functionality problems to difficulties with customer support and fund management processes.

Interface design and platform usability are not well-documented in available sources, though user feedback suggests that the trading environment may not provide the smooth, intuitive experience that modern traders expect from professional forex platforms. Registration and account verification processes are not clearly outlined in available documentation, potentially creating confusion for new users attempting to begin trading.

Common user complaints focus primarily on trust and security concerns, as well as inadequate customer support quality. The overall user experience appears to require significant improvement to meet industry standards and user expectations.

Conclusion

This trade gf review reveals substantial concerns about the broker's credibility, transparency, and operational standards. With consistently low trust ratings and negative user feedback across multiple evaluation criteria, Trade GF presents significant risks for potential investors considering this platform for forex trading activities.

The broker may appeal to newcomers interested in forex trading, but the lack of regulatory oversight, poor customer service quality, and questionable operational transparency make it unsuitable for traders seeking reliable and secure trading environments. The primary disadvantages include insufficient regulatory protection, poor communication standards, and limited operational transparency that undermines confidence in the platform's legitimacy and long-term viability.