Tongda 2025 Review: Everything You Need to Know

Executive Summary

This tongda review gives you a complete look at Tongda International Forex Broker. We used public information and user feedback to make our assessment. Our evaluation shows a neutral rating because the broker doesn't share enough details about trading conditions and regulatory information, which makes it hard to judge how reliable they really are.

Tongda does well with customer service. Users have given positive feedback about their support team in various reviews. Trustburn reports say "The customer service was also very helpful and responsive," which shows the broker cares about helping their clients. Related Tongda companies, like Qingdao Tongda Home Products Co., Ltd., have a strong 5-star rating on Made-in-China.com. This suggests they provide good service across different business areas.

The broker seems to target traders who want reliable customer service. They also appeal to those who don't need the most advanced platform features. However, we can't recommend Tongda to professional traders who need detailed information about trading conditions, regulations, and platform features because this information isn't available. The broker works best for beginner to intermediate traders who care more about responsive customer support than advanced trading tools and complete regulatory transparency.

Important Disclaimer

This review covers multiple Tongda business entities that work in different markets. Readers should know that Tongda includes various business divisions that might have different ways of operating and delivering services. The automotive service division started in 1997 and sits in Central Ohio near OSU in Clintonville, but it works separately from the forex trading services.

We based our assessment on public information and user reviews. We couldn't find specific regulatory details and complete trading conditions in the available sources. Potential clients should do their own research and ask the broker directly about regulatory compliance, trading terms, and platform details before making investment decisions.

Rating Framework

Broker Overview

Tongda International Forex Broker works in the competitive foreign exchange market. However, we don't know specific details like when they started or where their headquarters are located because this information isn't available to the public. The company focuses on providing forex trading services to retail clients and possibly institutional ones, though we need more clarity about exactly what they offer.

The broker's structure includes multiple business entities. Related companies work in automotive services and home products. This diverse business approach suggests they have an established corporate foundation, but we need clearer information about how these entities relate to the forex trading operations.

Tongda provides access to foreign exchange markets and possibly CFD instruments. However, available sources don't give specific details about currency pairs, trading instruments, and platform features. The lack of complete regulatory information in public materials creates a significant gap that potential clients should fill by talking directly with the broker before opening an account.

This tongda review shows that the broker needs better transparency about how they operate, their regulatory compliance status, and specific trading conditions. Traders need this information to make informed decisions.

Regulatory Framework: Available sources don't specify which regulatory authorities oversee Tongda International Forex Broker operations. This missing information is important for potential clients who want to evaluate broker credibility and client fund protection measures.

Deposit and Withdrawal Methods: We couldn't find specific information about available funding options, processing times, and fees. Traders usually need to understand payment methods completely before they set up an account.

Minimum Deposit Requirements: The exact minimum deposit amounts and account tier structures aren't specified in current information sources. This limits potential clients' ability to assess accessibility and plan their account requirements.

Promotional Offerings: Details about welcome bonuses, trading incentives, or promotional programs weren't available in the materials we reviewed. This information typically influences how traders choose brokers and decide on initial account funding.

Available Trading Assets: While forex and possibly CFD instruments seem to be offered, we lack detailed information about specific currency pairs, commodity options, indices, and other tradeable assets.

Cost Structure: Critical pricing information including spreads, commission rates, overnight financing charges, and additional fees wasn't provided in accessible materials. Understanding cost structures is fundamentally important for assessing trading profitability.

Leverage Ratios: Maximum leverage offerings and risk management parameters weren't specified in available information. These details significantly impact trading strategies and risk exposure.

Platform Options: We need clarification about specific trading platform availability, including MetaTrader versions, proprietary platforms, or web-based trading interfaces through direct broker contact.

This tongda review emphasizes how important it is to get complete trading specifications directly from the broker. This will help address these information gaps.

Detailed Rating Analysis

Account Conditions Analysis

Evaluating Tongda's account conditions faces big limitations because there isn't enough publicly available information. Standard account offerings, including account types like standard, premium, or professional tiers, aren't specified in current sources. This lack of transparency makes it challenging for potential clients to understand available options and select appropriate account structures.

We couldn't find details about minimum deposit requirements in accessible materials. These requirements typically vary across different account levels. Industry standards generally range from $50 to $10,000 depending on account type and target client segment. Without specific information, traders can't adequately plan initial funding requirements or assess how accessible the broker is for different investment levels.

Account opening procedures and verification requirements also lack detailed description in available sources. Modern forex brokers typically use comprehensive KYC procedures that involve identity verification, address confirmation, and financial background assessment. The absence of clear process descriptions may indicate either insufficient public disclosure or potentially streamlined verification procedures.

We didn't find mentions of special account features in reviewed materials. These might include Islamic accounts for Sharia-compliant trading, managed account options, or institutional account structures. These specialized offerings often help brokers stand out in competitive markets and attract specific client segments.

This tongda review identifies the need for direct broker contact to get comprehensive account condition details. This includes fees, features, and qualification requirements for different account tiers.

Assessing Tongda's trading tools and analytical resources encounters substantial information limitations in available public sources. Modern forex brokers typically provide comprehensive analytical suites including technical indicators, charting tools, economic calendars, and market research reports. The absence of specific tool descriptions makes it impossible to evaluate the broker's analytical capabilities.

Trading automation support remains unspecified. This includes Expert Advisor compatibility, algorithmic trading options, and copy trading services. These features increasingly represent standard offerings among competitive brokers and significantly impact trader experience, particularly for systematic trading approaches.

We couldn't find details about educational resources in accessible materials. These might include webinars, trading guides, video tutorials, and market analysis content. Quality educational support often helps brokers stand out and provides significant value for developing traders who want to enhance their skills and expand their market knowledge.

Research and analysis resources lack specific mention in available information. These include daily market commentary, fundamental analysis reports, and technical analysis insights. Professional traders typically require comprehensive market intelligence to support trading decisions and strategy development.

Third-party tool integration also remains unaddressed in current sources. This includes economic calendar feeds, sentiment indicators, and news services. These supplementary resources enhance trading environments and provide competitive advantages in market analysis and timing decisions.

Customer Service and Support Analysis

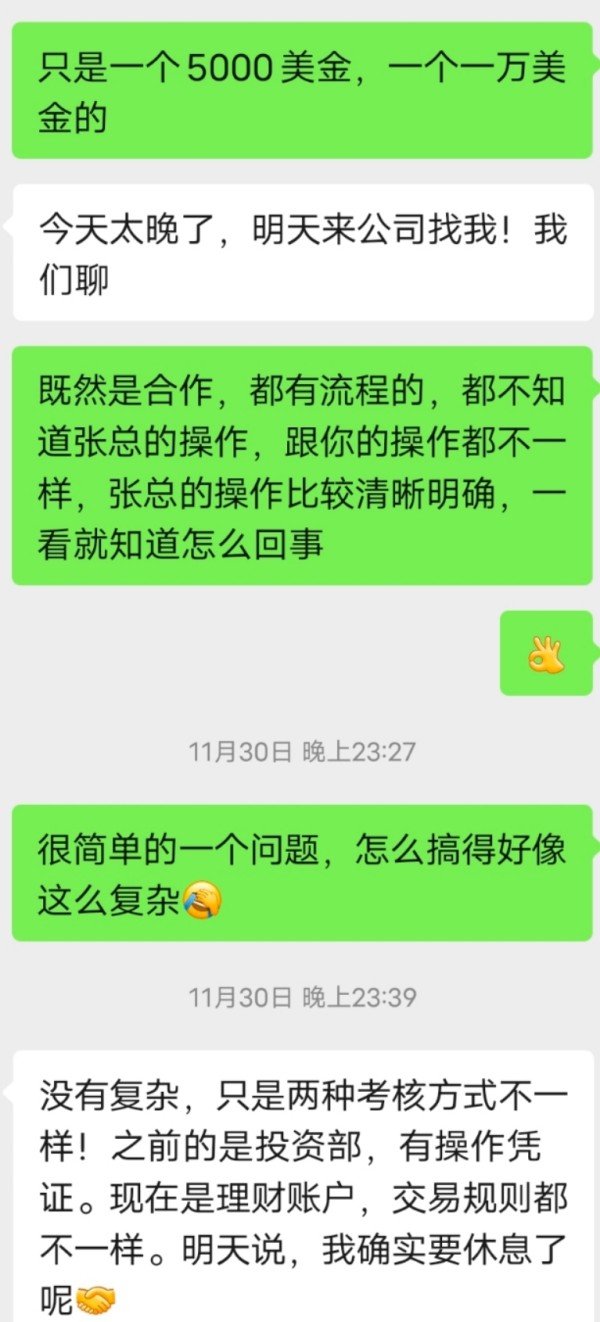

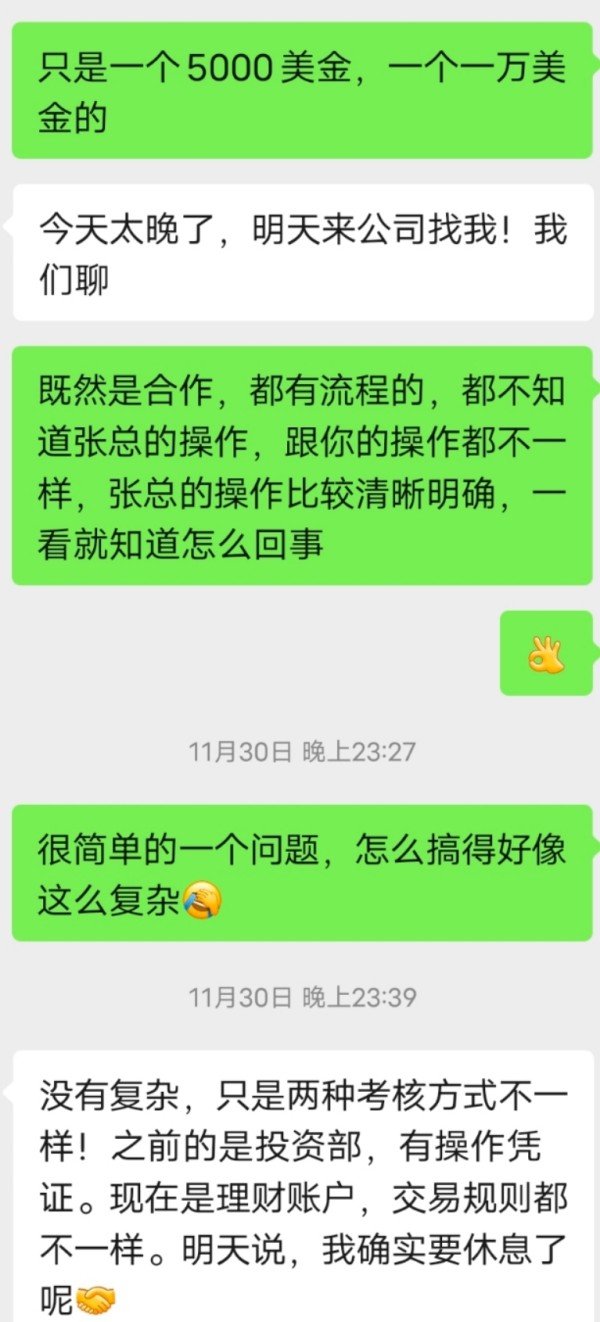

Customer service represents Tongda's strongest evaluated area based on available feedback. Trustburn reports show that user experiences highlight positive customer service interactions, with specific mention that "The customer service was also very helpful and responsive." This feedback suggests the broker prioritizes client support and maintains adequate response standards.

However, we couldn't find comprehensive details about specific customer service channels in available sources. This includes live chat availability, phone support hours, email response times, and support ticket systems. Modern brokers typically offer multiple communication channels with varying response time commitments based on inquiry complexity and account status.

Multilingual support capabilities remain unspecified. This feature significantly impacts international client satisfaction and accessibility. Brokers serving diverse geographic markets typically provide support in major languages including English, Spanish, French, German, and regional languages based on target markets.

We couldn't find details about support availability hours in accessible materials. This includes weekend and holiday coverage. Twenty-four-hour support during market hours represents industry standards, particularly for brokers serving global client bases across different time zones.

Problem resolution procedures and escalation processes also lack specific description. Effective customer service frameworks typically include clear escalation paths, resolution timeframes, and client communication protocols for complex issues requiring specialized attention.

Trading Experience Analysis

Evaluating Tongda's trading experience faces significant information constraints because of limited platform performance data and user experience feedback in available sources. Platform stability, execution speed, and order processing quality represent fundamental factors affecting trading success, yet we couldn't access specific performance metrics for assessment.

Order execution quality remains unspecified. This includes slippage rates, requote frequency, and execution speed statistics. These technical performance indicators significantly impact trading profitability, particularly for scalping strategies and high-frequency trading approaches requiring precise execution timing.

Platform functionality completeness lacks detailed description. This includes advanced order types, risk management tools, and trading interface customization options. Professional traders typically require sophisticated order management capabilities including stop-loss, take-profit, trailing stops, and conditional order types.

Available materials didn't specifically address mobile trading experience. This is increasingly important for modern traders requiring market access flexibility. Mobile platform features, synchronization capabilities, and performance optimization represent critical considerations for active traders.

We couldn't find details about trading environment factors in accessible sources. These include server locations, latency optimization, and technical infrastructure specifications. These technical considerations significantly impact execution quality and overall trading experience, particularly for latency-sensitive strategies.

This tongda review emphasizes how important platform testing is through demo accounts or trial periods. This helps assess trading experience quality before live account funding.

Trust and Reliability Analysis

Trust assessment encounters substantial challenges because of limited regulatory information disclosure in available sources. Regulatory oversight represents the foundation of broker credibility, providing client fund protection, operational standards, and dispute resolution mechanisms. The absence of specific regulatory details significantly impacts reliability evaluation.

We couldn't find details about client fund protection measures in accessible materials. These include segregated account policies, deposit insurance coverage, and bankruptcy protection procedures. These safeguards represent critical considerations for client capital security and regulatory compliance standards.

Corporate transparency regarding ownership structure, financial statements, and operational history remains limited in public information. Established brokers typically provide comprehensive corporate information including management backgrounds, company registration details, and operational track records.

Industry reputation assessment faces constraints because of limited third-party evaluations and professional recognition in available sources. Industry awards, regulatory commendations, and peer recognition often indicate broker standing within professional communities.

Reviewed materials didn't specifically address negative incident handling and dispute resolution procedures. Effective complaint handling mechanisms and transparent resolution processes typically indicate professional operational standards and client-focused business approaches.

User Experience Analysis

Comprehensive user experience evaluation encounters limitations because of insufficient detailed feedback and satisfaction data in available sources. Overall user satisfaction metrics, retention rates, and client testimonials provide valuable insights into broker performance from client perspectives.

Interface design and platform usability assessment requires direct platform interaction or comprehensive user reviews not available in current sources. Intuitive navigation, customization options, and learning curve considerations significantly impact user adoption and satisfaction levels.

Registration and account verification processes lack detailed description. These initial interactions significantly influence client first impressions and onboarding experiences. Streamlined procedures balanced with regulatory compliance requirements typically indicate professional operational standards.

We couldn't find comprehensive details about funding operation experiences in available materials. This includes deposit processing times, withdrawal procedures, and fee transparency. Efficient fund management represents fundamental user experience components affecting client satisfaction and operational convenience.

Current information sources don't identify common user complaints and recurring issues. Understanding typical client concerns provides valuable insights into operational strengths and potential improvement areas for prospective clients' consideration.

Conclusion

This tongda review concludes with a neutral overall assessment primarily because of substantial information gaps regarding critical operational aspects. These include regulatory framework, trading conditions, and platform specifications. While positive customer service feedback represents a notable strength, the absence of comprehensive operational transparency limits our ability to provide definitive recommendations.

Tongda appears most suitable for traders prioritizing responsive customer support. They also work well for those with moderate platform requirement expectations. The broker may serve entry-level traders seeking basic trading services with reliable customer assistance, though professional traders requiring advanced features and comprehensive regulatory transparency should seek additional information verification.

The primary advantage we identified centers on customer service quality. This is supported by positive user feedback regarding responsiveness and helpfulness. However, significant disadvantages include insufficient regulatory disclosure, limited trading condition transparency, and inadequate public information regarding platform capabilities and cost structures. Potential clients should conduct thorough research and request comprehensive information directly from the broker before account establishment.