Is Tongda safe?

Pros

Cons

Is Tongda Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (Forex) market, brokers play a pivotal role in facilitating trades for individual and institutional traders alike. One such broker, Tongda, has emerged as a point of interest among traders. Established in Russia, Tongda presents itself as a platform for trading various financial instruments including international spot forex, precious metals, and energy commodities. However, the lack of regulatory oversight and mixed reviews from users raise questions about its legitimacy and safety.

Given the potential risks associated with unregulated brokers, it is crucial for traders to conduct thorough evaluations before engaging with platforms like Tongda. This article aims to provide a comprehensive analysis of Tongda's operations, regulatory status, and user experiences, utilizing a structured framework that includes regulatory assessment, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

The regulatory status of a Forex broker is a critical indicator of its legitimacy. Regulatory bodies ensure that brokers adhere to industry standards, thereby protecting traders from potential fraud and malpractice. In the case of Tongda, it operates without any valid regulatory licenses, which raises significant concerns about its credibility.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

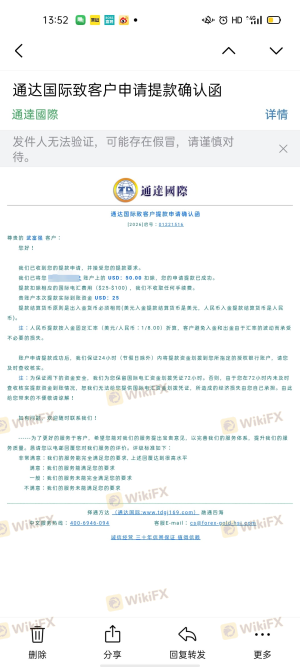

Tongda has been identified as a suspicious clone by the National Futures Association (NFA), indicating that it may be impersonating a regulated entity. The absence of regulatory oversight suggests that traders engaging with Tongda are exposed to high risks, including the potential for fund misappropriation and market manipulation. The lack of a verified regulatory framework means that there are no established investor protection measures in place, leaving clients vulnerable to fraudulent activities.

Company Background Investigation

Understanding the companys history and ownership structure is essential in assessing its reliability. Tongda International Investment Limited, the entity behind the Tongda brand, claims to have been operational for five to ten years. However, the lack of accessible information about its management team and ownership raises questions about transparency.

While the company markets itself as a provider of various trading instruments, the absence of a functional official website further complicates efforts to verify its claims. The management teams qualifications and experience in the financial sector remain unclear, which is a red flag for potential investors. Without transparency in ownership and management, it becomes increasingly difficult for traders to trust the platform.

Trading Conditions Analysis

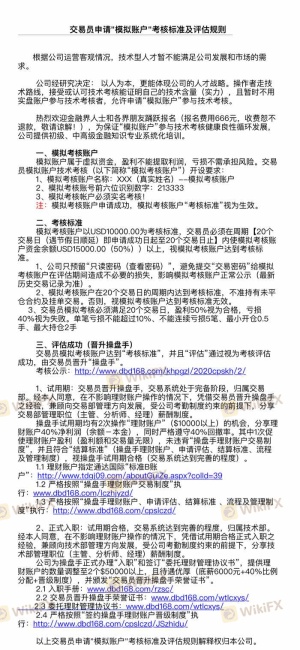

The trading conditions offered by a broker significantly influence a trader's experience. In the case of Tongda, the broker imposes high minimum deposit requirements, with a standard account needing at least $30,000 to open. Such a high barrier to entry may deter many potential users, particularly those who are new to trading.

| Fee Type | Tongda | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Rates | N/A | Varies |

While the broker claims to offer competitive trading spreads, the lack of specific information makes it challenging to assess its competitiveness against industry standards. Additionally, the absence of transparency regarding commissions and other fees can lead to unexpected costs for traders. Such unclear fee structures are often indicative of brokers that may not have the best interests of their clients in mind.

Client Fund Safety

The safety of client funds is paramount when choosing a Forex broker. Tongda's lack of regulatory oversight raises serious concerns regarding its fund security measures. A reputable broker should implement strict protocols for fund segregation, investor protection, and negative balance protection. However, there is no evidence to suggest that Tongda adheres to these best practices.

Traders should be particularly cautious when considering brokers that do not provide clear information about their fund safety measures. The absence of historical data on fund security issues or disputes further compounds the uncertainty surrounding Tongda's operations. Without a robust framework for protecting client funds, traders risk significant financial losses.

Customer Experience and Complaints

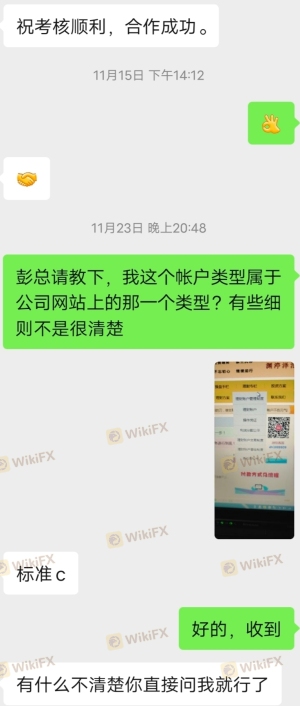

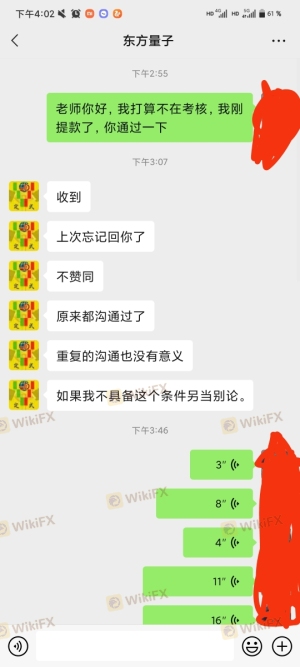

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews for Tongda indicate a pattern of negative experiences among users, particularly concerning withdrawal issues. Many clients have reported difficulties in accessing their funds, with some alleging that their requests for withdrawals were denied or delayed indefinitely.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Fund Misappropriation | High | Poor |

| Lack of Customer Support | Medium | Poor |

Common complaints include allegations of unauthorized account operations and slow response times from customer support. These issues highlight a significant lack of customer service and responsiveness, which are essential traits for any trustworthy broker. In particular, the inability to withdraw funds raises serious alarms about the broker's operational integrity.

Platform and Trade Execution

The performance of a trading platform is crucial for a smooth trading experience. Tongda offers the widely used MetaTrader 4 platform, which is known for its robust features. However, reports of slippage and order execution issues have surfaced, suggesting that the platform may not operate as reliably as expected.

Traders have expressed concerns about the execution quality, noting instances where orders were filled at unfavorable prices. Such issues can significantly impact trading outcomes and are often indicative of a broker that may engage in manipulative practices. The lack of transparency regarding order execution metrics further complicates the assessment of Tongda's platform reliability.

Risk Assessment

Engaging with a broker like Tongda comes with inherent risks that traders must carefully consider. The absence of regulation, high minimum deposit requirements, and negative customer feedback all contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulation available |

| Fund Safety | High | Lack of transparency on fund security |

| Customer Support | Medium | Poor response to complaints |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Tongda. It may be wise to start with a small investment or seek alternative brokers with proven track records and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tongda may pose significant risks to traders. The lack of regulatory oversight, high minimum deposit requirements, and negative customer feedback raise serious concerns about the broker's legitimacy and safety. Traders should exercise extreme caution when considering this platform and be wary of potential scams.

For those seeking reliable alternatives, brokers that are regulated by reputable authorities should be prioritized. Options such as Interactive Brokers, OANDA, and FXCM offer more trustworthy trading environments with established regulatory frameworks. Ultimately, ensuring safety in trading requires careful evaluation and informed decision-making.

Is Tongda a scam, or is it legit?

The latest exposure and evaluation content of Tongda brokers.

Tongda Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tongda latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.