The Vanguard Group 2025 Review: Everything You Need to Know

The Vanguard Group has long been recognized as a leader in low-cost investing, particularly for buy-and-hold investors. While it excels in providing a wide array of low-cost mutual funds and ETFs, it may not be the best choice for active traders due to its basic trading platform and higher-than-average options commissions. This review consolidates various expert opinions and user experiences to give you a comprehensive overview of what to expect from Vanguard in 2025.

Note: It is important to consider that Vanguard operates in different regions under various entities, which may affect your experience. This review aims to provide a fair and accurate assessment based on multiple sources.

Ratings Overview

We evaluate brokers based on a combination of user feedback, expert analysis, and factual data gathered from multiple sources.

Broker Overview

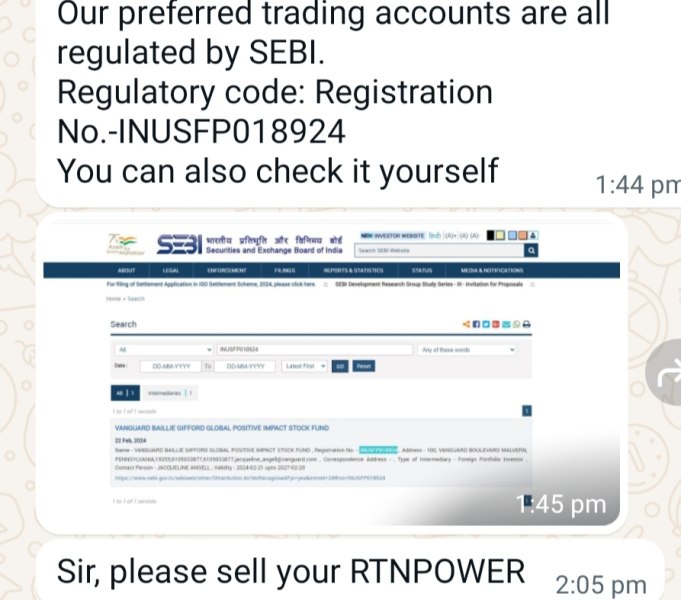

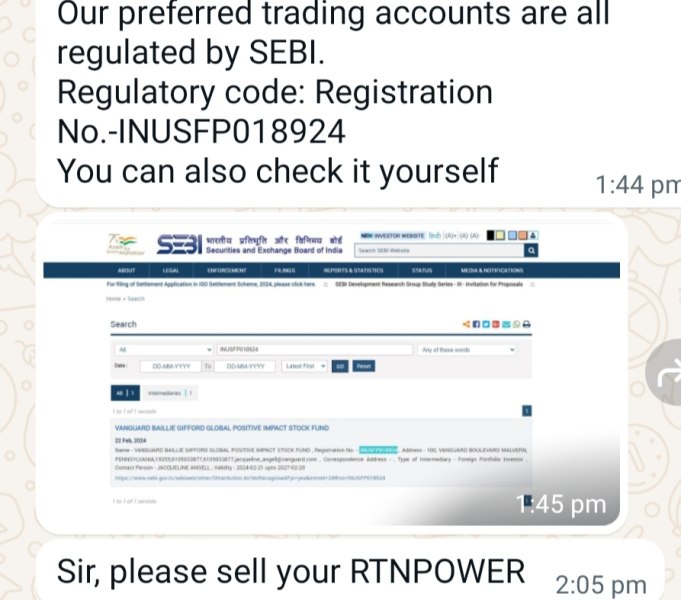

Founded in 1975 by John C. Bogle, the Vanguard Group has established itself as a pioneer in the index fund revolution. The firm is notable for its unique ownership structure, where it is owned by the funds it manages, aligning its interests with those of its investors. Vanguard offers a proprietary trading platform designed primarily for long-term investors, allowing access to a range of asset classes, including stocks, ETFs, mutual funds, and bonds. The company is regulated by multiple authorities, including the SEC, FINRA, and various international regulators.

Detailed Analysis

-

Regulated Geographical Areas/Regions:

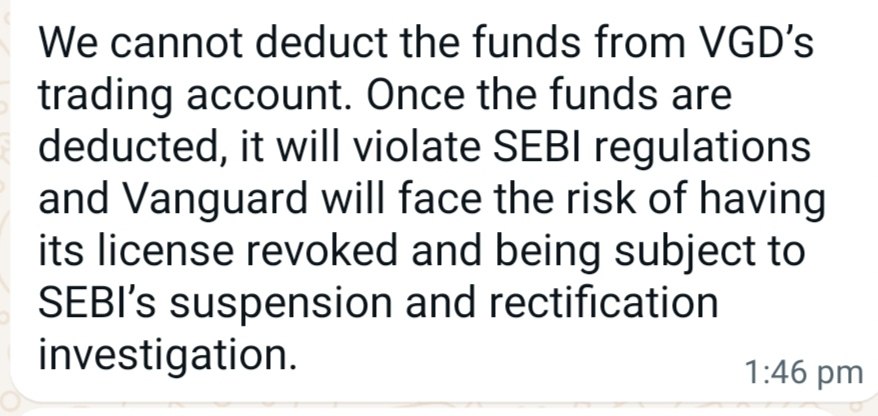

Vanguard operates in multiple jurisdictions, including the U.S., U.K., Australia, and Europe. Each region has its own regulatory framework, which can impact the services offered.

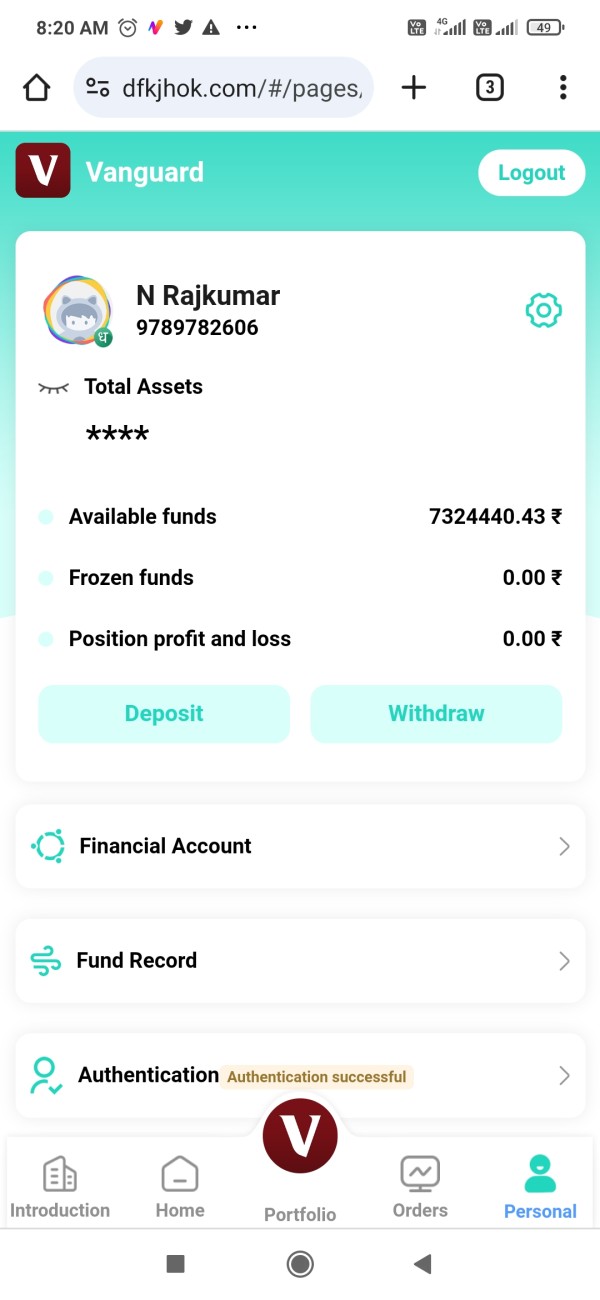

Deposit/Withdrawal Currencies/Cryptocurrency:

Investors can fund their accounts in USD, with options for wire transfers and ACH deposits. However, Vanguard does not currently support cryptocurrency trading.

Minimum Deposit:

Vanguard has a $0 minimum deposit requirement for brokerage accounts, but most mutual funds require a minimum investment ranging from $1,000 to $3,000, which may be a barrier for new investors.

Bonuses/Promotions:

Vanguard does not offer any cash bonuses or promotions for new customers, focusing instead on its low-cost investment strategy.

Tradable Asset Classes:

The Vanguard Group allows trading in a variety of asset classes, including stocks, ETFs, mutual funds, options, and bonds. However, it does not provide access to futures or forex trading.

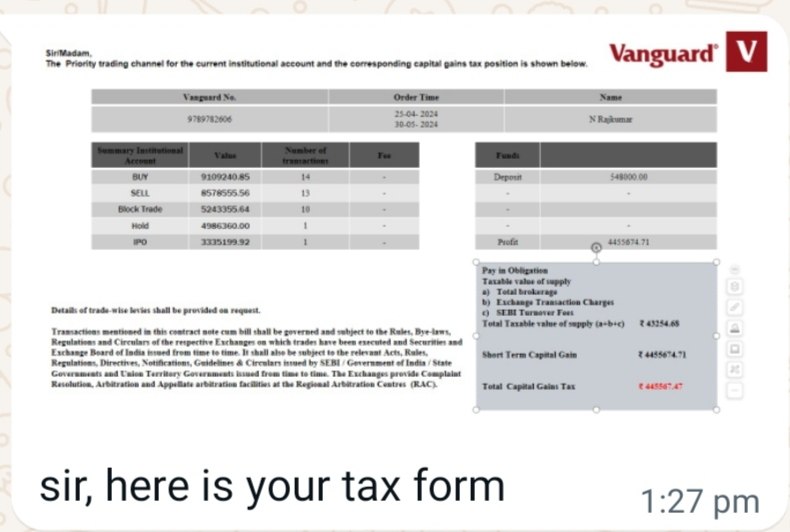

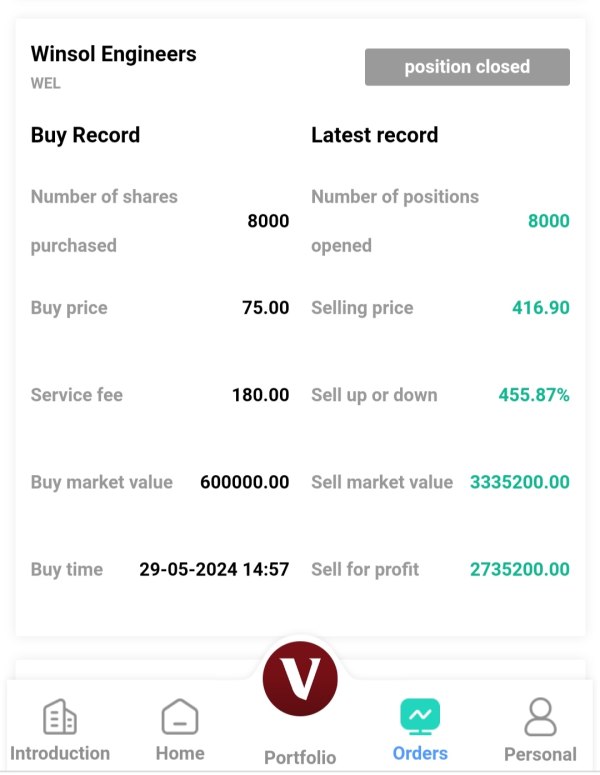

Costs (Spreads, Fees, Commissions):

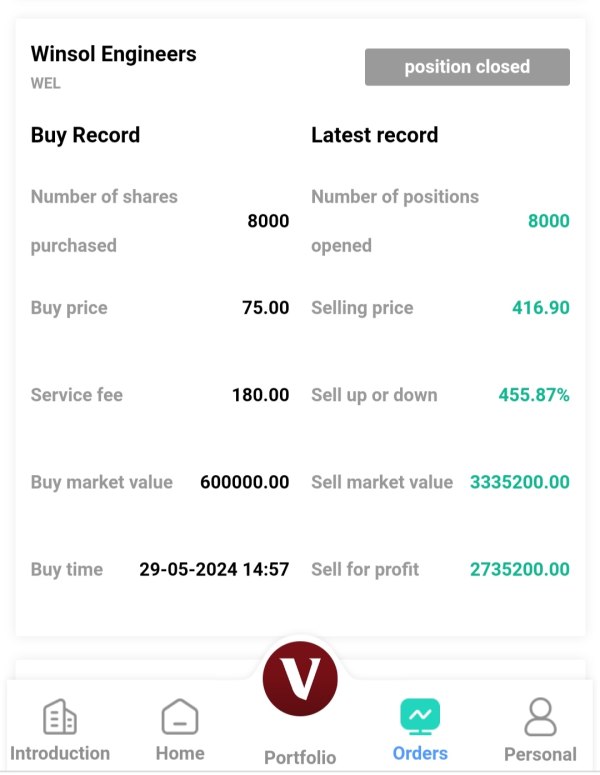

The Vanguard Group charges no commissions for online stock and ETF trades. Options trading incurs a fee of $1 per contract for accounts with less than $1 million in Vanguard funds. There is an annual account service fee of $20 for accounts under $1 million, which can be waived by opting for electronic delivery of documents.

Leverage:

Vanguard offers margin trading, but its rates are higher than those of many competitors. The interest rates for margin accounts vary based on the balance.

Allowed Trading Platforms:

Vanguard provides a proprietary trading platform that is relatively basic compared to competitors. It does not support advanced trading features or third-party platforms like MT4 or MT5.

Restricted Areas:

While Vanguard is available in many countries, its services may vary based on local regulations, and some features may not be accessible in certain regions.

Available Customer Service Languages:

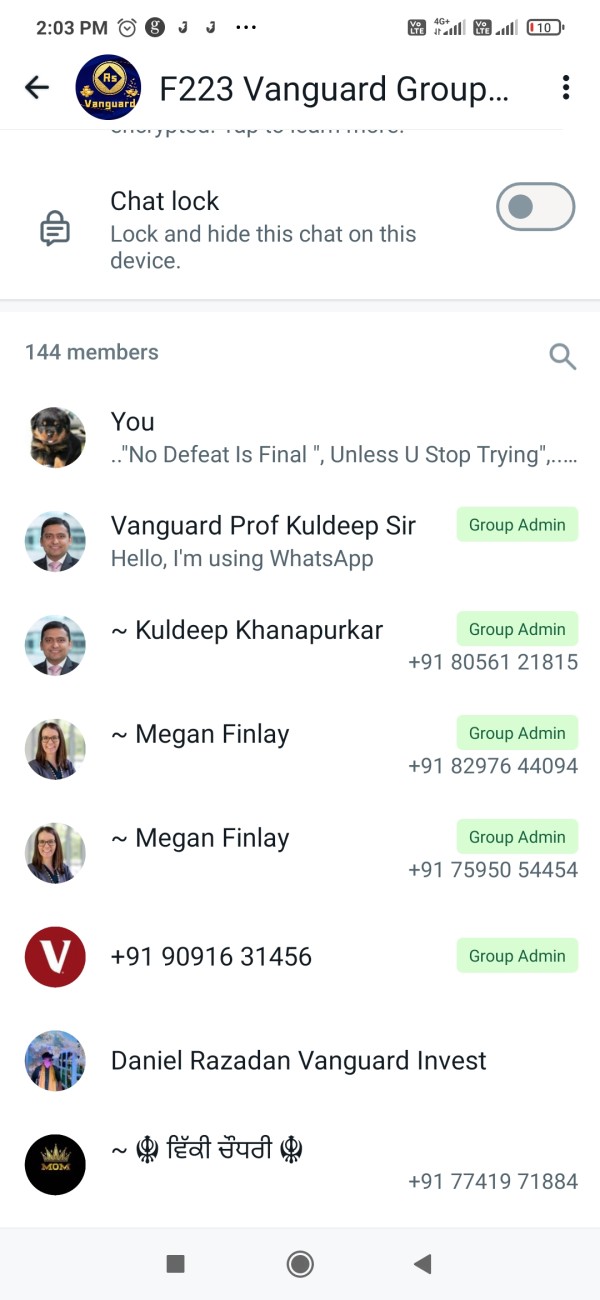

Vanguard primarily offers customer support in English, with phone support available Monday through Friday from 8 a.m. to 8 p.m. ET.

Repeat Ratings Overview

Detailed Breakdown

-

Account Conditions (8/10): Vanguard's account conditions are favorable, with no minimum deposit for brokerage accounts. However, the minimum investment for mutual funds can be a hurdle for new investors.

Tools and Resources (6/10): The Vanguard platform offers basic tools but lacks advanced features that active traders might seek. While it provides educational resources, they are more geared toward long-term investing rather than active trading.

Customer Service and Support (5/10): Customer service is limited to phone support during business hours, which may not meet the needs of all investors. The absence of live chat options and a slow account opening process have been points of concern.

Trading Setup (Experience) (6/10): The trading experience is straightforward but basic. Users have reported that the platform is not optimized for quick trades, which can be frustrating for those used to more sophisticated trading platforms.

Trustworthiness (9/10): Vanguard has a strong reputation for reliability and integrity, with no significant security breaches reported. Its client-owned structure adds a layer of trustworthiness.

User Experience (6/10): While the platform is functional, it has been criticized for its outdated design. Users seeking a more modern interface may find Vanguard lacking in this regard.

Costs (7/10): Vanguard's low-cost model remains one of its strongest features. However, some fees, like the $100 account closure fee, have raised eyebrows among users.

In conclusion, the Vanguard Group remains a top choice for long-term investors focused on low-cost investing strategies. However, those seeking an active trading environment or advanced trading tools may find it lacking. The Vanguard Group review suggests that while it excels in many areas, potential users should weigh their specific needs against the platform's limitations.