sh markets 2025 Review: Everything You Need to Know

Abstract

SH Markets is a new forex broker. It promises some of the best spreads in the market while giving traders advanced tools and complete asset tracking services. This sh markets review looks at the broker's overall trading setup, which appeals to traders who want many different financial products and a fast execution system. The broker offers good trading conditions and impressive technology, but it lacks important regulatory information. This raises concerns about whether it's legitimate and secure.

User feedback shows mixed results. There is one positive review, one neutral review, and three exposure reviews that show both the broker's strengths and problems. The broker offers competitive pricing through almost zero trading costs and instant transaction execution. Some users say it achieves 0ms transaction speed, which makes it more appealing. However, the lack of clear information about account conditions and regulatory oversight warns potential users to be careful.

While the platform offers cutting-edge tools and great spreads, you should think carefully before putting money in. The broker needs to be more transparent about important details. Users should do their own research before trading with SH Markets.

Important Considerations

SH Markets works differently in different regions, especially because it doesn't provide clear regulatory information. Potential users should check the broker's legal standing and do enough research before investing or trading. This review uses collected user feedback and a complete analysis of the available information summary.

Important details like specific deposit methods, minimum deposit requirements, and bonus promotions have not been shared in the available documents. This puts the responsibility on the trader to do additional checks. The broker talks about cutting-edge trading tools and fast execution speeds, but the lack of regulatory clarity can expose traders to potential risks. Users need to be extra careful when considering this broker.

Rating Framework

Broker Overview

SH Markets has its headquarters in Austin, Texas. It positions itself as a forward-thinking forex broker that specializes in forex trading and financial data integration. The exact founding year is not given in the available data, but the broker has created a niche by providing access to many financial instruments using its own TradingWeb platform.

The broker is designed to serve traders who value efficiency and technological innovation. SH Markets combines a fast execution environment with many different trading tools. The broker's business model focuses on delivering cutting-edge market data and investment portfolio insights. It caters specifically to those who need sophisticated asset tracking capabilities.

SH Markets also offers other trading products beyond forex. This expands its appeal to a broader user base. The broker uses the TradingWeb platform to create a smooth trading experience, though the details about its regulatory oversight remain undisclosed.

The absence of clear regulatory affiliation puts more emphasis on self-research by prospective traders. Despite this shortcoming, the platform is often praised for its low-cost trading environment and efficient trade executions. This sh markets review shows that while the broker presents good technological advances and competitive spreads, the lack of regulatory clarity might be a critical problem for risk-averse investors.

The available information summary does not give any details about the regulatory region where SH Markets operates. Users are advised to check any compliance or licensing details on their own before proceeding with trade activities. For deposit and withdrawal methods, specific operational mechanisms have not been provided by the broker.

There is no mention of a minimum deposit requirement. This leaves traders without guidance about initial funding expectations. Bonus promotions or any incentive schemes are also not detailed, leaving this aspect unclear for new account holders.

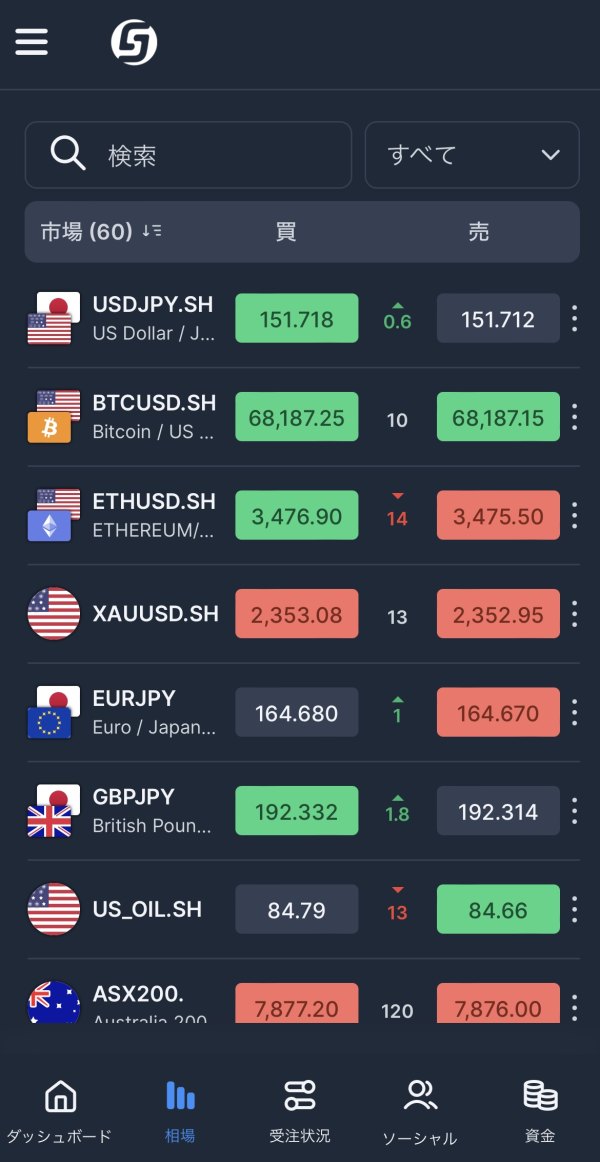

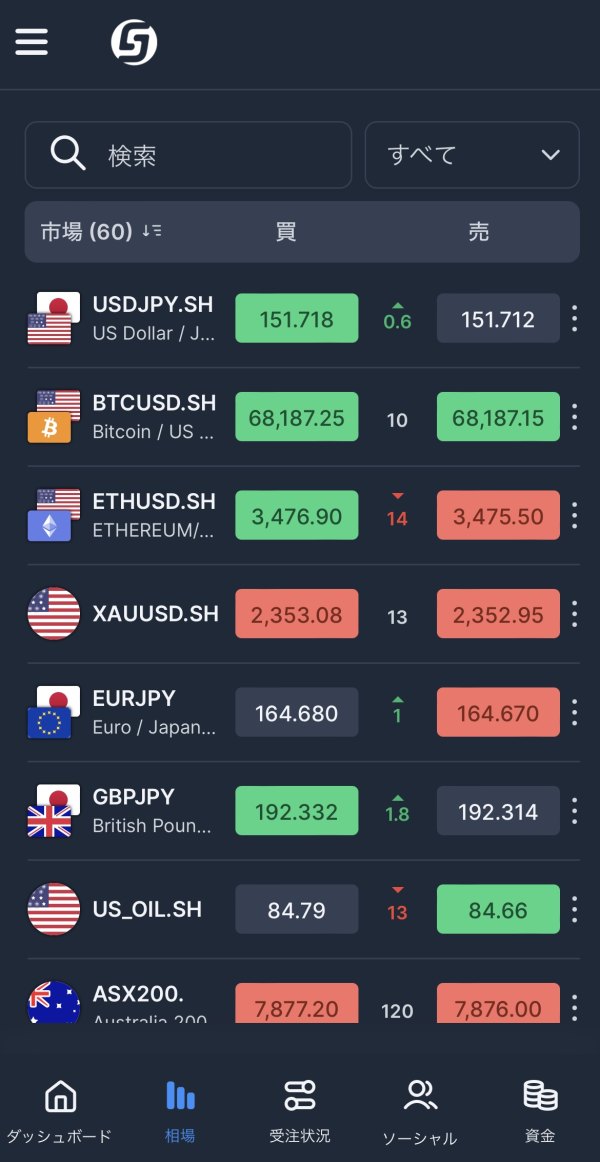

The platform allows trading in forex as well as many other financial products. This ensures broad market access for users. SH Markets is celebrated for offering some of the best spreads in the industry, but there is no available information about any additional commission fees or third-party cost structures.

No leverage ratio figures have been disclosed. This leaves a gap in understanding proper risk management parameters. SH Markets only uses the TradingWeb platform, which is known for its real-time data streaming and efficient execution speeds.

There is no mention of regional restrictions or specific customer service languages in the information summary. This potentially limits the platform's accessibility for a global audience. This sh markets review highlights that while the broker has made significant technological improvements in its platform capability, critical operational details remain unclear and require careful personal research.

Detailed Rating Analysis

1. Account Conditions Analysis

The analysis of account conditions shows several gaps in the transparency of SH Markets' offerings. No information has been provided about various account types, minimum deposit requirements, commission structures, or even any specialized account options, such as Islamic accounts. The absence of these details makes it challenging for traders to accurately assess the financial commitment required and tailor their trading strategies accordingly.

Many users have expressed concerns over the vague account setup process and lack of clarity on additional costs. This has raised questions about the broker's overall credibility. Other well-regulated brokers offer full transparency on account conditions that allow traders to make informed decisions.

This deficiency in detailed information coupled with reports about possible hidden stipulations in the account opening process has led to a cautious rating. The broker needs to provide more clear information about account setup and costs. Given these shortcomings, this sh markets review underlines that potential account holders need to conduct further personal research before committing to trading.

SH Markets shines in the area of tools and resources. This is evidenced by its robust suite of technological offerings. The broker provides users with real-time market data and complete asset tracking tools designed to monitor multiple portfolios and trading strategies effectively.

Among the key features are advanced portfolio analysis modules that support strategies such as covered calls, spreads, and straddles. Traders benefit considerably from these innovative tools, which enhance market analysis and execution precision. However, the information summary does not mention the availability of educational resources or automated trading support systems.

Despite this omission, the positive feedback about the platform's technological capabilities indicates that the broker prioritizes the integration of cutting-edge analytics and trading functionalities. Expert analysis has frequently praised the immediacy of data and the reliability of the trading interface. Overall, this aspect of SH Markets is a highlight in its offerings, ensuring that those who rely on advanced market insights and fast execution can potentially benefit from its platform.

3. Customer Service and Support Analysis

Customer service at SH Markets appears to be inconsistent according to user feedback. The available information indicates that while the broker does provide customer service, the quality and consistency of support have been flagged as significant issues. Users have reported varied experiences with response times and problem resolution.

Some complaints highlight that the service was either unresponsive or inadequate in addressing technical or account-related issues. There is no detailed information about the available customer service channels, operating hours, or whether multi-language support is offered. Such gaps make it difficult for users to rely solely on the broker's support framework, especially those who may require prompt assistance in a fast-paced trading environment.

Industry competitors typically display a higher level of service consistency and transparency in communications. The broker needs to improve its customer service quality and provide more information about support options. These factors collectively contribute to a moderate score in customer service for SH Markets.

4. Trading Experience Analysis

The trading experience provided by SH Markets is enhanced by its state-of-the-art TradingWeb platform. Users benefit from an almost instant trade execution speed, reported to be around 0ms, which is crucial for high-frequency trading and managing market volatility. The platform is also noted for its competitive trading costs, as no commissions are applied and the spreads are among the best in the market.

However, despite these strengths, some users have raised concerns about order execution consistency and the occasional platform malfunction. There is little discussion available about the mobile trading experience, which is an important consideration in today's market. The lack of any reported issues regarding slippage or liquidity is a positive note.

The incomplete transparency regarding trading conditions calls for further scrutiny. This sh markets review suggests that while the trading environment is technologically robust and fast, prospective clients need to remain vigilant about the incomplete information regarding overall trading performance and stability.

5. Trust Analysis

Trust remains a significant concern for SH Markets. This is primarily due to the absence of clear regulatory oversight. The information summary does not specify any regulatory body or licensing details, which is a major drawback when considering the safety of client funds and overall operational transparency.

The broker leverages modern network security measures to protect customer information, but this alone does not compensate for the lack of formal regulatory certification. Reports indicate that some users have experienced issues where the broker seemingly "vanished," further eroding trust. The limited disclosure of financial and operational practices has led to negative perceptions among segments of the trading community.

Well-established brokers openly display their regulatory credentials and maintain high transparency standards, but SH Markets falls short in instilling confidence among prospective traders. The broker needs to provide clear regulatory information and improve transparency. Overall, the trust score reflects these critical shortcomings, urging potential clients to exercise elevated caution in their dealings.

6. User Experience Analysis

User experience at SH Markets is characterized by mixed reviews. The trading platform offers a modern interface with fast execution speeds and a variety of analytical tools, but several users have reported difficulties with the overall usability. Specific concerns include a convoluted registration process, unclear navigation paths, and operational inconsistencies that at times have led to funds being difficult to access.

Some traders have even described instances where the broker "disappeared" from the platform. This undermines user confidence and satisfaction. A segment of users appreciates the swift trade execution and high-tech features, but the overall feedback indicates that improvements are needed in interface design and customer support responsiveness.

The absence of comprehensive account management details further complicates the user's journey from registration to active trading. The platform has potential, but it requires significant improvements in ease of use and operational transparency to meet the high expectations of modern traders. In summary, while the technology is advanced, the user experience needs substantial improvement.

Conclusion

SH Markets offers a compelling trading environment with competitive spreads, zero commission costs, and a technologically advanced TradingWeb platform. However, the significant drawback lies in its lack of regulatory transparency and inconsistent customer support. The platform appeals to traders in search of efficient, high-speed execution and advanced asset tracking, but the deficiencies in account information and oversight raise concerns about overall reliability.

Potential clients are advised to proceed with caution and perform their own research prior to engaging with the broker. The broker needs to improve transparency and regulatory compliance to build trust with users. Ultimately, this sh markets review recognizes the broker's strengths in technology and pricing while underscoring the vital need for improved regulatory compliance and customer service consistency.