QF Markets 2025 Review: Everything You Need to Know

Summary

This qf markets review gives you a complete look at QF Markets, an online forex broker that offers CFD trading services across many different types of assets. QF Markets has both good and bad points, but it does offer some nice features for people just starting to trade, especially with its very low minimum deposit of just $5 for Cent Accounts and support for both MT4 and MT5 trading platforms that most traders know well. The broker has some big problems with being open about important details, though, since there's not much information available about who watches over them, what their fees really are, and what the full trading conditions include.

QF Markets works in forex, stocks, commodities, and cryptocurrency trading, and they mainly try to help new traders and people who don't invest huge amounts of money. The broker says they provide customer service 24 hours a day, 7 days a week, and they claim they care most about making users happy, but we don't have specific numbers or lots of user reviews to prove this. While it's easy for beginners to start because you don't need much money, people thinking about trading should be careful because we don't know clearly who regulates them and they don't share enough details about how they really work.

Important Notice

QF Markets does not help people who live in the United States, Canada, Syria, North Korea, Iran, and Iraq because of rules in those places. This qf markets review uses information that we could find, but some important details about how they operate might be missing, so our review has some limits. People who want to trade should do more research on their own and check the current rules and conditions directly with the broker before they decide to invest any money.

The information we share here shows what we knew when we wrote this review, and it might not include new changes or updates to what the broker offers.

Rating Framework

Broker Overview

QF Markets works as an online forex trading broker that gives people CFD trading services across many different financial markets. We don't know exactly when the company started based on what we could find, but the company says it's a complete trading platform that lets people access forex, stocks, commodities, and cryptocurrency markets. The broker makes money by giving regular traders access to worldwide financial markets through popular trading platforms that many people already know how to use.

The company focuses on making trading easy for new people, which you can see from its very low minimum deposit rules and platform choices that are simple to use. QF Markets gives traders both MT4 and MT5 trading platforms, which are the standard choices in the industry that give traders interfaces they recognize and complete trading tools they need. But this qf markets review shows that we don't have much detailed information about the company's background, when it was founded, and how the company is set up.

Based on what we could find, QF Markets works without clearly telling people which authorities watch over them, which is something important that potential clients should think carefully about. The broker says it includes customer support 24 hours a day, 7 days a week, and claims it cares most about making customers happy, but we don't have specific performance numbers and detailed information about how they operate isn't easy to find.

Regulatory Status: The information we have doesn't tell us which specific authorities watch over QF Markets operations, which is a big gap in transparency that people thinking about trading should carefully consider.

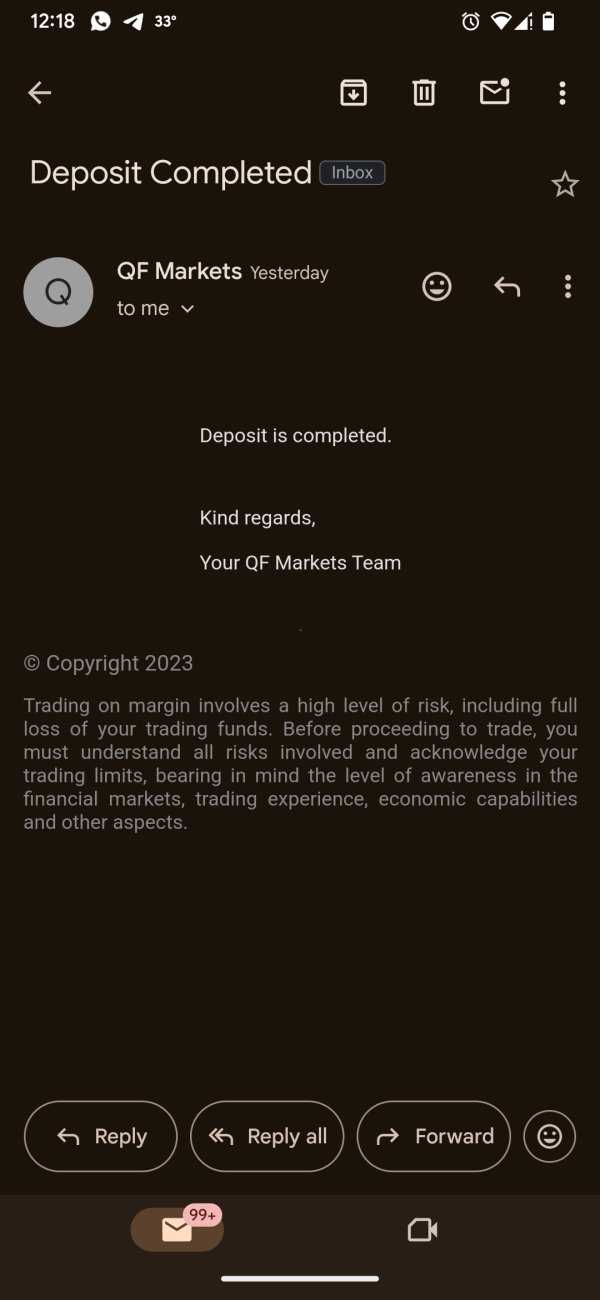

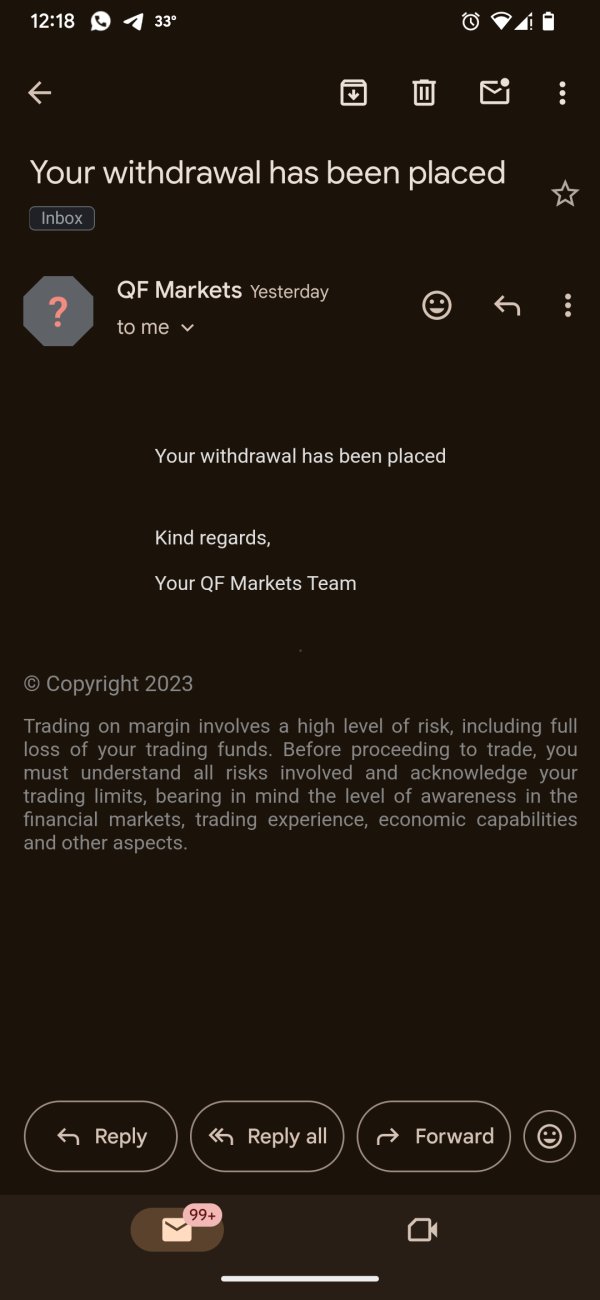

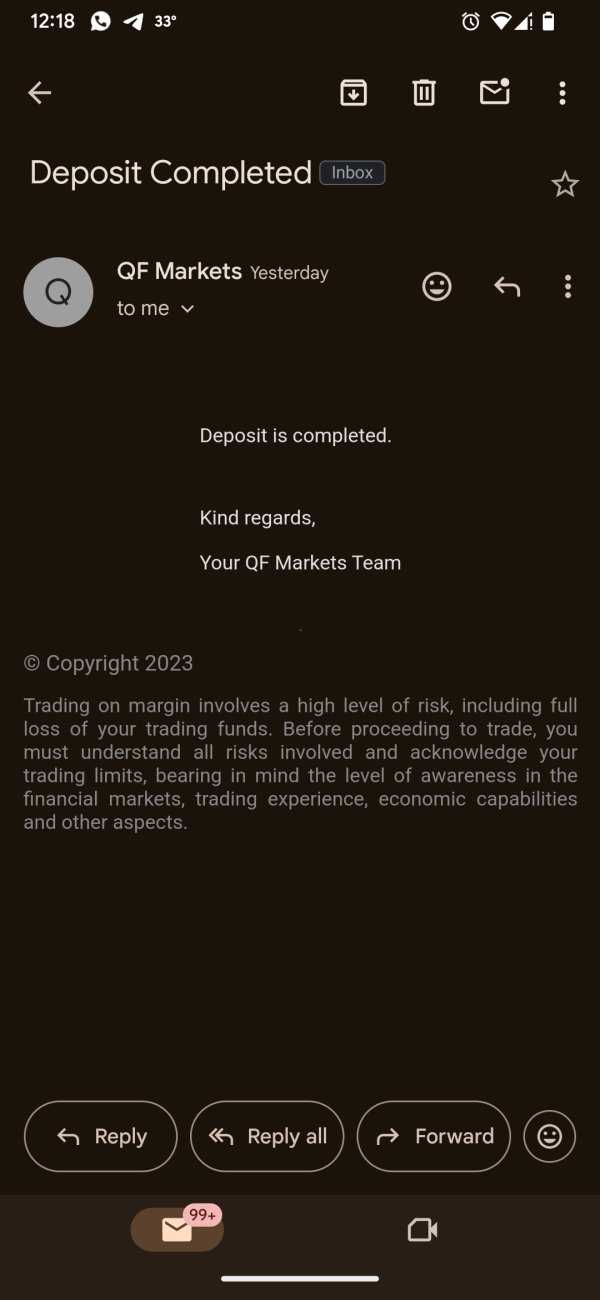

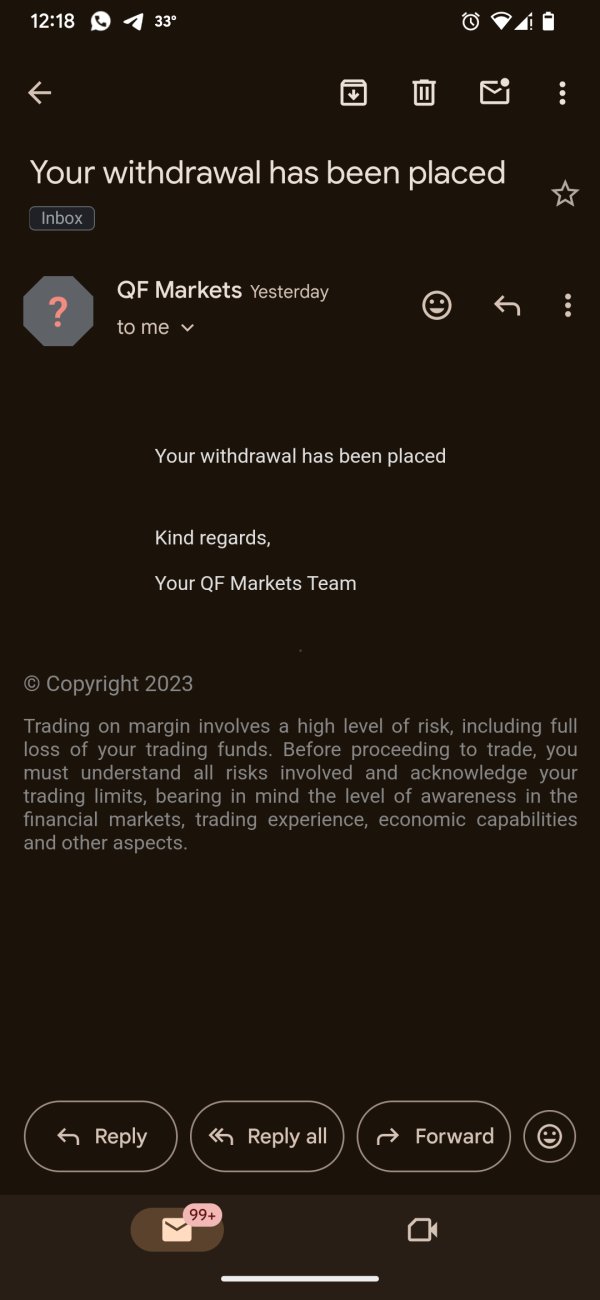

Deposit and Withdrawal Methods: We don't have specific information about what payment methods you can use and how they process payments in current sources, so you need to ask the broker directly.

Minimum Deposit Requirements: QF Markets has a Cent Account where you only need to deposit $5 minimum, which makes it possible for traders who don't have much money to start with.

Bonus and Promotions: We don't know what current promotional offers and bonus structures they have from the information sources we could find.

Tradeable Assets: The broker lets you access four main types of assets: forex pairs, stocks, commodities, and cryptocurrencies, which gives traders chances to diversify their investments.

Cost Structure: They advertise spreads as low as 1.01 pips, but we don't have details about specific commission structures and extra fees in the sources we found.

Leverage Options: We don't have information about specific leverage ratios and margin requirements in current information summaries.

Platform Selection: QF Markets supports both MetaTrader 4 and MetaTrader 5 platforms, which gives traders industry-standard tools and functionality they expect.

Geographic Restrictions: People who live in the United States, Canada, Syria, North Korea, Iran, and Iraq cannot use their services.

Customer Service Languages: We don't have details about specific language support in available sources, but they do advertise that service is available 24/7.

This qf markets review shows that while basic service information exists, many operational details need to be checked directly with the broker.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

QF Markets gets an above-average rating for account conditions mainly because it's easy to get started with them. The broker's Cent Account that only needs a $5 minimum deposit really stands out as attractive for new traders or people who want to test strategies without risking much money. This low barrier to entry is much better than many competitors who usually require minimum deposits of $100 or more.

But the rating has limits because we don't have detailed information about account types beyond the Cent Account. The sources we found don't tell us if QF Markets offers premium account levels, Islamic accounts, or professional trading accounts with better features. We also don't have clear information about how you open accounts, what verification you need, and what account management features they provide, which also limits our evaluation.

The broker seems focused on making things accessible rather than offering many account options, which might work well for beginners but could limit appeal for more experienced traders who want advanced account features. Without detailed fee structures, swap rates, or charges for inactive accounts, potential clients can't fully understand what it will cost them long-term to keep accounts with QF Markets.

This qf markets review notes that while the low minimum deposit is good, the limited transparency about complete account conditions prevents us from giving a higher rating in this category.

QF Markets gets an average rating for tools and resources, mainly based on providing MT4 and MT5 trading platforms. These industry-standard platforms give traders interfaces they know, complete charting tools, and support for automated trading through Expert Advisors. Having both platforms available gives flexibility for traders with different preferences and experience levels.

But the rating is held back by the lack of information about additional trading tools, research resources, and educational materials. The sources we found don't mention market analysis services, economic calendars, trading signals, or educational content that many modern brokers provide to help traders develop their skills. Not having proprietary trading tools or enhanced platform features also limits the broker's competitive position.

Without detailed information about research capabilities, third-party integrations, or advanced trading tools, traders who want comprehensive market analysis and educational support may find QF Markets' offerings insufficient. The platform selection is solid but represents a basic offering rather than a competitive advantage in today's broker landscape.

Customer Service Analysis (7/10)

QF Markets gets a good rating in customer service based on its advertised 24/7 availability and stated commitment to making customer satisfaction a priority. Having service available around the clock addresses a key need for forex traders who operate across different time zones and during various market sessions.

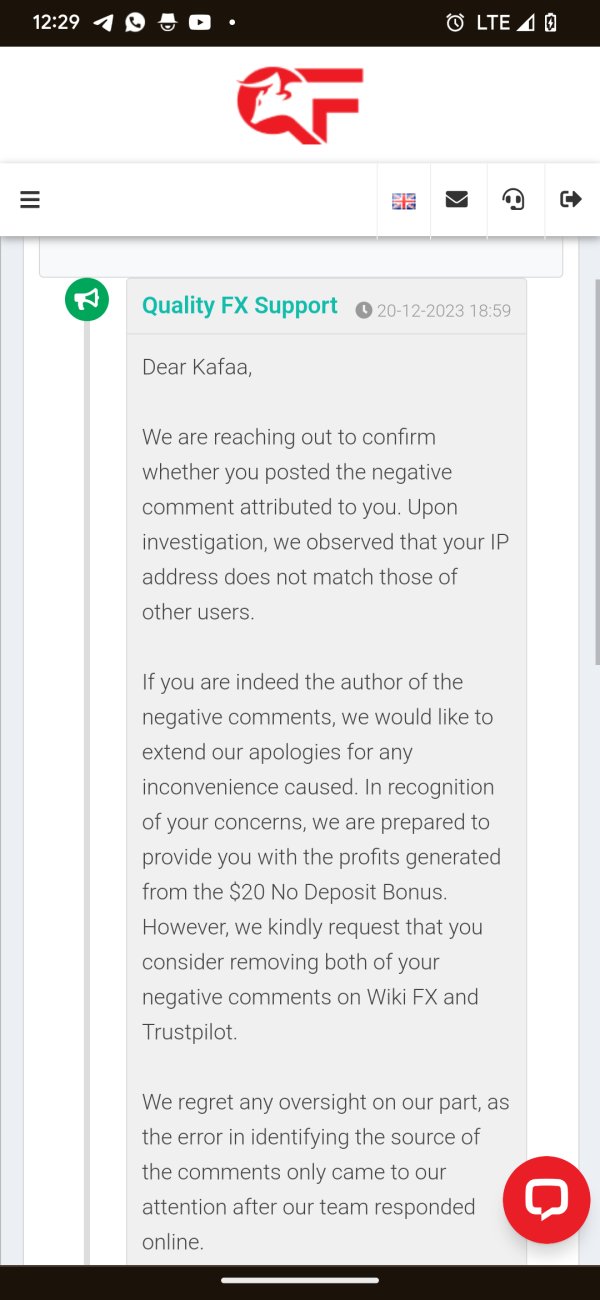

The broker's emphasis on customer satisfaction suggests they focus on service, but we don't have specific performance metrics like average response times, resolution rates, or customer satisfaction scores in available sources. Without information about available contact methods (live chat, email, phone), supported languages, or service quality assessments, our evaluation relies mainly on the stated commitment to continuous availability.

Not having documented customer service procedures, escalation processes, or specific support channel details prevents a higher rating. Also, without user feedback or third-party assessments of service quality, it's hard to verify whether the 24/7 availability actually translates into effective problem resolution and customer support.

Trading Experience Analysis (6/10)

The trading experience rating reflects QF Markets' provision of MT4 and MT5 platforms, which give traders proven, stable trading environments with comprehensive functionality. These platforms provide essential trading features including advanced charting, multiple order types, and automated trading capabilities that support various trading strategies.

The advertised spreads starting from 1.01 pips suggest competitive pricing, but we don't have detailed execution quality data, average spread information across different market conditions, or slippage statistics, which limits our assessment. Without specific information about trade execution speed, order fill rates, or platform stability metrics, traders can't fully evaluate the technical trading experience.

This qf markets review notes that while the platform selection provides a solid foundation for trading activities, the lack of detailed performance data, mobile trading experience information, or advanced trading features prevents a higher rating. The trading experience appears adequate for basic needs but may not satisfy traders who need advanced execution capabilities or specialized trading tools.

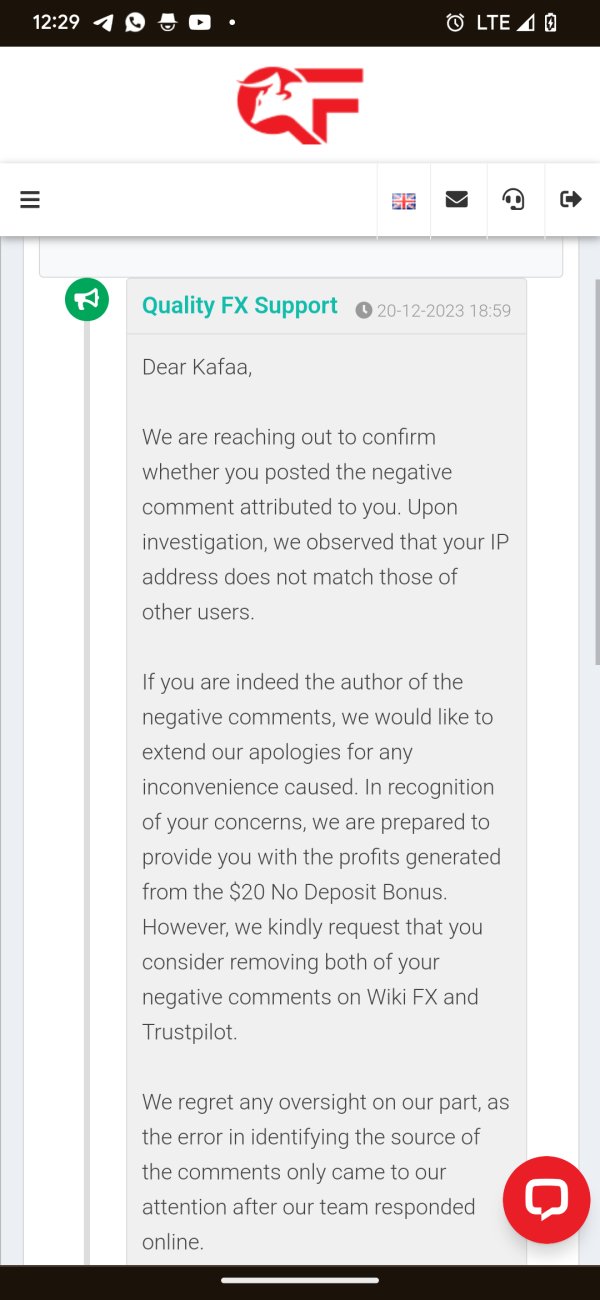

Trust and Regulation Analysis (4/10)

QF Markets gets a below-average rating for trust and regulation because there's no clear regulatory information in available sources. Not having specified regulatory oversight represents a significant concern for traders who prioritize fund security and regulatory protection. Without identified regulatory authorities, license numbers, or compliance frameworks, potential clients can't verify the broker's adherence to industry standards.

Having high-risk warnings in available information further emphasizes how important it is to consider carefully before engaging with the broker. Without details about fund segregation practices, investor compensation schemes, or regulatory reporting requirements, traders can't assess the security of their deposits or the broker's operational oversight.

Not having information about company registration details, regulatory history, or third-party audits also contributes to the limited trust assessment. While the lack of negative publicity or documented issues is neutral, not having positive regulatory credentials significantly impacts the trust evaluation.

User Experience Analysis (5/10)

The user experience rating reflects limited available information about actual trader feedback and platform usability. While QF Markets appears positioned for accessibility with its low minimum deposit and standard platform offerings, we don't have specific user satisfaction data, interface design quality, or ease-of-use assessments in available sources.

The broker's focus on serving new traders and small-scale investors suggests an emphasis on user-friendly approaches, but without documented user journeys, registration process reviews, or feedback about platform navigation, our evaluation remains constrained. Not having information about mobile app quality, website functionality, or customer onboarding experiences limits the assessment.

Without comprehensive user reviews, satisfaction surveys, or detailed usability studies, this qf markets review can't provide a thorough evaluation of the actual user experience. The average rating reflects the uncertainty rather than documented deficiencies, indicating a need for more detailed user feedback to properly assess this dimension.

Conclusion

This qf markets review reveals a broker with mixed characteristics that may appeal to specific trader segments while presenting notable limitations. QF Markets' primary strength lies in its accessibility, offering a low $5 minimum deposit that makes forex trading available to beginners and small-scale investors. The provision of MT4 and MT5 platforms provides traders with industry-standard tools and familiar trading environments that most people already know how to use.

However, significant transparency concerns limit the broker's overall appeal. The absence of clear regulatory information, detailed fee structures, and comprehensive operational details creates uncertainty for potential clients. While 24/7 customer service and competitive spreads starting from 1.01 pips represent positive features, the lack of detailed performance data and limited tool offerings constrain the trading experience.

QF Markets appears most suitable for new traders seeking low-cost entry into forex markets, though the regulatory uncertainty makes it essential for potential clients to conduct thorough due diligence before committing funds.