Is DLS GROUP safe?

Pros

Cons

Is DLS Group Safe or Scam?

Introduction

DLS Group is a forex broker that positions itself within the financial services sector, claiming to offer a variety of trading instruments and account types to cater to diverse investor needs. However, the forex market is notorious for its volatility and the presence of unscrupulous entities. Therefore, it is imperative for traders to conduct thorough due diligence before engaging with any broker. This article aims to objectively evaluate the safety and legitimacy of DLS Group by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

To arrive at a well-rounded assessment, this investigation utilizes a combination of qualitative and quantitative data sourced from reputable financial websites, user reviews, and regulatory bodies. The evaluation framework includes a detailed analysis of the broker's regulatory compliance, historical performance, fee structures, and user feedback.

Regulation and Legitimacy

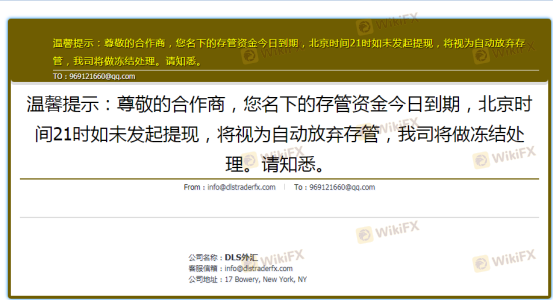

The regulatory status of a broker is a crucial factor in determining its legitimacy and safety. DLS Group claims to be regulated by the United States National Futures Association (NFA). However, this claim has been met with skepticism, as there are indications that the regulation might be a clone, lacking the necessary verification.

Here is a summary of the core regulatory information for DLS Group:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0271678 | United States | Unverified |

The absence of valid regulation raises significant concerns about the broker's operational integrity. A broker operating without a legitimate regulatory framework poses high risks to traders, as there is no governing body to oversee its activities or protect investors' funds. Furthermore, the lack of transparency regarding its claimed NFA regulation suggests that potential clients should approach DLS Group with caution.

Company Background Investigation

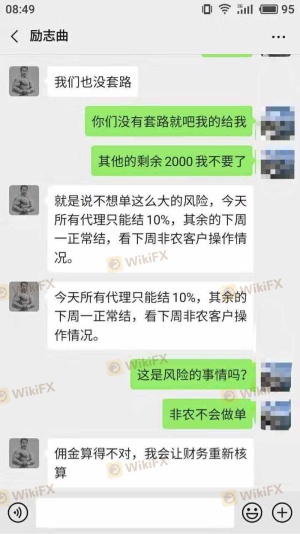

DLS Group Limited, as stated in its documentation, is based in the United States and has been active for approximately 2 to 5 years. However, the specific founding year is not disclosed, which raises questions about the broker's transparency. The ownership structure is also unclear, leaving potential investors in the dark regarding who is behind the company.

The management team's background is crucial in assessing the broker's credibility. Unfortunately, there is limited information available about the team members' qualifications and experience in the financial services industry. The lack of transparency regarding the management can be a red flag, as a reputable broker typically provides detailed information about its leadership.

In summary, the lack of comprehensive company history and management transparency contributes to the overall uncertainty surrounding DLS Group's legitimacy.

Trading Conditions Analysis

An examination of trading conditions is essential for evaluating a broker's overall attractiveness to potential clients. DLS Group offers a minimum deposit requirement of $100 and a maximum leverage of 1:500, which is relatively competitive in the industry. However, the broker's fee structure raises concerns.

Here is a comparison of core trading costs:

| Fee Type | DLS Group | Industry Average |

|---|

Is DLS GROUP a scam, or is it legit?

The latest exposure and evaluation content of DLS GROUP brokers.

DLS GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DLS GROUP latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.