DLS Group 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive DLS group review examines the various entities operating under the DLS Group name in 2025. DLS Group Limited operates as a financial services company in the United States. The company shows a mixed profile that requires careful evaluation. The company offers multi-asset trading services including currency pairs, energy commodities, and indices through its DLS Markets division.

Available information from multiple sources shows that DLS Group demonstrates some positive aspects. Customer service delivery stands out, with user feedback indicating satisfactory support experiences. However, this DLS group review reveals significant information gaps regarding specific regulatory details, trading conditions, and platform specifications. Potential clients should consider these limitations carefully.

The company appears to target investors seeking diversified trading opportunities across multiple asset classes. Some entities under the DLS Group umbrella show professional credentials, including SEC registration for certain divisions. The overall assessment remains neutral due to limited transparency in key operational areas. Prospective traders should carefully evaluate whether DLS Group's offerings align with their specific trading requirements and risk tolerance levels.

Important Notice

This DLS group review is based on publicly available information and user feedback collected from various online sources. Readers should note that different DLS Group entities may operate under varying regulatory frameworks and business models. DLS Group Limited's specific regulatory status and licensing information were not detailed in available materials. This may impact overall transparency assessments.

The evaluation methodology employed in this review relies on publicly accessible data, user testimonials, and industry reports rather than direct testing of trading services. Potential clients are advised to conduct independent verification of all trading conditions, regulatory status, and service terms. They should do this before making any investment decisions.

Rating Framework

Broker Overview

DLS Group Limited operates as a financial services entity within the United States market. Specific establishment dates were not clearly documented in available sources. The company structure appears to encompass multiple business divisions, including electronic equipment retail operations alongside financial services provision. This diversified approach suggests a broader business model beyond traditional brokerage services.

The organization's primary focus centers on providing multi-asset CFD trading opportunities to retail and institutional clients. Available information shows that DLS Markets serves as the trading division. The division offers access to various financial instruments including foreign exchange pairs, energy commodities, precious metals, and major market indices.

However, this DLS group review identifies notable gaps in publicly available information regarding the company's specific trading platform technology. The company may use industry-standard solutions like MetaTrader 4 or MetaTrader 5, or proprietary systems. The absence of detailed platform specifications may concern traders who prioritize technical analysis capabilities and automated trading features in their broker selection process.

Regulatory Jurisdiction: Available documentation does not specify the primary regulatory authority overseeing DLS Group Limited's operations. Some related entities show SEC registration status.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees was not detailed in accessible materials.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account tiers were not specified in available sources.

Promotional Offerings: Details regarding welcome bonuses, trading incentives, or loyalty programs were not mentioned in reviewed materials.

Tradeable Assets: The company offers multi-asset CFD trading including currency pairs, energy commodities, precious metals, and major market indices. These assets span across global exchanges.

Cost Structure: Specific information regarding spreads, commissions, overnight financing charges, and other trading costs was not detailed in available documentation. This represents a significant transparency gap for potential clients.

Leverage Ratios: Maximum leverage offerings and margin requirements were not specified in accessible materials.

Platform Options: Specific trading platform details, mobile application availability, and technical analysis tools were not comprehensively documented.

Geographic Restrictions: Information regarding restricted jurisdictions or regional limitations was not clearly outlined.

Customer Support Languages: Available support languages and regional service capabilities were not specifically mentioned.

This DLS group review highlights the need for prospective clients to directly contact the company. They should seek detailed operational information not publicly available.

Account Conditions Analysis

The evaluation of DLS Group's account conditions reveals significant information limitations. These limitations impact overall assessment quality. Available sources do not provide comprehensive details regarding account tier structures, minimum deposit requirements, or specific trading conditions that typically influence broker selection decisions.

Potential clients cannot adequately compare DLS Group's competitiveness against industry standards without access to detailed spread information, commission structures, or leverage offerings. This lack of transparency in account condition disclosure represents a notable concern for traders seeking comprehensive cost analysis before commitment.

The absence of specific account opening procedures, verification requirements, and funding options further complicates the evaluation process. Industry best practices typically involve clear disclosure of all account-related terms and conditions. This information gap is particularly noteworthy in our DLS group review assessment.

Professional traders often require detailed understanding of execution models, order types supported, and minimum trade sizes before selecting a broker. The limited availability of such technical specifications may indicate either inadequate marketing communication or selective information disclosure practices. These practices warrant further investigation.

DLS Group's trading tools and resources evaluation faces similar challenges due to limited publicly available information. Platform capabilities and analytical resources remain unclear. While the company advertises multi-asset CFD trading capabilities, specific details about charting packages, technical indicators, and automated trading support remain unclear.

The absence of detailed information regarding research provision, market analysis, and educational resources suggests either minimal investment in trader development services or inadequate communication of available offerings. Modern traders typically expect comprehensive analytical tools, economic calendars, and market commentary as standard broker services.

Educational resource availability plays a crucial role in trader satisfaction and success rates. This includes webinars, tutorials, and market analysis. The lack of specific information regarding such offerings in available materials represents a notable gap in this DLS group review evaluation.

Assessment of mobile trading capabilities, algorithmic trading support, and third-party integration options remains incomplete without access to detailed platform specifications. These technical capabilities significantly impact trading experience quality and overall platform suitability for different trader types.

Customer Service and Support Analysis

Customer service evaluation reveals more positive aspects compared to other assessment areas. Available user feedback indicates satisfactory support experiences. According to user testimonials found during research, DLS Group's customer service team demonstrates responsiveness and professional communication standards.

However, specific information regarding support channel availability, operating hours, and multilingual capabilities was not comprehensively documented. Modern traders expect 24/5 support availability, live chat functionality, and rapid response times for technical issues and account inquiries.

The limited user feedback available suggests generally positive experiences with problem resolution and account management support. However, the small sample size of available testimonials limits the statistical significance of these positive indicators. This affects overall service quality assessment.

Professional support quality often correlates with broker reliability and operational standards. While available feedback appears encouraging, the absence of comprehensive support infrastructure details prevents definitive conclusions. Service consistency and availability across different time zones and communication channels remain unclear.

Trading Experience Analysis

Trading experience evaluation faces significant limitations due to insufficient specific information regarding platform performance, execution quality, and user interface design. Comprehensive assessment remains challenging without access to detailed user testimonials regarding trading conditions, order execution speed, and platform stability.

Industry-standard evaluation typically examines slippage rates, execution speeds, platform uptime statistics, and mobile application functionality. The absence of such technical performance data in available materials represents a substantial gap in trading experience assessment for this DLS group review.

Platform functionality significantly impacts daily trading operations. This includes advanced order types, one-click trading capabilities, and customization options. Without specific information regarding these features, traders cannot adequately assess platform suitability for their particular trading strategies and requirements.

The lack of detailed user experience feedback regarding platform navigation, charting capabilities, and overall trading environment quality prevents definitive conclusions. DLS Group's trading experience standards compared to industry benchmarks and competitor offerings remain unclear.

Trust and Regulation Analysis

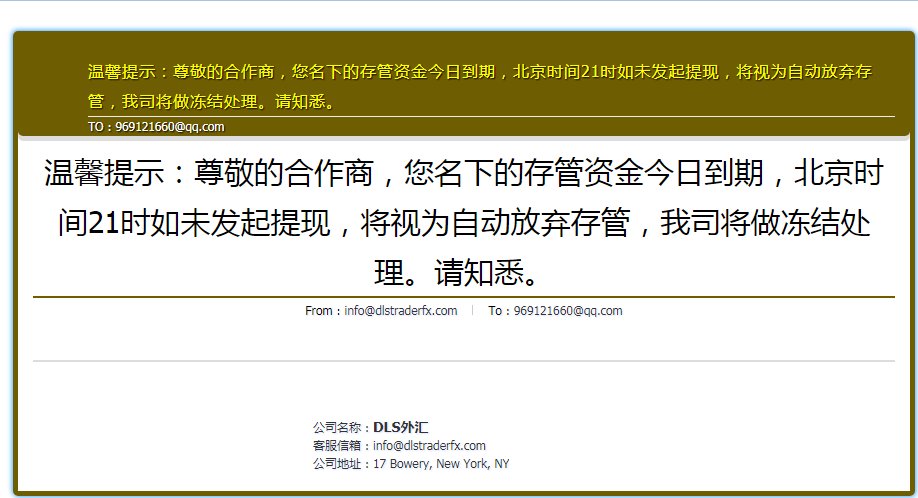

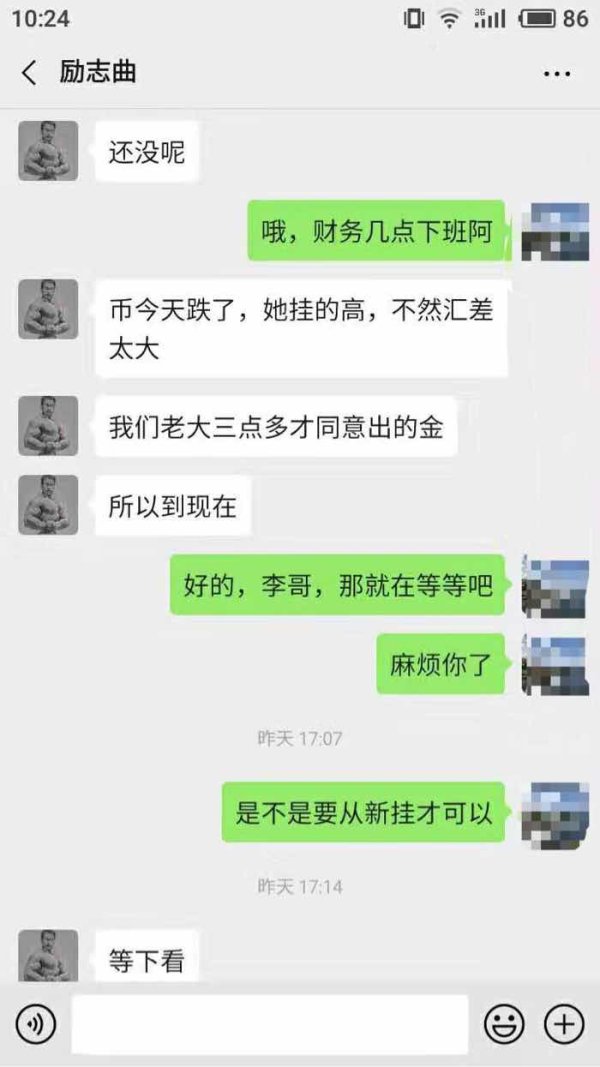

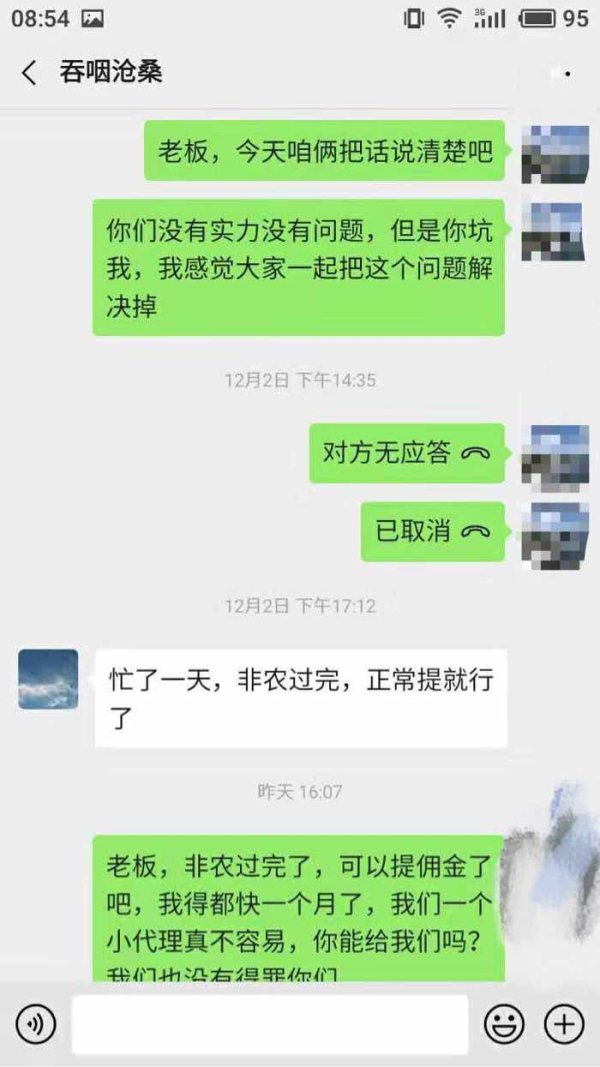

Trust and regulatory assessment reveals the most significant concerns identified in this DLS group review. The absence of clearly documented regulatory oversight, licensing information, and compliance frameworks raises important questions. These questions concern operational transparency and client protection measures.

While some related entities show SEC registration status, the specific regulatory framework governing DLS Group Limited's operations remains unclear from available documentation. This regulatory ambiguity may concern traders prioritizing broker oversight and investor protection mechanisms in their selection criteria.

Client fund protection measures were not detailed in accessible materials. These include segregated account policies, deposit insurance coverage, and compensation schemes. These safety mechanisms represent fundamental considerations for traders evaluating broker trustworthiness and financial security provisions.

The absence of detailed company background information, management team disclosure, and financial stability indicators further complicates trust assessment. Transparent brokers typically provide comprehensive corporate information, regulatory compliance details, and third-party audit results. They do this to establish credibility with potential clients.

User Experience Analysis

User experience evaluation based on available feedback suggests moderate satisfaction levels among DLS Group clients. Limited user testimonials indicate average service experiences with particular emphasis on customer support quality rather than trading platform excellence or competitive trading conditions.

The three-star average rating mentioned in available sources reflects mixed user experiences. Positive aspects include customer service responsiveness balanced against concerns regarding product quality and service consistency. This moderate satisfaction level suggests room for improvement in overall service delivery.

Interface design, platform navigation, and account management functionality assessments remain incomplete due to limited specific user feedback regarding these technical aspects. Modern traders expect intuitive platform design, efficient order management systems, and seamless mobile application integration.

User retention rates, complaint resolution effectiveness, and overall satisfaction trends could not be comprehensively evaluated due to limited available data. These metrics typically provide valuable insights into long-term service quality and client relationship management effectiveness. These aspects remain unclear for DLS Group operations.

Conclusion

This comprehensive DLS group review reveals a financial services company operating with mixed transparency levels and limited publicly available operational details. DLS Group Limited demonstrates some positive aspects, particularly in customer service delivery. However, significant information gaps regarding regulatory status, trading conditions, and platform specifications prevent definitive assessment conclusions.

The company appears most suitable for investors seeking multi-asset trading opportunities who prioritize customer service quality over detailed cost analysis and platform sophistication. However, the lack of comprehensive trading condition disclosure may concern cost-conscious traders. These traders require detailed fee structures and competitive spread information.

Primary advantages include responsive customer support and zero complaint records in available sources. Notable disadvantages encompass regulatory transparency limitations and insufficient trading condition documentation. Prospective clients should conduct thorough due diligence and direct communication with DLS Group representatives. They need to obtain essential operational details not publicly available.