FNB 2025 Review: Everything You Need to Know

Executive Summary

This fnb review looks at First National Bank Corporation. It's a financial services company based in Pittsburgh, Pennsylvania. The bank works across seven states and the District of Columbia, offering commercial banking, consumer banking, and wealth management through its network of smaller companies. FNB has some good features like the free Freestyle Checking account, but customers often complain about poor service and problems with basic operations.

User ratings from different websites show FNB gets 3.1 out of 5 stars. Many customers get frustrated with payment problems and bad customer service experiences. The bank mainly helps people on the East Coast and those who want different types of financial services. However, people in other parts of the country can't easily use FNB's services. Even though FNB has been around for a while, it struggles to keep customers happy compared to other banks.

Important Notice

Regional Service Limitations: FNB only works on the East Coast and in the District of Columbia. People who live outside these areas probably can't use FNB's services. First National Bank of Pennsylvania leads the bank's network and focuses on local markets instead of serving the whole country.

Review Methodology: This review uses customer feedback, public ratings, and company information to judge FNB. We couldn't find much specific information about trading platforms in public sources, so this review mainly looks at the bank's general services and what customers say about their experiences.

Rating Framework

Broker Overview

Company Background and Foundation

First National Bank Corporation is a financial services company based in Pittsburgh, Pennsylvania. The bank works through many smaller companies across seven states and the District of Columbia, with First National Bank of Pennsylvania as its biggest part. We don't know exactly when the bank started, but it has become an important regional player in banking.

FNB focuses on three main areas: commercial banking, consumer banking, and wealth management. This approach lets the bank serve different types of customers, from regular people who need basic banking to businesses that need complex financial help. The bank chooses to stay strong in East Coast markets instead of trying to expand across the whole country.

Service Portfolio and Market Position

The bank offers traditional banking products along with specialized financial services. The Freestyle Checking account stands out because FNB doesn't charge monthly fees for it, which might appeal to people who want to save money. Customers should still watch out for overdraft fees and other charges that could make the account more expensive.

FNB's position shows its regional banking strategy, focusing on markets where it knows the local area and has good relationships. Working across multiple states gives the bank some variety while keeping operations efficient through regional focus. However, we couldn't find much specific information about trading platforms, types of investments, and regulatory oversight, which limits how much we can analyze investment services.

Regulatory Environment: We couldn't find detailed information about specific regulatory oversight in available sources, though FNB follows standard banking rules for the areas where it operates.

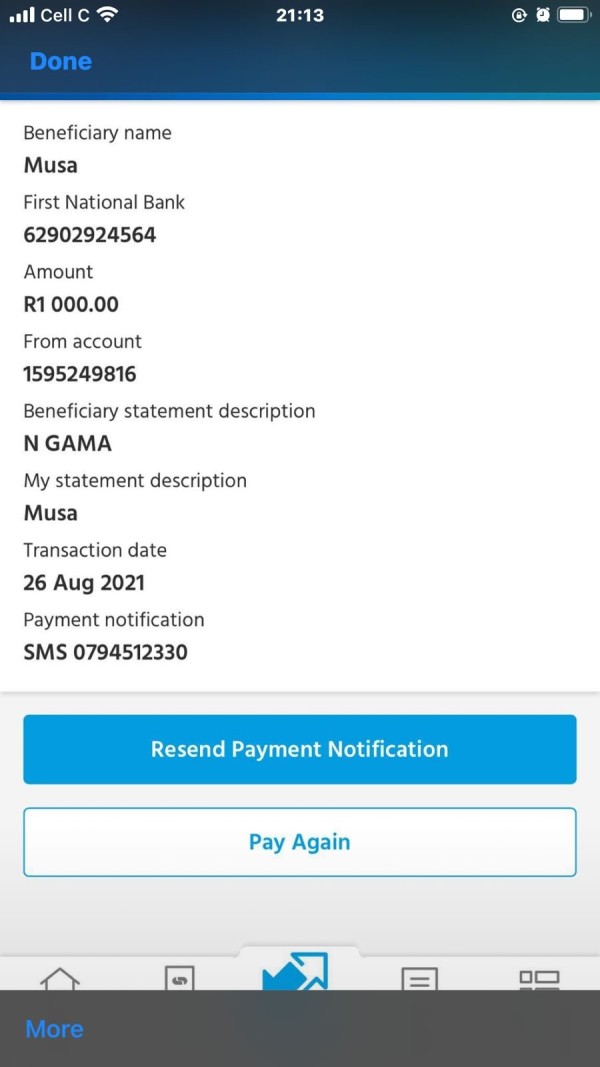

Deposit and Withdrawal Methods: Available sources didn't give detailed information about specific deposit and withdrawal options beyond normal banking methods.

Minimum Deposit Requirements: We couldn't find specific minimum deposit requirements for different account types in public information.

Promotional Offers: Current bonus promotions and special offers weren't mentioned in the sources we reviewed.

Tradeable Assets: We couldn't find detailed information about specific investments and trading products in the sources we looked at.

Cost Structure: The Freestyle Checking account offers banking without fees, but we couldn't find specific details about spreads, commissions, and other trading costs in available sources. Customers should know about possible overdraft fees and other standard banking charges.

Leverage Ratios: We couldn't find specific leverage information for trading products in the sources we reviewed.

Platform Options: We couldn't find detailed information about trading platforms and technology in available public sources.

Geographic Restrictions: FNB mainly serves East Coast residents and those in the District of Columbia, with limited presence outside these areas.

Customer Service Languages: We couldn't find specific information about support in different languages in available sources.

This fnb review shows that potential customers need to do more research for specific trading and investment details not covered in public sources.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

FNB's accounts focus on traditional banking products, with the Freestyle Checking account as a main feature for customers who want banking without fees. This account doesn't charge monthly maintenance fees, which can save money for people who watch their spending carefully. The bank still charges overdraft fees, so customers need to manage their account balances carefully to avoid surprise charges.

We couldn't find details about how to open accounts and what requirements customers need to meet, making it hard to judge how easy it is to start new accounts. Customer feedback shows mixed experiences with managing accounts, with some users having trouble with basic things like making loan payments. Without complete information about account levels, minimum balance requirements, and extra features, it's hard to fully judge how FNB compares to competitors.

When compared to major competitors like Interactive Brokers or Fidelity, FNB seems to focus more on traditional banking instead of complete trading and investment platforms. This fnb review shows that while the free checking account provides value, the overall account package might not meet the needs of users who want advanced trading abilities or complete investment services.

Available sources give limited information about FNB's trading tools and analysis resources, suggesting either few offerings in this area or poor public disclosure of available capabilities. The lack of detailed information about research platforms, market analysis tools, or educational resources represents a big gap for users who want complete trading support.

Traditional banks often provide basic financial planning tools and resources, but we couldn't find good documentation of FNB's specific offerings in this area. The lack of information about automated trading support, advanced charting capabilities, or connections to third-party platforms suggests that users who need sophisticated trading tools may need to look elsewhere.

Customer feedback doesn't talk much about the quality or availability of analysis tools, which could mean either limited use of such features or insufficient provision of these services. For users who prioritize complete research and analysis capabilities, this lack of detailed tool information represents a significant limitation in FNB's service portfolio.

Customer Service and Support Analysis (2/10)

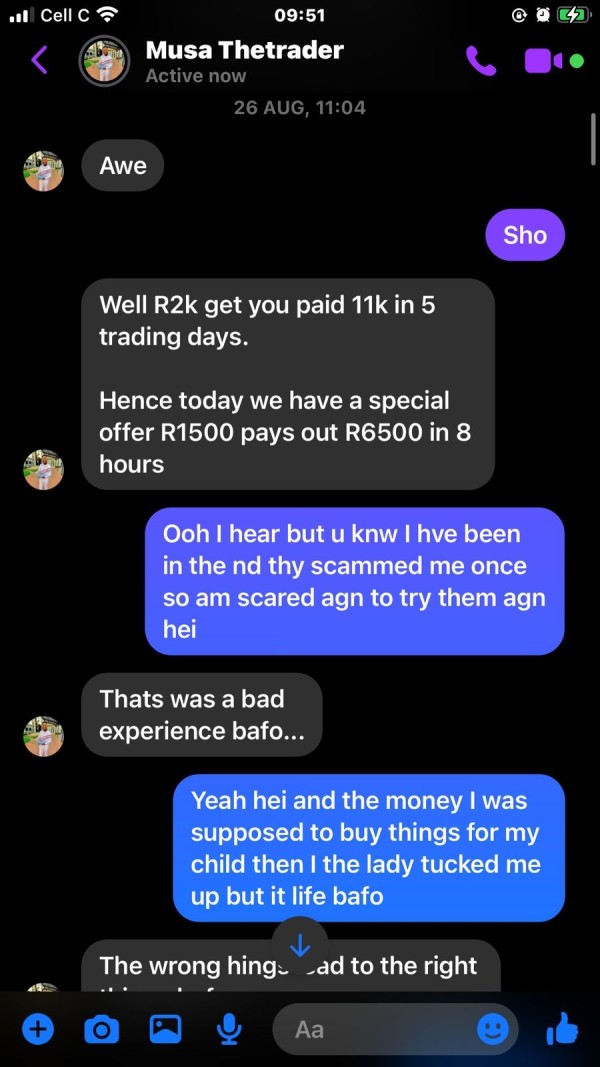

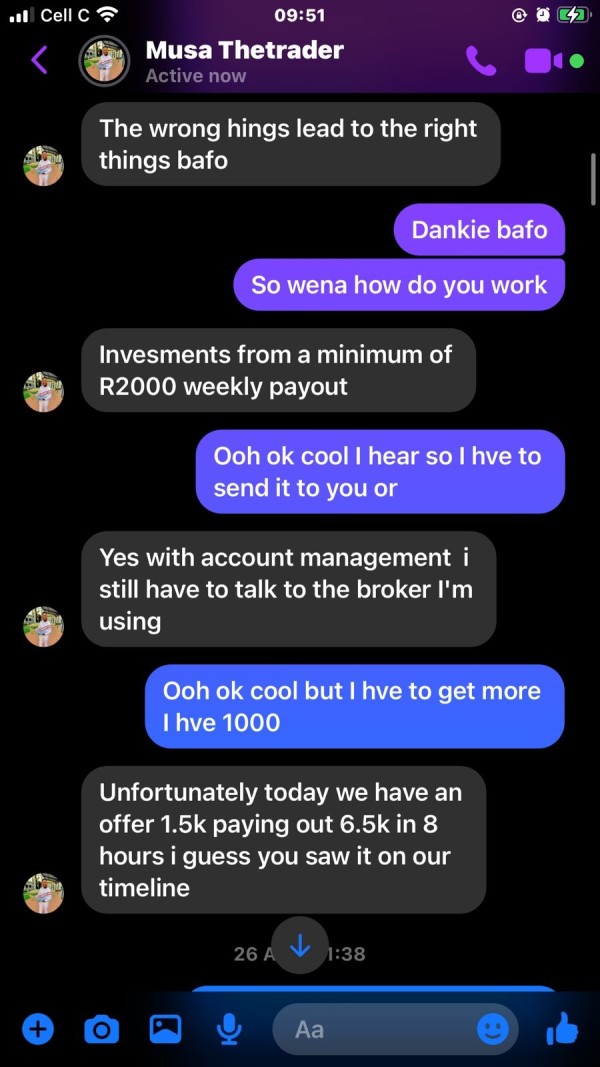

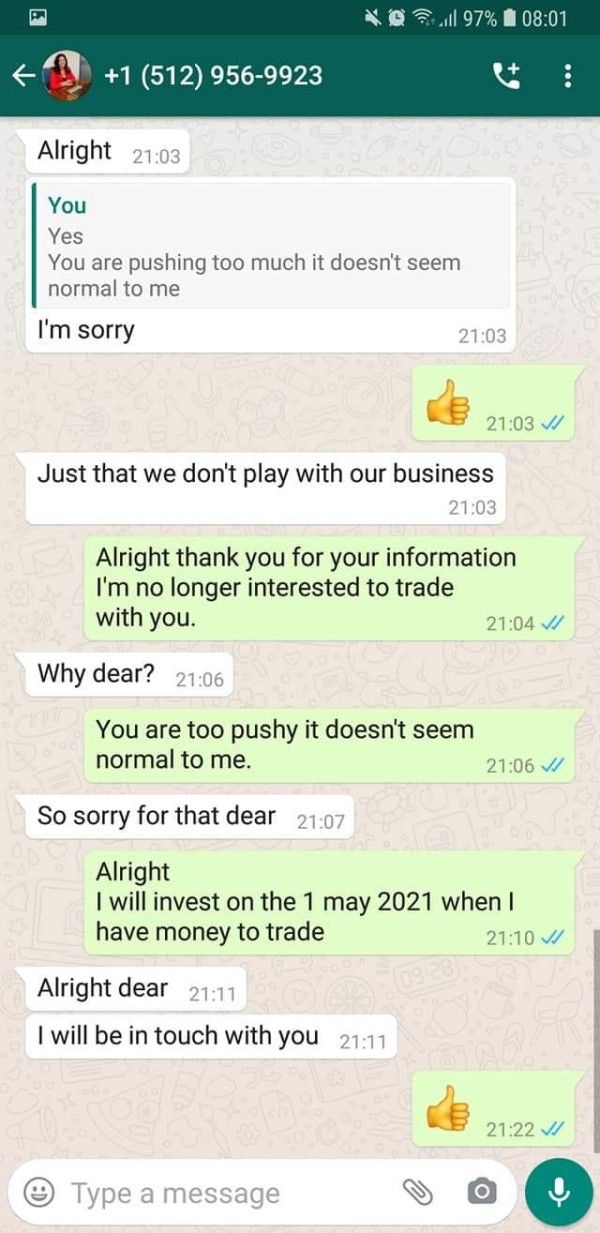

Customer service represents one of FNB's biggest challenges, based on available user feedback and ratings. Multiple customer stories highlight difficulties with basic operations, including payment processing problems that create frustration and inconvenience. One user specifically mentioned having unprecedented difficulty making car loan payments, suggesting system-wide issues with FNB's payment processing systems.

The overall customer rating of 3.1 out of 5 reflects widespread dissatisfaction with service quality, with several users giving one-star ratings along with detailed complaints about their experiences. These negative reviews often focus on operational difficulties and poor problem resolution, indicating potential problems in both system reliability and customer support responsiveness.

We couldn't find details about customer service channels, response times, and support in different languages in available sources, making it impossible to assess the accessibility and quality of support options. The pattern of negative feedback suggests that FNB may need significant improvements in customer service training, system reliability, and problem resolution processes to meet customer expectations and industry standards.

Trading Experience Analysis (4/10)

The trading experience evaluation is significantly limited by the lack of complete information about FNB's trading platforms and capabilities in available sources. This absence of detailed platform information suggests that FNB may not prioritize trading services or may not effectively communicate these capabilities to potential users.

We couldn't find information about platform stability, order execution quality, and mobile trading capabilities in available public information, making it impossible to provide detailed assessment of the actual trading environment. The lack of user feedback specifically related to trading experiences further complicates the evaluation process and may indicate limited usage of trading services among FNB's customer base.

For users seeking strong trading capabilities, the insufficient information about platform features, asset availability, and execution quality represents a significant concern. This fnb review suggests that potential trading clients should seek additional information directly from FNB or consider alternative platforms with more transparent and complete trading service documentation.

Trust and Reliability Analysis (3/10)

FNB's trust and reliability assessment reveals mixed indicators that raise concerns about overall institutional dependability. While the bank operates as an established financial institution with regulatory oversight, the pattern of customer complaints and low satisfaction ratings suggests potential issues with operational reliability and customer relationship management.

The 3.1 customer rating reflects underlying trust issues, with multiple users expressing frustration about basic service delivery and problem resolution. These negative experiences can significantly impact customer confidence and long-term relationship sustainability. The absence of detailed information about specific regulatory compliance measures and consumer protection policies in available sources further complicates the trust assessment.

We couldn't find complete coverage of fund security measures, deposit insurance coverage, and regulatory compliance details in available sources, though FNB should maintain standard protections as a banking institution. However, the pattern of operational difficulties reported by customers suggests potential gaps between regulatory compliance and practical service delivery that could affect customer trust and satisfaction levels.

User Experience Analysis (3/10)

User experience represents another area of significant concern for FNB, with customer feedback indicating widespread dissatisfaction with overall service quality and operational efficiency. The 3.1 rating reflects consistent problems that affect daily banking and financial service interactions, creating frustration and inconvenience for users seeking reliable financial services.

Customer stories frequently mention difficulties with basic operations like payment processing, suggesting system-wide issues that impact the fundamental user experience. These operational problems can create significant stress for customers attempting to manage their financial obligations and may indicate broader issues with system design, staff training, or process optimization.

The geographic limitation to East Coast markets may provide some advantages in terms of regional focus and local market knowledge, but customer feedback suggests that these potential benefits are not translating into superior user experiences. Users seeking reliable, efficient financial services may find FNB's current performance levels insufficient for their needs, particularly when compared to institutions with stronger customer satisfaction records.

Conclusion

This fnb review reveals a financial institution facing significant challenges in customer satisfaction and service delivery despite its established market presence and regional focus. While FNB offers some attractive features like the free Freestyle Checking account and operates across multiple East Coast states, the consistent pattern of customer complaints and low satisfaction ratings raises serious concerns about service quality and operational efficiency.

FNB appears most suitable for users seeking basic banking services in East Coast markets who prioritize regional presence over complete service quality. However, customers should carefully consider the documented service issues and limited information about advanced financial services before committing to FNB as their primary financial institution. The bank's strengths lie in its regional market knowledge and free checking options, but significant weaknesses in customer service and user experience may outweigh these benefits for many potential customers.