BSE Review 2

They delay the order for so long

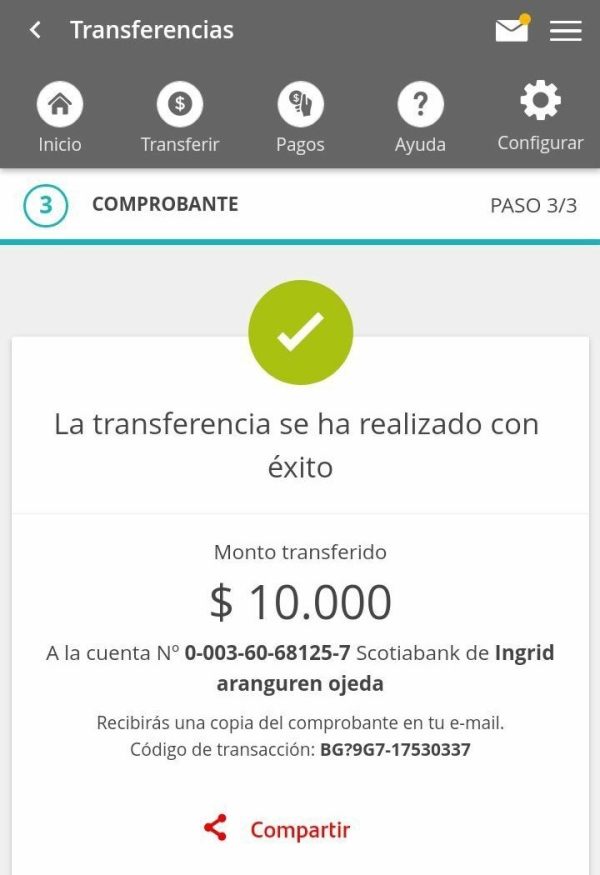

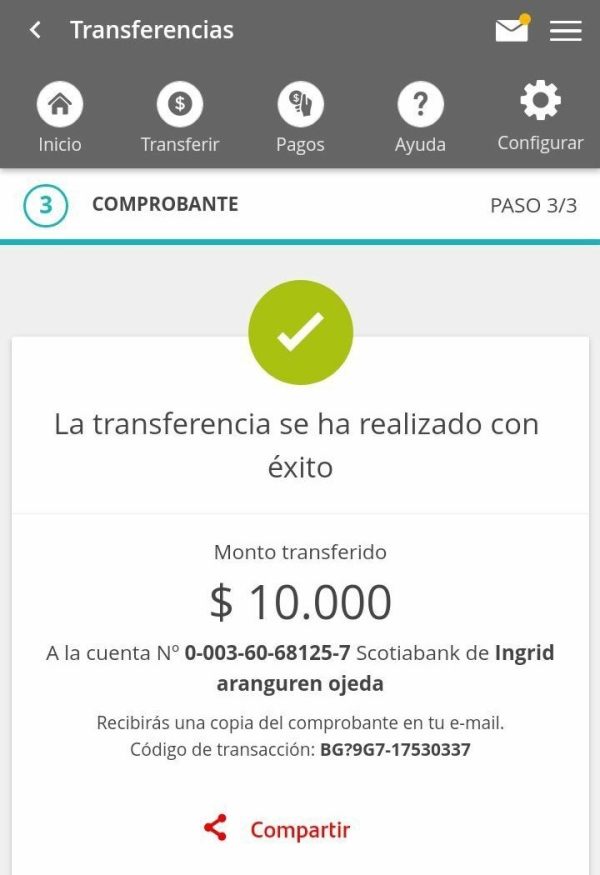

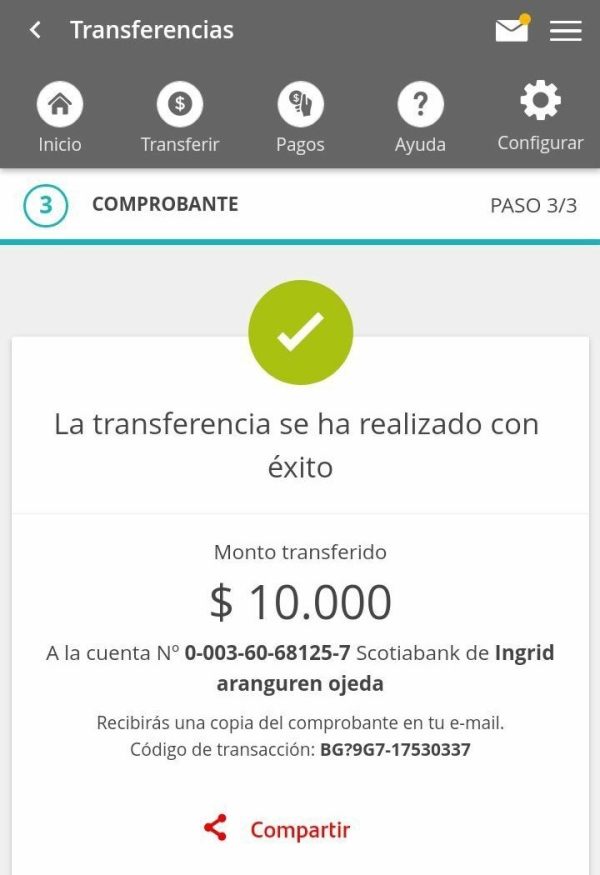

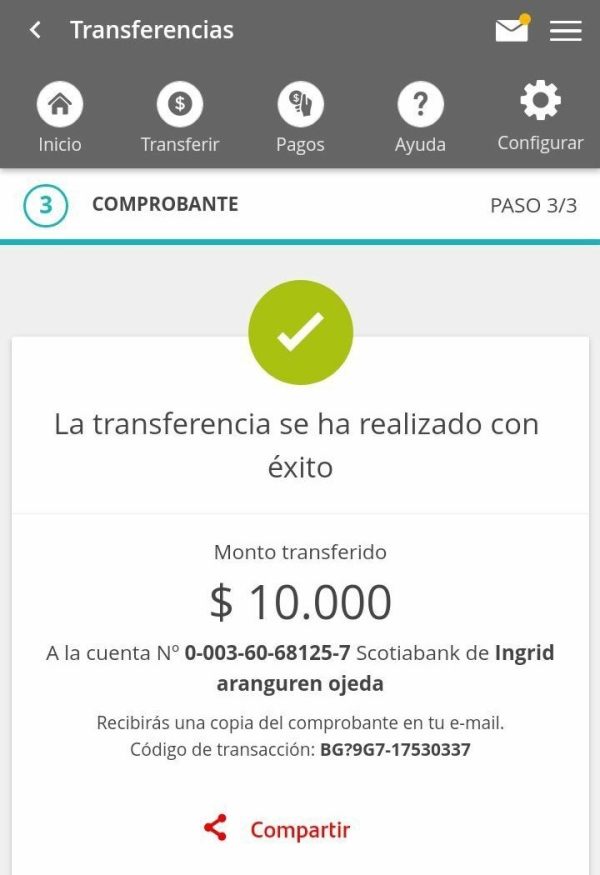

I deposited $10,000 but lost all of it. The scammers cheated me and promised the profit of $300 every week. But my withdrawal did not arrive. I went bankruptcy and had to raise the family.

BSE Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

They delay the order for so long

I deposited $10,000 but lost all of it. The scammers cheated me and promised the profit of $300 every week. But my withdrawal did not arrive. I went bankruptcy and had to raise the family.

This comprehensive bse review examines the Bombay Stock Exchange. BSE is one of Asia's oldest stock exchanges and plays a major role in India's financial markets. Overall, BSE shows mixed results. Employee ratings average 3.7 out of 5 on AmbitionBox, while user ratings stand at 3 out of 5 according to Justdial reviews. The exchange demonstrates solid institutional confidence with 64% of employees on Glassdoor recommending BSE as a workplace. This indicates internal organizational strength.

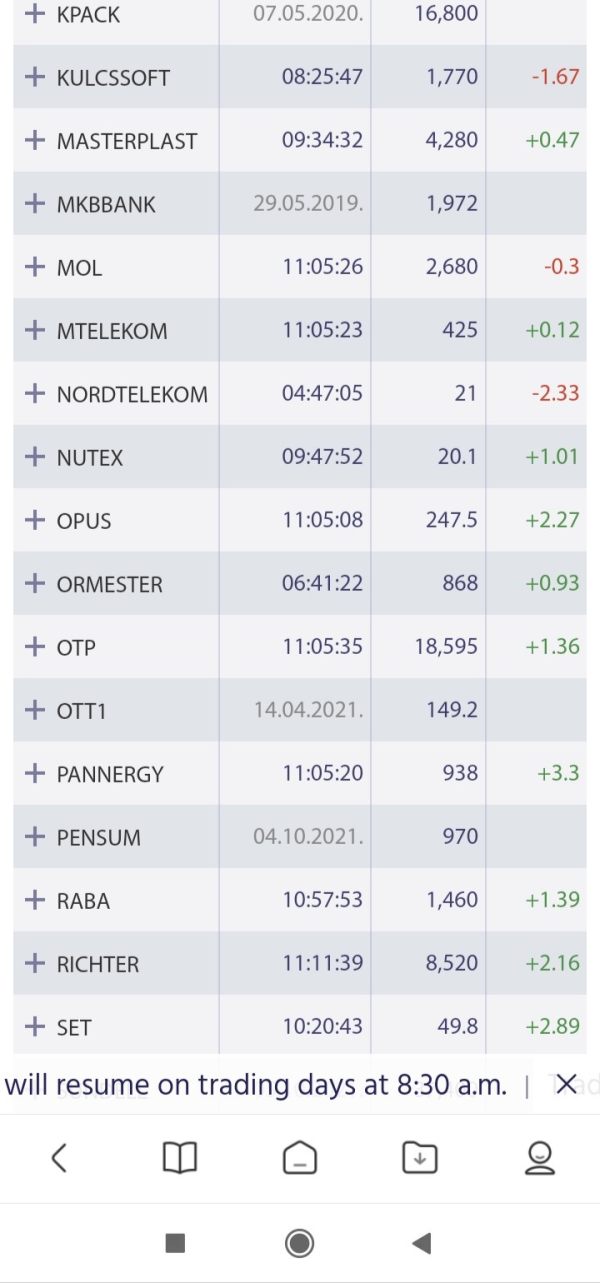

BSE's main appeal lies in its comprehensive equity trading platform. It serves as India's premier stock exchange, offering access to over 5,000 listed companies. The BSE PSU index shows promising growth potential. This makes it attractive for investors seeking exposure to India's public sector enterprises. The platform primarily targets retail investors, institutional traders, and international investors looking to access Indian equity markets.

However, limited information availability regarding specific trading conditions creates challenges. Customer service protocols and detailed fee structures are not clearly outlined. This presents problems for potential users seeking comprehensive service details. The exchange's focus remains heavily concentrated on the Indian domestic market. This may limit its appeal for traders seeking diverse international exposure.

BSE operates primarily as a stock exchange within India's regulatory framework. This may differ significantly from international brokerage services in terms of operational structure, regulatory oversight, and service delivery. As an exchange rather than a traditional forex broker, BSE's services and evaluation criteria differ from conventional brokerage platforms.

This review methodology combines employee feedback from platforms like Glassdoor and AmbitionBox with user ratings from Justdial. The analysis is supplemented by available market data and industry research. Readers should note that specific regulatory details and comprehensive service information were not extensively detailed in available materials. This may limit the depth of certain analytical sections.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific information in available materials not detailed |

| Tools and Resources | N/A | Specific information in available materials not detailed |

| Customer Service | N/A | Specific information in available materials not detailed |

| Trading Experience | N/A | Specific information in available materials not detailed |

| Trust and Reliability | N/A | Specific information in available materials not detailed |

| User Experience | 6/10 | Based on 3.7/5 employee rating and 3/5 user rating |

BSE was established as the Bombay Stock Exchange. It stands as one of Asia's oldest and most significant stock exchanges, playing a crucial role in India's capital markets ecosystem. While specific founding details were not comprehensively covered in available materials, BSE has evolved into a major financial institution. The exchange facilitates equity trading for thousands of companies across various sectors. BSE operates primarily within India's domestic market, providing a platform for both retail and institutional investors to trade securities.

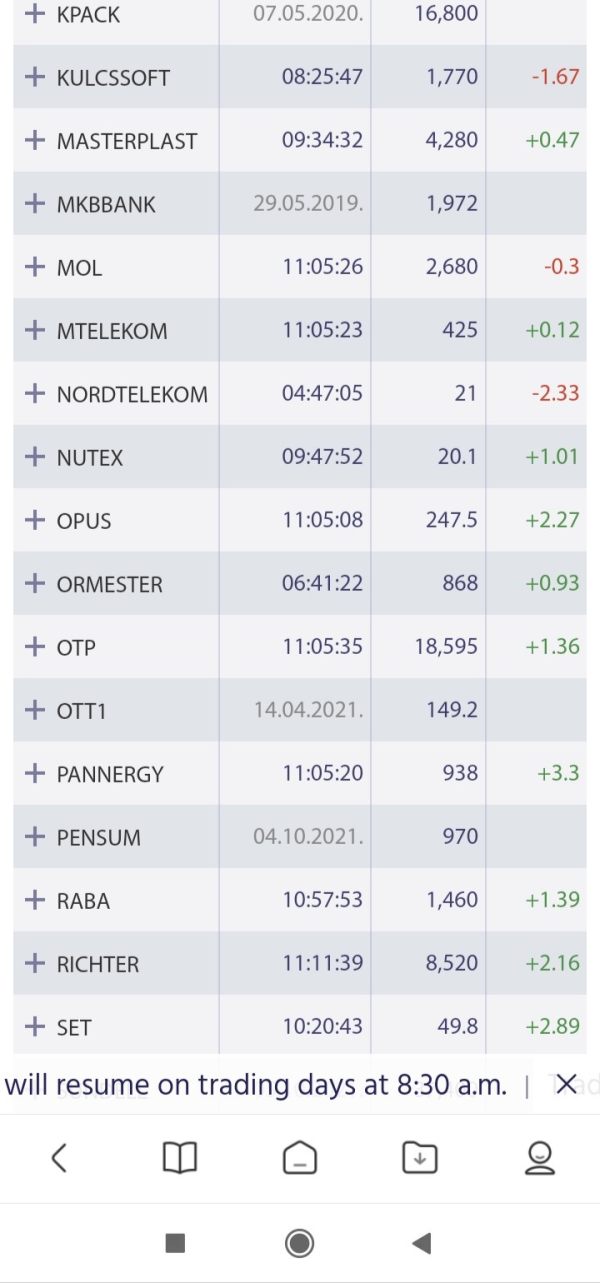

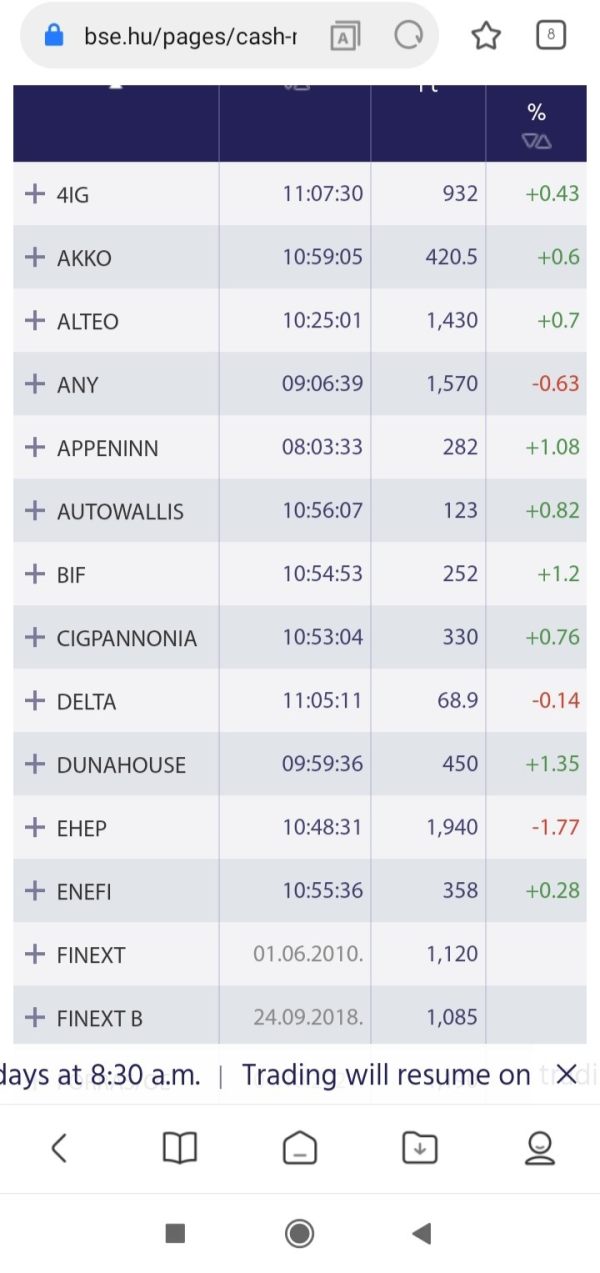

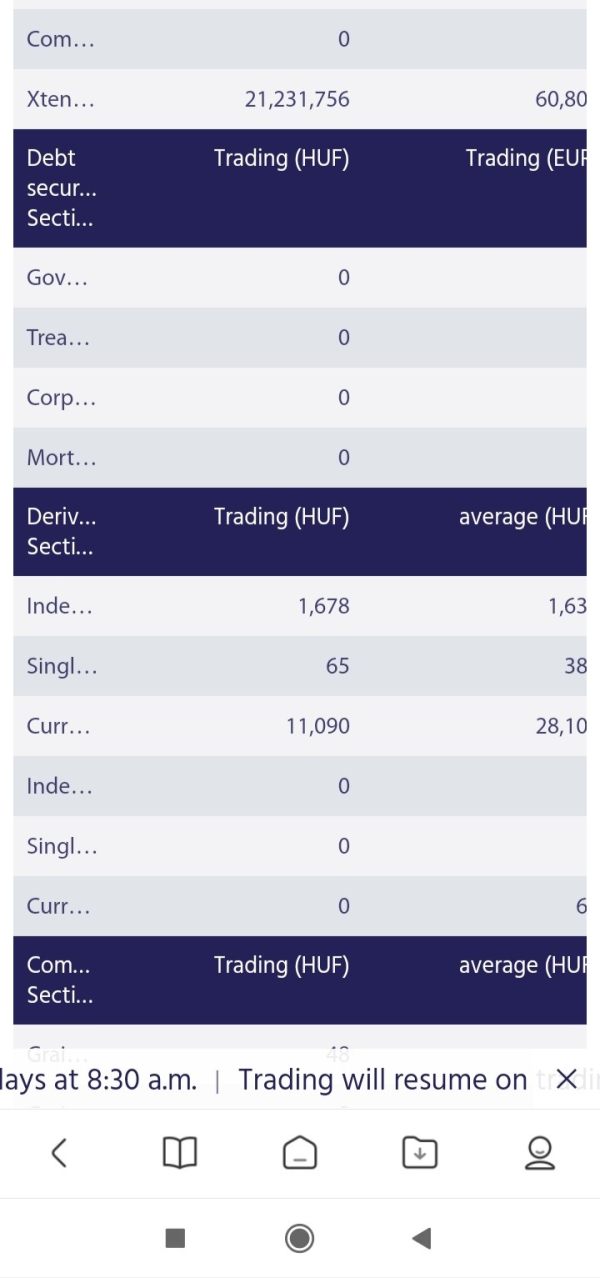

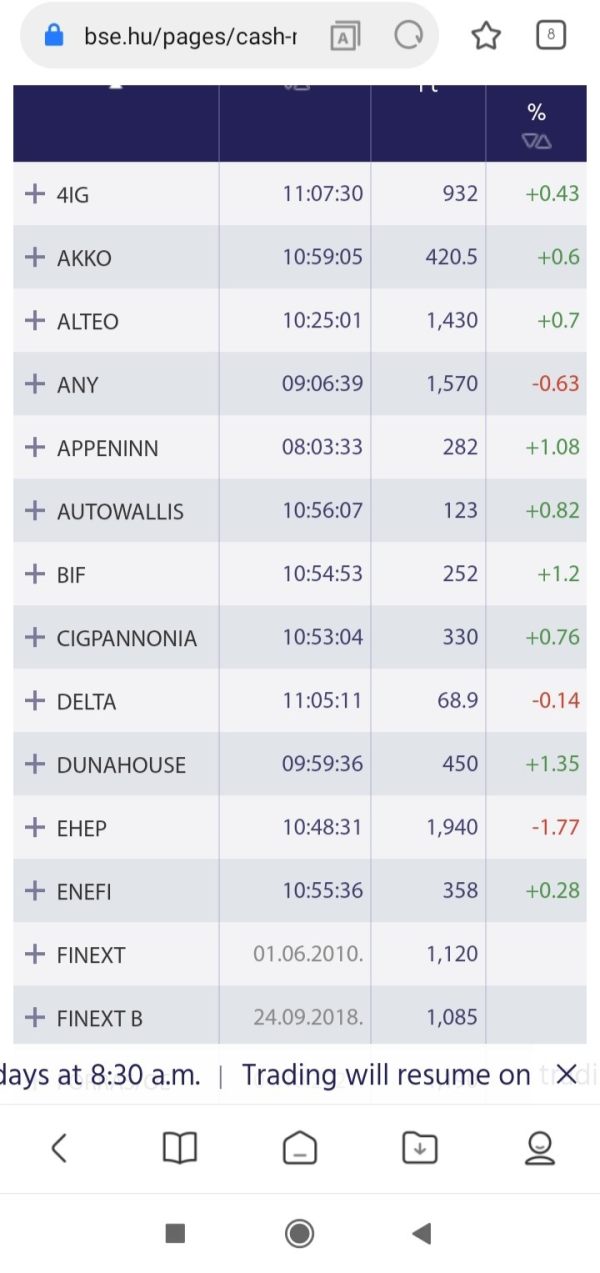

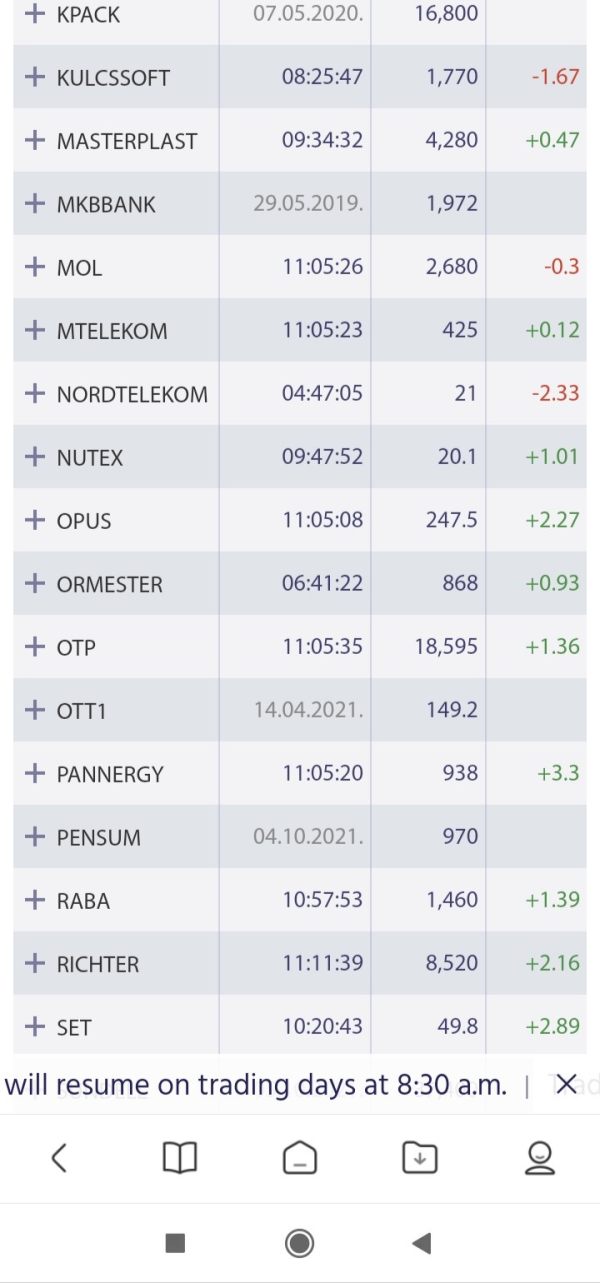

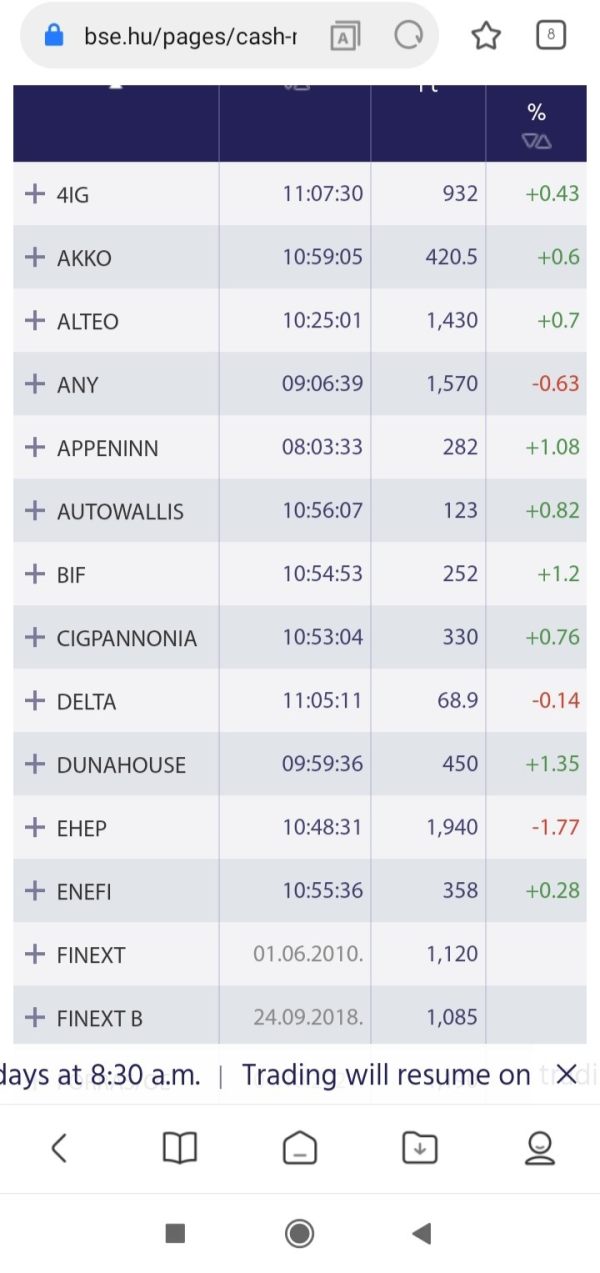

The exchange's business model centers on facilitating securities trading. It particularly focuses on the cash equity segment, while also offering various financial derivatives and other investment instruments. BSE serves as a critical infrastructure provider for India's financial markets. The exchange connects buyers and sellers through its electronic trading platform. BSE's role extends beyond simple trade facilitation, encompassing market regulation, price discovery, and maintaining trading standards across its listed securities.

According to available information, BSE primarily focuses on cash market trading for stocks and other financial instruments. Specific details about platform types and comprehensive asset coverage were not extensively detailed in source materials. The exchange operates under Indian financial regulations. Specific regulatory body details were not comprehensively outlined in available documentation.

Regulatory Jurisdiction: Specific information in available materials not detailed regarding primary regulatory oversight. BSE operates within India's financial regulatory framework as a recognized stock exchange.

Deposit and Withdrawal Methods: Specific information in available materials not detailed regarding funding mechanisms and withdrawal procedures for traders using BSE's platform.

Minimum Deposit Requirements: Specific information in available materials not detailed regarding minimum capital requirements for account opening or trading participation.

Bonuses and Promotions: Specific information in available materials not detailed regarding promotional offers or incentive programs for new or existing users.

Tradeable Assets: BSE primarily facilitates trading in cash market securities. The exchange focuses on equity stocks from over 5,000 listed companies across various sectors, including the BSE PSU index covering public sector enterprises.

Cost Structure: Specific information in available materials not detailed regarding trading fees, spreads, commissions, or other cost components associated with using BSE's trading platform.

Leverage Options: Specific information in available materials not detailed regarding leverage ratios or margin trading facilities available through the exchange.

Platform Selection: Specific information in available materials not detailed regarding trading platform options, software choices, or technological infrastructure details.

Geographic Restrictions: Specific information in available materials not detailed regarding international access limitations or regional trading restrictions.

Customer Service Languages: Specific information in available materials not detailed regarding multilingual support options or communication channels available to users.

This bse review highlights the significant information gaps present in publicly available materials. These gaps may impact traders' ability to make fully informed decisions about engaging with the platform.

The evaluation of BSE's account conditions faces significant limitations. This is due to insufficient detailed information in available materials regarding specific account types, opening procedures, and associated requirements. Unlike traditional forex brokers that typically offer multiple account tiers with varying features and minimum deposits, BSE operates as a stock exchange. Access is generally facilitated through registered brokers and intermediaries.

Specific information in available materials not detailed regarding minimum deposit amounts, account verification processes, or different account categories available to various investor types. The absence of clear account condition information makes it challenging to assess the accessibility and suitability of BSE's services. This affects evaluation for different investor segments, from retail traders to institutional participants.

Without comprehensive details about account opening requirements, maintenance fees, or specific documentation needed for different investor categories, potential users may find it difficult to prepare adequately for engagement with the platform. The lack of transparent account condition information represents a significant gap in this bse review. This highlights the need for more detailed disclosure from the exchange regarding user onboarding and account management procedures.

The assessment of BSE's trading tools and analytical resources encounters substantial limitations. This is due to the lack of specific information in available materials regarding platform capabilities, research offerings, and educational resources. Traditional exchanges typically provide various analytical tools, market data feeds, and research reports to support informed trading decisions. However, detailed specifications of BSE's offerings remain unclear.

Specific information in available materials not detailed regarding the availability of technical analysis tools, fundamental research reports, real-time market data quality, or third-party integrations that might enhance the trading experience. The absence of clear information about educational resources, webinars, market commentary, or training materials makes it difficult to evaluate BSE's commitment to trader education and skill development.

Without detailed information about automated trading support, API access, or algorithmic trading capabilities, technologically oriented traders cannot adequately assess whether BSE's platform meets their sophisticated trading requirements. This information gap significantly impacts the comprehensiveness of this evaluation. It suggests potential users should seek additional details directly from BSE or registered brokers.

Evaluating BSE's customer service capabilities proves challenging. This is due to insufficient specific information in available materials regarding support channels, response times, and service quality metrics. Effective customer support is crucial for any financial platform, particularly for resolving trading issues, account problems, or technical difficulties that may arise during market hours.

Specific information in available materials not detailed regarding available communication channels such as phone support, email assistance, live chat options, or in-person support availability. The absence of information about customer service hours, multilingual support capabilities, or specialized support for different types of trading issues creates uncertainty. Users cannot be sure about the level of assistance they can expect when problems arise.

Without clear data about average response times, problem resolution rates, or customer satisfaction metrics specific to support services, potential users cannot adequately assess whether BSE's customer service infrastructure meets their expectations and requirements. The lack of detailed support information represents a significant consideration for traders who value responsive and comprehensive customer assistance.

Assessing the overall trading experience on BSE encounters substantial limitations. This is due to insufficient specific information in available materials regarding platform stability, execution quality, and user interface design. The trading experience encompasses crucial factors such as order execution speed, platform reliability during high-volume periods, and the overall user-friendliness of the trading interface.

Specific information in available materials not detailed regarding platform uptime statistics, order execution speeds, slippage rates, or system performance during peak trading hours. The absence of detailed information about mobile trading capabilities, platform customization options, or advanced order types makes it difficult to evaluate whether BSE's trading environment meets modern trader expectations.

Without comprehensive data about the user interface design, navigation efficiency, or the learning curve for new users, potential traders cannot adequately assess whether the platform suits their trading style and technical proficiency level. This bse review identifies the need for more transparent disclosure of trading experience metrics and platform capabilities. This would support informed user decisions.

Evaluating BSE's trustworthiness and reliability faces challenges. This is due to limited specific information in available materials regarding detailed regulatory compliance, security measures, and transparency practices. Trust represents a fundamental factor for any financial institution, particularly for exchanges handling significant trading volumes and investor funds.

Specific information in available materials not detailed regarding comprehensive regulatory oversight details, security protocols for protecting user data and funds, or transparency measures in reporting and operations. The absence of detailed information about insurance coverage, segregation of client funds, or third-party auditing practices makes it difficult to fully assess the safety and security of engaging with the platform.

Without clear information about the exchange's track record in handling security incidents, regulatory compliance history, or dispute resolution mechanisms, potential users cannot completely evaluate the risk profile associated with using BSE's services. The limited transparency in available materials regarding these critical trust factors represents an important consideration for risk-conscious investors.

Based on available rating data, BSE's user experience presents a mixed picture. Employee satisfaction rating stands at 3.7 out of 5 and user ratings at 3 out of 5, suggesting moderate satisfaction levels across different stakeholder groups. The 64% employee recommendation rate on Glassdoor indicates reasonable internal organizational health. This often correlates with service quality delivery.

The user rating of 3 out of 5 suggests that while BSE provides functional services, there may be room for improvement in areas such as user interface design, service delivery, or meeting evolving user expectations. Specific information in available materials not detailed regarding common user complaints, praise points, or specific areas where users express satisfaction or dissatisfaction.

The target demographic of retail investors and those interested in Indian markets appears to find BSE's services adequate but not exceptional, based on the moderate rating levels. Without detailed user feedback about specific pain points or particularly valued features, it's challenging to identify precise areas for improvement or standout qualities. This makes it difficult to determine what differentiates BSE from competitors in the Indian market space.

This bse review reveals that BSE operates as a significant player in India's financial markets with moderate satisfaction levels among both employees and users. The exchange appears suitable for investors specifically interested in accessing Indian equity markets, particularly those focused on the extensive range of listed companies available through the platform. The 64% employee recommendation rate suggests reasonable organizational stability. This can translate to consistent service delivery.

However, the limited availability of detailed information regarding trading conditions, customer service protocols, and comprehensive platform features represents a significant drawback for potential users seeking transparent and detailed service specifications. The moderate user rating of 3 out of 5 indicates that while BSE provides functional services, there may be opportunities for enhancement in user experience and service delivery.

BSE appears most suitable for retail investors and institutional traders specifically targeting Indian markets, particularly those interested in the BSE PSU index and the broad range of listed securities. However, traders seeking comprehensive international exposure or detailed transparency regarding trading conditions may need to consider additional research or alternative platforms. This would help them meet their specific requirements.

FX Broker Capital Trading Markets Review