TCC Review 1

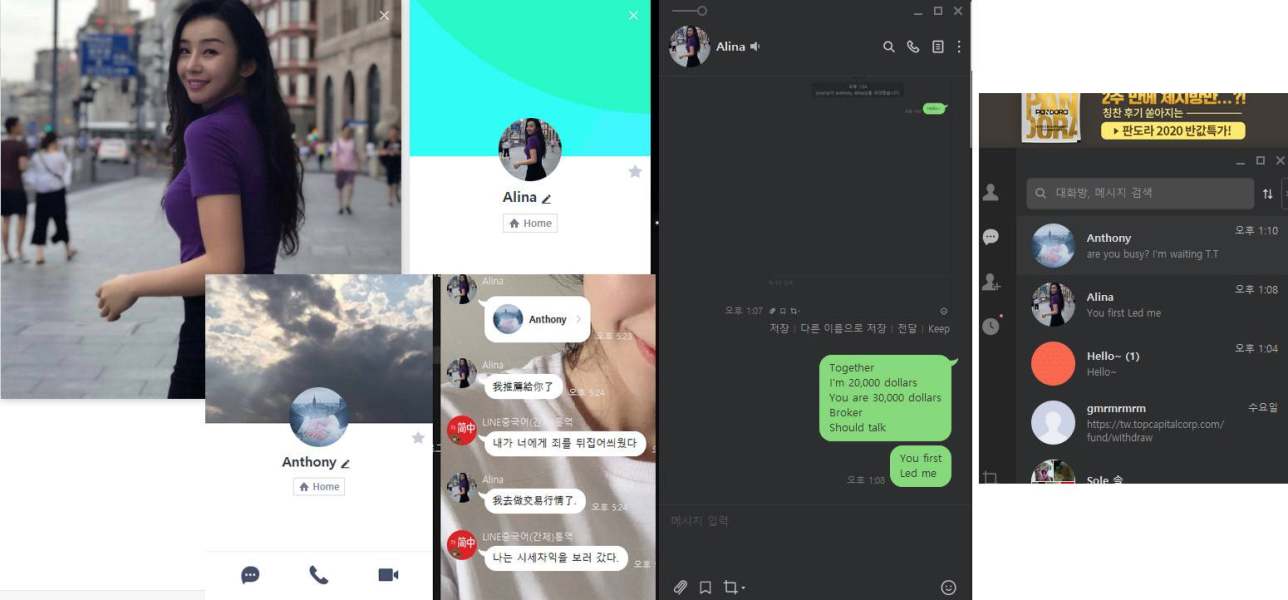

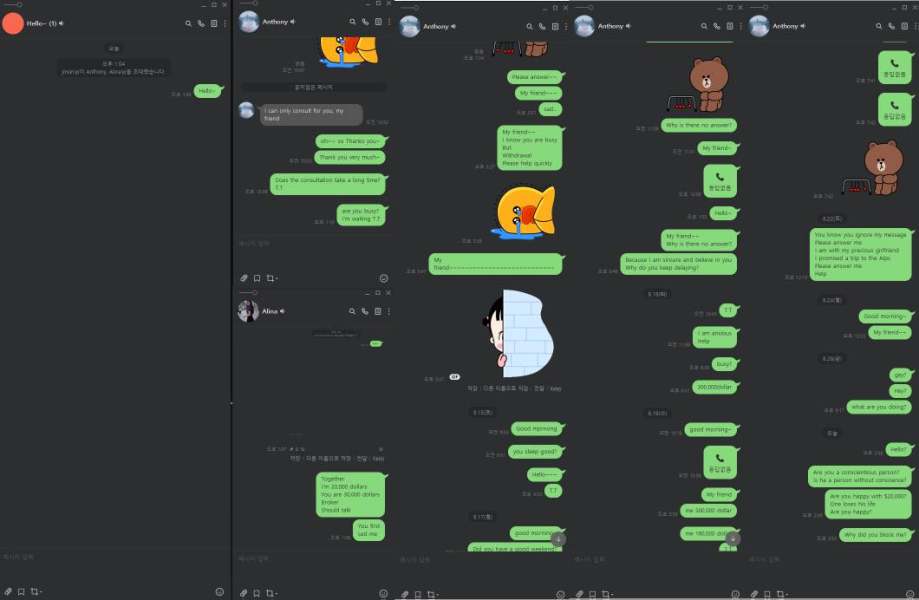

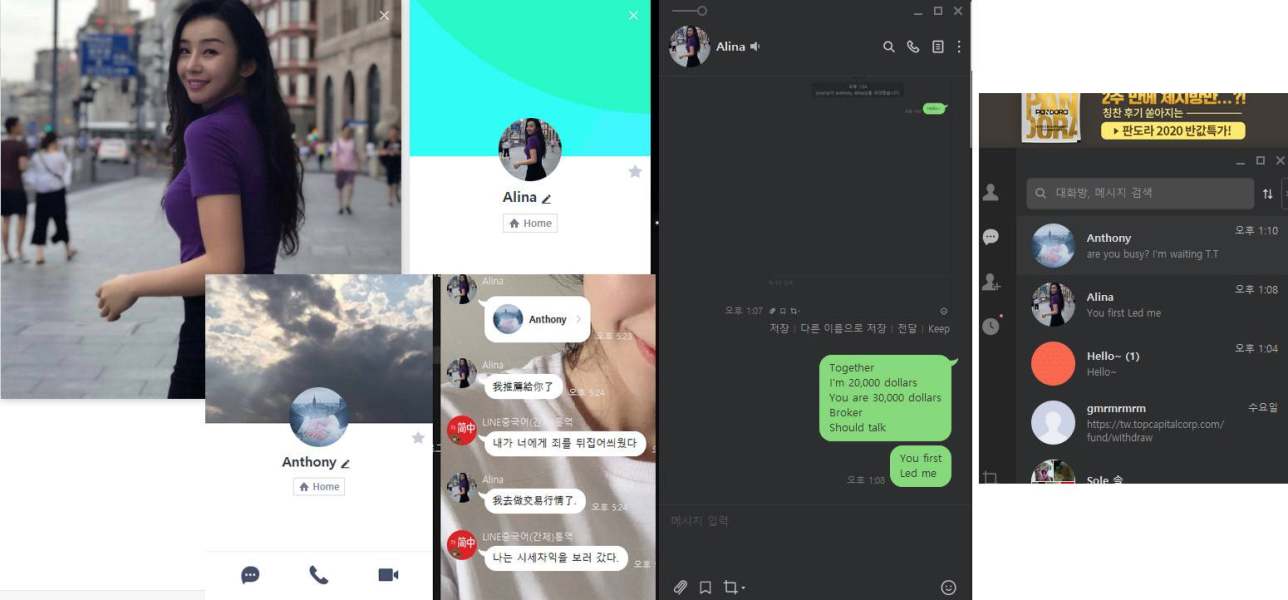

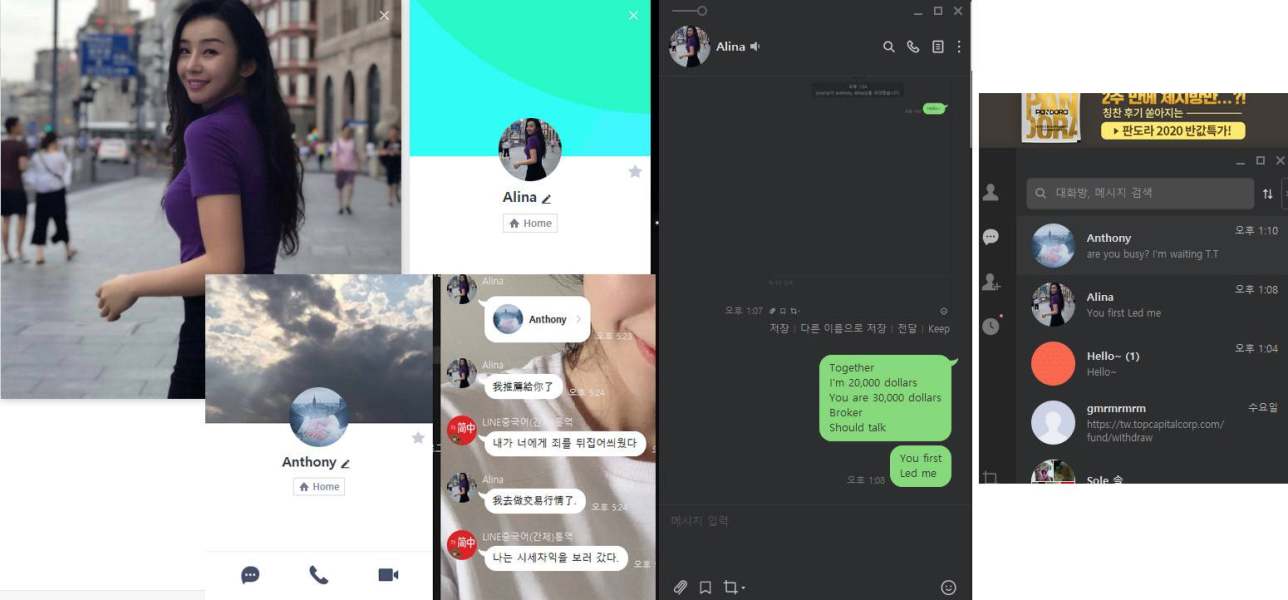

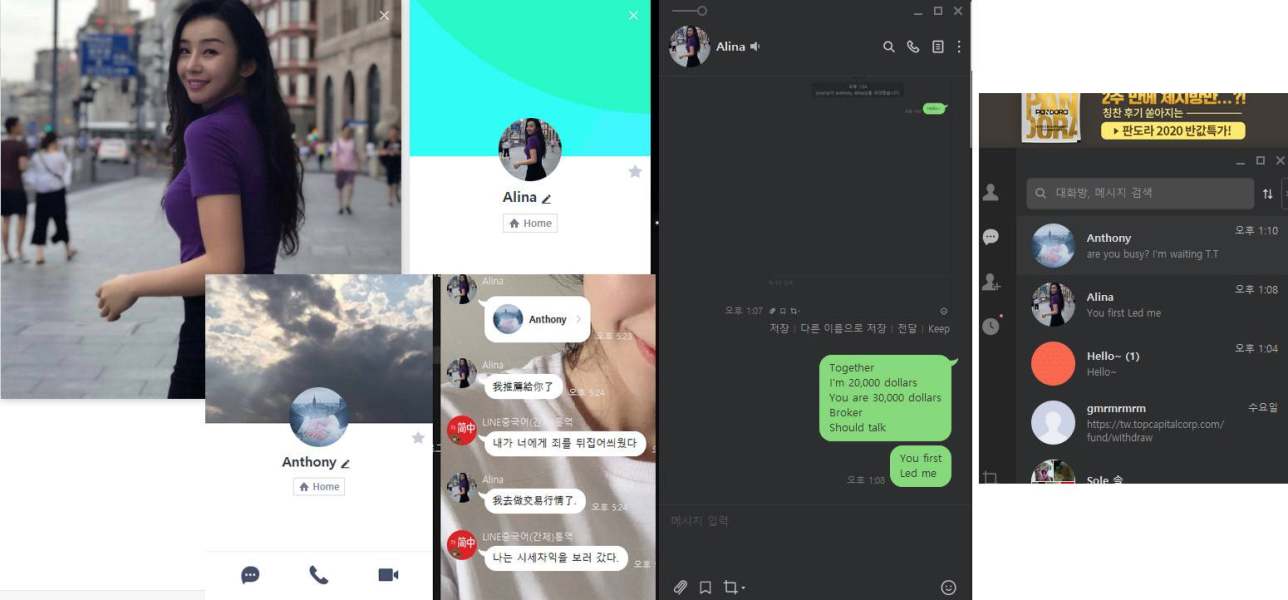

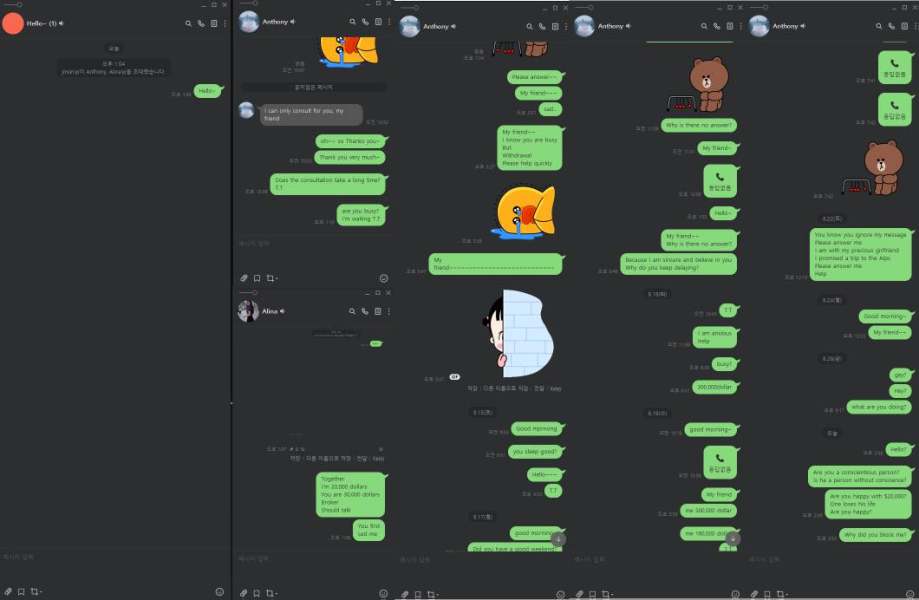

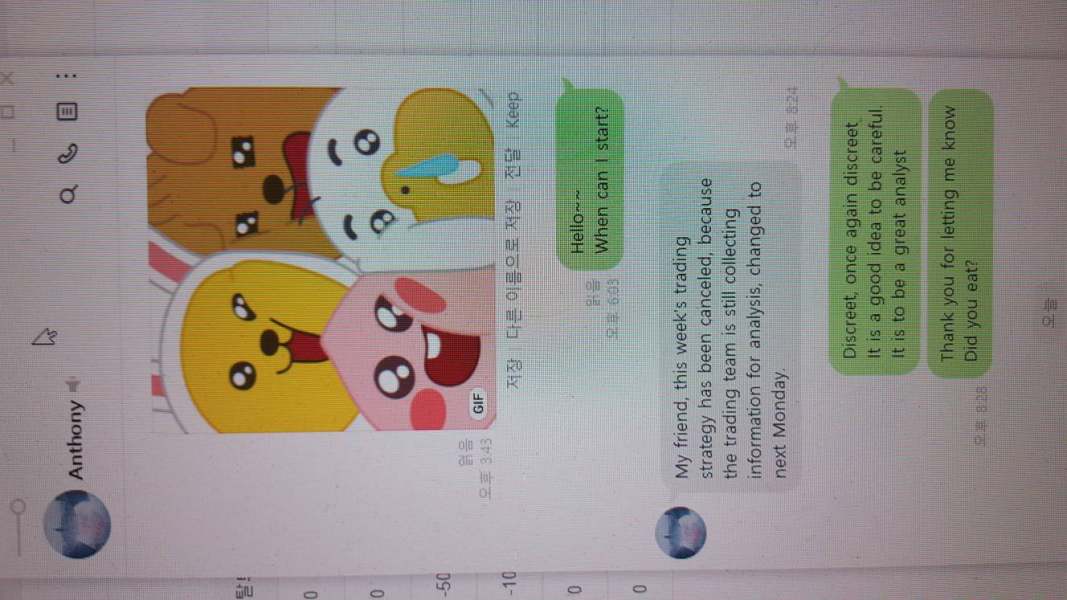

Never use it scammer Sweet words they say Ignore it I suffered a $2500 scam

TCC Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Never use it scammer Sweet words they say Ignore it I suffered a $2500 scam

TCC, known as Top Capital Corporation Limited, has made headlines in the forex trading community for both its enticing offers and troubling history. Founded in 2009, TCC operates as an online trading platform promising high leverage up to 1:500, starting spreads as low as 0.03 pips, and a standardized account type with a minimum deposit of $200. These offerings appeal particularly to experienced traders seeking to maximize their trading potential with low costs. However, TCCs unregulated status and a history of withdrawal issues raise significant red flags. Numerous complaints highlight the difficulty traders have faced when trying to access their funds, with some alleging they have lost substantial amounts. As such, new traders and risk-averse investors are advised to approach with caution. The blend of attractive trading conditions and serious operational risks poses a sobering challenge for potential clients.

Risk Statement: Trading with TCC comes with substantial risks that can result in significant financial losses.

Potential Harms:

Verification Guide:

| Dimension | Rating (Out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | TCC lacks regulatory oversight and has a history of user complaints and withdrawal issues. |

| Trading Costs | 4 | Offers low spreads and high leverage; however, hidden fees may offset these benefits. |

| Platforms & Tools | 3 | Utilizes MT4 platform but has limited educational resources; not beginner-friendly. |

| User Experience | 2 | Numerous complaints indicate poor customer service experiences and withdrawal difficulties. |

| Customer Support | 1 | Users report severe difficulties in accessing support and retrieving funds. |

| Account Conditions | 3 | High leverage and low minimum deposits are appealing, yet risks involved are a significant concern. |

TCC was established in 2009 and incorporated in the United Kingdom. The company, operating under the name of Top Capital Corporation Limited, aimed to serve traders by offering forex, Contracts for Difference (CFDs), and derivative products. However, the regulatory status of the broker has been a topic of concern. TCC's previous claims of regulation by the UK's Financial Conduct Authority (FCA) were revoked, leaving the broker unregulated. This creates a concerning operational legitimacy for traders looking for a secure trading environment.

TCC offers a limited range of trading options, specializing in forex, CFDs, and derivatives. The trading platform provided is MetaTrader 4 (MT4), a popular software utilized by many forex brokers globally. TCC claims to offer a plethora of forex trading pairs, although the absence of regulation poses risks for traders. The official website is currently inaccessible, further exacerbating concerns regarding TCC's operational capacity and legitimacy.

| Key Details | Information |

|---|---|

| Regulation | Unregulated (FCA revoked license) |

| Minimum Deposit | $200 |

| Leverage | Up to 1:500 |

| Major Fees | Withdrawal fees up to 2.50% (credit/debit cards) |

| Trading Platforms | MT4 |

| Customer Support | Limited availability, multiple complaints |

The lack of a regulatory framework for TCC presents significant risks to traders. The brokerage's former connection to the FCA has been revoked, which allows for high levels of uncertainty regarding safety and operational standards. This lack of oversight has led to numerous user complaints and warnings from both regulatory bodies and other traders.

Analysis of Regulatory Information Conflicts:

Conflicting information regarding TCC's regulatory status significantly raises alarms. The FCA has noted that TCC is no longer registered, exposing traders to unregulated risks that can lead to significant financial losses.

User Self-Verification Guide:

User feedback indicates a deteriorating sentiment towards fund safety with TCC.

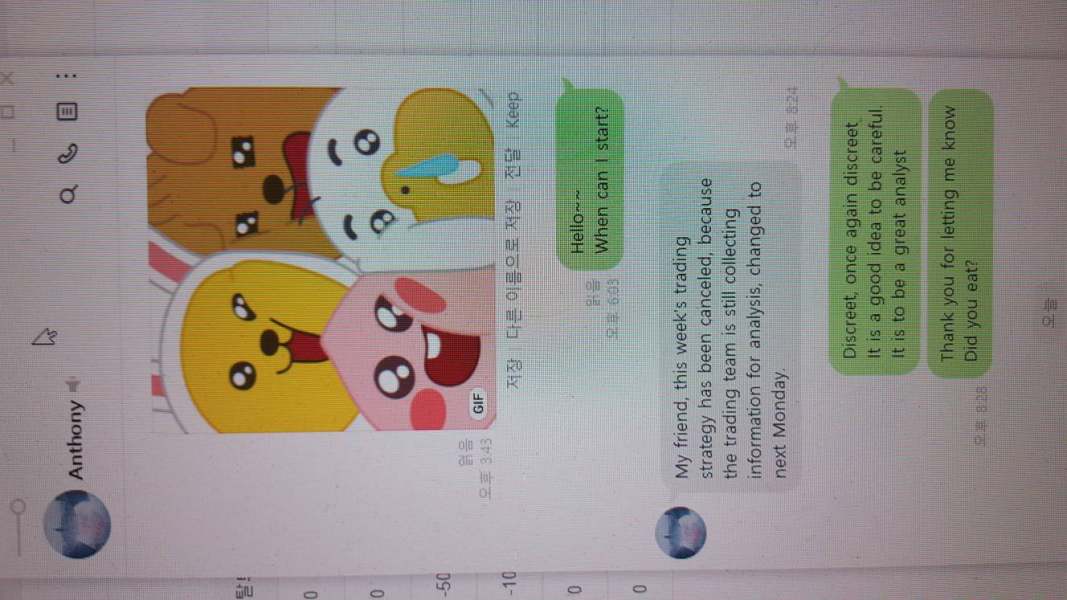

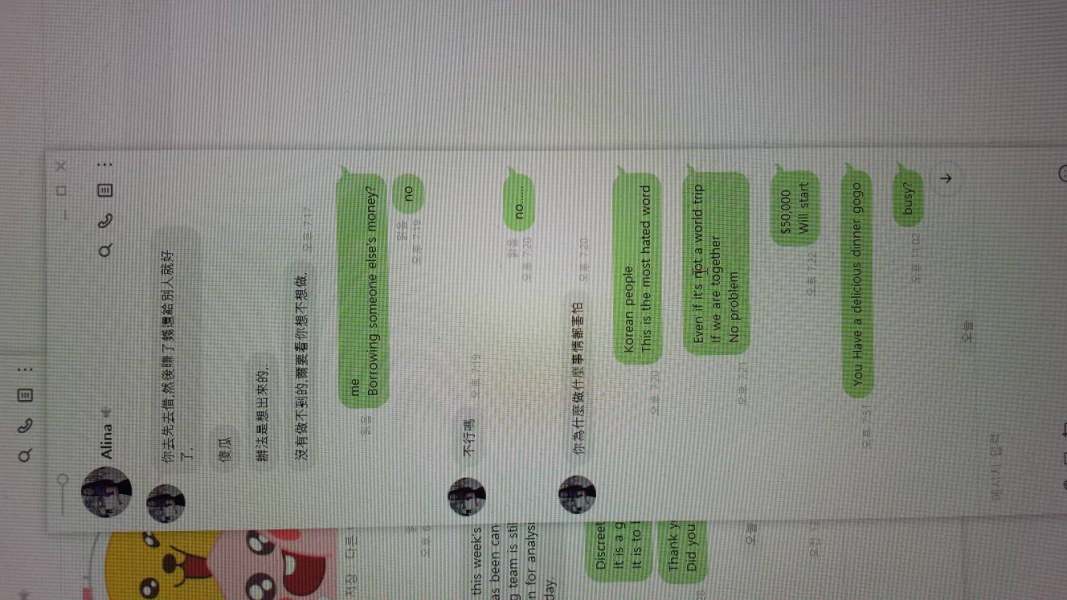

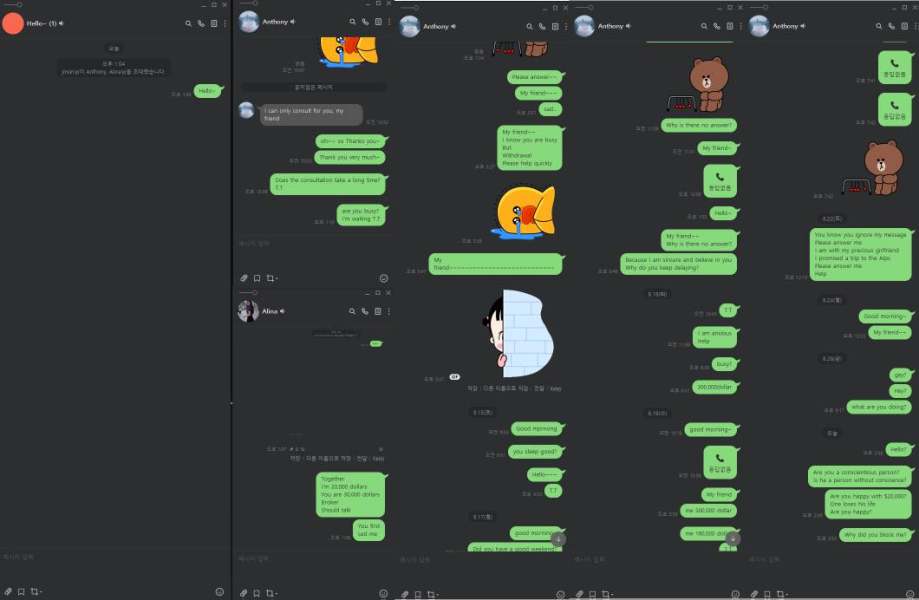

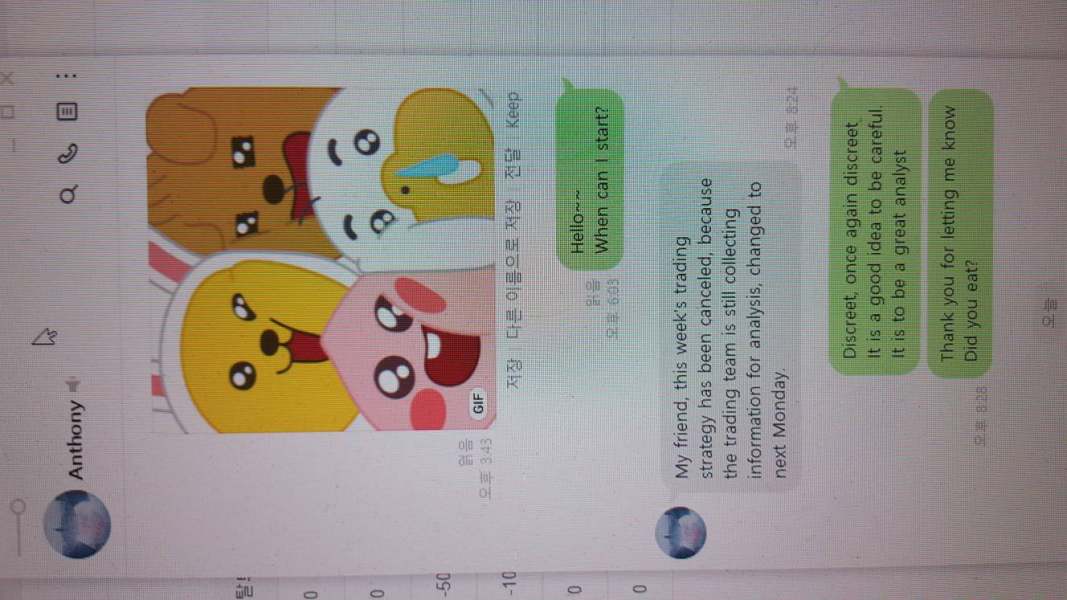

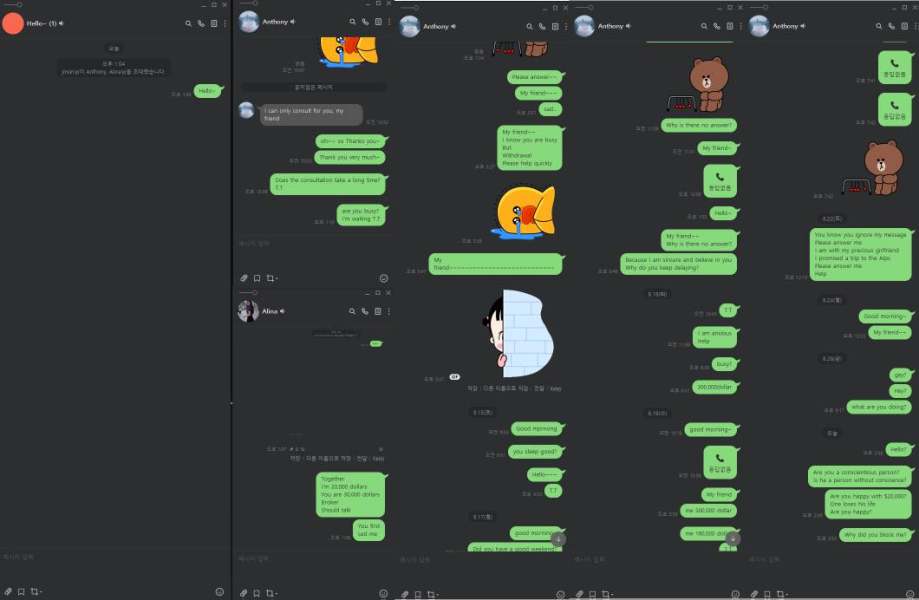

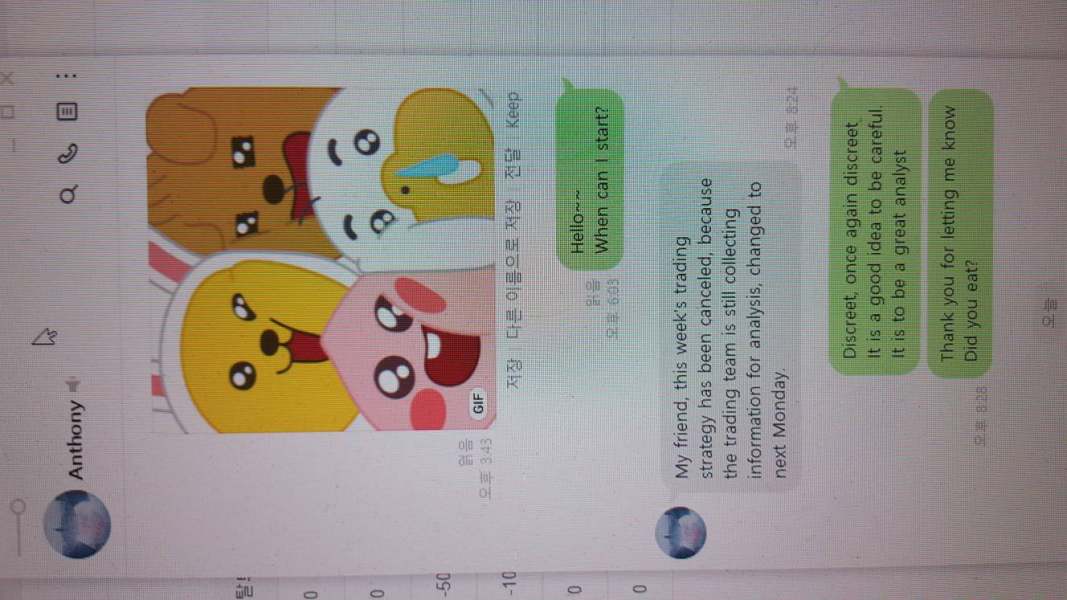

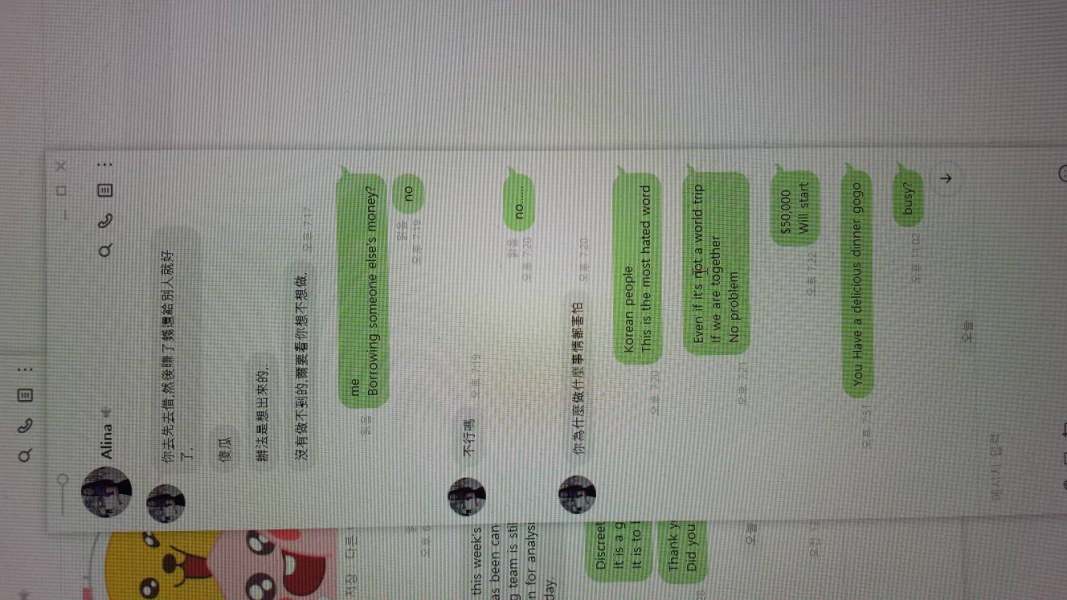

"Within about 6 weeks of using the group, everybody just disappeared, including Angela. I have been unable to withdraw my money from my account and nobody can be contacted" - a user complaint that illustrates serious trust issues.

While TCCs low commission structure and spreads might attract traders, the following hidden costs can potentially negate those advantages.

Advantages in Commissions:

TCC boasts a competitive low commission structure, with spreads starting at 0.03 pips. However, traders should remain vigilant about additional fees that could surface.

The "Traps" of Non-Trading Fees:

Users have reported substantial withdrawal fees. For example, one user noted a 2.50% fee for credit and debit card withdrawals, which could deter the net gains for many traders.

"I was only able to withdraw a $1000 and my $69,000 in the account is not accessible. TCC wanted to abscond with my money like they did for others."

For experienced traders with a keen understanding of the risks, TCC's low trading costs might still be enticing. However, risk-averse investors or newcomers are especially advised to weigh the hidden costs against the low trading fees when considering TCC.

TCC employs MetaTrader 4, a widely utilized forex trading platform that offers various features. However, it lacks in areas that are crucial for secure and beginner-friendly trading.

Platform Diversity:

MT4, while robust, may not provide sufficient educational tools or intuitive interfaces for novice traders. The lack of demo accounts for practice further limits user engagement and learning opportunities.

Quality of Tools and Resources:

The platform offers standardized trading tools, but reviews indicate a general scarcity of analytical tools and pre-trade insights. The limited educational materials can hinder new traders from grasping market dynamics effectively.

Platform Experience Summary:

User feedback shows mixed sentiments regarding usability.

"I made two bank transfers of $70,000 to TCC, and I was supposed to use them for trade, and it wasnt."

User experience with TCC has been marred by repeated issues in account management and withdrawal functionality.

Onboarding Experience:

New traders have reported a lack of clear onboarding processes, which can further complicate their trading journey.

Trading Environment:

Traders often express difficulty in managing their accounts, particularly regarding withdrawals and customer support interactions.

Overall User Sentiment:

Destructive experiences have led to a sense of mistrust.

"This platform is going to bankrupt. The boss embezzled customers' money."

TCCs customer support has been frequently criticized, overshadowing the trading experience.

Accessibility:

Users often report significant challenges in reaching customer support, particularly during critical withdrawal attempts.

Responsiveness:

Many traders have described customer support as slow or unhelpful when issues arise, further amplifying the user's sense of risk.

Summary of Complaints:

The overarching feeling among users suggests a major inability to recuperate funds or contact support when issues occur. Many have advised against trusting the customer service capabilities provided by TCC.

TCC presents a single trading account structure which might fit advanced traders but poses threats for others.

Type of Accounts Offered:

TCC operates mainly on a standard account with high leverage and a low minimum deposit, which may appeal to advanced traders.

Leverage and Margin Requirements:

The leverage of up to 1:500 could magnify returns but also the risks associated with significant losses given the unregulated environment.

Requirements Summary:

While advanced traders might find TCC's conditions appealing, those less experienced should approach with caution, given the underlying operational risks.

Understanding the conflicting information is paramount. Investment decisions should rely on credible sources to ensure a firm grasp on the broker's current legitimacy and reputational status. Any gap in information could lead to severe consequences.

Note: Current user reviews and testimonials may be incomplete; potential traders are encouraged to conduct thorough research before proceeding with TCC.

In closing, while TCC may present itself as an opportunity for low-cost trading with appealing conditions, the inherent risks surrounding regulatory status, withdrawal difficulties, and user complaints suggest a precarious trading environment. Consider all factors carefully before engaging with this broker.

FX Broker Capital Trading Markets Review