SuperForex 2025 Review: Everything You Need to Know

Summary

SuperForex is an online CFD and forex broker registered in Belize. This broker has received mixed reviews from traders around the world. This superforex review shows concerning information based on what users say and regulatory details. The broker has a user rating of 2.1 out of 10, which means traders have serious trust issues with the company. Some users call it unreliable or potentially fraudulent.

SuperForex offers over 350 financial instruments despite these problems. These instruments cover many asset classes including forex, CFDs, stocks, commodities, futures, and precious metals. The broker uses the popular MT4 trading platform. It claims to offer competitive spreads without commission charges, though extra fees may apply to some services.

The International Financial Services Commission of Belize regulates the broker. This provides some oversight but may not offer the same protection as top-tier regulators. This SuperForex review suggests the platform may work for traders who want access to diverse asset classes. However, extreme caution is advised given the negative user feedback and trust concerns that have emerged.

Important Notice

This review uses information from regulatory sources and user feedback. Different regional entities may operate under varying regulatory standards. This could significantly impact user experience and protection levels. The evaluation here draws from International Financial Services Commission regulatory information and user reviews from multiple sources.

Traders should do their own research and consider the regulatory environment in their area before making trading decisions.

Rating Overview

Broker Overview

SuperForex operates as an online CFD and forex broker. The company provides trading services across multiple asset classes. The company is registered in Belize and offers access to international financial markets through its trading platform.

The broker positions itself as a provider of diverse trading opportunities. It offers over 350 financial instruments to traders worldwide. The broker's business model centers on providing access to forex pairs, CFDs on stocks, commodities, futures, and precious metals trading.

SuperForex uses the MetaTrader 4 platform as its primary trading interface. This platform is widely recognized in the industry for its reliability and comprehensive features. However, this superforex review shows that user satisfaction remains significantly below industry standards despite the platform's capabilities.

The International Financial Services Commission provides regulatory oversight for its operations. The broker's regulatory framework is based in Belize. This offers a different level of protection compared to more stringent regulatory jurisdictions such as the FCA or CySEC.

Regulatory Status: SuperForex is regulated by the International Financial Services Commission in Belize. This provides basic regulatory oversight for its operations.

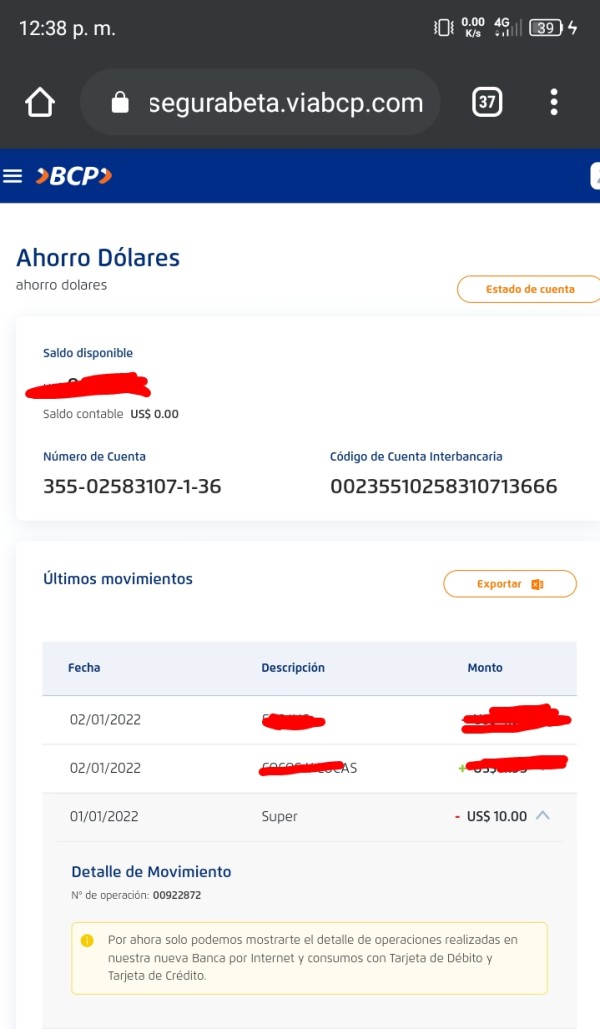

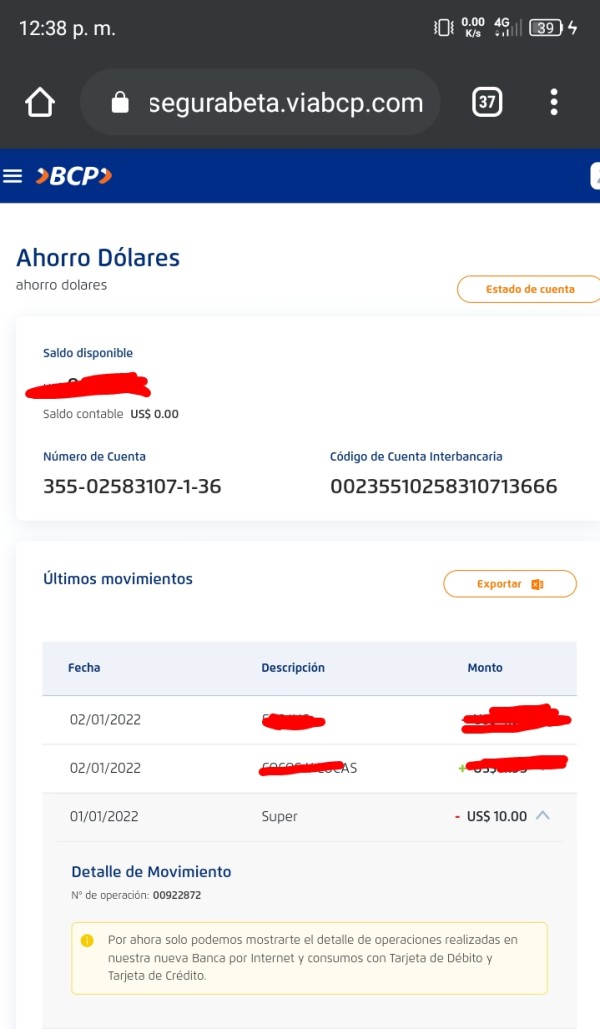

Funding Methods: Specific information about deposit and withdrawal methods was not detailed in available materials. Users need to contact the broker directly for this information.

Minimum Deposit: The exact minimum deposit requirement is not specified in current available documentation.

Promotions and Bonuses: Details about promotional offers or bonus programs are not clearly outlined in accessible materials.

Available Assets: The broker provides access to over 350 financial instruments. These span forex, CFDs, stocks, commodities, futures, and precious metals.

Cost Structure: SuperForex advertises competitive spreads and claims not to charge commissions. However, additional fees may apply to certain services or account types.

Leverage Options: Specific leverage ratios are not detailed in the available information sources.

Platform Options: The broker primarily operates through the MetaTrader 4 platform. This offers standard trading functionality.

Geographic Restrictions: Specific regional limitations are not clearly defined in current documentation.

Customer Support Languages: Available support languages are not specified in accessible materials. This superforex review suggests communication issues based on user feedback.

Account Conditions Analysis

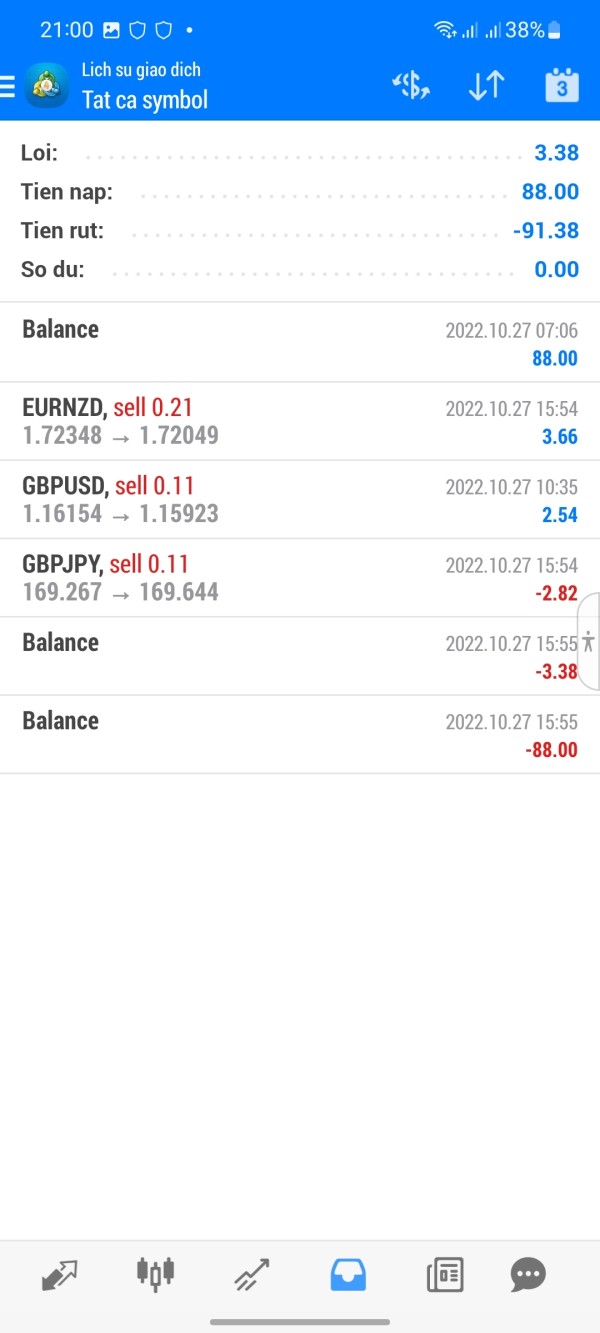

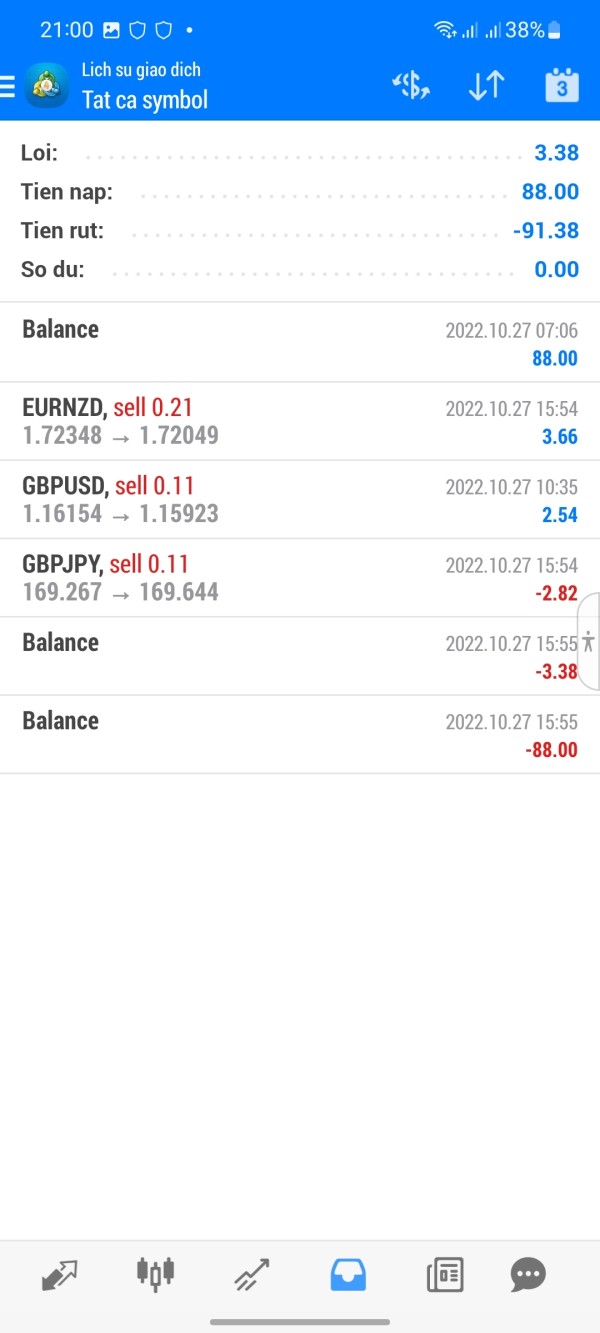

The account conditions at SuperForex present several areas of concern. These concerns are based on available information and user feedback. While the broker offers multiple account types, specific details about minimum deposit requirements, account features, and opening procedures remain unclear.

This lack of transparency has contributed to user frustration and uncertainty about account expectations. The account opening process appears to be standard for the industry. However, users have reported difficulties in obtaining clear information about account specifications and requirements.

The absence of detailed information about special account features is concerning. Features such as Islamic accounts or professional trader accounts are not clearly explained. This suggests either limited offerings or poor communication of available options. User feedback shows mixed experiences with account management.

Some traders express concerns about account conditions that were not clearly explained during registration. The lack of comprehensive account documentation and unclear fee structures have been cited as significant drawbacks. This superforex review finds that while the broker may offer competitive basic conditions, poor communication and lack of transparency significantly impact user experience and trust.

SuperForex demonstrates strength in its range of available trading instruments. The broker offers over 350 financial products across multiple asset classes. This extensive selection includes forex pairs, CFDs on stocks, commodities, futures, and precious metals.

These diverse options provide traders with many investment opportunities within a single platform. The broker's primary strength lies in its adoption of the MetaTrader 4 platform. MT4 is widely regarded as a reliable and feature-rich trading environment.

MT4 provides comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors. This gives traders access to professional-grade trading functionality. However, information about additional research and analysis resources remains limited in available documentation.

Educational materials, market analysis, and trading guides are not prominently featured in accessible sources. This may limit the platform's appeal to newer traders seeking comprehensive learning resources. The platform's tool selection appears adequate for experienced traders who primarily rely on MT4's built-in functionality.

The apparent lack of proprietary research tools or enhanced analytical resources may be a limitation for traders seeking comprehensive market insights and educational support.

Customer Service and Support Analysis

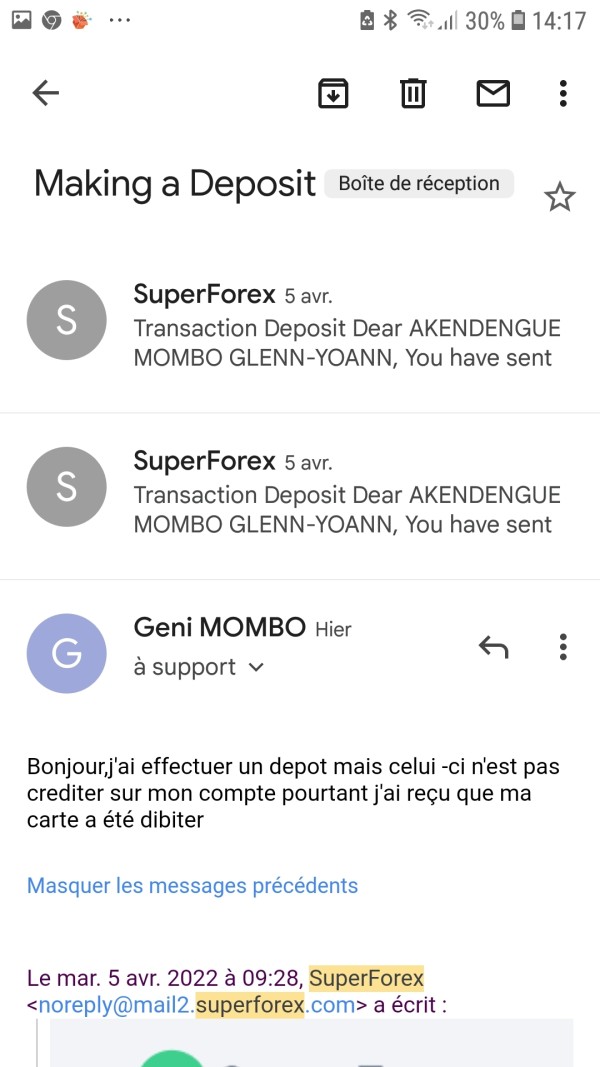

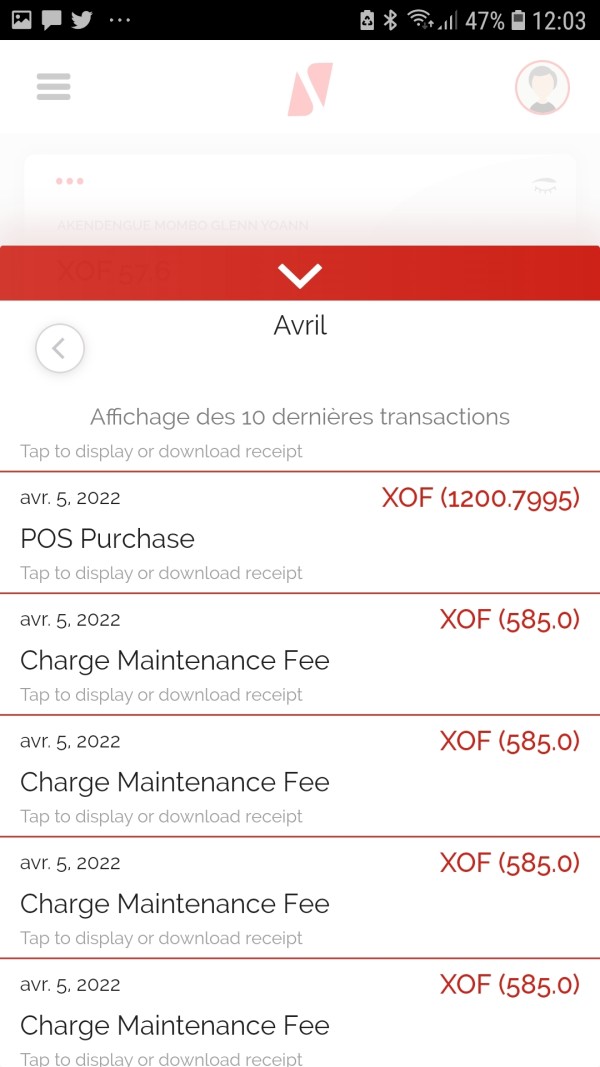

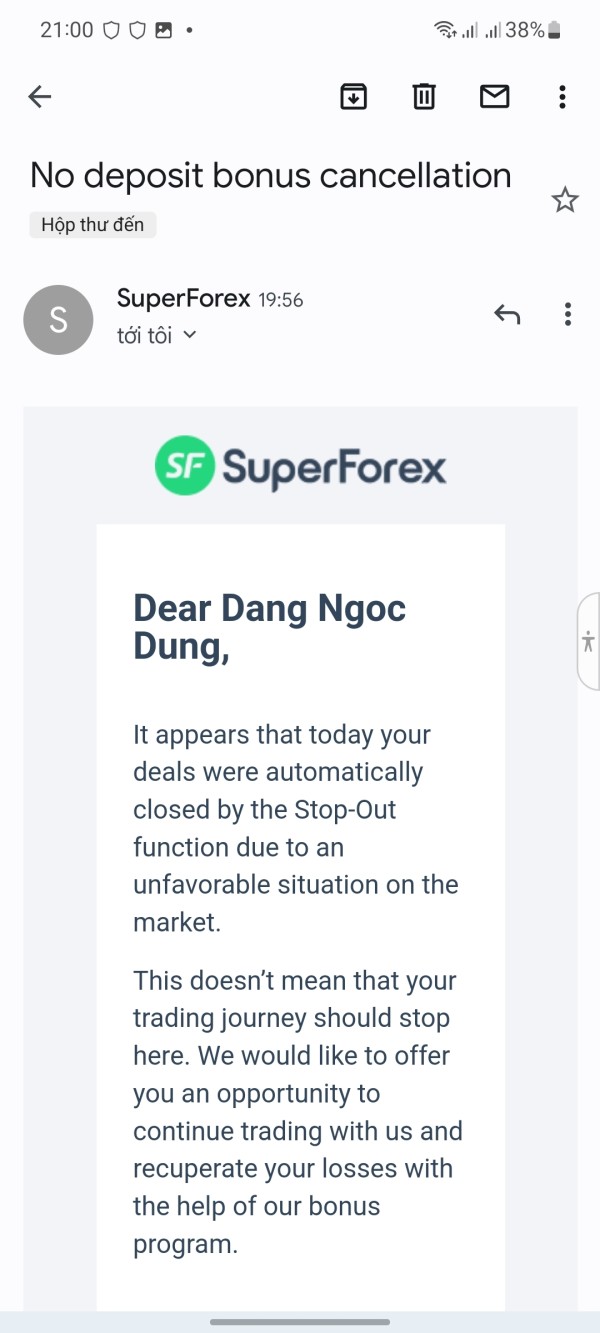

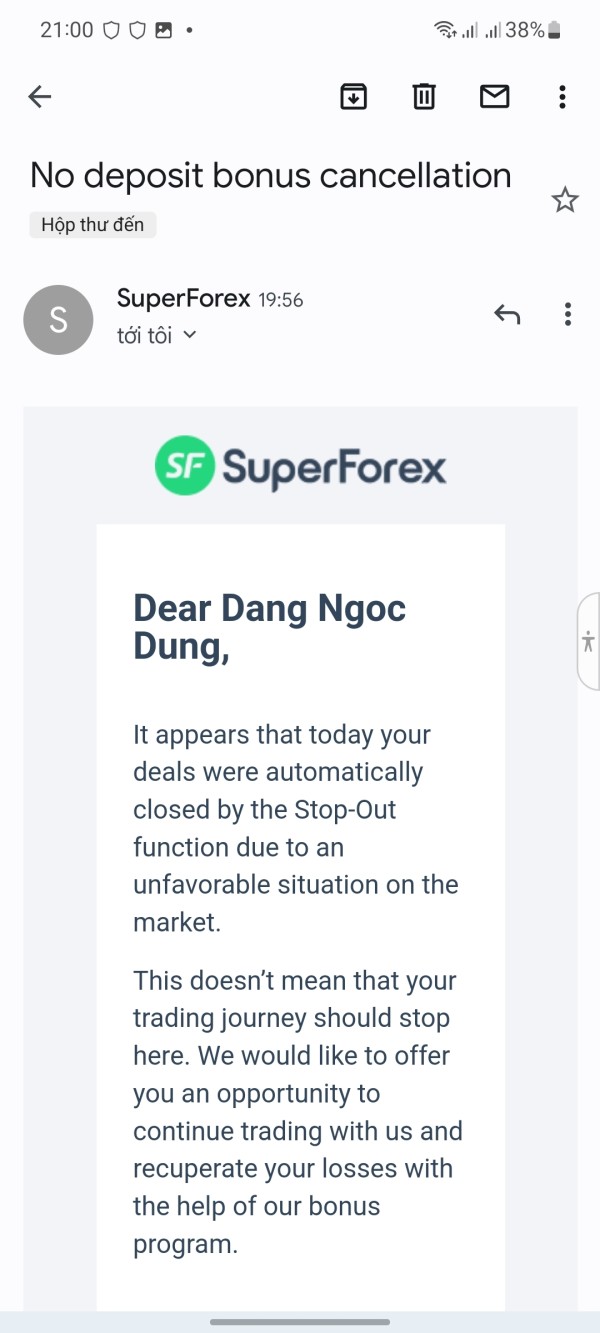

Customer service represents one of SuperForex's most significant weaknesses. This assessment is based on user feedback and available reviews. Multiple users have reported poor response times and inadequate problem resolution.

These issues contribute to the broker's low overall satisfaction rating of 2.1 out of 10. User complaints frequently mention difficulties in reaching customer support representatives and receiving timely responses to inquiries. When contact is established, users report that support staff often lack the knowledge or authority to resolve complex issues effectively.

This leads to prolonged resolution times and increased frustration. The quality of customer service has been particularly criticized in relation to account-related issues, withdrawal processes, and technical problems. Users have expressed concerns about the support team's ability to provide clear explanations and effective solutions.

This has contributed significantly to the trust issues surrounding the broker. Communication channels and availability hours are not clearly specified in available materials. This suggests either limited support options or poor communication of available services.

The apparent lack of comprehensive multilingual support may also limit accessibility for international traders seeking assistance in their native languages.

Trading Experience Analysis

The trading experience at SuperForex presents a mixed picture. This assessment is based on user feedback and platform capabilities. While the MetaTrader 4 platform provides a solid foundation for trading activities, user reports suggest inconsistencies in execution quality and overall platform performance.

Users have reported varying experiences with order execution speed and reliability. Some note acceptable performance while others express concerns about slippage and execution delays during volatile market conditions. The lack of specific performance data makes it difficult to assess the platform's technical capabilities objectively.

Platform stability appears to be adequate for basic trading needs. However, some users have mentioned occasional connectivity issues and platform freezes during peak trading hours. The mobile trading experience is supported through MT4's mobile applications.

Specific feedback about mobile performance is limited in available reviews. The trading environment's competitiveness is hampered by unclear spread information and fee structures. This makes it difficult for traders to accurately assess trading costs.

This superforex review indicates that while basic trading functionality is present, the overall experience is significantly impacted by trust concerns and customer service issues that affect trader confidence.

Trust and Safety Analysis

Trust and safety represent the most critical concerns for SuperForex. These concerns are based on user feedback and regulatory assessment. The broker's regulation by the International Financial Services Commission in Belize provides basic regulatory oversight.

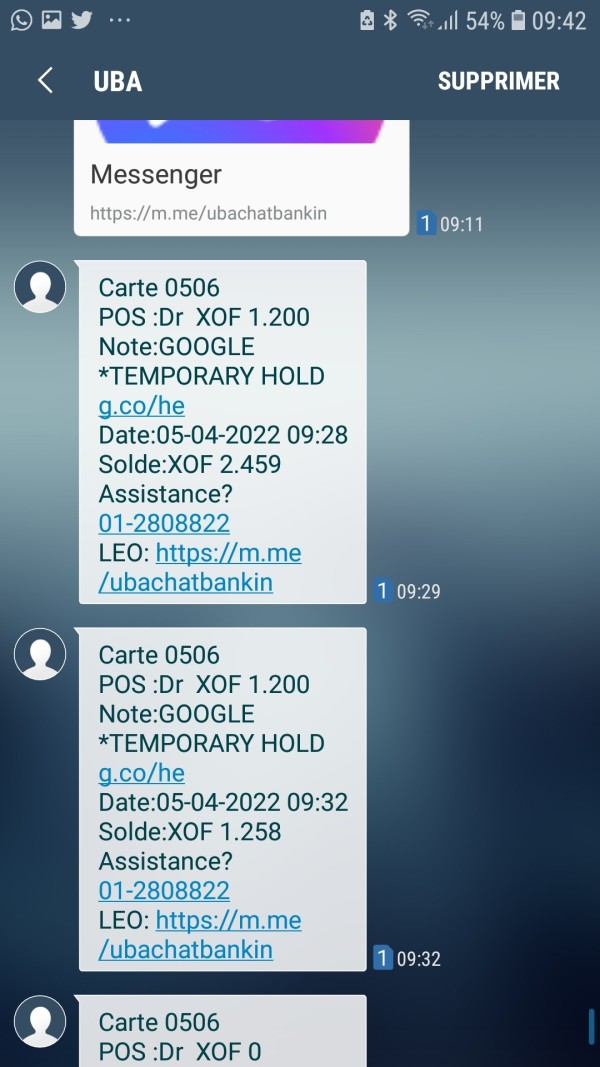

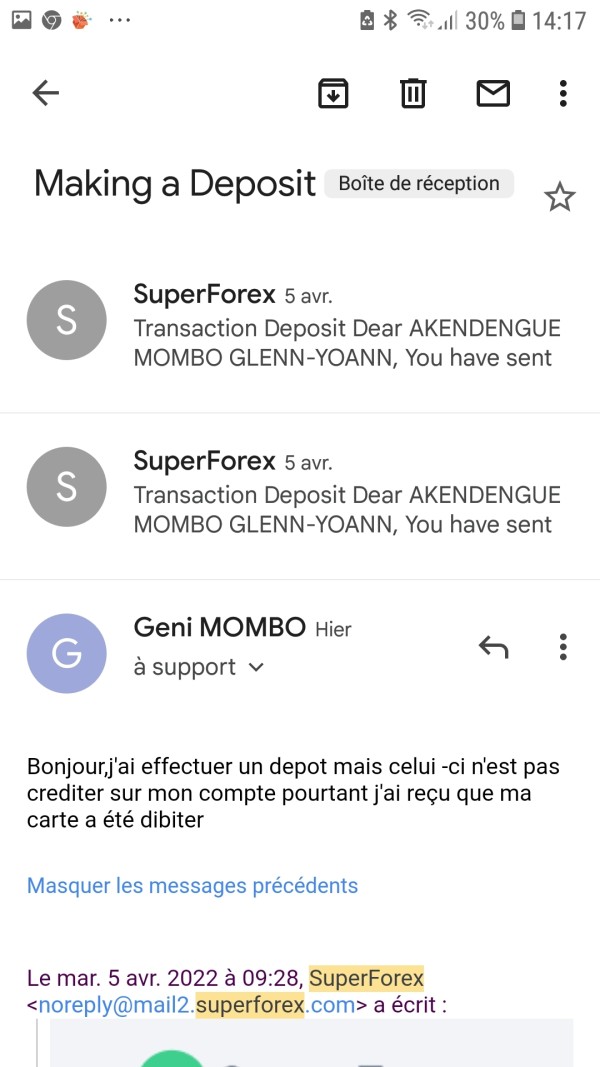

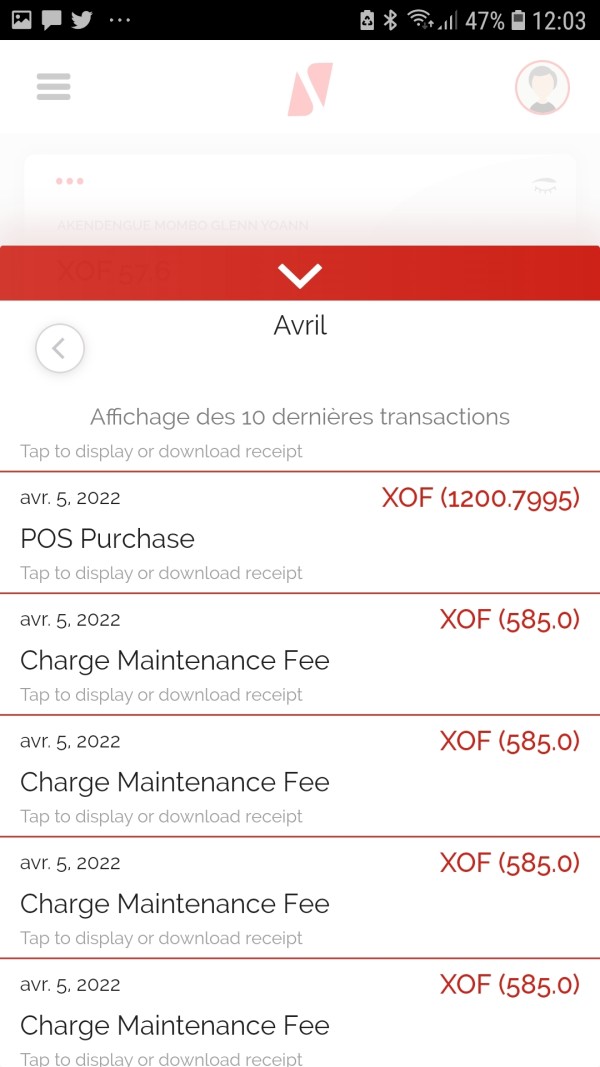

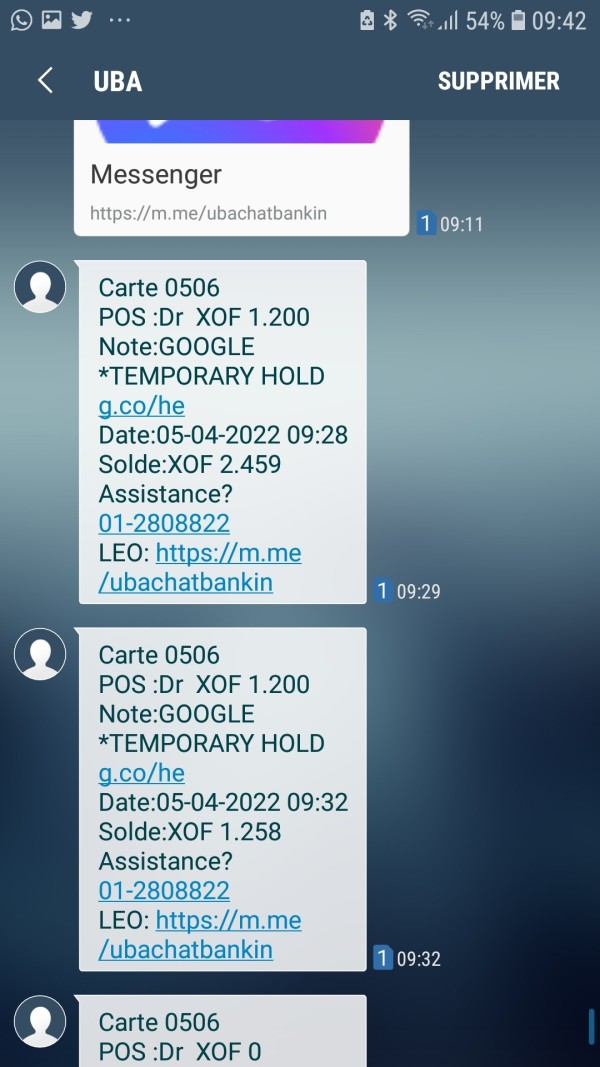

However, this jurisdiction is generally considered less stringent than top-tier financial regulators. User reviews contain serious allegations about the broker's reliability. Some users describe their experiences using terms such as "scam" or "untrustworthy."

These concerns appear to stem from issues with fund withdrawals, unexpected fee charges, and communication problems. These issues have left users questioning the broker's legitimacy. The company's transparency regarding its operations, fee structures, and business practices appears limited based on available information.

This lack of clear disclosure contributes to user uncertainty and trust issues. This is particularly problematic when combined with poor customer service experiences. Fund security measures and client protection protocols are not clearly detailed in accessible materials.

This raises additional concerns about trader protection. The absence of clear information about segregated accounts, insurance coverage, or compensation schemes further undermines confidence in the broker's safety measures.

User Experience Analysis

Overall user satisfaction with SuperForex is significantly below industry standards. The broker has a user rating of 2.1 out of 10, which reflects widespread dissatisfaction among traders. The low satisfaction score stems from multiple factors including poor customer service, trust concerns, and communication issues.

User interface and platform usability are generally acceptable due to the MT4 platform's established design and functionality. However, the broker's website and account management systems appear to lack clarity and comprehensive information. This contributes to user confusion and frustration.

The registration and verification process experiences are not well-documented. User complaints suggest potential issues with account opening procedures and documentation requirements. Unclear communication during these processes appears to contribute to negative first impressions.

Common user complaints center around withdrawal difficulties, unexpected fees, poor customer service response, and lack of transparency in broker operations. These issues have created a pattern of negative experiences that significantly impact the broker's reputation and user trust. The user base appears to consist primarily of traders seeking access to diverse asset classes.

However, the negative experiences reported suggest that even cautious traders should exercise extreme care when considering this platform.

Conclusion

This comprehensive SuperForex review reveals a broker with significant challenges that overshadow its potential strengths. The platform offers access to over 350 financial instruments and uses the reliable MT4 platform. However, serious concerns about trust, customer service, and transparency create substantial risks for potential users.

The broker may be suitable only for highly experienced traders who can navigate the apparent challenges and are comfortable with the associated risks. The overwhelming negative user feedback and trust concerns suggest that most traders would be better served by considering alternative brokers. These alternatives should have stronger regulatory oversight and better customer satisfaction records.

The combination of poor customer service, trust issues, and lack of transparency makes SuperForex difficult to recommend. This remains true despite its diverse asset offerings and competitive spread claims.