DGCTC 2025 Review: Everything You Need to Know

In the ever-evolving landscape of forex trading, DGCTC has emerged as a controversial player since its inception in 2022. This review aims to provide a comprehensive analysis of DGCTC, highlighting its strengths and weaknesses based on user experiences and expert opinions. With a focus on the broker's regulatory status, trading conditions, and overall reputation, this review will help potential traders make informed decisions.

Note: It is crucial to highlight that DGCTC operates across various jurisdictions, and its regulatory status raises significant concerns. This review aims for fairness and accuracy by relying on multiple sources to present a balanced view.

Ratings Overview

How We Rate Brokers: Our ratings are derived from a combination of user reviews, expert analysis, and factual data regarding the broker's services and regulations.

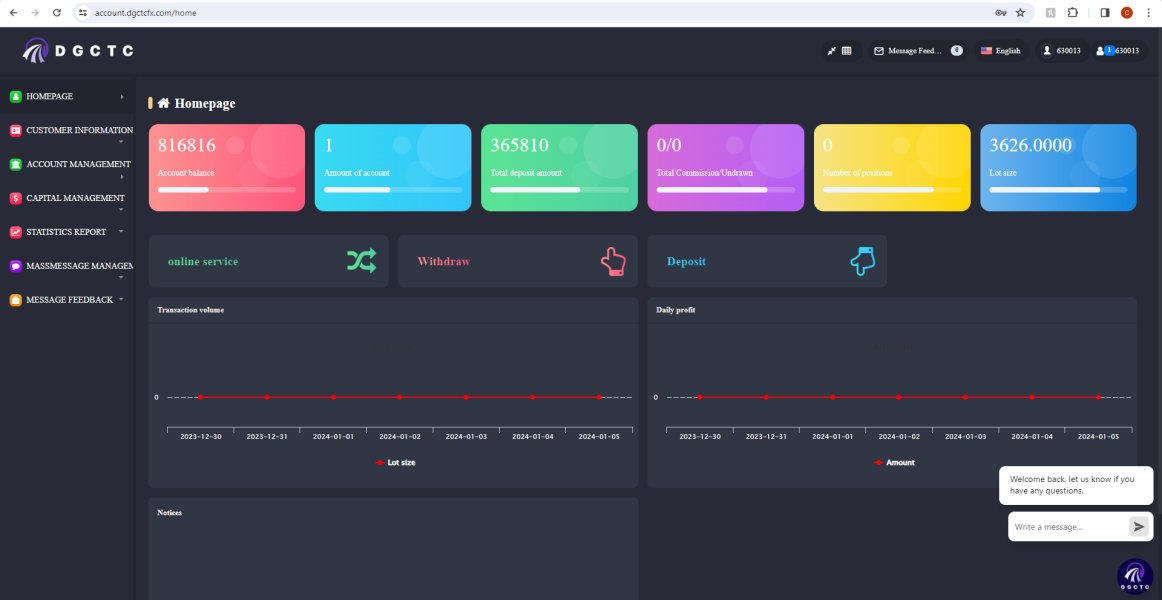

Broker Overview

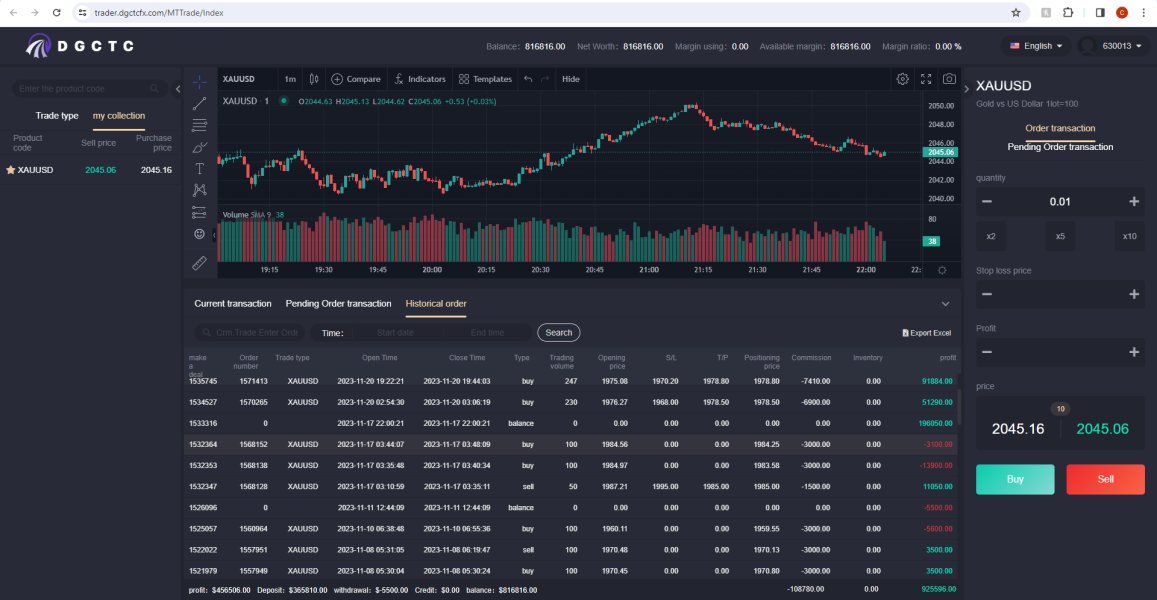

DGCTC, established in 2022, is registered in Australia but operates without any valid regulatory oversight. The broker offers access to various trading instruments, including gold, oil, and stocks, but notably lacks forex trading options. The trading platform utilized is HT5, which is relatively less common compared to industry standards like MT4 or MT5.

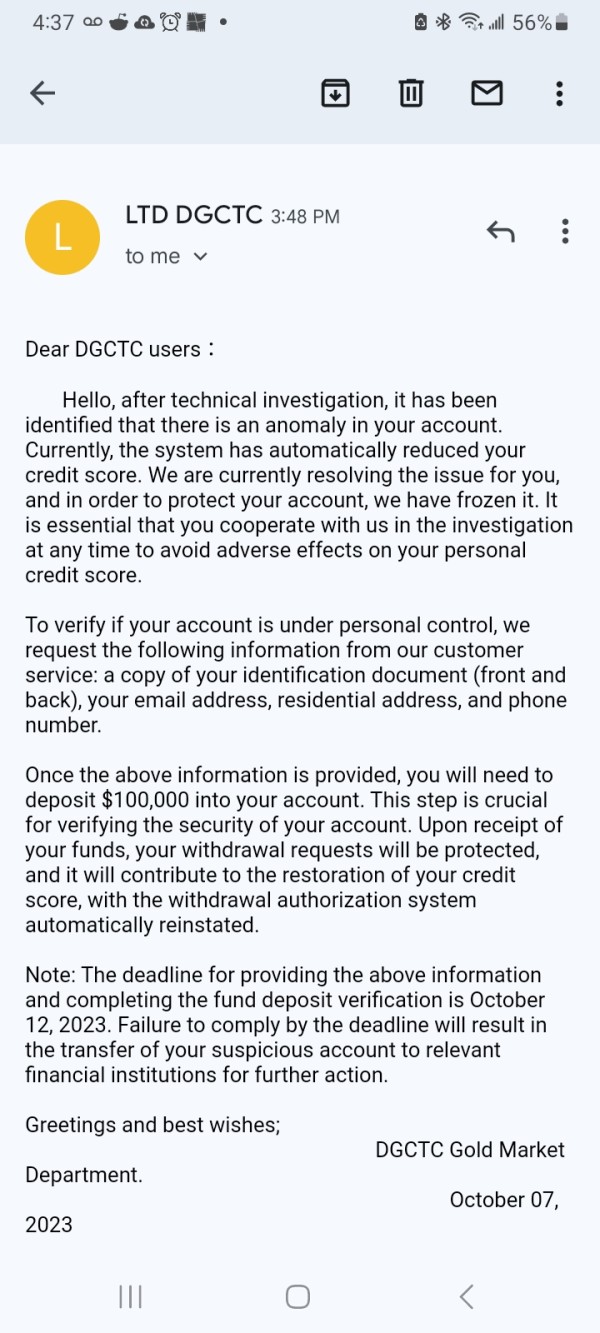

The absence of a regulatory framework raises red flags, as traders may find themselves vulnerable to potential fraud. According to various reviews, DGCTC has been flagged for its suspicious business practices and lack of transparency in operations.

Detailed Breakdown

Regulatory Status

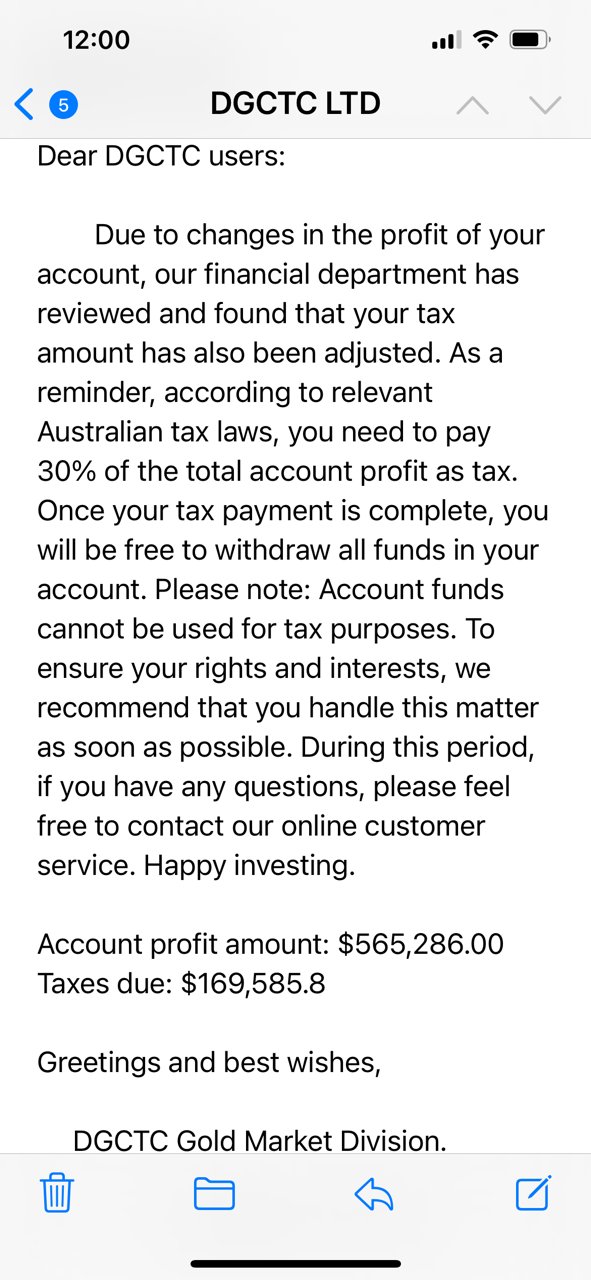

DGCTC is unregulated, which is a significant concern for potential traders. The lack of oversight means that users may not have legal recourse in case of disputes. According to WikiFX, the broker has a low score of 1.13/10, indicating a high risk of fraudulent activities. This lack of regulation is a major factor that potential users should consider before engaging with DGCTC.

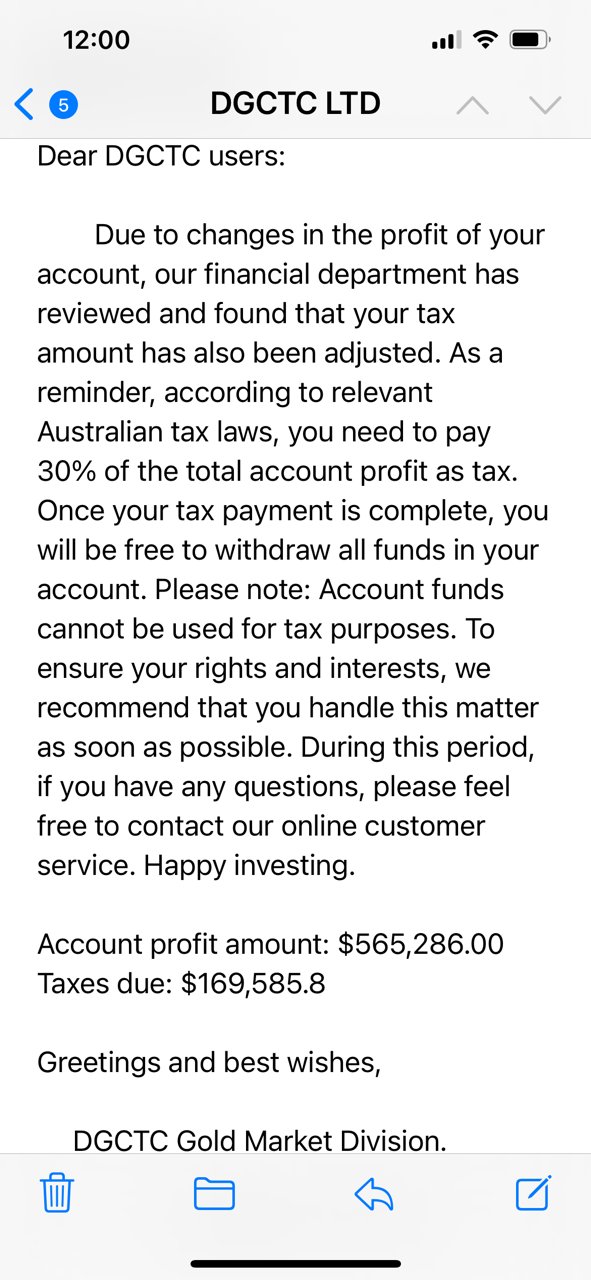

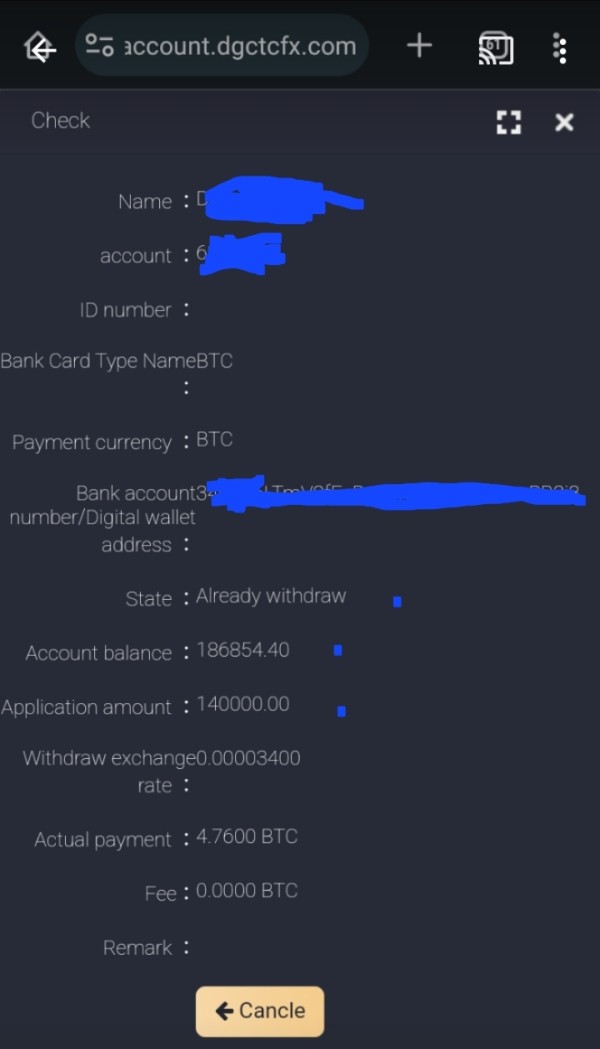

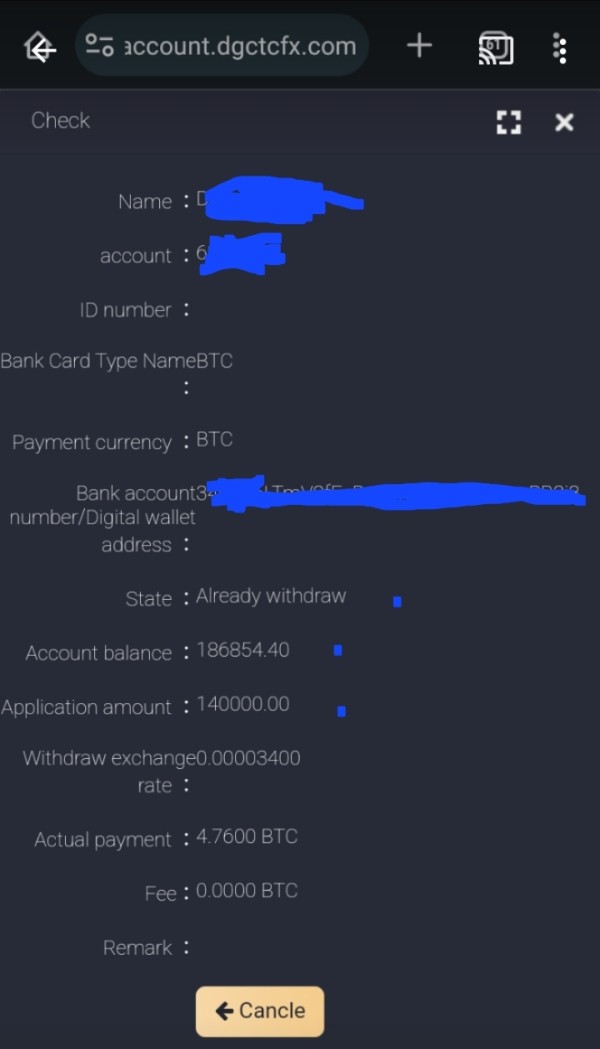

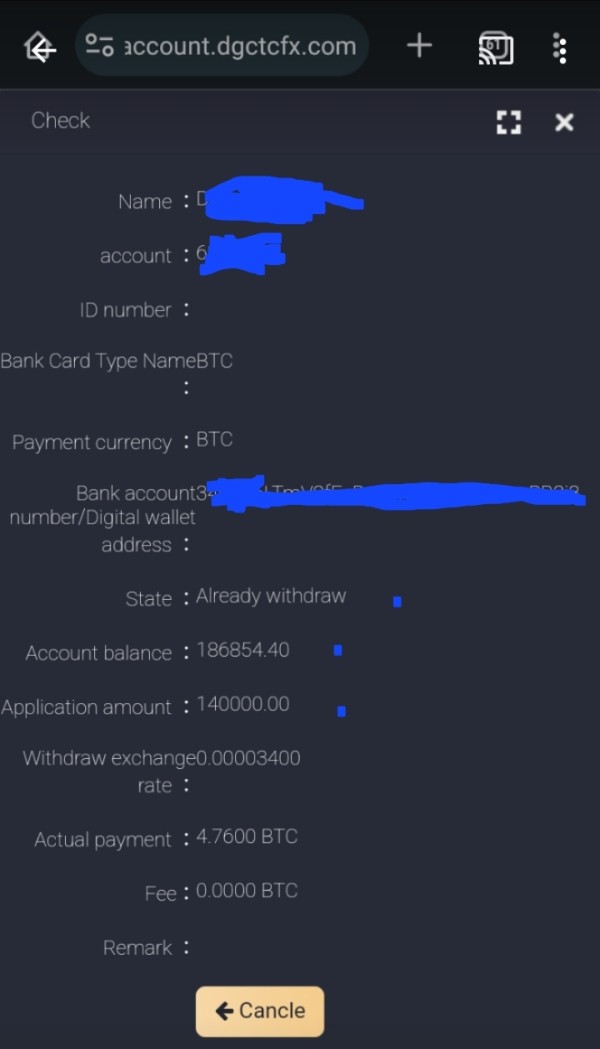

Deposit/Withdrawal Methods

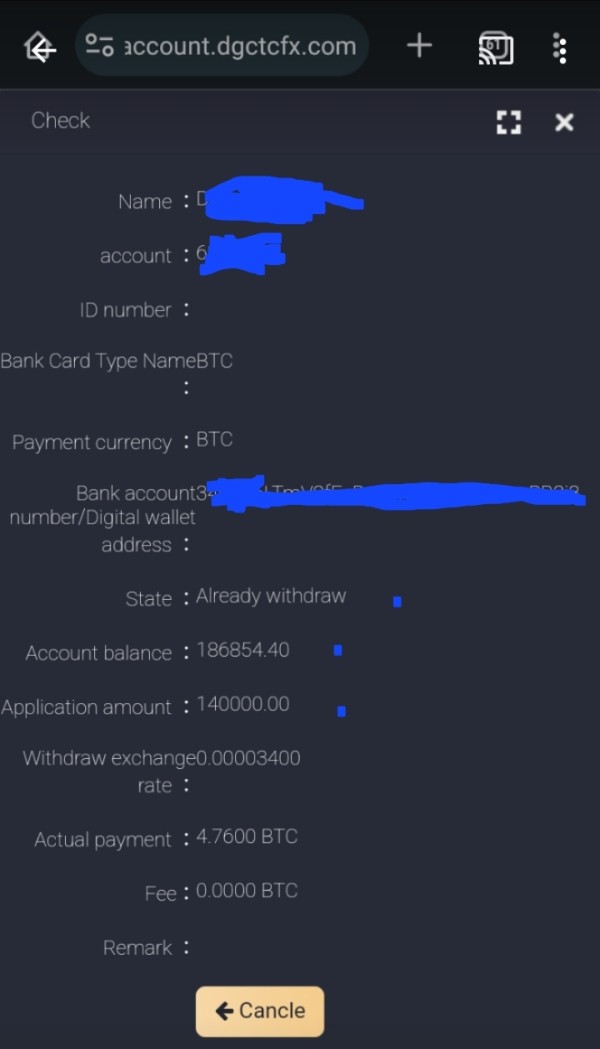

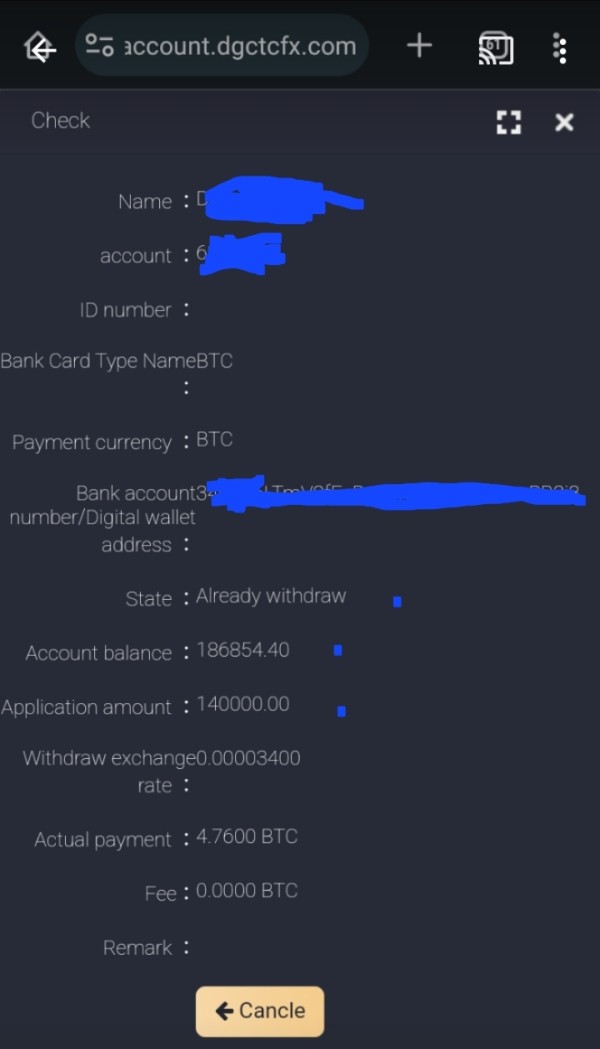

Traders can deposit and withdraw funds through bank transfers, but the minimum deposit requirements and withdrawal fees are not clearly stated. This lack of transparency can create challenges for users looking to manage their funds effectively.

Minimum Deposit

The specifics regarding the minimum deposit requirement are not disclosed, which can be a deterrent for many potential traders. This ambiguity raises concerns about the broker's transparency and reliability.

There is no information available regarding any bonuses or promotional offers. This lack of incentives may make DGCTC less appealing compared to other brokers that offer competitive bonuses to attract new clients.

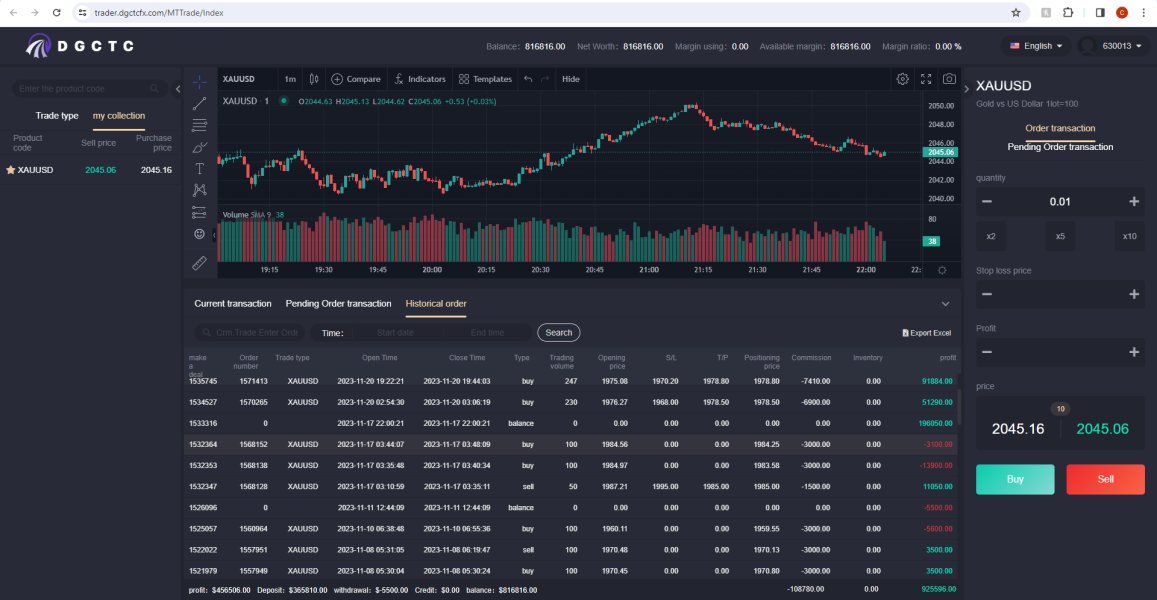

Tradable Asset Classes

DGCTC provides a limited selection of tradable instruments, focusing on gold, oil, and stocks, while notably excluding forex, commodities, cryptocurrencies, and indices. This limited range may not meet the diverse needs of traders looking for a more comprehensive trading experience.

Costs (Spreads, Fees, Commissions)

The broker offers spreads starting from 30 points, but there is no information regarding commissions. Potential traders should inquire directly with the broker to understand the full cost structure before committing funds.

Leverage

DGCTC offers leverage up to 1:400, which can attract traders looking for high-risk, high-reward opportunities. However, this also increases the potential for significant losses, especially for inexperienced traders.

The primary trading platform used by DGCTC is HT5, with mobile support available. However, the absence of more widely recognized platforms like MT4 or MT5 may limit the trading experience for some users.

Restricted Regions

While specific restricted regions are not mentioned, the lack of regulation and transparency may deter users from various jurisdictions from engaging with DGCTC.

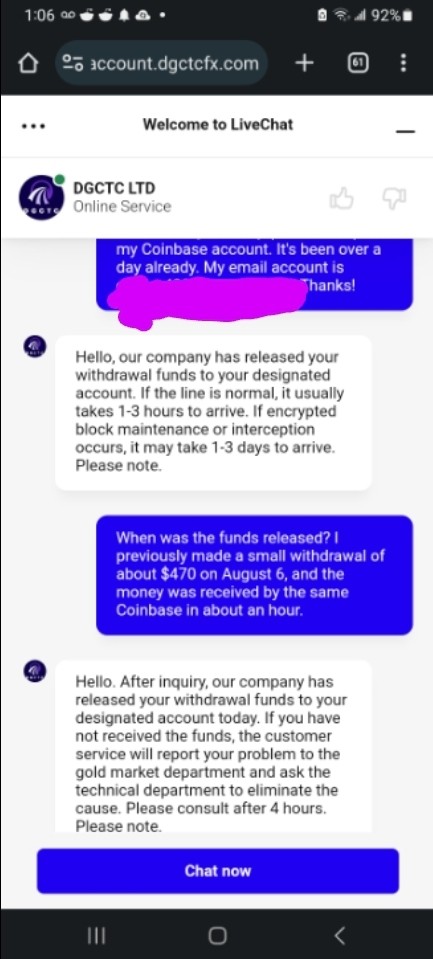

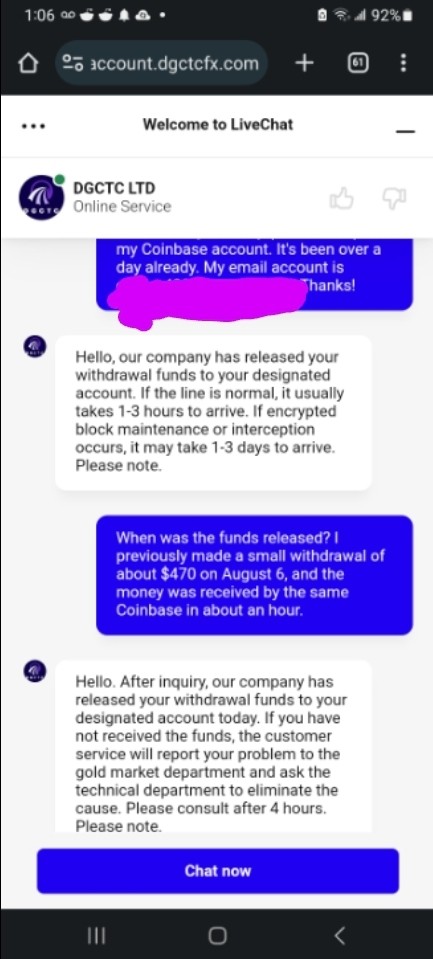

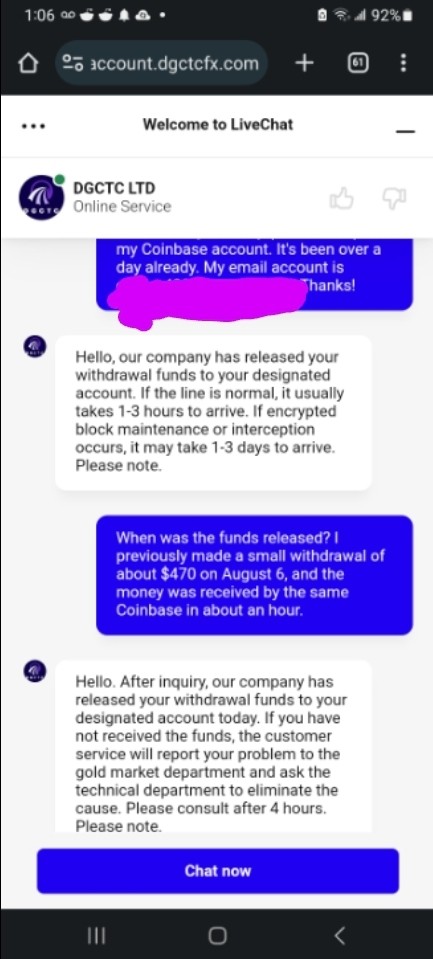

Customer Service Languages

DGCTC provides customer support in English, but the quality of service appears to vary based on user reviews. Many users have reported long waiting times for responses, which can be frustrating for traders seeking immediate assistance.

Ratings Recap

Detailed Rating Analysis

-

Account Conditions (3/10): The lack of clear information regarding minimum deposits and withdrawal fees is concerning. Users have expressed frustration over the ambiguous nature of account management.

Tools and Resources (4/10): Although the HT5 platform is functional, it lacks the advanced features found in more popular platforms like MT4 or MT5, which limits the trading capabilities for experienced traders.

Customer Service and Support (5/10): While some users report satisfactory interactions with customer service, the overall consensus indicates that response times can be lengthy, leading to dissatisfaction among traders.

Trading Experience (4/10): The limited selection of tradable assets and the absence of forex trading options make the overall trading experience less appealing for many users.

Trustworthiness (2/10): The unregulated status of DGCTC is a significant red flag. Users should exercise extreme caution when considering this broker, as the potential for fraud is high.

User Experience (3/10): User experiences vary widely, with many expressing concerns over withdrawal issues and the broker's transparency. This inconsistency adds to the overall distrust of DGCTC.

In conclusion, while DGCTC may offer some appealing features, the overwhelming concerns regarding its regulatory status, transparency, and user experiences suggest that potential traders should proceed with extreme caution. The findings in this DGCTC review indicate that it may be wise to consider more reputable and regulated alternatives in the forex market.