Spring FX Signals 2025 Review: Everything You Need to Know

Summary

Spring FX Signals presents itself as a forex trading broker offering multiple investment options. Our comprehensive spring fx signals review reveals significant concerns that potential traders must carefully consider before investing their money. The broker provides access to Meta Trader 4/5 and AiTrader platforms, along with global property trading and investment signals that promise various returns to users. However, according to WikiFX ratings, Spring FX Signals receives an extremely low credibility score of 1 out of 10. This rating raises serious red flags about its legitimacy and operational standards that traders should not ignore.

The platform targets investors with higher risk tolerance who are willing to take chances with their money. But the lack of proper regulatory oversight and numerous user complaints suggest that even experienced traders should exercise extreme caution when dealing with this broker. While the broker claims to offer diverse trading opportunities including global properties, trading signals, and investment plans, the absence of transparent regulatory information creates serious concerns. Poor user feedback scores indicate potential risks that far outweigh any advertised benefits that the company promotes. This review aims to provide traders with essential information to make informed decisions about engaging with Spring FX Signals.

Important Notice

This review is based on available public information and user feedback from various sources around the internet. Traders should note that Spring FX Signals operates without clear regulatory oversight from recognized financial authorities that typically monitor broker activities. The information presented in this evaluation comes from user reviews, industry analysis, and publicly available data that we could verify through multiple channels. Due to the lack of comprehensive regulatory documentation, potential clients must conduct their own due diligence before engaging with this broker.

Cross-regional regulatory differences may apply to traders in different countries. Traders from different jurisdictions should verify the legal status of Spring FX Signals in their respective countries before making any investment decisions. Our evaluation methodology incorporates user feedback analysis, platform assessment, and industry standard comparisons to provide an objective assessment of the broker's services.

Rating Framework

Broker Overview

Spring FX Signals operates as a forex trading broker in the competitive online trading landscape. Specific information about its establishment date and founding details remain unclear from available sources that we researched. The company positions itself as a provider of multiple investment opportunities, including forex trading, global property investments, and automated trading signals for various markets. However, the lack of transparent corporate information and regulatory documentation raises immediate concerns about the broker's legitimacy and operational standards.

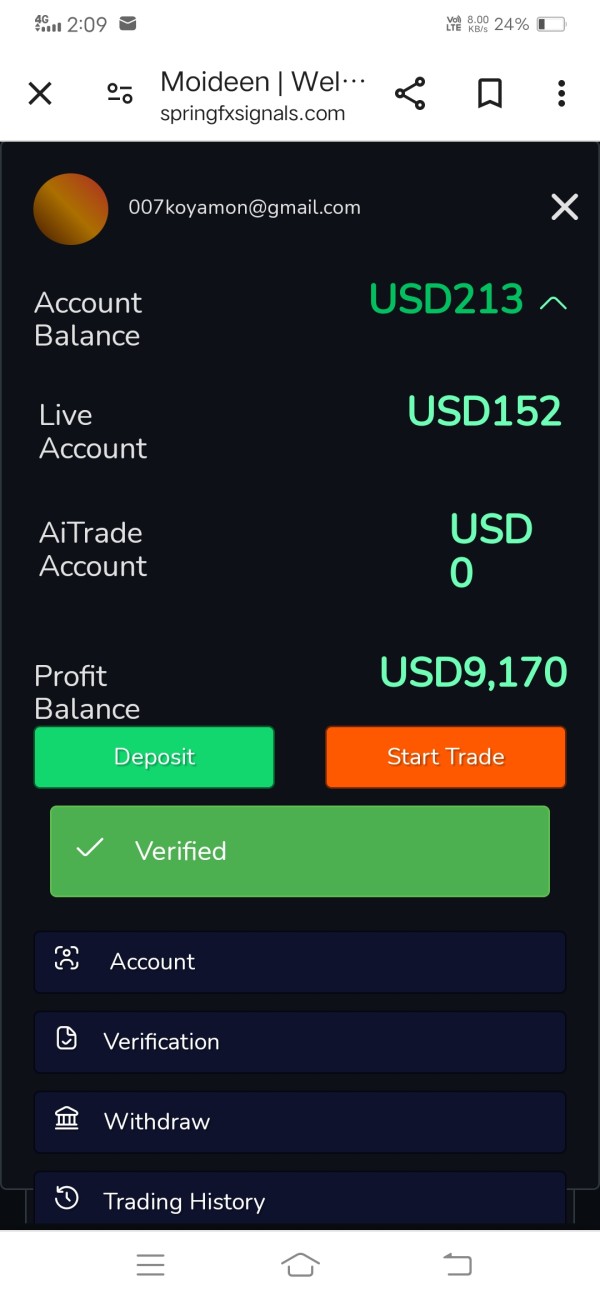

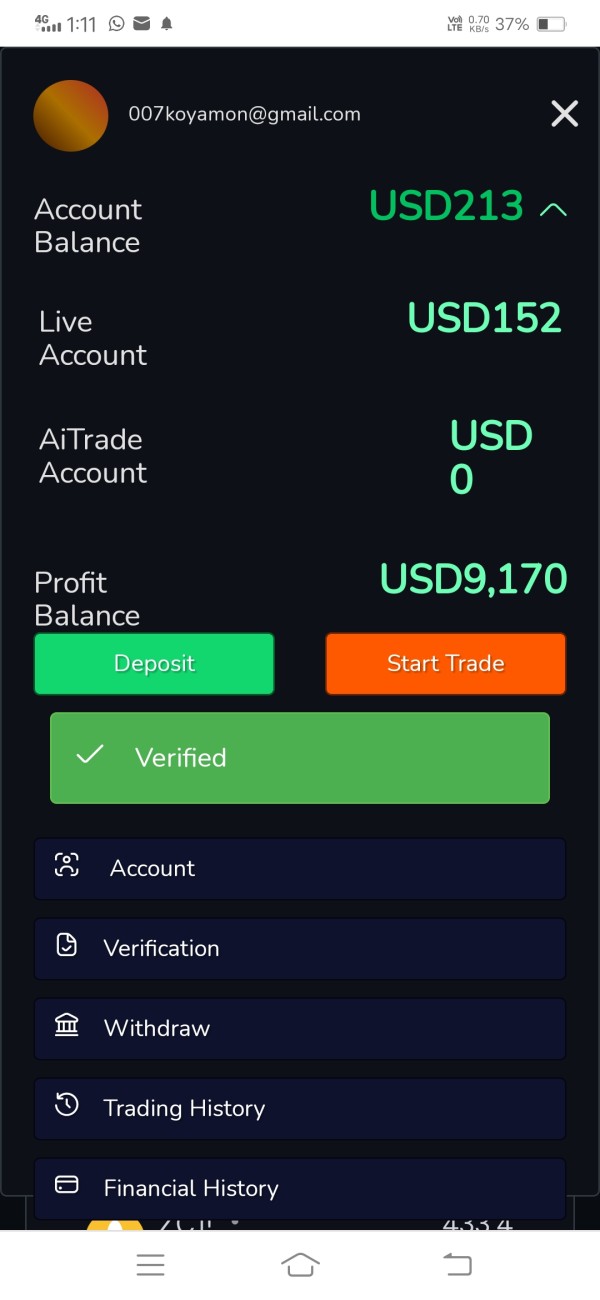

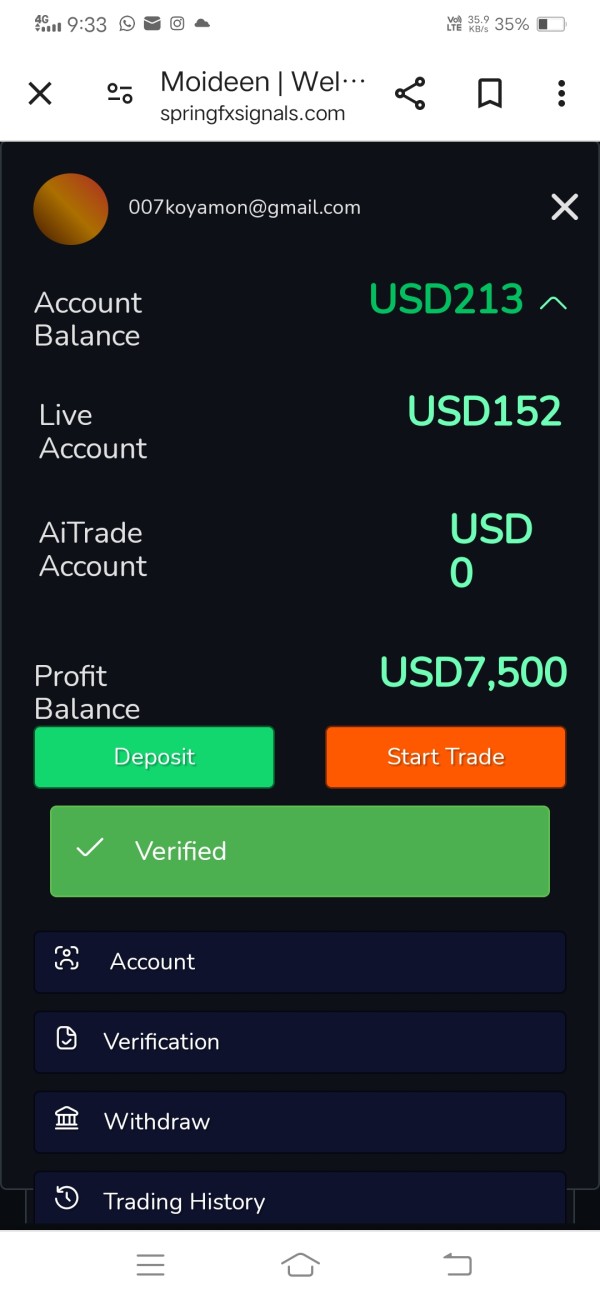

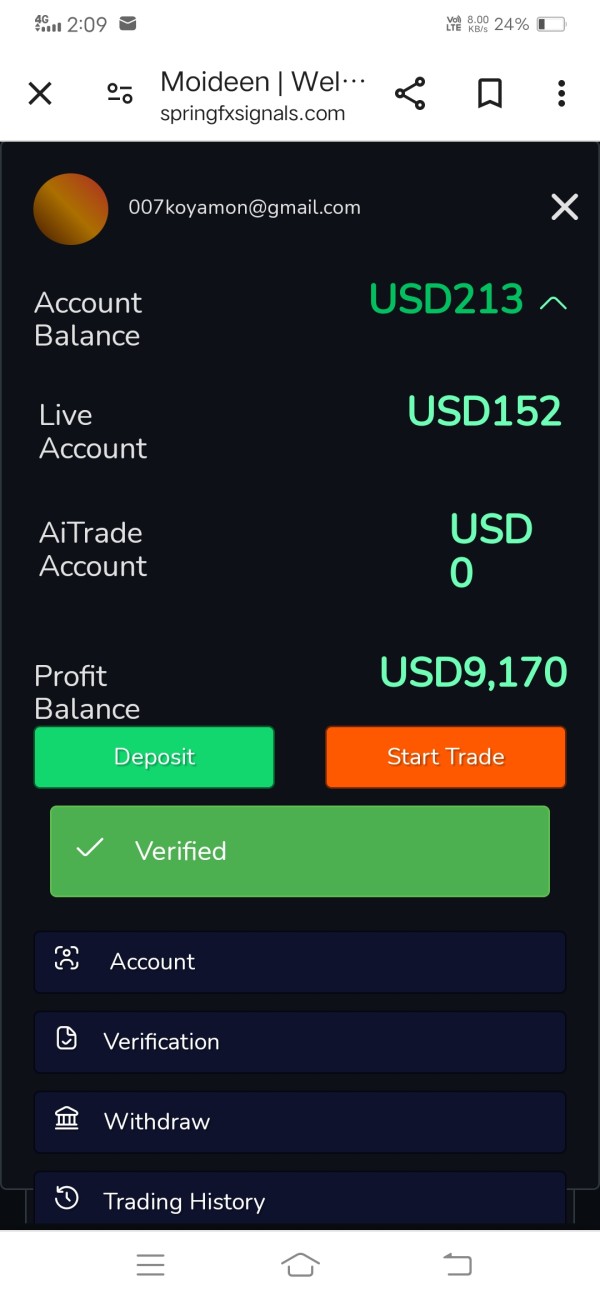

The broker's business model centers around offering access to popular trading platforms while promising various investment returns through different schemes. According to available information, Spring FX Signals provides access to Meta Trader 4/5 platforms alongside their proprietary AiTrader system that they developed internally. The company claims to facilitate global property trading and offers investment plans, though detailed information about these services remains limited and hard to verify. This spring fx signals review finds that the broker's operational transparency falls significantly short of industry standards. Minimal disclosure about company leadership, financial backing, or regulatory compliance measures creates additional concerns for potential investors.

Regulatory Status: Available information does not specify any regulatory oversight from recognized financial authorities. This represents a significant concern for potential traders seeking secure trading environments with proper oversight.

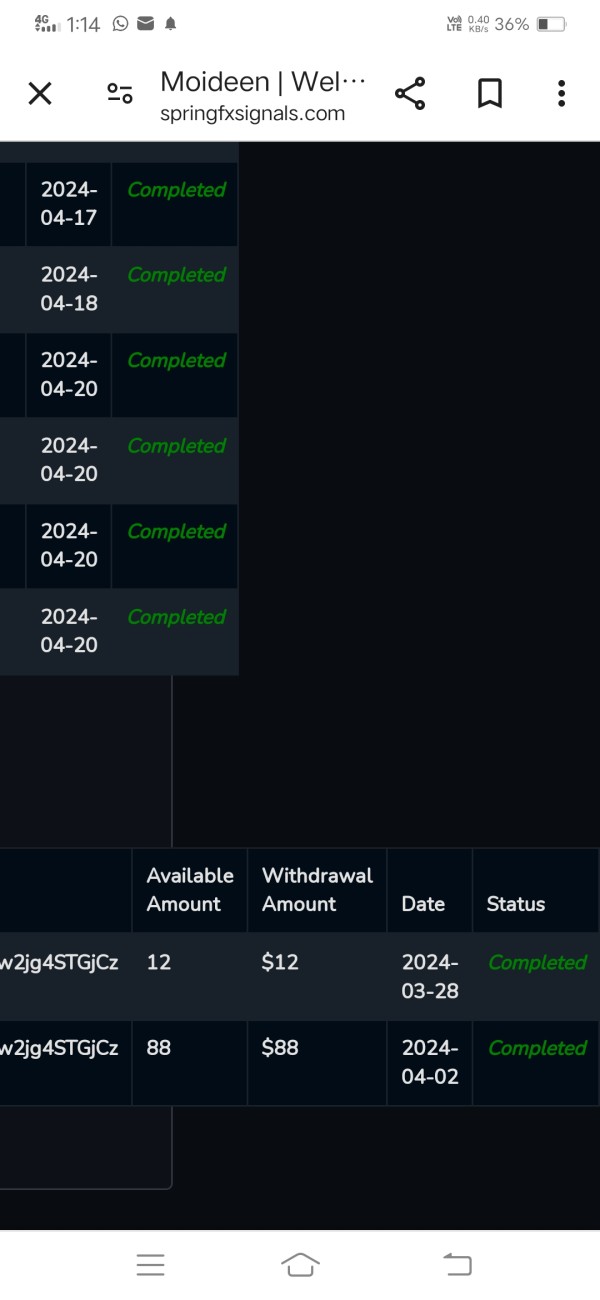

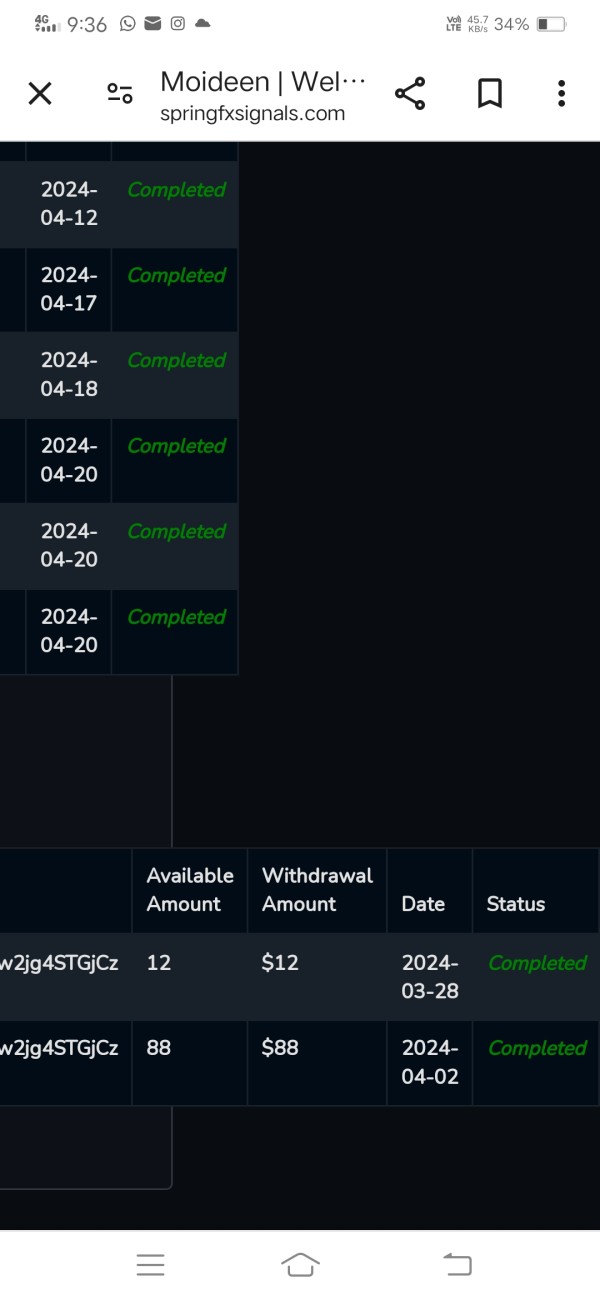

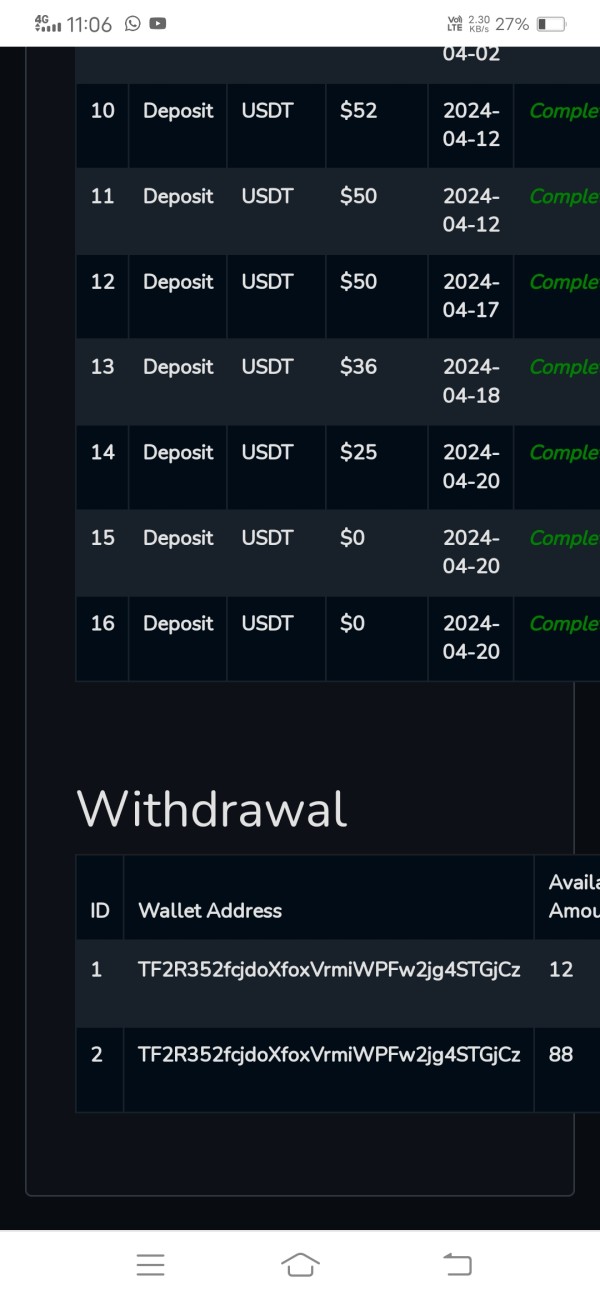

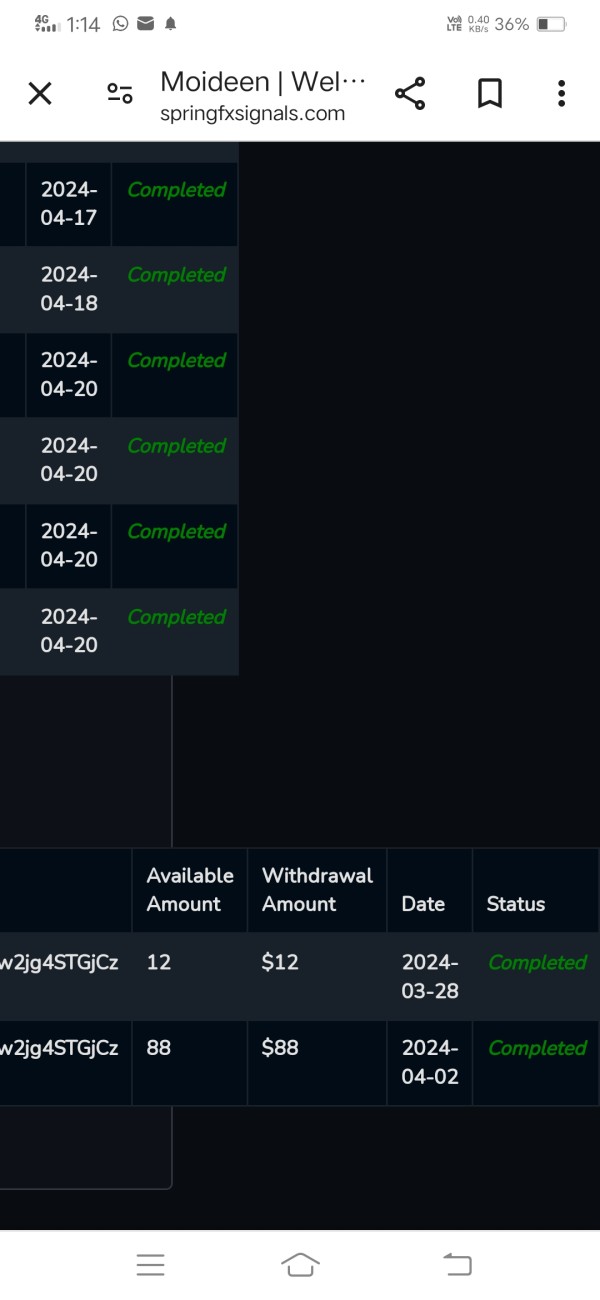

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. This creates uncertainty about fund management procedures that traders need to understand before investing.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts or account funding requirements clearly. This makes it difficult for potential clients to plan their investment approach effectively.

Bonus and Promotions: No specific promotional offers or bonus structures are mentioned in available documentation. Traders should be cautious of any unrealistic promotional claims that might appear later.

Tradeable Assets: Spring FX Signals claims to offer global property investments, trading signals, and various investment plans beyond traditional forex pairs. Detailed asset specifications are not provided in their available materials.

Cost Structure: Information regarding spreads, commissions, overnight fees, and other trading costs is not transparently disclosed. This is concerning for cost-conscious traders who need to understand all fees before trading.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available sources. This makes risk assessment difficult for potential clients who need to understand their exposure.

Platform Options: The broker provides access to Meta Trader 4/5 and AiTrader platforms. These offer familiar trading environments for experienced traders who know how to use these systems.

Regional Restrictions: Specific geographical limitations or restricted jurisdictions are not clearly outlined in available documentation. Traders should verify if their country allows trading with this broker.

Customer Support Languages: Available language support for customer service is not specified in current information sources. This spring fx signals review highlights the concerning lack of detailed operational information that reputable brokers typically provide to ensure transparency and regulatory compliance.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Spring FX Signals receive the lowest possible rating due to the complete absence of detailed information. Reputable forex brokers typically provide comprehensive details about different account tiers, minimum deposit requirements, and specific features associated with each account level that help traders make informed decisions. However, Spring FX Signals fails to disclose any meaningful information about their account offerings. This makes it impossible for potential traders to understand what they would be signing up for when opening an account.

The lack of transparency regarding account opening procedures, verification requirements, and account management policies raises serious concerns about the broker's operational standards. Professional trading platforms usually offer multiple account types to cater to different trader profiles, from beginners to institutional clients, with clear fee structures and benefit descriptions that help users choose appropriately. The absence of such basic information suggests either poor business practices or intentional hiding of terms that might not be favorable to clients.

Furthermore, there is no mention of special account features such as Islamic accounts for Muslim traders, demo accounts for practice, or institutional accounts for larger investors. This spring fx signals review finds that the broker's failure to provide essential account information represents a significant red flag. Potential clients should not ignore this warning when considering their trading options with this company.

Spring FX Signals receives a moderate rating for tools and resources primarily due to their provision of established trading platforms. The availability of MT4/MT5 platforms is significant because these are industry-standard tools that many traders are familiar with worldwide. These platforms offer comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors that experienced traders rely on.

However, the evaluation is limited by the lack of detailed information about additional research resources, market analysis tools, or educational materials. Professional trading platforms usually offer daily market analysis, economic calendars, trading signals, and educational webinars to support their clients' trading decisions effectively. The absence of clear information about such supplementary resources suggests that Spring FX Signals may not provide the comprehensive support that serious traders require for success.

The mention of AiTrader as a proprietary platform could potentially offer unique features that set them apart from competitors. But without detailed specifications about its capabilities, reliability, or user interface, it's difficult to assess its actual value to traders. Quality trading tools should include real-time market data, advanced charting options, risk management features, and seamless order execution capabilities. Verification of these features with Spring FX Signals remains challenging due to limited available information about their systems.

Customer Service and Support Analysis

The customer service and support dimension receives the lowest rating due to the complete absence of information about support channels. Reliable forex brokers typically provide multiple communication channels including live chat, phone support, email assistance, and comprehensive FAQ sections to address client needs promptly and effectively. The lack of disclosed customer service information raises serious concerns about how client issues, technical problems, or account-related queries would be handled by this broker.

Professional brokers usually maintain 24/5 or 24/7 support to accommodate traders across different time zones. This is especially important given the global nature of forex markets that operate around the clock. The absence of clear support contact information or service level commitments suggests that clients might face significant challenges when seeking assistance with their accounts or trading issues.

Additionally, reputable brokers often provide multilingual support to serve their international client base effectively. They also maintain specialized support teams for different account types or trading platforms to ensure expert assistance. The failure to provide any meaningful information about customer support infrastructure indicates either inadequate service capabilities or a lack of commitment to client satisfaction. Both of these possibilities are concerning for potential traders who need reliable support.

Trading Experience Analysis

The trading experience evaluation is severely impacted by the extremely low user ratings and lack of detailed platform performance information. While Spring FX Signals claims to offer access to popular MT4/MT5 platforms, the overall trading experience appears to be compromised by various operational issues. These problems have led to poor user feedback and low credibility ratings from industry watchdogs that monitor broker performance.

Effective trading experiences require stable platform performance, fast order execution, minimal slippage, and reliable market data feeds. The poor user ratings suggest that Spring FX Signals may struggle to deliver these essential elements consistently to their clients. Additionally, the lack of detailed information about execution speeds, server uptime, or platform stability metrics makes it impossible to verify the quality of the trading environment that they provide.

The absence of information about mobile trading capabilities, advanced order types, or trading tools integration further diminishes the overall trading experience assessment. Professional traders typically require sophisticated features such as one-click trading, advanced charting tools, multiple timeframe analysis, and seamless platform synchronization across devices for optimal performance. This spring fx signals review indicates that the broker may not meet these standard expectations. Available user feedback and operational transparency concerns support this conclusion about their service quality.

Trust and Reliability Analysis

Trust and reliability represent the most critical concern with Spring FX Signals, earning the lowest possible rating due to multiple red flags. The absence of clear regulatory oversight from recognized financial authorities such as FCA, ASIC, CySEC, or other reputable regulators represents a fundamental trust issue that cannot be overlooked by potential clients. These regulatory bodies provide essential oversight that protects traders from fraudulent activities and ensures fair trading practices.

The WikiFX rating of 1 out of 10 serves as a significant warning indicator for potential investors. This rating suggests that industry experts and user communities have identified serious concerns about the broker's operations that should not be ignored. Reputable forex brokers typically maintain transparent regulatory compliance, publish regular financial reports, and provide clear information about fund segregation and client protection measures that safeguard investor money.

Furthermore, the absence of information about client fund protection schemes, deposit insurance, or segregated account arrangements leaves traders vulnerable to potential financial losses. Professional brokers usually provide detailed information about how client funds are protected, their regulatory compliance status, and their financial stability measures that ensure client safety. The failure to provide such essential trust-building information suggests that potential clients should exercise extreme caution. Anyone considering this broker should carefully evaluate these trust concerns before making any investment decisions.

User Experience Analysis

The user experience analysis reveals significant concerns based on extremely poor user feedback and the lack of detailed information about platform usability. User experience encompasses everything from account registration and platform navigation to fund management and overall service satisfaction, areas where Spring FX Signals appears to fall short of industry standards. The low user ratings suggest widespread dissatisfaction with various aspects of the service that affect daily trading activities.

These negative ratings potentially include platform reliability issues, poor customer service responsiveness, problematic fund withdrawal processes, and overall service quality concerns. Positive user experiences typically result from intuitive platform design, efficient account management processes, transparent fee structures, and reliable customer support that helps traders succeed. These elements appear to be lacking based on available feedback from actual users of the platform.

Additionally, the absence of detailed information about user interface design, platform customization options, educational resources, and account management tools suggests poor prioritization. The broker may not prioritize user experience optimization that modern traders expect from professional platforms. Professional trading platforms usually invest heavily in user experience improvements, offering comprehensive onboarding processes, educational materials, and ongoing support to ensure client success and satisfaction throughout their trading journey.

Conclusion

This comprehensive spring fx signals review reveals significant concerns that strongly advise caution for potential traders considering this broker. While Spring FX Signals offers access to popular MT4/MT5 platforms and claims to provide various investment opportunities, the overwhelming evidence points to serious operational and trust issues. These problems outweigh any potential benefits that the company might offer to traders.

The broker appears suitable only for traders with extremely high risk tolerance who fully understand the potential for complete loss of invested funds. However, even risk-tolerant investors would be better served by choosing regulated alternatives that provide transparent operations, proper client protections, and reliable customer support. The main advantages include access to established trading platforms, but these are significantly overshadowed by critical disadvantages that create serious concerns for potential clients.

Critical disadvantages include lack of regulatory oversight, extremely poor user ratings, absence of transparent operational information, and concerning trust indicators. These issues suggest potential risks to client funds and trading success that responsible traders should not ignore when making investment decisions.