YIDUGJ Global Ltd 2025 Review: Everything You Need to Know

Executive Summary

This detailed YIDUGJ Global Ltd review shows major concerns about this forex broker. Traders should think carefully before opening an account with them. YIDUGJ Global Ltd started in 2023 and operates from Australia, but it has received a very low WikiFX safety score of just 1 out of 10. This score means the broker is high-risk. The broker's user rating of 1.26 shows that many clients are unhappy, especially about withdrawal problems and slow customer service.

Main problems include withdrawal requests that don't get processed, unclear rules and regulations, and poor customer support. The broker says it offers zero spreads, but this good feature doesn't make up for the serious problems that stop traders from getting their money. YIDUGJ Global Ltd tries to attract forex traders, but current users report big problems with managing funds and account operations.

The negative reviews and low safety ratings from independent services show that this YIDUGJ Global Ltd review suggests potential clients should be very careful. People should think twice before choosing this broker for trading.

Important Notice

This review uses public information and user feedback from sources like WikiFX monitoring services and user reviews. YIDUGJ Global Ltd doesn't share much regulatory information, so some standard broker details aren't available for full analysis. The missing regulatory information hurts the broker's credibility score.

Our review method includes user experiences, safety ratings from independent services, and available operational data. Traders should know that limited regulatory oversight might affect legal protections and ways to solve disputes.

Rating Framework

Broker Overview

YIDUGJ Global Ltd started offering forex brokerage services in 2023. The company says it operates from Australia as a trading service provider. Even though it's new, the company has gotten attention from traders, but sadly most of this attention comes from bad experiences rather than good trading results.

The broker focuses on forex trading services, but specific details about how they operate and their business partnerships are hard to find. WikiFX monitoring services give YIDUGJ Global Ltd a safety score of 1, which puts it in the high-risk group for potential clients. This rating shows concerns about how transparent the broker is, whether it follows regulations, and how good its customer service is.

The company appeared quickly in the competitive forex market, and users started complaining right away, which suggests problems with their systems and customer support. This YIDUGJ Global Ltd review shows that while the broker markets itself to forex trading fans, users have had many problems. The lack of detailed information about trading platforms, available assets, and regulatory compliance makes potential clients even more uncertain about their services.

Regulatory Status: Available information doesn't show clear regulatory oversight. This adds to the low safety rating and higher risk for potential clients.

Deposit and Withdrawal Methods: Specific information about supported payment methods isn't detailed in available sources. User feedback shows major issues with withdrawal processing.

Minimum Deposit Requirements: Minimum deposit information isn't specified in current documentation. People need to contact the broker directly for clarification.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in available broker information.

Tradeable Assets: The range of available trading instruments and asset classes isn't fully detailed in current sources.

Cost Structure: The broker advertises zero spreads, but commission structures and other potential fees aren't clearly specified. This YIDUGJ Global Ltd review notes that fee transparency remains limited.

Leverage Ratios: Specific leverage offerings aren't detailed in available information sources.

Platform Options: Trading platform specifications and technology infrastructure details aren't provided in current documentation.

Regional Restrictions: Geographic limitations and service availability aren't clearly specified.

Customer Service Languages: Supported languages for customer service aren't detailed in available information.

Detailed Rating Analysis

Account Conditions Analysis (2/10)

YIDUGJ Global Ltd's account conditions get a poor rating because of limited transparency and major user-reported issues. The broker advertises zero spreads, but this potential advantage gets ruined by basic problems in account management and fund access. The lack of detailed information about account types, minimum deposit requirements, and specific account features creates uncertainty for potential clients.

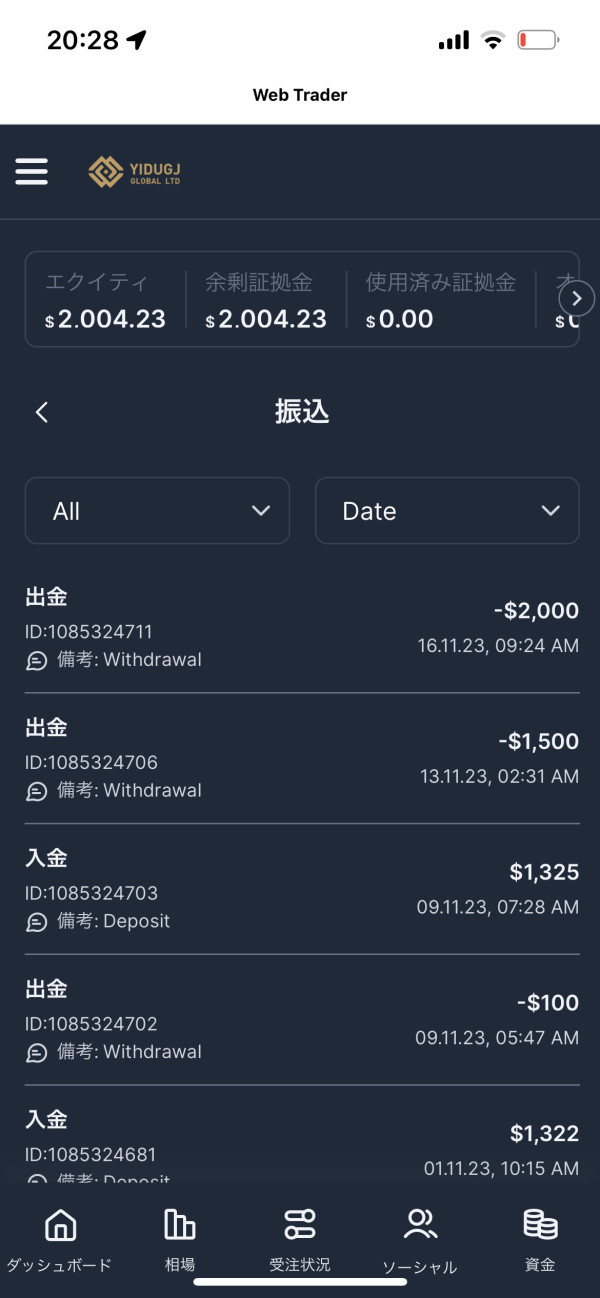

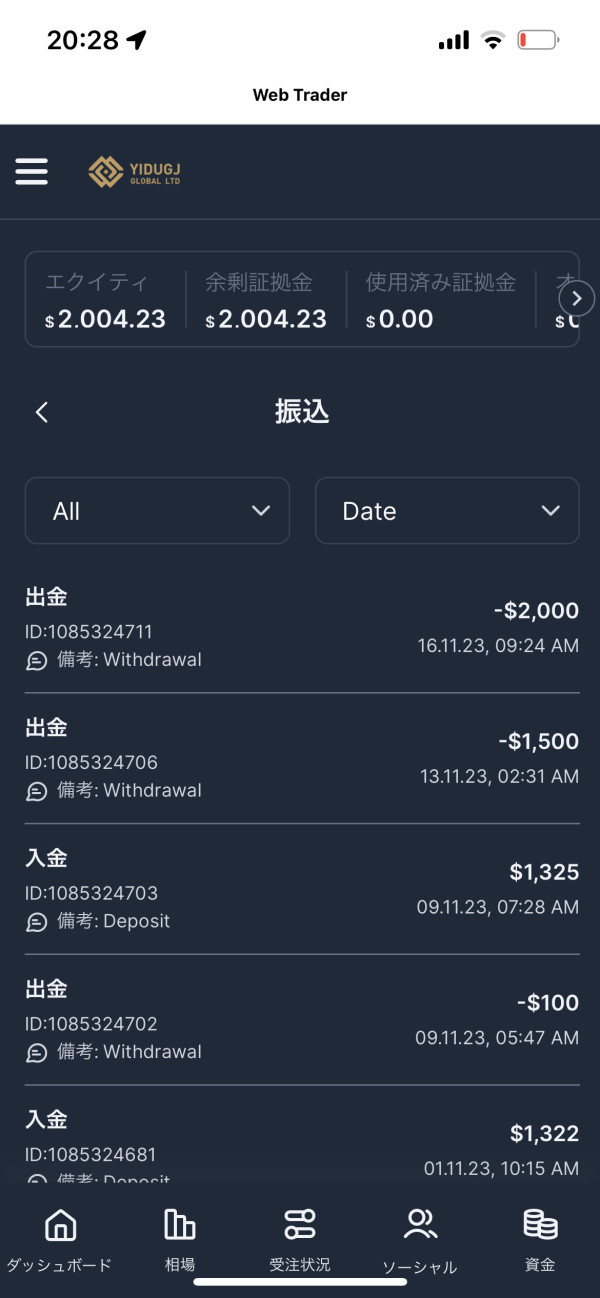

User feedback consistently shows withdrawal problems. This suggests that account holders have trouble accessing their funds even when account balances show successful withdrawal processing. This gap between displayed account information and actual fund availability represents a serious flaw in the broker's account management system.

The account opening process and verification procedures aren't well-documented. This makes it hard for potential clients to understand requirements and timelines. Without clear information about different account tiers, special features, or account benefits, traders can't make informed decisions about whether the broker's offerings match their trading needs and preferences.

This YIDUGJ Global Ltd review emphasizes that account condition transparency is essential for trader confidence. The current lack of detailed information significantly impacts the overall assessment of the broker's account offerings.

The tools and resources category gets the lowest possible rating because there's no information about trading tools, analytical resources, and educational materials. Professional forex brokers typically provide comprehensive trading platforms, technical analysis tools, market research, and educational content to support their clients' trading activities.

Available information about YIDUGJ Global Ltd doesn't mention specific trading platforms, charting tools, or analytical resources that would be essential for effective forex trading. The lack of educational materials, market analysis, or research reports suggests limited support for trader development and market understanding.

Automated trading support, expert advisors, and algorithmic trading capabilities aren't mentioned in available documentation. Modern forex traders often rely on these advanced tools for strategy implementation and risk management, so their absence is a major limitation.

The complete lack of information about available tools and resources shows either insufficient platform development or poor communication about existing capabilities. Either situation represents a big disadvantage for traders seeking comprehensive trading support.

Customer Service and Support Analysis (2/10)

Customer service gets a poor rating based on user feedback showing unresponsive support and unresolved withdrawal issues. According to user reports, withdrawal requests are processed at the account level but funds aren't actually transferred. Customer service fails to provide adequate resolution or explanation.

One user specifically reported that while their trading account showed successful withdrawal processing, the responsible personnel told them that withdrawal wasn't actually possible. This created confusion and frustration. This type of communication breakdown suggests serious problems in customer service training and support protocols.

The lack of information about available customer service channels, response times, operating hours, and multilingual support makes concerns about service quality even worse. Professional brokers typically provide multiple contact methods including live chat, email, and phone support with clearly defined response timeframes.

Without adequate customer service infrastructure and responsive support, traders face significant risks when issues arise. This is especially true for fund access and account management problems that require immediate attention and resolution.

Trading Experience Analysis (2/10)

The trading experience gets a poor rating because of lack of information about platform stability, order execution quality, and overall trading environment. User feedback suggests negative experiences, but specific details about platform performance, execution speeds, and trading conditions aren't fully documented.

Without information about trading platforms, mobile applications, or web-based trading interfaces, potential clients can't assess whether the broker's technology infrastructure meets their trading requirements. Platform stability, order execution reliability, and real-time data accuracy are basic requirements for effective forex trading.

The absence of details about execution models, slippage policies, and order types limits traders' ability to evaluate whether the broker can support their trading strategies effectively. Professional traders require transparent information about execution quality and trading conditions to make informed broker selection decisions.

This YIDUGJ Global Ltd review highlights that trading experience quality depends heavily on technological infrastructure and operational transparency. Both of these appear insufficient based on available information and user feedback.

Trustworthiness Analysis (1/10)

Trustworthiness gets the lowest rating because of the WikiFX safety score of 1 and absence of clear regulatory oversight information. Trust in financial services requires transparent regulatory compliance, clear operational procedures, and consistent positive user experiences. None of these are evident in available information about YIDUGJ Global Ltd.

The lack of regulatory information raises serious questions about legal protections for client funds, dispute resolution mechanisms, and compliance with international financial service standards. Regulatory oversight provides essential safeguards for traders, including segregated client funds, compensation schemes, and professional conduct requirements.

User reports of withdrawal problems combined with poor customer service responsiveness create additional trust concerns. When brokers fail to process withdrawals properly or provide adequate explanations for delays, it undermines confidence in their operational integrity and financial stability.

The broker's recent establishment in 2023, combined with immediate negative feedback and low safety ratings, suggests potential operational or structural problems. These affect trustworthiness and long-term viability as a reliable trading partner.

User Experience Analysis (2/10)

User experience gets a poor rating based on the 1.26 user rating and consistent negative feedback about withdrawal processing and customer service. The primary user complaints center on inability to access funds despite apparent successful withdrawal processing at the account level.

The frustrating experience of seeing withdrawal confirmations without receiving actual funds represents a basic failure in user experience design and operational execution. This type of problem creates significant stress and uncertainty for traders who depend on timely access to their capital.

Without detailed information about website navigation, account management interfaces, registration processes, and verification procedures, potential clients can't assess the overall user experience quality. Modern brokers typically invest heavily in user-friendly interfaces and streamlined processes to enhance client satisfaction.

The predominance of negative feedback with apparent absence of positive user testimonials suggests systematic problems in user experience delivery. Successful brokers typically maintain high user satisfaction through responsive service, transparent operations, and reliable platform performance. None of these appear consistently present based on available feedback.

Conclusion

This comprehensive YIDUGJ Global Ltd review reveals a high-risk broker with significant operational and service problems that make it unsuitable for most forex traders. The combination of a WikiFX safety score of 1, user rating of 1.26, and consistent reports of withdrawal problems shows basic issues with the broker's operations and customer service.

The broker is not recommended for traders seeking reliable fund access, responsive customer support, or transparent operational procedures. The lack of regulatory clarity, combined with user reports of withdrawal processing failures, creates unacceptable risks for potential clients.

Main disadvantages include high-risk safety rating, unresolved withdrawal issues, poor customer service responsiveness, and lack of operational transparency. The absence of identifiable advantages in this review reflects the broker's failure to demonstrate competency in essential brokerage services and client support.