Is Spring FX Signals safe?

Business

License

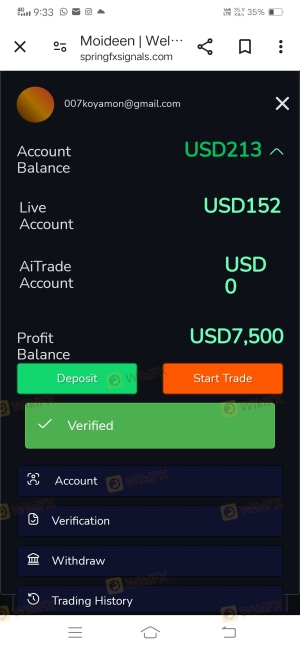

Is Spring FX Signals A Scam?

Introduction

Spring FX Signals is a relatively new player in the forex market, claiming to offer trading services across various asset classes including forex, stocks, and cryptocurrencies. Established in late 2022, the broker has positioned itself as a go-to platform for both novice and experienced traders. However, the rapid rise of online trading platforms has made it crucial for traders to critically evaluate the credibility and safety of these brokers before committing their funds. Given the prevalence of scams in the financial industry, understanding the regulatory environment, company background, trading conditions, and customer feedback is essential for making informed decisions. This article investigates the legitimacy of Spring FX Signals through comprehensive research, drawing on various sources to assess its regulatory status, operational practices, and user experiences.

Regulation and Legitimacy

The regulatory landscape is a fundamental aspect of any financial service provider's credibility. A broker's license signifies compliance with industry standards and offers a layer of protection for traders. Unfortunately, Spring FX Signals operates without any recognized regulatory oversight. This lack of regulation raises significant concerns regarding the safety of funds and the integrity of trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory license means that Spring FX Signals is not subject to the scrutiny of financial authorities, which could lead to potential risks for traders. In many jurisdictions, regulated brokers are required to maintain segregated accounts for client funds, ensuring that those funds are protected in the event of insolvency. Without such measures in place, traders using Spring FX Signals may find their investments at risk. Moreover, the lack of a transparent regulatory history raises red flags, as there is no accountability for the broker's actions.

Company Background Investigation

Spring FX Signals claims to have a global reach, with assertions of having over six million clients across 40 countries. However, the company's actual history is murky. The domain was registered in late 2022, indicating a very short operational timeline. The ownership structure is also unclear, with limited information available about the management team. This lack of transparency can be alarming for potential investors, as it raises questions about the broker's accountability and operational integrity.

The website lists an address in Carrollton, Texas, but this location appears to be a residential area rather than a legitimate office for a financial services firm. Such discrepancies further fuel suspicions regarding the broker's authenticity. As a result, potential clients are left in the dark about who is managing their investments and whether they can be trusted.

Trading Conditions Analysis

Spring FX Signals offers a variety of trading accounts with minimum deposits starting at $300. However, the overall fee structure lacks clarity, and many of the trading conditions are not disclosed. This opacity can be problematic for traders looking to understand the true cost of trading with this broker.

| Fee Type | Spring FX Signals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information about spreads, commissions, and overnight interest rates raises concerns about hidden fees that could significantly impact profitability. Traders should be wary of any broker that does not provide complete transparency regarding its fee structure. This lack of clarity can lead to unexpected costs and diminished returns.

Client Fund Safety

The safety of client funds is paramount in the trading environment. Spring FX Signals has not demonstrated any credible measures to protect client funds. Without proper segregation of accounts, clients' money may be co-mingled with the broker's operational funds, increasing the risk of loss in case of financial difficulties.

Additionally, the broker does not provide any information on investor protection schemes or negative balance protection policies. This lack of safeguards means that traders could potentially lose more than their initial investment. Historically, unregulated brokers often face allegations of misappropriating client funds, and the absence of a regulatory framework makes it challenging for clients to seek recourse in case of disputes.

Customer Experience and Complaints

User feedback is a vital indicator of a broker's reliability. Unfortunately, reviews for Spring FX Signals are predominantly negative, with many users reporting issues related to withdrawals and the quality of customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | High | Poor |

| Misleading Information | Medium | Poor |

Many clients have expressed frustration over their inability to withdraw funds, with some alleging that their accounts were blocked after attempting to access their money. This pattern of complaints aligns with typical behaviors exhibited by fraudulent brokers, making it imperative for potential investors to exercise caution.

Platform and Trade Execution

The trading platform offered by Spring FX Signals has been reported to be subpar, with users experiencing issues related to stability and execution quality. Traders have noted instances of slippage and order rejections, which can severely impact trading performance. Furthermore, there are allegations of platform manipulation, raising concerns about the broker's integrity.

A reliable trading platform should provide a seamless user experience, ensuring that trades are executed promptly and accurately. The reported issues with Spring FX Signals suggest that traders may not be receiving the quality of service they expect, potentially leading to significant financial losses.

Risk Assessment

Using Spring FX Signals poses several risks that potential traders should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases potential for fraud. |

| Fund Safety Risk | High | Lack of fund segregation could lead to loss of capital. |

| Execution Risk | Medium | Reports of slippage and order rejections could affect trading outcomes. |

Given these risks, it is crucial for traders to implement risk mitigation strategies, such as limiting initial investments and diversifying portfolios. Additionally, conducting thorough research on alternative brokers with better regulatory standing can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Spring FX Signals exhibits several characteristics of a potentially fraudulent operation. The absence of regulation, lack of transparency, negative customer feedback, and operational discrepancies raise significant concerns about the broker's legitimacy. Traders should approach this broker with caution, as the risks far outweigh any potential benefits.

For those considering forex trading, it is advisable to seek out regulated brokers that offer transparent trading conditions, robust customer support, and proven track records. Alternatives such as well-established platforms with positive reviews and regulatory oversight should be prioritized to ensure a safer trading experience. Ultimately, the question remains: Is Spring FX Signals safe? The consensus leans toward a resounding "no," making it essential for traders to remain vigilant and informed in their trading endeavors.

Is Spring FX Signals a scam, or is it legit?

The latest exposure and evaluation content of Spring FX Signals brokers.

Spring FX Signals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Spring FX Signals latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.