World Markets 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

World Markets, established in 2003, offers diverse trading platforms with features such as AI-managed accounts, attractive to both experienced traders interested in precious metals and cryptocurrencies as well as retail investors seeking innovative solutions. However, its lack of regulatory oversight, combined with disturbing user complaints regarding withdrawal difficulties and lack of transparency, casts a long shadow over its reliability. As such, it is crucial for potential clients to tread carefully and conduct thorough research before engaging with this broker. The following review provides an in-depth assessment of World Markets, detailing its offerings, the associated risks, and important considerations for potential investors.

⚠️ Important Risk Advisory & Verification Steps

Caution: World Markets operates without regulation from any major authority, raising significant concerns about user safety and fund security.

Self-Verification Steps:

- Check for Licenses: Visit the official regulatory authority websites (e.g., FCA, CySEC) and search for existing licenses that validate the broker's claims.

- Review User Feedback: Analyze multiple user reviews across various platforms to gauge overall user satisfaction and identify any recurring issues.

- Contact Customer Support: Reach out to customer service to assess response times and the quality of support before making any commitments.

- Read the Fine Print: Carefully review all terms, conditions, and fees associated with trading accounts to understand the potential costs involved.

Broker Overview

Company Background and Positioning

Founded in 2003, World Markets emerged as a broker specializing in precious metals before expanding into various trading instruments and asset classes, including cryptocurrencies and CFDs. Despite its claims of managing substantial assets and boasting a client base exceeding 50,000, serious doubts persist about its operational legitimacy due to a lack of verifiable regulatory authority.

Core Business Overview

The primary focus of World Markets includes trading in precious metals, cryptocurrencies, and various asset classes through its collaborations with regulated entities like HYCM. Despite these claimed partnerships which may suggest safety through regulation, many reviews indicate that interactions primarily connect users with HYCM rather than representing World Markets per se. This underscores the necessity of investigating whether these assurances genuinely translate to a reliable trading environment.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching Users to Manage Uncertainty.

The absence of regulatory compliance raises several red flags regarding World Markets' trustworthiness. Despite assertions of operating under regulatory frameworks, investigations reveal no concrete evidence confirming valid licenses. For instance, Italy's CONSOB and the UKs FCA have added World Markets to their list of warnings, citing unauthorized operations. Additionally, many users have raised alarms about their experiences on platforms such as BrokersView, where they reported elaborate withdrawal issues.

Analysis of Regulatory Information Conflicts: The broker claims to be associated with regulatory bodies, yet fails to provide evidence of such affiliations. The official website lacks comprehensive legal information, heightening concerns over transparency and user security.

User Self-Verification Guide:

- Step 1: Visit official regulatory authority websites.

- Step 2: Search for licensing information related to World Markets.

- Step 3: Check форуms and review websites to aggregate user feedback.

- Step 4: Directly query customer service about accountability and fund safety.

- Industry Reputation and Summary: The overwhelming consensus from user reviews indicates a dominant sentiment of dissatisfaction related to fund management and withdrawal processes, solidifying World Markets status as a risky trading option.

Trading Costs Analysis

The Double-Edged Sword Effect.

World Markets presents itself with competitive commission structures that are appealing at first glance, yet additional fees and hidden costs significantly undermine overall value.

Advantages in Commissions: Traders often note low upfront commissions, enabling a more lucrative trading experience for those accustomed to navigating higher-cost platforms. The high-frequency trading model appears attractive, with connected performance providing an average monthly return.

The "Traps" of Non-Trading Fees: While upfront commissions may be low, withdrawal fees can reach $35, and credit card transactions may incur quite steep fees of up to 2%. A notable user complaint observed that these unexpected costs were not transparent during onboarding.

Cost Structure Summary: While the trading costs might seem beneficial initially, these hidden fees can deter casual traders, especially those with smaller investment volumes, diminishing overall profitability over time.

Professional Depth vs. Beginner-Friendliness.

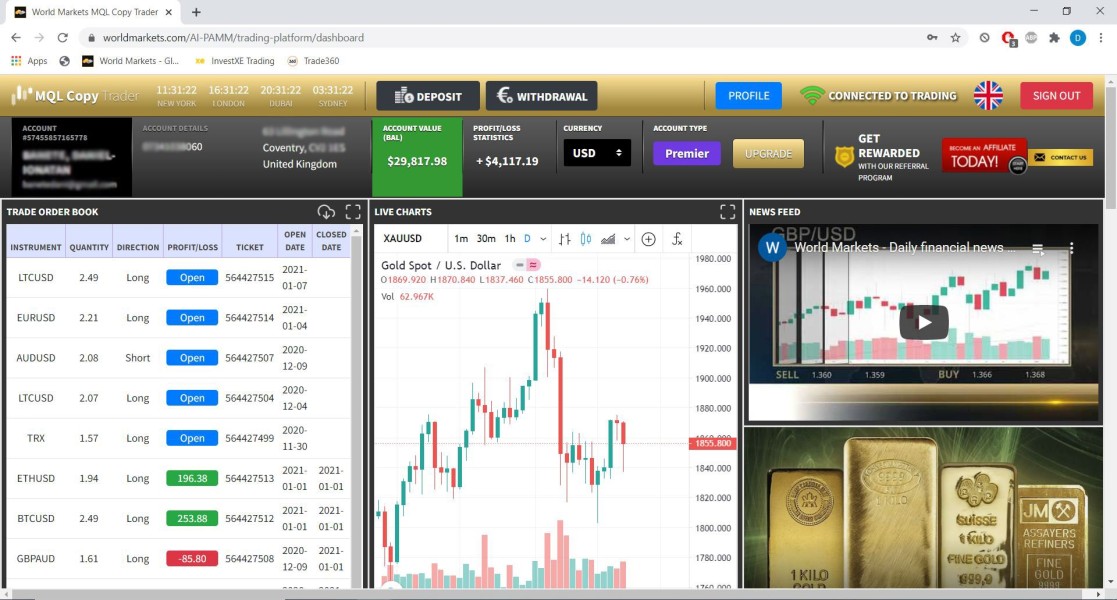

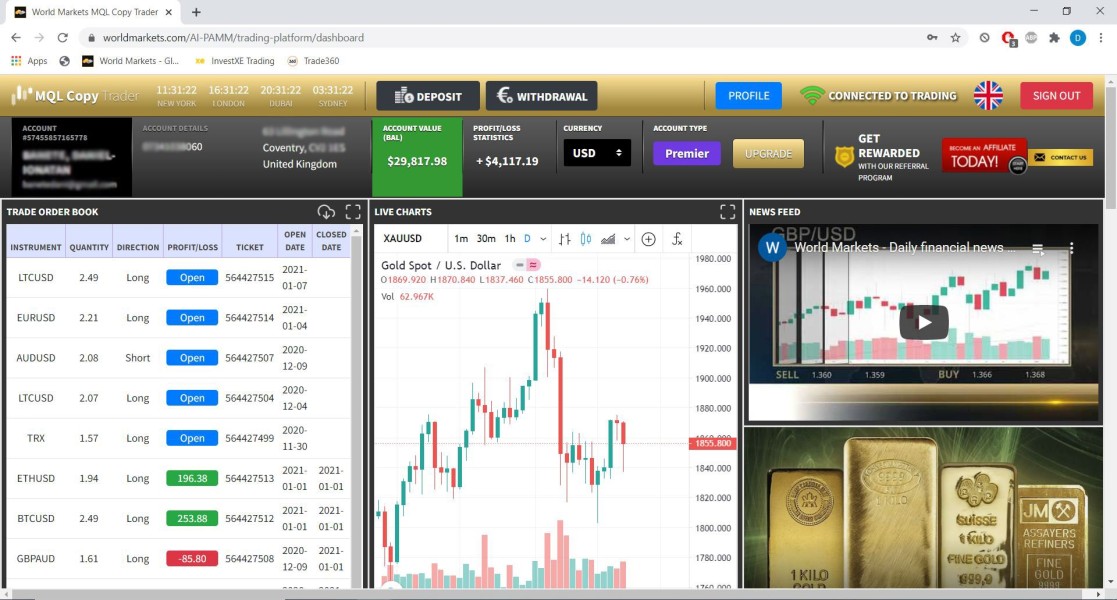

World Markets leverages popular platforms like MetaTrader 4 and 5 alongside its proprietary systems.

Platform Diversity: Users have access to established platforms like MT4 and MT5, which are praised for their features but come with a steeper learning curve for novice traders. The proprietary MQL Copy Trader provides a simplified interface for tracking AI-managed trades.

Quality of Tools and Resources: There are varying levels of satisfaction reported concerning the available educational material and market analysis tools. Some users expressed disappointment over the absence of comprehensive training resources accessible during the onboarding process.

Platform Experience Summary: Feedback often highlights usability issues alongside praise for functionality. User quotes frequently reflect ambivalence about platform access and efficacy, hinting at a need for improved developer focus on user interface design.

User Experience Analysis

Assessing the Trader's Encounter.

User experience on World Markets has become a contentious aspect of broker reviews, with significant reports of problematic engagement.

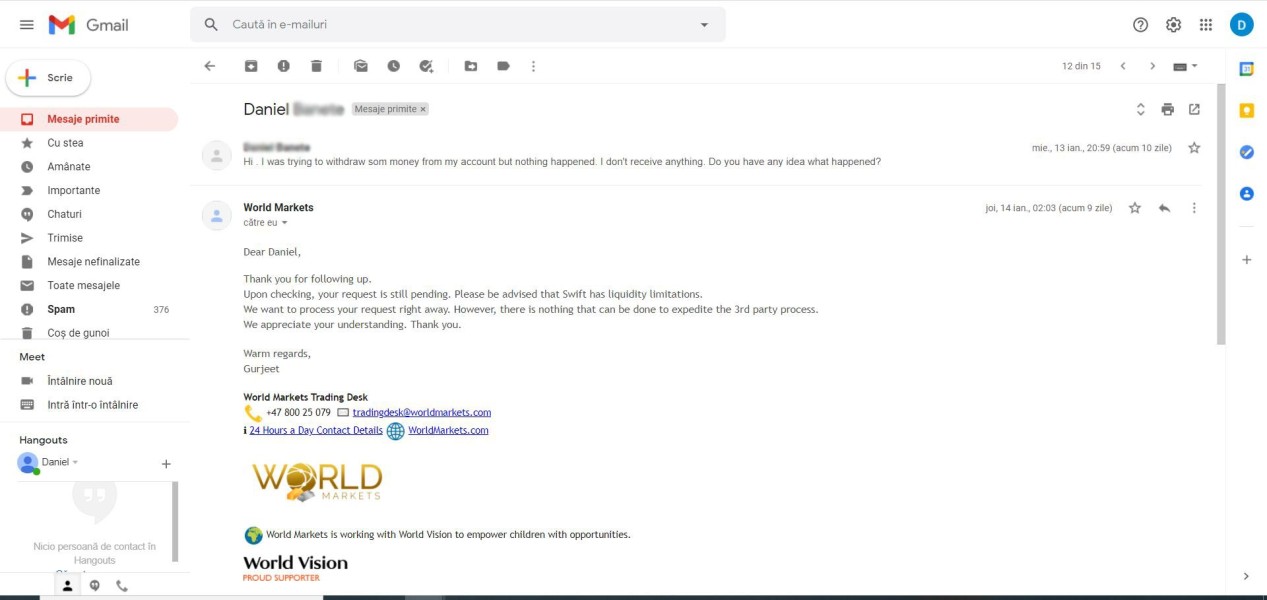

Complaints and Challenges: Numerous reviews emphasize the difficulty in account management, especially concerning blocked accounts and fund access. One user declared, “... I just couldn't use it one day; they refuse to talk to me.”

Account Disruptions: Instances of abrupt account suspension or errors have become frequent complaints within trader forums, reflecting troubling operational transparency and reliability.

Overall Sentiment Framework: A pervasive atmosphere of mistrust has grown, with user sentiment virtually summarized by a demand for more responsive service and transparency around account management.

Customer Support Analysis

The Backbone of User Confidence.

Customer support presents a less-than-stellar picture, with numerous complaints detailing inefficiency in resolving user issues.

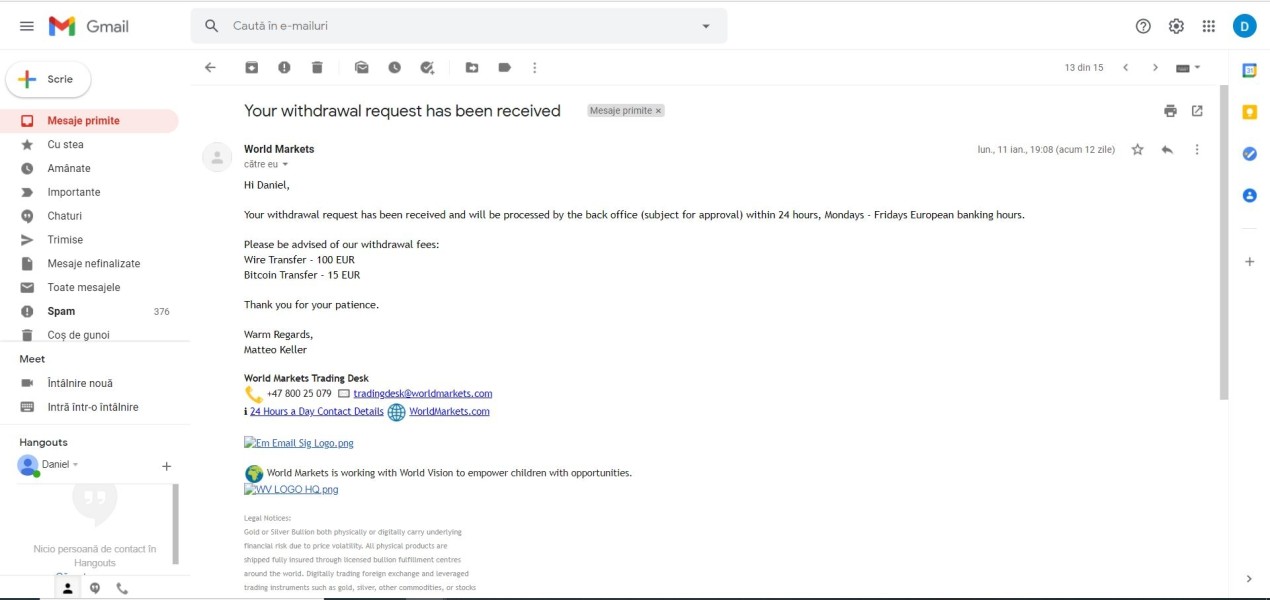

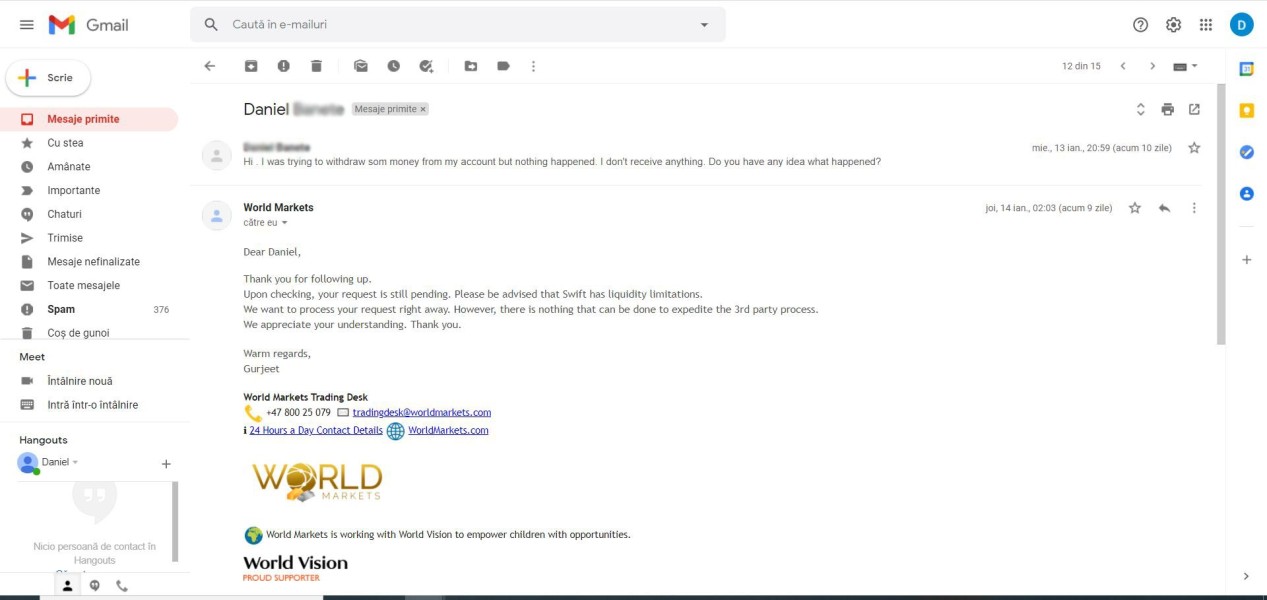

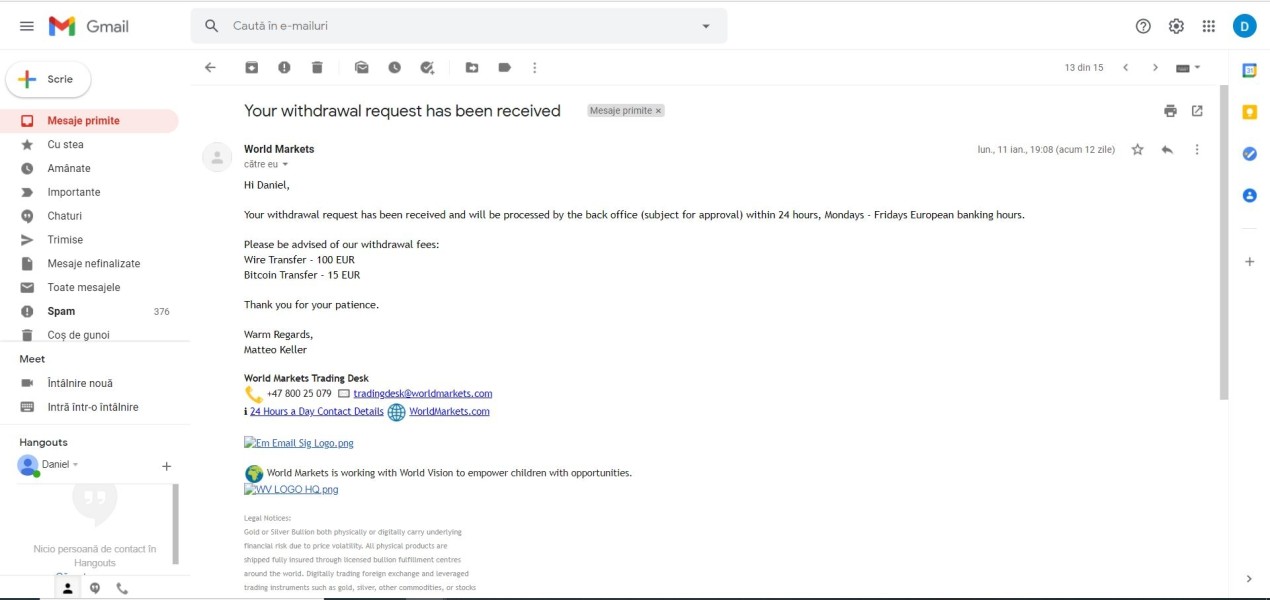

Response Times and Support Quality: Reviews reveal prolonged waiting times for customer responses, combining this with the broker's limited contact options, primarily email and ticket submissions. Ratings frequently echo disappointment in the lack of timely resolution for pressing issues.

Service Accessibility: Given the absence of live chat support or direct phone options, countless users reported feelings of isolation when seeking assistance. The limitations on communication channels pose a significant challenge during critical trading periods.

User Experiences Summary: Overall, customer support has earned low marks, often described as sluggish and unhelpful when navigating withdrawal complexities or resolving account errors, furthering doubts about the broker's reliability in customer care functions.

Account Conditions Analysis

Navigating Potential Engagement Risks.

World Markets hosts a range of account types, yet the conditions tied to them merit careful consideration.

Minimum Deposit Requirements: Set at $2,500 for AI-managed accounts, this threshold may deter beginner investors, especially without any guaranteed regulatory protection.

Withdrawal Protocols: The ability to make only one withdrawal per calendar month, unless additional stocks are performed, has emerged as a significant frustration in user reviews, consistently undermining the liquidity expectations generally afforded by trading platforms.

Account Overview Summary: Although various account types might appear to attract a wider audience, the risks bundled with each warrant a cautious approach from potential investors seeking either short-term agility or long-term engagement.

Conclusion

In a landscape fraught with risks and uncertainties, World Markets stands as a profoundly compelling yet troubling option for traders. While its innovative approach to AI-managed trading warrants recognition, the overarching themes of user dissatisfaction, inconsistent operational transparency, and a gaping regulatory oversight void raise considerable alarms about its trustworthiness. Retail investors, especially those who might lean towards risk-averse strategies, would be prudent to weigh these factors carefully before engaging with World Markets. Given the substantial risks involved, it is critical to prioritize self-protective measures and conduct independent research. Always remember to only invest what you can afford to lose.