Is MONTTORO safe?

Business

License

Is Monttoro Safe or Scam?

Introduction

Monttoro is an online forex and CFD brokerage that claims to operate out of the United States, offering traders access to the popular MetaTrader 5 platform. As with any financial service provider, it is essential for traders to exercise caution and conduct thorough due diligence before engaging with Monttoro. The forex market is rife with both legitimate brokers and scams, making it crucial for traders to assess the credibility and safety of their chosen platform. This article investigates Monttoro's regulatory status, company background, trading conditions, customer experiences, and overall safety to determine whether it is a trustworthy broker or a potential scam.

To conduct this investigation, we analyzed various online sources, including user reviews, regulatory databases, and expert opinions. Our assessment framework focuses on key areas such as regulatory compliance, company transparency, trading conditions, customer feedback, and risk factors, providing a comprehensive overview of Monttoros operations.

Regulation and Legitimacy

Regulatory Status

One of the most critical aspects to consider when evaluating any broker is its regulatory status. A well-regulated broker is often viewed as more trustworthy, as they are subject to strict oversight and must adhere to specific operational standards. Unfortunately, Monttoro does not appear to hold any valid regulatory licenses, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Monttoro's lack of regulatory oversight places it in a high-risk category. According to sources, the broker has been rated poorly on platforms like WikiFX, receiving a score of only 1.22 out of 10. This lack of regulation not only limits traders' legal recourse in case of disputes but also increases the risk of fraud and mismanagement of funds. The absence of a credible regulatory authority overseeing Monttoro's operations is a significant red flag for potential investors.

Company Background Investigation

Monttoro's company history and ownership structure are also essential factors in assessing its credibility. However, detailed information about the company's origins, management team, and operational history appears to be scarce. This lack of transparency is concerning, as reputable brokers typically provide clear information about their leadership and company structure.

The available data indicates that Monttoro claims to be based in New York, but without verifiable information about its ownership or management team, it is challenging to assess the broker's reliability. A transparent company usually discloses its executive team, their qualifications, and relevant industry experience. The absence of such information raises questions about Monttoro's commitment to transparency and accountability.

Trading Conditions Analysis

Fee Structure

Understanding a broker's fee structure is vital for traders looking to maximize their returns. Monttoro's trading conditions, including spreads, commissions, and overnight interest rates, are essential considerations for potential clients. However, the information available on Monttoro's fee structure is limited, and this lack of clarity can be a cause for concern.

| Fee Type | Monttoro | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | Varies (1-3 pips) |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific details regarding Monttoro's trading costs makes it difficult to evaluate how competitive its offerings are compared to other brokers. Traders should be cautious of brokers that do not provide clear information about fees, as hidden charges can significantly impact profitability. The lack of transparency in Monttoro's fee structure raises concerns about the overall trading experience and cost-effectiveness.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Monttoro's approach to fund security, including measures like fund segregation, investor protection, and negative balance protection, is unclear. Reputable brokers typically implement strict protocols to ensure that client funds are kept in separate accounts and are protected against potential insolvency.

Without verifiable information on Monttoro's fund security measures, it is difficult to ascertain the safety of investors' capital. Historical incidents involving fund mismanagement or security breaches can further exacerbate concerns. Traders should be wary of engaging with Monttoro until clearer information about its fund protection policies is made available.

Customer Experience and Complaints

User Feedback

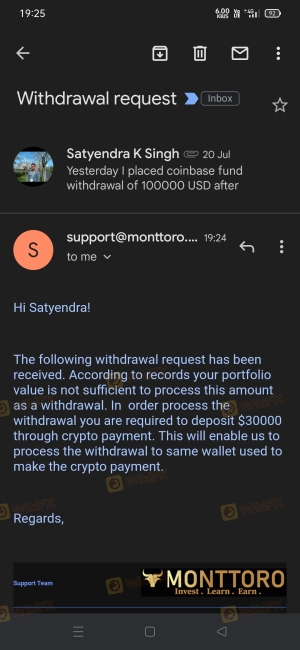

Customer experiences and feedback are invaluable resources for assessing a broker's reliability. Unfortunately, feedback regarding Monttoro has been predominantly negative, with numerous users reporting difficulties in withdrawing funds. Common complaints include issues related to account suspensions and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

Several users have recounted their struggles with Monttoro, alleging that their accounts were frozen after they attempted to withdraw funds. This pattern of complaints is alarming and suggests a potential operational issue or a lack of integrity within the brokerage. The companys failure to adequately address these complaints further diminishes its credibility and raises the question: Is Monttoro safe?

Platform and Execution

The trading platform's performance and execution quality are critical factors for traders. Monttoro claims to offer the MetaTrader 5 platform, known for its advanced trading features and user-friendly interface. However, there are concerns regarding order execution quality, slippage, and potential manipulation.

As of now, there are no comprehensive reports detailing Monttoro's platform performance, which leaves traders uncertain about the reliability of their trading environment. Any signs of platform manipulation or poor execution can severely impact traders' experiences and profitability.

Risk Assessment

Overall Risk

Engaging with Monttoro presents multiple risks, particularly due to its unregulated status and negative user feedback. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

| Transparency Risk | Medium | Lack of information about company structure and fees. |

To mitigate these risks, traders should conduct thorough research, consider starting with a minimal investment, and explore alternative brokers with better regulatory standing and user reviews.

Conclusion and Recommendations

In summary, the evidence suggests that Monttoro exhibits several characteristics typical of a scam broker. Its lack of regulation, negative customer feedback, opaque fee structure, and insufficient transparency raise significant concerns about its safety and legitimacy. As such, we recommend that traders exercise extreme caution when considering Monttoro as a trading platform.

For those seeking reliable alternatives, it would be prudent to consider brokers that are regulated by reputable authorities, have transparent fee structures, and maintain positive customer feedback. Ultimately, ensuring the safety of your investments should be the top priority, and choosing a trustworthy broker is a crucial step in that direction.

Is MONTTORO a scam, or is it legit?

The latest exposure and evaluation content of MONTTORO brokers.

MONTTORO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MONTTORO latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.