Gxcm 2025 Review: Everything You Need to Know

Gxcm has generated considerable attention in the online trading community, with opinions ranging from positive user experiences to serious allegations of fraud. This review synthesizes various sources to provide a comprehensive overview of Gxcm, highlighting key features, user experiences, and expert opinions.

Note: It is important to recognize that Gxcm operates under different entities across regions, which may impact regulatory oversight and user experience. This review aims to present a balanced view based on available information.

Ratings Overview

We evaluate brokers based on user feedback, expert analysis, and factual data.

Broker Overview

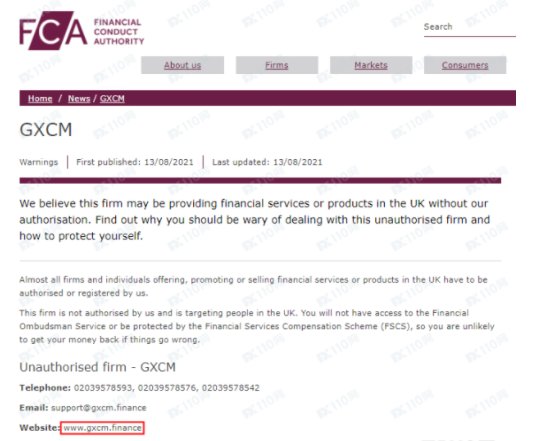

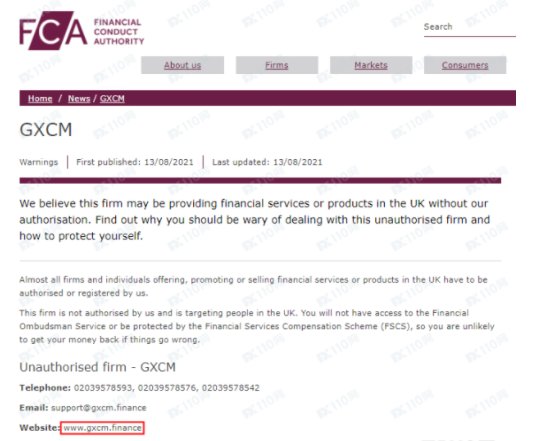

Founded in 2016, Gxcm operates as an online CFD and cryptocurrency trading platform, claiming to provide access to over 3,000 assets, including forex, stocks, indices, commodities, and cryptocurrencies. The platform is web-based, and while it is said to be user-friendly, it lacks the sophistication of established platforms like MetaTrader 4 or 5. Gxcm has been flagged by various regulatory bodies, including the UK's FCA, which warns potential users of its unregulated status.

Detailed Breakdown

Regulatory Geographical Areas

Gxcm is reportedly unregulated and operates under the name Gxcm Ltd, which appears to be nonexistent in official registries. The lack of regulation raises significant concerns regarding the safety of funds and the legitimacy of the broker. The FCA has issued warnings against Gxcm, indicating that clients may struggle to recover their funds if issues arise.

Deposit/Withdrawal Methods

Gxcm allows deposits via credit/debit cards and bank wire transfers, with a minimum deposit requirement of $250. However, withdrawal fees are steep, with a 3.5% charge on credit card transactions and a flat fee of $20 for wire transfers. Additionally, accounts inactive for three months incur a monthly fee, leading to concerns over hidden costs.

Minimum Deposit

The minimum deposit required to open an account with Gxcm is $250, which is relatively standard in the industry. However, given the broker's unregulated status, this initial investment could pose a significant risk.

While Gxcm does not appear to offer any bonuses or promotions, it has been reported that clients must trade a bonus amount up to 180 times before being eligible for withdrawals, further complicating the withdrawal process.

Tradable Asset Classes

Gxcm claims to offer a diverse range of tradable assets, including forex pairs, cryptocurrencies, indices, and commodities. However, the quality and actual availability of these assets remain questionable, given the broker's reputation.

Costs (Spreads, Fees, Commissions)

The average spread for popular currency pairs is reported to be around 3 pips, which is considered high compared to industry standards. Additionally, the various fees associated with withdrawals and inactivity further diminish the attractiveness of trading with Gxcm.

Leverage

Gxcm does not clearly state its leverage offerings, which is a significant red flag. Many unregulated brokers tend to offer high leverage to attract traders, but this can expose clients to substantial risks.

Gxcm operates on a proprietary web-based platform, which lacks the advanced features and user experience of established platforms like MetaTrader. The absence of a mobile app also limits trading flexibility.

Restricted Regions

Gxcm does not accept clients from the United States and operates primarily in regions where regulatory oversight is minimal. This lack of transparency regarding its operational regions raises further concerns.

Available Customer Support Languages

Customer support at Gxcm is reportedly limited to English, which may alienate non-English speaking users. Reviews indicate that the support staff is often unresponsive, leading to frustration among clients seeking assistance.

Repeated Ratings Overview

Detailed Breakdown of Ratings

Account Conditions

Gxcm's account conditions are underwhelming, with a minimum deposit of $250 and high withdrawal fees. Users have expressed concerns about the withdrawal process, often citing delays and complications.

While Gxcm claims to offer various resources, many users find the educational materials lacking. The platform's tools are not as advanced as those found in more reputable brokers.

Customer Service & Support

Customer service is one of Gxcm's weakest points, with many users reporting difficulties in reaching support and receiving timely responses. This lack of effective customer service further diminishes user trust.

Trading Setup/Experience

The trading experience on Gxcm's platform is often described as basic and lacking in functionality. Users have noted that the platform does not offer the same level of sophistication as industry-standard platforms like MetaTrader.

Trustworthiness

Gxcm's trustworthiness is heavily criticized, with multiple sources labeling it as a scam. The FCA has issued warnings, and many user reviews highlight significant withdrawal issues.

User Experience

User experiences with Gxcm are mixed, with some reporting smooth trading operations while others detail severe issues with withdrawals and customer support. The inconsistency in user feedback raises questions about the platform's reliability.

In conclusion, the Gxcm review indicates a broker with significant red flags, particularly concerning its regulatory status and user experiences. Potential traders should exercise extreme caution and consider more reputable alternatives.