Regarding the legitimacy of Huixin forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Huixin safe?

Pros

Cons

Is Huixin markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

匯鑫富(香港)投資有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港干諾道西28號威勝商業大廈9樓01室Phone Number of Licensed Institution:

25173808Licensed Institution Certified Documents:

Is Huixin A Scam?

Introduction

Huixin is a forex broker that claims to provide a wide range of trading services to investors, positioning itself as a competitive player in the foreign exchange market. However, the increasing number of reports regarding its suspicious activities has raised concerns among potential traders. As the forex market is highly decentralized and less regulated compared to traditional financial markets, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to critically assess whether Huixin is a safe trading platform or a potential scam.

To evaluate Huixin's credibility, we will explore its regulatory status, company background, trading conditions, customer fund safety, and user experiences. Our investigation relies on various credible sources, including user reviews, regulatory databases, and financial news outlets. By employing this comprehensive assessment framework, we aim to provide a balanced view of Huixin's operations and help traders make informed decisions.

Regulation and Legitimacy

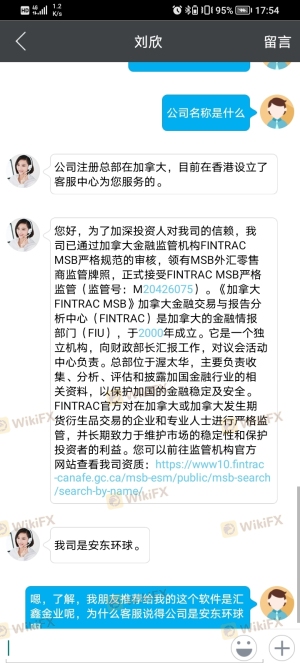

Regulation plays a vital role in ensuring the safety and transparency of financial transactions. Brokers that operate under strict regulatory frameworks are generally more reliable than those that do not. In the case of Huixin, the regulatory landscape appears concerning. The broker is reported to have a “suspicious clone” status from the Chinese Gold and Silver Exchange Society (CGSE), indicating that it may be impersonating a legitimate entity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 187 | China | Suspicious Clone |

The lack of a valid regulatory license raises significant red flags. It suggests that Huixin may not adhere to the necessary compliance standards that protect investors' funds. Furthermore, operating without proper oversight can expose traders to various risks, including fraud, misappropriation of funds, and lack of recourse in case of disputes. The absence of a functional website further complicates the situation, as potential clients cannot verify the broker's claims or access essential information.

Company Background Investigation

Understanding a broker's history, ownership structure, and management team is crucial for assessing its legitimacy. Unfortunately, detailed information about Huixin is sparse, raising concerns about its transparency. The company claims to have been established within the past few years, but its operational history and ownership structure remain unclear. This lack of transparency can be detrimental, as it prevents potential clients from evaluating the broker's reliability and trustworthiness.

Moreover, the absence of a well-defined management team with relevant industry experience adds to the concerns. A strong leadership team is essential for effective risk management and operational integrity. Without accessible information about the individuals behind Huixin, it becomes challenging to gauge the broker's commitment to ethical practices and investor protection.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions offered is essential. Huixin claims to provide various financial instruments, including forex currency pairs, indices, commodities, and cryptocurrencies. However, the actual trading conditions, such as spreads, commissions, and leverage, are not transparently disclosed.

| Fee Type | Huixin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of clarity regarding trading costs can be a significant issue for traders, as hidden fees may erode profits. Furthermore, the absence of a demo account prevents potential clients from testing the trading platform and its conditions before committing real funds. This situation raises questions about the broker's intentions and whether traders can expect fair treatment.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Huixin's approach to fund security is questionable, as there is little information available about its safety measures. A reliable broker typically employs segregated accounts to ensure that client funds are kept separate from the company's operational funds. This practice protects investors in case the broker faces financial difficulties.

Additionally, the absence of investor protection schemes, such as negative balance protection, further complicates the assessment of Huixin's safety. Traders need assurance that their investments are secure and that they will not incur losses exceeding their initial deposits. Given the available information, potential clients should be cautious regarding the safety of their funds when considering Huixin.

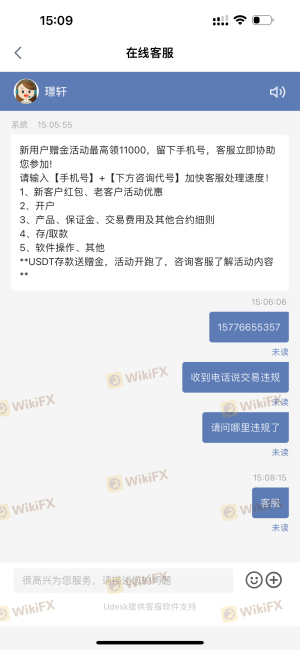

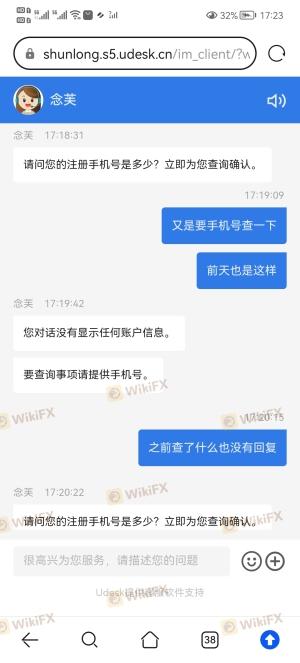

Customer Experience and Complaints

Customer feedback serves as a vital indicator of a broker's reliability and service quality. In the case of Huixin, numerous complaints have surfaced, highlighting issues such as withdrawal difficulties, account freezes, and unresponsive customer service. These complaints raise significant concerns about the broker's operational integrity and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Account Freezes | High | Unresponsive |

| Customer Service Delays | Medium | Unresponsive |

Several users have reported being unable to withdraw their funds, with accounts being frozen without explanation. Such practices are commonly associated with scam brokers, where clients are pressured to deposit more funds or engage in further trading to access their money. The lack of timely and effective responses from Huixin's customer service further exacerbates the situation, leading to frustration and distrust among clients.

Platform and Execution

The performance of a trading platform is critical for a seamless trading experience. While Huixin claims to offer a robust trading platform, the absence of user testimonials and independent reviews makes it challenging to assess its performance accurately. Key factors such as order execution speed, slippage, and rejection rates are crucial for traders, especially in the volatile forex market.

If users experience frequent slippage or order rejections, it can significantly impact their trading outcomes. Unfortunately, without reliable data on Huixin's platform performance, potential clients may find it difficult to gauge whether they can trust the broker's execution quality.

Risk Assessment

Engaging with Huixin presents several risks that traders should carefully consider. The overall lack of regulation, transparency, and customer support raises significant concerns. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Safety | High | Unclear fund protection measures |

| Customer Support Quality | High | Numerous complaints about unresponsiveness |

| Platform Performance | Medium | Lack of user feedback and reviews |

To mitigate these risks, traders should consider conducting thorough research, seeking out regulated brokers, and avoiding platforms with questionable reputations. Utilizing demo accounts and engaging with reputable trading communities can also help in making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about Huixin's legitimacy and safety. The broker's lack of regulatory oversight, transparency issues, and numerous customer complaints suggest that it may not be a safe option for traders. Potential clients should exercise extreme caution when considering Huixin, as there are clear indications of fraudulent practices.

For traders seeking reliable alternatives, it is advisable to choose brokers that are well-regulated, with positive user feedback and transparent trading conditions. Some reputable options include brokers regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). By prioritizing safety and transparency, traders can protect their investments and enhance their trading experience.

Is Huixin a scam, or is it legit?

The latest exposure and evaluation content of Huixin brokers.

Huixin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Huixin latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.