Is Winoteror safe?

Business

License

Is Winoteror Safe or Scam?

Introduction

Winoteror is a forex brokerage that has recently garnered attention in the trading community. Positioned primarily to cater to the Chinese market, it claims to offer a variety of trading instruments, including forex and CFDs. However, as with any forex broker, traders must exercise caution and thoroughly evaluate the legitimacy and reliability of the platform before committing their funds. Given the prevalence of scams in the forex industry, it is crucial for traders to discern trustworthy brokers from those that may pose risks to their investments. This article aims to provide a comprehensive analysis of Winoteror, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on a review of multiple credible sources, including regulatory filings, user reviews, and expert analyses.

Regulation and Legitimacy

When assessing whether Winoteror is safe, one of the first factors to consider is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards of conduct. Unfortunately, Winoteror appears to lack valid regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Winoteror is not subject to the strict compliance requirements imposed by financial authorities, making it potentially risky for traders. Without oversight, there is little recourse for traders in case of disputes or financial mishaps. Historical compliance records and the quality of regulation play a vital role in determining a broker's reliability. In this case, the lack of any regulatory framework surrounding Winoteror significantly undermines its credibility.

Company Background Investigation

A detailed examination of Winoteror's company background reveals a lack of transparency regarding its ownership and operational history. The company operates under the name Winoteror Global Limited, but there is scant information available about its founding, development timeline, or the individuals behind its management.

The management team's background and professional experience are crucial indicators of a broker's reliability. In the case of Winoteror, the absence of publicly available information regarding its leadership raises red flags. Transparency in operations and information disclosure is essential for building trust with clients. Traders are advised to be wary of brokers that do not provide adequate information about their corporate structure and management.

Trading Conditions Analysis

Understanding the trading conditions offered by Winoteror is essential for evaluating whether it is safe for traders. The broker claims to provide competitive trading fees; however, a lack of clarity on its fee structure can create confusion and potential pitfalls for traders.

| Fee Type | Winoteror | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 1.5 pips |

| Commission Structure | N/A | $3 - $8 per lot |

| Overnight Interest Range | N/A | 0.5% - 2% |

Without clear information on spreads, commissions, and overnight interest rates, traders may find themselves facing unexpected costs. Such opacity in fee structures can be a tactic used by less scrupulous brokers to exploit unaware traders. Therefore, it is essential to gather as much information as possible about the actual trading conditions before engaging with Winoteror.

Customer Fund Safety

The safety of customer funds is paramount when determining whether Winoteror is safe. A reliable broker should implement strict measures to ensure the security of client deposits. This includes segregating client funds from the broker's operational capital, offering investor protection schemes, and providing negative balance protection.

Unfortunately, Winoteror does not provide any information regarding its fund security measures. The lack of transparency in this area is concerning, as it leaves traders vulnerable to potential financial losses. Historical incidents of fund mismanagement or security breaches can severely impact a broker's reputation and reliability. Without a clear outline of Winoteror's safety protocols, traders should approach this broker with caution.

Customer Experience and Complaints

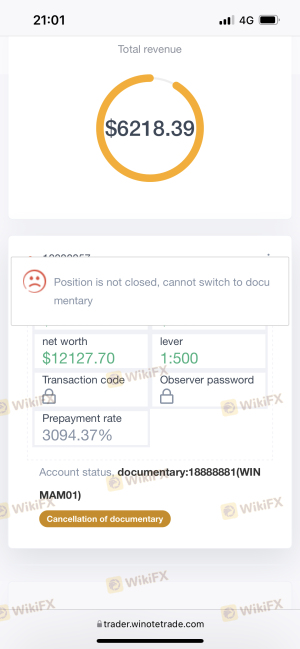

Customer feedback is a valuable resource for assessing the reliability of a broker. In the case of Winoteror, user experiences have been mixed, with several complaints surfacing regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Quality | Medium | Average |

| Lack of Transparency | High | None |

Common complaints include difficulties in withdrawing funds, inadequate customer support, and a general lack of transparency regarding trading conditions. These issues can significantly impact a trader's experience and trust in the broker. For instance, one user reported a lengthy delay in processing a withdrawal request, which raised concerns about the broker's credibility. Such complaints highlight the importance of a responsive and capable customer service team in fostering trader confidence.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial factors in determining whether Winoteror is safe for trading. A stable platform with efficient order execution is essential for traders to manage their investments effectively. However, there are reports suggesting that the platform may experience issues such as slippage and order rejections.

These problems can lead to significant financial losses, particularly in volatile market conditions. Traders should be cautious if they encounter any signs of platform manipulation or irregularities in trade execution. A broker's commitment to providing a fair and transparent trading environment is vital for building trust with clients.

Risk Assessment

Using Winoteror comes with inherent risks that traders should be aware of. The lack of regulation, transparency issues, and complaints about customer service contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Operational Risk | Medium | Potential platform issues |

| Financial Risk | High | Lack of fund security measures |

To mitigate risks, traders should consider starting with a small investment, thoroughly researching the broker's practices, and remaining vigilant about any red flags that may arise during their trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Winoteror may not be a safe choice for traders. The absence of regulatory oversight, a lack of transparency regarding fees and fund security, and mixed customer feedback indicate potential risks associated with this broker. Traders should exercise caution and consider alternative options with a proven track record of reliability and customer service.

For those seeking safer trading environments, it may be wise to explore brokers that are well-regulated and offer transparent trading conditions. Always prioritize due diligence and ensure that your trading partner is trustworthy before committing your funds.

Is Winoteror a scam, or is it legit?

The latest exposure and evaluation content of Winoteror brokers.

Winoteror Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Winoteror latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.