Is Node Capital Group safe?

Business

License

Is Node Capital Group Safe or Scam?

Introduction

Node Capital Group is a financial services provider that has emerged in the forex market, offering a range of trading products and services. As the trading landscape becomes increasingly competitive, traders must exercise caution and conduct thorough evaluations of forex brokers to safeguard their investments. With numerous reports of scams and fraudulent activities in the industry, it is crucial to assess the legitimacy and reliability of any trading platform before committing funds. This article will explore the safety and legitimacy of Node Capital Group, utilizing various sources and structured evaluations to provide a comprehensive overview.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and credibility. Node Capital Group is registered in the United Kingdom but operates without any significant regulation from reputable financial authorities. The absence of regulatory oversight raises concerns about the broker's legitimacy and the potential risks associated with trading through their platform.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | United States | Suspicious Clone |

Node Capital Group claims to hold a “common financial service license” in the United States, with a license number of 0543789. However, this license does not provide any sharing permissions, and there is no verifiable website, email address, physical address, or contact number associated with the licensed institution. The lack of regulation from prestigious bodies like the National Futures Association (NFA) or the Financial Conduct Authority (FCA) indicates that traders may not have sufficient protection or recourse in the event of disputes or issues. Therefore, the question remains: Is Node Capital Group safe? The absence of strong regulatory oversight suggests that traders should be cautious.

Company Background Investigation

Node Capital Group's history and ownership structure are essential to understanding its credibility. Established within the last 2 to 5 years, the company has positioned itself in the competitive forex market. However, the details surrounding its ownership and management team are somewhat opaque, with limited information available to the public. The lack of transparency can be a red flag for potential investors, as it raises questions about the company's operational integrity.

The management teams background and professional experience are critical indicators of a company's reliability. Unfortunately, Node Capital Group does not provide sufficient details regarding its leadership, which can lead to skepticism about their expertise in the financial markets. Moreover, the company's information disclosure level appears to be lacking, which is not conducive to building trust with potential clients. This raises the question: Is Node Capital Group safe? The limited transparency and information availability may deter cautious traders from engaging with the broker.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall cost structure. Node Capital Group provides access to various trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. However, the fee structure warrants careful examination, as any unusual or problematic policies could signal potential issues.

| Fee Type | Node Capital Group | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable starting at 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | $0 per lot (Standard Account) | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Node Capital Group are relatively high compared to industry averages, which could significantly impact trading profitability. Additionally, while the absence of commission fees on the standard account may seem appealing, it is essential to consider the overall trading costs, including potential hidden fees. This raises concerns regarding the transparency of their fee structure. Therefore, it is crucial for traders to ask themselves: Is Node Capital Group safe? The high trading costs may indicate that traders could face challenges in achieving profitable trades.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Node Capital Group's measures for securing client funds, including fund segregation, investor protection, and negative balance protection policies, are critical to assess. Unfortunately, there is limited information available regarding the broker's fund security protocols.

A reputable broker typically segregates client funds from its operational capital, ensuring that clients' money is protected even in the event of the broker's insolvency. Additionally, investor protection schemes can provide a safety net for traders, allowing them to recover funds in case of broker misconduct. However, the absence of clear information on these policies raises questions about the safety of funds deposited with Node Capital Group. Given these concerns, traders must consider whether Node Capital Group is safe to trade with, especially when it comes to the security of their investments.

Customer Experience and Complaints

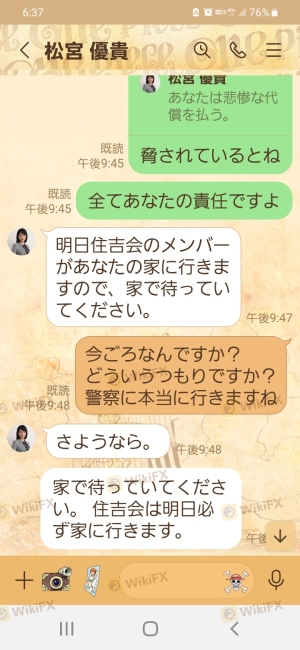

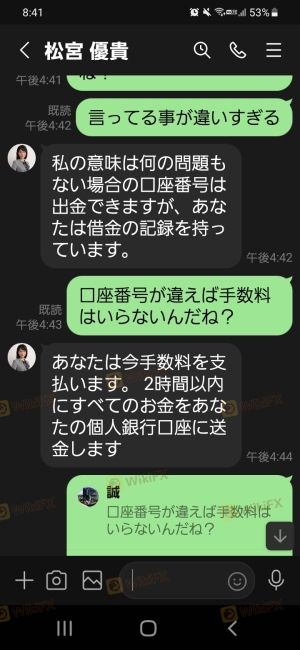

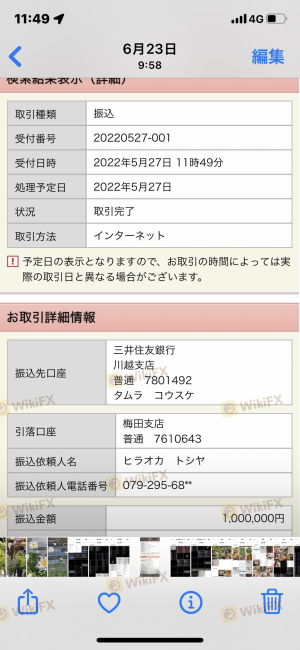

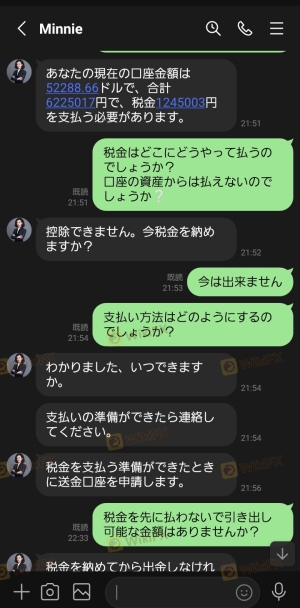

Analyzing customer feedback and real user experiences is crucial when evaluating a broker's reliability. Node Capital Group has garnered mixed reviews from clients, with numerous complaints regarding withdrawal issues, high fees, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Moderate |

| Customer Service Issues | High | Poor |

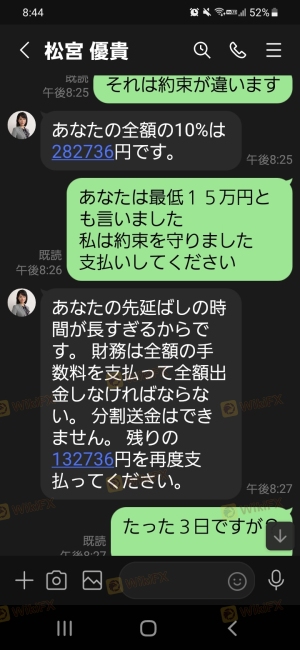

Many users have reported difficulties in withdrawing their funds, often citing unreasonable fees or being asked to pay additional charges before withdrawals are processed. These complaints indicate that the broker may not prioritize customer satisfaction, raising concerns about its operational integrity. This leads to the question: Is Node Capital Group safe? The prevalence of complaints and the company's inadequate response to these issues suggest that traders should exercise caution.

Platform and Execution

The performance and stability of the trading platform are critical for a seamless trading experience. Node Capital Group offers the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced charting capabilities. However, the effectiveness of order execution, slippage rates, and refusal rates are essential factors to consider.

Traders have reported varying experiences with order execution quality, with some noting instances of slippage during volatile market conditions. The presence of potential platform manipulation or technical issues could significantly impact trading outcomes. Therefore, traders must evaluate whether Node Capital Group is safe to use, given the reported inconsistencies in platform performance.

Risk Assessment

Engaging with any forex broker carries inherent risks, and assessing these risks is crucial for informed decision-making. Node Capital Group presents several risk factors that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from reputable authorities. |

| Financial Risk | Medium | High trading costs and potential withdrawal issues. |

| Operational Risk | High | Reports of platform manipulation and poor customer support. |

Given these identified risks, traders should consider implementing risk mitigation strategies, such as limiting the amount of capital invested and conducting thorough research before engaging with the broker. The overarching question remains: Is Node Capital Group safe? The high-risk levels associated with this broker suggest that traders should proceed with caution.

Conclusion and Recommendations

In conclusion, while Node Capital Group offers a range of trading products and services, significant concerns regarding its regulatory status, transparency, trading conditions, and customer experience raise red flags about its legitimacy. The absence of oversight from reputable financial authorities and numerous customer complaints indicate that traders may face challenges when engaging with this broker.

For those considering trading with Node Capital Group, it is essential to weigh the potential risks and challenges against the benefits. Cautious traders may want to explore alternative brokers with strong regulatory backing and positive customer feedback. Recommended alternatives include brokers that are regulated by top-tier authorities, providing a safer trading environment and better protection for client funds. Ultimately, the question of whether Node Capital Group is safe remains unanswered, and traders are advised to conduct thorough research and consider their risk tolerance before proceeding.

Is Node Capital Group a scam, or is it legit?

The latest exposure and evaluation content of Node Capital Group brokers.

Node Capital Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Node Capital Group latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.