Fx Live Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Fx Live Capital review examines a forex broker that has been operating since 2016. The company offers diverse trading services to international clients around the world. Based on available information and user feedback, Fx Live Capital presents itself as a multi-asset broker with some attractive features. However, certain regulatory aspects require careful consideration from potential traders.

The broker's standout features include zero commission accounts and leverage up to 500:1. These features appeal to traders seeking cost-effective and flexible trading conditions that can maximize their potential returns. According to Trustpilot, the platform maintains a solid 4.6 user rating. Customers particularly praise the support team's performance and responsiveness in handling their concerns.

Fx Live Capital targets investors seeking diverse asset classes and high leverage trading opportunities. The broker offers access to forex, shares, indices, oil/energies, cryptocurrencies, and metals. This makes it suitable for traders who prefer diversified portfolios across multiple market sectors. However, potential clients should note the limited regulatory information available. This may impact investment decisions for those prioritizing heavily regulated environments and maximum safety protections.

Important Notice

Regional Entity Differences: This Fx Live Capital review is based on available public information and user feedback. Prospective clients should be aware that regulatory information for Fx Live Capital is not prominently disclosed in available sources. This may affect the safety assessment for different jurisdictions and trading regions.

Review Methodology: Our evaluation methodology relies on user testimonials, publicly available data, and platform features. The absence of comprehensive regulatory information may limit the scope of our safety assessment. Potential clients should conduct additional due diligence before making investment decisions with this broker.

Rating Framework

Broker Overview

Company Background and Establishment

FX Live Capital operates as FXLIVECAPITAL LLC and was founded in 2016. The company maintains its office locations in Mexico and serves international markets. As a relatively newer player in the forex industry, the company has focused on building a multi-asset trading platform. This platform caters to diverse investor needs across multiple financial markets and asset classes.

The company's business model centers around providing access to multiple financial markets through various account types. These range from zero commission structures to professional ECN accounts with advanced features. This approach allows the broker to accommodate both beginner traders seeking cost-effective entry points and experienced traders requiring advanced trading conditions. The broker operates primarily in USD account currency and provides support in English.

Trading Platform and Asset Coverage

According to available information, Fx Live Capital offers access to six major asset categories. These include forex, shares, indices, oil/energies, cryptocurrencies, and metals for comprehensive portfolio building. This diversified offering enables traders to build comprehensive portfolios across traditional and alternative investment vehicles. The platform supports multiple funding methods including bank wire transfers, credit/debit cards, and e-wallets.

While specific trading platform details are not extensively detailed in available sources, user feedback suggests positive experiences. The overall trading environment meets standard industry expectations according to customer reviews. The broker's focus on multiple asset classes indicates an attempt to serve as a one-stop solution. This approach addresses diverse trading needs within a single platform environment.

Regulatory Framework

Available sources do not provide specific information about Fx Live Capital's regulatory status or licensing authorities. This represents a significant information gap that prospective clients should carefully consider. The absence of clear regulatory information may impact safety assessments when evaluating the broker's overall profile.

Funding and Withdrawal Options

The broker accepts bank wire transfers, credit/debit cards, and e-wallets as funding methods. However, specific details about processing times, fees, or minimum/maximum limits are not detailed in available sources. This lack of transparency may require direct contact with the broker for complete information.

Minimum Deposit Requirements

Specific minimum deposit requirements are not mentioned in available information. This may indicate flexible entry requirements or simply insufficient public disclosure of account opening terms.

Promotional Offers

Current promotional offers or bonus structures are not detailed in available sources. This suggests either no active promotions or limited marketing of such incentives to potential clients.

Available Trading Instruments

Fx Live Capital provides access to forex pairs, individual shares, market indices, energy commodities, cryptocurrencies, and precious metals. This broad selection enables diversified trading strategies across multiple market sectors. The variety allows traders to implement cross-asset strategies and hedge positions effectively across different markets.

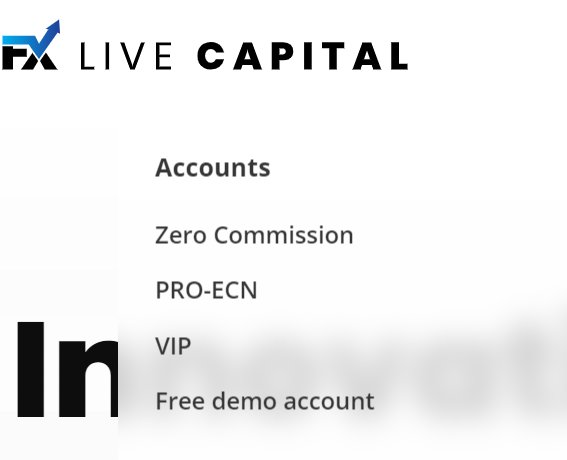

Cost Structure Analysis

The broker offers three distinct account types with varying commission structures. Zero Commission accounts charge $0 commission, PRO-ECN accounts start from $5 commission, and VIP accounts begin at $3 commission. Spread information is not specified in available sources, which may require direct inquiry for complete cost analysis.

Leverage Specifications

Maximum leverage reaches 500:1, which represents competitive terms for traders seeking enhanced position sizing capabilities. However, such high leverage also increases risk exposure significantly. Traders should carefully consider their risk management strategies when using high leverage ratios.

Platform Technology

Specific trading platform details are not comprehensively covered in available sources. This limits our ability to assess technological capabilities and platform performance features.

Geographic Restrictions

Information about geographic restrictions or prohibited jurisdictions is not specified in available sources. Potential clients should verify availability in their specific location before account opening.

Customer Support Languages

English support is confirmed, though additional language options are not detailed in available information. International clients may need to verify language support for their specific needs.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Fx Live Capital demonstrates solid account condition offerings through its three-tier account structure. The Zero Commission account provides an attractive entry point for cost-conscious traders seeking to minimize trading expenses. The PRO-ECN and VIP accounts offer professional-grade conditions with commission structures starting from $3-5 per transaction. This tiered approach allows traders to select accounts matching their trading volume and experience levels effectively.

The maximum leverage of 500:1 represents competitive terms in the current market environment. However, traders should carefully consider the associated risks when using such high leverage ratios. User feedback regarding commission structures appears positive, with several reviewers noting "good spreads and commissions" as highlighted in Trustpilot reviews. This suggests that the broker's pricing remains competitive within the industry standards.

However, the absence of detailed information about minimum deposit requirements and specific account features limits assessment capabilities. Additionally, there's no mention of Islamic account options, which may limit accessibility for certain religious communities. The account opening process details are not extensively documented in available sources. This makes it difficult to evaluate the efficiency and user-friendliness of the onboarding experience for new clients.

This Fx Live Capital review notes that while the account variety appears adequate, more transparency would strengthen the offering. Complete terms and conditions disclosure would help potential clients make more informed decisions about account selection.

The broker provides access to six major asset categories for comprehensive trading opportunities. These include forex, shares, indices, oil/energies, cryptocurrencies, and metals across multiple markets. This diversity allows traders to implement cross-asset strategies and diversify their portfolios effectively across different sectors. However, specific information about trading tools quality, analytical resources, or research capabilities is not detailed in available sources.

Educational resources and market analysis tools are not mentioned in available information. This represents a significant gap for traders seeking comprehensive learning and analysis support from their broker. Modern traders increasingly expect robust educational content, market commentary, and analytical tools as standard offerings. The absence of these features may limit the platform's appeal to developing traders who require guidance.

The absence of information about automated trading support, expert advisors, or API access limits platform assessment. Additionally, specific details about charting capabilities, technical indicators, and analytical features are not provided in available sources. User feedback focuses primarily on customer service and commission structures rather than trading tools and resources. This suggests either limited tool offerings or insufficient user awareness of available features within the platform.

Customer Service and Support Analysis (Score: 8/10)

Customer service represents one of Fx Live Capital's strongest areas based on available user feedback. Trustpilot reviews consistently highlight the "impressive" support team performance across multiple customer interactions. Users specifically note the responsiveness and helpfulness of customer service representatives in addressing their concerns. One user testimonial states: "their support team is really impressive," indicating quality customer service infrastructure investment.

The 4.6 Trustpilot rating further supports the positive customer service reputation among existing clients. Support quality significantly influences overall user satisfaction scores, and this rating reflects well on service standards. However, specific information about support channels, availability hours, or response time guarantees is not detailed in available sources. The confirmed English language support serves international clients, though additional language options would enhance global accessibility.

The broker appears to maintain active engagement with customer feedback through various channels. This is evidenced by official responses to Trustpilot reviews and proactive customer communication efforts. This proactive approach to customer communication suggests a commitment to maintaining high service standards. The company also demonstrates willingness to address user concerns promptly and professionally across different platforms.

Trading Experience Analysis (Score: 7/10)

User feedback indicates generally positive trading experiences with the platform's overall performance. The 4.6 Trustpilot rating reflects overall satisfaction with the broker's service delivery and trading conditions. Traders have specifically mentioned positive experiences with spreads and commission structures in their reviews. This suggests competitive trading conditions that meet or exceed trader expectations in the current market.

However, specific information about platform stability, execution speed, slippage rates, or requote frequency is not available. These technical performance metrics are crucial for assessing trading experience quality, particularly for active traders and scalpers. The multi-asset offering enhances the trading experience by providing diverse opportunities within a single platform environment. Access to traditional forex alongside cryptocurrencies, metals, and energy commodities allows for comprehensive portfolio management strategies.

Mobile trading capabilities and platform functionality details are not extensively covered in available sources. This limits our assessment of the complete trading experience across different devices and trading scenarios. Modern traders expect seamless mobile access and advanced platform features as standard offerings. The absence of detailed platform information may require direct testing to fully evaluate trading experience quality.

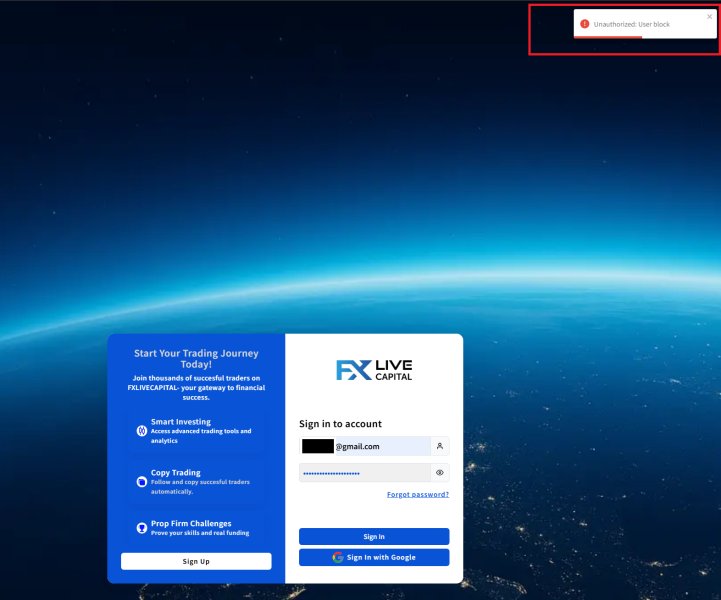

Trust and Safety Analysis (Score: 5/10)

The trust and safety assessment reveals significant concerns due to limited regulatory information disclosure. Available sources do not specify licensing authorities, regulatory compliance measures, or client fund protection schemes clearly. These are fundamental safety considerations for forex brokers and essential for client protection assessment.

Client money segregation policies, deposit compensation schemes, and negative balance protection measures are not detailed in available information. These safety features are increasingly standard in the industry and their absence from public disclosure raises questions. The lack of transparency regarding client protection levels may concern safety-conscious traders seeking maximum security.

The company's transparency regarding financial reporting, management team, or corporate structure is not evident in available sources. Industry awards, recognitions, or third-party certifications that could support the trust assessment are also not mentioned. However, the positive user feedback and 4.6 Trustpilot rating suggest that existing clients have generally positive experiences. This doesn't substitute for formal regulatory oversight and protection measures, but it does indicate operational competency.

User Experience Analysis (Score: 7/10)

The 4.6 Trustpilot rating indicates generally positive user experiences across multiple service aspects. Customers express satisfaction with key service elements including trading conditions and customer support quality. User testimonials highlight positive experiences with commission structures, customer support, and overall platform performance. Specific feedback includes appreciation for "good spreads and commissions" and "impressive support team" performance.

This suggests that core user needs are being met effectively by the broker's service delivery. The mentor recommendation mentioned in user reviews indicates word-of-mouth marketing success among existing clients. This typically reflects positive user experiences and satisfaction with the overall service quality provided.

However, detailed information about user interface design, platform navigation, registration processes, or account verification procedures is not available. These factors significantly impact overall user experience and adoption rates for new clients. The funding and withdrawal experience details are not extensively covered in current sources. This limits our assessment of the complete user journey from registration to active trading and fund management.

Conclusion

This Fx Live Capital review reveals a broker with both attractive features and notable limitations for consideration. The platform offers competitive account conditions including zero commission options and high leverage up to 500:1 for enhanced trading flexibility. These features are supported by reportedly excellent customer service that has earned positive user feedback. The broker has also achieved a solid 4.6 Trustpilot rating from existing clients across multiple service areas.

The broker appears well-suited for traders seeking diverse asset exposure and high leverage capabilities. It particularly appeals to those who value responsive customer support and competitive trading conditions. The multi-asset offering spanning forex, cryptocurrencies, metals, and energy commodities provides portfolio diversification opportunities. This allows traders to access multiple markets within a single platform environment for comprehensive strategy implementation.

However, significant concerns exist regarding regulatory transparency and client protection measures throughout the evaluation process. The absence of clear regulatory information and safety feature disclosure represents a major limitation for risk-conscious investors. While user feedback remains positive, the lack of formal regulatory oversight may deter traders who prioritize heavily regulated environments. This creates a significant decision point for potential clients weighing trading benefits against safety considerations.

Potential clients should carefully weigh the attractive trading conditions against the regulatory transparency concerns before proceeding. Conducting additional due diligence before committing funds is essential to ensure alignment with individual risk tolerance levels. This approach will help traders make informed decisions that match their safety requirements and trading objectives effectively.