SECURETRADE Review 1

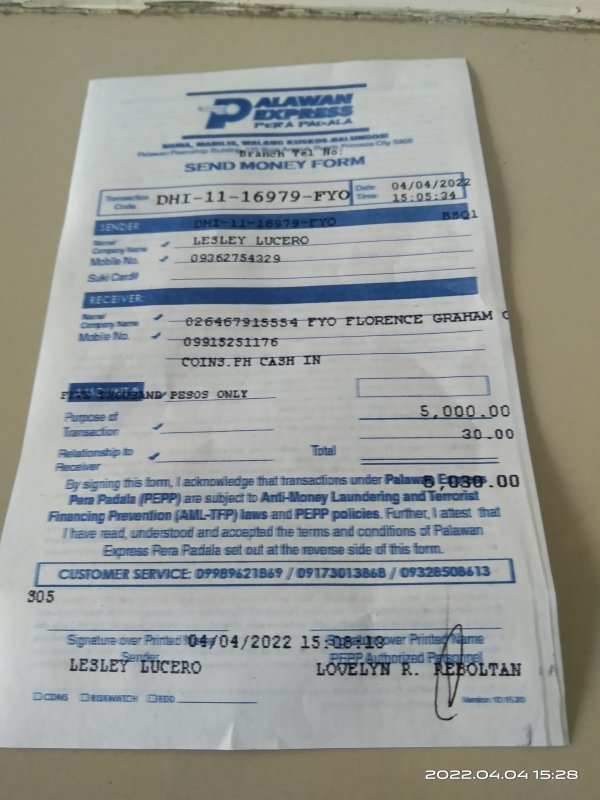

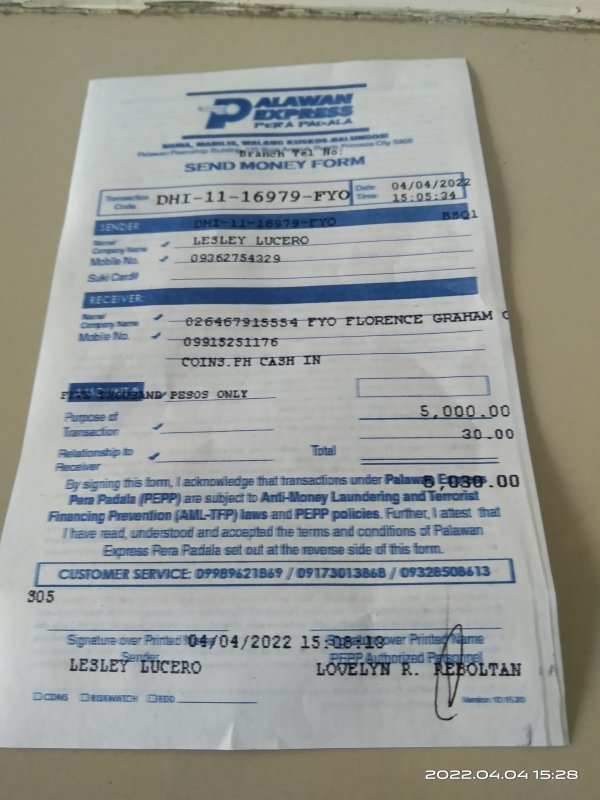

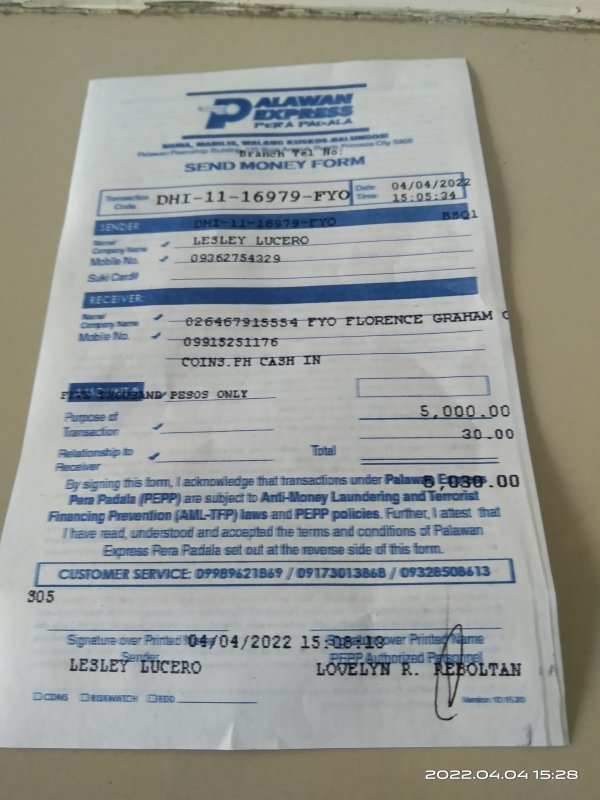

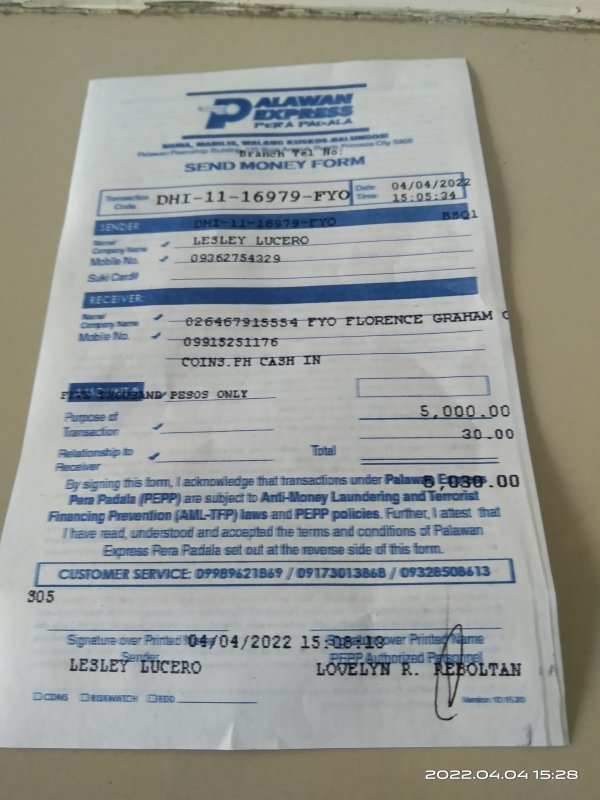

She wants me to send the payment for company commission fee but didn't told me before we send the money for investment the trading transaction is not give me my profit

SECURETRADE Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

She wants me to send the payment for company commission fee but didn't told me before we send the money for investment the trading transaction is not give me my profit

Securetrade works as an unregulated forex and cryptocurrency broker that creates big risks for traders. This securetrade review shows a worrying pattern of bad user feedback and missing rules that potential clients should think about carefully. The broker gives high leverage up to 1:500 and lets you use the MT4 trading platform, plus hundreds of trading assets like forex and cryptocurrency CFDs. But these features are hurt by the lack of clear fee structures and proper rule oversight.

The platform mainly targets traders who want high-leverage chances and different asset types, but you need a high risk tolerance because it has no regulation. User reviews always point out problems with customer support quality and taking out funds. Securetrade might appeal to experienced traders who are okay with high risk levels, but the missing regulatory protection and mostly bad user experiences make it wrong for most retail investors who want safe trading places.

Securetrade works without effective regulatory oversight, which may put traders at different legal risks depending on where they live. The lack of proper licensing means clients have limited options in case of disputes or money issues. This review uses available user feedback and market information, which may not fully show all user experiences. Potential traders should do thorough research and think about regulated alternatives before working with this broker.

| Category | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 6/10 | Average |

| Customer Service | 2/10 | Very Poor |

| Trading Experience | 5/10 | Below Average |

| Trust and Security | 1/10 | Unacceptable |

| User Experience | 4/10 | Poor |

Securetrade calls itself an online forex and cryptocurrency trading broker, though detailed information about when it started and its company background stays limited in available documents. The company works mainly as a CFD provider, giving traders access to forex markets and cryptocurrency trading chances. Without full regulatory oversight, the broker's business model relies heavily on high-leverage trading products to attract clients who want bigger market exposure.

The broker uses the MetaTrader 4 platform as its main trading interface, giving clients access to hundreds of trading tools across forex and cryptocurrency markets. Securetrade's asset list includes major and minor currency pairs along with various cryptocurrency CFDs, though specific details about exotic pairs and other asset classes are not clearly documented. The missing detailed regulatory information raises questions about the broker's operational transparency and client fund protection measures.

Regulatory Status: Securetrade works without recognized regulatory authorization, creating big risks for client fund security and dispute resolution. The missing oversight from established financial authorities means traders lack standard investor protections.

Deposit and Withdrawal: Specific information about deposit and withdrawal methods is not detailed in available documents, though user feedback suggests challenges with fund retrieval processes.

Minimum Deposit: The broker keeps high minimum deposit requirements that may exclude smaller retail traders from accessing the platform.

Promotions and Bonuses: Available materials do not specify current promotional offerings or bonus structures for new or existing clients.

Trading Assets: Securetrade gives access to forex and cryptocurrency CFD trading, covering hundreds of different instruments across these asset categories.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not transparently disclosed in available documents.

Leverage Options: The platform offers leverage up to 1:500, which represents significant amplification potential but also big risk exposure.

Platform Selection: MetaTrader 4 serves as the primary trading platform, though additional platform options are not specified.

Regional Restrictions: Specific geographical limitations for account opening are not clearly documented in available materials.

Customer Support Languages: Available documents do not specify supported languages for customer service interactions.

This securetrade review highlights the limited transparency in operational details, which itself represents a significant concern for potential clients.

Securetrade's account structure lacks the detailed transparency expected from professional brokers, with limited information available about different account tiers or specialized features. The high minimum deposit requirements create barriers for retail traders who want to test the platform with smaller initial investments. This approach suggests the broker targets clients with big trading capital rather than helping diverse trader profiles.

The account opening process details are not fully documented, raising questions about verification procedures and compliance standards. Without clear information about account features such as Islamic accounts for Shariah-compliant trading, the broker appears to offer limited help for diverse trading needs. User feedback always highlights difficulties with account management and fund access, suggesting systemic issues with account administration.

Compared to regulated brokers offering tiered account structures with varying minimum deposits, Securetrade's approach appears restrictive and less competitive. The lack of detailed account specifications makes it difficult for traders to understand what services and protections they receive. This securetrade review emphasizes that potential clients should expect limited account flexibility and unclear terms of service.

Securetrade gives the MetaTrader 4 platform, which offers standard charting capabilities and technical analysis tools familiar to most forex traders. But the broker appears to lack full educational resources and market analysis tools that professional traders typically expect. The missing detailed research materials and trading guides limits the platform's value for traders who want to develop their skills or stay informed about market developments.

The platform's asset diversity receives some recognition from users, with access to forex and cryptocurrency markets giving trading opportunities across different market segments. But the overall quality of trading tools and analytical resources falls short of industry standards set by regulated competitors. Automated trading support through MetaTrader 4 exists, but additional proprietary tools or advanced features are not prominently featured.

User feedback indicates that while the basic trading functionality meets minimum requirements, the lack of supplementary resources and educational materials creates a limited trading environment. Professional traders often require comprehensive market analysis, economic calendars, and educational content that appear absent from Securetrade's offering. The platform's tool selection suggests it caters to experienced traders who rely on external resources rather than broker-provided analysis.

Customer service represents one of Securetrade's most significant weaknesses, with user feedback always highlighting poor response times and inadequate problem resolution. The specific customer service channels available are not clearly documented, though user experiences suggest limited accessibility and professionalism. Response times appear to be much longer than industry standards, leaving clients without timely assistance during critical trading situations.

Service quality issues extend beyond response times to include fundamental problems with issue resolution and customer support expertise. Multiple user complaints indicate that customer service representatives lack the knowledge and authority to address account-related problems effectively. The missing multi-language support information suggests limited help for international clients, despite the broker's global online presence.

Users always report frustrating experiences when attempting to resolve account issues, withdraw funds, or seek technical support. The customer service problems appear systemic rather than isolated incidents, indicating fundamental deficiencies in the broker's support infrastructure. Without adequate customer service, traders face significant challenges in resolving disputes or accessing their funds, which compounds the risks associated with the broker's unregulated status.

The trading experience on Securetrade's platform receives mixed feedback from users, with platform stability and execution quality being primary concerns. While MetaTrader 4 gives familiar functionality, user reports suggest performance issues that can impact trading effectiveness. The missing detailed information about order execution speeds, slippage rates, and requote frequency makes it difficult to assess the platform's technical performance objectively.

Platform functionality appears to cover basic trading requirements, though advanced features and customization options may be limited compared to more comprehensive trading environments. Mobile trading experience details are not well-documented, which is increasingly important for active traders requiring platform access across devices. The trading environment's overall quality seems to fall short of expectations set by regulated brokers with robust technological infrastructure.

User feedback about trading experience trends negative, with complaints about platform reliability and execution quality appearing frequently in available reviews. The combination of technical issues and poor customer support creates compounding problems for traders experiencing difficulties. This securetrade review indicates that the trading experience may satisfy basic requirements but fails to meet professional standards expected in competitive forex markets.

Trust and security represent Securetrade's most critical deficiencies, with the broker working without recognized regulatory authorization from established financial authorities. The missing regulatory oversight means client funds lack standard protections such as segregated accounts, compensation schemes, or regulatory dispute resolution mechanisms. This fundamental gap in regulatory compliance creates big risks for client fund security.

Company transparency issues extend beyond regulatory status to include limited disclosure about corporate structure, ownership, and operational procedures. The lack of detailed company information makes it difficult for clients to assess the broker's financial stability and operational legitimacy. Industry reputation suffers significantly due to these transparency deficits and the missing regulatory endorsement.

Third-party evaluation services, including Scam Detector, assign extremely low trust scores to Securetrade, with ratings indicating high-risk status. User feedback always emphasizes concerns about fund security and withdrawal difficulties, suggesting systemic issues with client fund management. Multiple customer complaints about financial losses and fund access problems indicate that trust concerns are well-founded rather than isolated incidents. The combination of regulatory gaps and negative user experiences creates a trust profile that fails to meet basic industry standards.

Overall user satisfaction with Securetrade remains mostly negative, with feedback highlighting systemic issues across multiple aspects of the trading experience. Interface design and usability information is limited in available documents, though the MetaTrader 4 platform gives familiar navigation for experienced forex traders. But platform familiarity cannot compensate for underlying operational and service quality problems.

User registration and verification processes are not well-documented, creating uncertainty about account opening requirements and procedures. Fund operation experiences generate significant user complaints, with withdrawal difficulties being a recurring theme in available feedback. These operational challenges create frustration and financial stress for clients attempting to access their trading capital.

Common user complaints focus on fund access problems, poor customer support quality, and platform reliability issues. The user profile analysis suggests that even traders with high risk tolerance find the overall experience unsatisfactory due to operational deficiencies. While some users acknowledge the platform's asset diversity and leverage options, these features are always overshadowed by fundamental service and security concerns. The predominance of negative feedback indicates that user experience improvements would require comprehensive operational reforms rather than minor adjustments.

Securetrade works as a high-risk, unregulated forex and cryptocurrency broker that fails to meet basic industry standards for client protection and service quality. This comprehensive evaluation reveals significant deficiencies in regulatory compliance, customer service, and operational transparency that make the broker unsuitable for most traders. While the platform offers high leverage options and access to diverse trading assets, these features cannot compensate for fundamental security and service shortcomings.

The broker may only be appropriate for highly experienced traders with big risk tolerance who understand the implications of trading with unregulated entities. But even risk-tolerant traders should carefully consider whether the potential benefits justify the documented risks and service quality issues. Most traders would be better served by choosing regulated alternatives that provide standard investor protections and professional service standards.

FX Broker Capital Trading Markets Review