Executive Summary

Trades.com is positioned as a forex and CFD broker claiming to offer a wide variety of trading products. However, the broker operates in the high-risk category due to its unregulated status, which poses questions regarding fund safety and user trust. While it presents high leverage options and numerous trading instruments, this comes at the cost of significant risks, particularly for inexperienced traders. The ideal audience for Trades.com includes seasoned traders who understand the inherent dangers of engaging with unregulated brokers and are willing to navigate complex trading environments. However, newcomers looking for security and dependable support are better advised to avoid this platform.

⚠️ Important Risk Advisory & Verification Steps

- Unregulated Status: Trades.com lacks oversight from recognizable regulatory bodies.

- High Minimum Deposit: A steep threshold of $5,000 for the lowest account type restricts access for average retail investors.

- Withdrawal Challenges: Frequent complaints point to withdrawal issues and high fees that heighten the risk of potential scams.

Verification Steps:

- Cross-check regulatory status through official government registries.

- Look for trader testimonials on reputable review sites.

- Investigate online forums for user experiences related to fund withdrawals.

Rating Framework

Broker Overview

Company Background and Positioning

Trades.com has been identified as an offshore broker with questionable credibility. Registered in the Marshall Islands, it operates without any reputable regulatory oversight, which raises concerns regarding its legitimacy. Though it claims to provide a diverse selection of trading instruments, the risks linked to its unregulated status make it a dubious option for potential investors.

Core Business Overview

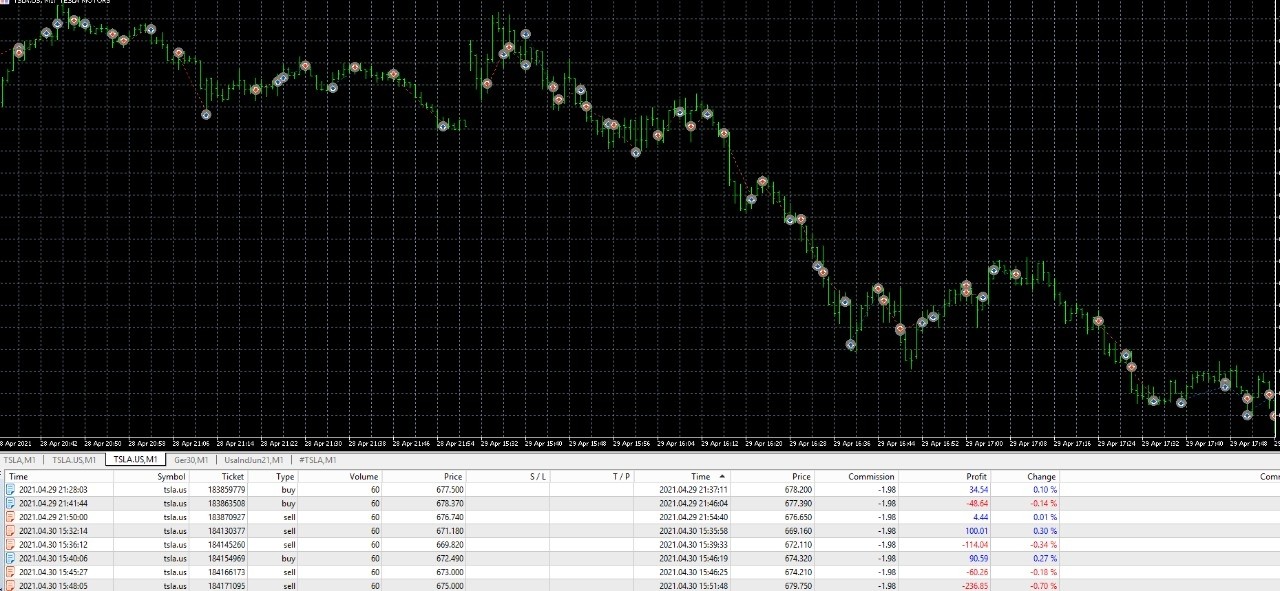

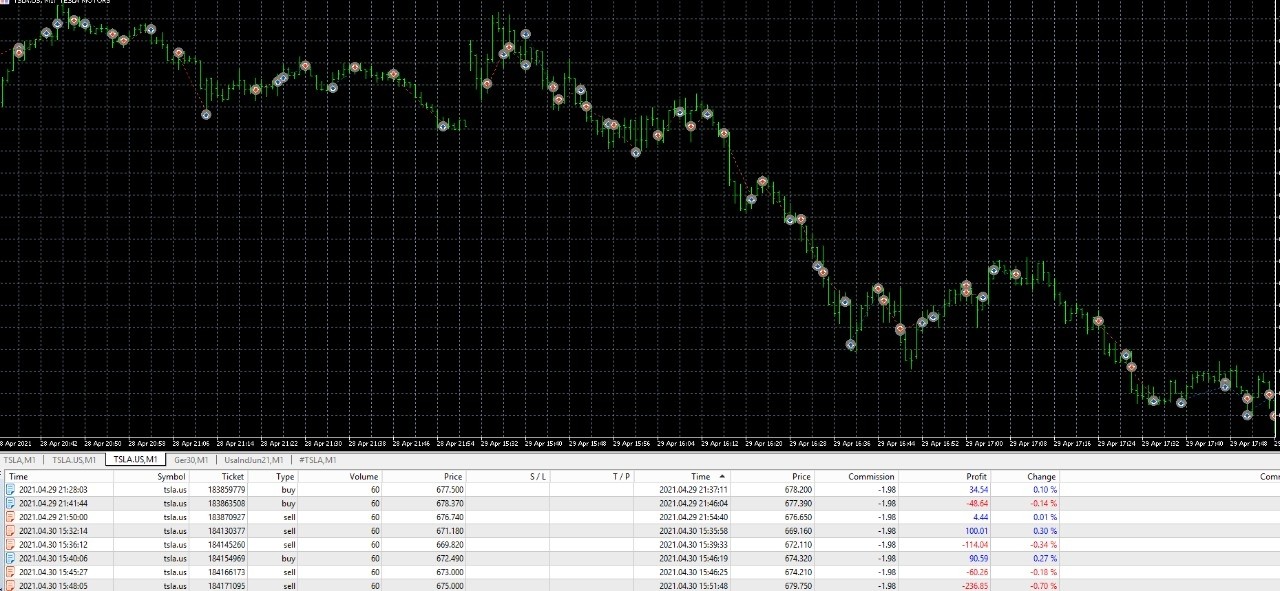

Trades.com offers a variety of trading products, primarily focusing on forex and Contract for Difference (CFD) instruments. It claims to utilize the MetaTrader 4 (MT4) platform—a favored choice among many traders. However, despite its claims of providing high-quality trading conditions, the glaring absence of a recognizable regulatory body significantly detracts from its reliability. The business model involves offering generous leverage of up to 1:200, but this comes with inherent risks tied to unregulated trading environments.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The lack of regulation is a critical concern for potential traders considering Trades.com. Operating without oversight from a financial authority suggests possible exploitation and lack of recourse for traders in the event of disputes or issues.

User Self-Verification Guide

- Research the Regulatory Body: Check official financial authority listings to verify if Trades.com is recognized.

- Search for Reviews: Look upon trusted review platforms for user experiences.

- Utilize Trusted Sources: Confirm Trades.coms registration through government financial regulatory sites.

Industry Reputation and Summary

User feedback overwhelmingly highlights concerns regarding the safety of funds, withdrawal difficulties, and overall trust in the platform. Major complaints indicate users struggling to recover their investments.

Trading Costs Analysis

Advantages in Commissions

The commission structure is not typical for an unregulated broker; they often seek to exploit their clients through hidden costs like excessive withdrawal fees and spreads.

The "Traps" of Non-Trading Fees

Users have reported exorbitant withdrawal fees and unexpected charges during fund recovery attempts. A standard spread of 3 pips for EUR/USD is considerably higher than the industry average of 1-2 pips.

Cost Structure Summary

The high costs associated with using Trades.com do not favor beginner traders. Nonetheless, experienced traders might find value if they thoroughly understand the costs involved and can strategically manage their trading activities.

Trades.com prominently offers the MetaTrader 4 platform. While this is a strong choice, the lack of modern tools could leave gaps in the offerings to attract a broader trader demographic.

The educational tools available are scant, particularly for new traders who might benefit from more guidance.

Feedback from users indicates that while MT4 is favored, the overall user experience suffers due to the brokers unresponsive support and limited capabilities.

User Experience Analysis

Investigate how well players perceive their interactions with the platform. There appears to be a trend of frustration among users regarding complex workflows, excessive fees, and a lack of support.

Customer Support Analysis

Customer complaints are dominated by slow responses and unresponsive communication channels, eroding trust and confidence in their trading experience.

Account Conditions Analysis

Account conditions set by Trades.com require a high initial deposit to open, which may alienate many traders looking for accessible entry points into trading activities.

Conclusion

In conclusion, while Trades.com presents itself as an option for traders seeking diverse instruments and high leverage, significant risks stem from its lack of regulation, excessive fees, and poor user feedback. For the safety of their capital, traders are encouraged to consider regulated alternatives that offer transparent practices, robust support, and comprehensive educational resources. Always conduct thorough research before engaging with unregulated entities in the trading world.