Founded in 2020 and registered in Saint Vincent and the Grenadines, QRS Global presents itself as an online brokerage that caters to inexperienced traders seeking easy market access. Despite claims of providing regulated trading environments through parent companies, ongoing investigations and claims from various reviews indicate that it might not be transparently affiliated with recognized financial authorities.

QRS Global markets itself as a brokerage for forex pairs, CFDs, and commodities, providing competitive conditions with leverage options stated as high as 1:500. The broker claims to offer a range of account types, including the QRS Cent and QRS Freedom accounts, aimed at accommodating different trader profiles. However, the reality of their operational capabilities is clouded by user complaints and the apparent lack of operational transparency.

The credibility of QRS Global is heavily in question due to conflicting information regarding its regulatory compliance and operational legitimacy. Various reports highlight its lack of a proper regulatory framework, meaning traders are at risk of losing their investments without the safeguards normally in place with regulated entities.

User self-verification is crucial here. Potential clients can take steps to confirm QRSs claims by:

- Checking against databases from recognized regulators, like ASIC or FCA.

- Verifying that the broker's websites provide clear and complete disclosure of licensing information.

- Reviewing user experiences related to fund withdrawal difficulties.

- Engaging with known financial forums and certifications.

“QRS Global is an offshore broker. Your money is not safe.” — Anonymous Review

Trading Costs Analysis

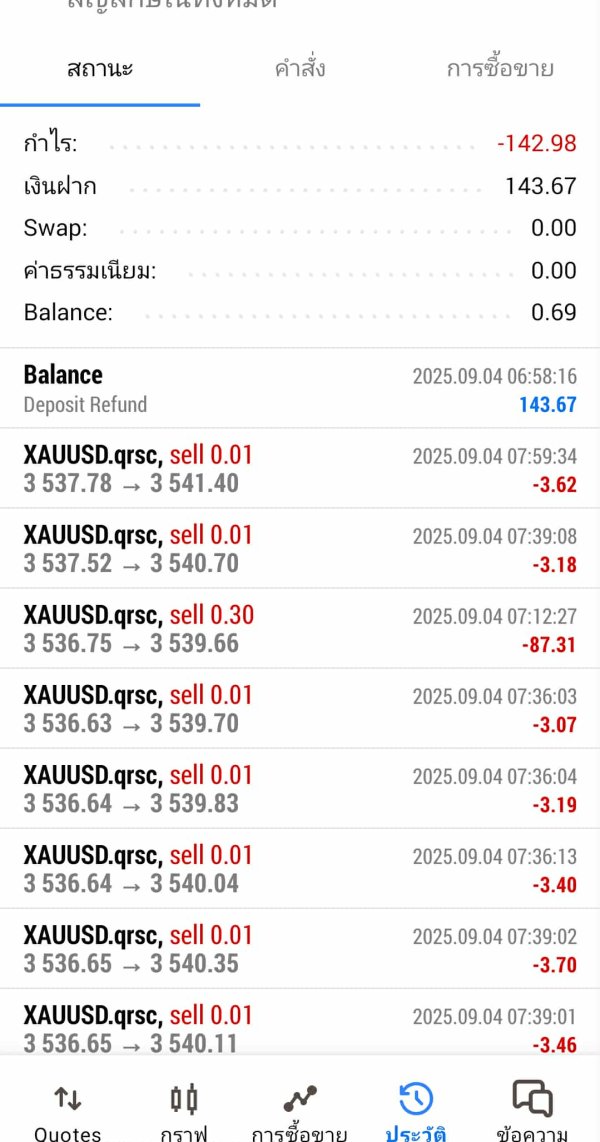

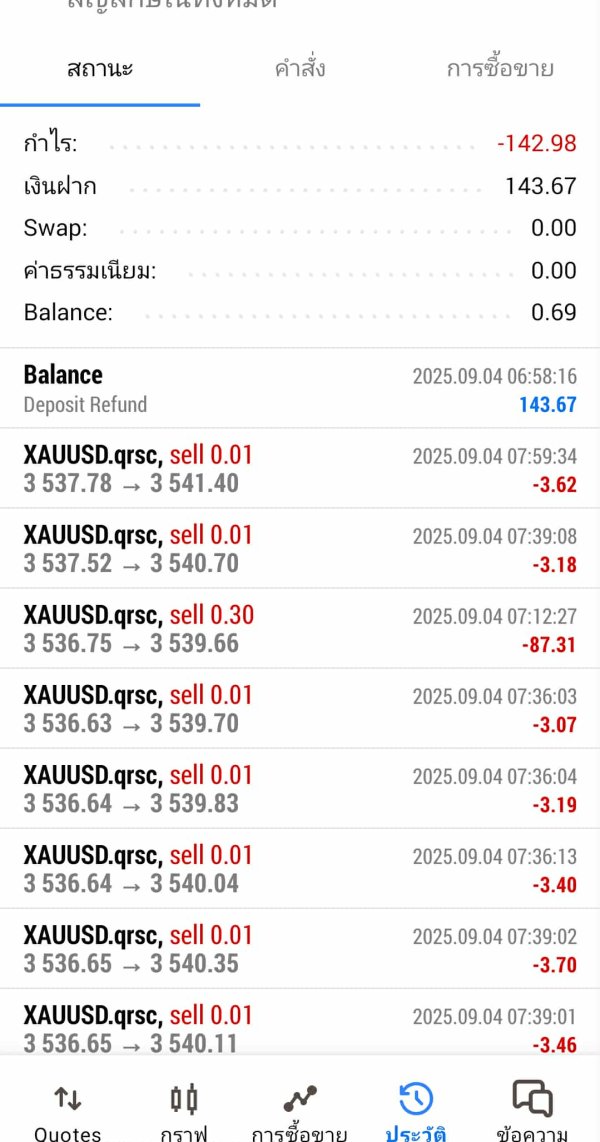

While QRS Global promotes a low-commission trading structure that appeals to new traders, its essential to weigh this against potential non-trading fees. Although commissions may be absent, users have reported high fees upon withdrawal—enough to significantly diminish the overall benefits of low trading costs.

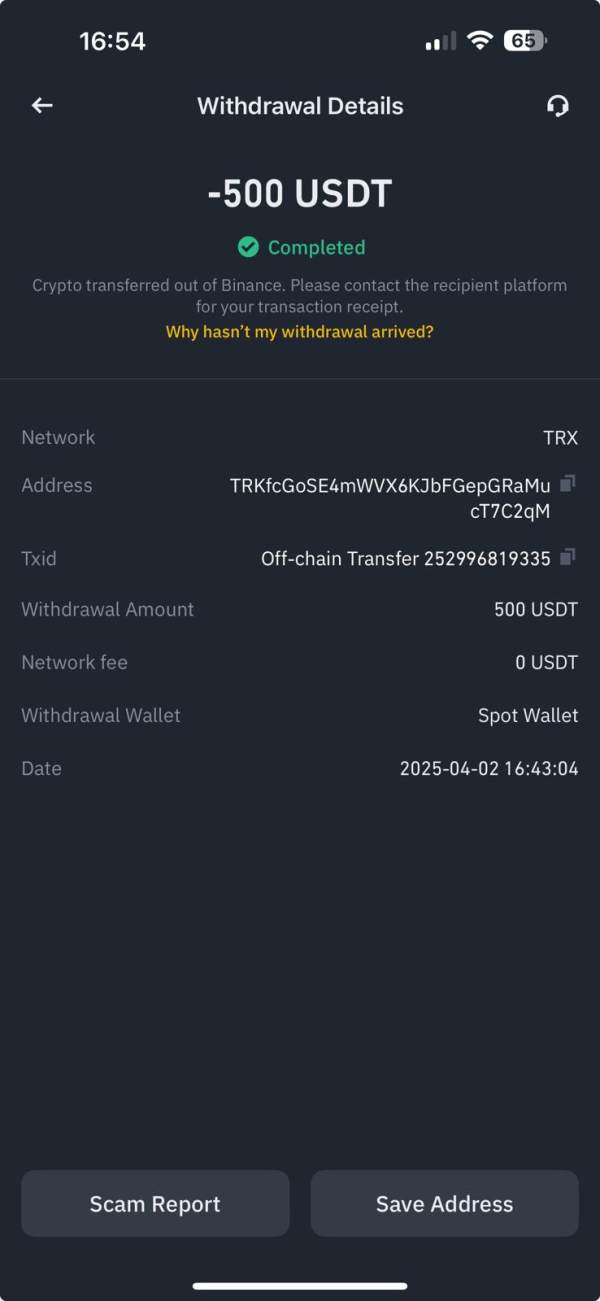

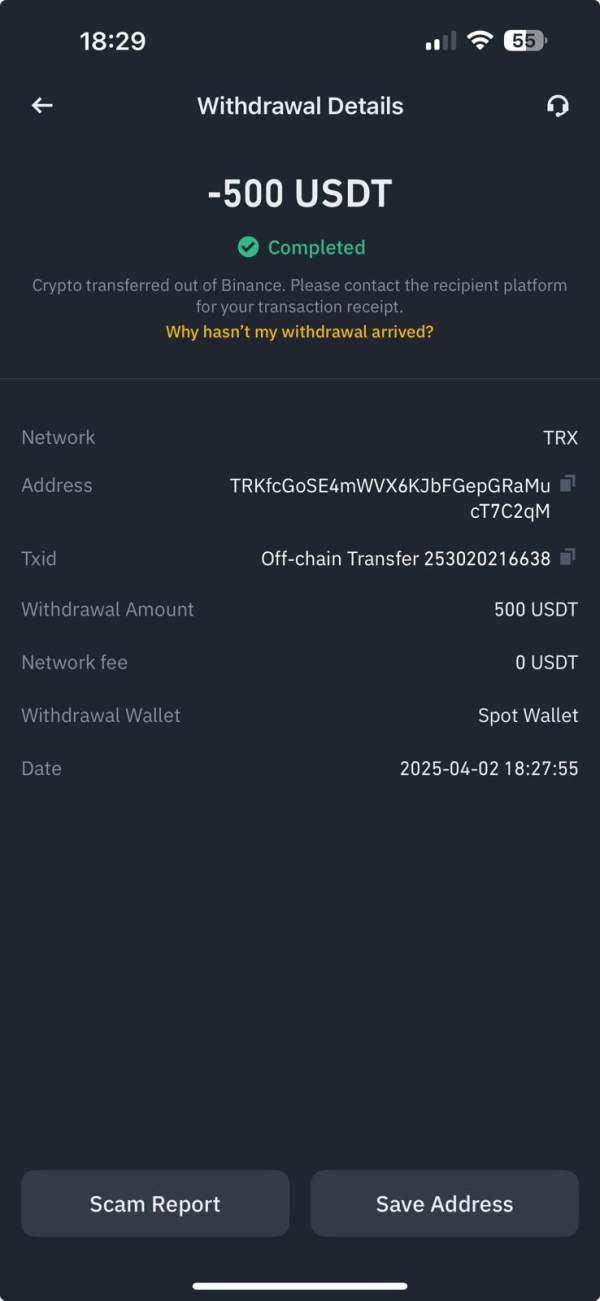

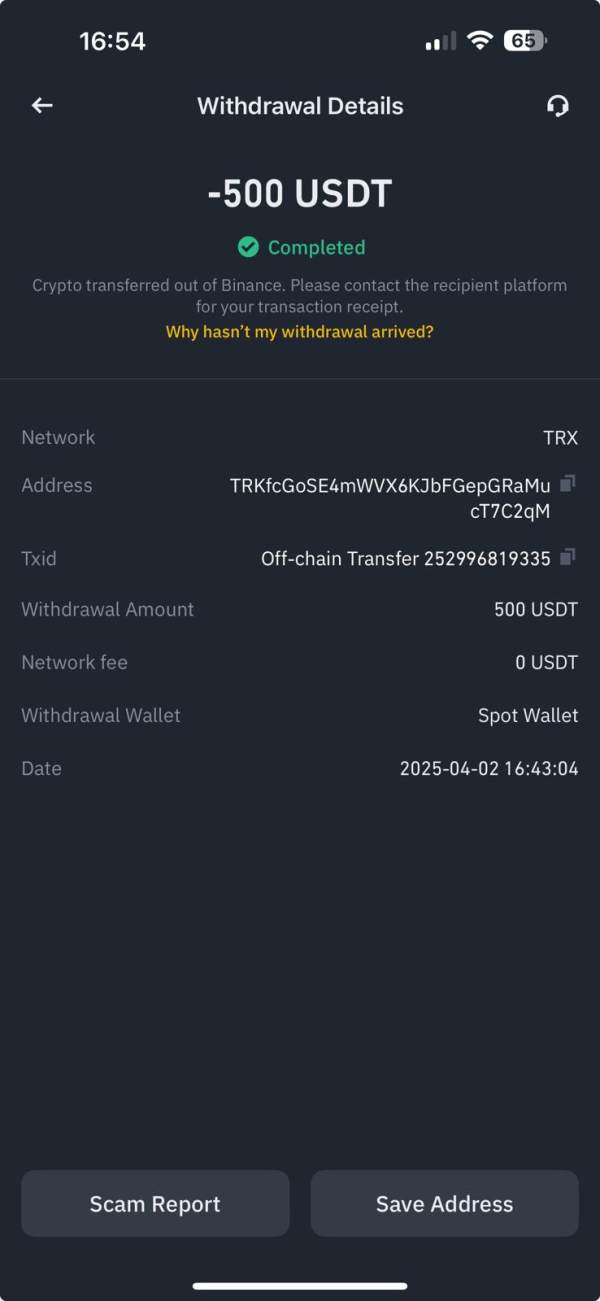

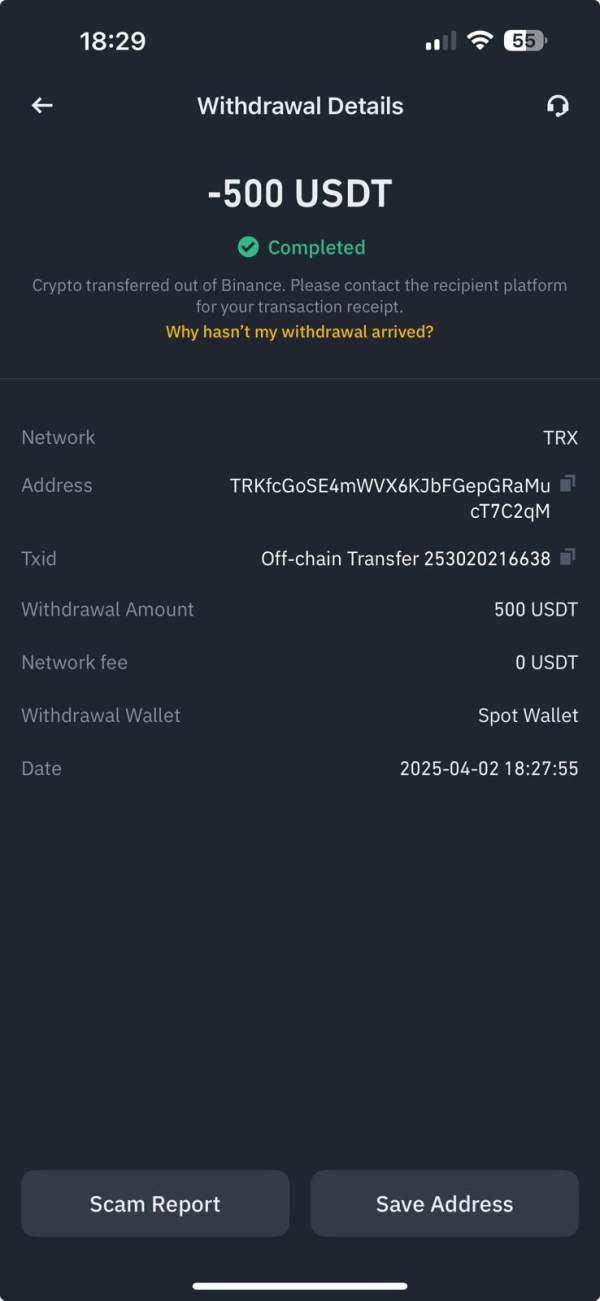

User complaints often cite withdrawal fees of up to 20% as a primary pain point, leading many to choose not to withdraw their funds at all.

In summary, while QRS Global presents itself as a cost-effective trading platform, the hidden costs significantly undermine this advantage. Traders should thoroughly examine their specific needs against QRSs offerings.

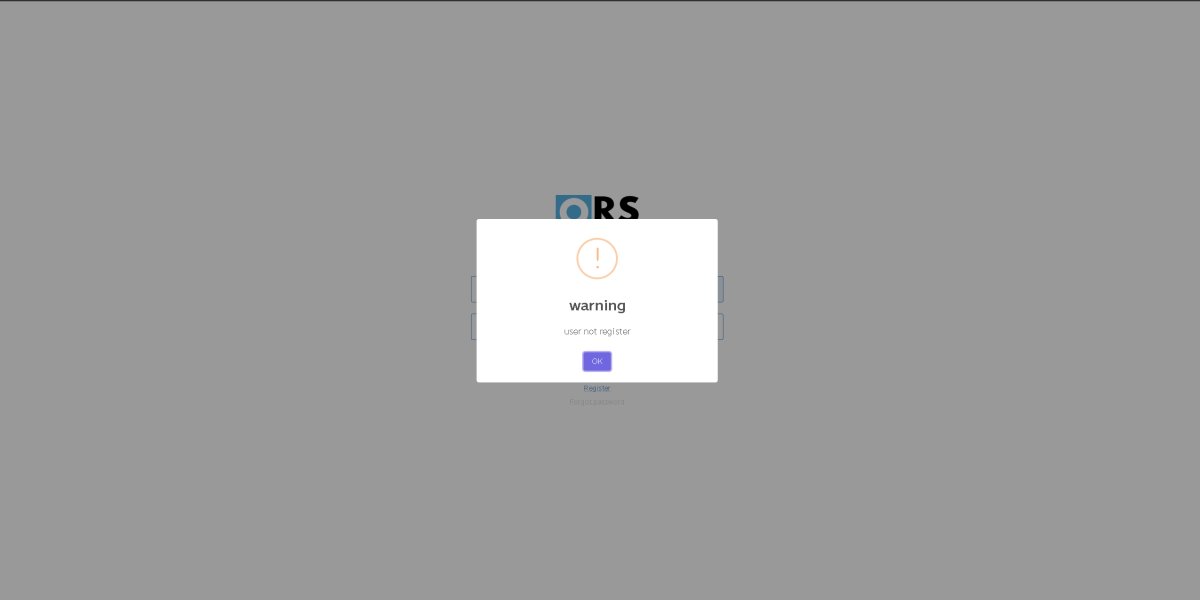

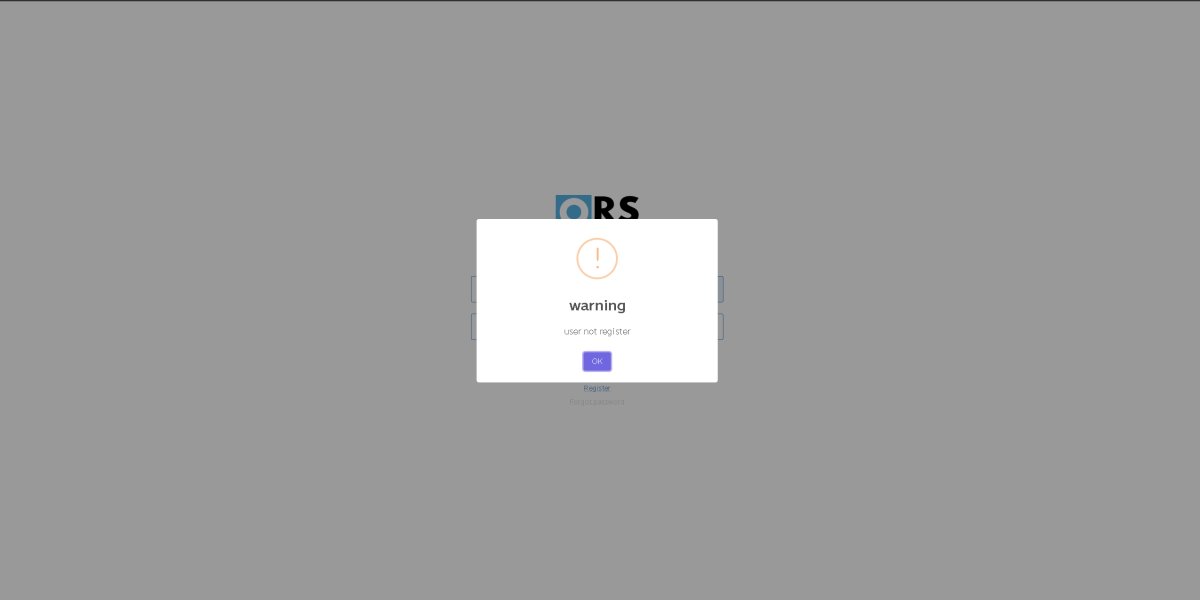

QRS Global claims to provide traders with access to the MT5 platform. However, closer investigation reveals issues regarding the functionalities available to users. The platform appears to be a demo version masquerading as the full MT5 offering, rendering it ineffective for actual trading activities. As a result, users might experience frustrations due to the limitations imposed by the trading software.

Without reliable trading platforms, users are likely inconvenienced when attempting to execute trades effectively, leading to adverse trading experiences.

User Experience Analysis

The process of onboarding new clients is often marred by insufficient support. Users have raised concerns about the overall registration experience with some indicating it does not provide clear instruction, leading to confusion.

Additionally, feedback on the trading interface is mixed; many new users find it challenging to navigate without adequate training resources or support from customer service teams. Prompt and clear communication is crucial yet currently lacking.

Customer Support Analysis

User testimonials often indicate grave dissatisfaction with QRS Global's customer support. Many have noted unresponsive channels when seeking assistance, highlighting an underlying problem in accessibility to reliable help.

Reports of slow response times and ineffective communication lead to significant concerns about fund security, especially as traders often require urgent support to address fund withdrawal concerns.

Account Conditions Analysis

QRS Global offers several account types with low initial deposit thresholds, attracting novice traders. However, while enticing, the flexibility stymied by stringent withdrawal policies and high fees significantly clouds enthusiasm surrounding these accounts.

Minimum deposit requirements vary, with reports of amounts starting from $10 to as high as $1000, indicating confusion around account parameters. Understanding these details is critical for potential users interested in engaging with QRS Global.

Conclusion

In summation, while QRS Global may attract novice traders with its low-cost trading prospects, the underlying risks—inherent through unregulated operations, conflicting information, and user complaints—render it a precarious choice for anyone looking to safely invest their funds. It is advisable to thoroughly investigate and consider the implications of trading with QRS Global, prioritizing financial security and regulatory compliance in any trading endeavor.

As traders navigate these waters, they must question whether the promise of high leverage and low fees is worth the potential risk of losing their capital in pursuit of trading opportunities through unregulated entities.