Fyers Review 1

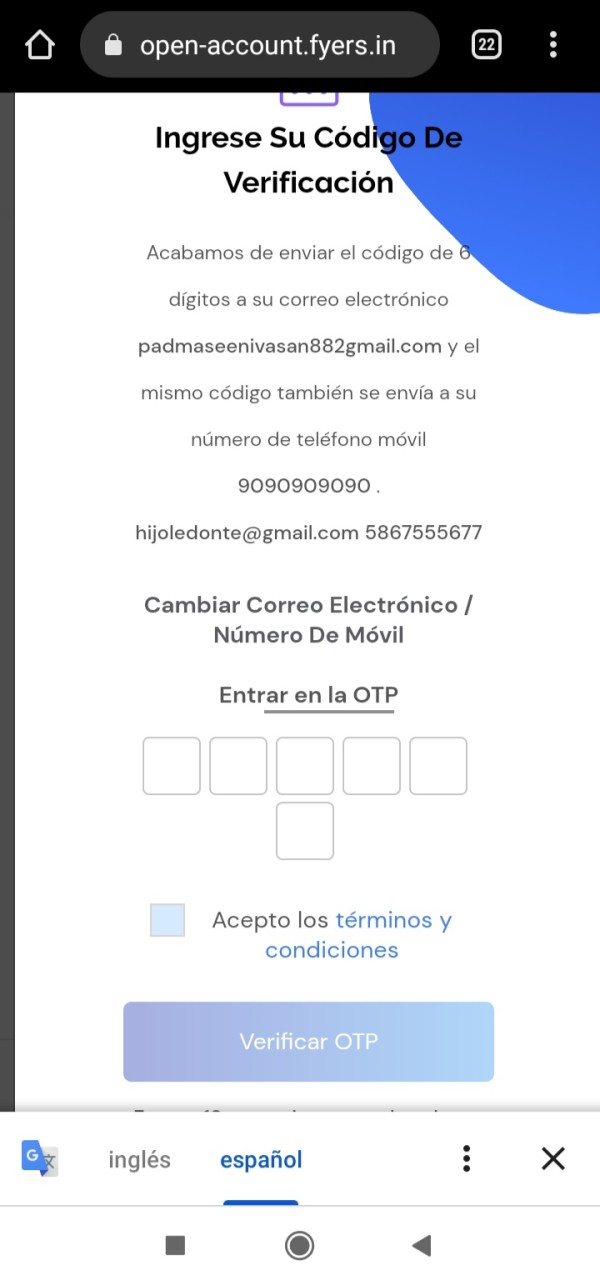

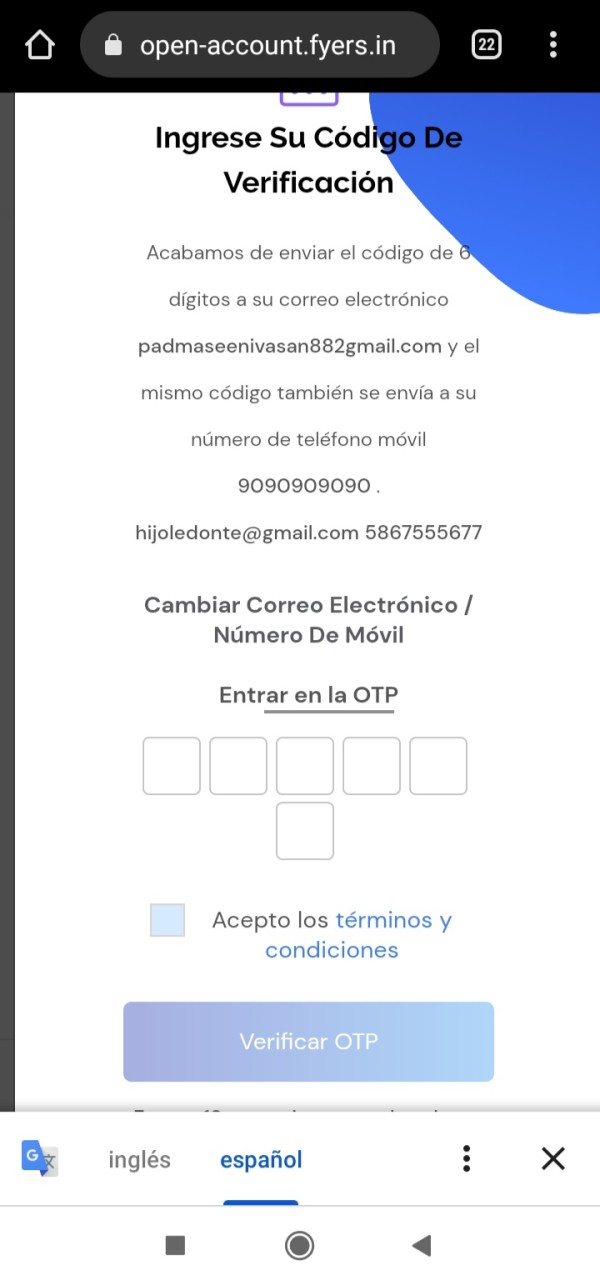

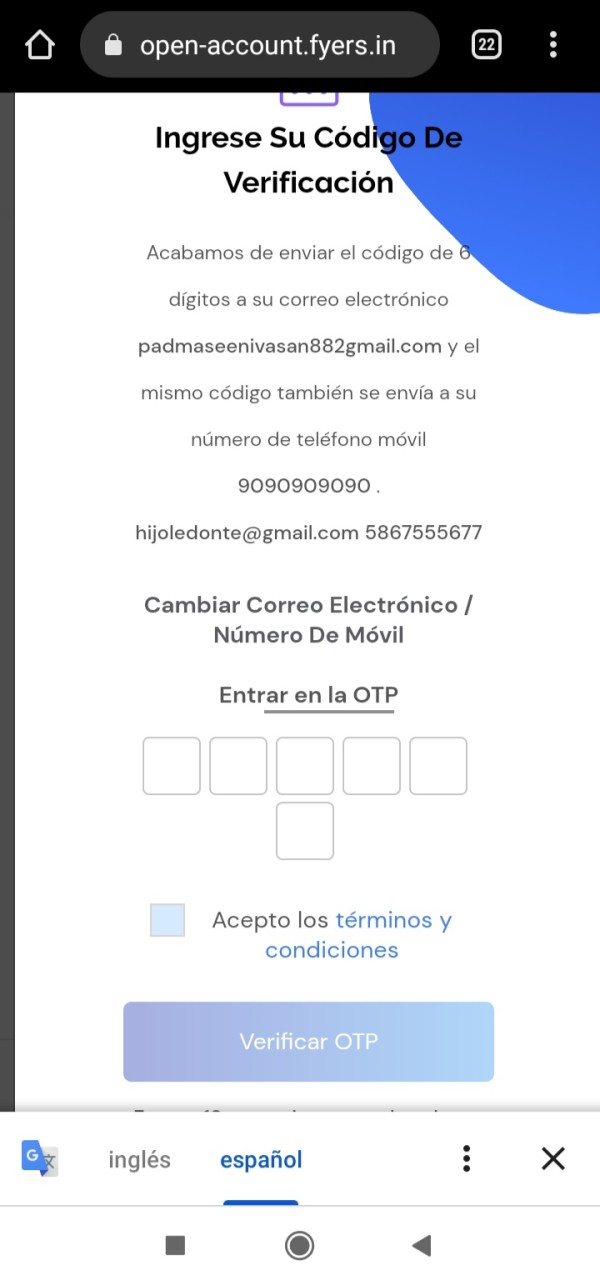

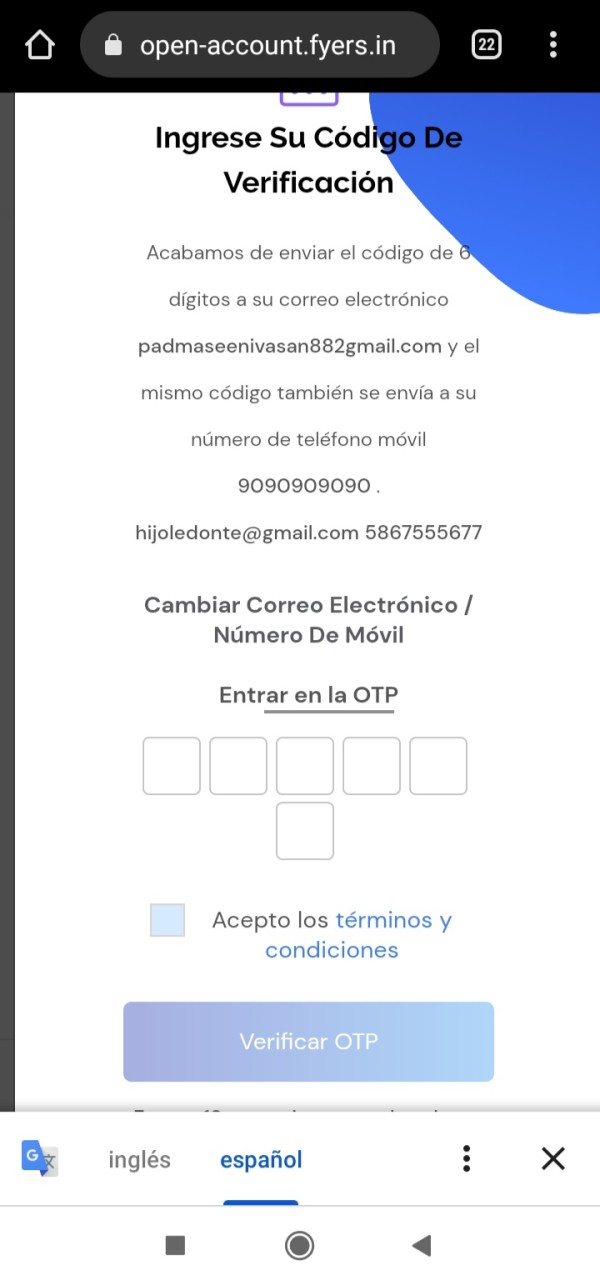

I deposited $10,000 at the beginning. When my balance was higher than $55,000, I had to verify my email but I could not receive the code when it remained unavailable. Please help me.

Fyers Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I deposited $10,000 at the beginning. When my balance was higher than $55,000, I had to verify my email but I could not receive the code when it remained unavailable. Please help me.

Fyers stands out as a technology-driven discount brokerage firm. The company has rapidly gained recognition in the Indian financial markets since its establishment in 2016. This Fyers review examines a Bengaluru-based fintech startup that offers a stable and reliable platform for efficient trading in Indian stock markets. The broker positions itself as a revolutionary name in the stockbroker industry. It brings crisp technology and smooth trading platforms along with the concept of thematic investment.

The platform caters to both beginner and professional traders. It provides access to a comprehensive range of financial instruments including equities, derivatives, commodities, and currencies. With transparent pricing at ₹20 brokerage charges and a focus on cost-effective trading solutions, Fyers has established itself as a competitive option in the discount brokerage space. The company's core emphasis lies in delivering a seamless trading experience. This happens through advanced market analysis tools and multiple platform options, including online trading platforms, desktop terminals, and mobile applications.

This review focuses primarily on Fyers' operations within the Indian market. The company maintains its primary business presence there. The evaluation is based on publicly available company information, user feedback from various review platforms, and market analysis data. Readers should note that regulatory requirements and service availability may vary by region. It's essential to verify current terms and conditions directly with the broker before making any trading decisions.

| Criteria | Rating | Score |

|---|---|---|

| Account Conditions | ⭐⭐⭐⭐⭐⭐⭐ | 7/10 |

| Tools and Resources | ⭐⭐⭐⭐⭐⭐⭐⭐ | 8/10 |

| Customer Service | ⭐⭐⭐⭐⭐⭐⭐ | 7/10 |

| Trading Experience | ⭐⭐⭐⭐⭐⭐⭐ | 7/10 |

| Trust and Safety | ⭐⭐⭐⭐⭐⭐⭐ | 7/10 |

| User Experience | ⭐⭐⭐⭐⭐⭐⭐ | 7/10 |

Founded in 2016, Fyers emerged as a Bengaluru-based fintech startup. The company has a clear mission to revolutionize the Indian stockbroking industry. The company has positioned itself as a new-age stockbroker that combines cutting-edge technology with user-friendly trading solutions. Fyers' business model focuses on providing cost-effective trading services. It maintains high standards of platform reliability and customer support. The broker's approach centers on democratizing access to financial markets through transparent pricing and advanced technological infrastructure.

The platform's comprehensive service offering includes trading across multiple asset classes. It has particular strength in the Indian equity markets. Fyers has built its reputation on delivering consistent performance and maintaining competitive pricing structures that appeal to both retail and institutional traders. According to Compare Share Brokers, Fyers has brought revolutionary changes to the stockbroker industry. The company achieves this with its crisp technology and smooth trading platform, along with innovative concepts like thematic investment options.

Fyers operates through multiple trading platforms. These platforms are designed to meet diverse trader preferences and requirements. The broker offers online trading platforms accessible through web browsers, downloadable desktop trading terminals for advanced functionality, and mobile trading applications for on-the-go market access. This multi-platform approach ensures that traders can maintain connectivity to markets regardless of their preferred trading environment or technical setup.

Regulatory Framework: Fyers operates as a registered stockbroker in India. Specific regulatory details require verification through official channels. The company maintains compliance with applicable Indian financial regulations and industry standards.

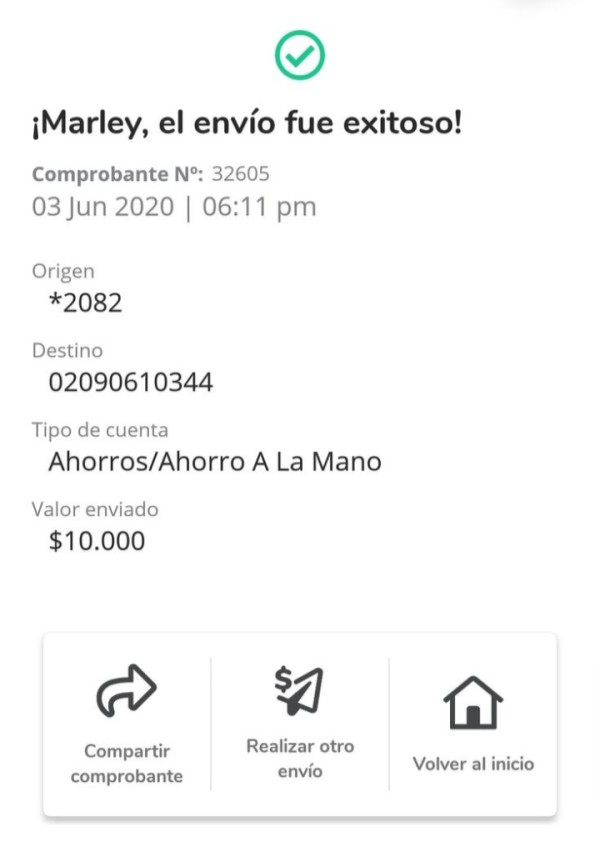

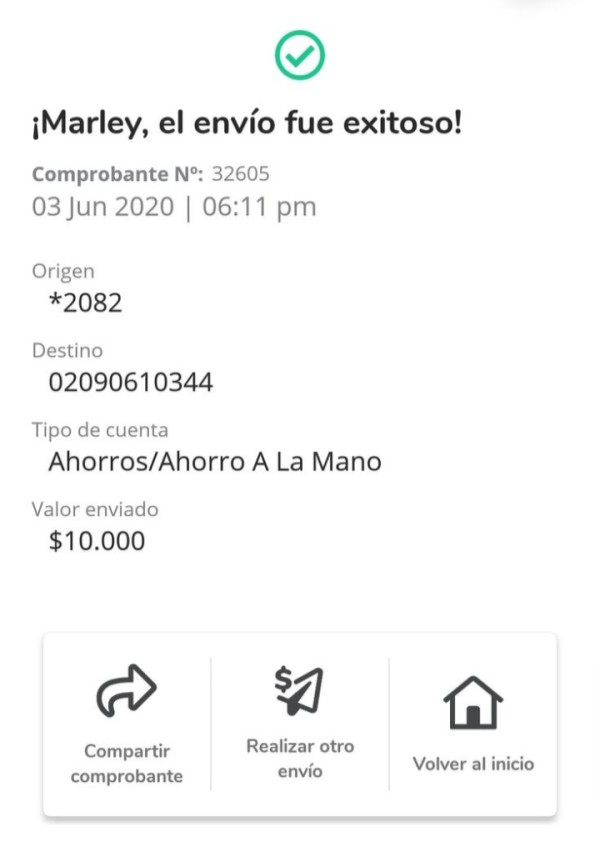

Deposit and Withdrawal Methods: The platform supports various funding methods typical of Indian brokerages. Specific details about payment processors and withdrawal timeframes should be confirmed directly with the broker.

Minimum Deposit Requirements: Account opening requirements and minimum deposit amounts are not specified in available materials. This suggests potential flexibility for different trader categories.

Promotional Offers: Current bonus structures and promotional campaigns are not detailed in available sources. This indicates that traders should check directly with Fyers for any ongoing offers.

Trading Instruments: Fyers provides access to a comprehensive range of financial instruments. These include equities, derivatives, commodities, and currencies. This diverse offering allows traders to build diversified portfolios and implement various trading strategies across different market segments.

Cost Structure: The broker maintains transparent pricing with ₹20 brokerage charges. This positions itself competitively within the discount brokerage segment. This pricing structure appeals to both frequent traders and long-term investors seeking cost-effective trading solutions.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available materials. The platform does offer derivatives trading which typically involves leveraged positions.

Platform Selection: Traders can choose from online platforms, desktop terminals, and mobile applications. This ensures accessibility across different devices and trading preferences.

Geographic Restrictions: The platform primarily serves the Indian market. Specific availability in other regions requires direct confirmation.

Customer Support Languages: Support language options are not specified in available materials. Given the Indian market focus, Hindi and English support would be expected.

This Fyers review reveals that the broker's account structure focuses on simplicity and accessibility. Specific details about account tiers and requirements remain limited in publicly available information. The platform appears to offer standardized account opening procedures typical of Indian discount brokerages. It emphasizes digital onboarding processes that align with modern fintech standards.

The account opening process likely follows Reserve Bank of India guidelines and SEBI requirements. These cover know-your-customer procedures, ensuring compliance with Indian financial regulations. While minimum deposit requirements are not explicitly stated, the broker's positioning as a discount platform suggests relatively accessible entry requirements for retail traders.

Account maintenance charges and annual fees follow industry standards. The ₹20 brokerage charge represents the primary cost structure for most trading activities. This transparent pricing approach eliminates hidden fees and provides clarity for traders planning their trading costs. The platform's focus on technology-driven solutions suggests streamlined account management features accessible through digital channels.

Special account features such as family accounts, corporate accounts, or specialized trading accounts are not detailed in available materials. Traders requiring specific account configurations should verify availability and requirements directly with Fyers customer service teams.

Fyers demonstrates strong capabilities in providing technology-driven market analysis tools. These tools cater to both novice and experienced traders. The platform's emphasis on advanced analytical capabilities positions it favorably within the competitive landscape of Indian discount brokerages. According to available information, the broker offers sophisticated tools for market analysis. Specific details about charting packages, technical indicators, and research resources require further investigation.

The platform's technological infrastructure supports comprehensive trading functionality across multiple asset classes. This suggests robust backend systems capable of handling diverse trading requirements. The availability of desktop terminals indicates advanced trading capabilities beyond basic web-based platforms. These potentially include features like advanced order types, portfolio analysis tools, and risk management systems.

Mobile trading applications extend the platform's functionality to smartphones and tablets. This ensures traders maintain market access regardless of location. The quality and feature completeness of these mobile solutions contribute significantly to the overall trading experience, particularly for active traders who require real-time market monitoring capabilities.

Educational resources and market research materials are not extensively detailed in available sources. The platform's focus on serving both beginners and professionals suggests some level of educational support. Traders should verify the availability of tutorials, webinars, market analysis reports, and other learning materials directly with the broker.

Customer service quality represents a critical factor in broker selection. This is particularly true for traders who may require technical support or account assistance. While specific information about Fyers' customer service channels, response times, and service quality is not detailed in available materials, the company's positioning as a technology-driven platform suggests emphasis on digital support solutions.

The broker's establishment in 2016 indicates several years of operational experience. During this time, customer service processes would have been refined based on user feedback and operational requirements. The Indian market focus suggests customer service teams familiar with local market conditions, regulatory requirements, and trader preferences specific to the region.

Support channel availability likely includes traditional methods such as phone and email support. These are potentially supplemented by modern digital channels like live chat, help desk systems, or in-app support features. The quality of multilingual support, particularly in Hindi and English, would be important for serving the diverse Indian trader base effectively.

Response time expectations and service availability hours are not specified in available materials. Given the nature of financial markets and the need for timely support, traders should verify support availability during market hours and emergency contact procedures for urgent account or trading issues.

The trading experience on Fyers platforms appears to prioritize stability and reliability. These are key factors for traders who depend on consistent platform performance for their trading activities. This Fyers review indicates that the broker has invested significantly in technological infrastructure to support smooth trading operations across multiple asset classes and market conditions.

Platform stability becomes particularly important during high-volatility periods. Market access and order execution speed can significantly impact trading outcomes during these times. The availability of multiple platform options, including web-based, desktop, and mobile solutions, provides redundancy and flexibility for traders who require consistent market access.

Order execution quality, while not specifically detailed in available materials, would be expected to meet industry standards for discount brokerages operating in Indian markets. The platform's focus on technology suggests investment in systems capable of handling order flow efficiently. Specific execution statistics would require verification through direct broker communication.

The user interface design and platform navigation experience contribute significantly to overall trading satisfaction. Modern traders expect intuitive interfaces that provide quick access to essential trading functions while maintaining the depth of features required for comprehensive market analysis and portfolio management.

Trust and safety considerations form the foundation of any broker-client relationship. This is particularly true in financial services where client funds and personal information require protection. Fyers' operation as a registered entity in the Indian financial services sector suggests compliance with applicable regulatory frameworks. Specific regulatory details should be verified through official sources.

The company's establishment in 2016 provides several years of operational history. During this period, regulatory compliance procedures and risk management systems would have been developed and refined. The broker's continued operation and growth suggest successful navigation of regulatory requirements and maintenance of necessary licenses and registrations.

Fund safety measures, segregation of client assets, and insurance coverage details are not extensively covered in available materials. These critical safety features should be verified directly with the broker. They represent essential protections for trader funds and account security.

The platform's technology infrastructure security, data protection measures, and cybersecurity protocols are not detailed in available sources. Given the increasing importance of digital security in financial services, traders should investigate the broker's security measures and data protection policies before opening accounts.

User experience encompasses the complete interaction journey from account opening through daily trading activities and ongoing account management. Fyers' positioning as a technology-driven platform suggests emphasis on creating intuitive and efficient user experiences. These meet modern trader expectations for digital financial services.

The availability of multiple platform options indicates recognition of diverse user preferences and trading styles. Some traders prefer comprehensive desktop applications with advanced features. Others prioritize mobile accessibility for flexible trading. The platform's multi-channel approach suggests efforts to accommodate these varying preferences effectively.

Interface design and navigation efficiency impact daily trading productivity. This is particularly true for active traders who execute multiple transactions and require quick access to market data, order entry functions, and account information. The platform's focus on smooth trading experiences suggests investment in user interface development and ongoing optimization based on user feedback.

Registration and account verification processes reflect the initial user experience. They set expectations for ongoing service quality. Streamlined digital onboarding processes that comply with regulatory requirements while minimizing friction contribute to positive initial impressions and user satisfaction.

This comprehensive Fyers review reveals a technology-focused discount brokerage that has established a solid position in the Indian financial markets since 2016. The platform demonstrates particular strength in providing cost-effective trading solutions with transparent pricing at ₹20 brokerage charges. This makes it accessible to both beginning and experienced traders seeking efficient market access.

Fyers appears well-suited for Indian traders who prioritize technological sophistication and cost-effectiveness in their trading platforms. The broker's multi-platform approach, covering web-based, desktop, and mobile trading solutions, provides flexibility for different trading styles and preferences. However, potential users should conduct direct verification of specific features, regulatory details, and service terms before making final decisions.

While the platform shows promise in several key areas, particularly in technological infrastructure and pricing transparency, some important details require further investigation. These include regulatory specifics, customer service quality, and advanced features that need verification through direct broker contact. Overall, Fyers represents a competitive option within the Indian discount brokerage landscape for traders seeking modern, technology-driven trading solutions.

FX Broker Capital Trading Markets Review